UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed

by a Party other than the Registrant x

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use

of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

¨ Soliciting

material Pursuant to §240.14a-12

Masimo Corporation

(Name of Registrant as Specified In Its Charter)

POLITAN CAPITAL MANAGEMENT LP

POLITAN CAPITAL MANAGEMENT GP LLC

POLITAN CAPITAL PARTNERS GP LLC

POLITAN CAPITAL NY LLC

POLITAN INTERMEDIATE LTD.

POLITAN CAPITAL PARTNERS MASTER FUND LP

POLITAN CAPITAL PARTNERS LP

POLITAN CAPITAL OFFSHORE PARTNERS LP

QUENTIN KOFFEY

MATTHEW HALL

AARON KAPITO

WILLIAM JELLISON

DARLENE SOLOMON

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee paid previously

with preliminary materials.

¨ Fee computed

on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Supplemental Proxy Materials

The disclosures in this filing are intended to

supplement the disclosures that Politan Capital Management LP, a Delaware limited partnership (“Politan”), together

with the other participants in the solicitation, previously made with respect to Masimo Corporation, a Delaware corporation (the “Company”)

in its definitive proxy statement filed with the Securities and Exchange Commission (the “SEC”) on June 21, 2024 (the

“Proxy Statement”) and certain definitive additional materials (together with the Proxy Statement, the “Solicitation

Materials”). These disclosures should be read in conjunction with the Solicitation Materials and the other filings Politan

has submitted to the SEC with respect to the Company. To the extent that the information set forth herein differs from or updates information

contained in the Solicitation Materials, the information set forth herein shall supersede or supplement the information in the Solicitation

Materials. Defined terms used but not defined herein have the meanings set forth in the Proxy Statement.

On July 15, 2024, the Company filed a complaint

(the “Complaint”) in the United States District Court for the Central District of California against Politan, Politan

Capital Management GP LLC, Politan Capital Partners GP LLC, Politan Capital NY LLC Politan Intermediate Ltd., Politan Capital Partners

Master Fund LP, Politan Capital Partners LP, Politan Capital Offshore Partners LP, Quentin Koffey, Michelle Brennan, Matthew Hall, Aaron

Kapito, William Jellison, and Darlene Solomon (collectively, the “Politan Defendants”). The Complaint seeks, among

other relief, a declaration that the nomination notice for Mr. Jellison and Dr. Solomon did not comply with the Company’s Fifth

Amended and Restated Bylaws, an injunction preventing Politan from voting any proxies it received by means of issuing misleading proxy

statements, and an order invalidating any such proxies.

Politan denies all allegations in the Complaint.

In particular, Politan has never had any contact with the law firm representing the plaintiff in the derivative action against Masimo’s

Board described below. Politan has no idea what the genesis of this false and defamatory accusation is. Politan views this allegation

as a continuation of a pattern of Masimo making unsubstantiated and conspiratorial claims about Mr. Koffey and Politan. Politan

is confident that these frivolous claims will be successfully defeated.

Politan believes that the Complaint is completely

without merit and is nothing more than an eleventh-hour attempt to interfere with stockholder voting rights. Much of the purported conduct

in the Complaint is alleged to have taken place months ago, and it is more than conspicuous that the Company decided to file the Complaint

shortly after Institutional Shareholder Services and Glass, Lewis & Co. recommended that shareholders vote for Mr. Jellison and Dr.

Solomon.

Nevertheless, to moot unmeritorious disclosure

claims, to avoid nuisance, potential expense, and delay, and to provide additional information to shareholders of the Company, Politan

has determined to voluntarily supplement the Proxy Statement by providing a copy of the Complaint to all shareholders and describing its

allegations below. The Complaint is attached hereto as Exhibit A and Politan refers shareholders to the Complaint for a complete recitation

of its contents. Nothing in this supplement to the Proxy Statement shall be deemed an admission of the legal necessity or materiality

under applicable laws of any of the disclosures set forth herein. To the contrary, Politan specifically denies all allegations in the

Complaint, including, without limitation, that any additional disclosure was or is required.

In the Complaint, Masimo alleges four causes of

action. First, the Complaint alleges that the Politan Defendants violated Section 14(a) of the Exchange Act (15 U.S.C. § 78n) and

SEC Rules 14a-9 (17 C.F.R. § 240.14a-9), 14a-12 (17 C.F.R. § 240.14a-12), and 14a-101 (17 C.F.R. § 240.14a-101)) by filing

false and misleading proxy materials or permitting their names to be used in connection with false and misleading proxy materials. The

proxy materials are allegedly false and misleading because they allegedly contain false and misleading statements about and omit details

regarding: (i) Mr. Koffey’s alleged “secret relationship” with Wolf Haldenstein Adler Freeman & Herz LLP (“Wolf

Haldenstein”), a law firm that represents the plaintiffs in a derivative action against Masimo’s Board, and that he is

“conspiring” with the firm against the Company’s interests; (ii) Mr. Koffey’s proposed terms for a potential spinoff

transaction and Mr. Koffey and Ms. Brennan’s alleged manipulation of the Special Committee; (iii) a potential joint venture transaction

and Mr. Koffey’s objections to it; (iv) Mr. Kiani’s purported entitlement to 2.7 million restricted stock units if the Mr.

Jellison and Dr. Solomon are elected to the Board; (v) the onboarding process for Mr. Koffey and Ms. Brennan, the information provided

to them, and their refusal to sign certain financial reports; and (vi) the Board’s oversight of the whole-company sale process.

Second, the Complaint alleges that Mr. Koffey

and Ms. Brennan breached their fiduciary duty of loyalty as members of the Board through the above-mentioned disclosure violation, as

well as (i) Mr. Koffey’s alleged “secret relationship” with Wolf Haldenstein, (ii) Mr. Koffey’s purportedly “sabotaging”

a spin-off deal, (iii) Mr. Koffey refusing to consider or support a potential joint venture until after the 2024 Annual Meeting, and (iv)

Mr. Koffey and Ms. Brennan allegedly disregarding their responsibility to fulfill their duties as directors, including by refusing to

sign certain financial statements. The Complaint also alleges that Mr. Koffey and Ms. Brennan breached their fiduciary duty of care based

on the conduct described in (i) through (iv) in this paragraph.

Finally, the Company asserts a breach of contract

claim against certain of the Politan Defendants alleging that the nomination notice for Mr. Jellison and Dr. Solomon did not comply with

the Company’s Bylaws because it failed to disclose that Mr. Koffey allegedly had been “secretly collaborating” with

Wolf Haldenstein against Masimo’s Board. Based on that alleged failure to disclose, Masimo contends that, under the Bylaws, the

Chairperson of the 2024 Annual Meeting has the authority to declare that the nomination notice shall not be presented at the 2024 Annual

Meeting and shall be disregarded. Mr. Kiani is the Chairperson who has this purported authority.

Politan denies all allegations in the Complaint,

including, without limitation, the false and defamatory allegation that Mr. Koffey is in any way involved with Wolf Haldenstein, and intends

to defend against them vigorously.

