false000181913300018191332022-08-102022-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGEACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2024

TANGO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-39485 |

85-1195036 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

201 Brookline Ave., Suite 901 Boston, MA |

02215 |

(Address of principal executive offices) |

(Zip code) |

Registrant’s telephone number, including area code: 857-320-4900

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b)under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c)under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, par value $0.001 per share |

|

TNGX |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, Tango Therapeutics, Inc. (“Tango” or the “Company”) issued a press release relating to its results of operations and financial condition for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The press release, and the information set forth therein (including Exhibit 99.1), is being furnished pursuant to Item 2.02 of this Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section. Nor shall such document be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in the filing unless specifically stated so therein.

Item 8.01 Other Events

PRMT5 Development Program Update

On November 6, 2024, the Company issued a press release announcing an update on its PRMT5 development program. A copy of the press release is attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

|

|

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TANGO THERAPEUTICS, INC.

Dated: November 6, 2024 By: /s/ Douglas Barry

Name: Douglas Barry

Title: Chief Legal Officer

Tango Therapeutics Reports Third Quarter 2024 Financial Results

and Provides Business Highlights

– Positive TNG462 clinical activity across multiple tumor types in the phase 1/2 clinical trial, program moving into full development with multiple combination studies –

– Clinical collaboration established with Revolution Medicines to evaluate TNG462 in combination with RAS(ON) multi- and G12D-selective inhibitors –

– Next-generation brain-penetrant MTA-cooperative PRMT5 inhibitor, TNG456, planned to enter the clinic in 1H 2025 –

– Strong cash position of $293 million as of September 30, 2024,

with cash runway into 3Q 2026 to prioritize resourcing of TNG462 and TNG456 clinical trials –

BOSTON, Mass. – November 6, 2024 – Tango Therapeutics, Inc. (NASDAQ: TNGX), a clinical-stage biotechnology company committed to discovering and delivering the next generation of precision cancer medicines, reported its financial results for the third quarter ended September 30, 2024, and provided business highlights.

“We have made great progress with our PRMT5 development program, including positive data from the TNG462 phase 1/2 clinical trial that showcase the best-in-class potential of TNG462 in multiple tumor types, including pancreatic and non-small cell lung cancers (NSCLC). Based on these early data, we are advancing TNG462 into trials with multiple targeted and standard of care combinations, including two RAS(ON) tri-complex inhibitors from Revolution Medicines. Given that nearly all MTAP-deleted pancreatic cancer has a co-occurring RAS mutation, we believe this could be a powerful approach to changing the treatment landscape for this challenging cancer,” said Barbara Weber, M.D., President and Chief Executive Officer of Tango Therapeutics. “As part of the expanded capabilities needed to rapidly move TNG462 development forward, Dr. Maeve Waldron-Lynch, M.D. is joining Tango as Senior Vice President, Head of Clinical Development. Dr. Waldron-Lynch has extensive late-stage oncology clinical development and regulatory experience and will be invaluable as we prepare to advance TNG462 to registration.”

In a separate press release issued earlier today, Tango Therapeutics provided an update on its ongoing PRMT5 clinical development program:

•Data from the ongoing phase 1/2 clinical trial of TNG462, a potentially best-in-class MTA-cooperative PRMT5 inhibitor, demonstrate clinical activity across multiple tumor types, including NSCLC and pancreatic cancer. Of note, this includes an ORR of 43% in cholangiocarcinoma (n=7). Substantive durability and a good safety and tolerability profile also were observed in this ongoing trial. The next clinical update is expected in 2025.

•The Company plans to initiate multiple targeted and standard of care combinations with TNG462 including RAS(ON) multi-selective and RAS(ON) G12D-selective inhibitors (Revolution Medicines), osimertinib (AstraZeneca) and pembrolizumab (Merck). These studies are expected to begin enrolling in 1H 2025.

•TNG908, an MTA-cooperative brain-penetrant PRMT5 inhibitor, is clinically active and well-tolerated across non-CNS cancers in the phase 1/2 clinical trial. In particular, there were a total of nine evaluable pancreatic cancer patients, two with partial responses (ORR 22%) and five with stable disease as best response to date. The five ongoing pancreatic cancer patients have been on study for an average of 24 weeks, the longest for 72 weeks.

•TNG908 did not demonstrate activity in glioblastoma (n=23 at active doses) likely because CNS exposure did not meet the required exposure threshold for clinical efficacy.

