Lucas GC Limited Announces 1H 2024 Financial Results: Revenue at US$83.32 million with Increases in Both Gross Margin and Net Income Margin

26 Septiembre 2024 - 4:00PM

Lucas GC Limited (NASDAQ: LGCL) (“Lucas” or the “Company”), an

artificial intelligence (the “AI”) technology-driven

Platform-as-a-Service (the “PaaS”) company whose technologies have

been applied to the human resources, insurance and wealth

management industry verticals, today announced its financial

results for 1H fiscal year of 2024.

1H 2024 Financial

Highlights

- Our revenue was RMB605.52 million (US$83.32 million) for the

six months ended June 30, 2024, compared with RMB820.07 million for

the six months ended June 30, 2023, representing a decrease of

26.16%.

- We recorded a gross margin of 33.54% for the six months ended

June 30, 2024, representing an increase of 516 bps compared with

that of the six months ended June 30, 2023.

- We recorded net income of RMB53.93 million (US$7.42 million)

for the six months ended June 30, 2024, compared with RMB53.69

million for the six months ended June 30, 2023.

- Our net income margin increased to 8.91% for the six months

ended June 30, 2024, compared with 6.55% for the six months ended

June 30, 2023.

1H 2024 Operational Highlights

- Increased active registered users by 10% to 702,060 in 1H 2024

as compared to Dec 2023.

- Obtained two patents related to core Artificial Intelligence

(AI) technology, bringing the total number of granted patents to

18.

- Signed two strategic agreements with publicly traded financial

institutions, i.e. Bank of Ningbo and Industrial Securities Co.,

Limited., to port the AI LLM technology into wealth management

vertical.

- Signed a strategic agreement with Beijing Fourth Paradigm

Technology Co., Limited to develop Artificial Intelligence training

programs.

- Won The 2024 Cberi Prize in The Most Valuable Brand for

Investment during the Asian Brand Economy Conference (ABEC).

Management Commentary

Howard Lee, Chief Executive Officer of Lucas,

said “We adopted a change of strategy in 1H 2024. We decided to

position ourselves as a technology company rather than a service

company. As a result, we started selling our technology to peers

and let them deliver the assignments themselves, rather than

compete with them. We tried to reduce our activities in delivering

the recruitment assignments directly ourselves, and instead we

focused on selling the technology and information to our peers and

clients with products that have higher margins than those of

assignment delivery services. That’s why we had significant gross

margin improvement in 1H 2024 compared to 1H 2023. The revenue

decrease was due to our change of strategy to focus on

higher-margin products, as well as the effect of one-time post

COVID recovery spike in China, making 1H 2023 a

higher-than-normal-business-run-rate comparison.”

“In order to sustain our technological leads as

a technology company, we have continued to invest significantly in

research and development. R&D expenses increased by 2.45%

compared to 1H 2023 due to continuous investments in AI-enabled

technologies including Generative Pre-trained Transformer (GPT) and

related artificial intelligence generated content (AIGC)

technologies. R&D as a percentage of revenue was 13.31% in 1H

2024 compared with 9.59% in 1H 2023.”

“We had a strong growth of our user base: our

active registered users reached 702,060 by June 2024, representing

10% growth in 1H 2024, compared to Dec 2023, setting the stage for

strong revenue growth for the future, not only within human

resource services, but in the areas such as IT outsourcing and

information services. I also expect to execute acquisitions or form

partnerships outside China that are accretive and will drive value

for shareholders in the coming months.”

About Lucas GC Limited

With 18 granted U.S. and Chinese patents and

over 74 registered software copyrights in the AI, data analytics

and blockchain technologies, Lucas GC Limited is an AI

technology-driven Platform as a Service (PaaS) company with over

702,060 agents working on its platform. Lucas’ technologies have

been applied to the human resources, insurance and wealth

management industry verticals. For more information, please visit:

https://www.lucasgc.com/.

Forward-Looking Statements

Statements in this press release about future

expectations, plans, and prospects, as well as any other statements

regarding matters that are not historical facts, may constitute

“forward-looking statements.” The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Actual results may

differ materially from those indicated by such forward-looking

statements as a result of various important factors, including the

uncertainties related to market conditions. Any forward-looking

statements contained in this press release speak only as of the

date hereof, and Lucas GC Limited specifically disclaims any

obligation to update any forward-looking statement, whether as a

result of new information, future events, or otherwise.

