Pre-recorded Conference Call to Follow at 1:30

p.m. PDT/4:30 p.m EDT

Tivic Health® Systems, Inc. (Nasdaq: TIVC), a health tech

company that develops and commercializes bioelectronic medicine,

today announced third quarter and nine-months ended September, 30,

2024 financial results and discussed growth strategies based on its

novel, patent-pending vagus nerve stimulation (VNS) science and

device technology.

“This quarter we made significant progress on each of the three

prongs of our strategy for delivering shareholder value," stated

Jennifer Ernst, CEO of Tivic Health. "The first prong is the

aggressive steps we have taken to improve the economics of the

ClearUP product line -- our commercially available handheld,

trigeminal nerve stimulation device for sinus and allergy

conditions. This quarter, we completed the redesign of our supply

chain, and, net of one-time costs, saw upwards of 70% gross margin

in the months following the transition.

"The second leg, and most important element of our strategy, is

our development of a non-invasive vagus nerve stimulation system

that has the potential to catalyze Tivic's long-term value. In a

Phase 1 trial earlier this year, we demonstrated clinically

meaningful changes in autonomic, cardiac and neurologic systems

using a patent-pending approach to non-invasive VNS. This positions

the company to enter significantly higher value markets. This

quarter we began the clinical optimization of our system, working

with industry experts at the Feinstein Institute of Bioelectronic

Medicine.

"In parallel, we have also engaged a leading growth consulting

firm to work closely with our clinical team on prioritizing these

high value use cases based on the needs of patients, providers and

payers. Already we have identified several multi-billion dollar

market opportunities for the program. We expect to reach a

significant inflection point in the business in the next twelve

months as we build out our VNS medical device program," concluded

Ernst.

Third Quarter and Subsequent Weeks Business and Operational

Updates

In the third quarter 2024 and subsequent weeks, the company

announced the following:

- Started and completed enrollment of patients in a Phase 1a

optimization study designed to identify device parameters that

optimally influence autonomic nervous system (ANS) function.

- Partnered with Fletcher Spaght (FSI), a leading healthcare

growth strategy firm, to accelerate development of Tivic's

commercial strategy for non-invasive cervical VNS (ncVNS).

- Appointed Lisa Wolf as interim CFO, effective October 1,

replacing Kimberly Bambach, who will continue to provide special

project work and strategic consulting to the company.

- Completed supply chain redesign to drive increased

profitability of ClearUP™ product line.

Financial Performance

- Revenue (net of returns) for the three and nine months ended

September 30, 2024 was $126,000 and $600,000, respectively, a

decrease of $219,000, or 27%, compared with the first nine months

of 2023 primarily due to a 36% decrease in unit sales, offset by a

13% increase in the per unit average sales price.

- Cost of sales for the three and nine months ended September 30,

2024 was $82,000 and $359,000, respectively, a decrease of

$178,000, or 34%, compared with the first nine months of 2023.

- Gross profit in the three and nine months ended September 30,

2024 was $44,000 and $241,000, respectively, compared with $108,000

and $282,000 in 2023.

- Total operating expenses year to date 2024 were reduced by $1.9

million compared to the nine months ended September 30, 2023. For

three months ended September 30, 2024 operating expenses totaled

$1.5 million, down from $1.9 million a year ago. For the nine

months ended September 30, 2024 total operating expenses were $4.4

million, down from $6.3 million in 2023.

- During the three months ended September 30, 2024 company

incurred a net loss of $1.4 million, compared with $1.8 million for

the same period in 2023. Net loss for the first nine months of 2024

was $4.2 million, a decrease of $1.8 million compared to the same

period in 2023.

- At September 30, 2024 cash and cash equivalents totaled $2.2

million, compared with $3.4 million at December 31, 2023. During

October and November 2024, the Company raised net proceeds of

$775,000 through sales of common stock pursuant to an Equity

Distribution Agreement.

Conference Call and Webcast Information

Management will host a webcast/conference call today, November

14, at 1:30 PM PST / 4:30 PM EST to discuss the company’s third

quarter 2024 financial results and provide a business update.

Conference Call Details: Toll Free: 877-545-0523

International: 973-528-0016 Access Code: 507355

Webcast Link

https://www.webcaster4.com/Webcast/Page/2865/51524

An audio replay of the call will be available for the next 90

days from the investor page on the Tivic Health website at

https://tivichealth.com/investor/.