Exhibit A: Complaint

| ATTOR NEY S AT LA W

ORANGE COUN TY

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

LATHAM & WATKINS LLP

Michele D. Johnson (Bar No. 198298)

Jordan D. Cook (Bar No. 293394)

650 Town Center Drive, 20th Floor

Costa Mesa, CA 92626-1925

T: (714) 540-1235 / F: (714) 755-8290

michele.johnson@lw.com

jordan.cook@lw.com

Colleen C. Smith (Bar No. 231216)

12670 High Bluff Drive

San Diego, California 92130

T: (858) 523-5400 / F: (858) 523-5450

colleen.smith@lw.com

Attorneys for Plaintiff Masimo Corporation

UNITED STATES DISTRICT COURT

CENTRAL DISTRICT OF CALIFORNIA

MASIMO CORPORATION,

Plaintiff,

v.

POLITAN CAPITAL

MANAGEMENT LP, POLITAN

CAPITAL MANAGEMENT GP LLC,

POLITAN CAPITAL PARTNERS GP

LLC, POLITAN CAPITAL NY LLC,

POLITAN INTERMEDIATE LTD.,

POLITAN CAPITAL PARTNERS

MASTER FUND LP, POLITAN

CAPITAL PARTNERS LP, POLITAN

CAPITAL OFFSHORE PARTNERS

LP, QUENTIN KOFFEY, MICHELLE

BRENNAN, MATTHEW HALL,

AARON KAPITO, WILLIAM

JELLISON, DARLENE SOLOMON,

Defendant(s).

CASE NO. 8:24-CV-1568

VERIFIED COMPLAINT FOR

VIOLATIONS OF THE FEDERAL

SECURITIES LAWS, BREACHES OF

FIDUCIARY DUTY, AND BREACH OF

CONTRACT

DEMAND FOR JURY TRIAL

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 1 of 74 Page ID #:1 |

| ATTOR NEY S AT LA W

ORANGE COUN TY i

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

TABLE OF CONTENTS

Page

I. NATURE OF THE CASE ................................................................... 1

II. THE PARTIES ..................................................................................... 8

III. JURISDICTION AND VENUE ........................................................ 10

IV. FACTUAL BACKGROUND ............................................................ 11

A. Under Joe Kiani’s Leadership, Masimo Stockholders

Have Benefitted From Its Legacy of Innovation and

Historically Strong Financial Performance........................................ 11

B. Masimo’s Other Independent Directors—Craig Reynolds

and Robert Chapek—Are Highly Qualified and

Committed to Delivering Long-Term Value for

Stockholders ....................................................................................... 12

C. Koffey and Politan Launched a “War” on Masimo and Mr. Kiani With the Ultimate Goal of Taking Control of

the Company ...................................................................................... 14

D. Once Elected, The Politan Directors Refuse to Fulfill

Their Duties as Directors in Order to Lay the

Groundwork for a Second Proxy Contest for Control of

the Company ...................................................................................... 17

E. Koffey Sabotages the Spin-Off Deal He Himself

Proposed ............................................................................................. 21

F. Koffey Sabotages a Potentially Value-Maximizing Joint

Venture and Furnishes the Invalid Nomination Notice ..................... 25

G. Koffey Betrays His Fiduciary Duties to Serve Masimo

and Its Stockholders by Secretly Collaborating With

Lawyers Who Are Pursing Litigation Against the Board .................. 28

H. Politan Files Its Incomplete Nomination Notice and False

and Misleading Proxy Materials ........................................................ 29

V. FALSE AND MISLEADING STATEMENTS ................................. 30

A. False and Misleading Statements and Omissions

Regarding the Politan Directors’ Commitment to Acting

in the Best Interests of Stockholders and Maximizing

Stockholder Value .............................................................................. 32

B. False and Misleading Statements and Omissions

Regarding Koffey’s Proposed Terms for a Potential Spin-Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 2 of 74 Page ID #:2 |

| ATTOR NEY S AT LA W

ORANGE COUN TY ii

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Off Transaction and the Politan Directors’ Manipulation

of the Special Committee ................................................................... 36

C. False and Misleading Statements and Omissions

Regarding a Potential Joint Venture and Koffey’s

Objections to It ................................................................................... 40

D. False and Misleading Statements and Omissions

Regarding Kiani’s Employment Agreement...................................... 45

E. False and Misleading Statements and Omissions

Regarding the Comprehensive Information Provided to

the Politan Directors .......................................................................... 47

F. False and Misleading Statements and Omissions

Regarding the Board’s Oversight of a Potential Whole-Company Sale Process ....................................................................... 55

VI. POLITAN’S NOMINATION NOTICE IS INVALID ...................... 58

VII. IRREPARABLE HARM AND INADEQUATE

REMEDIES AT LAW ....................................................................... 59

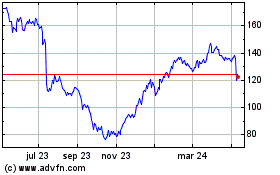

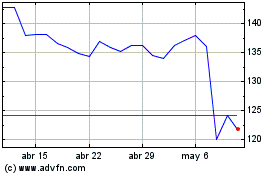

VIII. DEFENDANTS’ ACTIONS DEPRESS STOCK AND

WASTE RESOURCES ...................................................................... 60

IX. COUNT ONE ..................................................................................... 61

X. COUNT TWO .................................................................................... 63

XI. COUNT THREE ................................................................................ 66

XII. COUNT FOUR .................................................................................. 67

XIII. PRAYER FOR RELIEF .................................................................... 69

XIV. JURY DEMAND ............................................................................... 70

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 3 of 74 Page ID #:3 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 1

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Plaintiff Masimo Corporation (“Masimo” or the “Company”) brings this

complaint against Defendants Politan Capital Management LP (“Politan”), Politan

Capital Management GP LLC, Politan Capital Partners GP LLC, Politan Capital

NY LLC, Politan Intermediate Ltd., Politan Capital Partners Master Fund LP,

Politan Capital Partners LP, Politan Capital Offshore Partners LP (collectively, the

“Politan Funds”), William Jellison and Darlene Solomon (the “Nominee

Defendants”), Quentin Koffey and Michelle Brennan (the “Politan Directors”),

Matthew Hall, and Aaron Kapito (together, “Defendants”).

I. NATURE OF THE CASE

1. This case arises out of a battle for control of Southern California-based, multi-billion-dollar health technology company Masimo. On one side is

Masimo and its management, led by the Company’s inspirational founder,

Chairman, and CEO, Joe Kiani. On the other side is Politan, a New York hedge

fund led by Quentin Koffey, its avaricious founder and activist investor, who has

been “waging war” for the last two years against Masimo in an attempt to

improperly gain control of the Company through lies and deceit.

2. Koffey is desperate to take control of Masimo at any cost, for personal

gain and to the ultimate detriment of the Company and long-term stockholder

value—using lies, misrepresentations, mischaracterizations, and deceit, as well as

misusing confidential Company information he gained from inside the Masimo

boardroom itself. And it appears to be working. Voting has already begun and in

just the past few days, both Glass Lewis and ISS, two proxy advisory firms, have

advised Masimo stockholders to vote their proxies for the Nominee Defendants,

citing Defendants’ lies as the truth.

