UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

MASIMO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing

Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary

materials. |

| ☐ | Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Persons who are to respond to the collection of information contained

in this form are not required to respond unless the form displays a currently valid OMB control number.

Masimo Corporation (“Masimo”) participated in the

Goldman Sachs Global Healthcare Conference held in Miami, Florida, on Wednesday, June 12, 2024 at 8:00 a.m. Eastern Time, which

consisted of a question and answer session with Bennett Blau, Managing Director at Goldman Sachs. The following is a transcript of

the presentation, portions of which may be deemed proxy soliciting materials. While effort has been made to provide an accurate

transcription, there may be typographical mistakes, inaudible statements, errors, omissions or inaccuracies in the

transcript.

# # #

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Are we coming through on the mic? All good, excellent. Well,

look, we’re thrilled to have Joe, you here and Micah here from Masimo by way of background Bennett Blau, Managing Director with Goldman

Sachs.

So maybe we can just dive right on in Joe and Micah, as

you guys kind of step back and think about performance of the core health care business today going forward. Can you maybe give us a

sense of where that is today? How things are feeling just to help level set for the audience?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Yes. Absolutely. I think, you know, the health care

business we’ve been picking up market share from the first day we launched. COVID accelerated that, and we’ve been picking up market

share at two to three times our normal rate. We used to do about $130, $150 million of TI. TI is our definition of true incremental.

So if you look at the contracts we signed with hospitals, which have average five years, we were doing about 130, 150 a year, and we

would subtract any hospitals we would lose to come up with the true incremental. Well, the last three, four years, we’ve been doing

about $400 million. And after last year, which was a record at $400, Q1 we did $100 million. So we feel really good about our market

share gains.

And I really believe that’s because of not just our measure-through-motion technology, still the best, and no

one’s caught up with it. We’re the only company with Rainbow. We have 12 parameters that we can measure with a sensor on your

finger, including hemoglobin and recently cleared ORi.

We also have the only tetherless sensor, Radius PPG, and now the W1.

So, hospitals are all just realizing we make a huge difference in the lives of their patients. So things are going well. Now post,

at COVID, we had the huge bump where we had one year 400,000 drivers. Normally, we do about 200 to 240 thousand. And after that, we

thought maybe next year, it’s going to go to 0, or very close to that, but it didn’t, we still are doing about 200 to 240

thousand drivers a year.

And that’s going to continue. We feel good about the future, the second half. The drivers are

coming back to our normal rate. So then we had the census problem, which seems to be over. Post COVID, there wasn’t enough nursing

to have all the patients in the hospital. Also, some of the major insurance companies changed how they paid for people that were

there two days or less, they turn them all into outpatients.

So that pushed a lot of surgeries into the ambulatory surgery

centers. That’s all settled down and we came into 2024 projecting only 0% census increase at our low number, 1% at our high number.

And in Q1, couple of the private or public hospitals reported 3% census increase. And we’ve seen it, we see our sensor volumes

be a lot healthier than it has been for a long time, except for the middle of COVID.

So yes, we think the health care

business is doing great. We’re excited about it. And especially with this separation, it’s going to allow us to really increase our

earnings power. We’re targeting now 30% operating margin within five years.

We’re also hopefully a couple of new exciting

products are going to be rolled out before the end of the year. So yes, I’m, I’ve never been more comfortable and more resolute to

getting back to the days we used to, meet, beat and raise.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Oh, it sounds like it’s a true inflection point

for the company right now coming out of COVID, coming out of some of the noise. And certainly the indicators that you’re talking about

are trending in a way where it’s kind of getting back to kind of that market position leadership and consistent performance.

One topic that certainly we hear about across medtech, a large swath of medtech is what’s going on with inventory levels and especially

on the heels of COVID and how customers hospitals health systems are thinking about inventory levels.

What are you seeing kind of from your dialogue with the customer; trends that you’re seeing in the business as it relates to inventories?

