As filed with the Securities and Exchange Commission on November 21, 2024

File No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

__________________

UNION BANKSHARES, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Vermont | | 03-0283552 |

| (State or other jurisdiction | | (IRS Employer |

| of incorporation or Organization) | | Identification Number) |

| | |

| 20 Lower Main St., P.O. Box 667 |

| Morrisville, VT 05661-0667 |

| (Address of principal executive offices) |

| | |

| 2024 EQUITY INCENTIVE PLAN |

| (Full title of the Plan) |

| | |

| David S. Silverman | | With a copy to: |

| President and Chief Executive Officer | | Denise J. Deschenes, Esq. |

| Union Bankshares, Inc. | | Primmer Piper Eggleston & Cramer PC |

| 20 Lower Main St., P.O. Box 667 | | 106 Main Street, P.O. Box 349 |

| Morrisville, VT 05661-0667 | | Littleton, NH 03561-0349 |

| Telephone: (802) 888-6600 | | |

| (Name, Address and Telephone Number, Including Area Code, of Agent for Service) | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information*

Item 2. Registrant Information and Employee Plan Annual Information*

* The information specified in Part I of Form S-8 contained in the Section 10(a) Prospectus is omitted from this Registration Statement in accordance with the provisions of Form S-8 and the rules and regulations of the Securities and Exchange Commission (the “Commission”). The document(s) containing the information specified in this Part I will be sent or given to participants in the Union Bankshares, Inc. 2024 Equity Incentive Plan, in accordance with Rule 428(b)(1) under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Certain Documents by Reference

The following documents previously filed by Union Bankshares, Inc. (“Union” or the “Registrant”) with the Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are incorporated by reference into this Registration Statement:

(a)Union’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on March 26, 2024.

(b)Union’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024, and September 30, 2024 filed with the Commission on May 14, 2024, August 9, 2024, and November 14, 2024, respectively;

(c)Union’s Current Reports on Form 8-K filed with the Commission on January 17, 2024, February 1, 2024, April 17, 2024, May 2, 2024, May 16, 2024, July 18, 2024, August 1, 2024, September 5, 2024, October 16, 2024, November 7, 2024, and November 21, 2024;

(d)The description of Union’s Common Stock contained in Exhibit 4.1 to Union’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, updating the description contained in Union’s amended Registration Statement on Form 8-A/A, filed with the Commission on September 2, 2008 under Section 12 of the Exchange Act, and any subsequent amendments or reports filed for the purpose of updating such description.

All reports or other documents subsequently filed by Union pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold hereunder, shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of filing such reports and documents.

Any statement contained in a document incorporated by reference into this Registration Statement shall be deemed to be modified or superseded for purposes hereof to the extent that a statement contained herein (or in any other subsequently filed document which also is or is deemed incorporated herein) modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed to constitute a part hereof, except as so modified or superseded.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Names Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

I.Indemnification

Vermont Business Corporation Act. Union is a Vermont corporation subject to applicable provisions of the Vermont Business Corporation Act (“VBCA”) (codified at Title 11A of the Vermont Statutes Annotated). Sections 8.50 through 8.58 of the VBCA contain provisions governing the indemnification of corporate directors, officers, employees and agents. In general, the VBCA permits a corporation to indemnify any person who was or is a party to or is threatened to be made a party to a legal proceeding by reason of the fact that he or she is or was a director, officer, employee or agent of the corporation, against expenses (including reasonable attorney's fees), judgments, fines, penalties and amounts paid in settlement in connection with such proceeding if (i) he or she acted in good faith and (ii) in the case of conduct in the individual’s official capacity, he or she reasonably believed that his or her conduct was in the best interests of the corporation, or in the case of conduct outside the individual’s official capacity, he or she reasonably believed that such conduct was at least not opposed to the corporation’s best interests. With respect to any proceeding brought by a governmental entity, the indemnified individual must have had no reasonable cause to believe his or her conduct was unlawful and the individual must not have been finally found to have engaged in a reckless or intentional unlawful act. With respect to actions or suits by or in the right of the corporation, such indemnification is limited to expenses (including reasonable attorneys' fees) incurred by such person in connection with the proceeding and only if the individual has not been adjudged to be liable to the corporation, except to the extent that the court in such proceeding determines upon application that, despite the adjudication of liability but in view of all the circumstances of the case, the individual is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. Additionally, a corporation is required to indemnify its directors and officers against reasonable expenses to the extent that such directors or officers have been wholly successful on the merits or otherwise in defense of any legal proceeding referred to above.

