Filed by Heramba Electric

plc

Pursuant to Rule 425

under the Securities Act of 1933

and deemed filed pursuant

to Rule 14a-12

under the Securities

Exchange Act of 1934

Subject Company: Project

Energy Reimagined Acquisition Corp.

Commission File No.

001-40972

Date: February 7, 2024

Press Release

Düsseldorf, February 6, 2024

Heramba Successfully Completes

Acquisition of Kiepe Electric, A Global Leader in Sustainable Urban Transportation

| § | Heramba

GmbH, Berlin, acquires Kiepe Electric GmbH, Düsseldorf, from Knorr-Bremse |

| § | Acquisition

creates a unique pure-play global leader in sustainable urban transportation |

| § | Kiepe

Electric growth strategy builds on a strong core business, accelerating the expansion of urban transportation addressable market globally |

| § | Knorr-Bremse

to retain a 15% equity stake as a strategic partner and owner |

Düsseldorf, February 6, 2024

– Heramba GmbH and Heramba Holdings, Inc. (“Heramba”) today announced the completion of the purchase of majority control

of Kiepe Electric from the subsidiaries of Knorr-Bremse Systeme für Schienenfahrzeuge GmbH (“Knorr-Bremse”). As a result

of the transaction, Knorr-Bremse will continue to own 15% of Kiepe Electric and will remain a strategic partner. Kiepe Electric, a company

focused on decarbonization of commercial and public transportation, is a unique pure-play global leader in sustainable transportation.

Kiepe Electric is a global leader

in the electrification of road and rail urban transportation applications, including designing, manufacturing and implementing power electronics

products, electric drives and vehicle controls hardware for rail vehicles and electric buses. There is also intelligent software for fleet

management and energy management. The company’s software provides a holistic end-to-end dashboard from the charging systems to the end-vehicle.

Kiepe Electric is also a specialist in vehicle charging solutions and is a leading supplier of In-Motion Charging solutions for buses.

In 2022, Kiepe Electric introduced its proprietary High Power Charging platform, which facilitates vehicle fast charging and energy management

for battery-electric buses.

Dr. Hans-Jörg Grundmann, Managing

Director of Heramba said: “Kiepe Electric is an innovative provider of electrical solutions that is driving decarbonization of urban

public transport. In addition to a strong core business and financial position, we are very impressed by the know-how and passion of Kiepe

Electric employees. They are customer-centric, highly innovative, and consistently deliver world-class quality in production, modernization,

and service. Our goal is to become a key enabler of the electrification of public transport networks in Europe and North America. With

more than 550 employees in six countries, we believe Kiepe Electric is one of the most innovative companies in its industry and can provide

excellent support to customers throughout the product lifecycle. We are happy to have such a highly qualified team.”

Alexander Ketterl,

Managing Director of Kiepe Electric said: “Heramba has demonstrated strong conviction in our innovative products, commitment

of our employees and partnership mindset to continue to scale and grow our business. The megatrend of e-mobility opens great market

opportunities. With Heramba as a new owner of Kiepe Electric and Knorr-Bremse as a strategic partner, we will shape our product and

service portfolio for the future. Based on the strong core business of electrical systems for buses and trains for public

transportation, we are now expanding the sales of our innovative vehicle charging solutions for cities and regions. In the medium

term, we also plan to successfully work with other customer groups with our innovative mobility solutions. We would like to thank

the management and staff of Knorr-Bremse for their cooperation. In addition, we look forward to future joint projects, which we will

continue to implement in partnership with Knorr-Bremse to deliver the best customer solutions. Together, we believe Kiepe Electric

will be a leading player in the growth of the global e-mobility market.”

With the transaction, Heramba will

take over all business activities and all employees of Kiepe Electric, including the national companies. As a strategic partner, Knorr-Bremse

will continue to hold 15% equity in the new company. Heramba, with its business focus on clean energy and transportation, specifically

looked for promising companies in the e-mobility segment. In October 2023, Heramba entered into a business combination agreement with

Project Energy Reimagined Acquisition Corp. (“PERAC”). Following consummation of the proposed business combination (the “Business

Combination”), the combined company’s securities are expected to be listed on Nasdaq.

Building on proven Business Success

Kiepe Electric has a strong order

backlog with major projects as a consortium partner for trams and light rail systems in Gothenburg, Dortmund, Cologne, and Leipzig, among

others. Kiepe Electric also has active bus projects such as the double-articulated e-buses from Île-de-France Mobilités,

Paris, and IMC e-buses in Milan. Heramba intends to continue the successful business processes of Kiepe Electric to ensure continuity

of customer and supplier relationships, successful delivery of projects and fulfillment of contracts and contractual obligations. Kiepe

Electric’s management team and employees will remain with the company.