And can you talk a little bit about where that fits in to the overall kind of inflection point and positive trending that you’re talking

about, Joe?

| ● | Micah Young, Chief Financial Officer, Executive Vice President, Masimo Corporation |

So kind of where we’re at is last year, as you know, we

saw some destocking of inventory levels at hospitals that’s coming out of the years over the last three years, three or four years, where

ever since COVID started ordering patterns, were very difficult to understand. You would see a week and as we’d try to look at within

a quarter, you’d see one week, we have a big order, next week there will be hardly anything and it was very choppy between customers.

So it was very hard to understand inventory levels, especially when you’re going across 6,000 customers or how many customers that

are out there that are doing that are ordering at those kind of patterns. But if you look at kind of where we were last year. We’ve gotten

through that. We’re past the sensor inventory levels. We think that there’s nothing material out there, that’s in front of us that we’re

concerned about and we’ll manage it. We’re managing very tightly in terms of how we’re reviewing ordering patterns today and things have

smoothed out. I would say we’re back to kind of where pre COVID back in what we, what I saw before in 2017 through 2019, when I first

came on board of Masimo, you have very steady weekly patterns throughout the quarter. We’re finally back there. And that’s important

because, now we can much better forecast, we can predict the kind of where things are in terms of the inventory, and we feel that that’s

behind us.

Now, one thing that we did see and I mentioned on the fourth quarter call was there were some OEMs that had built some inventories of

our boards, technology boards and our boards go into their multiparameter monitors and they ship them to the customer. It’s not like

our Masimo branded equipment where we ship it and we record it once we send it to the customer, it actually goes into the OEM inventory.

So it was difficult to get full line of sight there. And but we knew that it was going to trough in Q1. So we saw that trough about 50,000

drivers in Q1. We’re feeling very good about the guidance we gave last quarter, which is kind of stepping back up to 55 plus and then

getting back up to that normal level, again, 60,000 a quarter going forward.

So, but the most important thing is our installed base has gone up from $1.8 million drivers back in 2019 to today, it’s about $2.6 million.

So you’ve got almost a 50% increase in your installed base. But our revenue per driver is at the same level as it was back in 2019. So

that’s showing good utilization. And even despite all the extra drivers that Joe mentioned that were shipped back in 2020 in the following

years.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

That’s fantastic, really helpful context. And are the patterns

that you’re describing, Micah, pretty consistent when you think about the customer base, is that pretty consistent you’d say, across

the base or are there any patterns that you’re seeing thematically in terms of differences from that perspective?

| ● | Micah Young, Chief Financial Officer, Executive Vice President,

Masimo Corporation |

I mean, just consistent across our customer base.

So you’re going to have some ebbs and flows with customers as with orders. But if you look across and we look at, I mean, I’m looking

at this thing every feels like daily or every hour now versus last year, but we’re seeing very steady patterns that show as you kind of

go out through and we have about 13 weeks per quarter based on our closing each quarter. So it’s a steady pattern that we’ve seen historically.

So the trends are in line and much more predictable than they were.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Super interesting. Very, very helpful context.

Maybe for a second, pivoting to the consumer topic, obviously, and thinking about kind of the core business getting back to the core.

Can you, any updates on consumer at the separation, whether it pathways or timing that you’d want to share?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Yes, sure. First of all, I just want to say we’re

two years into acquiring Sound United and our plans to get it in a big way into the hearables and the wearables, and it’s gone very well.

We still haven’t launched Freedom. This is a prototype I’m wearing right now, and once we do, I think we’ll see the rest of that

start happening.

But the vision we had that, a lot of care is going to happen at home is real. And I also believe a third of the people who buy smartwatches

have chronic illnesses and they’re looking for a serious product.

In fact, an interesting note. We, as you know, got an injunction against Apple, beginning of January, and we just saw their Q1 numbers.

Their sales of their watches is down 20%. So just tells you how important pulse oximetry is to the buyer.

So I say that because, I still believe keeping it all together is the right thing long term for Masimo. But I also understand that the

majority owners of Masimo, which is no longer me, they don’t want to be solving for 10 years from now. They want to be solving for two

to three years from now.

