0001801169FALSE00018011692024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 8-K

__________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

Opendoor Technologies Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39253 | 30-1318214 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

410 N. Scottsdale Road, Suite 1600 | |

| Tempe, | AZ | 85288 |

(Address of principal executive offices) | (Zip Code) |

(480) 618-6760

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

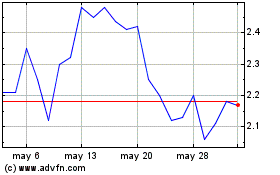

| Common stock, $0.0001 par value per share | | OPEN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02Results of Operations and Financial Condition

On August 1, 2024, Opendoor Technologies Inc. (the “Company”) issued a press release and a shareholder letter announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release and the shareholder letter is furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure

On August 1, 2024, the Company posted an earnings supplement (the “Supplement”) in the “Investor Relations” portion of its website at investor.opendoor.com. A copy of the Supplement is attached to this Current Report on Form 8-K as Exhibit 99.3.

The information contained in Items 2.02 and 7.01 of this Current Report (including Exhibits 99.1, 99.2, and 99.3 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01Financial Statements and Exhibits

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (Cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Opendoor Technologies Inc. |

| | |

Date: August 1, 2024 | By: | /s/ Christina Schwartz |

| Name: | Christina Schwartz |

| Title: | Interim Chief Financial Officer |

Exhibit 99.1

Opendoor Announces Second Quarter of 2024 Financial Results

SAN FRANCISCO, California - August 1, 2024 - Opendoor Technologies Inc. (Nasdaq: OPEN), a leading e-commerce platform for residential real estate transactions, today reported financial results for its second quarter ended June 30, 2024. Opendoor’s second quarter 2024 financial results and management commentary can be accessed through the Company’s shareholder letter on the “Quarterly Reports” page of Opendoor’s investor relations website at https://investor.opendoor.com.

“We are proud of our second quarter performance and the progress we’ve made in building a platform where all customers can begin their home selling journey. Revenue, Contribution Margin, and Adjusted EBITDA exceeded the high end of our guidance, and our acquisitions outperformed expectations, growing nearly 80% year-over-year. We continue to make meaningful progress increasing brand awareness, delivering industry-leading seller NPS, expanding our product offerings, and driving structural efficiencies across our platform that we expect will benefit the Company for years to come,” said Carrie Wheeler, CEO of Opendoor.

Wheeler continued, “During the back half of the second quarter, we began responding to signals that indicated additional slowing in the housing market. We are making decisions that appropriately balance growth, margin, and risk in what continues to be a challenging environment. While the housing cycle will eventually recover, the improvements we are making in the business are enduring. We continue to expect to make meaningful progress in both increasing acquisitions and reducing Adjusted Net Losses this year, as compared to 2023.”

Second Quarter 2024 Key Highlights

•Revenue of $1.5 billion, down (24)% versus 2Q23 and up 28% versus 1Q24; with 4,078 total homes sold, down (24)% versus 2Q23 and up 32% versus 1Q24

•Gross profit of $129 million, versus $149 million in 2Q23 and $114 million in 1Q24; Gross Margin of 8.5%, versus 7.5% in 2Q23 and 9.7% in 1Q24

•Net (loss) income of $(92) million, versus $23 million in 2Q23 and $(109) million in 1Q24

•Inventory balance of $2.2 billion, representing 6,399 homes, up 94% versus 2Q23 and up 19% versus 1Q24

•Purchased 4,771 homes, up 78% versus 2Q23 and up 38% versus 1Q24

•Ended the quarter with 1,793 homes under contract for purchase, up 29% versus 2Q23 and down (31)% versus 1Q24

Non-GAAP Key Highlights*

•Contribution Profit (Loss) of $95 million, versus $(90) million in 2Q23 and $57 million in 1Q24; Contribution Margin of 6.3%, versus (4.6)% in 2Q23 and 4.8% in 1Q24

•Adjusted EBITDA of $(5) million, versus $(168) million in 2Q23 and $(50) million in 1Q24; Adjusted EBITDA Margin of (0.3)%, versus (8.5)% in 2Q23 and (4.2)% in 1Q24

•Adjusted Net Loss of $(31) million, versus $(197) million in 2Q23 and $(80) million in 1Q24

*See “—Use of Non-GAAP Financial Measures” below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

Third Quarter 2024 Financial Outlook

•3Q24 revenue guidance of $1.2 billion to $1.3 billion

•3Q24 Contribution Profit1 guidance of $35 million to $45 million

•3Q24 Adjusted EBITDA1 guidance of $(70) million to $(60) million

Conference Call and Webcast Details

Opendoor will host a conference call to discuss its financial results on August 1, 2024, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from Opendoor’s Investor Relations website at https://investor.opendoor.com. An archived version of the webcast will be available from the same website after the call.

About Opendoor

Opendoor’s mission is to power life’s progress, one move at a time. Since 2014, Opendoor has provided people across the U.S. with a simple and certain way to buy and sell a home. Opendoor currently operates in markets nationwide.

For more information, please visit www.opendoor.com

Forward Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking, including statements regarding the current and future health and stability of the real estate housing market and general economy; anticipated future results of operations and financial performance, including our third quarter 2024 financial outlook and our ability to balance growth, margin and risk in a challenging environment; the health and status of our financial condition and whether we will be able to increase acquisitions and improve Adjusted Net Loss through the remainder of 2024 in a potentially slowing housing market; whether efficiencies we have implemented across our platform will result in future benefits; and business strategy and plans, including plans to continue to invest in our products. These forward-looking statements generally are identified by the words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “intend”, “may”, “might”, “opportunity”, “outlook”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “strategy”, “strive”, “target”, “vision”, “will”, or “would”, any negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. The factors that could cause or contribute to actual future events to differ materially from the forward-looking statements in this press release include but are not limited to: the current and future health and stability of the economy, financial conditions and residential housing market, including any extended downturn or slowdown; changes in general economic and financial conditions (including federal monetary policy, interest rates,

1 Opendoor has not provided a quantitative reconciliation of forecasted Contribution Profit (Loss) to forecasted GAAP gross profit (loss) nor a reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this press release because the Company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to, inventory valuation adjustment and equity securities fair value adjustment. These items, which could materially affect the computation of forward-looking GAAP gross profit (loss) and net income (loss), are inherently uncertain and depend on various factors, some of which are outside of the Company’s control. For more information regarding the non-GAAP financial measures discussed in this press release, please see “Use of Non-GAAP Financial Measures” following the financial tables below.

inflation, actual or anticipated recession, home price fluctuations, and housing inventory), as well as the probability of such changes occurring, that may impact demand for our products and services, lower our profitability or reduce our access to future financings; actual or anticipated fluctuations in our financial condition and results of operations; changes in projected operational and financial results; our real estate assets and increased competition in the U.S. residential real estate industry; our ability to operate and grow our core business products, including the ability to obtain sufficient financing and resell purchased homes; investment of resources to pursue strategies and develop new products and services that may not prove effective or that are not attractive to customers and/or partners or that do not allow us to compete successfully; our ability to acquire and resell homes profitably; our ability to grow market share in our existing markets or any new markets we may enter; our ability to manage our growth effectively; our ability to expeditiously sell and appropriately price our inventory; our ability to access sources of capital, including debt financing and securitization funding to finance our real estate inventories and other sources of capital to finance operations and growth; our ability to maintain and enhance our products and brand, and to attract customers; our ability to manage, develop and refine our digital platform, including our automated pricing and valuation technology; our ability to comply with multiple listing service rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers; our ability to obtain or maintain licenses and permits to support our current and future business operations; acquisitions, strategic partnerships, joint ventures, capital-raising activities or other corporate transactions or commitments by us or our competitors; actual or anticipated changes in technology, products, markets or services by us or our competitors; our ability to protect our brand and intellectual property; our success in retaining or recruiting, or changes required in, our officers, key employees and/or directors; the impact of the regulatory environment within our industry and complexities with compliance related to such environment; any future impact of pandemics or epidemics, including any future resurgences of COVID-19 and its variants, or other public health crises on our ability to operate, demand for our products and services, or general economic conditions; changes in laws or government regulation affecting our business; and the impact of pending or future litigation or regulatory actions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 15, 2024, as updated by our periodic reports and other filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations.