3. Mr. Kiani founded Masimo in his Orange County garage in 1989.

Since then, Masimo has grown into a leading health technology and consumer

electronics company that employs nearly 8,000 people in California and around the

world and generates $2 billion in revenues per year. Masimo manufactures life-Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 4 of 74 Page ID #:4 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 2

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

saving patient monitoring devices and technologies, including non-invasive

sensors, patient management tools, and telehealth platforms. It is most famous for

its revolutionary, life-saving pulse oximetry monitoring technology. Since going

public in 2007, Masimo has year after year delivered an average annual revenue

growth rate of 12%, which is more than double the market growth rate.

4. In 2022, Koffey set his sights on Masimo. Koffey believed Masimo’s

stock price was temporarily depressed following its announcement that it planned

to acquire a consumer electronics company. Politan surreptitiously acquired a

stake of over 8%. Koffey then demanded representation on Masimo’s Board of

Directors (the “Board”).

5. Masimo was rightfully concerned about acquiescing to Koffey’s

demands for these Board seats, given that Koffey (i) refused to disclose his

intentions and backers and (ii) has a demonstrated record of value destruction at

the companies he targets. Koffey and Politan have launched successful proxy

contests against Centene Corporation and Azenta Life Sciences, both of which

have underperformed the S&P 500 since Koffey came onto the scene. When

Masimo refused to gift Board seats to Koffey, he vowed to “wage war” on Masimo

and Mr. Kiani.

6. In 2023, Politan nominated Koffey and Defendant Michelle Brennan

to serve on Masimo’s Board. Masimo’s Board then had six directors, serving

three-year terms. Only two directors were up for reelection that year. Koffey

represented both publicly to Masimo’s stockholders and privately to Masimo that

he had no intention of trying to take control of Masimo and claimed that he wanted

to work with Mr. Kiani. Indeed, pushing out Mr. Kiani, the driving force behind

Masimo’s success since its inception, would have been catastrophic.

7. Koffey and Brennan stood for election based on these and other

falsehoods, and under the auspices of minority voice in the boardroom were

elected. In this way, Koffey and Politan took control of two out of Masimo’s six

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 5 of 74 Page ID #:5 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 3

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

board seats. And while Koffey represented to Masimo and its stockholders that he

would stop there, he did not.

8. Mr. Kiani and the other members of the Board took Koffey at his

word that he would work in the best interests of Masimo and its stockholders, and

not for his own personal interests. So Mr. Kiani, the other directors, and the

Masimo management team welcomed Koffey and Brennan to the Board. They

provided Koffey and Brennan with extensive information through a weeks’-long

onboarding process.

9. Little did Mr. Kiani and the others know, Koffey and Brennan had no

intention of fulfilling their duties as directors. Despite the Masimo management

team’s efforts to bring the new directors up to speed and engage them in Board

discussions and decisions, it quickly became clear that they had no intention of

working toward maximizing value for stockholders or participating meaningfully

in corporate governance at all.

10. Since being elected, neither Koffey nor Brennan has ever proposed a

single concrete step (let alone a plan) to maximize long-term stockholder value.

Instead, Koffey and Brennan embarked on a value-wrecking campaign to take over

Masimo in 2024 without paying a control premium to all of Masimo’s

stockholders. Accordingly, they purposefully buried their heads in the sand,

refused to educate themselves on Masimo’s financial information, refused to

engage with Masimo’s outside auditors, refused to approve and sign Masimo’s

periodic filings with the Securities and Exchange Commission (“SEC”), and

falsely claimed that they had not been provided with important financial

information—all in an effort to undermine the Company’s credibility with

investors and at the risk of jeopardizing timely SEC filings which (if successful)

would have led to a stock price drop and a significant loss of stockholder value.

11. That was not enough. In a private meeting, Mr. Kiani proposed to

Koffey spinning off Masimo’s consumer products business (the “Consumer

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 6 of 74 Page ID #:6 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 4

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Products Business”). Koffey initially supported the idea and sent Mr. Kiani a term

sheet for the proposed deal. In February 2024, the Board set up an independent

committee to oversee the proposed spin-off—which Koffey would chair. Koffey

proceeded to undermine the spin-off process by intentionally withholding

information from other committee members and demanding new terms that made

the spin-off untenable. Koffey successfully tanked the deal and has blamed Mr.

Kiani for the entire process, based on falsehoods.

12. While the spin-off process was dying thanks to Koffey’s efforts,

Masimo’s management received an offer from a third-party (the “Potential Joint

Venture Partner”) to buy the majority of the consumer business (the “Potential

Joint Venture”). Together, Masimo’s management and non-Politan Board

members decided to move forward with plans to separate the consumer business

from Masimo’s legacy healthcare business. Masimo announced this plan to the

market on Friday, March 22, 2024, and the stock price spiked 14% in after-hours

trading on the news. This stock price increase ran counter to Koffey’s efforts to

gain control of Masimo. The separation proposal was highly favorable for both

Masimo and its stockholders. It would have given Masimo the ability to sell 70-

85% of its Consumer Product Business at an attractive price, while paying down

debt and providing stockholders with some residual ownership in the consumer

business. But a successful joint venture would undermine Koffey’s efforts to take

control of the Company, so he refused to support the Potential Joint Venture and

demanded to delay any decision on the Potential Joint Venture until after the

annual stockholder meeting and election. Koffey once again sabotaged Masimo’s

share price gains by announcing—on the very next business day—that he would

nominate two so-called “independent” candidates for Masimo’s Board and

disparaging Mr. Kiani and the rest of the Board. Koffey also claimed—without

basis—that any separation of its Consumer Products Business done by Masimo’s

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 7 of 74 Page ID #:7 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 5

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

management and the non-Politan Board members would be fraught with self-dealings and would damage Masimo.

13. Now, Koffey and Politan look to complete their overthrow attempt by

launching their second proxy contest in as many years, this time seeking full

control over Masimo, without regard to the harm to stockholders. Koffey has gone

so far as to secretly collaborate with plaintiffs’ lawyers that have brought and are

currently pursuing litigation against Masimo’s Board—all the while with full

inside knowledge of Masimo’s confidential information given Koffey’s position on

the Board — thereby jeopardizing Masimo’s position in this and related litigation

in a blatant breach of his fiduciary obligations to Masimo and its stockholders.

14. If successful, Koffey will have realized his goal of taking control of

Masimo: his hedge fund will have appointed four of the six directors, and Koffey

will thus be able to direct Masimo as he pleases without the payment of a control

premium to the stockholders. Politan’s claims that it did not seek to control

Masimo have been exposed as lies. If Koffey succeeds in taking control based on

these and the many other lies outlined herein, he will be empowered to dismantle

Masimo in any form or fashion he wishes.