And I heard them, Micah and I went and met with our, or as many of our investors as we could meet physically, a couple of rounds, and

we, after sitting down with them, we decided to go forward and separate. Not just the audio company, which came with a sales force, came

with the audio engineers, which we need and this product in the pipeline, you’re not aware of that will make a lot of sense for why we

bought that company.

But regardless, I think we came up with a plan to separate, a plan that allows that team with the wearables and the hearables to really

fulfill the vision of the future that’s coming, and yet let Masimo shareholders have the healthcare company they like and, and I don’t

blame them.

I don’t know if we’re the best health care company, but we’re one of the best health care companies in the world, and that’s something

to never lose sight of and build. So far as where are we, we announced the spin. That’s something that’s fully in our control that we

plan to do. At the same time, a company came forward and offered to do a JV. Right now, the JV looks more like an acquisition because,

they’ll be ending up with about 85% of it and we’ll end up with 15%.

But the numbers they put in front of us are really attractive. They’re probably about 2, 3 times what some people thought. And if we get

there, the debt will pretty much go away. So that hopefully they’ll add $0.60 a share to our earnings and people will like that. So if

that deal materializes, we should know by end of June, we will announce that, at least as something that we could accept.

Now we’re probably not going to do it until the AGM is over because I don’t want people to think we’re trying to put something together

quickly because we’re worried about something. We’re not worried about anything. So we’ll be patient. Hopefully, they’ll stick around,

but we will be able to hopefully announce by end of the month what the terms are.

And I think once we do that, then I want to meet with our shareholders and find out what do they prefer. Do they prefer the JV or do they

prefer the spin. And there’s other news coming maybe before it’s all over that they may prefer to keep it together, but I am committed

to do whatever they want. It’s not, I have done this for 35 years and I’m not going get caught up in that.

But what I really want to see through is not only the health care business delivering on its mission, but I want the consumer health business

to deliver on its and the way we’re doing the separation, both are intact. So I’m happy.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Super interesting updates, and I appreciate all

of that. It sounds like the way that you’re approaching it is kind of one of significant flexibility as you think about dialogue with

shareholders as you think about some of the inputs after you kind of receive and announce what the potential terms are. So it sounds like

that will be kind of toward the end of this month as you think about expectations around timing.

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Correct. End of the month we will be able to know the terms

of the JV, if any. We think it’s there, we think it’s going to happen as an option for us. And then probably, I’d say, middle of August,

if we decide to go the JV route where we could hopefully get something done. And if we decide to do the spin and we, being the majority

shareholders, that will probably happen next year.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Wonderful. Very helpful. Maybe once some of this plays out

and kind of, as you think about kind of to the Masimo’s post separation again on the health care side rather than the consumer side when

the dust settles. Can you talk a little bit about what the biggest value drivers looking forward for Masimo will be as you think about

kind of that core business and what are you really excited about from that perspective?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer,

Masimo Corporation |

I think really what’s unique about Masimo, is that we

have been serial innovators. We come up with disruptive innovation, at least every several years. SET pulse oximetry was the

foundation of Masimo. We’re now the number one company in the world in pulse oximetry and that growth is going to continue. I think

we’re doing about $1 billion and about a $2,$3 billion space.

Then the second way for us is Rainbow. We’re the only company

in the world with Rainbow technology, which is 12 wavelength, the technology that allows us to measure, not just pulse oximetry, but

hemoglobin, carbon monoxide, ORi and we’re about $200 million of revenue with that, and that’s about 10% of where it will be.

Then the third piece of hospital automation, this is taking both AI which we develop, we launched in 2010 called Halo, where it

helped clinicians know the status of the patient and where the patient’s going, whether they’re likely to have opioid

induced respiratory depression, whether they’re likely to have sepsis, whether they’re likely to have heart conditions and other

things.

But we have this connectivity that connects everything in every room, sends it to the EMR, brings data back to the

EMR for Halo. We’re just a few percentage into what could be a several billion dollar TAM. That’s the third wave. And the fourth is

the telemonitoring, telehealth, which really began to become concrete in middle of COVID.

If you remember at the very

beginning of COVID, we came up with SafetyNet for COVID. FDA cleared it within a week. We had rolled it out in the month. Hundreds

of hospitals deployed it. The study showed that mortality had dropped by 70%, saved $11,000 a patient. But guess what every one of

those hospitals that did that with us are now doing hospital at home with us.

They’re transferring patients home with

either Radius PPG and our SafetyNet or W1. We just got a big order in Spain, 1,000 W1s to do that. NHS just got an award for their

program with W1 and others to do telemonitoring. Saudi Arabia, we just won the tender. Hopefully in a couple of weeks, we’ll get the

PO. We’ll get that rolling.

US, a lot of good stuff. That’s really the fourth wave. I think overall, what I’m excited

about, we have for the next 10, if not 20 years a growth where we can grow, hopefully, double digits, grow our earnings even beyond

that.

So and if we’re not investing in all the new technologies for home, for the wearables, for the hearables, the R&D

will be less. We’ll get to really take advantage of our SG&A footprint. We have 1,000 salespeople in the field now.

So

we have a lot of growth to do, but a lot, with not a lot of investment. That’s why we think 30% operating margin within five years

is achievable. And we have our sights on 40%, whether we ever get to 40%. I don’t know, that’s the ultimate vision.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Very helpful, and it sounds like, you know, combining

that kind of growth outlook with a pretty disciplined and improving OpEx line from that perspective. Can you talk a little bit about kind

of how M&A, if at all, plays into that growth strategy, as well as you think about those four different waves. Is M&A a part of

that? Are there technologies or capabilities that you would want to think about? As you kind of execute on each of those waves in the

coming months and years?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Well, we see the 10, 20 years ahead of us without needing

to acquire anything. But we can’t just put our head in the sand, we have to keep looking. So if something interesting comes along, we’re

trying to do a better job of communicating to the street before we do it next time. But I can see a lot of tuck-ins and we’ve done like

10 acquisitions over the past several years, all small things that have been really helpful to the overall plan. So yes.

| ● | Micah Young, Chief Financial Officer, Executive Vice President, Masimo Corporation |

Absolutely, I think it will be a key part of our capital

allocation strategy going forward is tuck-ins. Nothing large, but things that can really augment those categories that Joe mentioned,

whether it’s in automation, telemonitoring and just to add to the portfolio. So I think that’s a big part, and I think it’s going to,

it’s great to get back to really the cash flow focus as well, not just the margin expansion story, the earnings power and the earnings

story is back for the core healthcare business in terms of, you know, we can really start to show that power over the next five years.

And it’s not just from the mar-, the revenue growth, the margin expansion, but it’s also, we’re paying down debt. So as we pay down the

debt that’s another nice tailwind below the line that’s going to drive earnings growth.

So and then last is important to us is free cash flow and continuing to drive that as well and getting that up to some pretty high targets

over the next five years.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Absolutely. That’s very helpful. And just, Micah, on the

capital allocation point, as you think about debt paydown and that being kind of a clear opportunity to drive some of that tailwind.

Would you say that kind of with the M&A framework you talked about those two things are your top priority. Have there been other

discussions around thinking around capital allocation, shareholder return and things like that?

| ● | Micah Young, Chief Financial Officer, Executive Vice President, Masimo Corporation |

I would say number one is debt paydown. I think,

Joe and I’ve talked through this debt paydowns, number one, I think, you know, definitely tuck-in M&A is right there, probably number

two. And then of course, if we’re not finding some of those things that we can bring in that we’ll be opportunistic about share buybacks.

That will be another third leg of that capital allocation, makes total sense.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

I think, maybe pivoting to another topic. Is there

anything else on the innovation or R&D roadmap that you’d like to share?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Well, like I said, we were excited about the couple

of major products we want to roll out by the end of the year. We might start giving you some. Hence, we’ve already said it’s a next-generation

Root, but that’s going to be phenomenally. I really feel like there’s things we can do to help patients and help hospitals. And I think

Root second generation, should, we should call it root square, but hopefully deliver on that. So we’re excited.