•TNG908 enrollment is being stopped to allow full resourcing of TNG462 as a potential best-in-class molecule. In particular, the notably longer time on treatment observed – 24 weeks and still increasing for TNG462 versus 16 weeks for TNG908 – the superior target coverage, and the safety and tolerability profile all support selection of TNG462 for further development.

•TNG456 is a next-generation brain-penetrant MTA-cooperative PRMT5 inhibitor that is 55X selective for MTAP deletion with 20 nM potency. Preclinical studies suggest TNG456 central nervous system exposure has the potential to be sufficient for meaningful efficacy in glioblastoma and brain metastases.

•The Company expects to begin enrolling patients in the planned phase 1/2 trial during 1H 2025.

Business Highlights

Clinical collaboration with Revolution Medicines

•In November 2024, the Company entered into a clinical collaboration with Revolution Medicines to evaluate the efficacy and safety of TNG462 in combination with RMC-6236, a RAS(ON) multi-selective inhibitor, and with RMC-9805, a RAS(ON) G12D-selective inhibitor.

•The agreement provides that Revolution Medicines will supply RMC-6236 and RMC-9805 to Tango and that Tango will be the sponsor of any combination trials. Each company will retain commercial rights to their respective compounds and the agreement is mutually non-exclusive.

TNG260, a first-in-class, highly selective CoREST complex inhibitor

•The TNG260 phase 1/2 clinical trial is ongoing, evaluating safety, pharmacokinetics, pharmacodynamics and efficacy of TNG260 in combination with pembrolizumab in patients with locally advanced or metastatic solid tumors with an STK11 loss-of-function mutation. To date, safety, tolerability and pharmacokinetic profiles are favorable.

•STK11 mutations occur in approximately 15% of non-small cell lung, 15% of cervical, 10% of carcinoma of unknown primary, 5% of breast and 3% of pancreatic cancers.

Upcoming Milestones

•TNG462 clinical data update expected in 2025

•TNG462 combination trial enrollment expected to begin 1H 2025

•TNG456 phase 1/2 trial enrollment expected to begin 1H 2025

•TNG260 clinical data expected in 2025

Additional Business and Pipeline Highlights

Leadership Update

Maeve Waldron-Lynch, M.D. will join Tango as Senior Vice President, Head of Clinical Development later this month. In this role, Dr. Waldron-Lynch will lead clinical development functions under Adam Crystal, M.D., Ph.D., President of Research and Development at Tango. Dr. Waldron-Lynch most recently served as VP and Global Clinical Program Head at MorphoSys, where she oversaw the clinical program for tafasitamab. Prior to MorphoSys, she was a Clinical Development Medical Director at Novartis. Dr. Waldron-Lynch also has served as Senior Clinical Director, Oncology at Roche, and as Associate Director of Medical Science, Oncology at Mundipharma. Dr. Waldron-Lynch graduated from the University College Cork School of

Medicine and served as a Specialty Registrar Medical Oncology at the Royal College of Physicians of Ireland, and a Clinical Fellow in Medical Oncology at the Yale University School of Medicine.

Financial Results

As of September 30, 2024, the Company held $293.3 million in cash, cash equivalents and marketable securities, which the Company expects to be sufficient to fund operations into the third quarter of 2026, including for additional planned TNG462 and TNG456 clinical trials.

Collaboration revenue was $11.6 million for the three months ended September 30, 2024, compared to $10.7 million for the same period in 2023, and $25.9 million for the nine months ended September 30, 2024 compared to $26.1 million for the same period in 2023. Collaboration revenue increased due to changes to estimated costs expected to be incurred under the collaboration during the three months ended September 30, 2024.

License revenue was $0 and $12.1 million for the three and nine months ended September 30, 2024, respectively, compared to $0 and $5.0 million for the three and nine months ended September 30, 2023, respectively. The year-to-date increase is primarily due to licensing a drug discovery program to Gilead for $12.0 million during the second quarter of 2024 as compared to Gilead licensing a program for $5.0 million during the second quarter of 2023.

Research and development expenses were $33.3 million for the three months ended September 30, 2024, compared to $27.1 million for the same period in 2023, and $110.0 million for the nine months ended September 30, 2024 compared to $83.9 million for the same period in 2023. The change is due to increased spend related to the advancement of TNG462, preclinical programs and personnel-related costs to support our research and development activities.

