UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024.

____________________________________

Commission File Number: 001-40627

SOPHiA GENETICS SA

(Exact name of registrant as specified in its charter)

La Pièce 12

CH-1180 Rolle

Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURE

This Report on Form 6-K (other than Exhibit 99.3 hereto), including Exhibits 99.1 and 99.2 hereto, shall be deemed to be incorporated by reference into the registration statements on Form F-3 (Registration No. 333-266704; Registration No. 333-280060) of SOPHiA GENETICS SA and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| SOPHiA GENETICS SA |

Date: November 5, 2024 | | |

| | |

| By: | /s/ Daan van Well |

| Name: | Daan van Well |

| Title: | Chief Legal Officer |

EXHIBIT INDEX

Exhibit 99.1

Index to Consolidated Financial Statements

Table of Contents

SOPHiA GENETICS SA

Unaudited Interim Condensed Consolidated Financial Statements

SOPHiA GENETICS SA, Rolle

Interim Condensed Consolidated Statements of Loss

(Amounts in USD thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended September 30, | | Nine months ended September 30, |

| | Notes | | 2024 | | 2023 | | 2024 | | 2023 | | |

| Revenue | | 5 | | $ | 15,853 | | | $ | 16,303 | | | $ | 47,440 | | | $ | 45,323 | | | |

| Cost of revenue | | | | (5,199) | | | (5,030) | | | (15,605) | | | (14,309) | | | |

| Gross profit | | | | 10,654 | | | 11,273 | | | 31,835 | | | 31,014 | | | |

| Research and development costs | | | | (7,874) | | | (8,984) | | | (25,223) | | | (27,209) | | | |

| Selling and marketing costs | | | | (7,306) | | | (6,830) | | | (21,515) | | | (20,457) | | | |

| General and administrative costs | | | | (10,880) | | | (12,749) | | | (34,288) | | | (40,032) | | | |

| Other operating income, net | | | | 43 | | | 746 | | | 67 | | | 805 | | | |

| Operating loss | | | | (15,363) | | | (16,544) | | | (49,124) | | | (55,879) | | | |

| Interest income, net | | | | 267 | | | 1,152 | | | 1,475 | | | 3,148 | | | |

| Fair value adjustments on warrant obligations | | 9 | | 182 | | | — | | | 266 | | | — | | | |

| Foreign exchange (losses) gains, net | | | | (3,394) | | | 1,867 | | | 655 | | | (1,711) | | | |

| Loss before income taxes | | | | (18,308) | | | (13,525) | | | (46,728) | | | (54,442) | | | |

| Income tax expense | | | | (130) | | | (299) | | | (607) | | | (478) | | | |

| Loss for the period | | | | (18,438) | | | (13,824) | | | (47,335) | | | (54,920) | | | |

| Attributable to the owners of the parent | | | | (18,438) | | | (13,824) | | | (47,335) | | | (54,920) | | | |

| | | | | | | | | | | | |

| Basic and diluted loss per share | | 7 | | $ | (0.28) | | | $ | (0.21) | | | $ | (0.72) | | | $ | (0.85) | | | |

The notes form an integral part of these unaudited interim condensed consolidated financial statements.

SOPHiA GENETICS SA, Rolle

Interim Condensed Consolidated Statements of Comprehensive Loss

(Amounts in USD thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended September 30, | | Nine months ended September 30, |

| | | | 2024 | | 2023 | | 2024 | | 2023 | | |

| Loss for the period | | | | $ | (18,438) | | | $ | (13,824) | | | $ | (47,335) | | | $ | (54,920) | | | |

| Other comprehensive (loss) income: | | | | | | | | | | | | |

| Items that may be reclassified to statement of loss (net of tax) | | | | | | | | | | | | |

| Currency translation adjustments | | | | 6,990 | | | (3,382) | | | (2,149) | | | 2,269 | | | |

| Total items that may be reclassified to statement of loss | | | | 6,990 | | | (3,382) | | | (2,149) | | | 2,269 | | | |

| Items that will not be reclassified to statement of loss (net of tax) | | | | | | | | | | | | |

| Remeasurement of defined benefit plans | | | | (173) | | | 13 | | | (231) | | | (283) | | | |

| Total items that will not be reclassified to statement of loss | | | | (173) | | | 13 | | | (231) | | | (283) | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other comprehensive (loss) income for the period | | | | $ | 6,817 | | | $ | (3,369) | | | $ | (2,380) | | | $ | 1,986 | | | |

| Total comprehensive loss for the period | | | | $ | (11,621) | | | $ | (17,193) | | | $ | (49,715) | | | $ | (52,934) | | | |

| Attributable to owners of the parent | | | | $ | (11,621) | | | $ | (17,193) | | | $ | (49,715) | | | $ | (52,934) | | | |

The notes form an integral part of these unaudited interim condensed consolidated financial statements.

SOPHiA GENETICS SA, Rolle

Interim Condensed Consolidated Balance Sheets

(Amounts in USD thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Notes | | September 30, 2024 | | December 31, 2023 |

| Assets | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | | | $ | 95,787 | | | $ | 123,251 | |

| | | | | | |

| Accounts receivable | | 5, 6 | | 9,762 | | | 13,557 | |

| Inventory | | | | 6,477 | | | 6,482 | |

| Prepaids and other current assets | | | | 5,178 | | | 4,757 | |

| Total current assets | | | | 117,204 | | | 148,047 | |

| Non-current assets | | | | | | |

| Property and equipment | | | | 6,018 | | | 7,469 | |

| Intangible assets | | | | 30,354 | | | 27,185 | |

| Right-of-use assets | | | | 15,768 | | | 15,635 | |

| Deferred tax assets | | | | 1,826 | | | 1,720 | |

| Other non-current assets | | | | 6,438 | | | 6,100 | |

| Total non-current assets | | | | 60,404 | | | 58,109 | |

| Total assets | | | | $ | 177,608 | | | $ | 206,156 | |

| Liabilities and equity | | | | | | |

| Current liabilities | | | | | | |

| Accounts payable | | | | $ | 5,869 | | | $ | 5,391 | |

| Accrued expenses | | | | 13,818 | | | 17,808 | |

| Deferred contract revenue | | | | 8,150 | | | 9,494 | |

| | | | | | |

| Lease liabilities, current portion | | | | 2,477 | | | 2,928 | |

| | | | | | |

| Warrant obligations | | 9 | | 546 | | | — | |

| Total current liabilities | | | | 30,860 | | | 35,621 | |

| Non-current liabilities | | | | | | |

| | | | | | |

| Borrowings | | 9 | | 13,162 | | | — | |

| Lease liabilities, net of current portion | | | | 16,034 | | | 15,673 | |

| Defined benefit pension liabilities | | | | 3,603 | | | 3,086 | |

| Other non-current liabilities | | | | 442 | | | 334 | |

| Total non-current liabilities | | | | 33,241 | | | 19,093 | |

| Total liabilities | | | | 64,101 | | | 54,714 | |

| Equity | | | | | | |

| Share capital | | | | 4,188 | | | 4,048 | |

| Share premium | | | | 472,211 | | | 471,846 | |

| Treasury share | | | | (719) | | | (646) | |

| Other reserves | | | | 62,946 | | | 53,978 | |

| Accumulated deficit | | | | (425,119) | | | (377,784) | |

| Total equity | | | | 113,507 | | | 151,442 | |

| Total liabilities and equity | | | | $ | 177,608 | | | $ | 206,156 | |

The notes form an integral part of these unaudited interim condensed consolidated financial statements.