15. Defendants’ lies and half-truths violate Section 14(a) and Rule 14a-9

of the Securities Exchange Act of 1934. The Politan Proxy Materials, as defined

infra at Section IV.H, contain a litany of actionable false and misleading

statements and omissions including with respect to:

Concealing Koffey’s secret relationship with plaintiffs’ counsel in an

action proceeding against Masimo’s Board;

Misrepresenting the proposed spin-off of the Consumer Products

Business and the special committee overseeing that potential

transaction;

Misrepresenting the Potential Joint Venture, including false claims

that the Potential Joint Venture would personally benefit Mr. Kiani;

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 8 of 74 Page ID #:8 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 6

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Falsely claiming that Masimo will not owe Mr. Kiani 2.7 million

restricted stock units (“RSUs”) under the operative change-in-control

provisions if Mr. Kiani is not reelected to the Board;

Mischaracterizing the information Masimo and its management

provided the Politan Directors during their tenure on the Board,

including how that information relates to the Politan Directors’ refusal

to approve and sign any of Masimo’s quarterly or annual reports since

joining the Board; and

Misstating the Board’s grant of authority to management in

connection with a potential sale of the Company.

16. Defendants’ actions violate Article I of Masimo’s Fifth Amended and

Restated Bylaws, dated as of February 5, 2023 (the “Bylaws”), which requires that

nominees make all disclosures required by Section 14(a).

17. Koffey and Brennan have violated their fiduciary duties, including

their duty of loyalty and care by, among other things:

Aiding plaintiffs’ counsel in litigation against Masimo’s Board;

Consciously disregarding and refusing to perform their duties as

directors;

Issuing false and misleading proxy materials;

Sabotaging the very spin-off deal Koffey proposed for Masimo’s

Consumer Products Business;

Interfering with the potentially value-maximizing joint venture by

refusing to consider or support the Potential Joint Venture until after

the annual meeting, presumably to prevent Masimo from negotiating a

favorable deal that might harm the Politan election changes; and

Using Masimo’s confidential information they learned as Board

members to serve their own personal interests in the proxy contest.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 9 of 74 Page ID #:9 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 7

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

18. Masimo now has no choice but to seek the Court’s intervention to set

the record straight and prevent irreparable harm to the Company and its

stockholders. Without immediate intervention, Koffey will take control of Masimo

through lies and deceit, only to destroy the value that Mr. Kiani and others have

spent decades building for the benefit of all stockholders.

19. Plaintiff seeks the following relief: (1) an order declaring that the

Politan Proxy Materials on Schedule 14A and all amendments violate Section

14(a) of the Securities Exchange Act, and Rules 14a-9, 14a-12, and 14a-101; (2) an

order declaring the Nomination Notice (defined below) does not comply with

Masimo’s Bylaws; (3) an order enjoining Defendants from voting any proxies

received by means of the misleading Politan Proxy Materials; (4) an order

invalidating any proxies Defendants or other persons acting in concert with them

obtained pursuant to the misleading Politan Proxy Materials; and (5) an order

requiring Defendants to correct their material misstatements and omissions, and to

furnish accurate disclosures required by law before the annual stockholder

meeting.

20. Masimo further seeks relief against Koffey and Brennan for violating

their fiduciary duties under Delaware law. When they were elected to Masimo’s

Board, Koffey and Brennan assumed a fiduciary duty to serve Masimo and all of

Masimo’s stockholders — not just Politan. Instead, they have cast aside their

fiduciary obligation in their single-minded pursuit of control of Masimo. Koffey’s

sole focus over the past year at Masimo has been to position himself better for this

year’s proxy fight, by which he hopes to take control of the Company. And the

effect of his takeover campaign will not only be to harm the Company by

removing its founder and CEO — an outcome that even Koffey realizes would be

catastrophic — but to deliver control into the hands of a New York hedge fund

without the payment of a control premium to all of Masimo’s stockholders.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 10 of 74 Page ID #:10 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 8

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

21. The immediate relief that Masimo seeks is the most limited available

under the circumstances: corrections to Politan’s false and misleading proxy

materials so that stockholders can cast an informed vote.

II. THE PARTIES

22. Plaintiff Masimo is a publicly traded Delaware corporation. It is

headquartered at 52 Discovery, Irvine, California 92618.

23. Defendant Politan is a Delaware limited partnership formed in 2021

with its principal place of business at 106 West 56th Street, 10th Floor, New York,

New York 10019. Politan serves as an investment advisor to certain affiliated

funds, including Politan Capital Offshore Partners LP, Politan Capital Partners LP,

and Politan Capital Partners Master Fund LP. Koffey is the Managing Partner and

Chief Information Officer of Politan.

24. Defendant Politan Capital Management GP LLC is a Delaware

limited liability company with its principal place of business at 106 West 56th

Street, 10th Floor, New York, New York 10019. The principal business of Politan

Capital Management GP LLC is to serve as the general partner of certain affiliated

funds including the Politan Funds.

25. Defendant Politan Capital Partners GP LLC is a Delaware limited

liability company with its principal place of business at 106 West 56th Street, 10th

Floor, New York, New York 10019.

26. Defendant Politan Capital NY LLC is a New York limited liability

company and is the “record stockholder” that holds shares in Masimo. Politan

Capital NY LLC’s principal business is to invest in securities and serve as record

holder of shares of companies in which the Politan Funds invest. Politan Capital

NY LLC’s principal place of business is at 106 West 56th Street, 10th Floor, New

York, New York 10019.

27. Defendant Politan Intermediate Ltd. is an exempted company

organized under the laws of the Cayman Islands with its principal place of business

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 11 of 74 Page ID #:11 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 9

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

at 106 West 56th Street, 10th Floor, New York, New York 10019. The principal

business of Politan Intermediate Ltd. is to invest in securities.

28. Defendant Politan Capital Partners Master Fund LP is an exempted

limited partnership organized under the laws of the Cayman Islands with its

principal place of business at 106 West 56th Street, 10th Floor, New York, New

York 10019. The principal business of Politan Capital Partners Master Fund LP is

to invest in securities.

29. Defendant Politan Capital Partners LP is a Delaware limited

partnership with its principal place of business at 106 West 56th Street, 10th Floor,

New York, New York 10019. The principal business of Politan Capital Partners

LP is to invest in securities.

30. Defendant Politan Capital Offshore Partners LP is an exempted

company organized under the laws of the Cayman Islands with its principal place

of business at 106 West 56th Street, 10th Floor, New York, New York 10019. The

principal business of Politan Capital Offshore Partners LP is to invest in securities.

31. Defendant Matthew Hall is a Politan investment analyst. His

principal business address is 106 West 56th Street, 10th Floor, New York, New

York 10019.

32. Defendant Aaron Kapito is a Politan investment analyst. His principal

business address is 106 West 56th Street, 10th Floor, New York, New York 10019.