Indemnification may be made by a corporation only in the manner prescribed by the statute upon a finding that indemnification is proper in the circumstances because the party seeking indemnification has met the applicable standard of conduct as set forth in the VBCA. Statutory indemnification rights are not deemed to be exclusive of any other rights to which those seeking indemnification may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors, or otherwise. A corporation also has the power to purchase and maintain insurance on behalf of any person covering any liability incurred by such person in his capacity as a director, officer, employee or agent of the corporation, or while serving at the corporation’s request as a director, officer, partner, trustee, employee or agent of another entity, employee benefit plan or enterprise, whether or not the corporation would have the power to indemnify him against such liability under Sections 8.51 (Authority to Indemnify) or 8.52 (Mandatory Indemnification) of the VBCA.

Bylaws. Article VI of Union’s Amended and Restated Bylaws, as in effect on the date of this Registration Statement, addresses indemnification of directors, officers and others and provides in its entirety as follows:

ARTICLE VI

INDEMNIFICATION AND INSURANCE

Section 6.1.In General. The Corporation shall indemnify its Directors, and, by affirmative vote of a majority of its Directors, may indemnify its officers, employees and agents, against any liability incurred by any of them in any Proceeding in their capacity as such, to the fullest extent permitted by applicable law, in accordance with the provisions of this Article VI and the VT BCA. For purposes of this Article VI, the term “Proceeding” means any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative and whether formal or informal.

Section 6.2.Mandatory Indemnification of Directors; Permissive Indemnification of Officers and Others. The Corporation shall indemnify any Director, and may indemnify any other person, who was or is a party or is threatened to be made a party to any Proceeding, by reason of the fact that he is or was (i) serving as a director, officer, employee or agent of the Corporation, or (ii) is or was serving at the request of the Corporation as director, officer, trustee or fiduciary, employee or agent of another corporation, partnership, joint venture, trust or other enterprise or employee benefit plan or trust, against all expenses (including attorney’s fees and court costs), judgments, liabilities, fines (including excise taxes assessed with respect to an employee benefit plan) and amounts paid in settlement actually and reasonably incurred or suffered by him or her in connection with such Proceeding, provided he or she satisfied the applicable standard of conduct in Section 8.51 of the VT BCA. The termination of any Proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not meet the applicable standard of conduct.

Section 6.3.Mandatory Indemnification of Officers in Some Circumstances. Notwithstanding anything to the contrary in Sections 6.1 or 6.2, the Corporation shall indemnify any officer who was wholly successful, on the merits or otherwise, in the defense of any Proceeding to which the officer was a party because he or she is or was an officer of the Corporation, against reasonable expenses incurred by the officer in connection with the Proceeding.

Section 6.4.Limitations and Prohibitions on Indemnification. Notwithstanding anything to the contrary in these Bylaws, (i) in connection with a Proceeding by or in right of the Corporation, indemnification shall be limited to reasonable expenses incurred in connection with the Proceeding, except that no indemnification whatsoever shall be permitted in connection with such Proceeding if the individual was adjudged liable to the Corporation in the Proceeding; (ii) in connection with any Proceeding charging improper personal benefit to the individual, whether or not involving action in such individual’s official capacity, no indemnification whatsoever shall be permitted if the individual was adjudged liable on the basis that he or she received an improper personal benefit; and (iii) no indemnification shall be paid by the Corporation if it would violate the applicable restrictions on indemnification set forth in Section 18(k) of the Federal Deposit Insurance Act (12 U.S.C. 1828(k)).