About Tivic Health

Tivic Health is a commercial health tech company advancing the

field of bioelectronic medicine. Tivic Health’s technology

platforms leverage stimulation of the trigeminal, sympathetic, and

vagus nerve structures. Tivic Health’s non-invasive and targeted

approach to the treatment of inflammatory chronic health conditions

gives consumers and providers drug-free therapeutic solutions with

high safety profiles, low risk, and broad applications. Tivic

Health’s first commercial product ClearUP™ is an FDA approved,

award-winning, handheld bioelectronic sinus device. ClearUP™ is

clinically proven, doctor-recommended, and is available through

online retailers and commercial distributors. For more information

visit http://tivichealth.com @TivicHealth

Forward-Looking Statements

This press release may contain “forward-looking statements” that

are subject to substantial risks and uncertainties. All statements,

other than statements of historical fact, contained in this press

release are forward-looking statements. Forward-looking statements

contained in this press release may be identified by the use of

words such as “anticipate,” “believe,” “contemplate,” “could,”

“estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “target,” “aim,” “should,”

“will” “would,” or the negative of these words or other similar

expressions, although not all forward-looking statements contain

these words. Forward-looking statements are based on Tivic Health

Systems, Inc.’s current expectations and are subject to inherent

uncertainties, risks, and assumptions that are difficult to

predict. Further, certain forward-looking statements are based on

assumptions as to future events that may not prove to be accurate.

Actual results could differ materially from those contained in any

forward-looking statement as a result of various factors,

including, without limitation: the future development of ncVNS

treatment; Tivic Health’s ability to commercialize products arising

out of the ncVNS treatment and Tivic Health’s plans to seek

regulatory approval for such clinical products; Tivic Health’s

continued focus on developing ncVNS treatment, including in the

epilepsy, post-traumatic stress disorder, and/or ischemic stroke

space; expected clinical utility, including which patient

populations may be pursued; market and other conditions; supply

chain constraints; macroeconomic factors, including inflation;

Tivic Health's ability to raise additional capital on favorable

terms, or at all, when needed; Tivic Health's ability to maintain

its Nasdaq listing; and unexpected costs, charges or expenses that

reduce Tivic Health’s capital resources. Given these risks and

uncertainties, you are cautioned not to place undue reliance on

such forward-looking statements. For a discussion of other risks

and uncertainties, and other important factors, any of which could

cause Tivic Health’s actual results to differ from those contained

in the forward-looking statements, see Tivic Health’s filings with

the SEC, including, its Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the SEC on March 29, 2024,

under the heading “Risk Factors”; as well as the company’s

subsequent filings with the SEC. Forward-looking statements

contained in this press release are made as of this date, and Tivic

Health Systems, Inc. undertakes no duty to update such information

except as required by applicable law.

Tivic Health Systems, Inc.

Condensed Balance Sheets

(in thousands, except share and per

share data)

September 30, 2024

December 31, 2023

(Unaudited)

(Audited)

ASSETS

Cash and cash equivalents

$

2,189

$

3,395

Other current assets

974

1,257

TOTAL CURRENT ASSETS

3,163

4,652

PROPERTY AND EQUIPMENT, NET

119

122

NONCURRENT ASSETS

112

383

TOTAL ASSETS

$

3,394

$

5,157

LIABILITIES AND STOCKHOLDERS’

EQUITY

Accounts payable and accrued expenses

$

560

$

1,208

Other current liabilities

—

193

TOTAL CURRENT LIABILITIES

560

1,401

TOTAL LONG-TERM LIABILITIES

—

176

STOCKHOLDERS' EQUITY

Common stock

1

—

Additional paid in capital

44,897

41,466

Accumulated deficit

(42,064

)

(37,886

)

TOTAL STOCKHOLDERS' EQUITY

2,834

3,580

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

3,394

$

5,157

Tivic Health Systems, Inc.

Condensed Statements of

Operations

(in thousands, except share and per

share data)

Three Months Ended September

30,

Nine Months Ended

2024

2023

2024

2023

REVENUES

$

126

$

282

$

600

$

819

COST OF SALES

82

174

359

537

GROSS PROFIT

44

108

241

282

OPERATING EXPENSES

Research and development

422

337

980

1,295

Sales and marketing

234

480

946

1,390

General and administrative

819

1,051

2,433

3,598

TOTAL OPERATING EXPENSES

1,475

1,868

4,359

6,283

NET OPERATING LOSS

(1,431

)

(1,760

)

(4,118

)

(6,001

)

OTHER EXPENSE

—

—

60

—

NET LOSS

$

(1,431

)

$

(1,760

)

$

(4,178

)

$

(6,001

)

NET LOSS PER SHARE - BASIC AND DILUTED

$

(0.23

)

$

(1.48

)

$

(1.07

)

$

(10.60

)

WEIGHTED-AVERAGE NUMBER OF SHARES - BASIC

AND DILUTED

6,191,127

1,189,821

3,897,938

566,228

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114160019/en/

Media Contact: Morgan Luke

Morgan.Luke@tivichealth.com

Investor Contact: Hanover International, Inc.

ir@tivichealth.com

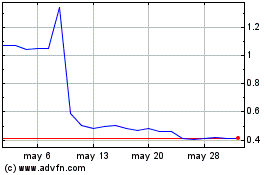

Tivic Health Systems (NASDAQ:TIVC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

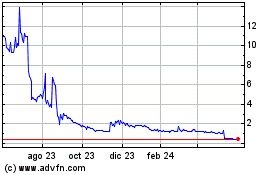

Tivic Health Systems (NASDAQ:TIVC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024