General and administrative expenses were $11.2 million for the three months ended September 30, 2024, compared to $9.2 million for the same period in 2023, and $32.7 million for the nine months ended September 30, 2024 compared to $26.4 million for the same period in 2023. The change was primarily due to increases in personnel-related costs.

Net loss for the three months ended September 30, 2024 was $29.2 million, or $0.27 per share, compared to a net loss of $22.3 million, or $0.23 per share, in the same period in 2023. Net loss for the nine months ended September 30, 2024 was $92.6 million, or $0.85 per share, compared to a net loss of $71.0 million, or $0.78 per share, in the same period in 2023.

About Tango Therapeutics

Tango Therapeutics is a clinical-stage biotechnology company dedicated to discovering novel drug targets and delivering the next generation of precision medicine for the treatment of cancer. Using an approach that starts and ends with patients, Tango leverages the genetic principle of synthetic lethality to discover and develop therapies that take aim at critical targets in cancer. For more information, please visit www.tangotx.com.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events, Tango’s future operating performance and goals, the anticipated benefits of therapies and combination therapies (that include a Tango pipeline product), as well as the expectations, beliefs and development objectives for Tango’s product pipeline and clinical trials. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “goal”, “estimate”, “anticipate”, “believe”, “predict”, “designed,” “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. For example, implicit or explicit statements concerning the following include or constitute forward-looking statements: the Company is advancing TNG462 into clinical trials as a monotherapy and with multiple targeted and standard of care combinations, including two RAS(ON) tri-complex inhibitors from Revolution Medicines, Inc.; the Company believes the combination of TNG462 with RAS(ON) inhibitors could be a powerful approach to changing the treatment landscape for pancreatic cancer; potential combination strategies for PRMT5 inhibitors; the Company’s view that TNG462 has the potential to be a best-in-class MTA-cooperative PRMT5 inhibitor in multiple tumor types, including pancreatic and non-small cell lung cancers; the Company is moving TNG462 into full development; the Company expects cash runway into the third quarter of 2026; the Company expects to share another clinical update on TNG462 in 2025; the Company’s planned and ongoing clinical trials, including the anticipated timing for enrollment and the timing to report results and updates of such trials; the Company’s understanding of the central nervous system exposure required to provide meaningful efficacy in glioblastoma and brain metastases; the Company’s plans to enroll patients in a planned Phase 1/2 clinical trial for TNG456 in the first half of 2025; the Company continues to advance TNG260 for cancers with STK11 loss-of-function mutations, with the phase 1/2 clinical trial ongoing; Tango is committed to discovering and delivering the next generation of precision cancer medicines; Dr. Weber’s statements in this press release; and the expected timing of: (i) development candidate declaration for certain targets; (ii) initiating IND-enabling studies; (iii) filing INDs; (iv) clinical trial

initiation, dose escalation and dose expansion (including for combination studies) and (v) disclosing initial, interim, additional and final clinical trial results (including for combination studies); and the expected benefits of the Company's development candidates and other product candidates. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Tango and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the benefits of product candidates seen in preclinical tests and analyses may not be evident when tested in later preclinical studies or in clinical trials or when used in broader patient populations (if approved for commercial sale); Tango has limited experience conducting clinical trials (and will rely on a third party to operate its clinical trials) and may not be able to commence its clinical trials (including opening clinical trial sites, dosing the first patient, and continued enrollment and dosing of an adequate number of clinical trial participants) when expected, may not be able to continue dosing, initiate dose escalation and/or dose expansion on anticipated timelines, and may not generate or report clinical trial results (including final, initial or additional safety, efficacy data and proof-of-mechanism and proof-of-concept) in the anticipated timeframe (or at all); future clinical trial data releases may differ materially from initial or interim data from our current and future clinical trials; Tango’s pipeline products may not be safe and/or effective in humans; Tango has a limited operating history and has not generated any revenue to date from product sales, and may never become profitable; other companies may be able to identify and develop product candidates more quickly than the Company and commercially introduce the product prior to the Company; the Company’s proprietary discovery platform is novel and may not identify any synthetic lethal targets for future development; the Company may not be able to identify development candidates on the schedule it anticipates due to technical, financial or other reasons; the Company may not be able to file INDs for development candidates on time, or at all, due to technical or financial reasons or otherwise; the Company may utilize cash resources more quickly than anticipated; Tango will need to raise capital in the future and if we are unable to raise capital when needed or on attractive terms, we would be forced to delay, scale back or discontinue some of our development programs or future commercialization efforts (which may delay filing of INDs, dosing patients, initiation of dose expansion, reporting clinical trial results and filing new drug applications); Tango’s approach to the discovery and development of product candidates is novel and unproven, which makes it difficult to predict the time, cost of development, and likelihood of successfully developing any products; the Company may be unable to advance our preclinical development programs into and through the clinic for safety or efficacy reasons or commercialize our product candidates or