For Investor Inquiries and Media

Contact:https://www.lucasgc.com/ir@lucasgc.comT: 818-741-0923

|

|

|

LUCAS GC LIMITEDUNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS(All amounts in thousands, except for share

and per share data, or otherwise noted) |

|

|

| |

|

As of December 31, |

|

As of June 30, |

|

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

US$ |

|

| |

|

|

|

(Unaudited) |

| ASSETS |

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

30,123 |

|

|

51,513 |

|

|

7,088 |

|

| Restricted cash |

|

100 |

|

|

- |

|

|

- |

|

| Accounts receivable, net |

|

28,144 |

|

|

46,448 |

|

|

6,391 |

|

| Advance to suppliers, net |

|

164,802 |

|

|

223,004 |

|

|

30,686 |

|

| Deferred offering costs |

|

6,541 |

|

|

706 |

|

|

97 |

|

| Prepaid expenses and other

current assets |

|

1,626 |

|

|

1,616 |

|

|

222 |

|

| Total current

assets |

|

231,336 |

|

|

323,287 |

|

|

44,484 |

|

|

|

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

| Software and equipment,

net |

|

48,299 |

|

|

76,388 |

|

|

10,511 |

|

| Operating lease right-of-use

assets, net |

|

84 |

|

|

797 |

|

|

110 |

|

| Deferred tax assets |

|

12,103 |

|

|

12,897 |

|

|

1,775 |

|

| Total non-current

assets |

|

60,486 |

|

|

90,082 |

|

|

12,396 |

|

|

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

291,822 |

|

|

413,369 |

|

|

56,880 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

| Short-term borrowings |

|

39,381 |

|

|

57,829 |

|

|

7,958 |

|

| Accounts payable |

|

35,217 |

|

|

51,997 |

|

|

7,155 |

|

| Contract liabilities |

|

13,552 |

|

|

17,203 |

|

|

2,367 |

|

| Income tax payable |

|

131 |

|

|

131 |

|

|

18 |

|

| Amounts due to related

parties |

|

3,097 |

|

|

2,120 |

|

|

292 |

|

| Operating lease liabilities,

current |

|

86 |

|

|

449 |

|

|

62 |

|

| Accrued expenses and other

current liabilities |

|

3,766 |

|

|

3,580 |

|

|

490 |

|

| Total current

liabilities |

|

95,230 |

|

|

133,309 |

|

|

18,342 |

|

|

|

|

|

|

|

|

|

|

| Operating lease liabilities,

non-current |

|

- |

|

|

401 |

|

|

55 |

|

| Total non-current

liability |

|

- |

|

|

401 |

|

|

55 |

|

| TOTAL

LIABILITIES |

|

95,230 |

|

|

133,710 |

|

|

18,397 |

|

|

|

|

|

|

|

|

|

|

| Shareholders’

equity |

|

|

|

|

|

|

|

| Ordinary shares (US$0.000005

par value; 10,000,000,000 and 10,000,000,000 shares authorized as

of December 31, 2023 and June 30, 2024; 78,063,300 and 78,063,300

shares issued and outstanding as of December 31, 2023 and June 30,

2024, respectively) |

|

3 |

|

|

3 |

|

|

- |

|

| Subscription receivables |

|

(3 |

) |

|

(3 |

) |

|

- |

|

| Additional paid-in

capital |

|

113,554 |

|

|

142,255 |

|

|

19,575 |

|

| Statutory reserve |

|

19,559 |

|

|

23,758 |

|

|

3,269 |

|

| Retained earnings |

|

61,041 |

|

|

110,372 |

|

|

15,188 |

|

| Accumulated other

comprehensive (loss)/income |

|

(11 |

) |

|

427 |

|

|

59 |

|

| Total Lucas GC Limited

shareholders’ equity |

|

194,143 |

|

|

276,812 |

|

|

38,091 |

|

| Non-controlling interests |

|

2,449 |

|

|

2,847 |

|

|

392 |

|

| Total shareholders’

equity |

|

196,592 |

|

|

279,659 |

|

|

38,483 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

291,822 |

|

|

413,369 |

|

|

56,880 |

|

| |

|

|

|

|

|

|

|

|

|

|

LUCAS GC LIMITEDUNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF INCOME AND COMPREHENSIVE INCOME(All amounts