SOPHiA GENETICS SA, Rolle

Interim Condensed Consolidated Statements of Changes in Equity

(Amounts in USD thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Share | | Share | | | | Treasury | | Other | | Accumulated | | |

| | Notes | | | | capital | | premium | | | | share | | reserves | | deficit | | Total |

| As of January 1, 2024 | | | | | | $ | 4,048 | | | $ | 471,846 | | | | | $ | (646) | | | $ | 53,978 | | | $ | (377,784) | | | $ | 151,442 | |

| Loss for the period | | | | | | — | | | — | | | | | — | | | — | | | (47,335) | | | (47,335) | |

| Other comprehensive loss | | | | | | — | | | — | | | | | — | | | (2,380) | | | — | | | (2,380) | |

| Total comprehensive loss | | | | | | — | | | — | | | | | — | | | (2,380) | | | (47,335) | | | (49,715) | |

| Share-based compensation | | 10 | | | | — | | | — | | | | | — | | | 11,410 | | | — | | | 11,410 | |

| Transactions with owners | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Vesting of restricted stock units | | | | | | — | | | — | | | | | 62 | | | (62) | | | — | | | — | |

| Issuance of shares to be held as treasury shares | | | | | | 140 | | | — | | | | | (140) | | | — | | | — | | | — | |

| Exercise of share options | | | | | | — | | | 365 | | | | | 5 | | | — | | | — | | | 370 | |

| As of September 30, 2024 | | | | | | $ | 4,188 | | | $ | 472,211 | | | | | $ | (719) | | | $ | 62,946 | | | $ | (425,119) | | | $ | 113,507 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Share | | Share | | | | Treasury | | Other | | Accumulated | | |

| | Notes | | | | capital | | premium | | | | share | | reserves | | deficit | | Total |

| Balance as of July 1, 2024 | | | | | | $ | 4,048 | | | $ | 472,140 | | | | | $ | (590) | | | $ | 52,526 | | | $ | (406,681) | | | $ | 121,443 | |

| Loss for the period | | | | | | — | | | — | | | | | — | | | — | | | (18,438) | | | (18,438) | |

| Other comprehensive income | | | | | | — | | | — | | | | | — | | | 6,817 | | | — | | | 6,817 | |

| Total comprehensive loss | | | | | | — | | | — | | | | | — | | | 6,817 | | | (18,438) | | | (11,621) | |

| Share-based compensation | | 10 | | | | — | | | — | | | | | — | | | 3,613 | | | — | | | 3,613 | |

| Transactions with owners | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Vesting of restricted stock units | | | | | | — | | | — | | | | | 10 | | | (10) | | | — | | | — | |

| Issuance of shares to be held as treasury shares | | | | | | 140 | | | — | | | | | (140) | | | — | | | — | | | — | |

| Exercise of share options | | | | | | — | | | 71 | | | | | 1 | | | — | | | — | | | 72 | |

| As of September 30, 2024 | | | | | | $ | 4,188 | | | $ | 472,211 | | | | | $ | (719) | | | $ | 62,946 | | | $ | (425,119) | | | $ | 113,507 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Share | | Share | | | | Treasury | | Other | | Accumulated | | |

| | Notes | | | | capital | | premium | | | | share | | reserves | | deficit | | Total |

| As of January 1, 2023 | | | | | | $ | 3,464 | | | $ | 471,623 | | | | | $ | (117) | | | $ | 23,963 | | | $ | (298,803) | | | $ | 200,130 | |

| Loss for the period | | | | | | — | | | — | | | | | — | | | — | | | (54,920) | | | (54,920) | |

| Other comprehensive income | | | | | | — | | | — | | | | | — | | | 1,986 | | | — | | | 1,986 | |

| Total comprehensive loss | | | | | | — | | | — | | | | | — | | | 1,986 | | | (54,920) | | | (52,934) | |

| Share-based compensation | | 10 | | | | — | | | — | | | | | — | | | 11,036 | | | — | | | 11,036 | |

| Transactions with owners | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Vesting of restricted stock units | | | | | | — | | | — | | | | | 46 | | | (46) | | | — | | | — | |

| Issuance of shares to be held as treasury shares | | | | | | 584 | | | — | | | | | (584) | | | — | | | — | | | — | |

| Exercise of share options | | | | | | — | | | 204 | | | | | 3 | | | — | | | — | | | 207 | |

| As of September 30, 2023 | | | | | | $ | 4,048 | | | $ | 471,827 | | | | | $ | (652) | | | $ | 36,939 | | | $ | (353,723) | | | $ | 158,439 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Share | | Share | | | | Treasury | | Other | | Accumulated | | |

| | Notes | | | | capital | | premium | | | | share | | reserves | | deficit | | Total |

| Balance as of July 1, 2023 | | | | | | $ | 4,048 | | | $ | 471,827 | | | | | $ | (657) | | | $ | 36,383 | | | $ | (339,899) | | | $ | 171,702 | |

| Loss for the period | | | | | | — | | | — | | | | | — | | | — | | | (13,824) | | | (13,824) | |

| Other comprehensive loss | | | | | | — | | | — | | | | | — | | | (3,369) | | | — | | | (3,369) | |

| Total comprehensive loss | | | | | | — | | | — | | | | | — | | | (3,369) | | | (13,824) | | | (17,193) | |

| Share-based compensation | | 10 | | | | — | | | — | | | | | — | | | 3,930 | | | — | | | 3,930 | |

| Transactions with owners | | | | | | | | | | | | | | | | | | |

| Vesting of restricted stock units | | | | | | — | | | — | | | | | 5 | | | (5) | | | — | | | — | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 | | | | | | $ | 4,048 | | | $ | 471,827 | | | | | $ | (652) | | | $ | 36,939 | | | $ | (353,723) | | | $ | 158,439 | |

The notes form an integral part of these unaudited interim condensed consolidated financial statements.

SOPHiA GENETICS SA, Rolle

Interim Condensed Consolidated Statements of Cash Flows

(Amounts in USD thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Nine months ended September 30, |

| | Notes | | 2024 | | 2023 | | |

| Operating activities | | | | | | | | |

| Loss before tax | | | | $ | (46,728) | | | $ | (54,442) | | | |

| Adjustments for non-monetary items | | | | | | | | |

| Depreciation | | | | 3,439 | | | 4,339 | | | |

| Amortization | | | | 2,870 | | | 2,016 | | | |

| | | | | | | | |

| | | | | | | | |

| Finance (income) expense, net | | | | (2,333) | | | 1,641 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Fair value adjustments on warrant obligations | | 9 | | (266) | | | — | | | |

| Expected credit loss allowance | | 6 | | (252) | | | 54 | | | |

| Share-based compensation | | 10 | | 11,410 | | | 11,036 | | | |

| | | | | | | | |

| Movements in provisions and pensions | | | | 246 | | | 764 | | | |

| Research tax credit | | | | (460) | | | (785) | | | |

| Loss on disposal of property and equipment | | | | — | | | 28 | | | |

| Gain on disposal of lease liability | | | | — | | | (730) | | | |

| Working capital changes | | | | | | | | |

| Decrease (Increase) in accounts receivable | | | | 3,813 | | | (2,880) | | | |

| Increase in prepaids and other assets | | | | (420) | | | (2,869) | | | |

| Decrease (Increase) in inventory | | | | 48 | | | (328) | | | |

| (Decrease) Increase in accounts payables, accrued expenses, deferred contract revenue, and other liabilities | | | | (4,822) | | | 2,284 | | | |

| Cash used in operating activities | | | | (33,455) | | | (39,872) | | | |

| Income tax paid | | | | (374) | | | (759) | | | |

| Interest paid | | 9 | | (1,133) | | | (6) | | | |

| Interest received | | | | 2,741 | | | 3,354 | | | |

| Net cash flows used in operating activities | | | | (32,221) | | | (37,283) | | | |

| Investing activities | | | | | | | | |

| Purchase of property and equipment | | | | (187) | | | (1,369) | | | |

| Acquisition of intangible assets | | | | (195) | | | (1,033) | | | |

| Capitalized development costs | | | | (5,854) | | | (4,575) | | | |

| Proceeds upon maturity of term deposits | | | | — | | | 17,546 | | | |

| | | | | | | | |

| Net cash flow (used in) provided from investing activities | | | | (6,236) | | | 10,569 | | | |

| Financing activities | | | | | | | | |

| Proceeds from exercise of share options | | | | 370 | | | 207 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Proceeds from borrowings, net of transaction costs | | 9 | | 13,930 | | | — | | | |

| | | | | | | | |

| | | | | | | | |

| Payments of principal portion of lease liabilities | | | | (2,142) | | | (2,518) | | | |

| Net cash flow provided from (used in) financing activities | | | | 12,158 | | | (2,311) | | | |

| Decrease in cash and cash equivalents | | | | (26,299) | | | (29,025) | | | |

| Effect of exchange differences on cash balances | | | | (1,165) | | | 487 | | | |

| Cash and cash equivalents at beginning of the year | | | | 123,251 | | | 161,305 | | | |

| Cash and cash equivalents at end of the period | | | | $ | 95,787 | | | $ | 132,767 | | | |

The notes form an integral part of these unaudited interim condensed consolidated financial statements.