we may experience significant delays in doing so as a result of factors beyond Tango’s control; the Company may not be able to realize the benefits of orphan drug or Fast Track designation (and such designations may not advance any anticipated approval timelines); the expected benefits of our product candidates in patients as single agents and/or in combination may not be realized; the Company may experience delays or difficulties in the initiation, enrollment, or dosing of patients in clinical trials or the announcement of clinical trial results, Tango may not identify or discover additional product candidates or may expend limited resources to pursue a particular product candidate or indication and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success; the Company’s product candidates may cause adverse or other undesirable side effects (or may not show requisite efficacy) that could, among other things, delay or prevent regulatory approval; our dependence on one or a limited number third parties for conducting clinical trials and producing drug substance and drug product (including drug substance, which is currently sole sourced); government regulation may negatively impact the Company’s business, including the potential approval of the BIOSECURE Act; and our ability to obtain and maintain patent and other intellectual property protection for our technology and product candidates or the scope of intellectual property protection obtained is not sufficiently broad. Additional information concerning risks, uncertainties and assumptions can be found in Tango’s filings with the Securities and Exchange Commission (SEC), including the risk factors referenced in Tango’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented and/or modified by its most recent Quarterly Report on Form 10-Q. You should not place undue reliance on forward-looking statements in this press release, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Tango specifically disclaims any duty to update these forward-looking statements.

Investor Contact:

Sam Martin/Andrew Vulis

Argot Partners

tango@argotpartners.com

Media Contact:

Amanda Brown Galgay

SVP, Corporate Communications, Tango Therapeutics

media@tangotx.com

Consolidated Statements of Operations

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Collaboration revenue |

|

$ |

11,607 |

|

|

$ |

10,732 |

|

|

$ |

25,852 |

|

|

$ |

26,096 |

|

License revenue |

|

|

— |

|

|

|

— |

|

|

|

12,100 |

|

|

|

5,000 |

|

Total revenue |

|

|

11,607 |

|

|

|

10,732 |

|

|

|

37,952 |

|

|

|

31,096 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

33,263 |

|

|

|

27,149 |

|

|

|

109,981 |

|

|

|

83,859 |

|

General and administrative |

|

|

11,222 |

|

|

|

9,209 |

|

|

|

32,656 |

|

|

|

26,397 |

|

Total operating expenses |

|

|

44,485 |

|

|

|

36,358 |

|

|

|

142,637 |

|

|

|

110,256 |

|

Loss from operations |

|

|

(32,878 |

) |

|

|

(25,626 |

) |

|

|

(104,685 |

) |

|

|

(79,160 |

) |

Other income, net |

|

|

3,765 |

|

|

|

3,386 |

|

|

|

12,212 |

|

|

|

8,266 |

|

Loss before income taxes |

|

|

(29,113 |

) |

|

|

(22,240 |

) |

|

|

(92,473 |

) |

|

|

(70,894 |

) |

Provision for income taxes |

|

|

(54 |

) |

|

|

(23 |

) |

|

|

(159 |

) |

|

|

(87 |

) |

Net loss |

|

$ |

(29,167 |

) |

|

$ |

(22,263 |

) |

|

$ |

(92,632 |

) |

|

$ |

(70,981 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share – basic and diluted |