The other thing we’re seeking, you know, last year was great by the end of the year, we got FDA approval for W1, we got FDA approval,

I should say, clearance for W1. We got FDA approval for opioid Halo. We got FDA clearance for ORi. FDA approval for Stork.

So we got a lot that was pent up that got through. Right now, one of the key things we want to do, we have this very innovative cardiac

output technology along with hemoglobin and ORi. We can give clinicians oxygen delivery, but we’re seeking the clearance for that indication,

which I think will be a big deal. So yes, so I think those things I think should be exciting.

Halo opioid, Halo and bridge are doing really well. The opioid epidemic, 100,000 people died last year, again from opioid overdose, 20,000

from prescription opioids and there’s only three solutions out there, it’s Naloxone, it’s now opioid Halo, which helps detect when

someone is about to die and either wake them or at the latest stage, send a notification to a nearest ambulance with their address to

come rescue them.

And I think, bridge, the only solution to help someone get rid of the withdrawal symptoms. When we talk with to people that have had addiction

problems with opioid. They say the reason they first go to opioids, it’s because, that good feeling they get. The reason they don’t stop

it’s because, it feels like they’re going to die when they’re trying to stop.

So once they try, they don’t try again, they keep doing it because, they don’t want that pain, they literally think they’re going

to die. So we have a solution called bridge, which does nerve stimulation on the back of the ear for nerves, occipital vagus and for 80%

of the population, within 20 minutes, their withdrawal symptoms are gone.

We’re getting some incredible results from being used in prisons, to being used at the rehab centers, even being used in hospitals, where

they’re trying to titrate opioid back before the patient goes home. So a lot of cool stuff, a lot of good stuff coming that, I think the

second generation of these devices are coming that will really help push those forward.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

And can you talk a little bit, I mean such a good

example of the type of innovation that you’re going after? Maybe a little bit of what was the background, the vision, the identification

of this category? And what does it tell us about kind of the approach that you’re going to be taking to innovation. As an example, as

an analogy for the type of approach you will be taking?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Well, when I started Masimo in ’89, literally the goal was

to solve the motion artifact, a false alarm problems with pulse oximetry. We knew majority of pulse oximetry alarms were false due to

people moving or having low blood flow. We literally back in ’89 that we, me, I thought if we could solve that problem, we could help

patients not die of opioid overdose in hospitals because, even in hospitals, in the postsurgical wards where people are given pain medication,

they weren’t being continuously monitored.

Every 2 to 3 hours a nurse would come and check on them, roll in, something to test them. And sometimes they’d find them dead.

This is called dead in bed phenomenon. So that was the goal back in ’89, to hopefully fix that. Then I was actually sitting at a, had

a dinner conversation with President Clinton, where he began talking about how he lost a few of his friends’ kids to opioid overdose

and how I said 40, 50 thousand people at the time were dying from opioid overdose.

And I didn’t know about that problem. I literally did not know that problem. I went home that night and I said how do we solve it and

I sketched out the plan for it. The next morning, I went to my team told them about it. They got excited, we began developing. So how

do we figure out? We try trying to go after problems that nobody else is going after.

We try to figure out what is it, that has not been done and try to fix it. Things that we think we know how to fix. And that’s really

how we approach from solving the pulse oximetry motion problems to doing Rainbow, doing hospital automation, telehealth, telemonitoring,

and now this whole deal with dealing with the opioid epidemic in our country.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Very helpful context and background. Thank you

for that, Joe. Maybe we can talk pivoting a little bit to everything that’s going on with Politan, as it relates to obviously, some of

the noise around governance and so on and so forth.

