0001413447false00014134472024-11-212024-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 21, 2024

NXP Semiconductors N.V.

(Exact name of Registrant as specified in charter)

| | | | | | | | | | | | | | |

Netherlands | | 001-34841 | | 98-1144352 |

(State or other jurisdiction of incorporation) | | (Commission file number) | | (IRS employer identification number) |

| | | | | | | | | | | | | | |

| 60 High Tech Campus | | | | |

| Eindhoven | | | | |

| Netherlands | | | | 5656 AG |

(Address of principal executive offices) | | | | (Zip code) |

| | | | |

| | | | | | | | | | | | | | |

| | +31 | 40 | 2729999 |

(Registrant’s telephone number, including area code) |

| | |

| NA |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading symbol(s) | Number of each exchange on which registered |

Common shares, EUR 0.20 par value | NXPI | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Item 8.01 Other Events.

On November 21, 2024, the Board of Directors of NXP Semiconductors N.V. (the "Company") approved the payment of an interim dividend of $1.014 per ordinary share for the fourth quarter of 2024. The interim dividend will be paid on January 8, 2025 to shareholders of record as of December 5, 2024.

A copy of the Company's press release announcing the dividend payment and additional share repurchase authorization is attached as Exhibit 99.1 to this Current Report on Form 8-K, and is incorporated by reference herein.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

| |

(d) Exhibits | |

| |

| 99.1 | |

| |

104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NXP Semiconductors N.V. | |

| |

| | By: /s/ Timothy Shelhamer | |

| | Name: Timothy Shelhamer | |

| Title: SVP and Chief Corporate Counsel | |

Date: November 21, 2024

NXP Semiconductors Announces Quarterly Dividend

EINDHOVEN, The Netherlands, November 21, 2024 – As part of its ongoing capital return program, NXP Semiconductors N.V. (NASDAQ: NXPI) today announced that its board of directors has approved the payment of an interim dividend. The actions are based on the continued and significant strength of the NXP capital structure, and the board’s confidence in the company’s ability to drive long-term growth and strong cash flow.

The board of directors has approved the payment of an interim dividend of $1.014 per ordinary share for the fourth quarter of 2024. The interim dividend will be paid in cash on January 8, 2025, to shareholders of record as of December 5, 2024.

Taxation – Cash Dividends

Cash dividends will be subject to the deduction of Dutch dividend withholding tax at the rate of 15 percent, which may be reduced in certain circumstances. Non-Dutch resident shareholders, depending on their circumstances, may be entitled to a full or partial refund of Dutch dividend withholding tax. If you are uncertain as to the tax treatment of any dividends, consult your tax advisor.

About NXP Semiconductors

NXP Semiconductors N.V. (NASDAQ: NXPI) is the trusted partner for innovative solutions in the automotive, industrial & IoT, mobile, and communications infrastructure markets. NXP's "Brighter Together" approach combines leading-edge technology with pioneering people to develop system solutions that make the connected world better, safer, and more secure. The company has operations in more than 30 countries and posted revenue of $13.28 billion in 2023. Find out more at www.nxp.com.

Forward-looking Statements

This document includes forward-looking statements which include statements regarding NXP’s business strategy, financial condition, results of operations, market data, as well as any other statements which are not historical facts. By their nature, forward-looking statements are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected. These factors, risks and uncertainties include the following: market demand and semiconductor industry conditions; our ability to successfully introduce new technologies and products; the demand for the goods into which NXP’s products are incorporated; trade disputes between the U.S. and China, potential increase of barriers to international trade and resulting disruptions to NXP's established supply chains; the impact of government actions and regulations, including restrictions on the export of US-regulated products and technology; increasing and evolving cybersecurity threats and privacy risks, including theft of sensitive or confidential data; the ability to generate sufficient cash, raise sufficient capital or refinance corporate debt at or before maturity to meet both NXP's debt service and research and development and capital investment requirements; our ability to accurately estimate demand and match our production capacity accordingly or obtain supplies from third-party producers to meet demand; our access to production capacity from third-party outsourcing partners, and any events that might affect their business or NXP’s relationship with them; our ability to secure adequate and timely supply of equipment and materials from suppliers; our ability to avoid operational problems and product defects and, if such issues were to arise, to correct them quickly; our ability to form strategic partnerships and joint ventures and to successfully cooperate with our alliance partners; our ability to win competitive bid selection processes; our ability to develop products for use in customers’ equipment and products; the ability to successfully hire and retain key management and senior product engineers; global hostilities, including the invasion of

Ukraine by Russia and resulting regional instability, sanctions and any other retaliatory measures taken against Russia and the continued hostilities and the armed conflict in the Middle East, which could adversely impact the global supply chain, disrupt our operations or negatively impact the demand for our products in our primary end markets; the ability to maintain good relationships with NXP's suppliers; and a change in tax laws could have an effect on our estimated effective tax rate. In addition, this document contains information concerning the semiconductor industry, our end markets and business generally, which is forward-looking in nature and is based on a variety of assumptions regarding the ways in which the semiconductor industry, our end markets and business will develop. NXP has based these assumptions on information currently available, if any one or more of these assumptions turn out to be incorrect, actual results may differ from those predicted. While NXP does not know what impact any such differences may have on its business, if there are such differences, its future results of operations and its financial condition could be materially adversely affected. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak to results only as of the date the statements were made. Except for any ongoing obligation to disclose material information as required by the United States federal securities laws, NXP does not have any intention or obligation to publicly update or revise any forward-looking statements after we distribute this document, whether to reflect any future events or circumstances or otherwise. For a discussion of potential risks and uncertainties, please refer to the risk factors listed in our SEC filings. Copies of our SEC filings are available on our Investor Relations website, www.nxp.com/investor or from the SEC website, www.sec.gov

For further information, please contact:

Investors: Media:

Jeff Palmer Paige Iven

jeff.palmer@nxp.com paige.iven@nxp.com

+1 408 518 5411 +1 817 975 0602

NXP-Corp

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

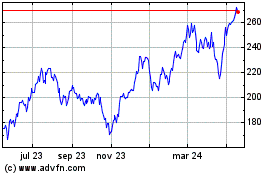

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

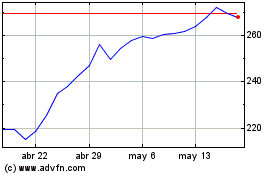

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024