SOPHiA GENETICS SA, Rolle

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

1. Company information

General information

SOPHiA GENETICS SA and its consolidated subsidiaries (NASDAQ: SOPH) (“the Company”) is a cloud-native software company in the healthcare space, incorporated on March 18, 2011, and headquartered in Rolle, Switzerland. The Company is dedicated to establishing the practice of data-driven medicine as the standard of care in health care and for life sciences research. The Company has built a software platform capable of analyzing data and generating insights from complex multimodal datasets and different diagnostic modalities. This platform, commercialized as “SOPHiA DDM TM,” standardizes, computes and analyzes digital health data and is used in decentralized locations to break down data silos. The Company collectively refers to SOPHiA DDM TM Platform and related products and solutions as “SOPHiA DDM Platform.”

On June 26, 2023, during the Company’s Annual General Meeting, the move of the statutory seat from Saint-Sulpice, Canton Vaud, Switzerland to Rolle, Canton Vaud, Switzerland was approved.

As of September 30, 2024, the Company had the following wholly-owned subsidiaries:

| | | | | | | | |

| Name | | Country of domicile |

| SOPHiA GENETICS S.A.S. | | France |

| SOPHiA GENETICS LTD | | U.K. |

| SOPHiA GENETICS, Inc. | | U.S. |

| SOPHiA GENETICS Intermediação de Negócios LTDA | | Brazil |

| SOPHiA GENETICS PTY LTD | | Australia |

| SOPHiA GENETICS S.R.L. | | Italy |

All intercompany transactions and balances have been eliminated in consolidation.

The Company’s Board of Directors approved the issue of the unaudited interim condensed consolidated financial statements on November 5, 2024.

Basis of preparation

Compliance with International Financial Reporting Standards

These unaudited interim condensed consolidated financial statements, as of and for the three and nine months ended September 30, 2024, of the Company have been prepared in accordance with International Accounting Standard (“IAS”) 34, Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”) and should be read in conjunction with the audited consolidated financial statements as of and for the year ended December 31, 2023.

Accounting policies

The material accounting policies adopted in the preparation of these unaudited interim condensed consolidated financial statements are the same as those applied in the Company’s annual consolidated financial statements as of and for the year ended December 31, 2023, and have been consistently applied, unless otherwise stated. Where expense is definitively calculated only on an annual basis, as is the case for income taxes and pension costs, appropriate estimates are made for interim reporting periods.

Borrowings

Borrowings are initially recognized at fair value, net of transaction costs incurred. Transaction costs include any incremental costs directly attributable to the issuance of the financial liability, that would otherwise have not been incurred if the Company did not issue the financial instrument. Borrowings are subsequently measured at amortized cost using the effective interest method. The effective interest method recognizes any difference between the loan proceeds, net of transaction costs, and the redemption amount as interest expense through the statement of profit and loss. Changes in the effective interest rate (“EIR”) are updated prospectively based on the most recent interest payment rate at the end of each reporting period. Borrowings are removed from the balance sheet when the obligation is discharged, cancelled, or repaid. When the borrowing is removed from the balance sheet, any difference between the carrying amount of the financial liability, and the consideration paid, is recognized in profit or loss as a non-operating income or expense. Borrowings are classified as current liabilities unless the maturity date is greater than 12 months or Company has an unconditional right to defer settlement of the liability for at least 12 months after the reporting period.

Income tax expense

Taxes on income in the interim periods are accrued using the tax rates that would be applicable based on the expected annual profit or loss of each of the Company entities.

Post-employment defined benefit plan expense

Post-employment defined benefit plan expense in interim reporting periods is recognized on the basis of the current year cost estimate made by the actuaries in their annual report as of the end of the preceding year. Potential remeasurement gains or losses from the defined benefits plan are estimated based on the relevant indexes at the end of the reporting period and recorded in the Company’s statements of comprehensive loss.

Designated cash

Previously, the Company had designated cash in a separate bank account to be used exclusively to settle potential liabilities arising from claims against directors and officers covered under the Company’s Directors and Officers Insurances Policy (“D&O Policy”). Setting up the designated account significantly reduced the premiums associated with the D&O Policy. As of September 30, 2023, the Company had $15 million of designated cash in a separate bank account to be used exclusively to settle potential liabilities arising from claims against directors and officers covered under the Company’s D&O Policy. In June 2024, the Company renewed the policy and under the new D&O policy removed the requirement for the Company to maintain a designated cash amount. The new D&O policy and elimination of designated cash went into effect in July 2024.

Recent new accounting standards, amendments to standards, and interpretations

New standards, amendments to standards, and interpretations issued recently effective

As of January 1, 2024 the amendments to paragraphs 69 to 76 of IAS 1, Presentation of Financial Statements (“IAS 1”), as issued by the IASB became effective. The Company assessed the changes to the accounting standard and determined the amendments did not have a material impact on the Company’s financial statements.

New standards, amendments to standards, and interpretations issued not yet effective

In April 2024, IFRS 18, Presentation and Disclosure in Financial Statements, was issued to achieve comparability of the financial performance of similar entities. The standard, which will replace IAS 1 impacts the presentation of primary financial statements and notes, including the statement of profit and loss where companies will be required to present separate categories of income and expense for operating, investing, and financing activities with prescribed subtotals for each new category. The standard will also require management-defined performance measures to be explained and included in a separate note within the consolidated financial statements. The standard is effective for annual reporting periods beginning on or after January 1, 2027, and requires retrospective application. The Company is currently evaluating the new standard to determine if it will have a material impact on the Company’s financial statements.

There are no other IFRS Accounting Standards or IFRS Interpretations Committee interpretations that are not yet effective and that could have a material impact to the interim condensed consolidated financial statements.

Critical estimates and judgments

The preparation of the unaudited interim condensed consolidated financial statements in conformity with IAS 34 requires management to make judgments, estimates and assumptions. Information regarding accounting areas where such judgments, estimates and assumptions are of particular significance is set out in the annual financial statements under “Critical estimates and judgments.”

Going concern basis

These unaudited interim condensed consolidated financial statements have been prepared on a going concern basis.

Foreign currency translation

Items included in the financial statements of each of the Company’s entities are measured using the currency of the primary economic environment in which the entity operates (“functional currency”). The Company’s reporting currency of the Company’s consolidated financial statements is the United States Dollar (“USD”). Assets and liabilities denominated in foreign currencies are translated at the month-end spot exchange rates, income statement accounts are translated at average rates of exchange for the period presented, and equity is translated at historical exchange rates. Any translation gains or losses are recorded in other comprehensive income (loss). Gains or losses resulting from foreign currency transactions are included in net income.

Historical cost convention

The financial statements have been prepared on a historical cost basis except for certain assets and liabilities, which are carried at fair value.

Issued share capital

As of September 30, 2024, the Company had issued 79,321,220 shares, of which 66,438,595 are outstanding, and 12,882,625 are held by the Company as treasury shares. As of September 30, 2023, the Company had issued 76,898,164 shares, of which 65,132,006 were outstanding, and 11,766,158 were held by the Company as treasury shares.

Treasury shares

During the third quarter of 2024, the Company issued 2,423,056 registered shares to SOPHiA GENETICS LTD pursuant to a share delivery and repurchase agreement, which were immediately exercised, and repurchased the shares to hold as treasury shares for the purposes of administering the Company's equity incentive programs. As of September 30, 2024, the Company held 12,882,625 treasury shares. As of September 30, 2023, the Company held 11,766,158 treasury shares.