About Kiepe Electric

Kiepe Electric is a

global provider of systems and components for the electrification of trains and buses, primarily for urban public transport. In

2022, a dedicated business segment for innovative charging systems was created. The company, with six international locations in

Europe and North America, generated sales of approximately 120 million euros in 2022. More than 550 employees develop efficient and

ecologically sustainable concepts for the mobility transition in public transport. Recent innovation highlights include the new

modular HPC platform for 12-, 18- and 24-meter e-buses and high-power charging infrastructure solutions for e-buses up to 800 kW

inclusive battery storage systems.

About Heramba

Heramba GmbH, founded in January 2023

and headquartered in Berlin, Germany and Atlanta, United States, is a special-purpose company focused on investing in companies with technologies

and capabilities that can accelerate the decarbonization of commercial transportation. Heramba is led by Dr. Hans-Jörg Grundmann

(Managing Director), who has dedicated his career to innovating and improving commercial transportation, including in his role as CEO

of Siemens Mobility and his other leadership roles with industry leaders Siemens and AEG.

Piper Sandler is serving as financial

advisor to Heramba, and Latham & Watkins LLP and Smith, Gambrell & Russell, LLP are serving as legal counsel to Heramba.

Important Information About the Business Combination

and Where to Find It

This communication does not contain

all the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment

decision or any other decision in respect of the Business Combination. In connection with the Business Combination, Heramba and PERAC,

through Heramba Electric plc (“Holdco”), have filed with the Securities and Exchange Commission (the “SEC”) a

registration statement on Form F-4 (the “Registration Statement”), which contains a preliminary proxy statement/prospectus

that will constitute (i) a proxy statement relating to the Business Combination in connection with PERAC’s solicitation of proxies

for the vote by PERAC’s shareholders regarding the Business Combination and related matters, as described in the Registration Statement,

and (ii) a prospectus relating to, among other things, the offer of the securities to be issued by Holdco in connection with the Business

Combination. After the Registration Statement has been declared effective, PERAC will mail the definitive proxy statement/prospectus and

other relevant documents to its shareholders as of the record date established for voting on the Business Combination. INVESTORS AND SECURITY

HOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS, AND ANY AMENDMENTS OR SUPPLEMENTS

THERETO AND ANY OTHER RELATED DOCUMENTS FILED WITH THE SEC BY PERAC OR HOLDCO WHEN THEY BECOME AVAILABLE, CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT HERAMBA, PERAC, HOLDCO AND THE BUSINESS COMBINATION, INCLUDING WITH RESPECT TO THE

PRO FORMA IMPLIED ENTERPRISE VALUE OF THE COMBINED COMPANY. Investors and security holders may obtain free copies of the Registration

Statement, proxy statement/prospectus and any amendments or supplements thereto and other related documents filed with the SEC by PERAC

or Holdco (in each case, when available) through the website maintained by the SEC at http://www.sec.gov. These documents (when available)

can also be obtained free of charge from PERAC upon written request to PERAC at: Project Energy Reimagined Acquisition Corp., 1280 El

Camino Real, Suite 200, Menlo Park, California 94025.

INVESTMENT IN ANY SECURITIES DESCRIBED

HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY, NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED

THE MERITS OF THE BUSINESS COMBINATION PURSUANT TO WHICH ANY SECURITIES ARE TO BE OFFERED OR THE ACCURACY OR ADEQUACY OF THE INFORMATION

CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Cautionary Statement Regarding

Forward-Looking Statements

Certain statements included in this

communication that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United

States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,”

“seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends

or events that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements

regarding market opportunity, Heramba’s acquisition of Kiepe Electric, and the consummation of the Business Combination and related

transactions. These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations

of Heramba, PERAC and Holdco management and are not predictions of actual performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance,

a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict

and will differ from assumptions. Many actual events and circumstances are beyond the control of Heramba, PERAC and Holdco. These forward-looking

statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial,

political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the Business Combination, including

the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely

affect the combined company, the expected benefits of the Business Combination or that the approval of the shareholders of PERAC is not

obtained, that redemptions by shareholders of PERAC reduce the funds in trust or available to the combined company following the Business

