Companies partner with service providers on

digital transformations to meet economic, climate, customer service

challenges, ISG Provider Lens™ report says

Insurance companies in Australia and New Zealand continue to

invest in new technologies and services, including AI, to become

data-driven, digital-first organizations, according to a new

research report published today by Information Services Group (ISG)

(Nasdaq: III), a leading global technology research and advisory

firm.

The 2024 ISG Provider Lens™ Insurance Services report for

Australia and New Zealand finds that insurers in the region are

carrying out digital transformations to become more efficient and

comply with evolving regulations. Insurers face declining margins,

with inflation and extreme weather affecting claims. Changing

consumer expectations and competition from startups are forcing

established firms to innovate in products and customer

experiences.

“Insurance companies in Australia and New Zealand need to move

beyond legacy systems and cultures to remain competitive,” said

Michael Gale, partner and head of ISG Asia Pacific. “Service

providers are helping them make essential leaps in technology.”

AI and generative AI are playing a growing role as insurers in

the region adopt tools for use cases such as automated claims

processing, better customer interactions and predictive analytics

for risk management, the report says. The analytical and

performance capabilities of AI are expected to simplify complex

insurance products and enable cost optimization. However, full AI

readiness will require the ability to cultivate and apply highly

granular data.

Property and casualty (P&C) insurers, for one, are

implementing data analytics to improve risk assessment and customer

segmentation, leading to better decision-making, the report says.

To improve and personalize customer service, they are integrating

traditional and digital channels. There is a growing trend toward

partnerships with newer insurtech companies to boost innovation and

efficiency. Business process outsourcing (BPO) providers are

helping P&C insurers comply with regulations, especially in

security and automation efforts.

Life and retirement (L&R) insurers are also turning to BPO

providers to meet evolving policyholder demands, ISG says. While

L&R insurance is less commonly purchased than P&C coverage

in Australia and New Zealand, growing economic uncertainty has led

more consumers to improve their insurance protection.

Traditional IT outsourcing remains a big part of insurance

enterprises’ IT budgets in Australia and New Zealand, though

companies are exploring a range of strategies, including

nearshoring, offshoring, insourcing and outsourcing, to address

resource issues, ISG says. As they update IT infrastructures,

insurers are increasingly adopting Agile methodologies and relying

on cloud-based platforms.

“Digital transformation for insurers in this region will require

major investments in cloud, data management and security,” said Jan

Erik Aase, partner and global leader, ISG Provider Lens Research.

“ITO service providers with expertise in these areas will be

important partners in this process.”

The report also examines other trends affecting insurers in

Australia and New Zealand, including the need for enterprises to

retain intellectual property rights when adopting AI and the

growing importance of controls to prevent data leakage from AI

models.

For more insights into the challenges faced by insurance

enterprises in Australia and New Zealand, along with ISG’s advice

for addressing them, see the ISG Provider Lens™ Focal Points

briefing here.

The 2024 ISG Provider Lens™ Insurance Services report for

Australia and New Zealand evaluates the capabilities of 40

providers across four quadrants: Life and Retirement (L&R)

Insurance BPO Services, Property and Casualty (P&C) Insurance

BPO Services, Insurance ITO Services and Insurance ITO Services —

Midmarket Next-gen.

The report names TCS and Tech Mahindra as Leaders in three

quadrants each. It names Cognizant, Genpact, TSA and Wipro as

Leaders in two quadrants each. Accenture, Capgemini, Cloud4C, DXC

Technology, EXL, Fujitsu, IBM, Infosys, Iron Mountain, Kyndryl,

Publicis Sapient, Randstad Digital, Teleperformance, Unisys and WNS

are named as Leaders in one quadrant each.

In addition, EXL, HCLTech, WNS and Xceedance are named as Rising

Stars — companies with a “promising portfolio” and “high future

potential” by ISG’s definition — in one quadrant each.

A customized version of the report is available from WNS.

In the area of customer experience, Persistent system is named

the global ISG CX Star Performer for 2024 among insurance services

providers. Persistent system earned the highest customer

satisfaction scores in ISG's Voice of the Customer survey, which is

part of the ISG Star of Excellence™ program, the premier quality

recognition for the technology and business services industry.

The 2024 ISG Provider Lens™ Insurance Services report for

Australia and New Zealand is available to subscribers or for

one-time purchase on this webpage.

About ISG Provider Lens™ Research

The ISG Provider Lens™ Quadrant research series is the only

service provider evaluation of its kind to combine empirical,

data-driven research and market analysis with the real-world

experience and observations of ISG's global advisory team.

Enterprises will find a wealth of detailed data and market analysis

to help guide their selection of appropriate sourcing partners,

while ISG advisors use the reports to validate their own market

knowledge and make recommendations to ISG's enterprise clients. The

research currently covers providers offering their services

globally, across Europe, as well as in the U.S., Canada, Mexico,

Brazil, the U.K., France, Benelux, Germany, Switzerland, the

Nordics, Australia and Singapore/Malaysia, with additional markets

to be added in the future. For more information about ISG Provider

Lens research, please visit this webpage.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 900 clients, including more than 75 of the

world’s top 100 enterprises, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including AI, cloud and data analytics; sourcing advisory; managed

governance and risk services; network carrier services; strategy

and operations design; change management; market intelligence and

technology research and analysis. Founded in 2006, and based in

Stamford, Conn., ISG employs more than 1,600 digital-ready

professionals operating in more than 20 countries—a global team

known for its innovative thinking, market influence, deep industry

and technology expertise, and world-class research and analytical

capabilities based on the industry’s most comprehensive marketplace

data. For more information, visit www.isg-one.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250120886186/en/

Will Thoretz, ISG +1 203 517 3119 will.thoretz@isg-one.com

Julianna Sheridan, Matter Communications for ISG +1 978-518-4520

isg@matternow.com

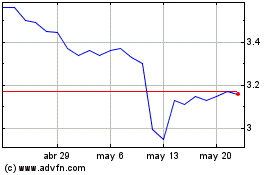

Information Services (NASDAQ:III)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

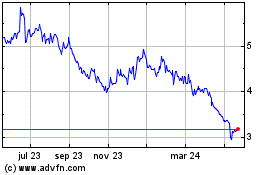

Information Services (NASDAQ:III)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025