Treasury shares are recognized at acquisition cost and recorded at the time of the transaction. Upon exercise of share options or vesting of restricted stock units, the treasury shares are subsequently transferred. Any consideration received is included in shareholders’ equity.

2. Fair Value

As of September 30, 2024, the carrying amount was a reasonable approximation of fair value for the following financial assets and liabilities:

Financial assets

•Cash and cash equivalents

•Accounts receivable

•Other non-current assets—lease deposits

Financial liabilities

•Accounts payable

•Accrued liabilities

•Borrowings

Recurring fair-value measurements

The following table presents the Company’s fair value hierarchy for its financial assets and financial liabilities that were measured at fair value on a recurring basis as of September 30, 2024 (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 |

| Financial assets: | | | | | | |

| Cash and cash equivalents: | | | | | | |

| Money market funds | | $ | 48,919 | | | $ | — | | | $ | — | |

| Total financial assets | | $ | 48,919 | | | $ | — | | | $ | — | |

| | | | | | |

| Financial liabilities: | | | | | | |

| Warrant obligation: | | | | | | |

| Perceptive Credit Holdings warrants | | $ | — | | | $ | 546 | | | $ | — | |

| Total financial liabilities | | $ | — | | | $ | 546 | | | $ | — | |

The following table presents the Company’s fair value hierarchy for its financial assets that were measured at fair value on a recurring basis as of December 31, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 |

| Financial assets: | | | | | | |

| Cash and cash equivalents | | | | | | |

| Money market funds | | $ | 60,683 | | | $ | — | | | $ | — | |

| Total financial assets | | $ | 60,683 | | | $ | — | | | $ | — | |

The Company had no financial liabilities measured at fair value on a recurring basis as of December 31, 2023.

In the three and nine months ended September 30, 2024, there were no significant changes in the business or economic circumstances that affected the fair value of the Company’s financial assets and financial liabilities.

3. Financial Risk Management

In the course of its business, the Company is exposed to a number of financial risks including credit and counterparty risk, funding and liquidity risk and market risk (i.e. foreign currency risk and interest rate risk). The unaudited interim condensed consolidated financial statements do not include all financial risk management information and disclosures required in the annual financial statements and should be read in conjunction with the Company’s consolidated financial statements as of December 31, 2023. There have been no significant changes in financial risk management since year-end.

4. Segment Reporting

The Company operates in a single operating segment. The Company’s financial information is reviewed, and its performance assessed as a single segment by the senior management team led by the Chief Executive Officer (“CEO”), the Company’s Chief Operating Decision Maker (“CODM”).

5. Revenue

Disaggregated revenue

When disaggregating revenue, the Company considered all of the economic factors that may affect its revenues. The Company assess its revenues by four geographic regions Europe, the Middle East, and Africa (“EMEA”); North America (“NORAM”); Latin America (“LATAM”); and Asia-Pacific (“APAC”). The following tables disaggregate the Company's revenue from contracts with customers by geographic market (in USD thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| | | | | | | | | | |

| Switzerland | | $ | 308 | | | $ | 372 | | | $ | 833 | | | $ | 769 | | | |

| France | | 2,721 | | | 2,450 | | | 7,805 | | | 7,411 | | | |

| Italy | | 2,342 | | | 2,014 | | | 7,035 | | | 6,300 | | | |

| Spain | | 1,445 | | | 1,493 | | | 4,413 | | | 4,861 | | | |

| Rest of EMEA | | 4,600 | | | 5,158 | | | 13,523 | | | 13,037 | | | |

| EMEA | | $ | 11,416 | | | $ | 11,487 | | | $ | 33,609 | | | $ | 32,378 | | | |

| | | | | | | | | | |

| United States | | $ | 2,021 | | | $ | 2,269 | | | $ | 6,922 | | | $ | 6,387 | | | |

| Rest of NORAM | | 478 | | | 336 | | | 1,437 | | | 881 | | | |

| NORAM | | $ | 2,499 | | | $ | 2,605 | | | $ | 8,359 | | | $ | 7,268 | | | |

| | | | | | | | | | |

| LATAM | | $ | 739 | | | $ | 1,149 | | | $ | 2,341 | | | $ | 3,062 | | | |

| | | | | | | | | | |

| APAC | | $ | 1,199 | | | $ | 1,062 | | | $ | 3,131 | | | $ | 2,615 | | | |

| Total revenue | | $ | 15,853 | | | $ | 16,303 | | | $ | 47,440 | | | $ | 45,323 | | | |

Revenue streams

The Company’s revenue from contracts with customers has been allocated to the revenue streams indicated in the table below (in USD thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 | |

| SOPHiA DDM Platform | | $ | 15,584 | | | $ | 15,995 | | | $ | 46,302 | | | $ | 44,331 | | | |

| Workflow equipment and services | | 269 | | | 308 | | | 1,138 | | | 992 | | | |

| Total revenue | | $ | 15,853 | | | $ | 16,303 | | | $ | 47,440 | | | $ | 45,323 | | | |

6. Accounts receivable

The following table presents the accounts receivable, accrued contract revenue, and lease receivable less the expected credit loss (in USD thousands):

| | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| Accounts receivable | | $ | 5,760 | | | $ | 10,259 | |

| Accrued contract revenue | | 4,895 | | | 4,451 | |

| Lease receivable | | — | | | 28 | |

| Allowance for expected credit losses | | (893) | | | (1,181) | |

| Net accounts receivable | | $ | 9,762 | | | $ | 13,557 | |

The Company records increases to, reversals of, and write-offs of the allowance for expected credit losses as “Selling and Marketing” expenses within its interim condensed consolidated statements of profit and loss. The following table provides a rollforward of the allowance for expected credit losses for the nine months ended September 30, 2024 and 2023, that is deducted from the amortized cost basis of accounts receivable to present the net amount expected to be collected (in USD thousands):

| | | | | | | | | | | | | | |

| | 2024 | | 2023 |

| As of January 1 | | $ | 1,181 | | | $ | 1,095 | |

| Increase | | 103 | | | 995 | |

| Reversals | | (355) | | | (941) | |

| Write-off | | (30) | | | (110) | |

| Currency translation adjustments | | (6) | | | 17 | |

| As of September 30 | | $ | 893 | | | $ | 1,056 | |

As of September 30, 2024 and December 31, 2023, the Company’s largest customer’s balance represented 8% and 24% of accounts receivable, respectively. All customer balances that individually exceeded 1% of accounts receivable in aggregate amounted to $3.4 million and $6.7 million as of September 30, 2024 and December 31, 2023, respectively.

7. Loss per share

The Company’s shares are comprised of ordinary shares. Each share has a nominal value of $0.05 (CHF 0.05). The basic loss per share is calculated by dividing the net loss attributable to shareholders by the weighted average number of shares in issue during the period excluding treasury shares, which are shares owned by the Company. The table presents the loss for the three and nine months ended September 30, 2024 and 2023, respectively (in USD thousands, except shares and loss per share):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss attributed to shareholders | | $ | (18,438) | | | $ | (13,824) | | | $ | (47,335) | | | $ | (54,920) | |

| Weighted average number of shares in issue | | 66,383,160 | | | 65,072,600 | | | 65,871,305 | | | 64,607,758 | |

| Basic and diluted loss per share | | $ | (0.28) | | | $ | (0.21) | | | $ | (0.72) | | | $ | (0.85) | |

For the three and nine months ended September 30, 2024, the potential impact, on the calculation of loss per share, of the existing potential ordinary shares related to the share option plans and warrants are not presented, as the impact would be to dilute a loss, which causes them to be deemed “non-dilutive” for the purposes of the required disclosure.

8. Leases

Boston lease

On June 27, 2024, the Company entered into a 73-month lease for office space in Boston, Massachusetts primarily to support the expansion of the Company’s growth in the United States. The lease in total is for approximately 12,807 square feet with lease commencement initiating upon the Company gaining access to the leased space. The Company gained access to the space during the third quarter of 2024 and recorded a right-of-use asset of $2.0 million and a lease liability of $1.9 million.

