false

0001039065

0001039065

2024-10-24

2024-10-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE

OF REPORT (DATE OF EARLIEST EVENT REPORTED): October 24, 2024

OSI

SYSTEMS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN

ITS CHARTER)

| Delaware |

000-23125 |

33-0238801 |

(STATE OR OTHER JURISDICTION

OF INCORPORATION) |

(COMMISSION FILE NUMBER) |

(IRS EMPLOYER IDENTIFICATION

NO.) |

12525 CHADRON AVENUE

HAWTHORNE,

CA 90250 |

| (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) (ZIP CODE) |

(310)

978-0516

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA

CODE)

N/A

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $0.001 par value |

|

OSIS |

|

The Nasdaq Global Select Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On October 24, 2024,

we issued a press release announcing our financial results for the quarter ended September 30, 2024. A copy of the press release

is attached hereto as Exhibit 99.1 and incorporated herein by this reference.

We are furnishing the information

contained in this Item 2.02 (including Exhibit 99.1). It shall not be deemed to be “filed” for any purpose, including

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that

section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities

Exchange Act of 1934, as amended, regardless of any general incorporation language in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

| |

Exhibit 99.1: |

Press Release of OSI Systems, Inc. dated October 24, 2024. |

| |

|

|

| |

Exhibit 104: |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

OSI SYSTEMS, INC. |

| |

|

| Date: October 24, 2024 |

|

| |

|

|

| |

By: |

/s/ Alan Edrick |

| |

|

Alan Edrick |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

OSI SYSTEMS REPORTS FISCAL 2025 FIRST QUARTER

FINANCIAL RESULTS

| · | Record Fiscal Q1 Revenues of $344 Million (23% growth year-over-year) |

| · | Q1 Earnings Per Diluted Share |

| o | Record Q1 Non-GAAP Adjusted EPS of $1.25 |

| · | Q1 Operating Income Growth of 34% Year-Over-Year |

| · | Q1-Ended Backlog of Approximately $1.8 Billion |

| · | Company Increases Fiscal 2025 Revenues and Non-GAAP Adjusted Diluted EPS Guidance |

HAWTHORNE, Calif. — (BUSINESS WIRE) —

October 24, 2024—OSI Systems, Inc. (the “Company” or “OSI Systems”) (NASDAQ: OSIS) today announced

its financial results for the first quarter of fiscal 2025.

Deepak Chopra, OSI Systems’ Chairman and

Chief Executive Officer, stated “We are pleased to kick off fiscal 2025 with a strong first quarter in which we posted record Q1

revenues and non-GAAP earnings per share led again by outstanding growth in the Security division. Given our robust backlog and high visibility

into the opportunity pipeline, we anticipate a strong fiscal year.”

For Q1 FY25, the Company reported revenues of

$344.0 million, a 23% increase over the $279.2 million reported for the same quarter of the prior year. Net income for Q1 FY25 was $17.9

million, or $1.05 per diluted share, compared to net income of $12.9 million, or $0.75 per diluted share, for the same quarter of the

prior year. Non-GAAP net income for Q1 FY25 was $21.3 million, or $1.25 per diluted share, compared to non-GAAP net income for the same

quarter of the prior year of $15.6 million, or $0.91 per diluted share.

The Company's backlog was approximately $1.8 billion

as of September 30, 2024, compared to approximately $1.7 billion as of June 30, 2024. For Q1 FY25, net cash used in operating

activities was $37.2 million, driven primarily by increases in working capital to support planned future growth. Capital expenditures

were $7.7 million and depreciation and amortization was $11.5 million for Q1 FY25. The Company repurchased 531,314 shares during Q1 FY25

for an aggregate cost of approximately $80 million.

Mr. Chopra commented, “The Security

division results reflect continuing strong momentum with heightened demand for our product and service offerings, as well as our superior

competitive position. The Security division’s revenues in the first quarter of fiscal 2025 increased 36% year-over-year, leading

to significant operating income growth and year-over-year adjusted operating margin expansion. During the quarter, we acquired a business

that provides critical military, space and surveillance solutions, which is expected to be complementary to our sales channel. Security

bookings were solid and we ended the quarter with near-record backlog in this division. This provides us significant confidence that the

Security division is well-positioned for the future.”