Contact Information

Investors:

investors@opendoor.com

Media:

press@opendoor.com

OPENDOOR TECHNOLOGIES INC.

FINANCIAL HIGHLIGHTS AND OPERATING METRICS

(In millions, except percentages, homes sold, number of markets, homes purchased, and homes in inventory)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | |

| | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | | | | | | | |

| Revenue | | $ | 1,511 | | | $ | 1,181 | | | $ | 870 | | | $ | 980 | | | $ | 1,976 | | | | | | | | | |

Gross profit | | $ | 129 | | | $ | 114 | | | $ | 72 | | | $ | 96 | | | $ | 149 | | | | | | | | | |

| Gross Margin | | 8.5 | % | | 9.7 | % | | 8.3 | % | | 9.8 | % | | 7.5 | % | | | | | | | | |

| Net (loss) income | | $ | (92) | | | $ | (109) | | | $ | (91) | | | $ | (106) | | | $ | 23 | | | | | | | | | |

| Number of markets (at period end) | | 50 | | | 50 | | | 50 | | | 53 | | | 53 | | | | | | | | | |

| Homes sold | | 4,078 | | | 3,078 | | | 2,364 | | | 2,687 | | | 5,383 | | | | | | | | | |

| Homes purchased | | 4,771 | | | 3,458 | | | 3,683 | | | 3,136 | | | 2,680 | | | | | | | | | |

| Homes in inventory (at period end) | | 6,399 | | | 5,706 | | | 5,326 | | | 4,007 | | | 3,558 | | | | | | | | | |

| Inventory (at period end) | | $ | 2,234 | | | $ | 1,881 | | | $ | 1,775 | | | $ | 1,311 | | | $ | 1,149 | | | | | | | | | |

Percentage of homes “on the market” for greater than 120 days (at period end) | | 14 | % | | 15 | % | | 18 | % | | 12 | % | | 24 | % | | | | | | | | |

Non-GAAP Financial Highlights (1) | | | | | | | | | | | | | | | | | | |

| Contribution Profit (Loss) | | $ | 95 | | | $ | 57 | | | $ | 30 | | | $ | 43 | | | $ | (90) | | | | | | | | | |

| Contribution Margin | | 6.3 | % | | 4.8 | % | | 3.4 | % | | 4.4 | % | | (4.6) | % | | | | | | | | |

| Adjusted EBITDA | | $ | (5) | | | $ | (50) | | | $ | (69) | | | $ | (49) | | | $ | (168) | | | | | | | | | |

| Adjusted EBITDA Margin | | (0.3) | % | | (4.2) | % | | (7.9) | % | | (5.0) | % | | (8.5) | % | | | | | | | | |

| Adjusted Net Loss | | $ | (31) | | | $ | (80) | | | $ | (97) | | | $ | (75) | | | $ | (197) | | | | | | | | | |

(1) See “—Use of Non-GAAP Financial Measures” for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share amounts which are presented in thousands, and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended

June 30, |

| June 30,

2024 | | March 31,

2024 | | June 30,

2023 | | 2024 | | 2023 |

| REVENUE | $ | 1,511 | | | $ | 1,181 | | | $ | 1,976 | | | $ | 2,692 | | | $ | 5,096 | |

| COST OF REVENUE | 1,382 | | | 1,067 | | | 1,827 | | | 2,449 | | | 4,777 | |

| GROSS PROFIT | 129 | | | 114 | | | 149 | | | 243 | | | 319 | |

| OPERATING EXPENSES: | | | | | | | | | |

| Sales, marketing and operations | 116 | | | 113 | | | 124 | | | 229 | | | 312 | |

| General and administrative | 48 | | | 47 | | | 44 | | | 95 | | | 110 | |

| Technology and development | 37 | | | 41 | | | 39 | | | 78 | | | 79 | |

| | | | | | | | | |

| Restructuring | — | | | — | | | 10 | | | — | | | 10 | |

| Total operating expenses | 201 | | | 201 | | | 217 | | | 402 | | | 511 | |

| LOSS FROM OPERATIONS | (72) | | | (87) | | | (68) | | | (159) | | | (192) | |

| | | | | | | | | |

| (LOSS) GAIN ON EXTINGUISHMENT OF DEBT | (1) | | | — | | | 104 | | | (1) | | | 182 | |

| INTEREST EXPENSE | (30) | | | (37) | | | (53) | | | (67) | | | (127) | |

| OTHER INCOME – Net | 12 | | | 15 | | | 41 | | | 27 | | | 60 | |

(LOSS) INCOME BEFORE INCOME TAXES | (91) | | | (109) | | | 24 | | | (200) | | | (77) | |

| INCOME TAX EXPENSE | (1) | | | — | | | (1) | | | (1) | | | (1) | |

NET (LOSS) INCOME | $ | (92) | | | $ | (109) | | | $ | 23 | | | $ | (201) | | | $ | (78) | |

| | | | | | | | | |

| | | | | | | | | |

Net (loss) income per share attributable to common shareholders: | | | | | | | | | |

| Basic | $ | (0.13) | | | $ | (0.16) | | | $ | 0.04 | | | $ | (0.29) | | | $ | (0.12) | |

| Diluted | $ | (0.13) | | | $ | (0.16) | | | $ | 0.03 | | | $ | (0.29) | | | $ | (0.12) | |

| Weighted-average shares outstanding: | | | | | | | | | |

| Basic | 693,445 | | | 682,457 | | | 646,062 | | | 687,951 | | | 646,750 | |

| Diluted | 693,445 | | | 682,457 | | | 667,159 | | | 687,951 | | | 646,750 | |

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| ASSETS | | | | |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents | | $ | 790 | | | $ | 999 | |

| Restricted cash | | 121 | | | 541 | |

| Marketable securities | | 19 | | | 69 | |

| Escrow receivable | | 24 | | | 9 | |

| | | | |

| Real estate inventory, net | | 2,234 | | | 1,775 | |

Other current assets | | 61 | | | 52 | |

| Total current assets | | 3,249 | | | 3,445 | |

| PROPERTY AND EQUIPMENT – Net | | 71 | | | 66 | |

| RIGHT OF USE ASSETS | | 23 | | | 25 | |

| GOODWILL | | 4 | | | 4 | |

| INTANGIBLES – Net | | 2 | | | 5 | |

| OTHER ASSETS | | 23 | | | 22 | |

| TOTAL ASSETS | | $ | 3,372 | | | $ | 3,567 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable and other accrued liabilities | | $ | 73 | | | $ | 64 | |

| Non-recourse asset-backed debt – current portion | | 315 | | | — | |

| | | | |

| | | | |

| | | | |

| Interest payable | | 1 | | | 1 | |

| Lease liabilities – current portion | | 4 | | | 5 | |

| Total current liabilities | | 393 | | | 70 | |

| NON-RECOURSE ASSET-BACKED DEBT – Net of current portion | | 1,739 | | | 2,134 | |

| CONVERTIBLE SENIOR NOTES | | 377 | | | 376 | |

| | | | |

| LEASE LIABILITIES – Net of current portion | | 18 | | | 19 | |

| OTHER LIABILITIES | | — | | | 1 | |

| Total liabilities | | 2,527 | | | 2,600 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| SHAREHOLDERS’ EQUITY: | | | | |

