Established companies modernize software,

data management to stay relevant as climate change, new competitors

shake up business models, ISG Provider Lens™ report says

Insurance enterprises in North America are integrating new

technologies, including AI, to succeed in an unpredictable, rapidly

changing market, according to a new research report published today

by Information Services Group (ISG) (Nasdaq: III), a leading global

technology research and advisory firm.

The 2024 ISG Provider Lens™ Insurance Services report for North

America finds that the industry is grappling with rising costs,

changing customer expectations and shrinking profit margins.

Property and casualty (P&C) insurers need to cover growing

claims from increasingly severe natural disasters, while life and

retirement (L&R) firms face falling interest rates and economic

uncertainty.

Adaptability is key to survival, ISG says. During the COVID-19

pandemic, insurance companies that had carried out digital

transformations swiftly adopted online platforms and remote work,

gaining advantages over rivals. Forward-thinking insurers today are

using technologies including AI and automation to improve

efficiency, profitability and policyholder experience.

“The leading North American insurance companies are

distinguishing themselves through aggressive automation, AI,

digital and business innovation,” said Dennis Winkler, Americas

leader, Insurance, with ISG. “Those that resist change risk losing

market share and becoming obsolete.”

Most insurers in the region are replacing the systems they use

for core insurance functions, such as underwriting and billing, or

exploring how best to do so, ISG says. Many of these platforms are

decades old, dating from a time when technical requirements and

consumer demands changed more slowly. Providers can help clients

migrate, but the change is a long-term project that requires

extensive preparation.

Along with their core platforms, companies are updating

supporting systems for functions such as accounting and customer

relationship management, ISG says. This can be a complex

undertaking itself, requiring the right ecosystem strategy to

ensure there are no gaps in a company’s capabilities. Insurers are

addressing this need by working with strategic consulting firms,

preferring engagements that place some accountability on the

provider for business outcomes.

Insurance companies are beginning to use AI to derive new

insights and better decision-making from huge volumes of data, ISG

says. This typically requires massive data modernization projects

to identify relevant information and make it usable. Most North

American firms are at the early stages of this process, still

behind newer insurers in other markets, such as Asia.

New technologies are playing a major role in improving customer

experience, the report says. Traditional insurance companies are

building out personalized, omnichannel customer support systems to

meet modern customer expectations and compete with cloud-native

startups. Partnerships with business process outsourcing and

third-party administrator (TPA) providers help insurers efficiently

serve consumers’ needs.

“Investing in advanced technology and services enables insurance

companies to meet and exceed evolving market expectations,” said

Jan Erik Aase, partner and global leader, ISG Provider Lens

Research. “It can set them up to thrive in the near term and grow

and adapt in the long term.”

The report also explores other trends in the North American

insurance industry, including the impact of increasing regulation

and the growing use of straight-through processing to settle claims

faster.

For more insights into the challenges facing insurance companies

in North America, including maintaining profitability and

reinventing business models, see the ISG Provider Lens™ Focal

Points briefing here.

The 2024 ISG Provider Lens™ Insurance Services report for North

America evaluates the capabilities of 67 providers across five

quadrants: Life and Retirement (L&R) Insurance BPO Services,

Property and Casualty (P&C) Insurance BPO Services, Life and

Retirement (L&R) Insurance TPA Services, Insurance ITO

Services, Insurance ITO Services — Midmarket and Insurance ITO

Services — Midmarket Next-gen.

The report names Accenture, Cognizant and EXL as Leaders in four

quadrants each. It names Genpact, Infosys, TCS and WNS as Leaders

in three quadrants each and DXC Technology, NTT DATA, Tech Mahindra

and Wipro as Leaders in two quadrants each. Capgemini, Coforge,

Davies Group, Ensono, EPAM, Fujitsu, GFT, HCLTech, Hexaware, HTC

Global Services, Illumifin, Iron Mountain, Kyndryl, LTIMindtree,

Mphasis, Persistent Systems, Publicis Sapient, Randstad Digital,

ReSource Pro, Sutherland, Unisys, Xceedance, Zensar Technologies

and Zinnia are named as Leaders in one quadrant each.

In addition, Sutherland is named as a Rising Star — a company

with a “promising portfolio” and “high future potential” by ISG’s

definition — in two quadrants. EPAM, Patra Corporation,

Teleperformance and Virtusa are named as Rising Stars in one

quadrant each.

In the area of customer experience, Persistent system is named

the global ISG CX Star Performer for 2024 among Insurance Services

providers. Persistent system earned the highest customer

satisfaction scores in ISG's Voice of the Customer survey, part of

the ISG Star of Excellence™ program, the premier quality

recognition for the technology and business services industry.

Customized versions of the report are available from Sutherland

and WNS.

The 2024 ISG Provider Lens™ Insurance Services report for North

America is available to subscribers or for one-time purchase on

this webpage.

About ISG Provider Lens™ Research

The ISG Provider Lens™ Quadrant research series is the only

service provider evaluation of its kind to combine empirical,

data-driven research and market analysis with the real-world

experience and observations of ISG's global advisory team.

Enterprises will find a wealth of detailed data and market analysis

to help guide their selection of appropriate sourcing partners,

while ISG advisors use the reports to validate their own market

knowledge and make recommendations to ISG's enterprise clients. The

research currently covers providers offering their services

globally, across Europe, as well as in the U.S., Canada, Mexico,

Brazil, the U.K., France, Benelux, Germany, Switzerland, the

Nordics, Australia and Singapore/Malaysia, with additional markets

to be added in the future. For more information about ISG Provider

Lens research, please visit this webpage.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 900 clients, including more than 75 of the

world’s top 100 enterprises, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including AI, cloud and data analytics; sourcing advisory; managed

governance and risk services; network carrier services; strategy

and operations design; change management; market intelligence and

technology research and analysis. Founded in 2006, and based in

Stamford, Conn., ISG employs more than 1,600 digital-ready

professionals operating in more than 20 countries—a global team

known for its innovative thinking, market influence, deep industry

and technology expertise, and world-class research and analytical

capabilities based on the industry’s most comprehensive marketplace

data. For more information, visit www.isg-one.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250120449671/en/

Press:

Will Thoretz, ISG +1 203 517 3119 will.thoretz@isg-one.com

Julianna Sheridan, Matter Communications for ISG +1 978-518-4520

isg@matternow.com

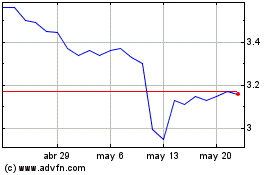

Information Services (NASDAQ:III)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

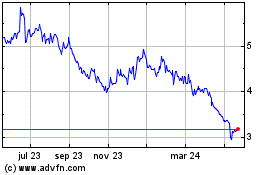

Information Services (NASDAQ:III)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025