33. Defendant Quentin Koffey is the Managing Partner and Chief

Investment Officer of Politan and the Managing Member of Politan Capital

Management GP and Politan Capital Partners GP. His principal business address

is 106 West 56th Street, 10th Floor, New York, New York 10019. Koffey is a

member of Masimo’s Board and was appointed in June 2023. Koffey is a member

of the Audit Committee.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 12 of 74 Page ID #:12 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 10

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

34. Defendant Michelle Brennan resides in Spearfish, South Dakota.

Brennan was a Politan nominee to Masimo’s Board and was appointed in June

2023.

35. Politan holds approximately 8.9% of the outstanding shares of

Masimo’s Common Stock, based on 53,085,556 shares of Common Stock

outstanding as of March 30, 2024, as reported in the Company’s Q1 2024 10-Q.

36. Defendant William Jellison is a Politan nominee to the Masimo

Board. His principal business address is 9946 W. Gull Lake Drive, Richland,

Michigan 49083.

37. Defendant Darlene Solomon is a Politan nominee to the Masimo

Board. Her principal business address is 17 Valley Oak, Portola Valley, California

94028.

III. JURISDICTION AND VENUE

38. This action arises under Section 14(a) of the Securities Exchange Act

of 1934, 15 U.S.C. §§ 78 m(d), 78n(a), the rules and regulations promulgated

thereunder, and common law.

39. This Court has jurisdiction over the subject matter of this action based

on 28 U.S.C. § 1331 and Section 27 of the Securities Exchange Act of 1934, as

amended, 15 U.S.C. § 78aa.

40. This Court has personal jurisdiction over the Defendants because each

of them has sufficient minimum contacts in the State of California to satisfy

California’s long-arm statute and constitutional due process requirements as

Defendants are soliciting the votes of stockholders of Masimo, which is

headquartered in California.

41. Venue in this District is proper pursuant to 28 U.S.C. § 1391 and

Section 27 of the Securities Exchange Act of 1934, as amended, 15 U.S.C. § 78aa,

because various acts or transactions constituting the offenses herein occurred

within the Central District of California. Among other things, (i) the misleading

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 13 of 74 Page ID #:13 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 11

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Politan Proxy Materials were transmitted to and received by Masimo whose

headquarters and principal place of business is in this District, (ii) the misleading

Politan Proxy Materials were filed with the SEC in anticipation and for the purpose

of their distribution to Masimo’s stockholders, including stockholders located

within this District, in order to obtain proxies to be used at Masimo’s 2024 Annual

Meeting, and (iii) the 2024 Annual Meeting currently will be hosted from

Masimo’s headquarters, which are located within this District.

IV. FACTUAL BACKGROUND

A. Under Joe Kiani’s Leadership, Masimo Stockholders Have

Benefitted From Its Legacy of Innovation and Historically Strong

Financial Performance

42. Masimo is a medical technology company based in Irvine, California

that develops, manufactures, and markets non-invasive health monitoring

technologies. Masimo has been publicly traded since its initial public offering on

the NASDAQ stock exchange on August 8, 2007.

43. Masimo was a garage start-up founded in 1989 by Mr. Kiani in

Mission Viejo, California, who sought to solve a pulse-oximetry problem experts

thought was unsolvable. Masimo solved the problem by inventing Signal

Extraction Technology (“SET”), which enables non-invasive measurement of a

patient’s pulse and blood-oxygen saturation even during patient motion and low

blood flow. Masimo’s market-leading SET allows clinicians to detect life-threatening events, reduce blindness in premature babies, prevent deaths in general

care environments, and reduce deaths after surgery. Masimo manufactures and

sells pulse oximeters that professional caregivers use to monitor over 200 million

patients a year.

44. Beyond pulse-oximetry, Masimo offers additional noninvasive

measurement technologies, including patient wearable devices that have enabled a

host of hospital automation and telehealth medical monitoring solutions.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 14 of 74 Page ID #:14 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 12

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

45. Masimo’s market-leading position has driven strong financial results.

Since going public in 2007, Masimo has delivered average annual revenue growth

of 12%, which is more than double the rate of market growth.

46. As Masimo developed new technologies for healthcare providers to

improve patient outcomes, it also sought to expand its business into the home.

Masimo had traditionally sold products to hospitals, physicians’ offices, and long-term care facilities, and lacked a distribution network to sell consumer products.

Before entering the consumer market, Masimo considered building its own

distribution channel or buying companies that had existing networks. Ultimately,

at the recommendation of its independent Board members, Masimo decided to buy

Sound United, a company that sold and distributed premium audio products to

consumers around the world.

47. Sound United had extensive consumer relationships and distribution

expertise, which Masimo planned to leverage to accelerate distribution of the

Masimo’s expanding portfolio of consumer-focused products such as baby

monitors, smart bands, smart watches, ear buds, hearing aids, and headphones.

48. Some investors questioned this strategic decision. But Masimo

believed Sound United had what Masimo lacked and needed.

B. Masimo’s Other Independent Directors—Craig Reynolds and

Robert Chapek—Are Highly Qualified and Committed to

Delivering Long-Term Value for Stockholders

49. Masimo’s Board is comprised of five members: Joe Kiani, Craig

Reynolds, Robert Chapek, Quentin Koffey, and Michelle Brennan. The sixth and

seventh board seats are vacant due to two recent resignations. One of the Board

seats will be filled at the upcoming annual meeting. Masimo has nominated

Christoper Chavez for the seat.

50. Mr. Kiani has been on the Board since 1989. He is listed on over 500

patents and patent applications in signal processing, sensors, and patient

monitoring, which have been fundamental to Masimo’s ability to innovate and

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 15 of 74 Page ID #:15 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 13

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

differentiate itself from competitors. No one understands Masimo’s history,

culture, and technology better than he does. His impact on Masimo’s technology

and market position is second to none and cannot be overstated.

51. Mr. Reynolds is Masimo’s Lead Independent Director. He brings

over three decades of experience in the healthcare and medical device industry and

possesses a deep understanding of industrial management, strategy, and medical

device products. He has a wealth of experience in medical device products, which

he developed through leadership positions at a wide variety of medical device

companies including Cereve, Healthdyne, and Phillips-Respironics Home Health

Solutions. His medical device experience is complemented by his board

experience, having served as a director of Vapotherm, Symmetry Surgical,

Symmetry Medical, and Respironics.

52. Mr. Chapek joined the Board in 2024. He brings to Masimo’s Board

a rich background in the media and consumer industry, with nearly three decades

of experience including his role as CEO of The Walt Disney Company from 2020

to 2022. His leadership roles at Disney, including his previous positions

overseeing Disney Parks, Experiences, and Products and Disney Consumer

Products, have provided him with a deep understanding of global operations and

consumer engagement. Mr. Chapek’s insights into consumer behavior and market

dynamics are particularly valuable as Masimo continues to expand its consumer

health technologies and seeks to engage with a broader consumer audience.

53. Mr. Chavez, a current nominee, is similarly qualified in the medical

device industry. He is the former CEO and President of TriVascular, the former

President of St. Jude Medical, and the former CEO and President of Advanced

Neuromodulation Systems. Mr. Chavez also served as the Chairman of the

Medical Device Manufacturers Association. He has over thirty years of experience

with medical devices and has a strong understanding of the healthcare industry and

its operations.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 16 of 74 Page ID #:16 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 14

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

C. Koffey and Politan Launched a “War” on Masimo and Mr. Kiani

With the Ultimate Goal of Taking Control of the Company

54. The remaining members of the Masimo Board—Quentin Koffey and

Michelle Brennan—were elected during the 2023 annual stockholder meeting,

after a contentious proxy fight.

