false000178774000017877402024-11-142024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 14, 2024 |

Tivic Health Systems, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41052 |

81-4016391 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

47685 Lakeview Blvd. |

|

Fremont, California |

|

94538 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 888 276-6888 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

TIVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information provided below in “Item 7.01 - Regulation FD Disclosure” of this Current Report is incorporated by reference into this Item 2.02.

Item 7.01 Regulation FD Disclosure.

On November 14, 2024, Tivic Health Systems, Inc. (the “Company”) issued a press release regarding the Company’s financial results for its third quarter ended September 30, 2024. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information set forth under Item 7.01 of this Current Report on Form 8-K (this “Current Report”), including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Forward-Looking Statements

This Current Report, including Exhibit 99.1 attached hereto, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes,” “will” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Current Report, including Exhibit 99.1 attached hereto, or hereafter, including in other publicly available documents filed with the Securities and Exchange Commission, reports to the stockholders of the Company and other publicly available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to, the risks set forth herein and in such other documents filed with the Securities and Exchange Commission, each of which could adversely affect our business and the accuracy of the forward-looking statements contained herein. Our actual results, performance or achievements may differ materially from those expressed or implied by such forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TIVIC HEALTH SYSTEMS, INC. |

|

|

|

|

Date: |

November 14, 2024 |

By: |

/s/ Jennifer Ernst |

|

|

|

Name: Jennifer Ernst

Title: Chief Executive Officer |

Exhibit 99.1

Tivic Reports Third Quarter 2024 Financial Results and Provides Business Update

Pre-recorded Conference Call to Follow at 1:30 p.m. PDT/4:30 p.m EDT

FREMONT, Calif.– November 14, 2024 – Tivic Health® Systems, Inc. (Nasdaq: TIVC), a health tech company that develops and commercializes bioelectronic medicine, today announced third quarter and nine-months ended September, 30, 2024 financial results and discussed growth strategies based on its novel, patent-pending vagus nerve stimulation (VNS) science and device technology.

“This quarter we made significant progress on each of the three prongs of our strategy for delivering shareholder value," stated Jennifer Ernst, CEO of Tivic Health. "The first prong is the aggressive steps we have taken to improve the economics of the ClearUP product line -- our commercially available handheld, trigeminal nerve stimulation device for sinus and allergy conditions. This quarter, we completed the redesign of our supply chain, and, net of one-time costs, saw upwards of 70% gross margin in the months following the transition.

"The second leg, and most important element of our strategy, is our development of a non-invasive vagus nerve stimulation system that has the potential to catalyze Tivic's long-term value. In a Phase 1 trial earlier this year, we demonstrated clinically meaningful changes in autonomic, cardiac and neurologic systems using a patent-pending approach to non-invasive VNS. This positions the company to enter significantly higher value markets. This quarter we began the clinical optimization of our system, working with industry experts at the Feinstein Institute of Bioelectronic Medicine.

"In parallel, we have also engaged a leading growth consulting firm to work closely with our clinical team on prioritizing these high value use cases based on the needs of patients, providers and payers. Already we have identified several multi-billion dollar market opportunities for the program. We expect to reach a significant inflection point in the business in the next twelve months as we build out our VNS medical device program," concluded Ernst.

Third Quarter and Subsequent Weeks Business and Operational Updates

In the third quarter 2024 and subsequent weeks, the company announced the following:

•Started and completed enrollment of patients in a Phase 1a optimization study designed to identify device parameters that optimally influence autonomic nervous system (ANS) function.

•Partnered with Fletcher Spaght (FSI), a leading healthcare growth strategy firm, to accelerate development of Tivic's commercial strategy for non-invasive cervical VNS (ncVNS).

•Appointed Lisa Wolf as interim CFO, effective October 1, replacing Kimberly Bambach, who will continue to provide special project work and strategic consulting to the company.

•Completed supply chain redesign to drive increased profitability of ClearUPTM product line.