Mr. Chopra continued, “Our Optoelectronics

and Manufacturing division delivered solid quarterly results, reporting year-over-year revenue growth despite certain customers continuing

to adjust inventory levels and purchasing patterns. The division continues to benefit from our global manufacturing footprint with exposure

across multiple end markets.”

Mr. Chopra concluded, “During the first

quarter of fiscal 2025, we saw improved margins in the Healthcare division on a comparable level of revenues with the same quarter of

the prior year. We continue to focus on new product development, principally in our patient monitoring portfolio.”

In July 2024 the Company issued $350 million

of convertible senior notes due in fiscal 2030 at an interest rate of 2.25%. The net proceeds of the issuance were partially used to reduce

the outstanding balance under the Company’s revolving credit facility and to repurchase shares of common stock.

Fiscal Year 2025 Outlook

| | |

Current Updated Guidance | |

Previous Guidance |

| Revenues | |

$1.670 billion - $1.695 billion | |

$1.620 billion - $1.650 billion |

| Growth Rate | |

8.5% - 10.2% | |

5.3% - 7.2% |

| | |

| |

|

| Non-GAAP Adjusted Diluted Earnings Per Share | |

$9.00 - $9.30 | |

$8.80 - $9.15 |

| Growth Rate | |

10.7% - 14.4% | |

8.2% - 12.5% |

The Company is increasing its fiscal 2025 revenues

and non-GAAP adjusted diluted earnings per share guidance. Actual revenues and adjusted diluted earnings per share could vary from this

guidance due to factors discussed under “Forward-Looking Statements” or other factors.

The Company’s fiscal 2025 adjusted diluted

earnings per share guidance is provided on a non-GAAP basis only. The Company does not provide a reconciliation of guidance for non-GAAP

adjusted diluted EPS to GAAP diluted EPS (the most directly comparable GAAP measure) on a forward-looking basis because the Company is

unable to provide a meaningful or accurate compilation of reconciling items and certain information is not available. This is due to the

inherent difficulty and complexity in accurately forecasting the timing and amounts of various items included in the calculation of GAAP

diluted EPS but excluded in the calculation of non-GAAP adjusted diluted EPS, such as acquisition costs and other non-recurring items

that have not yet occurred, are out of the Company’s control or cannot otherwise reasonably be predicted. For the same reasons,

the Company is unable to address the significance of unavailable information which may be material and therefore could result in GAAP

diluted EPS, the most directly comparable GAAP financial measure, being materially different from projected non-GAAP adjusted diluted

EPS.

Presentation of Non-GAAP Financial Measures

This earnings release includes a presentation

of non-GAAP net income, non-GAAP adjusted diluted earnings per share, non-GAAP operating income (loss) by segment and non-GAAP operating

margin, all of which are non-GAAP financial measures. The presentation of these non-GAAP figures for all fiscal periods is provided to

allow for the comparison of the underlying performance of the Company, net of impairment, restructuring and other charges (including certain

legal costs), amortization of intangible assets acquired through business acquisitions, and their associated tax effects, and the impact

of discrete income tax items. Although we exclude amortization of acquired intangible assets from our non-GAAP figures, revenue generated

from such intangibles is included within revenue in determining non-GAAP financial performance of the Company. Management believes that

the non-GAAP financial measures presented in this earnings release provide (i) enhanced insight into the ongoing operations of the

Company, (ii) meaningful information regarding the Company’s financial results (excluding amounts management does not view

as reflective of ongoing operating results) for purposes of planning, forecasting and assessing the performance of the Company’s

businesses, (iii) a meaningful comparison of financial results of the current period against results of past periods and (iv) financial

results that are generally more comparable to financial results of peer companies than are GAAP figures. Non-GAAP financial measures should

not be assessed in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP. These non-GAAP

measures may not be the same as measures used by other companies due to possible differences in methods and in the items or events for

which adjustments are made.

Reconciliations of GAAP financial information

to non-GAAP financial information are provided in the accompanying tables. The financial results calculated in accordance with GAAP and

reconciliations from those financial results should be carefully evaluated.