|

$ |

(0.27 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.85 |

) |

|

$ |

(0.78 |

) |

Weighted average number of common shares outstanding – basic and diluted |

|

|

108,507,390 |

|

|

|

97,033,273 |

|

|

|

108,990,011 |

|

|

|

91,268,133 |

|

Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

53,148 |

|

|

$ |

66,385 |

|

Marketable securities |

|

|

240,130 |

|

|

|

270,500 |

|

Restricted cash |

|

|

— |

|

|

|

856 |

|

Prepaid expenses and other current assets |

|

|

7,537 |

|

|

|

8,797 |

|

Total current assets |

|

|

300,815 |

|

|

|

346,538 |

|

Property and equipment, net |

|

|

8,590 |

|

|

|

9,908 |

|

Operating lease right-of-use assets |

|

|

40,430 |

|

|

|

43,508 |

|

Restricted cash, net of current portion |

|

|

2,567 |

|

|

|

2,567 |

|

Other assets |

|

|

13 |

|

|

|

46 |

|

Total assets |

|

$ |

352,415 |

|

|

$ |

402,567 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

4,112 |

|

|

$ |

2,785 |

|

Accrued expenses and other current liabilities |

|

|

15,006 |

|

|

|

15,401 |

|

Operating lease liabilities |

|

|

2,863 |

|

|

|

2,082 |

|

Deferred revenue |

|

|

15,602 |

|

|

|

25,670 |

|

Total current liabilities |

|

|

37,583 |

|

|

|

45,938 |

|

Operating lease liabilities, net of current portion |

|

|

34,763 |

|

|

|

36,838 |

|

Deferred revenue, net of current portion |

|

|

50,899 |

|

|

|

66,683 |

|

Total liabilities |

|

|

123,245 |

|

|

|

149,459 |

|

Total stockholders’ equity |

|

|

229,170 |

|

|

|

253,108 |

|

Total liabilities and stockholders’ equity |

|

$ |

352,415 |

|

|

$ |

402,567 |

|

Tango Therapeutics Reports Positive TNG462 Clinical Data and Provides Update on PRMT5 Development Program

– TNG462 demonstrated durable clinical activity across multiple tumor types, including non-small cell lung cancer (NSCLC) and pancreatic cancer, in ongoing phase 1/2 clinical trial, moving into full development –

– Multiple TNG462 combination studies planned in 1H 2025 –

– Clinical collaboration established with Revolution Medicines to evaluate TNG462 in combination with RAS(ON) multi- and G12D-selective inhibitors –

– TNG456, a next-generation brain penetrant MTA-cooperative PRMT5 inhibitor with enhanced potency and MTAP-deleted-selectivity, entering phase 1/2 clinical trial 1H 2025 to be evaluated both as a monotherapy and in combination with CDK4/6 inhibitor abemaciclib –

– TNG908 enrollment being stopped to fully resource TNG462 and TNG456 –

BOSTON, Mass. – November 6, 2024 – Tango Therapeutics, Inc. (NASDAQ: TNGX), a clinical-stage biotechnology company committed to discovering and delivering the next generation of precision cancer medicines, announced an update on its PRMT5 program. Based on positive data from the dose escalation and early dose expansion cohorts of the TNG462 phase 1/2 clinical trial, the Company has selected TNG462 to move forward into full development. TNG908, an MTA-cooperative brain penetrant PRMT5 inhibitor, is clinically active and well-tolerated in non-CNS solid tumors including NSCLC and pancreatic cancer. However, TNG908 did not meet the pharmacokinetic exposure threshold for clinical efficacy in glioblastoma (GBM) in the phase 1/2 trial. Thus, the Company is introducing TNG456, a next-generation brain penetrant MTA-cooperative PRMT5 inhibitor with enhanced potency and selectivity for the treatment of GBM, NSCLC and selected other solid tumors. TNG908 enrollment is being stopped in order to fully resource TNG462 and TNG456.

“Early data from the TNG462 phase 1/2 clinical trial demonstrate activity, durability and tolerability, with the potential to be a best-in-class molecule. In this ongoing clinical trial, patients remain on treatment with a current median of 24 weeks and is still increasing,” said Adam Crystal, M.D., Ph.D., President, Research and Development of Tango Therapeutics. “In addition, we are introducing TNG456, our next-generation brain-penetrant molecule, which is

anticipated to enter the clinic in the first half of next year. Given the increased potency, selectivity and predicted brain penetrance of TNG456, we expect CNS exposure to be in the range needed for meaningful efficacy in glioblastoma and brain metastases. While it’s disappointing that, unlike in other solid tumors, TNG908 is not active in GBM, we believe this is due to lower-than-predicted central nervous system exposure. We remain steadfastly committed to bringing an effective treatment to people with glioblastoma and we are strongly positioned to achieve our goal of reaching as many patients as possible with MTAP-deleted cancers.”

“Clinical data from the phase 1/2 trial demonstrate that TNG462 has potentially best-in-class characteristics including clinical activity across multiple tumor types included in the trial, substantive durability, and a good safety and tolerability profile, thus we are moving rapidly into the next phase of development. This includes clinical evaluation of TNG462 as a monotherapy and in multiple combinations of both targeted and standard of care agents to begin in 1H 2025, in preparation for registrational trials in NSCLC and pancreatic cancer. It also includes building key capabilities within Tango to bring TNG462 to a broad range of patients in the coming years. As part of this effort, we have entered into a clinical collaboration with Revolution Medicines under which we plan to conduct the first combination trials of an MTA-cooperative PRMT5 inhibitor with the exciting class of RAS(ON) tri-complex inhibitors. Given that nearly all MTAP-deleted pancreatic cancers have a co-occurring RAS mutation, we believe this could be a powerful approach to changing the treatment landscape for this challenging cancer,” said Barbara Weber, M.D., President and Chief Executive Officer of Tango Therapeutics.

TNG462, a potentially best-in-class MTA-cooperative PRMT5 inhibitor

•TNG462 dose escalation began in July 2023 and enrollment in the dose expansion cohorts began in June 2024. With a data cutoff of 20 October 2024, a total of 59 patients have been enrolled, 39 evaluable patients across 13 histologies at active doses (160-300 mg QD).

•TNG462 is active and well-tolerated across multiple tumor types, including NSCLC and pancreatic cancer, with a current median time on treatment of 24 weeks, and is still increasing.

•As has been reported with other MTA-cooperative PRMT5 inhibitors, tumors continue to shrink over time in multiple tumor types. Median time to response is 16 weeks (8-32 weeks) and ~60% of patients with partial responses were initially assessed with stable disease.

•While there is not yet a sufficient number of evaluable patients and follow-up to accurately estimate ORR for most cancer types, we have enrolled seven

cholangiocarcinoma patients and observed confirmed partial responses in 3/7 of these patients (ORR 43%). 4/7 cholangiocarcinoma patients are ongoing with a median time on study of 24 weeks, and is still increasing.

•TNG462 has a good safety profile and is well-tolerated at active doses, with thrombocytopenia as the dose limiting toxicity. Other adverse events reported for the class, including nausea, vomiting, diarrhea, and fatigue, occurred in less than 20% of patients and were predominantly grade 1. Dysgeusia has not been reported with the doses being evaluated in expansion.

•TNG462 efficacy and tolerability continue to be evaluated at 200 mg, 250 mg and 300 mg daily, predominantly in NSCLC and pancreatic cancer. The next clinical update is planned for 2025.

•Development plans for TNG462 being implemented include targeted combinations with two RAS(ON) inhibitors – RAS(ON) multi-selective inhibitor, RMC-6236, and RAS(ON) G12D-selective inhibitor, RMC-9805 (Revolution Medicines) – osimertinib (AstraZeneca) and pembrolizumab (Merck), with enrollment planned to start in 1H 2025.

•Combinations of TNG462 and standard of care chemotherapy for NSCLC and pancreatic cancer also are being planned as potential paths to approval in the first line setting and we are initiating conversations with the FDA in preparation for multiple registrational studies.

TNG908, a blood-brain barrier penetrant, MTA-cooperative PRMT5 inhibitor

•TNG908 dose escalation began in August 2022 and enrollment in the dose expansion cohorts began in April 2024. With a data cutoff of 20 October 2024, a total of 103 patients have been enrolled, 70 non-CNS patients across 24 histologies and 33 glioblastoma patients.

•TNG908 is active and well-tolerated across multiple non-CNS solid tumors, including NSCLC and pancreatic cancer, with a median time on study of 16 weeks.

•Of the 70 patients with non-CNS solid tumors, 31 were treated at active doses (400-600 mg BID) and had at least one tumor assessment. Four partial responses were observed. Responses occurred in pancreatic cancer (2/9), NSCLC (1/4) and urothelial cancer (1/1).

•Of note, there were a total of nine evaluable pancreatic cancer patients, two with partial responses (ORR 22%) and five with stable disease as best response to date. The five ongoing pancreatic cancer patients have been on study for an average of 24 weeks, the longest for 72 weeks.

•Of the 33 patients with glioblastoma, 23 were treated at active doses (400-600 mg BID) and had at least one tumor assessment. No partial responses by RANO criteria were observed and median time on study was less than 8 weeks.