9. Borrowings

Perceptive Credit Agreement

On May 2, 2024 (the “closing date”), the Company and its subsidiary SOPHiA GENETICS, Inc. entered into a credit agreement and guaranty (the “Perceptive Credit Agreement”) with Perceptive Credit Holdings IV, LP (the “lender”), as lender and administrative agent, pursuant to which the Company may borrow up to $50.0 million principal amount of term loans, including (i) an initial tranche (“Tranche A”) of $15.0 million principal amount of term loans on the closing date and (ii) up to $35.0 million principal amount of term loans that the Company may draw upon on or prior to March 31, 2026 (“Tranche B”), subject to satisfaction of certain customary conditions. The term loans are scheduled to mature on the fifth anniversary of the closing date and accrue interest at Term SOFR plus 6.25% per annum; provided that upon the occurrence and during the continuation of any event of default, the term loans will accrue interest at Term SOFR plus 9.25% per annum. Term SOFR means the SOFR reference rate that is two business days prior to the first day of the preceding calendar month. The Company has the right to prepay the term loans at any time subject to applicable prepayment premiums. The Perceptive Credit Agreement also contains certain mandatory prepayment provisions, including prepayments from the proceeds from certain asset sales and casualty events (subject to a right to reinvest such proceeds in assets used in the Company’s business within 180 days) and from issuances or incurrences of non-permitted debt, which will also be subject to prepayment premiums. The obligations under the Perceptive Credit Agreement are secured by substantially all of the Company and certain of the Company’s subsidiaries’ assets and are guaranteed initially on the closing date by SOPHiA GENETICS SA and SOPHiA GENETICS, Inc. The Perceptive Credit Agreement contains customary covenants, including an affirmative covenant to maintain qualified cash of at least $3.0 million, an affirmative last twelve months revenue covenant tested on a quarterly basis beginning June 30, 2024, and negative covenants including limitations on indebtedness, liens,

fundamental changes, asset sales, investments, dividends and other restricted payments and other matters customarily restricted in such agreements. The Perceptive Credit Agreement also contains customary events of default, including payment defaults, material inaccuracy of representations and warranties, covenant defaults, bankruptcy and insolvency proceedings, cross-defaults to certain other agreements, judgments against the Company and the Company’s subsidiaries and change in control, the occurrence of which gives the lenders the right to declare the term loans and all obligations under the Perceptive Credit Agreement immediately due and payable. The Company remains in full compliance with all covenants contained in the Perceptive Credit Agreement as of September 30, 2024.

In addition, the Company issued to Perceptive Credit Holdings IV, LP a warrant certificate (the “Warrant Certificate”) representing the right to purchase up to 400,000 ordinary shares at $4.9992 per share, with 200,000 ordinary shares available immediately and 200,000 ordinary shares to be available upon the drawdown of the second tranche of the term loans. The purchase rights represented by the Warrant Certificate are exercisable after becoming available, on a cash basis, at the option of the holder at any time prior to 5:00 p.m., Eastern time on the tenth anniversary of the applicable date of availability. The Warrant Certificate contains customary anti-dilution adjustments. In addition, the Company is required to file, within 30 business days of each availability date, a registration statement that registers for resale under the Securities Act the ordinary shares issuable upon exercise of the purchase rights represented by the Warrant Certificate. The Company will be required to keep such registration statement effective until all such ordinary shares have been sold, are eligible to be immediately sold to the public without registration or restriction, are no longer outstanding or are no longer held by persons entitled to registration rights.

Accounting for Tranche A

The Company accounted for Tranche A of the term loans and warrants as two separate financial instruments, with the $15.0 million draw down: (i) a warrant obligation and (ii) a loan.

i) The warrant obligation is presented in the interim condensed consolidated balance sheet as a short-term liability given the warrants are not settled in the entity’s functional currency and thus are not considered to be settled in a fixed amount and can be exercised currently without restriction or right to defer. The warrant obligation was initially measured at fair value using a Black-Scholes pricing model and is subsequently remeasured to fair value at each reporting date. Changes in the fair value (gains or losses) of the warrant obligation at the end of each period are recorded in the interim condensed consolidated statement of loss. The Company determined the Tranche A warrant obligation qualified as a level 2 fair value liability as inputs to the fair value measurement are derived principally from or corroborated by observable market data by correlation or other means. Refer to Note 2 — “Fair Value” for the current fair value amount for the warrant obligation.

ii) The term loan was initially recorded at its amortized cost of $15.0 million less any capitalized expenses and fees payable upon the issuance (“transaction costs”) and after allocating a portion of the proceeds to the fair value of the warrant obligation. The loan is presented as a long-term financial liability in the interim condensed consolidated balance sheet.

The Company assessed the allocation of transaction costs in accordance with IFRS 9 and determined the allocation to warrants was immaterial, as such the Company allocated the total amount of the transaction costs to the term loan. The transaction costs are presented net of the term loan on the interim condensed consolidated balance sheet. The transaction costs are amortized as non-cash interest expense recorded to the interim condensed consolidated statement of loss as the difference between the stated interest rate and the EIR. The EIR was determined upon the initial draw down of Tranche A at 15.2% and reassessed based on changes in the variable interest rate from the Perceptive Credit Agreement. The Company estimated the EIR over the three months from September 30, 2024 to December 31, 2024 as 15.4%.

The Company calculated the fair value of the warrant obligation on issuance using the Black-Scholes pricing model. The warrant obligation was recorded at an initial fair value of $0.7 million on May 2, 2024. Key inputs for the valuation of the warrant obligation upon issuance were as follows:

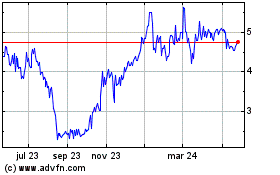

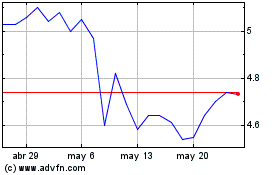

| | | | | | | | |

| | As of May 2, 2024 |

| Exercise price in USD | | $5.00 |

| Share price in USD | | $5.08 |

| Risk-free interest rate | | 4.53% |

| Expected volatility (annualized) | | 71.77% |

| Expected term (years) | | 10.00 |

| Dividend yield | | —% |

| Black-Scholes value in USD | | $4.06 |

The Company remeasures the fair value of the warrant obligation on a quarterly basis. Key inputs for the remeasurement of the warrant obligation as of September 30, 2024 were as follows:

| | | | | | | | |

| | As of September 30, 2024 |

| Exercise price in USD | | $5.00 |

| Share price in USD | | $3.65 |

| Risk-free interest rate | | 3.75% |

| Expected volatility | | 73.12% |

| Expected term (years) | | 9.58 |

| Dividend yield | | —% |

| Black-Scholes value in USD | | $2.73 |

The loan was recorded at an initial amortized cost of $13.3 million on May 2, 2024. This amount represents the residual amount of the $15.0 million draw down after allocating $0.7 million for the fair value of the warrant obligation and the $1.1 million of transaction costs to be amortized as interest expense over the life of the loan. The following table presents the allocation of the loan proceeds and any movements in the liability for the nine months ended September 30, 2024, (in USD thousands):

| | | | | | | | |

| Loan issuance amount | | $ | 15,000 | |

| Warrant obligation | | (656) | |

| Transaction costs | | (1,070) | |

| Initial loan amortized cost | | 13,274 | |

| | |

| Interest expense | | 810 | |

| Interest paid | | (792) | |

| Foreign currency revaluation | | (130) | |

| Net amortized cost as of September 30, 2024 | | $ | 13,162 | |

The Company notes there were no outstanding amounts under this credit agreement for the nine months ended September 30, 2023.