Conference Call Information

The Company will host a conference call and simultaneous

webcast beginning at 9:00am PT (12:00pm ET) today to discuss its results for Q1 FY25. To listen, please visit the Investor Relations

section of the OSI Systems website at http://investors.osi-systems.com/index.cfm and follow the link that will be posted on the

front page. A replay of the webcast will be available beginning shortly after the conclusion of the conference call until November 10,

2024. The replay can be accessed through the Company’s website at www.osi-systems.com.

About OSI Systems

OSI Systems is a vertically integrated designer

and manufacturer of specialized electronic systems and components for critical applications in the homeland security, healthcare, defense

and aerospace industries. The Company combines more than 40 years of electronics engineering and manufacturing experience with offices

and production facilities in more than a dozen countries to implement a strategy of expansion into selective end-product markets. For

more information on OSI Systems and its subsidiary companies, visit www.osi-systems.com. News Filter: OSIS-E

Forward-Looking Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements

relate to the Company's current expectations, beliefs, and projections concerning matters that are not historical facts. Forward-looking

statements are not guarantees of future performance and involve uncertainties, risks, assumptions, and contingencies, many of which are

outside the Company's control and which may cause actual results to differ materially from those described in or implied by any forward-looking

statement. Forward-looking statements include, but are not limited to, information provided regarding expected revenues, earnings, growth,

and operational performance in fiscal 2025 and beyond. The Company could be exposed to a variety of negative consequences as a result

of delays related to the award of domestic and international contracts; failure to secure the renewal of key customer contracts; delays

in customer programs; delays in revenue recognition related to the timing of customer acceptance; the impact of potential information

technology, cybersecurity or data security breaches; changes in domestic and foreign government spending and budgetary, procurement and

trade policies adverse to the Company's businesses; the impact of the Russia-Ukraine conflict or conflicts in the Middle East, including

the potential for broad economic disruption; global economic uncertainty; material delays and cancellations of orders or deliveries

thereon, supply chain disruptions, plant closures, or other adverse impacts on the Company’s ability to execute business plans;

unfavorable currency exchange rate fluctuations; unfavorable interest rate fluctuations; effect of changes in tax legislation; market

acceptance of the Company's new and existing technologies, products, and services; the Company's ability to win new business and convert

orders received to sales within the current fiscal year; contract and regulatory compliance matters, and actions which, if brought, could

result in judgments, settlements, fines, injunctions, debarment, or penalties; and other risks and uncertainties, including, but not limited

to, those detailed herein and from time to time in the Company's Securities and Exchange Commission filings, which could have a material

and adverse impact on the Company's business, financial condition, and results of operations. For additional information on these and

other factors that could cause the Company's future results to differ materially from those in any forward-looking statements, see the

section titled "Risk Factors" in the Company's most recently filed Annual Report on Form 10-K and other risks described

therein and in documents subsequently filed by the Company from time to time with the Securities and Exchange Commission. Undue reliance

should not be placed on forward-looking statements, which are based on currently available information and speak only as of the date on

which they are made. The Company assumes no obligation to update any forward-looking statement made in this press release that becomes

untrue because of subsequent events, new information, or otherwise, except to the extent required to do so under federal securities laws.

For Additional Information, Contact:

OSI Systems, Inc.

Ajay Vashishat

Vice President, Business Development

Tel: (310) 349-2237

avashishat@osi-systems.com

OSI SYSTEMS, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED Consolidated Statements of Operations

(in thousands, except per share data)