Section 6.5.Payment in Advance of Expenses. The Corporation may pay for or reimburse the reasonable expenses incurred by an individual who is or was a party to a Proceeding in advance of final disposition of the Proceeding if

(i)he or she furnishes the Corporation a written affirmation of his good faith belief that he has met the standard of conduct described and referred to in Section 8.51 of the VT BCA;

(ii)he or she furnishes the Corporation a written undertaking, executed personally or on his or her behalf, to repay the advance if it is ultimately determined that he or she did not meet the standard of conduct; and

(iii)a determination is made in a manner authorized under the VT BCA that the facts then known to those making the determination would not preclude indemnification.

Section 6.6.Non-exclusivity. The indemnification provided under this Article VI (i) shall not be deemed exclusive of any other rights to which those seeking indemnification may be entitled under any agreement, vote of shareholders or disinterested directors or otherwise, both as to action in his or her official capacity and as to action in another capacity while holding such office, (ii) shall continue as to a person who has ceased to be a director, officer, employee or agent and (iii) shall inure to the benefit of the heirs, executors and administrators of such person.

Section 6.7.Insurance. The Corporation shall have power to purchase and maintain insurance on behalf of any individual who is or was a director, officer, employee, or agent of the Corporation, or who, while a director, officer, employee, or agent of the Corporation, is or was serving at the request of the Corporation as a director, officer, partner, trustee, fiduciary, employee, or agent of another foreign or domestic corporation, partnership, joint venture, trust, employee benefit plan, or other enterprise, against liability asserted against or incurred by him or her in that capacity or arising from his or her status as a director, officer, employee, or agent, whether or not the Corporation would have power to indemnify him or her against the same liability under the VT BCA.

Insurance. As authorized by Section 8.57 of the VBCA and Section 6.7 of the Bylaws, Union maintains in effect liability insurance covering its directors and officers and those of its wholly-owned subsidiary, Union Bank.

II.Limitation of Director Liability.

Vermont Business Corporation Act. Section 2.02(b)(4) of the VBCA authorizes a Vermont corporation to include in its articles of incorporation a provision eliminating or limiting the personal liability of a director to the corporation or its shareholders for monetary damages for breach of fiduciary duty as a director. However, no such provision may eliminate or limit a director’s liability with respect to:

•the amount of a financial benefit received by a director to which he or she is not entitled;

•an intentional or reckless infliction of harm on the corporation or the shareholders;

•payment of unlawful distributions proscribed under Section 8.33 of the VBCA; or

•an intentional or reckless criminal act.

Union’s Articles of Incorporation. Article 8 of Union’s Amended and Restated Articles of Association eliminates the liability of a director to Union or its shareholders for monetary damages for breach of fiduciary duty as a director to the fullest extent permitted by the VBCA. Article 8 reads as follows:

8.Liability of Directors. A Director of the Corporation shall have no personal liability to the Corporation or to its shareholders for money damages for any action taken, or any failure to take any action, solely as a director, based on a failure to discharge his or her own duties in accordance with Section 8.30 of Title 11A of the Vermont Statutes Annotated, except for (a) the amount of a financial benefit received by the Director to which the Director is not entitled; (b) an intentional reckless infliction of harm on the Corporation or its shareholders; (c) a violation of Section 8.33 of Title 11A of the Vermont Statutes Annotated or (d) an intentional or reckless criminal act. This Section 8 shall not be deemed to eliminate or limit the liability of a Director for any act or omission occurring prior to the date this Section becomes effective. No amendment or repeal of this Section 8 shall apply to or have any effect on the liability or alleged liability of any Director of the Corporation for or with respect to any acts or omissions of such Director occurring prior to such amendment or repeal.