Revolving credit facility

On April 23, 2024, the Company terminated its existing credit agreement with Credit Suisse SA for up to CHF 5.0 million ($5.5 million). Additionally, the Company entered into a new credit agreement with Credit Suisse SA

for up to CHF 0.1 million ($0.1 million) to be used for cash credits, contingent liabilities, or as margin for OTC derivative transactions. Borrowings under the new credit agreement will bear interest at a rate to be established between the Company and Credit Suisse SA at the time of each draw down. As of September 30, 2024, the Company had no borrowings outstanding under the Credit Facility.

10. Share-based compensation

Stock Options

Share-based compensation expense for all stock awards consists of the following (in USD thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Research and development | | $ | 953 | | | $ | 932 | | | $ | 2,871 | | | $ | 2,489 | |

| Selling and marketing | | 567 | | | 416 | | | 1,453 | | | 794 | |

| General and administrative | | 2,093 | | | 2,582 | | | 7,086 | | | 7,753 | |

| Total | | $ | 3,613 | | | $ | 3,930 | | | 11,410 | | | 11,036 | |

11. Related party transactions

Related parties are comprised of the Company’s executive officers and directors, including their affiliates, and any person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control of, the Company.

Key management personnel are comprised of six Executive Officers and Directors and six Non-Executive Directors as of September 30, 2024. Key management personnel were comprised of six Executive Officers and Directors and seven Non-Executive Directors as of September 30, 2023.

The following table provides compensation for key management and non-executive directors for the three and nine months ended September 30, 2024 and 2023 (in USD thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Salaries and other short-term employee benefits | | $ | 1,459 | | | $ | 1,237 | | | $ | 2,975 | | | $ | 3,106 | |

| Pension costs | | 62 | | | 59 | | | 192 | | | 175 | |

| Share-based compensation expense | | 2,447 | | | 2,917 | | | 7,936 | | | 7,713 | |

| | | | | | | | |

| Total | | $ | 3,968 | | | $ | 4,213 | | | $ | 11,103 | | | $ | 10,994 | |

12. Events after the reporting date

The Company has evaluated, for potential recognition and disclosure, events that occurred prior to the date at which the unaudited interim condensed consolidated financial statements were approved to be issued.

Exhibit 99.2

Management’s discussion and analysis of financial conditions and results of operations

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our interim condensed consolidated financial statements and the related notes included as Exhibit 99.1 to the Report on Form 6-K to which this discussion and analysis is included as Exhibit 99.2 and our audited financial statements and the related notes and the section “Operating and Financial Review and Prospects” in our Annual Report on Form 20-F for the year ended December 31, 2023.

Our interim condensed consolidated financial statements are presented in U.S. dollars and have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IFRS”). None of the consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The terms “dollar,” “USD” and “$” refer to U.S. dollars and the terms “Swiss franc” and “CHF” refer to the legal currency of Switzerland, unless otherwise indicated.

Unless otherwise indicated or the context otherwise requires, all references to “SOPHiA GENETICS,” “SOPH,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to SOPHiA GENETICS SA and its consolidated subsidiaries.

Cautionary Statement Regarding Forward-Looking Statements

This discussion and analysis contain statements that constitute forward-looking statements. All statements other than statements of historical facts, including statements regarding our future results of operations and financial position, business strategy, technology, as well as plans and objectives of management for future operations are forward-looking statements. Many forward-looking statements can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate,” “will” and “potential,” among others. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified in the “Risk Factors” section of our Annual Report on Form 20-F for the year ended December 31, 2023 and in our other Securities and Exchange Commission (“SEC”) filings. These forward-looking statements include, among others:

•our expectations regarding our revenue, gross margin, expenses, other operating results and cash usage, including statements relating to the portion of our remaining performance obligation that we expect to recognize as revenue in future periods;

•our plans regarding further development of our SOPHiA DDMTM Platform and related products and solutions, which we collectively refer to as “SOPHiA DDM Platform,” and its expansion into additional features, applications and data modalities;

•future investments in our business, our anticipated capital expenditures and our estimates regarding our capital requirements, future revenues, expenses, reimbursement rates and needs for additional financing;

•our expectations regarding the market size for our platform, applications, products, and services and the market acceptance they will be able to achieve;

•our expectations regarding changes in the healthcare systems in different jurisdictions, in particular with respect to the manner in which electronic health records are collected, distributed and accessed by various stakeholders;

•the timing or outcome of any domestic and international regulatory submissions;

•impact from future regulatory, judicial, and legislative changes or developments in the United States and foreign countries;

•our ability to acquire new customers and successfully engage and retain customers;

•the costs and success of our marketing efforts, and our ability to promote our brand;

•our ability to increase demand for our applications, products, and services, obtain favorable coverage and reimbursement determinations from third-party payors and expand geographically;

•our expectations of the reliability, accuracy and performance of our applications, products, and services, as well as expectations of the benefits to patients, medical personnel and providers of our applications, products and services;

•our expectations regarding our ability, and that of our manufacturers, to manufacture our products;

•our efforts to successfully develop and commercialize our applications, products, and services;

•our competitive position and the development of and projections relating to our competitors or our industry;

•our ability to identify and successfully enter into strategic collaborations in the future, and our assumptions regarding any potential revenue that we may generate thereunder;

•our ability to obtain, maintain, protect and enforce intellectual property protection for our technology, applications, products, and services, and the scope of such protection;

•our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property or proprietary rights of third parties;

•our ability to attract and retain qualified key management and technical personnel; and

•our expectations regarding the time during which we will be an emerging growth company under the Jumpstart our Business Startups Act of 2012 (“JOBS Act”) and a foreign private issuer.

These forward-looking statements speak only as of the date of this discussion and analysis and are subject to a number of risks, uncertainties and assumptions described in the “Risk Factors” section of our Annual Form 20-F for the year ended December 31, 2023, this discussion and analysis and our other SEC filings. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. You should read this discussion and analysis completely and with the understanding that our actual future results may be materially different from what we expect.

Overview

We are a cloud-native software technology company in the healthcare space dedicated to establishing the practice of data-driven medicine as the standard of care and for life sciences research. We purposefully built a cloud-native software platform capable of analyzing data and generating insights from complex multimodal data sets and different diagnostic modalities. Our platform standardizes, computes and analyzes digital health data and is used across decentralized locations to break down data silos. This enables healthcare institutions to share knowledge and experiences and to build a collective intelligence. We envision a future in which all clinical diagnostic test data is channeled through a decentralized analytics platform that will provide insights powered by large real-world data sets and AI. We believe that a decentralized platform is the most powerful and effective

solution to create the largest network, leverage data and bring the benefits of data-driven medicine to customers and patients globally. In doing so, we can both support and benefit from growth across the healthcare ecosystem.

In 2014, we launched the first application of our platform to analyze next-generation sequencing (“NGS”) data for cancer diagnosis. We offer a broad range of applications used by healthcare providers, clinical and life sciences research laboratories and biopharmaceutical companies for precision medicine across oncology, rare diseases, infectious diseases, cardiology, neurology, metabolism and other disease areas. In 2019, we launched our solution for radiomics data that enables longitudinal monitoring of cancer patients and tumor progression throughout their disease journey. In 2022, we unveiled SOPHiA CarePath, a new multimodal module on our SOPHiA DDM Platform powered by our artificial intelligence and machine learning algorithms that integrates the capabilities of our genomics and radiomics solutions with additional modalities to further enable clinical decision-making. The module will allow healthcare practitioners to visualize data across multiple modalities (including genomic, radiomic, clinical, and biological) for individual patients in a longitudinal manner and derive additional insights through cohort design and comparison. SOPHiA CarePath has already been deployed as part of our Deep-Lung IV multimodal clinical study on non-small cell lung cancer.

We offer a range of platform access models to meet our customers’ needs. Our primary pricing strategy for our clinical customers is a pay-per-use model, in which customers can access our platform free of charge but pay for each analysis performed using our platform. To commercialize our applications and products, we employ our direct sales force, use local distributors and form collaborations with other global product and service providers in the healthcare ecosystem to assemble solutions to address customer needs. For example, we combine our solution and applications with other products used in the genomic testing process to provide customers integrated products in the testing workflow. As of September 30, 2024, our direct sales team consisted of more than 94 field-based commercial representatives.

