Marqeta Announces Marqeta Flex, An Industry-Leading, Buy Now, Pay Later Solution That Can Be Embedded Into Payment Apps

28 Octubre 2024 - 5:00AM

Business Wire

Marqeta Flex is being developed with payments

platform Branch and payment providers Klarna and Affirm, enabling

real time and customized BNPL options for consumers.

Marqeta (NASDAQ: MQ), the global modern card issuing platform

that enables embedded finance solutions for the world’s innovators,

today unveiled its Marqeta Flex solution at Money 2020, an

innovative new solution that revolutionizes the way BNPL payment

options can be delivered inside payment apps and wallets, surfacing

them at the moment of need within an existing payment flow.

Marqeta Flex is being developed with leading payment providers

Klarna and Affirm and payments platform Branch. Branch, a key

innovation partner, plans to integrate the solution into its

payments app for W-2 and 1099 workers, enabling their end users to

easily access BNPL loan options catered to their individual

needs.

“Marqeta Flex is about building upon the transformational impact

that Buy Now, Pay Later has had over the last decade, and helping

consumers access these options intuitively from inside an even

greater range of payment experiences,” said Simon Khalaf, Marqeta's

Chief Executive Officer. “We are excited to partner with

industry-leading BNPL players Klarna and Affirm in the space to

give consumers more choice in how they pay for every transaction

they want to make.”

Marqeta has already partnered to support the exponential growth

of BNPL solutions, bringing pay over time options to millions of

consumers globally. Marqeta Flex is poised to bring even further

syndication to the BNPL space. The solution expands the

distribution of BNPL while personalizing the experience for

shoppers, providing them with access to their favorite BNPL options

when they need them. Supporting some of the largest BNPL solutions

and card issuers today, Marqeta is uniquely positioned to recognize

the opportunity for expanded BNPL distribution and how it allows

for enhanced payment capabilities and greater consumer choice.

The intended benefits of Marqeta Flex for consumers, payment

providers and issuers include:

- Consumers: With Marqeta Flex, consumers will be guided

to the BNPL options that can meet their needs. They get access to

personalized BNPL options inside of the payment apps they use most

often.

- Payment Providers: Marqeta Flex expands BNPL

distribution, allowing payment providers that offer pay over time

options to benefit from even greater access to consumers and higher

transaction volumes.

- Card issuers and digital wallets: Marqeta Flex is a

powerful solution for digital wallets and card issuers, allowing

them to drive payment volume by incorporating multiple BNPL

offerings into the transaction experience that can be customized to

user preferences. With a single integration with Marqeta Flex,

they’ll have access to a variety of global BNPL providers,

increasing the speed at which they can build and launch card

solutions that offer flexible payment methods, including custom and

user-friendly BNPL loan options.

“We’re thrilled to be building this with Marqeta and innovating

how BNPL can be applied,” said Ahmed Siddiqui, Chief Payments

Officer at Branch. “We look forward to giving the workers we serve

even greater payment access and choice.”

Marqeta Flex is intended to be fast and simple for consumers.

When launched, the user will choose the Pay Later option within

their payment app and be provided with personalized BNPL payment

plan options.

For more information about Marqeta Flex, please click here.

About Marqeta (NASDAQ: MQ)

Marqeta makes it possible for companies to build and embed

financial services into their branded experience—and unlock new

ways to grow their business and delight users. The Marqeta platform

puts businesses in control of building financial solutions,

enabling them to turn real-time data into personalized, optimized

solutions for everything from consumer loyalty to capital

efficiency. With compliance and security built-in, Marqeta’s

platform has been proven at scale, processing more than $200

billion in annual payments volume in 2023. Marqeta is certified to

operate in more than 40 countries worldwide and counting. Visit

www.marqeta.com to learn more.

About Branch

Branch is the leading workforce payments platform that helps

businesses deliver fast, flexible options for workers to get paid.

Whether it’s sending earnings to employees or contractors,

companies choose Branch because they know that faster payments can

help them strengthen worker loyalty, save time and money, and drive

business growth. Earners that sign up with Branch can receive quick

access to earnings, rewards, and personal finance tools to help

them manage their cash flow between pay cycles. Branch partners

with the nation’s leading companies in hospitality, healthcare, gig

platforms & marketplaces, and staffing services. Branch has

been honored with a Webby Award—Best Financial Services, FinTech

Breakthrough Award, Gartner Eye on Innovation: Financial Services,

and Great Place to Work Certification. To learn more about Branch,

visit https://www.branchapp.com and follow us on Twitter/X and

LinkedIn.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, quotations and statements relating to changing

consumer preferences; increasing consumer adoption of certain

digital payment methods, products, and solutions; which payment,

banking, and financial services products and solutions may succeed;

technological and market trends; Marqeta’s business; Marqeta’s

products and services; and statements made by Marqeta’s senior

leadership. Actual results may differ materially from the

expectations contained in these statements due to risks and

uncertainties, including, but not limited to, the following: any

factors creating issues with changes in domestic and international

business, market, financial, political and legal conditions; and

those risks and uncertainties included in the “Risk Factors”

disclosed in Marqeta's Annual Report on Form 10-K, as may be

updated from time to time in Marqeta’s periodic filings with the

SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in

this press release are based on information available to Marqeta as

of the date hereof. Marqeta disclaims any obligation to update any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028294384/en/

James Robinson press@marqeta.com

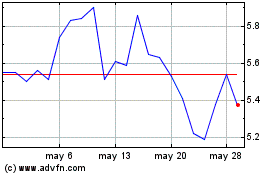

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

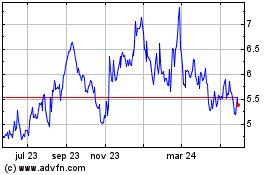

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024