Common stock, $0.0001 par value; 3,000,000,000 shares authorized; 698,843,166 and 677,636,163 shares issued, respectively; 698,843,166 and 677,636,163 shares outstanding, respectively | | — | | | — | |

| Additional paid-in capital | | 4,379 | | | 4,301 | |

| Accumulated deficit | | (3,534) | | | (3,333) | |

| Accumulated other comprehensive loss | | — | | | (1) | |

| Total shareholders’ equity | | 845 | | | 967 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 3,372 | | | $ | 3,567 | |

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (201) | | | $ | (78) | |

| Adjustments to reconcile net loss to cash, cash equivalents, and restricted cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 26 | | | 39 | |

| Amortization of right of use asset | 3 | | | 4 | |

| | | |

| Stock-based compensation | 66 | | | 63 | |

| | | |

| | | |

| Inventory valuation adjustment | 41 | | | 37 | |

| | | |

| | | |

| Change in fair value of equity securities | 4 | | | (7) | |

| | | |

| | | |

| | | |

| Other | 3 | | | (1) | |

| | | |

| Proceeds from sale and principal collections of mortgage loans held for sale | — | | | 1 | |

| Loss (gain) on extinguishment of debt | 1 | | | (182) | |

| Changes in operating assets and liabilities: | | | |

| Escrow receivable | (15) | | | 17 | |

| Real estate inventory | (498) | | | 3,259 | |

| Other assets | (10) | | | (3) | |

| Accounts payable and other accrued liabilities | 7 | | | (31) | |

| Interest payable | — | | | (10) | |

| Lease liabilities | (4) | | | (6) | |

| Net cash (used in) provided by operating activities | (577) | | | 3,102 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchase of property and equipment | (16) | | | (17) | |

| | | |

| | | |

| Proceeds from sales, maturities, redemptions and paydowns of marketable securities | 47 | | | 61 | |

| | | |

| Proceeds from sale of non-marketable equity securities | — | | | 1 | |

| | | |

| | | |

| Net cash provided by investing activities | 31 | | | 45 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Repurchase of convertible senior notes | — | | | (270) | |

| | | |

| Proceeds from exercise of stock options | — | | | 2 | |

| Proceeds from issuance of common stock for ESPP | 2 | | | 1 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from non-recourse asset-backed debt | 217 | | | 236 | |

| Principal payments on non-recourse asset-backed debt | (302) | | | (2,099) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Payment for early extinguishment of debt | — | | | (4) | |

| Net cash used in financing activities | (83) | | | (2,134) | |

| NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (629) | | | 1,013 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – Beginning of period | 1,540 | | | 1,791 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – End of period | $ | 911 | | | $ | 2,804 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION – Cash paid during the period for interest | $ | 62 | | | $ | 126 | |

| DISCLOSURES OF NONCASH ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Stock-based compensation expense capitalized for internally developed software | $ | 10 | | | $ | 10 | |

| | | |

| RECONCILIATION TO CONDENSED CONSOLIDATED BALANCE SHEETS: | | | |

| Cash and cash equivalents | $ | 790 | | | $ | 1,120 | |

| Restricted cash | 121 | | | 1,684 | |

| Cash, cash equivalents, and restricted cash | $ | 911 | | | $ | 2,804 | |

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding the Company’s financial results, this press release includes references to certain non-GAAP financial measures that are used by management. The Company believes these non-GAAP financial measures including Adjusted Gross Profit (Loss), Contribution Profit (Loss), Adjusted Net Loss, Adjusted EBITDA, and any such non-GAAP financial measures expressed as a Margin, are useful to investors as supplemental operational measurements to evaluate the Company’s financial performance.

The non-GAAP financial measures should not be considered in isolation or as a substitute for the Company’s reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled measures reported by other companies. Management uses these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the Company’s performance by excluding certain items that may not be indicative of the Company’s recurring operating results.

Adjusted Gross Profit (Loss) and Contribution Profit (Loss)

To provide investors with additional information regarding our margins and return on inventory acquired, we have included Adjusted Gross Profit (Loss) and Contribution Profit (Loss), which are non-GAAP financial measures. We believe that Adjusted Gross Profit (Loss) and Contribution Profit (Loss) are useful financial measures for investors as they are supplemental measures used by management in evaluating unit level economics and our operating performance. Each of these measures is intended to present the economics related to homes sold during a given period. We do so by including revenue generated from homes sold (and adjacent services) in the period and only the expenses that are directly attributable to such home sales, even if such expenses were recognized in prior periods, and excluding expenses related to homes that remain in inventory as of the end of the period. Contribution Profit (Loss) provides investors a measure to assess Opendoor’s ability to generate returns on homes sold during a reporting period after considering home purchase costs, renovation and repair costs, holding costs and selling costs.

Adjusted Gross Profit (Loss) and Contribution Profit (Loss) are supplemental measures of our operating performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, costs required to be recorded under GAAP in the same period. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit.

Adjusted Gross Profit (Loss) / Margin

We calculate Adjusted Gross Profit (Loss) as gross profit under GAAP adjusted for (1) inventory valuation adjustment in the current period, and (2) inventory valuation adjustment in prior periods. Inventory valuation adjustment in the current period is calculated by adding back the inventory valuation adjustments recorded during the period on homes that remain in inventory at period end. Inventory valuation adjustment in prior periods is calculated by subtracting the inventory valuation adjustments recorded in prior periods on homes sold in the current period. Adjusted Gross Margin is Adjusted Gross Profit (Loss) as a percentage of revenue.

We view this metric as an important measure of business performance as it captures gross margin performance isolated to homes sold in a given period and provides comparability across reporting periods. Adjusted Gross Profit (Loss) helps management assess home pricing, service fees and renovation performance for a specific resale cohort.

Contribution Profit (Loss) / Margin

We calculate Contribution Profit (Loss) as Adjusted Gross Profit (Loss), minus certain costs incurred on homes sold during the current period including: (1) holding costs incurred in the current period, (2) holding costs incurred in prior periods, and (3) direct selling costs. The composition of our holding costs is described in the footnotes to the reconciliation table below. Contribution Margin is Contribution Profit (Loss) as a percentage of revenue.