The foregoing summaries of certain provisions of the VBCA are necessarily subject to the complete text of the applicable statutes, and are qualified in their entirety by reference thereto.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

The Registrant files herewith, or incorporates by reference herein to prior filings with the Commission, the following exhibits:

| | | | | |

| Exhibit | |

| Number | Exhibit Description |

| Amended and Restated Articles of Incorporation of Union Bankshares, Inc. (as of August 1, 2007), previously filed with the Commission as Exhibit 3.1 to the Company’s June 30, 2007 Quarterly Report on Form 10-Q, and incorporated herein by reference. |

| Bylaws of Union Bankshares, Inc., as amended and restated, previously filed with the Commission on November 21, 2024 as Exhibit 3.1 to the Company's Current Report on Form 8-K, and incorporated herein by reference. |

| Union Bankshares, Inc. 2024 Equity Incentive Plan, previously filed with the Commission on April 2, 2024 at pages A-1 through A-17 of the definitive proxy statement for the 2024 Annual Meeting of Union’s Shareholders, and incorporated herein by reference. |

| Opinion of Primmer Piper Eggleston & Cramer PC regarding the legality of the securities being registered.* |

| Form of Award Certificate (Restricted Stock Units)* |

| Consent of Berry Dunn McNeil & Parker, LLC.* |

| Consent of Primmer Piper Eggleston & Cramer PC (included in Exhibit 5)* |

| Filing Fee Calculation Table* |

____________________

* Filed herewith

Item 9. Undertakings

The undersigned Registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the

aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement;

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment to this Registration Statement on Form S-8 by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)That, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Town of Morrisville, State of Vermont, on November 21, 2024.

| | | | | | | | | | | | | | |

| | | UNION BANKSHARES, INC. |

| | | (Registrant) |

| | | | |

| | | By: | /s/ David S. Silverman |

| | | | David S. Silverman |

| | | | President and Chief Executive Officer |

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed below on November 21, 2024 by the following persons in the capacities indicated.

| | | | | | | | |

| /s/ David S. Silverman | | /s/ Karyn J. Hale |

| David S. Silverman | | Karyn J. Hale |

| Director, President and Chief Executive Officer | | Vice President, Treasurer and Chief Financial Officer |

| (Principal Executive Officer) | | (Principal Financial Officer and Principal Accounting Officer) |

| | |

| /s/ Joel S. Bourassa | | /s/ Dawn D. Bugbee |

| Joel S. Bourassa, Director | | Dawn D. Bugbee, Director |

| | |

| /s/ Mary K. Parent | | /s/ Nancy C. Putnam |

| Mary K. Parent, Director | | Nancy C. Putnam, Director |

| | |

| /s/ Gregory D. Sargent | | /s/ Timothy W. Sargent |

| Gregory D. Sargent, Director | | Timothy W. Sargent, Director |

| | |

| /s/ Janet P. Spitler | | /s/ Cornelius J. Van Dyke |

| Janet P. Spitler, Director | | Cornelius J. Van Dyke, Director and Board Chair |

EXHIBIT INDEX

| | | | | |

| Exhibit | |

| Number | Exhibit Description |

| Amended and Restated Articles of Incorporation of Union Bankshares, Inc. (as of August 1, 2007), previously filed with the Commission as Exhibit 3.1 to the Company’s June 30, 2007 Quarterly Report on Form 10-Q, and incorporated herein by reference |

| Bylaws of Union Bankshares, Inc., as amended and restated, previously filed with the Commission on November 21, 2024 as Exhibit 3.1 to the Company’s Current Report on Form 8-K, and incorporated herein by reference |

| Union Bankshares, Inc. 2024 Equity Incentive Plan, previously filed with the Commission on April 2, 2024 as pages A-1 through A-17 of the definitive proxy statement for the 2024 Annual Meeting of Union’s Shareholders, and incorporated herein by reference |

| Opinion of Primmer Piper Eggleston & Cramer PC regarding the legality of the securities being registered* |

| Form of Award Certificate (Restricted Stock Units)* |

| Consent of Berry Dunn McNeil & Parker, LLC.* |

| Consent of Primmer Piper Eggleston & Cramer PC (included in Exhibit 5)* |

| Filing Fee Calculation Table* |

____________________

* Filed herewith

Exhibit 5 and 23.2

| | |

| 30 Main Street, Suite 500│ P.O. Box 1489 │Burlington, VT 05402-1489 |

November 21, 2024

Board of Directors

Union Bankshares, Inc.