Combination, any of the other conditions to closing are not satisfied or that events or other circumstances give rise to the termination

of the business combination agreement relating to the Business Combination; (iii) changes to the structure of the Business Combination

that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining the necessary regulatory

approvals; (iv) the ability to meet stock exchange listing standards following the consummation of the Business Combination; (v) the risk

that the Business Combination disrupts current plans and operations of Heramba as a result of the announcement and consummation of the

Business Combination; (vi) failure to realize the anticipated benefits of the Business Combination, which may be affected by, among other

things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and

suppliers and retain its management and key employees; (vii) costs related to the Business Combination; (viii) changes in applicable law

or regulations; (ix) the outcome of any legal proceedings that may be instituted against Heramba, PERAC or Holdco; (x) the effects of

competition on Heramba’s future business; (xi) the ability of PERAC, Heramba or Holdco to issue equity or equity-linked securities

or obtain debt financing in connection with the Business Combination or in the future; (xii) the enforceability of Heramba’s intellectual

property rights, including its copyrights, patents, trademarks and trade secrets, and the potential infringement on the intellectual property

rights of others; and (xiii) those factors discussed under the heading “Risk Factors” in PERAC’s Annual Report on Form

10-K for the fiscal year ended December 31, 2022, filed with the SEC on April 7, 2023, and any subsequent Quarterly Reports on Form 10-Q,

and other documents filed, or to be filed, by PERAC and/or Holdco, with the SEC. If any of these risks materialize or the assumptions

of Heramba, PERAC and Holdco management prove incorrect, actual results could differ materially from the results implied by these forward-looking

statements. There may be additional risks that none of Heramba, PERAC nor Holdco presently know or that Heramba, PERAC or Holdco currently

believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition,

forward-looking statements reflect Heramba’s, PERAC’s or Holdco’s expectations, plans or forecasts of future events

and views as of the date of this communication. Heramba, PERAC and Holdco anticipate that subsequent events and developments may cause

Heramba’s, PERAC’s or Holdco’s assessments to change. However, while Heramba, PERAC and Holdco may elect to update these

forward-looking statements at some point in the future, Heramba, PERAC and Holdco specifically disclaim any obligation to do so. Nothing

in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be

achieved or that any of the contemplated results of such forward-looking statements will be achieved. Accordingly, undue reliance should

not be placed upon the forward-looking statements.

Participants in the Solicitation

Heramba, PERAC and Holdco and their

respective directors and certain of their respective executive officers, other members of management and employees, under SEC rules, may

be considered participants in the solicitation of proxies with respect to the Business Combination. Information about the directors and

executive officers of PERAC is included in PERAC’s Annual Report on Form 10-K, filed with the SEC on April 7, 2023, which is available

free of charge at the SEC’s website at http://www.sec.gov. Additional information regarding the participants in the proxy solicitation

and a description of their direct interests, by security holdings or otherwise, will be set forth in the Registration Statement, and the

proxy statement/prospectus included therein, and other related materials to be filed with the SEC regarding the Business Combination by

PERAC or Holdco. Shareholders, potential investors and other interested persons should read the Registration Statement, proxy statement/prospectus

and any amendments or supplements thereto and other related documents filed with the SEC by PERAC or Holdco (in each case, when available)

carefully before making any voting or investment decisions. These documents, when available, can be obtained free of charge from the sources

indicated above.

No Offer or Solicitation

This communication is for informational

purposes only and is not intended to and shall not constitute an offer to sell or exchange, or the solicitation of an offer to sell, exchange,

buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section

10 of the Securities Act of 1933, as amended (the “Securities Act”), or pursuant to an exemption from the Securities Act,

and otherwise in accordance with applicable law.

No Assurances

There can be no assurance that the

Business Combination will be completed, nor can there be any assurance, if the Business Combination is completed, that the potential benefits

of the Business Combination will be realized.

Contact:

Christoph Wede

Director Global Sales E-Mobility und Business Development

Kiepe Electric GmbH

Kiepe-Platz 1

40599 Düsseldorf

Tel: +49 (0)211 7497 614

E-Mail: christoph.wede@knorr-bremse.com

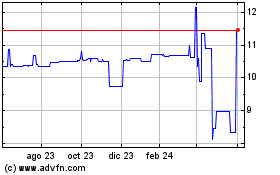

Project Energy Reimagine... (NASDAQ:PEGRU)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

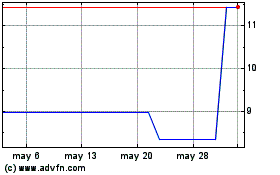

Project Energy Reimagine... (NASDAQ:PEGRU)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025