•In preclinical primate studies of TNG908, cerebral spinal fluid (CSF) exposure was 50-70% of plasma exposure. In CSF samples from three glioblastoma patients on study, exposure was ~30% of plasma exposure and below the threshold required for efficacy.

•Dose-limiting toxicities were elevated creatine kinase and aspartate aminotransferase in one patient and altered mental status in a second patient, both at 900 mg BID. Nausea and fatigue were reported in ~40% of patients at 600 mg BID, the expansion dose.

•While TNG908 is an active and well-tolerated MTA-cooperative PRMT5 inhibitor in non-CNS solid tumors, enrollment is being stopped to allow full resourcing of TNG462 as a potential best-in-class molecule. In particular, the notably longer time on treatment observed – 24 weeks and still increasing for TNG462 versus 16 weeks for TNG908 – the superior target coverage and the safety and tolerability profile all support selection of TNG462 for further development.

TNG456, a next-generation, brain penetrant MTA-cooperative PRMT5 inhibitor

•TNG456 is a novel, brain-penetrant MTA-cooperative PRMT5 inhibitor that is 55X selective for MTAP deletion with 20 nM potency (GI50) in preclinical studies.

•Based on primate CSF exposure that is 50%-110% of plasma levels and the markedly increased potency and selectivity of TNG456 compared to TNG908 (GI50 120 nM, 15X MTAP-deleted selectivity), TNG456 CNS exposure is predicted to be in the range needed for efficacy in glioblastoma and brain metastases.

•TNG456 will be evaluated in glioblastoma, NSCLC and select other solid tumors as a monotherapy and in combination with the brain-penetrant CDK4/6 inhibitor abemaciclib (Lilly). The combination with abemaciclib is based on the co-deletion of CDKN2A and MTAP in essentially all MTAP-deleted cancers and on strong synergy observed in preclinical models.

•The Company plans to begin enrolling patients in the TNG456 phase 1/2 study in 1H 2025.

About Tango Therapeutics

Tango Therapeutics is a clinical-stage biotechnology company dedicated to discovering novel drug targets and delivering the next generation of precision medicine for the treatment of cancer. Using an approach that starts and ends with patients, Tango leverages the genetic principle of synthetic lethality to discover and develop therapies that take aim at critical targets in cancer. This includes expanding the universe of precision oncology targets into novel areas such as tumor suppressor gene loss and their contribution to the ability of cancer cells to evade immune cell killing. For more information, please visit www.tangotx.com.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events, Tango’s future operating performance and goals, the anticipated benefits of therapies and combination therapies (that include a Tango pipeline product), as well as the expectations, beliefs and development objectives for Tango’s product pipeline and clinical trials. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “goal”, “estimate”, “anticipate”, “believe”, “predict”, “designed,” “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. For example, implicit or explicit statements concerning the following include or constitute forward-looking statements: the Company is advancing TNG462 into clinical trials as a monotherapy and with multiple targeted and standard of care combinations, including two RAS(ON) tri-complex inhibitors from Revolution Medicines, Inc.; the Company believes the combination of TNG462 with RAS(ON) inhibitors could be a powerful approach to changing the treatment landscape for pancreatic cancer; potential combination strategies for PRMT5 inhibitors; the Company’s view that TNG462 has the potential to be a best-in-class MTA-cooperative PRMT5 inhibitor in multiple tumor types, including pancreatic and non-small cell lung cancers; the Company is moving TNG462 into full development; the Company expects cash runway into the third quarter of 2026; the Company expects to share another clinical update on TNG462 in 2025; the Company continues to advance TNG260 for cancers with STK11 loss-of-function mutations, with the phase 1/2 clinical trial ongoing; Tango is committed to discovering and delivering the next generation of precision cancer medicines; Tango’s commitment to bringing effective treatment to people with glioblastoma; the Company’s planned and ongoing clinical trials, including the anticipated timing for enrollment and the timing to report results and updates of such trials; the Company’s understanding of the central nervous system exposure required to provide meaningful efficacy in glioblastoma and brain metastases; the Company’s belief that it is strongly positioned to achieve its goal of reaching as many patients as possible with MTAP-deleted cancers; the Company’s ability to build key internal capabilities; the Company’s plans to enter the clinic in a Phase 1/2 clinical trial for TNG456 in the first half of 2025; the Company’s plans to evaluate TNG456 in certain solid tumors as a monotherapy and in combination with abemaciclib; Dr. Weber’s and Dr. Crystal’s statements in this press release; the Company’s initiation of conversations with the FDA in preparation for multiple registrational studies; the potential paths to approval in a first line setting for combinations of TNG462 and standard of care chemotherapy for NSCLC and ipancreatic cancer; and the expected timing of: (i) development candidate declaration for certain targets; (ii) initiating IND-enabling studies; (iii) filing INDs; (iv) clinical trial initiation, dose escalation and dose expansion (including for