Recent Developments

Continued Focus on Strategic Partnerships and Transactions

We are continually developing strategic relationships and engaging in strategic transactions across the healthcare ecosystem with companies who also provide products and services to our customers.

Actions Taken to Re-accelerate Revenue Growth in BioPharma and Clinical Markets

In order to re-accelerate our biopharma and clinical businesses, we have made certain changes to our sales and marketing strategies for the two market segments. For the biopharma market, we have refocused our sales efforts to target smaller, more repeatable business that we can execute in high volume to expedite our sales cycle, and we have restructured the biopharma business by separating our Data and Diagnostics product offerings. For the clinical market, we have reallocated resources from our more established and penetrated markets in EMEA to higher-growth and under-penetrated regions in NORAM and APAC, as well as specific markets in EMEA, such as the U.K., Germany, and the Middle East. We also implemented a more strategic approach towards winning and managing key, high-volume accounts in the clinical market.

Key Operating Performance Indicators

We regularly monitor a number of key performance indicators and metrics to evaluate our business, measure our performance, identify key operating trends and formulate financial projections and strategic plans. We believe that the following metrics are representative of our current business, but the metrics we use to measure our performance could change as our business continues to evolve. Our key performance indicators primarily focus on metrics related to our SOPHiA DDM Platform, as platform revenue comprises the majority of our revenues.

Our Core Genomics Customers can access our platform using three different models: dry lab access, bundle access and integrated access. In the dry lab access model, our customers use the testing instruments and solutions of their choice and our SOPHiA DDM Platform and algorithms for variant detection and identification. In the bundle access model, we bundle DNA enrichment solutions with our analytics solution to provide

customers the ability to perform end-to-end workflows. In the integrated access model, our customers have their samples processed and sequenced through select SOPHiA DDM Platform collaborators within our clinical network and access their data through our SOPHiA DDM Platform. As used in this section, the term “Core Genomics Customer” refers to any customer who accesses our SOPHiA DDM Platform through the dry lab, bundle, or integrated access models. We exclude from this definition customers who only use Alamut through our SOPHiA DDM Platform.

Platform Analysis Volume

The following table shows platform analysis volume for the three and nine months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| SOPHiA DDM Platform analysis volume* | | 90,965 | | 78,366 | | 261,429 | | 232,239 | | |

*The figures in the table above have been adjusted to exclude analyses conducted during the period but for which chargebacks were issued or other adjustments were made to customers after the period. We do not believe that such adjustments are material to the periods presented.

Platform analysis volume represents a key business metric that reflects our overall business performance, as we generate revenue on a pay-per-analysis basis. Platform analysis volume measures the number of analyses that generated revenue to us and were conducted by our Core Genomics Customers. Analysis volume is a direct function of the number of active customers and usage rates across our customer base during a specified time period. While our platform analysis volume is a major driver of our revenue growth, other factors, including product pricing, access model used, customer size mix, Alamut license sales, biopharma service revenue and workflow equipment and services revenue, also affect our revenue. Because of that, our revenue may increase in periods in which our analysis volume decreases and vice versa.

Analysis volume increased to 90,965 from 78,366 and 261,429 from 232,239 for the three and nine months ended September 30, 2024 and 2023, representing year-over-year growth of 16% and 13% for the three and nine months ended September 30, 2024, respectively. The increase in volume for both the three and nine months ended September 30, 2024 was attributable to growth in our core platform analysis volume as we saw increased usage from our existing customer base as well as contributions from new customers we brought into routine usage. Regionally, analysis volumes in NORAM and APAC grew faster than the company’s historical average, while analysis volume in EMEA grew in line with the company’s historical average. Volume growth was partially offset by slower year-over-year growth in analysis volume in LATAM, primarily due to the churn of a large customer earlier in the year.

Total Core Genomics Customers

The following table shows the number of existing Core Genomics Customers, as of September 30, 2024 and 2023, new Core Genomics Customers that went into routine usage during the three months ended September 30, 2024 and 2023, and the total number of Core Genomics Customers as of September 30, 2024 and 2023:

| | | | | | | | | | | | | | |

| | Three months ended September 30, |

| | 2024 | | 2023 |

| Existing Core Genomics Customers | | 440 | | | 417 | |

| New Core Genomics Customers | | 22 | | | 14 | |

| | | | |

| Total Core Genomics Customers | | 462 | | | 431 | |

We track the number of our Core Genomics Customers, defined as the number of customers who generated revenue through our usage of our bundle access, dry lab, and integrated access models during the specified time period, as a key measure of our ability to generate recurring revenue from our install base. We further

define our Core Genomics Customers as “Existing,” if the customer had generated revenue prior to the current period presented, or “New,” if the customer first generated revenue in the current period presented.

The analysis excludes customers without any usage of our SOPHiA DDM Platform over the past twelve months and customers who have executed agreements with us that have not generated any revenue to us, including customers that are in the process of being onboarded onto our SOPHiA DDM Platform.

Total Core Genomics Customers increased to 462 as of September 30, 2024 from 431 as of September 30, 2023. The increase is primarily attributable to our continued customer acquisition momentum over the course of the intervening period net of churn.

Net Dollar Retention (NDR)

The following table shows the net dollar retention as of September 30, 2024 and 2023:

| | | | | | | | | | | | | | |

| | As of September 30, |

| | 2024 | | 2023 |

| Net dollar retention (NDR) | | 109 | % | | 127 | % |

We track net dollar retention for our dry lab, bundle access, and integrated access customers as a measure of our ability to grow the revenue generated from our Core Genomics Customers through our “land and expand” strategy net of revenue churn, which we define as the annualized revenues we estimate to have lost from customers who access our platform through our dry lab access, bundle access and integrated access models and have not generated revenue over the past twelve months in that period based on their average quarterly revenue contributions from point of onboarding as a percentage of total recurring platform revenue. To calculate net dollar retention, we first specify a measurement period consisting of the trailing two-year period from our fiscal period end. Next, we define a measurement cohort consisting of Core Genomics Customers who use our dry lab access, bundle access, and integrated access models from whom we have generated revenues during the first month of the measurement period, which we believe is generally representative of our overall dry lab access, bundle access, and integrated customer base. We then calculate our net dollar retention as the ratio between the U.S. dollar amount of revenue generated from this cohort in the second year of the measurement period and the U.S. dollar amount of revenue generated in the first year. Any customer in the cohort that did not use our platform in the second year are included in the calculation as having contributed zero revenue in the second year.

Net dollar retention decreased to 109% as of September 30, 2024 compared to 127% as of September 30, 2023. The decrease is primarily driven by the challenging performance and customer churn in LATAM and the moderation in growth in revenue in EMEA. The decrease was partially offset by slightly more favorable foreign exchange movements for revenue generated in key transactional currencies other than the U.S. dollar, particularly the euro and the Swiss franc, on average over the trailing 12-month period, Our annualized revenue churn rate was 4%, which is consistent with our prior comparative period and historical average.

Components of Results of Operations

For a discussion of our components of results of operations, see the “Operating and Financial Review and Prospects—Operating Results—Components of Results of Operations” section of our Annual Report on Form 20-F for the year ended December 31, 2023.

