UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 11)*

Masimo Corporation

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

574795100

(CUSIP Number)

Quentin Koffey

Politan Capital Management LP

106 West 56th Street, 10th

Floor

New York, New York 10019

646-690-2830

With a copy to:

Richard M. Brand

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

212-504-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 12, 2024

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * | The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 574795100 |

|

Page 2 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Management LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

* All percentage calculations set forth herein

are based upon the aggregate of 53,182,247 shares of Common Stock outstanding as of June 13, 2024, as reported in the Issuer’s definitive

proxy statement, filed with the Securities and Exchange Commission (the “SEC”) on June 17, 2024 (the “Issuer

Proxy Statement”).

| CUSIP No. 574795100 |

|

Page 3 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Management GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

* All percentage calculations set forth herein

are based upon the aggregate of 53,182,247 shares of Common Stock outstanding as of June 13, 2024, as reported in the Issuer Proxy Statement.

| CUSIP No. 574795100 |

|

Page 4 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Partners GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

* All percentage calculations set forth herein

are based upon the aggregate of 53,182,247 shares of Common Stock outstanding as of June 13, 2024, as reported in the Issuer Proxy Statement.

| CUSIP No. 574795100 |

|

Page 5 |

| 1 |

NAME OF REPORTING PERSON

Quentin Koffey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

1,228 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

1,228 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,714,746* |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%** |

| 14 |

TYPE OF REPORTING PERSON

IN |

* Includes Mr. Koffey’s 1,228 restricted

share units granted to him on June 26, 2023 by virtue of his position as a director on the Board and that vest upon the earliest of the

first anniversary of the grant date, the date of the next annual meeting of stockholders, or a change in control of the Issuer.

** Mr. Koffey’s percentage calculations

set forth herein are based upon the aggregate of 53,182,247 shares of Common Stock outstanding as of June 13, 2024, as reported in the

Issuer Proxy Statement.

| CUSIP No. 574795100 |

|

Page 6 |

This Amendment No. 11 to Schedule

13D (this “Amendment No. 11”) amends and supplements the Schedule 13D filed on August 16, 2022 (as amended and supplemented

through the date of this Amendment No. 11, collectively, the “Schedule 13D”) by the Reporting Persons, relating to

the common stock, par value $0.001 per share, of Masimo Corporation, a Delaware corporation

(the “Issuer”). Capitalized terms not defined in this Amendment No. 11 shall have the meaning ascribed to them in the

Schedule 13D.

The information set forth

in response to Item 4 below shall be deemed to be a response to all Items where such information is relevant.

|

ITEM 4. PURPOSE OF TRANSACTION

Item 4 of the Schedule 13D is hereby amended

and supplemented with the following information:

On July 12, 2024, Politan,

a Reporting Person, sent a letter to the Board, regarding empty voting. As discussed in the Issuer Proxy Statement, stockholders of record

of the Issuer may revoke their proxy or change their vote at any time before the final vote tabulation at the annual meeting of the Issuer’s

stockholders. The letter is qualified in its entirety by reference to Exhibit 99.13, which is attached hereto and is incorporated herein

by reference. |

| ITEM 7. |

MATERIAL TO BE FILED AS AN EXHIBIT |

| Exhibit 99.1 |

Joint Filing Agreement among Politan Capital Management LP, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, and Quentin Koffey* |

| |

|

| Exhibit 99.2 |

Trading Data* |

| |

|

| Exhibit 99.3 |

Trading Data* |

| |

|

| Exhibit 99.4 |

Form of Verified Complaint, filed with the Delaware Court of Chancery on October 21, 2022* |

| |

|

| Exhibit 99.5 |

Form of Second Amended and Supplemented Complaint, filed as an Exhibit to the Motion for Leave to Amend with the Delaware Court of Chancery on March 10, 2023* |

| Exhibit 99.6 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and Michelle Brennan* |

| Exhibit 99.7 |

Trading Data* |

| Exhibit 99.8 |

Press Release, dated June 26, 2023* |

| Exhibit 99.9 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and each of William Jellison and Darlene Solomon* |

| Exhibit 99.10 |

Demand Letter, dated May 8, 2024* |

| Exhibit 99.11 |

Politan Letter, dated May 9, 2024* |

| Exhibit 99.12 |

Politan Letter, dated July 3, 2024* |

| Exhibit 99.13 |

Politan Letter, dated July 12, 2024 |

*Previously filed.

| CUSIP No. 574795100 |

|

Page 7 |

SIGNATURES

After reasonable inquiry and to the best of each

of the undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in this statement is

true, complete and correct.

Date: July 12, 2024

| |

POLITAN CAPITAL MANAGEMENT LP |

| |

|

| |

By: |

Politan Capital Management GP LLC, |

| |

|

its general partner |

| |

|

|

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

POLITAN CAPITAL MANAGEMENT GP LLC |

| |

|

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

POLITAN CAPITAL PARTNERS GP LLC |

| |

|

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

QUENTIN KOFFEY |

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| CUSIP No. 574795100 |

|

Page 8 |

INDEX TO EXHIBITS

|

Exhibit |

Description |

| Exhibit 99.1 |

Joint Filing Agreement among Politan Capital Management LP, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, and Quentin Koffey* |

| |

|

| Exhibit 99.2 |

Trading Data* |

| |

|

| Exhibit 99.3 |

Trading Data* |

| |

|

| Exhibit 99.4 |

Form of Verified Complaint, filed with the Delaware Court of Chancery on October 21, 2022* |

| |

|

| Exhibit 99.5 |

Form of Second Amended and Supplemented Complaint, filed as an Exhibit

to the Motion for Leave to Amend with the Delaware Court of Chancery on March 10, 2023*

|

| Exhibit 99.6 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and Michelle Brennan* |

| Exhibit 99.7 |

Trading Data* |

| Exhibit 99.8 |

Press Release, dated June 26, 2023* |

| Exhibit 99.9 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and each of William Jellison and Darlene Solomon* |

| Exhibit 99.10 |

Demand Letter, dated May 8, 2024* |

| Exhibit 99.11 |

Politan Letter, dated May 9, 2024* |

| Exhibit 99.12 |

Politan Letter, dated July 3, 2024* |

| Exhibit 99.13 |

Politan Letter, dated July 12, 2024 |

*Previously filed.

