Marqeta Becomes First Issuer Processor in the US Certified to Enable Visa Flexible Credential

25 Julio 2024 - 7:00AM

Business Wire

Working with Visa and Affirm, Marqeta will

enable the ultimate flexible payment experience for consumers by

providing access to different funding sources on one payment card

for the first time

Marqeta (NASDAQ: MQ), the global modern card issuing platform

that enables embedded finance solutions for the world’s innovators,

today announced it is working with Visa and Affirm to offer the

Visa Flexible Credential, a single card product that can toggle

between payment methods, putting the power of choice in the hands

of the consumer. Marqeta achieved certification with Visa Flexible

Credential in May 2024, which will enable cardholders of Marqeta’s

participating customers to easily set parameters or choose whether

they use debit, credit, “pay-in-four” with Buy Now, Pay Later or

even pay using rewards points.

As previously announced, Visa Flexible Credential will be first

launching in the U.S. with Affirm later this year. This will

provide consumers with the potential opportunity to benefit from

Visa’s acceptance, the simplicity and ease of Marqeta’s platform,

and Affirm’s technology and underwriting capabilities in Buy Now,

Pay Later. Affirm's decision to have its industry-leading

technology and underwriting capabilities, beginning with Affirm

Card, run on Visa’s Flexible Credential demonstrates the

opportunities that can arise when issuer processors innovate like

Marqeta.

Consumers are increasingly seeking greater flexibility and more

options around ways to pay. The Marqeta State of Credit Report in

2023 found that when searching for their next credit card,

consumers surveyed reported being most influenced by the level of

flexibility and personalization available, with 46% citing

convenience as the biggest benefit of using credit cards.

Additionally, 71% of U.S. BNPL users surveyed would be interested

in accessing other financial services through their BNPL provider,

demonstrating the willingness for consumers to seek out additional

payment options that are the best fit for their current financial

situation and lifestyle.

Marqeta is the first issuer processor in the U.S. certified for

Visa Flexible Credential, enabling participating Marqeta customers

to offer multiple types of payment options on a single card,

creating a streamlined and frictionless payment experience

regardless of what payment method they choose. This also helps

Marqeta customers improve the consumer purchase experience and

increase merchant acceptance.

“Marqeta is at the forefront of what’s possible in payments.

We’re proud to be the first issuer processor in the U.S. certified

for Visa Flexible Credential,” said Simon Khalaf, CEO, Marqeta.

“Combining the ubiquity and acceptance of Visa, with Affirm’s

technology, underwriting and consumer experience with the

simplicity and seamlessness of Marqeta’s platform is a win-win-win

for consumers, merchants, and issuers. We look forward to

continuing to work with our partners to enable new technologies

that make payments simpler and more flexible for consumers, helping

them get the most out of their payment cards.”

About Marqeta (NASDAQ: MQ)

Marqeta’s modern card issuing platform empowers its customers to

create customized and innovative payment cards and embedded finance

offerings. Marqeta’s platform, powered by open APIs, gives its

customers the ability to build more configurable and flexible

payment experiences, accelerating product development and

democratizing access to card issuing technology. Its modern

architecture provides instant access to highly scalable,

cloud-based payment infrastructure that enables customers to launch

and manage their own card programs, issue cards and authorize and

settle transactions. Marqeta is headquartered in Oakland,

California and is certified to operate in more than 40 countries

globally. For more information, visit www.marqeta.com, Twitter and

LinkedIn.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, quotations and statements relating to changing

consumer preferences; increasing consumer adoption of certain

digital payment methods, products, and solutions; which payment,

banking, and financial services products and solutions may succeed;

technological and market trends; Marqeta’s business and growth;

Marqeta’s products and services; and statements made by Marqeta’s

senior leadership. Actual results may differ materially from the

expectations contained in these statements due to risks and

uncertainties, including, but not limited to, the following: any

factors creating issues with changes in domestic and international

business, market, financial, political and legal conditions; and

those risks and uncertainties included in the “Risk Factors”

disclosed in Marqeta's Annual Report on Form 10-K, as may be

updated from time to time in Marqeta’s periodic filings with the

SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in

this press release are based on information available to Marqeta as

of the date hereof. Marqeta disclaims any obligation to update any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725208527/en/

James Robinson 530-913-0844 jrobinson@marqeta.com

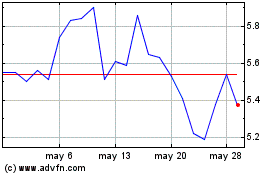

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

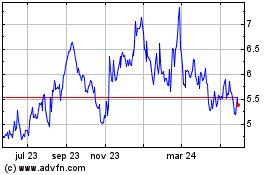

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024