Can you give, maybe this audience a little bit of perspective as to what some of the takeaways from your perspective should be in terms

of where things are now, where things are going and how we should be thinking about that?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Well, first of all, I hope one day Quentin will

serve on the Board of everyone who put him on my Board. Because, we warned them that we didn’t think he’d be helpful and he has

been nothing but disruptive. He has come on our Board, has had no input, no suggestions. All he does is take, take, take, take, ask for

gobs of data that has nothing to do with his board seat.

And now it’s clear why. He wanted it for the next proxy, even though he said he didn’t want control, it’s clear he always wanted

control. Why he wants control? I don’t know. I don’t understand his motivation at all and you guys don’t know what’s in our product pipeline.

He does. I sat down with him. He knows what’s coming in the next five years.

He knows how revered I am and we are by our team, by the partners, by the customers and the fact that he’s now trying to get control,

which in that process he has to get rid of me—just isn’t what’s right for the stock. And we never understood who his investors are,

we tried to get him to tell us. He won’t tell us who his investors are.

So that’s got to be the other motivation, it can’t be the stock price because the best way to get to a good return is to not

do what he’s trying to do. So where are we with that? He’s fighting it, we tried, my Board, God bless them. I can’t believe they’re

still trying, they are still in here. We lost two great Board members because of that toxicity and the threats and the problems that he

brought in.

But thank God, Craig Reynolds is hanging in there, Bob Chapek is hanging in there and I think we’re going to get through this. I feel

like this time the calculus is different. People know, it’s not just what’s it going to hurt to have two seats out of five or two seats

out of seven, by the way we want to get to seven, but he’s threatening us that if we bring more Board members, he will sue us again. So

we have to wait till the AGM before we, and I want to take it to 9 or 10, just in case we lose anybody else. I don’t want to get back

down to five anymore. But hopefully this time, shareholders will see what he didn’t do and what he did do and they will not do what he’s

asking for because, if they do, it is going to be really bad.

I feel like I’m responsible to tell you this, he is a Board member. As a Board member, he has a duty of candor to the stockholders and

I read his proxy and almost every paragraph is either an outright lie or half-truth and that’s not how you are supposed to behave with

your stockholders and I think people think if you’re filing something with the SEC, and you are a Board member afraid of prison time,

you’re telling the truth. And it’s just been a crazy period like I said, I wish upon all the people who voted him in on my Board that

he will sit on their board one day and they can see what we went through the last year.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Thank you for the perspective, Joe. Very, very helpful and

appreciate the candor. Maybe just finally, in closing, as we think about the next 12, 24 months, for Masimo again, going back to that

inflection point in multiple ways in terms of where you are. What are the two or three things, you would say investors should be really

looking out for that, they should be tracking, being excited about and kind of following as they view you over the next 12, 24 months?

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Well, I think, as Micah said, things have stabilized

again. I think those in the room who are engineers, whenever we have a big impulse, there’s going to be ringing. So the COVID is

100 once hope, every 100 year impulse and it was fun at the beginning, not as humanity, but as people were saying, we’re the only game

in town.

We were getting an incredible demand and then we saw the oscillation afterwards. I think we’re done with that. I think we’re back to the

way we used to do things which is what I think 24 out of 25 quarters, we met, beat and raised. I think we’re back in that world again.

And I think with the host of products the FDA cleared last year, even if we didn’t get anything else done, the next couple of years, it’s

going to be great. Everything really, really humming.

| ● | Bennett Blau, Managing Director, Investment Banking, Goldman Sachs |

Absolutely. Well, look, I just want to thank both of you

for coming today. It’s truly our privilege to host you and so great seeing you both and thank you again.

| ● | Joe Kiani, Chairman of the Board, Chief Executive Officer, Masimo Corporation |

Thank you for having us.

| ● | Micah Young, Chief Financial Officer, Executive Vice President, Masimo Corporation |

Thank you.