20 Lower Main Street

Morrisville, VT 05661-0667

Re: Issuance of Common Stock under Registration Statement on Form S-8

We refer to the Registration Statement on Form S-8 (the “Registration Statement”) filed by Union Bankshares, Inc., a Vermont corporation (the “Company”), with the United States Securities and Exchange Commission (the “Commission”) on or about the date hereof, relating to the registration under the Securities Act of 1933, as amended (the “Act”), of 250,000 shares of common stock of the Company, $2.00 par value per share (the “Shares”), which may be issued from time to time pursuant to equity compensation grants under the Company’s 2024 Equity Incentive Plan (the “Plan”).

We have examined such documents and have reviewed such questions of law as we have considered necessary and appropriate for the purposes of our opinion set forth below. In rendering such opinion, we have assumed the authenticity of all documents submitted to us as originals, the genuineness of all signatures, the conformity to authentic originals of all documents submitted to us as copies and the legal capacity of all natural persons. As to questions of fact material to our opinion, with your permission we have relied upon certificates of officers of the Company and of public officials.

Based on the foregoing, we are of the opinion that the Shares to be issued by the Company pursuant to the Plan have been duly authorized and, upon issuance, delivery and payment therefor in accordance with the terms of the Plan, will be validly issued, fully paid and nonassessable.

The foregoing opinion is limited to the laws of the State of Vermont. We express no opinion as to the effect of the laws of any other jurisdiction. Further, the opinion expressed herein assumes that each award under the Plan pertaining to any of the Shares will be duly approved by the Company’s Board of Directors or an authorized committee of the Board of Directors.

We hereby consent to the use of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not hereby concede that we are within the category of persons whose consent is required under Section 7 of the Act, or the rules and regulations of the Commission thereunder.

Very truly yours,

Primmer Piper Eggleston & Cramer PC

Exhibit 10

UNION BANKSHARES, INC.

2024 EQUITY INCENTIVE PLAN

AWARD CERTIFICATE

(____ Plan Year)

| | | | | | | | | | | |

| Participant: | | |

| Type of Award: | | |

| Aggregate Number of RSUs Granted: | | |

| Aggregate Number of Underlying Shares: | | |

| Grant Date: | | |

1.Grant of Restricted Stock Units. This Award Certificate (this “Award Certificate” or “Certificate”) evidences the grant to you on ____________, 20__ by the Compensation Committee (the “Committee” or the “Compensation Committee”) and the Board of Directors (the “Board”) of Union Bankshares, Inc. (the “Company”) under the Company’s 2024 Equity Incentive Plan (the “Plan”) of the number of restricted stock units (“RSUs”) shown above and on the attached Exhibit A, on the terms and subject to the conditions set forth in this Award Certificate, the Plan and the 20__ Equity Award Summary (the “Summary”) (the “Award”). This Award of RSUs represents the right to receive the aggregate number of shares of the Company’s Common Stock, par value $2.00 per share (the “Common Stock”) set forth above and on Exhibit A upon the specified vesting dates of the RSU Tranches (as defined), subject to satisfaction of applicable terms and conditions. Each Tranche of such combined performance-based and time-based RSUs (“PBRSUs”) and time-based RSUs (“TBRSUs”) included in this Award is intended to be treated as a separate award for purposes of Internal Revenue Code Section 409A and the implementing regulations thereunder (“Code Section 409A”). For purposes of this Award, “Tranche” means, with respect to the PBRSUs and TBRSUs granted hereby, each separate portion of such PBRSUs award or TBRSUs award differentiated by specified vesting date, as shown on Exhibit A. The Plan and the Summary are incorporated herein by reference and made a part of this Award Certificate. Copies of the Plan and the Summary were previously delivered to you and additional copies are available from the Company’s Human Resources Department upon request. You should review the terms of this Award Certificate, the Plan and the Summary carefully.

2.Certain Definitions. Capitalized terms used in this Award Certificate and not defined in this Section 2 or elsewhere in this Notice have the definitions given to such terms in the Summary or the Plan. Notwithstanding anything in the Plan to the contrary, the following definitions apply for purposes of this Award Certificate:

(a)“Code Section 409A” means, collectively, Section 409A of the Internal Revenue Code, as amended, and the implementing regulations thereunder.

(b)The following terms have the definitions ascribed to them in the Summary and are intended to conform to the definitions of such terms or concepts under Code Section 409A and shall be interpreted in a manner consistent with such intent:

(i)“Change in Control”

(ii)“Disability”

(iii)“Separation from Service” and

(iv)“Specified Employee”.

(c)“Qualified Retirement” means your voluntary Separation from Service from Union after attainment of at least age 55 and at least five years of continuous service with Union, provided, however, that, on the date of such Separation from Service, (i) your combined age and years of service with Union total at least 70, disregarding any partial years of age or service; and (ii) you are an employee of Union in good standing at the time of such Separation from Service.

(d)“Qualified Retirement Eligibility Date” means the first date upon which you satisfy the combined age and service requirements for a Qualified Retirement, whether or not you elect to retire on or as of such date.

(e)“Tranche” means, with respect to PBRSU’s and TBRSU’s granted in this Award, a separate portion of such PBRSUs award or TBRSUs award differentiated by specified vesting date. Each Tranche of PBRSUs and TBRSUs is intended to be treated as a separate award for purposes of Code Section 409A.

(f)“Union” refers to the Company and its subsidiary, Union Bank, and future subsidiaries of the Company (if any).

3.Vesting of Award.

(a)Except as otherwise expressly provided in Section 3(b), vesting of the Tranche(s) of this Award will occur on the applicable vesting date of such Tranche(s) specified in this Award Certificate (the “Vesting Date”), provided you maintain continuous employment with Union through such Vesting Date, and any unvested Tranche(s) of an Award will be forfeited upon your termination of employment prior to the applicable Vesting Date(s) of such Tranche(s). The scheduled Vesting Date(s) of the Tranches of this Award are specified on the attached Exhibit A.

(b)If prior to the scheduled Vesting Date(s) of any Tranche(s) of this Award any of the Permitted Acceleration Events (as defined) occurs, any unvested Tranches of an Award will not be forfeited, and the Vesting Date(s) of such Tranche(s) will be accelerated to the date of such Permitted Termination (the “Accelerated Vesting Date”). For this purpose, a “Permitted Acceleration Event” means any of the following events: (i) your death, (ii) your Disability or (iii) if your award is not a Short-Term Deferral Award, your Separation from Service from Union due to your Qualified Retirement.

(c)For the avoidance of doubt, a Tranche of RSUs granted in this Award will vest on the earliest to occur of (i) the applicable scheduled Vesting Date for such Tranche specified in this Award, but only if you have remained in Union’s continuous employ through such Vesting Date; or (ii) your death; (iii) your Disability; or (iv) your Separation from Service from Union due to your Qualified Retirement.

4.Status of Awards under Code Section 409A; Settlement and Issuance of Shares Following Vesting.

(a)If no Tranche of an Award is scheduled to vest on a Vesting Date that is on or after your Qualified Retirement Eligibility Date, such Award is intended to constitute a short-term deferral exempt from Code Section 409A (a “Short-Term Deferral Award”) and each Tranche of the Award will be settled by issuance of shares of Common Stock as soon as administratively practicable following the applicable Vesting Date, and in all events no later than March 15 of the calendar year following the calendar year in which such vesting occurs.