| | |

Three Months Ended September 30, | |

| | |

2023 | | |

2024 | |

| Revenues: | |

| | |

| |

| Products | |

$ | 199,709 | | |

$ | 255,808 | |

| Services | |

| 79,501 | | |

| 88,199 | |

| Total net revenues | |

| 279,210 | | |

| 344,007 | |

| Cost of goods sold: | |

| | | |

| | |

| Products | |

| 136,983 | | |

| 170,422 | |

| Services | |

| 43,482 | | |

| 52,083 | |

| Total cost of goods sold | |

| 180,465 | | |

| 222,505 | |

| Gross profit | |

| 98,745 | | |

| 121,502 | |

| Operating expenses: | |

| | | |

| | |

| Selling, general and administrative | |

| 59,798 | | |

| 72,223 | |

| Research and development | |

| 15,922 | | |

| 17,773 | |

| Restructuring and other charges, net | |

| 466 | | |

| 1,178 | |

| Total operating expenses | |

| 76,186 | | |

| 91,174 | |

| Income from operations | |

| 22,559 | | |

| 30,328 | |

| Interest and other expense, net | |

| (5,748 | ) | |

| (7,359 | ) |

| Income before income taxes | |

| 16,811 | | |

| 22,969 | |

| Provision for income taxes | |

| (3,932 | ) | |

| (5,033 | ) |

| Net income | |

$ | 12,879 | | |

$ | 17,936 | |

| | |

| | | |

| | |

| Diluted earnings per share | |

$ | 0.75 | | |

$ | 1.05 | |

| Weighted average shares outstanding – diluted | |

| 17,175 | | |

| 17,055 | |

UNAUDITED

Segment Information

(in thousands)

| | |

Three Months Ended September 30, | |

| | |

2023 | | |

2024 | |

| Revenues – by Segment: | |

| | | |

| | |

| Security division | |

$ | 164,629 | | |

$ | 224,314 | |

| Optoelectronics and Manufacturing division, including intersegment revenues | |

| 96,128 | | |

| 97,795 | |

| Healthcare division | |

| 37,787 | | |

| 37,102 | |

| Intersegment eliminations | |

| (19,334 | ) | |

| (15,204 | ) |

| Total | |

$ | 279,210 | | |

$ | 344,007 | |

| | |

| | | |

| | |

| Operating income (loss) – by Segment: | |

| | | |

| | |

| Security division | |

$ | 20,609 | | |

$ | 28,856 | |

| Optoelectronics and Manufacturing division | |

| 11,437 | | |

| 10,609 | |

| Healthcare division | |

| 164 | | |

| 800 | |

| Corporate | |

| (9,916 | ) | |

| (9,510 | ) |

| Intersegment eliminations | |

| 265 | | |

| (427 | ) |

| Total | |

$ | 22,559 | | |

$ | 30,328 | |

OSI SYSTEMS, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands) |

| | |

June 30, 2024 | | |

September 30, 2024 | |

| Assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 95,353 | | |

$ | 85,053 | |

| Accounts receivable, net | |

| 648,155 | | |

| 687,610 | |

| Inventories | |

| 397,939 | | |

| 456,030 | |

| Prepaid expenses and other current assets | |

| 74,077 | | |

| 81,310 | |

| Total current assets | |

| 1,215,524 | | |

| 1,310,003 | |

| Property and equipment, net | |

| 113,967 | | |

| 124,613 | |

| Goodwill | |

| 351,480 | | |

| 381,444 | |

| Intangible assets, net | |

| 139,529 | | |

| 183,222 | |

| Other non-current assets | |

| 115,508 | | |

| 114,232 | |

| Total Assets | |

$ | 1,936,008 | | |

$ | 2,113,514 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Bank lines of credit | |

$ | 384,000 | | |

$ | 259,000 | |

| Current portion of long-term debt | |

| 8,167 | | |

| 8,217 | |

| Accounts payable and accrued expenses | |

| 248,427 | | |

| 269,067 | |

| Other current liabilities | |

| 174,043 | | |

| 176,252 | |

| Total current liabilities | |

| 814,637 | | |

| 712,536 | |

| Long-term debt | |

| 129,383 | | |

| 468,084 | |

| Other long-term liabilities | |

| 128,505 | | |

| 146,399 | |

| Total liabilities | |

| 1,072,525 | | |

| 1,327,019 | |

| Total stockholders’ equity | |

| 863,483 | | |

| 786,495 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 1,936,008 | | |

$ | 2,113,514 | |

Reconciliation

of GAAP to Non-GAAP

NET INCOME AND EARNINGS PER SHARE

(in thousands, except earnings per share data)