We view this metric as an important measure of business performance as it captures the unit level performance isolated to homes sold in a given period and provides comparability across reporting periods. Contribution Profit (Loss) helps management assess inflows and outflows directly associated with a specific resale cohort.

OPENDOOR TECHNOLOGIES INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(In millions, except percentages, and homes sold)

(Unaudited)

The following table presents a reconciliation of our Adjusted Gross Profit (Loss) and Contribution Profit (Loss) to our gross profit, which is the most directly comparable GAAP measure, for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended

June 30, |

| (in millions, except percentages and homes sold, or as noted) | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | 2024 | | 2023 |

| Revenue (GAAP) | | $ | 1,511 | | | $ | 1,181 | | | $ | 870 | | | $ | 980 | | | $ | 1,976 | | | $ | 2,692 | | | $ | 5,096 | |

Gross profit (GAAP) | | $ | 129 | | | $ | 114 | | | $ | 72 | | | $ | 96 | | | $ | 149 | | | $ | 243 | | | $ | 319 | |

| Gross Margin | | 8.5 | % | | 9.7 | % | | 8.3 | % | | 9.8 | % | | 7.5 | % | | 9.0 | % | | 6.3 | % |

| Adjustments: | | | | | | | | | | | | | | |

Inventory valuation adjustment – Current Period(1)(2) | | 34 | | | 7 | | | 11 | | | 17 | | | 14 | | | 38 | | | 18 | |

Inventory valuation adjustment – Prior Periods(1)(3) | | (9) | | | (17) | | | (17) | | | (29) | | | (156) | | | (23) | | | (432) | |

| | | | | | | | | | | | | | |

| Adjusted Gross Profit (Loss) | | $ | 154 | | | $ | 104 | | | $ | 66 | | | $ | 84 | | | $ | 7 | | | $ | 258 | | | $ | (95) | |

| Adjusted Gross Margin | | 10.2 | % | | 8.8 | % | | 7.6 | % | | 8.6 | % | | 0.4 | % | | 9.6 | % | | (1.9) | % |

| Adjustments: | | | | | | | | | | | | | | |

Direct selling costs(4) | | (43) | | | (34) | | | (26) | | | (28) | | | (58) | | | (77) | | | (143) | |

Holding costs on sales – Current Period(5)(6) | | (5) | | | (5) | | | (3) | | | (4) | | | (6) | | | (16) | | | (31) | |

Holding costs on sales – Prior Periods(5)(7) | | (11) | | | (8) | | | (7) | | | (9) | | | (33) | | | (13) | | | (62) | |

Contribution Profit (Loss) | | $ | 95 | | | $ | 57 | | | $ | 30 | | | $ | 43 | | | $ | (90) | | | $ | 152 | | | $ | (331) | |

| Homes sold in period | | 4,078 | | | 3,078 | | | 2,364 | | | 2,687 | | | 5,383 | | | 7,156 | | | 13,657 | |

Contribution Profit (Loss) per Home Sold (in thousands) | | $ | 23 | | | $ | 19 | | | $ | 13 | | | $ | 16 | | | $ | (17) | | | $ | 21 | | | $ | (24) | |

| Contribution Margin | | 6.3 | % | | 4.8 | % | | 3.4 | % | | 4.4 | % | | (4.6) | % | | 5.6 | % | | (6.5) | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

________________

(1)Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value.

(2)Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end.

(3)Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented.

(4)Represents selling costs incurred related to homes sold in the relevant period. This primarily includes broker commissions, external title and escrow-related fees and transfer taxes.

(5)Holding costs include mainly property taxes, insurance, utilities, homeowners association dues, cleaning and maintenance costs. Holding costs are included in Sales, marketing, and operations on the Condensed Consolidated Statements of Operations.

(6)Represents holding costs incurred in the period presented on homes sold in the period presented.

(7)Represents holding costs incurred in prior periods on homes sold in the period presented.

Adjusted Net Loss and Adjusted EBITDA

We also present Adjusted Net Loss and Adjusted EBITDA, which are non-GAAP financial measures that management uses to assess our underlying financial performance. These measures are also commonly used by investors and analysts to

compare the underlying performance of companies in our industry. We believe these measures provide investors with meaningful period over period comparisons of our underlying performance, adjusted for certain charges that are non-cash, not directly related to our revenue-generating operations, not aligned to related revenue, or not reflective of ongoing operating results that vary in frequency and amount.

Adjusted Net Loss and Adjusted EBITDA are supplemental measures of our operating performance and have important limitations. For example, these measures exclude the impact of certain costs required to be recorded under GAAP. These measures also include inventory valuation adjustments that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, inventory valuation adjustments required to be recorded under GAAP in the same period. These measures could differ substantially from similarly titled measures presented by other companies in our industry or companies in other industries. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is net (loss) income.

Adjusted Net Loss

We calculate Adjusted Net Loss as GAAP net (loss) income adjusted to exclude non-cash expenses of stock-based compensation, equity securities fair value adjustment, and intangibles amortization expense. It excludes expenses that are not directly related to our revenue-generating operations such as restructuring. It excludes loss (gain) on extinguishment of debt as these expenses or gains were incurred as a result of decisions made by management to repay portions of our outstanding credit facilities and the 0.25% convertible senior notes due in 2026 (the "2026 Notes") early; these expenses are not reflective of ongoing operating results and vary in frequency and amount. Adjusted Net Loss also aligns the timing of inventory valuation adjustments recorded under GAAP to the period in which the related revenue is recorded in order to improve the comparability of this measure to our non-GAAP financial measures of unit economics, as described above. Our calculation of Adjusted Net Loss does not currently include the tax effects of the non-GAAP adjustments because our taxes and such tax effects have not been material to date.

Adjusted EBITDA / Margin

We calculated Adjusted EBITDA as Adjusted Net Loss adjusted for depreciation and amortization, property financing and other interest expense, interest income, and income tax expense. Adjusted EBITDA is a supplemental performance measure that our management uses to assess our operating performance and the operating leverage in our business. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of revenue.

The following table presents a reconciliation of our Adjusted Net Loss and Adjusted EBITDA to our net (loss) income, which is the most directly comparable GAAP measure, for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended

June 30, |

| (in millions, except percentages) | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | 2024 | | 2023 |

| Revenue (GAAP) | | $ | 1,511 | | | $ | 1,181 | | | $ | 870 | | | $ | 980 | | | $ | 1,976 | | | $ | 2,692 | | | $ | 5,096 | |

| Net (loss) income (GAAP) | | $ | (92) | | | $ | (109) | | | $ | (91) | | | $ | (106) | | | $ | 23 | | | $ | (201) | | | $ | (78) | |

| Adjustments: | | | | | | | | | | | | | | |

| Stock-based compensation | | 33 | | | 33 | | | 32 | | | 31 | | | 21 | | | 66 | | | 63 | |

Equity securities fair value adjustment(1) | | 2 | | | 2 | | | (3) | | | 11 | | | (6) | | | 4 | | | (7) | |

| | | | | | | | | | | | | | |

Intangibles amortization expense(2) | | 1 | | | 2 | | | 2 | | | 2 | | | 1 | | | 3 | | | 3 | |

Inventory valuation adjustment – Current Period(3)(4) | | 34 | | | 7 | | | 11 | | | 17 | | | 14 | | | 38 | | | 18 | |