(b)Any Award that is not a Short-Term Deferral Award or that is not otherwise exempt from Code Section 409A is intended to comply with the requirements of Code Section 409A applicable to deferred compensation in a manner designed to avoid any additional taxes or penalties under Code Section 409A. Settlement of any Tranche of such an award will occur as soon as administratively practicable following the scheduled Vesting Date, or the Accelerated Vesting Date, as the case may be, of such Tranche but in no event later than ninety (90) days following such date; subject, however, to any delay required under Section 7, if applicable.

(c)Any RSUs granted in this Award will be settled solely in shares of Company Common Stock, with one share issued for each vested RSU. The shares of Common Stock issuable upon settlement of any Tranche of an Award will be issued during your lifetime only to you, or after your death to your designated beneficiary, or, in the absence of such beneficiary, to your duly qualified personal representative.

5.Effect of Change In Control. In connection with a Change in Control of the Company or Union Bank, your rights under this Award will be determined in accordance with the provisions of the Summary and Article 10, Section 10.7 of the Plan and (if applicable) any change in control agreement you may have with the Company and/or Union Bank.

6.Nature of Award. This Award Certificate represents an award of RSUs, as defined in the Plan. Until vested in accordance with the provisions of the Summary and this Award Certificate, the unvested Tranches constitute only the Company’s unfunded and unsecured promise to issue shares of Common Stock to you on a future date, subject to satisfaction of applicable vesting conditions.

7.Six Month Delay in Settlement Due to Separation from Service. Notwithstanding anything to the contrary in this Award Certificate or in the Summary, if (i) the RSUs granted under any Tranche(s) of an Award constitute deferred compensation under Code Section 409A, as contemplated in Section 4(b), (ii) settlement of such Award is made due to your Separation from Service, and (iii) you are a Specified Employee on the date of your Separation from Service, settlement and distribution to you of shares of Common Stock upon the settlement of any vested Tranche(s) of an Award following such Separation from Service will be delayed for a period of six (6) months following your Separation from Service. If settlement of any Tranche(s) of the Award is delayed in accordance with the preceding sentence, such settlement will be made as soon as administratively practicable following expiration of the six-month delay period. You will not be allowed to defer the distribution of your shares of Common Stock to a later date, nor to receive such shares at an earlier date, except that in the case of your death during the six month delay period, the six-month delay requirement will no longer apply and the vested RSUs will be settled and the Common Stock issued to your designated beneficiary, legal representative, heirs or legatees, as applicable, as soon as administratively practicable after the date of death.

8.No Rights as a Shareholder; No Dividend Equivalents. Prior to the vesting of the shares of Common Stock underlying a Tranche, you will not have any of the rights of a shareholder with respect to such unvested shares. Without limiting the foregoing, prior to vesting of a Tranche and issuance of the underlying shares, you will have no right to receive dividends or other distributions, if any, as may be declared on such shares of Common Stock from time to time, nor will you have the right to vote (in person or by proxy) such shares at any meeting of shareholders of the Company. No “Dividend Equivalents” (as that term is defined in the Plan) shall be accrued or paid with respect to any of the shares of Common Stock underlying any Tranche.

9.Rights of the Company and Subsidiaries. This Award Certificate does not limit or otherwise affect the right of the Company or its subsidiary to take any corporate action whatsoever, including without limitation its right to recapitalize, reorganize or make other changes in its capital structure or business, merge or consolidate, to issue bonds, notes, shares of Common Stock or other securities, including preferred stock, or stock options, or dissolve or liquidate, or sell or transfer any part of its assets or business.

10.No Effect on Employment Status. This Award Certificate does not confer on you any right to continued employment with the Company or its subsidiary during the vesting period or otherwise, and does not limit or otherwise affect the right of the Company or its subsidiary to terminate your employment at any time.

11.Restrictions on Issuance or Transfer of Shares. If at any time the Company reasonably determines that, under federal or state securities laws or other applicable laws, the listing, registration or qualification of the shares of Common Stock to be issued upon vesting of any Tranche, or any subsequent transfer of such shares, is necessary in order to avoid violation of any such laws, the Company may delay such issuance, or the processing of such transfer; provided, however, that the Company shall issue such shares as soon as reasonably practicable following the first date on which the Company reasonably expects that such issuance will not cause a violation of applicable securities or other laws.

