NXP Semiconductors Announces Quarterly Dividend

21 Noviembre 2024 - 3:10PM

As part of its ongoing capital return program, NXP Semiconductors

N.V. (NASDAQ: NXPI) today announced that its board of directors has

approved the payment of an interim dividend. The actions are based

on the continued and significant strength of the NXP capital

structure, and the board’s confidence in the company’s ability to

drive long-term growth and strong cash flow.

The board of directors has approved the payment of an interim

dividend of $1.014 per ordinary share for the fourth quarter

of 2024. The interim dividend will be paid in cash on January 8,

2025, to shareholders of record as of December 5, 2024.

Taxation – Cash Dividends Cash dividends will

be subject to the deduction of Dutch dividend withholding tax at

the rate of 15 percent, which may be reduced in certain

circumstances. Non-Dutch resident shareholders, depending on their

circumstances, may be entitled to a full or partial refund of Dutch

dividend withholding tax. If you are uncertain as to the tax

treatment of any dividends, consult your tax advisor.

About NXP SemiconductorsNXP Semiconductors N.V.

(NASDAQ: NXPI) is the trusted partner for innovative solutions in

the automotive, industrial & IoT, mobile, and communications

infrastructure markets. NXP's "Brighter Together" approach combines

leading-edge technology with pioneering people to develop system

solutions that make the connected world better, safer, and more

secure. The company has operations in more than 30 countries and

posted revenue of $13.28 billion in 2023. Find out more at

www.nxp.com.

Forward-looking StatementsThis document

includes forward-looking statements which include statements

regarding NXP’s business strategy, financial condition, results of

operations, market data, as well as any other statements which are

not historical facts. By their nature, forward-looking statements

are subject to numerous factors, risks and uncertainties that could

cause actual outcomes and results to be materially different from

those projected. These factors, risks and uncertainties include the

following: market demand and semiconductor industry conditions; our

ability to successfully introduce new technologies and products;

the demand for the goods into which NXP’s products are

incorporated; trade disputes between the U.S. and China, potential

increase of barriers to international trade and resulting

disruptions to NXP's established supply chains; the impact of

government actions and regulations, including restrictions on the

export of US-regulated products and technology; increasing and

evolving cybersecurity threats and privacy risks, including theft

of sensitive or confidential data; the ability to generate

sufficient cash, raise sufficient capital or refinance corporate

debt at or before maturity to meet both NXP's debt service and

research and development and capital investment requirements; our

ability to accurately estimate demand and match our production

capacity accordingly or obtain supplies from third-party producers

to meet demand; our access to production capacity from third-party

outsourcing partners, and any events that might affect their

business or NXP’s relationship with them; our ability to secure

adequate and timely supply of equipment and materials from

suppliers; our ability to avoid operational problems and product

defects and, if such issues were to arise, to correct them quickly;

our ability to form strategic partnerships and joint ventures and

to successfully cooperate with our alliance partners; our ability

to win competitive bid selection processes; our ability to develop

products for use in customers’ equipment and products; the ability

to successfully hire and retain key management and senior product

engineers; global hostilities, including the invasion of Ukraine by

Russia and resulting regional instability, sanctions and any other

retaliatory measures taken against Russia and the continued

hostilities and the armed conflict in the Middle East, which could

adversely impact the global supply chain, disrupt our operations or

negatively impact the demand for our products in our primary end

markets; the ability to maintain good relationships with NXP's

suppliers; and a change in tax laws could have an effect on our

estimated effective tax rate. In addition, this document contains

information concerning the semiconductor industry, our end markets

and business generally, which is forward-looking in nature and is

based on a variety of assumptions regarding the ways in which the

semiconductor industry, our end markets and business will develop.

NXP has based these assumptions on information currently available,

if any one or more of these assumptions turn out to be incorrect,

actual results may differ from those predicted. While NXP does not

know what impact any such differences may have on its business, if

there are such differences, its future results of operations and

its financial condition could be materially adversely affected.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak to results only as of the

date the statements were made. Except for any ongoing obligation to

disclose material information as required by the United States

federal securities laws, NXP does not have any intention or

obligation to publicly update or revise any forward-looking

statements after we distribute this document, whether to reflect

any future events or circumstances or otherwise. For a discussion

of potential risks and uncertainties, please refer to the risk

factors listed in our SEC filings. Copies of our SEC filings are

available on our Investor Relations website, www.nxp.com/investor

or from the SEC website, www.sec.gov

For further information, please contact:

| Investors: |

Media: |

| Jeff Palmer |

Paige Iven |

| jeff.palmer@nxp.com |

paige.iven@nxp.com |

| +1 408 518 5411 |

+1 817 975 0602 |

| |

|

NXP-Corp

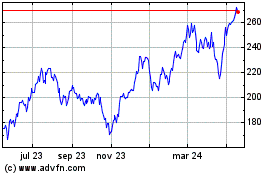

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

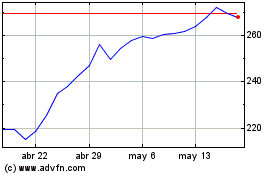

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024