Inventory valuation adjustment — Prior Periods(3)(5) | | (9) | | | (17) | | | (17) | | | (29) | | | (156) | | | (23) | | | (432) | |

Restructuring(6) | | — | | | — | | | 4 | | | — | | | 10 | | | — | | | 10 | |

| | | | | | | | | | | | | | |

Loss (gain) on extinguishment of debt | | 1 | | | — | | | (34) | | | — | | | (104) | | | 1 | | | (182) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Other(7) | | (1) | | | 2 | | | (1) | | | (1) | | | — | | | 1 | | | (1) | |

Adjusted Net Loss | | $ | (31) | | | $ | (80) | | | $ | (97) | | | $ | (75) | | | $ | (197) | | | $ | (111) | | | $ | (606) | |

| Adjustments: | | | | | | | | | | | | | | |

| Depreciation and amortization, excluding amortization of intangibles | | 7 | | | 11 | | | 15 | | | 9 | | | 9 | | | 18 | | | 21 | |

Property financing(8) | | 26 | | | 32 | | | 32 | | | 38 | | | 44 | | | 58 | | | 104 | |

Other interest expense(9) | | 4 | | | 5 | | | 5 | | | 9 | | | 9 | | | 9 | | | 23 | |

Interest income(10) | | (12) | | | (18) | | | (24) | | | (30) | | | (34) | | | (30) | | | (52) | |

| Income tax expense | | 1 | | | — | | | — | | | — | | | 1 | | | 1 | | | 1 | |

| Adjusted EBITDA | | $ | (5) | | | $ | (50) | | | $ | (69) | | | $ | (49) | | | $ | (168) | | | $ | (55) | | | $ | (509) | |

| Adjusted EBITDA Margin | | (0.3) | % | | (4.2) | % | | (7.9) | % | | (5.0) | % | | (8.5) | % | | (2.0) | % | | (10.0) | % |

________________

(1)Represents the gains and losses on certain financial instruments, which are marked to fair value at the end of each period.

(2)Represents amortization of acquisition-related intangible assets. The acquired intangible assets have useful lives ranging from 1 to 5 years and amortization is expected until the intangible assets are fully amortized.

(3)Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value.

(4)Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end.

(5)Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented.

(6)Restructuring costs consist primarily of severance and employee termination benefits and bonuses incurred in connection with employees’ roles being eliminated.

(7)Includes primarily gain or loss on the sale of available for sale securities, sublease income, gain or loss on the disposal of property and equipment, income from equity method investments, and gain on lease termination.

(8)Includes interest expense on our non-recourse asset-backed debt facilities.

(9)Includes amortization of debt issuance costs and loan origination fees, commitment fees, unused fees, other interest related costs on our asset-backed debt facilities, and interest expense related to the 2026 Notes outstanding.

(10)Consists mainly of interest earned on cash, cash equivalents, restricted cash and marketable securities.

Letter to Shareholders 2Q24 Charlene Pinckney Columbia, South Carolina Exhibit 99.2

Charlene Pinckney Sold: Columbia, South Carolina 2 Dealing with staging, putting the home on the market, having to leave the home so people could see it… I didn’t have to do any of that. Opendoor made a difficult, uncomfortable situation easy. – Charlene Pinckney When Charlene Pinckney’s two daughters graduated college earlier this year, she knew it was time for her next life journey: selling her home and downsizing. However, she hadn’t sold a home before, and she was in a time crunch to access her home equity. That’s when she discovered Opendoor. After researching her options online, Charlene entered her address and received an all-cash offer. As she reviewed the details and learned more about the process, she decided Opendoor was the right choice for selling her home to make her next move a reality. She closed quickly and found a cozy new home just a few miles away. “It was fast,” she said. “And when I needed to move the closing date up a few days, Opendoor did that for me.” As a first-time home seller, Charlene was concerned about the typical stresses that come with the traditional process – especially staging and showings. But with Opendoor, she avoided those hassles and found peace of mind with a simple, certain, and fast sale. Today, she’s debt-free and pursuing her next chapter with financial freedom and less unwanted space to take care of. With the stress of her home sale behind her, she’s starting to enjoy new hobbies like gardening and traveling. “I can’t wait to tell my friends that I Opendoor’d my home!” she said. Scan here to watch her story

Note: Adjusted Operating Expenses, Adjusted Gross Profit, Contribution Profit, Contribution Margin, Adjusted Net Loss, and Adjusted EBITDA are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” following the financial tables below for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures. 3 Quarter in Review… 2Q24 Revenue $1.5 billion 2Q24 Acquisitions 4,771 2Q24 Contribution Margin 6.3% At Opendoor, our vision is to transform the residential real estate market by building a generational and profitable business that customers love. This commitment has earned us a Net Promoter Score (NPS) of over 80 from our sellers. We are working to create a future where every customer starts their home selling journey with an Opendoor offer. In the second quarter, acquisition volumes, revenue, Contribution Profit, and Adjusted EBITDA all exceeded guidance due to strong execution and operating and cost discipline across the business. Financial highlights from the second quarter include: ● Purchased 4,771 homes, outperforming our guidance of over 4,500, and up 78% versus 2Q23. ● Sold 4,078 homes, which generated over $1.5 billion of revenue, just above the high end of our guidance range of $1.4 billion to $1.5 billion. ● Delivered gross profit of $129 million, representing an 8.5% gross margin. Contribution Profit was $95 million, representing a 6.3% Contribution Margin, above the high end of our Contribution Margin guidance range of 5.4% to 5.7%. ● Recognized Net Loss of $(92) million, as compared to Net Income of $23 million in 2Q23. Adjusted Net Loss was $(31) million, as compared to $(197) million in 2Q23. ● Adjusted EBITDA Loss was $(5) million, as compared to $(168) million in 2Q23 and significantly ahead of our guidance range of $(35) million to $(25) million.

4 …and the Path Ahead We remain focused on optimizing the business while balancing growth, margin, and risk. As we have shared before, there are three main drivers to increase volumes: 1) growing our top of funnel to reach more sellers; 2) expanding our product offering to convert more customers; and 3) reducing spreads to increase conversion. Our progress demonstrates our continued focus on controlling what we can control. ● Growing our top of funnel. We aim to bring more consumers to the Opendoor platform by continuing to expand our distribution channels, including building awareness through advertising and growing and deepening our partnerships. ● Expanding our product offering. We continue to broaden our suite of products in order to facilitate the transaction that best suits our customers’ specific needs. ● Reducing spreads. We strive to durably reduce our spreads via improvements to our pricing platform and cost structure, and, over the longer-term, the addition of adjacent services. As we outlined last quarter, we operate our business to be responsive to macroeconomic factors. Changes in leading indicators are reflected in our pricing strategies, which can impact our spread levels. During the second half of the second quarter, we observed signals in leading macro metrics that indicated slowing in the housing market. Delistings began to rise and are currently at a higher level for this time of year than we’ve seen in our ten-year operating history. Second quarter market clearance rates, or the percent of listed homes that enter into a sales contract per day, have been declining more than seasonally typical. These dynamics resulted in softness in month-over-month home price appreciation (HPA), which entered negative territory in June, two months earlier than in a typical year. In response to these signals, we began increasing our spreads more than anticipated, pressuring acquisition volumes. We also increased home-level price drops to maintain our resale targets, impacting Contribution Margin in the near term. There are reasons to believe the macro environment could improve in the second half of the year, including increasing prospects of easing interest rates, which should provide tailwinds for our business. However, we are providing guidance based on current conditions.