Financial Performance

•Revenue (net of returns) for the three and nine months ended September 30, 2024 was $126,000 and $600,000, respectively, a decrease of $219,000, or 27%, compared with the first nine months of 2023 primarily due to a 36% decrease in unit sales, offset by a 13% increase in the per unit average sales price.

•Cost of sales for the three and nine months ended September 30, 2024 was $82,000 and $359,000, respectively, a decrease of $178,000, or 34%, compared with the first nine months of 2023.

•Gross profit in the three and nine months ended September 30, 2024 was $44,000 and $241,000, respectively, compared with $108,000 and $282,000 in 2023.

•Total operating expenses year to date 2024 were reduced by $1.9 million compared to the nine months ended September 30, 2023. For three months ended September 30, 2024 operating expenses totaled $1.5 million, down from $1.9 million a year ago. For the nine months ended September 30, 2024 total operating expenses were $4.4 million, down from $6.3 million in 2023.

•During the three months ended September 30, 2024 company incurred a net loss of $1.4 million, compared with $1.8 million for the same period in 2023. Net loss for the first nine months of 2024 was $4.2 million, a decrease of $1.8 million compared to the same period in 2023.

•At September 30, 2024 cash and cash equivalents totaled $2.2 million, compared with $3.4 million at December 31, 2023. During October and November 2024, the Company raised net proceeds of $775,000 through sales of common stock pursuant to an Equity Distribution Agreement.

Conference Call and Webcast Information

Management will host a webcast/conference call today, November 14, at 1:30 PM PST / 4:30 PM EST to discuss the company’s third quarter 2024 financial results and provide a business update.

Conference Call Details:

Toll Free: 877-545-0523

International: 973-528-0016

Access Code: 507355

Webcast Link

https://www.webcaster4.com/Webcast/Page/2865/51524

An audio replay of the call will be available for the next 90 days from the investor page on the Tivic Health website at https://tivichealth.com/investor/.

About Tivic Health

Tivic Health is a commercial health tech company advancing the field of bioelectronic medicine. Tivic Health’s technology platforms leverage stimulation of the trigeminal, sympathetic, and vagus nerve structures. Tivic Health’s non-invasive and targeted approach to the treatment of inflammatory chronic health conditions gives consumers and providers drug-free therapeutic solutions with high safety profiles, low risk, and broad applications. Tivic Health’s first commercial product ClearUPTM is an FDA approved, award-winning, handheld bioelectronic sinus device. ClearUPTM is clinically proven, doctor-recommended, and is available through online retailers and commercial distributors. For more information visit http://tivichealth.com@TivicHealth

Forward-Looking Statements

This press release may contain “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Tivic Health Systems, Inc.’s current expectations and are subject to inherent uncertainties, risks, and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: the future development of ncVNS treatment; Tivic Health’s ability to commercialize products arising out of the ncVNS treatment and Tivic Health’s plans to seek regulatory approval for such clinical products; Tivic Health’s continued focus on developing ncVNS treatment, including in the epilepsy, post-traumatic stress disorder, and/or ischemic stroke space; expected clinical utility, including which patient populations may be pursued; market and other conditions; supply chain constraints; macroeconomic factors, including inflation; Tivic Health's ability to raise additional capital on favorable terms, or at all, when needed; Tivic Health's ability to maintain its Nasdaq listing; and unexpected costs, charges or expenses that reduce Tivic Health’s capital resources. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Tivic Health’s actual results to differ from those contained in the forward-looking statements, see Tivic Health’s filings with the SEC, including, its Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 29, 2024, under the heading “Risk Factors”; as well as the company’s subsequent filings with the SEC. Forward-looking statements contained in this press release are made as of this date, and Tivic Health Systems, Inc. undertakes no duty to update such information except as required by applicable law.

