New Marqeta Research Finds Tremendous Opportunity for Credit Providers to Rethink Customer Loyalty

29 Octubre 2024 - 5:00AM

Business Wire

- Even among consumers with no plans to apply

for a new card, 70% said they could be swayed with the right offer

or feature.

- Among US consumers surveyed who said they

missed a credit card payment in the past year, 57% said it was the

first time they had missed a payment.

- Nearly one-third (31%) of US consumers

surveyed report personalized rewards as a “need to have” for credit

card perks.

Traditional approaches to credit card loyalty have shifted as

more people use digital payments, and financial services companies

need to reinvent their approach to reflect the current reality,

according to new research out today from Marqeta (NASDAQ: MQ), the

global modern card issuing platform that enables embedded finance

solutions for the world’s innovators. The fourth annual State of

Credit Report, released today at Money2020 in Las Vegas surveyed

3,000 people, including 2,000 in the United States, about their use

of credit cards, Buy Now Pay Later products and preferences when

seeking out new cards. The company’s research found that among

people surveyed, credit card loyalty is close to nonexistent,

economic uncertainty is leading to more people struggling to pay

their credit card bills, and that people have high expectations for

what a credit card can provide, but they’re not getting their needs

met.

Even happy cardholders are on the lookout for better

options

Nearly three quarters (72%) of consumers who said they were

satisfied with their credit card still said they plan to apply for

a new card in the next year, and almost half (44%) of 18-43 year

olds surveyed in the US plan to apply for a credit card in the next

12 months. Even people without plans to apply for a card could be

swayed by the right offer. Eighty percent of US 18-43 year olds who

had no plans on applying for a card reported that the right feature

or reward could get them to apply for a new card, including cash

back of $100 or more (51%), 0% interest rate the first year (41%),

or a major points sign-up bonus (32%).

“As even the best brands know, customer loyalty is fragile. Even

among highly satisfied customers, people are always hunting for the

next best thing, and the traditional methods of building loyalty

haven’t caught up with the way people are using their cards today,”

said Todd Pollak, Chief Revenue Officer, Marqeta. “Brands that

don’t evolve to offer highly personalized, flexible card

experiences that consumers have come to expect will be left

behind.”

Expectations are high when it comes to credit cards, but

needs are not being met

Nearly one-third (32%) of US consumers surveyed said that they

have stopped using a credit card in the past 12 months. Of US

consumers who stopped using a credit card in the last year,

one-quarter (25%) said they got a new card that better fits their

needs, over one-third (36%) said the interest rate was too high,

and 24% said they needed a higher credit limit. When asked what

would lead them to use a credit card more frequently, US consumers

cited better rewards (44%), lower interest rates (37%), and low or

no annual fee (29%) as top reasons.

People surveyed want more personalization, more flexible options

and lower interest rates from their credit cards. They’re just not

getting what they’re looking for. Nearly one-third (31%) of US

consumers surveyed reported personalized rewards and faster access

to rewards (35%), as “needs to have” for credit card perks. Given

the economic environment, interest rates (44%) topped rewards (41%)

as the top feature consumers surveyed are looking for when

evaluating credit cards, with 39% of people surveyed looking for a

higher credit limit, up from 26% in 2023. In addition:

- Forty-two percent of US consumers surveyed would be interested

in a payment card that can switch between debit, credit and BNPL

features and capabilities, increasing to 59% of consumers 25-44

years old, and 67% of consumers with plans to apply for a new

credit card.

- Fifty-four percent of 18-34 year old US consumers surveyed

consider 24/7 dedicated concierge services as a standard card

feature, and 38% consider exclusive events a standard card feature

as well.

People rely on credit, but are struggling to keep up

While credit is critical to driving people’s livelihoods and

spending power, Marqeta’s new report shows that American consumers

are struggling. According to the Federal Reserve Bank of New York,

credit card debt was at a record high of $1.14 trillion as of the

second quarter of 2024, and the average credit card interest rate

was 21.76% as of October 2024, up five percentage points from

before the pandemic. Marqeta’s research found that 19% of US

consumers surveyed reported missing a credit card payment in the

past 12 months, with 57% of those missing a card payment for the

first time ever. In addition:

- Forty-one percent of 18-44 year olds surveyed in the US

reported their credit card debt is higher than it was 12 months

ago.

- Thirty-nine percent of US consumers surveyed delayed making a

major purchase on credit because of high interest rates.

- Buy Now, Pay Later (BNPL) services have helped consumers unlock

purchasing power during these fluctuating economic times, with 62%

of BNPL users surveyed reporting that BNPL has helped them make

ends meet in the past year, up from 46% in 2022.

To download the full report, please click here.

About Marqeta (NASDAQ: MQ)

Marqeta makes it possible for companies to build and embed

financial services into their branded experience—and unlock new

ways to grow their business and delight users. The Marqeta platform

puts businesses in control of building financial solutions,

enabling them to turn real-time data into personalized, optimized

solutions for everything from consumer loyalty to capital

efficiency. With compliance and security built-in, Marqeta’s

platform has been proven at scale, processing more than $200

billion in annual payments volume in 2023. Marqeta is certified to

operate in more than 40 countries worldwide and counting. Visit

www.marqeta.com to learn more.

About The 2024 State of Credit Report

Marqeta’s 2024 State of Credit survey was fielded by Propeller

Research in August 2024 on behalf of Marqeta, surveying 3,021

consumers ages 18 and up (2,020 in the US, 1,001 in the UK).

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, quotations and statements relating to changing

consumer preferences; increasing consumer adoption of certain

digital payment methods, products, and solutions; which payment,

banking, and financial services products and solutions may succeed;

technological and market trends; Marqeta’s business; Marqeta’s

products and services; and statements made by Marqeta’s senior

leadership. Actual results may differ materially from the

expectations contained in these statements due to risks and

uncertainties, including, but not limited to, the following: any

factors creating issues with changes in domestic and international

business, market, financial, political and legal conditions; and

those risks and uncertainties included in the “Risk Factors”

disclosed in Marqeta's Annual Report on Form 10-K, as may be

updated from time to time in Marqeta’s periodic filings with the

SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in

this press release are based on information available to Marqeta as

of the date hereof. Marqeta disclaims any obligation to update any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029426991/en/

James Robinson press@marqeta.com

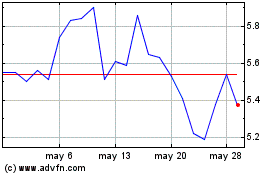

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

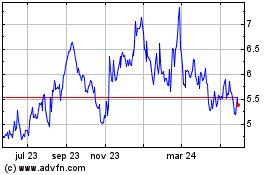

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024