Exhibit 99.13

106

West 56th Street, 10th Floor

New York, New York 10019

July 12, 2024

Via Email

The Board of Directors

c/o Masimo Corporation

52 Discovery

Irvine, CA 92618

Re: Letter to Board of Directors on behalf of Politan Capital

Management LP

Dear Members of the Board:

Last week I raised serious

concerns about an empty voting scheme we believe is being perpetrated by a friend of Joe Kiani to manipulate the outcome of the upcoming

annual meeting.

This investor, who it has

now come to light is RTW Investments based on Glass Lewis’s report and subsequent media reports, accumulated a 9.9% voting stake

through a trading strategy known as “record date capture” and “empty voting” that involves securing a large voting

position divorced from actual economic exposure.

RTW and Mr. Kiani were the

two earliest major investors to deliver proxies — well before other major holders voted. As Craig Reynolds, Masimo’s Lead

Independent Director and Chair of all three Board committees knows, RTW’s portfolio manager responsible for the Masimo investment

and Mr. Kiani are friends who have dinner together with their spouses and are both members of the Orange County community. This relationship

is underscored by Mr. Kiani being featured on RTW’s website praising the investment firm as a “trusted partner” and

noting that Mr. Kiani is an investor in RTW’s funds. A research firm has also reported on additional connectivity between RTW’s

CIO and Mr. Kiani.

Glass Lewis issued its recommendation

last night, and we are grateful that it decided to recommend that stockholders vote for both Politan nominees. We were also troubled by

the facts that emerged in the recommendation regarding RTW's effort to influence Glass Lewis by claiming they were a 9.9% holder. The

relevant discussion from Glass Lewis follows:

“We do note that on July 1, 2024,

we received an inbound contact from RTW Investments (“RTW”) representing its ownership interest in Masimo as 9.9% and

expressing support for Masimo nominees Chavez and Kiani, opposition to Politan’s nominees and a willingness to engage further

in relation to such views. On July 8, 2024, we responded to RTW by offering engagement windows on July 9 and July 10, 2024. To date,

RTW has not responded to these offers. Per S&P Capital IQ, RTW was the owner of a 2.8% interest in Masimo as of March 31, 2024,

indicating the ownership position communicated in the July 1, 2024, email represented an increase of approximately 3.6x by RTW over

the course of approximately three months.

Page 1 of 2

We are presently unable to ascertain

RTW’s current economic exposure and have no information regarding the presence of any agreements or understandings in relation to

the voting of RTW’s shares. We do, however, acknowledge the specified ownership interest and implied rate of accrual appear to align

with certain of the concerns raised by Politan in the letter filed with the SEC on July 8, 2024. If additional materials corroborating

Politan’s concerns subsequently emerge, whether prior to or following the forthcoming meeting, we would view such circumstances

as a highly inappropriate manipulation of the shareholder franchise and a severe indictment of Masimo's credibility and corporate

governance.”

Unknown to Glass

Lewis, at the time of RTW’s solicitation to them, we believe RTW had already disposed of the vast majority of its position. Indeed,

by July 1, the brokerage firm associated with RTW held less than 2% of Masimo’s shares even though RTW retained its voting power

and had cast its 9.9% proxy for Mr. Kiani, in effect disenfranchising every other stockholder. Describing themselves to Glass Lewis as

a 9.9% owner is yet another instance of manipulation that benefits nobody other than Mr. Kiani.

The Board's refusal

to do the right thing here further underscores the critical need at Masimo for a majority of truly independent directors. Instead of conducting

any real inquiry or taking any action to protect stockholders from what we believe to be blatant manipulation and vote rigging, the Board

has refused to even meet to discuss the matter and has attacked Politan for raising the issue and proposing solutions. To protect the

integrity of the vote, Masimo should demand that RTW abstain from voting any shares that exceed its economic interest — or set a

record date that would allow stockholders to vote promptly in a fair election untainted by empty voting. The company should disclose any

and all contact it has had with RTW. We find the company’s categorical denials of any involvement to be difficult to believe. The

Board should also hire independent counsel to investigate the matter, determine if Mr. Kiani and RTW are a group and pursue disgorgement

of any Section 16 short-swing profits.

In light of the

additional information that has surfaced and the Board’s failure to take any action, we feel it is necessary to make this letter

public so investors understand the status of the situation and our heightened concern.

Thank you,

Quentin Koffey

Managing Member

Page 2 of 2

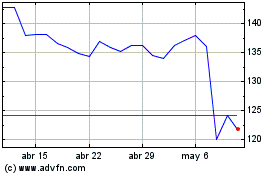

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

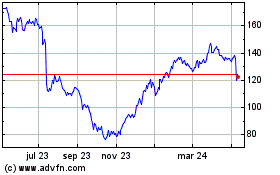

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024