# # #

Forward-Looking Statements

This communication includes forward-looking statements as defined

in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in

connection with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others,

statements regarding the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) of Masimo and the potential

stockholder approval of the Board’s nominees, the proposed separation of Masimo’s consumer business, including the

potential timing and structure thereof and the expectation that the proposed separation will maximize shareholder value or be the

best path for success, any potential joint venture involving Masimo’s consumer business and any proposed terms thereof,

Masimo’s expectations regarding the performance of the health care business and the impact of the proposed separation on the

future performance of the health care business and earnings power, Masimo’s expectations regarding roll out of new products

and timing thereof, Masimo’s estimates and expectations for the pulse oximetry global market size and revenue forecasts and

goals for operating margins, the expected treatment of Masimo’s existing debt in the event of a potential separation, and

Masimo’s plans for any potential acquisitions, share buybacks or alternative capital allocation methods. These forward-looking

statements are based on current expectations about future events affecting Masimo and are subject to risks and uncertainties, all of

which are difficult to predict and many of which are beyond Masimo’s control and could cause its actual results to differ

materially and adversely from those expressed in its forward-looking statements as a result of various risk factors, including, but

not limited to (i) uncertainties regarding a potential separation of Masimo’s consumer business, (ii) uncertainties regarding

future actions that may be taken by Politan in furtherance of its nomination of director candidates for election at the 2024 Annual

Meeting, (iii) the potential cost and management distraction attendant to Politan’s nomination of director nominees at the

2024 Annual Meeting and (iv) factors discussed in the “Risk Factors” section of Masimo’s most recent reports filed

with the Securities and Exchange Commission (“SEC”), which may be obtained for free at the SEC’s website at

www.sec.gov. Although Masimo believes that the expectations reflected in its forward-looking statements are reasonable, the Company

does not know whether its expectations will prove correct. All forward-looking statements included in this communication are

expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of today’s date. Masimo does not undertake any obligation to update, amend or

clarify these statements or the “Risk Factors” contained in the Company’s most recent reports filed with the SEC,

whether as a result of new information, future events or otherwise, except as may be required under the applicable securities

laws.

Additional Information Regarding the 2024 Annual Meeting of Stockholders

and Where to Find It

The Company has filed a

revised preliminary proxy statement and draft form of GOLD proxy card with the U.S. Securities and Exchange Commission (the

“SEC”) in connection with its solicitation of proxies for its 2024 Annual Meeting. The proxy statement is in preliminary

form and the Company intends to file and mail a definitive proxy statement to its stockholders. THE COMPANY’S STOCKHOLDERS ARE

STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING GOLD PROXY

CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any

amendments or supplements to the proxy statement and other documents as and when filed by the Company with the SEC without charge

from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company, its directors

and certain of its executive officers and employees may be deemed to be participants in connection with the solicitation of proxies

from the Company’s stockholders in connection with the matters to be considered at the 2024 Annual Meeting. Information

regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive

officers in the Company is included in Amendment No. 1 to the Company’s Annual Report on Form 10-K for the fiscal year ended

December 30, 2023 under the heading “Security Ownership of Certain Beneficial Owners and Management”, filed with the SEC

on April 29, 2024, which can be found through the SEC’s website at

https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000093755624000027/masi-20231230.htm and in the Company’s revised

preliminary proxy statement for the 2024 Annual Meeting, which was filed with the SEC on June 10, 2024 and can be found through the

SEC’s website at https://www.sec.gov/ix?doc=/Archives/edgar/data/937556/000121390024051353/ea0206756-02.htm, and will be

included in the Company’s definitive proxy statement for the 2024 Annual Meeting, once available. More detailed and updated

information regarding the identity of these potential participants, and their direct or indirect interests of the Company, by

security holdings or otherwise, will be set forth in the definitive proxy statement for the 2024 Annual Meeting and other materials

to be filed with the SEC. These documents, when filed, can be obtained free of charge from the sources indicated above.

10

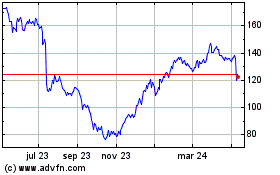

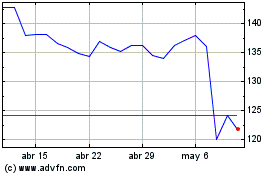

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024