Media Contact:

Morgan Luke

Morgan.Luke@tivichealth.com

Investor Contact:

Hanover International, Inc.

ir@tivichealth.com

Tivic Health Systems, Inc.

Condensed Balance Sheets

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

|

(Unaudited) |

|

|

(Audited) |

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,189 |

|

|

$ |

3,395 |

|

Other current assets |

|

|

974 |

|

|

|

1,257 |

|

TOTAL CURRENT ASSETS |

|

|

3,163 |

|

|

|

4,652 |

|

PROPERTY AND EQUIPMENT, NET |

|

|

119 |

|

|

|

122 |

|

NONCURRENT ASSETS |

|

|

112 |

|

|

|

383 |

|

TOTAL ASSETS |

|

$ |

3,394 |

|

|

$ |

5,157 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

560 |

|

|

$ |

1,208 |

|

Other current liabilities |

|

|

— |

|

|

|

193 |

|

TOTAL CURRENT LIABILITIES |

|

|

560 |

|

|

|

1,401 |

|

TOTAL LONG-TERM LIABILITIES |

|

|

— |

|

|

|

176 |

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Common stock |

|

|

1 |

|

|

|

— |

|

Additional paid in capital |

|

|

44,897 |

|

|

|

41,466 |

|

Accumulated deficit |

|

|

(42,064 |

) |

|

|

(37,886 |

) |

TOTAL STOCKHOLDERS' EQUITY |

|

|

2,834 |

|

|

|

3,580 |

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

3,394 |

|

|

$ |

5,157 |

|

Tivic Health Systems, Inc.

Condensed Statements of Operations

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

REVENUES |

|

$ |

126 |

|

|

$ |

282 |

|

|

$ |

600 |

|

|

$ |

819 |

|

COST OF SALES |

|

|

82 |

|

|

|

174 |

|

|

|

359 |

|

|

|

537 |

|

GROSS PROFIT |

|

|

44 |

|

|

|

108 |

|

|

|

241 |

|

|

|

282 |

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

422 |

|

|

|

337 |

|

|

|

980 |

|

|

|

1,295 |

|

Sales and marketing |

|

|

234 |

|

|

|

480 |

|

|

|

946 |

|

|

|

1,390 |

|

General and administrative |

|

|

819 |

|

|

|

1,051 |

|

|

|

2,433 |

|

|

|

3,598 |

|

TOTAL OPERATING EXPENSES |

|

|

1,475 |

|

|

|

1,868 |

|

|

|

4,359 |

|

|

|

6,283 |

|

NET OPERATING LOSS |

|

|

(1,431 |

) |

|

|

(1,760 |

) |

|

|

(4,118 |

) |

|

|

(6,001 |

) |

OTHER EXPENSE |

|

|

— |

|

|

|

— |

|

|

|

60 |

|

|

|

— |

|

NET LOSS |

|

$ |

(1,431 |

) |

|

$ |

(1,760 |

) |

|

$ |

(4,178 |

) |

|

$ |

(6,001 |

) |

NET LOSS PER SHARE - BASIC AND DILUTED |

|

$ |

(0.23 |

) |

|

$ |

(1.48 |

) |

|

$ |

(1.07 |

) |

|

$ |

(10.60 |

) |

WEIGHTED-AVERAGE NUMBER OF SHARES - BASIC AND DILUTED |

|

|

6,191,127 |

|

|

|

1,189,821 |

|

|

|

3,897,938 |

|

|

|

566,228 |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

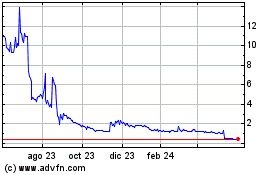

Tivic Health Systems (NASDAQ:TIVC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

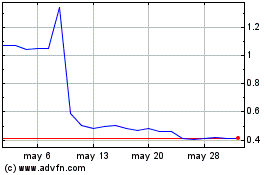

Tivic Health Systems (NASDAQ:TIVC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024