55. While Brennan has some medical device industry experience, Koffey

does not. Koffey, who describes himself as a “veteran activist,” founded Politan in

2021 and serves as its Managing Partner and Chief Investment Officer. Before

founding Politan, Koffey was a partner or portfolio manager at several well-known

activist investment firms and hedge funds, including Elliott Management, D.E.

Shaw (where he led activist campaigns against Lowe’s Companies and Bunge

Ltd.), and the Senator Investment Group (as the head of the firm’s activism

strategy). Koffey has never held a senior management position at any medical or

consumer technology company (or any public company), has no prior investment

experience in the medical device industry, and had no public company board

experience before joining Masimo’s Board in 2023. In connection with the prior

proxy contest, he sued the Company and its current and former directors, an action

taken in support of his long-term goal of gaining control of Masimo.

56. Politan and Koffey are well known for seeking corporate shake-ups at

companies in which they invest, often at the expense of long-term stockholder

value. For instance, Politan made headlines in late 2021 when its campaign for

board seats at Centene, a publicly traded managed care company, resulted in the

appointment of five new directors and resignation of the company’s CEO and

founder. Politan’s activism at Centene did not translate into success for the

business. Since Koffey implemented these changes, Centene has consistently

underperformed the S&P 500. Further, before Koffey intervened at the end of

2021, Centene’s revenue had grown from approximately $75 billion in 2019 to

approximately $126 billion in 2021. After Koffey’s activist campaign, Centene

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 17 of 74 Page ID #:17 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 15

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

announced that it incurred a $172 million loss in the second quarter of 2022 and

that it would be forced to divest certain international business units.

57. Koffey also targeted Azenta, a biotechnology company based in

Massachusetts. After Politan disclosed in November 2023 that it nominated a

director candidate and entered into a non-disclosure agreement with Azenta, the

company added two directors following dialogue with Politan, and Politan

withdrew its nomination. Since those directors joined the Board, Azenta’s CEO

announced his retirement, and the stock has underperformed the S&P 500.

58. Koffey operates with control as his clear agenda: in all but one of his

past campaigns, the CEO has been replaced within one year of the campaign.

59. Koffey launched his campaign to take control of Masimo on August

16, 2022, when Politan disclosed it had begun amassing an ownership stake in

Masimo. Politan’s Schedule 13D filing that day revealed it had acquired beneficial

ownership of approximately 4.4 million shares—amounting to 8.4% of Masimo’s

outstanding common stock. That ownership percentage later increased to 8.8% by

September 27, 2022. That ownership position has since risen through purchases of

other securities, including swaps.

60. Koffey’s intentions became clear. Activism news source, The 13D

Monitor, published an article the same day—August 16, 2022—reporting

(presumably, based on information planted by Politan and Koffey) that Politan

would “work quietly and behind the scenes” with Masimo “to try to get one or two

seats on the Board,” but that if Masimo “does not settle, Politan … will … go

multiple years and multiple proxy fights if that is what is necessary.”

61. Koffey sought a meeting with Masimo’s management team, a request

which Mr. Kiani and others readily accommodated. The meeting took place on

September 2, 2022. Koffey and two other Politan principals met with Mr. Kiani

and other members of Masimo’s senior management at the Company’s

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 18 of 74 Page ID #:18 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 16

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

headquarters, in Masimo’s Discovery Lab, a showroom for Masimo’s products and

technologies.

62. Neither Koffey nor any other Politan representative asked about

Masimo’s business or strategy during the meeting. The Masimo management team

asked Koffey and the other representatives from Politan multiple times about their

strategy and vision for Masimo and solicited their input, but none of them offered a

new strategic vision for Masimo.

63. Koffey expressed no interest in learning about Masimo; indeed,

Masimo offered to provide him and Politan with confidential information under a

non-disclosure agreement, an offer which Koffey flatly rejected.

64. Instead, Koffey made his intentions clear during this meeting and

delivered an ultimatum: If Mr. Kiani supported Koffey’s nomination to serve as a

director, then Koffey promised he would be Mr. Kiani’s “biggest cheerleader” and

would help get the “Joe Kiani Multiples” for stockholders again. If, however, Mr.

Kiani did not express his support, Koffey would wage war against Masimo and

win the board seats anyway.

65. Masimo’s Board concluded it would not be in Masimo’s best interest

to invite Koffey to join the Board. On April 29, 2023, Koffey made good on his

promise to seek election, and through Politan, nominated himself and Brennan to

serve on the Board.

66. Notwithstanding his private threat to “wage war” against Masimo,

Koffey publicly told the Company’s stockholders in a May 30, 2023 press release

that “Masimo’s claims Politan is seeking ‘control’ of the Company are absurd,”

and stated that “Politan is seeking refreshed corporate governance at Masimo

befitting a public company, not corporate control—and any suggestion otherwise is

completely baseless.” These statements were false. Koffey’s objective from the

beginning was to take control of Masimo, not to support management or participate

in any meaningful way in running the Company.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 19 of 74 Page ID #:19 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 17

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

67. Based on these and other false statements, on June 26, 2023, Masimo

stockholders elected Koffey and Brennan to the Board.

D. Once Elected, The Politan Directors Refuse to Fulfill Their Duties

as Directors in Order to Lay the Groundwork for a Second Proxy

Contest for Control of the Company

68. While the 2023 proxy contest was contentious, the Masimo

management team stood ready to welcome Koffey and Brennan and provide them

with a full introduction to Masimo and its business. Both Koffey and Brennan

were provided with an extensive onboarding process, including (i) extensive

Board-related information, including copies of all Board and Board Committee

meeting minutes, quarterly financial updates, Board books dating back to 2021, a

Board calendar, a list of Board Committees and members, a list of Masimo’s

consultants and amounts paid for 2022 and 2023, all Board policies and

procedures, a signature authority matrix, a director search status report from

Masimo’s independent director search firm, forecasts and results by product

platform for 2021 and 2022, and forecasts by product platform for 2023; (ii)

engagement letters with Masimo’s independent financial advisor, director search

firm, and an organizational chart for Masimo’s healthcare business; (iii) updates on

litigation; (iv) a half-day meeting with Mr. Reynolds and the then-Chairman of the

Audit Committee; (v) an hour-long meeting with Masimo’s independent financial

advisor managing the strategic alternatives review process; and (vi) a meeting with

Mr. Kiani and Mr. Reynolds with an extensive presentation regarding Masimo’s

past, present, and 5-year product and partnership roadmap. The Politan Directors’

onboarding also included a number of meetings with key leaders and certain

Company outside advisors, during which Koffey and Brennan had every

opportunity to ask questions and obtain additional information about Masimo. Mr.

Kiani even invited Koffey and Brennan to an all-day meeting, where he personally

walked through Masimo’s business, product road map, competitors and strategic

plans.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 20 of 74 Page ID #:20 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 18

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

69. After the onboarding process, the Politan Directors also received: (i)

thousands of pages of information about Masimo’s financial plans for 2024

through 2033; (ii) details regarding Masimo’s quarterly closing procedures; (iii) a

detailed walk through of financial statements, including details and discussions of

income statement, balance sheet, and cash flow statement items; (iv) a regulatory

and quality review; (v) Masimo’s compliance policies and related information

regarding whistleblower history, significant accounting matters, SOX compliance

program, and internal audit function; and (vi) information related to a number of

other specific accounting, business, and finance items including sensor discounts,

debt covenants, inventory valuation, the Sound United impairment analysis, details

on consumer efforts spending, and Malaysia operations.

70. While on the Board, the Politan Directors continued to have full

access to management to answer questions. From June 24, 2023, through May 23,

2024, Masimo call logs reflect that Koffey spoke with Mr. Kiani eighteen separate

times, Micah Young, Masimo’s Chief Financial Officer, twenty separate times, and

Tom McClenahan, Masimo’s General Counsel, ten separate times. These private

calls were in addition to meetings and in-person interactions between Koffey and

Masimo management.

71. Koffey and Brennan—along with all other members of the Board—

also received regular quarterly updates from Masimo’s CEO, CFO, and General

Counsel. These updates took place on August 1, 2023, October 31, 2023, February

13, 2024, and April 30, 2024, and were in addition to several interim Board

meetings and Board updates. Each of these quarterly meetings involved

presentation and discussion of key financial information including with respect to

market studies, product roadmaps, and business cases for Masimo products. Other

information included merger and acquisition updates, detailed overviews of both

healthcare and non-healthcare revenues, revenue growth, non-GAAP operating

profit and growth, and earnings per share. Directors were briefed on full-year

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 21 of 74 Page ID #:21 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 19

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

guidance for all Company segments and reviewed, among other matters,

anticipated litigation costs, performance compensation, and expense reductions.

These segment updates further included breakdowns by product, key engineering

projects, including rainbow®, soon-to-be-launched Root2, 2024 cost reduction

initiatives, and the inventory reduction plan. Koffey was also provided access to

Masimo’s banker and had numerous conversations with them starting immediately

after he was appointed to the Board.

72. In addition, as a member of the Audit Committee, Koffey routinely

met with Grant Thornton, Masimo’s independent auditor, and members of the

Masimo management team and had the opportunity to ask questions about any and

all aspects of Masimo’s financials, including its impairment analysis for the

Consumer Products Business segment.

73. Despite receiving extensive onboarding, obtaining all requested

information, and attending all board meetings, all Audit Committee meetings, and

all Nominating, Compliance, and Corporate Governance Committee meetings that

have been held since the Politan Directors joined the Board, the Politan Directors

have consistently refused to fulfill their fiduciary duties to Masimo and the

stockholders that elected them. They have abstained from certain critical votes,

failed to participate or ask questions, and refused—without basis—to sign off on

Masimo’s financial statements.

74. For example, on August 4, 2023, the Audit Committee of the Board

held a meeting during which it reviewed and considered, among other things,

Masimo’s Quarterly Report on Form 10-Q for the second quarter of 2023 and

associated earnings release. The Audit Committee met again on November 6,

2023, to review and consider Masimo’s Quarterly Report on Form 10-Q for the

third quarter of 2023 and associated earnings release. At that meeting,

management provided a draft 10-Q, discussed substantive changes to the 10-Q

compared to the last quarter, and discussed the timing for filing. Disregarding his

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 22 of 74 Page ID #:22 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 20

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

obligation as a member of the Audit Committee to oversee the financial statements

and internal controls of the Company, Koffey consistently refused to sign off on

the Masimo financial statements and abstained from all votes to approve them.

75. Both Politan Directors refused to sign off on Masimo’s 2023 Annual

Report, despite having served on the Board for several months and having been

provided with voluminous information about Masimo, its products, and its

financials. On February 13, 2024, the CFO presented to the full Board, including

the Politan Directors, the final 2024 financial plan targets for revenue, gross

margin, operating expenses, operating profit, operating margin, non-operating

income / (expense), income taxes, shares outstanding, and non-GAAP earnings per

share. Furthermore, the revenue, non-GAAP operating profit and non-GAAP

earnings per share financial plan targets were used for setting Executive

performance-based compensation, which was approved by the Compensation

Committee. The CFO presented key operational metrics and historical trends for

operating cash flow, free cash flow, capital expenditures, net working capital, days

sales outstanding, inventory days on hand, days payables outstanding, cash

conversion cycle, net debt and net leverage ratio.

76. The same day, the Chief Operating Officer and the COO of the

Consumer Products Business presented the 2024 operating plans for the healthcare

and consumer businesses. This included detailed information for revenue (by

product category and geography), industry and market data, hospital contracting,

key engineering projects, marketing programs, and new product introductions, as

well as initiatives for inventory improvement, manufacturing efficiencies, cost

reduction and margin expansion.

77. On February 26, 2024, the Board—including Koffey and Brennan—

met to discuss and finalize Masimo’s annual report on Form 10-K for the fiscal

year ended December 30, 2023 (the “2023 Annual Report”). The Politan Directors

did not ask any questions and did not object to any statements or information in the

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 23 of 74 Page ID #:23 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 21

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

report, yet still refused to sign off on the report, citing insufficient information (but

no particulars).

78. The next day, on February 27, 2024, the Board reconvened to discuss

the 2023 Annual Report in advance of the filing deadline. The heads of Finance &

Accounting, Cybersecurity, Compliance, Quality, and Supply Chain made

presentations. After those presentations, Koffey confirmed to Mr. Reynolds that

he had everything he needed and was satisfied with the information provided.

Confirmation notwithstanding, Koffey and Brennan still declined to sign off on the

2023 Annual Report, claiming Koffey’s lawyer advised him not to sign the 10-K

because it would look unusual for him to do so, given he spent months

complaining about Masimo’s governance. Brennan followed Koffey’s lead.

Confirming that this excuse was mere pretense to set up a second proxy fight—the

second battle in Koffey’s “war” for control—the Politan Directors actually

encouraged other members of the Board to sign off on that same report.

Tellingly, at no point has either of them identified anything in the financial

statements they believe to be unreliable or misstated.