in thousands, except for share and per share data, or otherwise

noted) |

|

|

| |

|

For the six months ended June 30, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

|

(Unaudited) |

|

(Unaudited) |

| Revenues |

|

|

|

|

|

|

|

Recruitment service |

|

395,360 |

|

|

155,812 |

|

|

21,440 |

|

| Outsourcing service |

|

366,550 |

|

|

418,456 |

|

|

57,581 |

|

| Others |

|

58,162 |

|

|

31,250 |

|

|

4,300 |

|

| Total

revenues |

|

820,072 |

|

|

605,518 |

|

|

83,321 |

|

| Cost of

revenues |

|

(587,382 |

) |

|

(402,438 |

) |

|

(55,377 |

) |

| Gross

profit |

|

232,690 |

|

|

203,080 |

|

|

27,944 |

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

| Selling and marketing

expenses |

|

(41,678 |

) |

|

(39,000 |

) |

|

(5,367 |

) |

| General and administrative

expenses |

|

(61,389 |

) |

|

(30,298 |

) |

|

(4,169 |

) |

| Research and development

expenses |

|

(78,675 |

) |

|

(80,612 |

) |

|

(11,093 |

) |

| Total operating

expenses |

|

(181,742 |

) |

|

(149,910 |

) |

|

(20,629 |

) |

|

|

|

|

|

|

|

|

| Income from

operations |

|

50,948 |

|

|

53,170 |

|

|

7,315 |

|

|

|

|

|

|

|

|

|

| Other/(expenses)

income |

|

|

|

|

|

|

| Financial expenses, net |

|

(273 |

) |

|

(754 |

) |

|

(104 |

) |

| Other income, net |

|

2,535 |

|

|

718 |

|

|

99 |

|

| Total other

income/(expenses), net |

|

2,262 |

|

|

(36 |

) |

|

(5 |

) |

|

|

|

|

|

|

|

|

| Income before income

tax benefit |

|

53,210 |

|

|

53,134 |

|

|

7,310 |

|

| Income tax benefit |

|

482 |

|

|

794 |

|

|

109 |

|

| Net

income |

|

53,692 |

|

|

53,928 |

|

|

7,419 |

|

| Less: net income attributable

to non-controlling interests |

|

(397 |

) |

|

(398 |

) |

|

(55 |

) |

| Net income

attributable to Lucas GC Limited |

|

53,295 |

|

|

53,530 |

|

|

7,364 |

|

|

|

|

|

|

|

|

|

| Net

income |

|

53,692 |

|

|

53,928 |

|

|

7,419 |

|

| Other comprehensive

income: |

|

|

|

|

|

|

| Foreign currency translation

difference, net of tax of nil |

|

6 |

|

|

438 |

|

|

60 |

|

| Total comprehensive

income |

|

53,698 |

|

|

54,366 |

|

|

7,479 |

|

| Less: total comprehensive

income attributable to non-controlling interests |

|

(397 |

) |

|

(398 |

) |

|

(55 |

) |

| Comprehensive income

attributable to Lucas GC Limited |

|

53,301 |

|

|

53,968 |

|

|

7,424 |

|

|

|

|

|

|

|

|

|

| Net income per

share: |

|

|

|

|

|

|

| Basic |

|

0.68 |

|

|

0.69 |

|

|

0.09 |

|

| Diluted |

|

0.68 |

|

|

0.69 |

|

|

0.09 |

|

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding used in calculating basic and diluted loss per

share: |

|

|

|

|

|

|

| Basic |

|

78,063,300 |

|

|

78,063,300 |

|

|

78,063,300 |

|

| Diluted |

|

78,063,300 |

|

|

78,063,300 |

|

|

78,063,300 |

|

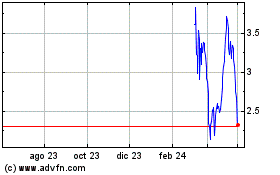

Lucas GC (NASDAQ:LGCL)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

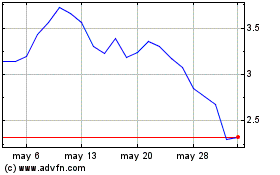

Lucas GC (NASDAQ:LGCL)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025