Results of Operations

Comparison of the Three Months Ended September 30, 2024 and 2023

The following table summarizes our results of operations:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change |

| (Amounts in USD thousands, except %) | | 2024 | | 2023 | | $ | | % |

| Revenue | | $ | 15,853 | | | $ | 16,303 | | | $ | (450) | | | (3) | % |

| Cost of revenue | | (5,199) | | | (5,030) | | | (169) | | | 3 | % |

| Gross profit | | 10,654 | | | 11,273 | | | (619) | | | (5) | % |

| Research and development costs | | (7,874) | | | (8,984) | | | 1,110 | | | (12) | % |

| Selling and marketing costs | | (7,306) | | | (6,830) | | | (476) | | | 7 | % |

| General and administrative costs | | (10,880) | | | (12,749) | | | 1,869 | | | (15) | % |

| Other operating income, net | | 43 | | | 746 | | | (703) | | | (94) | % |

| Operating loss | | (15,363) | | | (16,544) | | | 1,181 | | | (7) | % |

| Interest income, net | | 267 | | | 1,152 | | | (885) | | | (77) | % |

| Fair value adjustments on warrant obligations | | 182 | | | — | | | 182 | | | 100 | % |

| Foreign exchange (losses) gains, net | | (3,394) | | | 1,867 | | | (5,261) | | | (282) | % |

| Loss before income taxes | | (18,308) | | | (13,525) | | | (4,783) | | | 35 | % |

| Income tax expense | | (130) | | | (299) | | | 169 | | | (57) | % |

| Loss for the period | | $ | (18,438) | | | $ | (13,824) | | | $ | (4,614) | | | 33 | % |

Revenue

The following table presents revenue by stream:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change |

| (Amounts in USD thousands, except %) | | 2024 | | 2023 | | $ | | % |

| SOPHiA DDM Platform | | $ | 15,584 | | | $ | 15,995 | | | $ | (411) | | | (3) | % |

| Workflow equipment and services | | 269 | | | 308 | | | (39) | | | (13) | % |

| Total revenue | | $ | 15,853 | | | $ | 16,303 | | | $ | (450) | | | (3) | % |

Revenue was $15.9 million for the three months ended September 30, 2024 as compared to $16.3 million for the three months ended September 30, 2023. This slight decrease was primarily attributable to a decrease in SOPHiA DDM Platform revenue, partially offset by a foreign exchange tailwind of $0.1 million related to favorable movements in exchange rates between key transactional currencies, particularly the euro and Swiss franc, and our reporting currency, the U.S. dollar. SOPHiA DDM Platform revenue was $15.6 million for the three months ended September 30, 2024 as compared to $16.0 million for the three months ended September 30, 2023. This decrease was primarily attributable to a decrease in biopharma revenue driven by customer budget constraints and other macro environment impacts, partially offset by continued clinical revenue growth driven by customer demand and analysis volume. Workflow equipment and services revenue was $0.3 million for the three months ended September 30, 2024 as compared to $0.3 million for the three months ended September 30, 2023.

Cost of Revenue

The following table presents cost of revenue, gross profit, and gross margin:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change |

| (Amounts in USD thousands, except %) | | 2024 | | 2023 | | $ | | % |

| Cost of revenue | | $ | (5,199) | | | $ | (5,030) | | | $ | (169) | | | 3 | % |

| Gross profit | | $ | 10,654 | | | $ | 11,273 | | | $ | (619) | | | (5) | % |

| Gross margin | | 67 | % | | 69 | % | | | | |

Cost of revenue was $5.2 million for the three months ended September 30, 2024 as compared to $5.0 million for the three months ended September 30, 2023. Cost of revenue increased slightly by $0.2 million driven primarily by a $0.4 million increase in amortization of capitalized developments costs, as newly developed products are commercialized, and a $0.3 million increase in licenses costs related to expanded usage of select products utilizing external licensed technology, partially offset by a $0.3 million decrease in computational and hosting-related costs associated with economies of scale and a $0.1 million decrease in inventory reserve and inventory scrap. The decrease in gross profit margin to 67% for the three months ended September 30, 2024 from 69% for the three months ended September 30, 2023 was primarily driven by lower revenue contribution from our biopharma customers.

Operating Expenses

The following table presents research and development costs, selling and marketing costs, general and administrative costs, and other operating income, net:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change |

| (Amounts in USD thousands, except %) | | 2024 | | 2023 | | $ | | % |

| Research and development costs | | $ | (7,874) | | | $ | (8,984) | | | $ | 1,110 | | | (12) | % |

| Selling and marketing costs | | (7,306) | | | (6,830) | | | (476) | | | 7 | % |

| General and administrative costs | | (10,880) | | | (12,749) | | | 1,869 | | | (15) | % |

| Other operating income, net | | 43 | | | 746 | | | (703) | | | (94) | % |

| Total operating expenses | | $ | (26,017) | | | $ | (27,817) | | | $ | 1,800 | | | (6) | % |

Research and Development Costs

Research and development costs were $7.9 million for the three months ended September 30, 2024 as compared to $9.0 million for the three months ended September 30, 2023. The decrease was primarily attributable to a $0.5 million increase in capitalized development costs related to internal and external labor to develop new products, a $0.5 million decrease in professional fees as we reduce our reliance on outsourced development services, and a $0.2 million decrease in license costs, partially offset by a $0.2 million increase in share-based compensation expense.

Selling and Marketing Costs

Selling and marketing costs were $7.3 million for the three months ended September 30, 2024 as compared to $6.8 million for the three months ended September 30, 2023. The increase was primarily attributable to a $0.4 million increase in professional fees to support our sales teams and streamline processes and a $0.2 million increase in license costs from increased usage of sales specific software applications, partially offset by a $0.1 million decrease in employee-related expenses, including share-based compensation, due to efficiencies gained after the headcount reduction at the end of fiscal year 2023.

General and Administrative Costs

General and administrative costs were $10.9 million for three months ended September 30, 2024 as compared to $12.7 million for the three months ended September 30, 2023. This decrease was primarily attributable to a $0.9 million decrease in employee-related expenses, including share-based compensation and social charges, associated with our headcount-related action taken at the end of fiscal year 2023, a $0.3 million decrease in professional fees, as we reduce reliance on external consultants, a $0.2 million decrease in licenses, as we consolidate and streamline our software platforms, and a $0.1 million decrease in public company related expenses.

Other Operating Income, Net

Other operating income, net was less than $0.1 million for the three months ended September 30, 2024 as compared to $0.7 million for the three months ended September 30, 2023.

Interest Income, net

The following table presents the interest income, net:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change |

| (Amounts in USD thousands, except %) | | 2024 | | 2023 | | $ | | % |

| Interest income, net | | $ | 267 | | | $ | 1,152 | | | $ | (885) | | | (77) | % |

Interest income, net was $0.3 million for the three months ended September 30, 2024, compared to $1.2 million for the three months ended September 30, 2023. The decrease was primarily driven by a $0.4 million decrease in interest income from lower average cash balance in interest earning bank accounts and short-term deposits and an increase of $0.4 million in interest expense related to the Perceptive Credit Agreement, which did not exist in the third quarter of 2023.

Fair value adjustments on warrant obligations

The following table presents the fair value adjustments on warrant obligations:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change |

| (Amounts in USD thousands, except %) | | 2024 | | 2023 | | $ | | % |

| Fair value adjustments on warrant obligations | | $ | 182 | | | $ | — | | | $ | 182 | | | 100 | % |

Fair value adjustments on warrant obligations was $0.2 million gain for the three months ended September 30, 2024 related to the revaluation of warrants at each reporting period, which is primarily driven by the decrease in our stock price compared to the previous reporting period’s closing price.We did not have any fair value adjustments on warrant obligations for the three months ended September 30, 2023 as we had no warrants outstanding in 2023.

Foreign exchange losses, net

The following table presents the foreign exchange losses, net:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change |

| (Amounts in USD thousands, except %) | | 2024 | | 2023 | | $ | | % |

| Foreign exchange (losses) gains, net | | $ | (3,394) | | | $ | 1,867 | | | $ | (5,261) | | | (282) | % |

Foreign exchange losses, net were $3.4 million for the three months ended September 30, 2024, compared to foreign exchange gain, net of $1.9 million for the three months ended September 30, 2023. The increase in foreign exchange losses, net recorded for the three months ended September 30, 2024 is primarily driven by an increase in unrealized foreign exchange losses of $5.2 million, primarily related to the outstanding intercompany receivable balances held by the Swiss parent entity that have not been settled with other subsidiaries, and an increase of less than $0.1 million in realized net foreign exchange loss. Unrealized gains and losses do not constitute a cash impact until the related transactions are settled.

Income Tax Expense

The following table presents the income tax expense: