Roper Technologies increases dividend 10% - its 32nd consecutive annual dividend increase

06 Noviembre 2024 - 12:00PM

Roper Technologies, Inc. (Nasdaq: ROP) announced

today that its Board of Directors has declared a quarterly cash

dividend of $0.825 per share, payable on January 17, 2025 to

stockholders of record as of January 3, 2025. This represents an

increase of 10% over the dividend paid in each quarter of 2024, or

an expected $0.30 increase on an annual basis ($0.075 on a

quarterly basis). This is the thirty-second consecutive year in

which Roper has increased its dividend.

About Roper Technologies

Roper Technologies is a constituent of the

Nasdaq 100, S&P 500, and Fortune 1000. Roper has a proven,

long-term track record of compounding cash flow and shareholder

value. The Company operates market leading businesses that design

and develop vertical software and technology enabled products for a

variety of defensible niche markets. Roper utilizes a disciplined,

analytical, and process-driven approach to redeploy its excess

capital toward high-quality acquisitions. Additional information

about Roper is available on the Company’s website at

www.ropertech.com.

Contact information: Investor

Relations941-556-2601 investor-relations@ropertech.com

The information provided in this press release contains

forward-looking statements within the meaning of the federal

securities laws. These forward-looking statements may include,

among others, statements regarding operating results, the success

of our internal operating plans, and the prospects for newly

acquired businesses to be integrated and contribute to future

growth, profit and cash flow expectations. Forward-looking

statements may be indicated by words or phrases such as

"anticipate," "estimate," "plans," "expects," "projects," "should,"

"will," "believes," "intends" and similar words and phrases. These

statements reflect management's current beliefs and are not

guarantees of future performance. They involve risks and

uncertainties that could cause actual results to differ materially

from those contained in any forward-looking statement. Such risks

and uncertainties include any ongoing impacts of the COVID-19

pandemic on our business, operations, financial results and

liquidity, which will depend on numerous evolving factors which we

cannot accurately predict or assess, including: the duration and

scope of the pandemic, new variants of the virus and the

distribution and efficacy of vaccines; any negative impact on

global and regional markets, economies and economic activity;

actions governments, businesses and individuals take in response to

the pandemic; the effects of the pandemic, including all of the

foregoing, on our customers, suppliers and business partners. Such

risks and uncertainties also include our ability to identify and

complete acquisitions consistent with our business strategies,

integrate acquisitions that have been completed, realize expected

benefits and synergies from, and manage other risks associated

with, acquired businesses, including obtaining any required

regulatory approvals with respect thereto. We also face other

general risks, including our ability to realize cost savings from

our operating initiatives, general economic conditions and the

conditions of the specific markets in which we operate, including

risks related to labor shortages and rising interest rates, changes

in foreign exchange rates, difficulties associated with exports,

risks associated with our international operations, cybersecurity

and data privacy risks, including litigation resulting therefrom,

risks related to political instability, armed hostilities,

incidents of terrorism, public health crises (such as the COVID-19

pandemic) or natural disasters, increased product liability and

insurance costs, increased warranty exposure, future competition,

changes in the supply of, or price for, parts and components,

including as a result of the current inflationary environment and

ongoing supply chain constraints, environmental compliance costs

and liabilities, risks and cost associated with litigation,

potential write-offs of our substantial intangible assets, and

risks associated with obtaining governmental approvals and

maintaining regulatory compliance for new and existing products.

Important risks may be discussed in current and subsequent filings

with the SEC. You should not place undue reliance on any

forward-looking statements. These statements speak only as of the

date they are made, and we undertake no obligation to update

publicly any of them in light of new information or future

events.

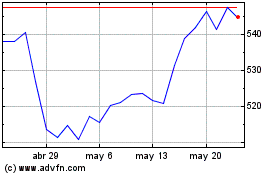

Roper Technologies (NASDAQ:ROP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

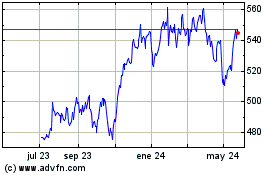

Roper Technologies (NASDAQ:ROP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024