| | |

Three Months Ended September 30, | |

| | |

2023 | | |

2024 | |

| | |

Net income | | |

Diluted EPS | | |

Net income | | |

Diluted EPS | |

| GAAP basis | |

$ | 12,879 | | |

$ | 0.75 | | |

$ | 17,936 | | |

$ | 1.05 | |

| Restructuring and other charges, net | |

| 466 | | |

| 0.02 | | |

| 1,178 | | |

| 0.07 | |

| Amortization of acquired intangible assets | |

| 3,707 | | |

| 0.22 | | |

| 3,867 | | |

| 0.23 | |

| Non-cash interest expense | |

| - | | |

| - | | |

| - | | |

| - | |

| Tax effect of above adjustments | |

| (1,079 | ) | |

| (0.06 | ) | |

| (1,211 | ) | |

| (0.07 | ) |

| Discrete tax benefit | |

| (413 | ) | |

| (0.02 | ) | |

| (482 | ) | |

| (0.03 | ) |

| Non-GAAP basis | |

$ | 15,560 | | |

$ | 0.91 | | |

$ | 21,288 | | |

$ | 1.25 | |

RECONCILIATION OF GAAP TO NON-GAAP

OPERATING INCOME (LOSS) AND OPERATING MARGIN

BY SEGMENT

(in thousands, except percentages)

| Three Months Ended September 30, 2023 |

|

| | |

Security Division | | |

Optoelectronics and Manufacturing Division | | |

Healthcare Division | | |

Corporate / Elimination | | |

Total | |

| | |

| | |

% of

Sales | | |

| | |

% of

Sales | | |

| | |

% of

Sales | | |

| | |

| | |

% of

Sales | |

| GAAP basis – operating income (loss) | |

$ | 20,609 | | |

| 12.5 | % | |

$ | 11,437 | | |

| 11.9 | % | |

$ | 164 | | |

| 0.4 | % | |

$ | (9,651 | ) | |

$ | 22,559 | | |

| 8.1 | % |

| Restructuring and other charges, net | |

| 272 | | |

| 0.2 | % | |

| 51 | | |

| 0.1 | % | |

| - | | |

| 0.0 | % | |

| 143 | | |

| 466 | | |

| 0.2 | % |

| Amortization of acquired intangible assets | |

| 2,627 | | |

| 1.6 | % | |

| 779 | | |

| 0.8 | % | |

| 301 | | |

| 0.8 | % | |

| - | | |

| 3,707 | | |

| 1.3 | % |

| Non-GAAP basis– operating income (loss) | |

$ | 23,508 | | |

| 14.3 | % | |

$ | 12,267 | | |

| 12.8 | % | |

$ | 465 | | |

| 1.2 | % | |

$ | (9,508 | ) | |

$ | 26,732 | | |

| 9.6 | % |

| Three Months Ended September 30, 2024 |

|

| | |

Security Division | | |

Optoelectronics and Manufacturing Division | | |

Healthcare Division | | |

Corporate / Elimination | | |

Total | |

| | |

| | |

% of

Sales | | |

| | |

% of

Sales | | |

| | |

% of

Sales | | |

| | |

| | |

% of

Sales | |

| GAAP basis – operating income (loss) | |

$ | 28,856 | | |

| 12.9 | % | |

$ | 10,609 | | |

| 10.8 | % | |

$ | 800 | | |

| 2.2 | % | |

$ | (9,937 | ) | |

$ | 30,328 | | |

| 8.8 | % |

| Restructuring and other charges, net | |

| 479 | | |

| 0.2 | % | |

| 547 | | |

| 0.6 | % | |

| 152 | | |

| 0.4 | % | |

| - | | |

| 1,178 | | |

| 0.3 | % |

| Amortization of acquired intangible assets | |

| 2,986 | | |

| 1.3 | % | |

| 580 | | |

| 0.6 | % | |

| 301 | | |

| 0.8 | % | |

| - | | |

| 3,867 | | |

| 1.2 | % |

| Non-GAAP basis– operating income (loss) | |

$ | 32,321 | | |

| 14.4 | % | |

$ | 11,736 | | |

| 12.0 | % | |

$ | 1,253 | | |

| 3.4 | % | |

$ | (9,937 | ) | |

$ | 35,373 | | |

| 10.3 | % |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

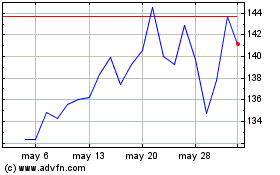

OSI Systems (NASDAQ:OSIS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

OSI Systems (NASDAQ:OSIS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024