5 1. Opendoor has not provided a quantitative reconciliation of forecasted Contribution Profit (Loss) to forecasted GAAP gross profit (loss) nor a reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this shareholder letter because the Company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to, inventory valuation adjustment and equity securities fair value adjustment. These items, which could materially affect the computation of forward-looking GAAP gross profit (loss) and net income (loss), are inherently uncertain and depend on various factors, some of which are outside of the Company’s control. For more information regarding the non-GAAP financial measures discussed in this shareholder letter, please see “Use of Non-GAAP Financial Measures” following the financial tables below. 3Q23 Sequential Growth in Acquisitions 17% We expect the following results for the third quarter of 2024: ● Revenue is expected to be between $1.2 billion and $1.3 billion ● Contribution Profit1 is expected to be between $35 million and $45 million, or Contribution Margin between 2.9% and 3.5% ● Adjusted EBITDA1 is expected to be between $(70) million and $(60) million We are committed to both increasing acquisitions and reducing Adjusted Net Losses this year as compared to 2023. Our north star remains rescaling the business in a durable and sustainable way. We continue to increase brand awareness, improve the customer experience, expand our product offerings, and drive structural efficiencies across our platform. While we expect the current macro environment to be temporary, the improvements we are driving across the business are enduring. Opendoor is reinventing one of life’s most important transactions, and we remain steadfast in our vision of helping people move with simplicity and certainty. We are proud of our progress and believe we are well-positioned for the future. …and the Path Ahead

6 Business Highlights In the second quarter, we continued to focus on executing against the growth levers we control. While the challenging macro environment masks the impact of the structural improvements we have made to our spreads, our progress broadening our top of funnel and delivering products that delight customers sets us up for future success. Growing our Top of Funnel Our total addressable market is massive – our buybox across our markets currently sits north of $650 billion – and we’re just scratching the surface in terms of market penetration. One of the most important growth levers we have is making more customers aware of the benefits of Opendoor’s product offering. Thus far in 2024, 28% of true sellers, or consumers within our buybox that went on to list or sell their home, had previously entered their address on our website. While more than one in four sellers come to us first, we still have a significant opportunity to get all sellers to start with Opendoor. To increase brand awareness with potential sellers, we have strategically shifted more of our marketing dollars from direct response to brand media spend. As a result of our marketing investments, aided awareness and consideration have reached their highest levels in Opendoor history. Increasing awareness not only expands the number of customers in our funnel, but it also increases conversion. We have 45% average awareness in some of our most mature markets, and we believe that higher intent customers find us when our brand awareness is stronger. For example, these more mature markets have seen 33% higher conversion from offer to contract as compared to some of our newer markets that have 26% average awareness. Moreover, we launched more than half of our markets during 2021 and 2022, ahead of the 2022 market reset when we began reducing marketing and inventory levels. Average awareness in those markets sits at just 19% today, presenting the potential for over 75% in offer-to-contract conversion improvements. We believe the combination of consistent marketing and expanding brand awareness across markets should provide meaningful embedded tailwinds that we can unlock over time.

Expanding Our Suite of Services We are intently focused on developing innovative, seller-focused products. Once we get a customer into the funnel, we aim to provide a suite of products that can meet each seller’s specific needs. While many sellers are looking for the simplicity and certainty of our all-cash offer product, we have found that other sellers are interested in price discovery via listing on the MLS. To better serve these customers, we expanded our List with Opendoor product from 17 markets at the start of the year to nearly all of our markets by the end of the second quarter. This product release gives sellers the choice to weigh the options of a simple and certain sale directly to Opendoor or listing on the market. If a customer chooses List with Opendoor, we connect them with a local Opendoor partner agent to list their home on the MLS, and we charge a listing fee. If they don’t find the price they want, they can still complete their sale by accepting Opendoor’s flagship cash offer, which is valid for 30 days. Since launching this listing product, we have observed a 9% uplift in NPS, proving that offering multiple selling solutions is resonating with customers. Over time, this capital-light product has the potential to be accretive to total acquisition volumes and margins. 7 Business Highlights List with Opendoor

8 Financial Highlights 2Q24 Revenue $1.5 billion 2Q24 Homes Acquired 4,771 3,683 4,771 2,680 2Q23 3Q23 4Q23 1Q24 2Q24 $870 $980 2Q23 3Q23 4Q23 1Q24 2Q24 $1,976 $1,511 3,136 $1,181 3,458 In the second quarter, acquisitions, revenue, Contribution Margin, and Adjusted EBITDA each exceeded the high end of our guidance ranges. These results demonstrate continued progress toward rescaling the business with attractive and sustainable unit economics and cost discipline, as well as the value of Opendoor’s seamless, simple, and certain customer experience. GROWTH In the second quarter, we delivered over $1.5 billion of revenue, coming in just above the high end of the guidance range of $1.4 billion to $1.5 billion and representing 4,078 homes sold. On the acquisition side, we purchased 4,771 homes in the second quarter, up 38% sequentially and up 78% versus 2Q23. Year-over-year acquisition growth was attributable to lower spreads, increased marketing and brand media spend, and contributions from partnership channels. UNIT ECONOMICS GAAP Gross Profit was $129 million in 2Q24, versus $114 million in 1Q24 and $149 million in 2Q23. Adjusted Gross Profit, which aligns the timing of inventory valuation adjustments recorded under GAAP to the period in which the home is sold, was $154 million in 2Q24, versus $104 million in 1Q24 and $7 million in 2Q23. Contribution Profit (Loss) was $95 million in the second quarter, versus $57 million in 1Q24 and $(90) million in 2Q23. Contribution Margin of 6.3% came in above our guidance range of 5.4% to 5.7% and compares to 4.8% in 1Q24 and (4.6)% in 2Q23. The outperformance on margin was partially due to our resale mix, as we sold through newly listed homes with shorter holding periods more quickly than anticipated. NET LOSS AND ADJUSTED EBITDA GAAP Net Loss was $(92) million in 2Q24 versus $(109) million in 1Q24 and $23 million in 2Q23. Adjusted Net Loss was $(31) million in 2Q24 versus $(80) million in 1Q24 and $(197) million in 2Q23. 2Q24 Contribution Margin 6.3%