E. Koffey Sabotages the Spin-Off Deal He Himself Proposed

79. On top of the Politan Directors’ refusal to engage with Masimo’s

financial statements, they have consistently declined to offer constructive ideas and

strategies for the Company. During a meeting in Boston among Adam Mikkelson,

then an independent Masimo director, Mr. Reynolds, and Koffey in August 2023,

shortly after the election of the Politan Directors, Koffey was asked what his ideas

and strategies for the Company were. In response, Koffey offered none, other than

to say that a major stockholder would like to see Masimo get rid of the Consumer

Products Business. When asked what price Masimo should be willing to take for

that business, Koffey replied that the stockholders would be happy if Masimo gave

the Consumer Products Business away for nothing.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 24 of 74 Page ID #:24 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 22

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

80. Despite this lack of engagement or new ideas by Koffey, over the next

several months, Mr. Reynolds, Mr. Kiani, and others continued to attempt to

engage with Koffey and solicit ideas from the Politan Directors, with no

meaningful input from them. Nevertheless, Mr. Kiani reached out to Koffey and

invited him to dinner on a trip to New York. The two met for dinner on January

29, 2024. During this dinner meeting in New York, Mr. Kiani proposed a potential

spin-off of Masimo’s Consumer Products Business from its professional healthcare

businesses to create two separate public companies, each with a distinctive

investment profile that would allow investors greater flexibility with respect to

their holdings of Masimo.

81. Koffey responded that he was surprised to have such a productive

meeting. Koffey then suggested that Mr. Kiani should instead be given control of

the new company through super-majority voting shares to avoid Mr. Kiani having

to spend his funds on an uncertain investment. Koffey also proposed that Masimo

and the new company should split the costs and any judgments in pending

litigation. Mr. Kiani agreed.

82. The next day, January 30, 2024, Koffey contacted Mr. Kiani

expressing Koffey’s enthusiasm for a potential spin-off and asked Mr. Kiani to

meet with him. The two met later that day. At that meeting, Koffey presented Mr.

Kiani with a one-page term sheet that largely reflected the terms the two men had

discussed the previous night.

83. The term sheet prepared by Koffey included Koffey’s proposals that

(1) Mr. Kiani would be paid all amounts due to him under his employment

agreement in connection with the proposed transaction, and (2) Mr. Kiani would be

provided an opportunity to acquire either voting control or majority ownership of

the spun-off company’s stock, including in exchange for consideration to be

determined at a later time. Specifically, the term sheet proposed by Koffey,

entitled “Outline of Plan to Create Two New Companies,” proposed a “New

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 25 of 74 Page ID #:25 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 23

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Masimo: control held by Joe as Chair & CEO” and “Control: Joe to get either high

vote stock or 50%+ of New Masimo.” With respect to Mr. Kiani’s employment

agreement, Koffey’s proposal contemplated, “Employment Contract: Special

Payment not forfeited and instead triggered by above.” During this meeting and at

the February 13 Board meeting, Koffey explained that he proposed that Mr. Kiani

receive high-vote stock in the new company so Mr. Kiani “wouldn’t have to deal

with another asshole like me going forward.”

84. The Politan Proxy Materials falsely state that on February 3, 2024,

Mr. Kiani’s counsel sent Koffey “a substantially revised term sheet that

significantly expanded on Mr. Kiani’s earlier positions,” which included additional

“demands at this stage” for supermajority voting stock and payments under Mr.

Kiani’s employment agreement. Politan Preliminary Proxy at 11. This is wrong.

These were Koffey’s proposals, not Mr. Kiani’s “demands.” Nor were these new,

significantly expanded terms; instead, these terms were discussed at the meeting

between Koffey and Mr. Kiani days before as evidenced by the term sheet he

handed to Mr. Kiani. And the additional proposed terms regarding the retention of

the Company’s corporate headquarters with its innovative Discovery building,

sufficient cash to provide working capital to the new company ($120M-$150M),

and change-in-control payments for employees of the new business were likewise

discussed in that January 30 meeting.

85. A special committee was formed at a Board meeting on February 13,

2024 for the spin-off. The special committee consisted of Brennan, former director

Rolf Classon, Koffey, and Mr. Reynolds (collectively, the “Special Committee”).

Mr. Kiani had proposed that Mr. Reynolds be the Chair, but Koffey insisted he be

the Chair. Mr. Kiani supported his request, and Koffey was appointed as the lead

director of the Special Committee. At no point did Mr. Kiani stand in the way of

the formation of the Special Committee.

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 26 of 74 Page ID #:26 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 24

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

86. Instead of sharing the original term sheet with the Special Committee,

on March 11, 2024, the Special Committee’s legal counsel sent Mr. Kiani’s

personal legal counsel a new term sheet with proposed transaction terms for the

spin off that were entirely different from the transaction contemplated in the term

sheet Koffey proposed in February. Among other things, the new term sheet

proposed that the consumer business should not own the intellectual property that

was needed in pending litigation and would have far more liabilities than Koffey

and Mr. Kiani had discussed, leaving it insolvent.

87. Mr. Kiani asked Koffey why the Special Committee’s counsel had

proposed a new set of terms in March that did not reflect the February term sheet.

Mr. Kiani expressed his view that the March term sheet was not feasible because

the spun-off consumer business would not be viable; it would not be sufficiently

capitalized nor have access to assets that would allow it to pursue a viable

standalone market strategy. Koffey represented that the March proposal reflected

the views of the Special Committee. This, too, was false. Mr. Kiani contacted

Special Committee members Mr. Reynolds and Mr. Classon, who both agreed that

the March term sheet represented an entirely new proposed transaction that they

likewise believed would lead to an unviable consumer business.

88. Rather than end the process, later in March, Masimo’s independent

directors sent Koffey an updated proposal for a potential spin-off transaction.

Koffey responded that he no longer wanted to engage with the process. Even after

Mr. Kiani said that he would forgo any controlling interest in the consumer

business, and leave Masimo as its CEO and Chairman, resulting in no change of

control special payments being required, Koffey refused to engage.

89. Politan’s Proxy Materials state that on “March 12, 2024, Mr. Kiani

called Mr. Koffey and said that he would seek to dissolve the Special Committee.”

Politan Preliminary Proxy at 11. This did not happen. Instead, on April 30, 2024,

Mr. Kiani stated that he would forego any controlling interest in the consumer

Case 8:24-cv-01568 Document 1 Filed 07/15/24 Page 27 of 74 Page ID #:27 |

| ATTOR NEY S AT LA W

ORANGE COUN TY 25

VERIFIED COMPLAINT FOR VIOLATIONS OF

FEDERAL SECURITIES LAWS

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

business and would remain Chairman and CEO of Masimo. Mr. Classon,

however, resigned from the Special Committee because he disagreed with the way

Koffey conducted the Special Committee business. In response, Koffey threatened

Mr. Classon and demanded that he fall into line with the Special Committee, or he

would run a proxy contest against him and ruin his reputation. Ultimately, with

Mr. Kiani’s potential conflicts removed, and a process established to proceed with

the separation without related party issues, the Board dissolved the Special

Committee with a commitment that if related party transactions arose with Mr.

Kiani, then the Board would consider those without the involvement of Mr. Kiani.

F. Koffey Sabotages a Potentially Value-Maximizing Joint Venture

and Furnishes the Invalid Nomination Notice

90. At the same time that Koffey was engaged in efforts to sabotage the

potential spin-off transaction, in March 2024, the Potential Joint Venture Partner

contacted Masimo’s management team expressing interest in exploring an

acquisition of a majority of the Consumer Products Business, the Potential Joint

Venture.