combination studies) and (v) disclosing initial, interim, additional and final clinical trial results; and the expected benefits of the Company's development candidates and other product candidates (including for combination studies). Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Tango and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the benefits of product candidates seen in preclinical tests and analyses may not be evident when tested in later preclinical studies or in clinical trials or when used in broader patient populations (if approved for commercial sale); Tango has limited experience conducting clinical trials (and will rely on a third party to operate its clinical trials) and may not be able to commence its clinical trials (including opening clinical trial sites, dosing the first patient, and continued enrollment and dosing of an adequate number of clinical trial participants) when expected, may not be able to continue dosing, initiate dose escalation and/or dose expansion on anticipated timelines, and may not generate or report clinical trial results (including final, initial or additional safety, efficacy data and proof-of-mechanism and proof-of-concept) in the anticipated timeframe (or at all); future clinical trial data releases may differ materially from initial or interim data from our current and future clinical trials; Tango’s pipeline products may not be safe and/or effective in humans; Tango has a limited operating history and has not generated any revenue to date from product sales, and may never become profitable; other companies may be able to identify and develop product candidates more quickly than the Company and commercially introduce the product prior to the Company; the Company’s proprietary discovery platform is novel and may not identify any synthetic lethal targets for future development; the Company may not be able to identify development candidates on the schedule it anticipates due to technical, financial or other reasons; the Company may not be able to file INDs for development candidates on time, or at all, due to technical or financial reasons or otherwise; the Company may utilize cash resources more quickly than anticipated; Tango will need to raise capital in the future and if we are unable to raise capital when needed or on attractive terms, we would be forced to delay, scale back or discontinue some of our development programs or future commercialization efforts (which may delay filing of INDs, dosing patients, initiation of dose expansion, reporting clinical trial results and filing new drug applications); Tango’s approach to the discovery and development of product candidates is novel and unproven, which makes it difficult to predict the time, cost of development, and likelihood of successfully developing any products; the Company may be unable to advance our preclinical development programs into and through the clinic for safety or efficacy reasons or commercialize our product candidates or we may experience significant delays in doing so as a

result of factors beyond Tango’s control; the Company may not be able to realize the benefits of orphan drug or Fast Track designation (and such designations may not advance any anticipated approval timelines); the expected benefits of our product candidates in patients as single agents and/or in combination may not be realized; the Company may experience delays or difficulties in the initiation, enrollment, or dosing of patients in clinical trials or the announcement of clinical trial results; Tango may not identify or discover additional product candidates or may expend limited resources to pursue a particular product candidate or indication and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success; the Company’s product candidates may cause adverse or other undesirable side effects (or may not show requisite efficacy) that could, among other things, delay or prevent regulatory approval; our dependence on one or a limited number third parties for conducting clinical trials and producing drug substance and drug product (including drug substance, which is currently sole sourced); government regulation may negatively impact the Company’s business, including the potential approval of the BIOSECURE Act; and our ability to obtain and maintain patent and other intellectual property protection for our technology and product candidates or the scope of intellectual property protection obtained is not sufficiently broad. Additional information concerning risks, uncertainties and assumptions can be found in Tango’s filings with the Securities and Exchange Commission (SEC), including the risk factors referenced in Tango’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented and/or modified by its most recent Quarterly Report on Form 10-Q. You should not place undue reliance on forward-looking statements in this press release, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Tango specifically disclaims any duty to update these forward-looking statements.

Investor Contact:

Sam Martin/Andrew Vulis

Argot Partners

tango@argotpartners.com

Media Contact:

Amanda Brown Galgay

SVP, Corporate Communications, Tango Therapeutics

media@tangotx.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

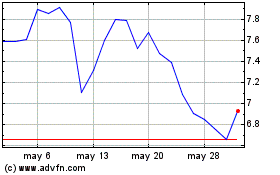

Tango Therapeutics (NASDAQ:TNGX)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Tango Therapeutics (NASDAQ:TNGX)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025