GAAP Operating Expenses were $201 million in 2Q24, flat versus $201 million in 1Q24 and down from $217 million in 2Q23. Adjusted Operating Expenses, defined as the delta between Contribution Profit (Loss) and Adjusted EBITDA, were $100 million in 2Q24, down from $107 million in 1Q24 and up from $78 million in 2Q23. The outperformance versus guidance on Adjusted Operating Expenses was due to a pullback in marketing spend, coupled with lower than expected fixed expenses related to reduced hiring. Excluding the impact from timing adjustments (expenses related to the holding costs associated with selling down and rebuilding inventory), Adjusted Operating Expenses are down year-over-year, demonstrating our ability to drive growth while leveraging our fixed cost base. Adjusted EBITDA was $(5) million in 2Q24, ahead of the high end of our guidance range of $(35) million to $(25) million, and compares to $(50) million in 1Q24 and $(168) million in 2Q23. As a percentage of revenue, Adjusted EBITDA was (0.3)% in 2Q24 versus (4.2)% in 1Q24 and (8.5)% in 2Q23. Adjusted EBITDA exceeded our expectations due to margin outperformance and ongoing cost discipline. INVENTORY We ended the second quarter with 6,399 homes in inventory on our balance sheet, representing $2.2 billion in net inventory, which was up 19% from 1Q24 and up 94% from 2Q23 as we have ramped our acquisition pace over the last year. Additionally, as of June 30, 2024, 14% of our homes had been listed on the market for more than 120 days, compared to 15% for the broader market, as adjusted for our buybox. OTHER BALANCE SHEET ITEMS We ended the quarter with $1.2 billion in capital, which includes $809 million in unrestricted cash and marketable securities and $300 million of equity invested in homes and related assets, net of inventory valuation adjustments. This compares to $1.3 billion in capital as of the end of 1Q24, which included $1.0 billion in unrestricted cash and marketable securities and $181 million of equity invested in homes and related assets, net of inventory valuation adjustments. 9 Financial Highlights 2Q24 Contribution Margin 6.3% $(20.7)k 2Q24 Trailing Twelve Month Contribution Profit per Home $18,377 $3.0k $(18.8)k $18.4k $(13.7)k 2Q23 3Q23 4Q23 1Q24 2Q24 2Q24 Adj. Operating Expenses $100 million $92 $107 $78 $100 2Q23 3Q23 4Q23 1Q24 2Q24 $(38.1)k $99 2Q24 Trailing Twelve Month Adjusted EBITDA per Home $(14,141) $(24.9)k $(36.1)k $(14.1)k $(33.5)k 2Q23 3Q23 4Q23 1Q24 2Q24 (5.5)% 2Q24 Trailing Twelve Month Contribution Margin 4.9% 0.8% (4.9)% 4.9% (3.7)% 2Q23 3Q23 4Q23 1Q24 2Q24 $(48.1)k 2Q24 Trailing Twelve Month Adjusted Net Income per Home $(23,194) $(47.2)k $(41.6)k 2Q23 3Q23 4Q23 1Q24 2Q24 $(33.3)k $(23.2)k 2Q24 Total Capital $1.2 billion 2Q24 Cash, Cash Equivalents, and Marketable Securities $809 million

10 Financial Highlights At quarter-end, we had $7.0 billion in non-recourse, asset-backed borrowing capacity, comprising $3.0 billion of senior revolving credit facilities and $4.0 billion of senior and mezzanine term debt facilities, of which total committed borrowing capacity was $2.3 billion. MAINSTAY Today, we announced that our business line, Mainstay, is becoming an independent, privately-held company in conjunction with an outside equity investment led by Khosla Ventures. Although Opendoor will retain less than 50% ownership on a fully diluted basis, it will continue to be the largest shareholder, enabling Opendoor to benefit from any future upside in the business. Mainstay is a comprehensive market intelligence and transaction platform for the single-family rental industry, which we started in order to better serve enterprise customers. This transaction sets up both Opendoor and Mainstay to focus on building their respective businesses with dedicated teams and resources. HOUSING MACRO The housing market remains challenging as mortgage rates continue to be elevated and volatile, keeping sellers on the sidelines and straining housing affordability for buyers. In the second quarter, overall volumes in the U.S. housing market remained depressed, with seasonally adjusted annual existing home sales of just over four million, slightly below last year’s levels and well below the ten-year average of over five million annual transactions. New listings are hovering around decade lows, and in the back half of the second quarter, we saw an uptick in delistings, which are now at decade highs for this time of year. Additionally, clearance rates have slowed more quickly than is seasonally typical, down nearly 30% in 2Q24 versus 2Q23 levels. As a result, month-over-month home price appreciation made a meaningful departure to the downside, underperforming 2023 levels and crossing into slightly negative territory by mid-June, earlier than we’ve seen in the last decade outside of 2020. Further, increasing delisting rates suggest that reported home price appreciation numbers are inflated relative to historical levels with many sellers failing to find an attractive clearing price.

11 Financial Highlights Notwithstanding the weak housing market, the U.S. economy overall continues to show signs of resilience despite elevated interest rates. Inflation has been trending downward, which has increased the probability and quantum of expected rate cuts meaningfully. Today, the pricing of federal-funds rate futures indicates a high probability of at least a 50 basis point reduction in the rate by the end of the year. This dynamic could provide a boost to various sectors, including housing market activity. While we are not underwriting a rosier macro outlook, we believe that we are well positioned to benefit from any potential tailwinds from positive changes in interest rates. We remain flexible in setting spreads dynamically, with the goal of optimizing our performance against the vectors of growth, margin, and risk. We believe this decision-making framework will allow us to act nimbly and respond to a range of macroeconomic outcomes. GUIDANCE We expect the following results for the third quarter of 2024: ● Revenue is expected to be between $1.2 billion and $1.3 billion ● Contribution Profit1 is expected to be between $35 million and $45 million, or Contribution Margin between 2.9% and 3.5% ● Adjusted EBITDA1 is expected to be between $(70) million to $(60) million ● Stock-based compensation expense is expected to be approximately $35 million Outlook for the third quarter reflects the expected reduction in Adjusted Operating Expenses as a result of the Mainstay transaction, which closed on July 31, 2024. In the first half of 2024, Mainstay’s business had a de minimis impact on Opendoor’s revenue and Contribution Profit and incurred approximately $17 million of Adjusted Operating Expenses. Going forward, Mainstay will run independently from Opendoor, and Opendoor will maintain less than 50% ownership on a fully diluted basis. The Company is in the process of assessing the financial statement impact of the 3Q24 Revenue Guidance $1.2 to $1.3 billion 3Q24 Contribution Profit1 Guidance $35 to $45 million 3Q24 Adjusted EBITDA1 Guidance $(70) to $(60) million

12 Financial Highlights fundraise, but we do not anticipate recognizing Mainstay’s ongoing financial results in Opendoor’s income or loss from operations going forward. Given the macro factors highlighted above, we widened our spreads more than previously anticipated and slowed marketing spend to ensure our dollars are being spent efficiently. These dynamics and actions are expected to result in 3Q24 home acquisitions that are up slightly year-over-year. We will continue to acquire homes at spreads we believe are appropriate as we manage our business amid various macro backdrops. Additionally, if the current macro conditions persist, there is a risk to achieving our 5% to 7% annual Contribution Margin target for 2024. As always, we will continue to assess our cost structure to mitigate losses. We remain committed to making meaningful progress in increasing acquisitions and reducing Adjusted Net Losses year-over-year in 2024. CONCLUSION At Opendoor, we are building products and perfecting the customer experience to bring efficiency and transparency to a trillion dollar industry. The traditional real estate process is still broken for the millions of people who move every year – solving this is our purpose. Opendoor provides the only platform at scale for a home seller to transact directly and for a home buyer to have an e-commerce-like transaction experience. While we’re a small piece of the pie today, we are committed to creating products and services that compel everyone to start their home selling and buying journey with us.

13Raleigh-Durham, NC Carrie Wheeler, CEO Christy Schwartz, Interim CFO CONFERENCE CALL INFORMATION Opendoor will host a conference call to discuss its financial results on August 1, 2024 at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from Opendoor’s Investor Relations website at https://investor.opendoor.com. An archived version of the webcast will be available from the same website after the call. August 1, 2024 at 2 p.m. PT investor.opendoor.com LIVE WEBCAST

/ Opendoor/ OpendoorHQ Company / Opendoor-com investor.opendoor.com

15 Definitions & Financial Tables

This shareholder letter contains certain forward-looking statements within the meaning of Section 27A the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking, including, without limitation, statements regarding: current and future health and stability of the real estate housing market and general economy; volatility of mortgage interest rates and expectations regarding the future shifts in behavior by consumers and partners; the health and status of our financial condition, whether we will be able to rescale our business and whether we will be able to increase acquisitions and improve Adjusted Net Loss through the remainder of 2024 in a potentially slowing housing market; anticipated future results of operations or financial performance, including our third quarter of 2024 and full-year outlook and our ability to balance growth, margin and risk in a challenging environment, our ability to deliver Contribution Margin within our target annual range and our ability to achieve other long-term performance targets; whether we are able to reduce Adjusted Operating Expenses in the third quarter of 2024 as a result of the Mainstay transaction; our expectations regarding the impact of trends in seasonality on the real estate industry and our business; priorities of the Company to achieve future financial and business goals; our ability to continue to effectively navigate the markets in which we operate; anticipated future and ongoing impacts and benefits of acquisitions, advertising, partnership channel expansions, product innovations and other business decisions; health of our balance sheet to weather ongoing market transitions; our ability to adopt an effective approach to manage economic and industry risk, as well as inventory health; our expectations with respect to the future success of our partnerships and our ability to drive significant growth in sales volumes through such partnerships; business strategy and plans, including any plans to expand into additional markets, market opportunity and expansion and objectives of management for future operations, including statements regarding the benefits and timing of the roll out of new markets, products or technology; and the expected diversification of funding sources. Forward-looking statements generally are identified by the words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “intend”, “may”, “might”, “opportunity”, “outlook”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “strategy”, “strive”, “target”, “vision”, “will”, or “would”, any negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. The factors that could cause or contribute to actual future events to differ materially from the forward-looking statements in this shareholder letter include but are not limited to: the current and future health and stability of the economy, financial conditions and the residential housing market, including any extended downturns or slowdowns; changes in general economic and financial conditions (including federal monetary policy, interest rates, inflation, actual or anticipated recession, home price fluctuations, and housing inventory), as well as the probability of such changes occurring, that may impact demand for our products and services, lower our profitability or reduce our access to future financings; our real estate assets and increased competition in the U.S. residential real estate industry; our ability to operate and grow our core business products, including the ability to obtain sufficient financing and resell purchased homes; investment of resources to pursue strategies and develop new products and services that may not prove effective or that are not attractive to customers and real estate partners or that do not allow us to compete successfully; our ability to acquire and resell homes profitably; our ability to grow market share in our existing markets or any new markets we may enter; our ability to manage our growth effectively; our ability to expeditiously sell and appropriately price our inventory; our ability to access sources of capital, including debt financing and securitization funding to finance our real estate inventories and other sources of capital to finance operations and growth; our ability to maintain and enhance our products and brand, and to attract customers; our ability to manage, develop and refine our technology platform, including our automated pricing and valuation technology; ability to comply with multiple listing service rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers; our ability to obtain or maintain licenses and permits to support our current and future business operations; acquisitions, strategic partnerships, joint ventures, capital-raising activities or other corporate transactions or commitments by us or our competitors; actual or anticipated changes in technology, products, markets or services by us or our competitors; our success in retaining or recruiting, or changes required in, our officers, key employees and/or directors; any future impact of pandemics or epidemics, including any future resurgences of COVID-19 and its variants, or other public health crises on our ability to operate, demand for our products and services, or other general economic conditions; the impact of the regulatory environment within our industry and complexities with compliance related to such environment; changes in laws or government regulation affecting our business; and the impact of pending or any future litigation or regulatory actions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 15, 2024, as updated by our periodic reports and other filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations. 16 Forward-Looking Statements

Use of Non-GAAP Financial Measures To provide investors with additional information regarding the Company’s financial results, this shareholder letter includes references to certain non-GAAP financial measures that are used by management. The Company believes these non-GAAP financial measures including Adjusted Gross Profit (Loss), Contribution Profit (Loss), Adjusted Net Loss, Adjusted EBITDA, Adjusted Operating Expenses, and any such non-GAAP financial measures expressed as a Margin, are useful to investors as supplemental operational measurements to evaluate the Company’s financial performance. The non-GAAP financial measures should not be considered in isolation or as a substitute for the Company’s reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled measures reported by other companies. Management uses these non- GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the Company’s performance by excluding certain items that may not be indicative of the Company’s recurring operating results. Adjusted Gross Profit (Loss) and Contribution Profit (Loss) To provide investors with additional information regarding our margins and return on inventory acquired, we have included Adjusted Gross Profit (Loss) and Contribution Profit (Loss), which are non-GAAP financial measures. We believe that Adjusted Gross Profit (Loss) and Contribution Profit (Loss) are useful financial measures for investors as they are supplemental measures used by management in evaluating unit level economics and our operating performance. Each of these measures is intended to present the economics related to homes sold during a given period. We do so by including revenue generated from homes sold (and adjacent services) in the period and only the expenses that are directly attributable to such home sales, even if such expenses were recognized in prior periods, and excluding expenses related to homes that remain in inventory as of the end of the period. Contribution Profit (Loss) provides investors a measure to assess Opendoor’s ability to generate returns on homes sold during a reporting period after considering home purchase costs, renovation and repair costs, holding costs and selling costs. Adjusted Gross Profit (Loss) and Contribution Profit (Loss) are supplemental measures of our operating performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, costs required to be recorded under GAAP in the same period. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit. 17 Definitions

Adjusted Gross Profit (Loss) / Margin We calculate Adjusted Gross Profit (Loss) as gross profit under GAAP adjusted for (1) inventory valuation adjustment in the current period, and (2) inventory valuation adjustment in prior periods. Inventory valuation adjustment in the current period is calculated by adding back the inventory valuation adjustments recorded during the period on homes that remain in inventory at period end. Inventory valuation adjustment in prior periods is calculated by subtracting the inventory valuation adjustments recorded in prior periods on homes sold in the current period. Adjusted Gross Margin is Adjusted Gross Profit (Loss) as a percentage of revenue. We view this metric as an important measure of business performance as it captures gross margin performance isolated to homes sold in a given period and provides comparability across reporting periods. Adjusted Gross Profit (Loss) helps management assess home pricing, service fees and renovation performance for a specific resale cohort. Contribution Profit (Loss) / Margin We calculate Contribution Profit (Loss) as Adjusted Gross Profit (Loss), minus certain costs incurred on homes sold during the current period including: (1) holding costs incurred in the current period, (2) holding costs incurred in prior periods, and (3) direct selling costs. The composition of our holding costs is described in the footnotes to the reconciliation table below. Contribution Margin is Contribution Profit (Loss) as a percentage of revenue. We view this metric as an important measure of business performance as it captures the unit level performance isolated to homes sold in a given period and provides comparability across reporting periods. Contribution Profit (Loss) helps management assess inflows and outflows directly associated with a specific resale cohort. 18 Definitions