12.Holding Period Requirement. In accordance with the terms of the Summary, you shall be required to retain ownership of 25% of the shares of Common Stock issued to you upon vesting of any Tranche, throughout the term of your employment with the Company or Union Bank. The Company shall retain custody of the certificates(s) representing such retained shares, or place appropriate stop orders with the transfer agent if such shares are issued in book entry.

13.Tax Withholdings. You are responsible for payment of all federal, state and local tax liabilities applicable to you upon vesting of any Tranche, up to an amount based on your maximum individual tax rate (and not any greater amount). You may pay your federal and state tax withholding obligations up to the amount permitted under the Plan (the “Withholding Amount”) (i) in cash with your own funds; or (ii) by having the Company withhold or deduct from your vested Tranche a number of whole shares of Company Common Stock having a Fair Market Value (as defined in the Plan) on the date of withholding equal to the Withholding Amount (“Shares for Withholdings”), or (iii) by a combination of cash payment and

Shares for Withholdings. The Human Resources Department of the Company or Union Bank may adopt procedures to implement this provision, including without limitation requirements for receipt of written notice from you in advance of vesting regarding your selected method of paying the Withholding Amount, and provisions for share rounding in calculating the number of whole shares of common stock required to implement any Shares for Withholdings that you may elect.

14.Nonassignability. Neither your rights under this Award Certificate nor the unvested shares of Common Stock underlying any Tranche may be sold, assigned, transferred, pledged, hypothecated, margined or otherwise encumbered in any way, in whole or in part, prior to the vesting of such Tranche(s), whether by operation of law or otherwise, except by will or the laws of descent and distribution. After vesting of a Tranche, the sale or other transfer of the shares of Common Stock issued upon such vesting shall be subject to applicable federal and state laws and regulations, in addition to satisfaction of the holding period requirement in Section 12 with respect to 25% of vested Awards.

15.Compliance with Code Section 409A. The terms of this Award Certificate are intended to be administered and interpreted in a manner consistent with the requirements for avoiding additional taxes or penalties under Code Section 409A. Notwithstanding the foregoing, neither the Company nor Union Bank makes any representations or warranties that the payments and benefits provided under this Award will comply with Code Section 409A and in no event shall the Company or Union Bank be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by you on account of any non-compliance with Code Section 409A.

16.Amendments. Except as otherwise provided by the Plan, the Company may alter, amend or terminate this Award Certificate without your consent in any respect deemed by the Committee or the Company’s Board of Directors to be necessary in order to preserve compliance with Code Section 409A or the terms of the Plan and Summary, or otherwise to comply with applicable law.

17.Plan and Summary Control. This Award Certificate is subject to all of the provisions of the Plan, including provisions governing antidilution adjustments, and the Summary, which are hereby incorporated by reference, and is further subject to all the interpretations, amendments, rules and regulations that may from time to time be promulgated and adopted by the Committee or Board pursuant to the Plan and Summary.

18.Governing Law. This Award Certificate shall be governed by and construed in accordance with the laws of the State of Vermont, except as superseded by applicable federal law, without giving effect to its conflicts of law provisions.

ACKNOWLEDGEMENT

The undersigned grantee acknowledges receipt of, and understands and agrees to be bound by, this Award Certificate, the Plan and the Summary (including any modifications thereof adopted by the Committee or Board). The undersigned further acknowledges that this Award Certificate, the Plan and the Summary set forth the entire understanding between him or her and the Company regarding all Tranches of the RSU award represented by this Award Certificate and that this Award Certificate, the Plan and the Summary supersede all prior oral and written understandings or agreements on that subject, including any nonbinding Contingent Award Notice.

EXHIBIT A

RSU VESTING SCHEDULE

(20__ Plan Year)

Aggregate number of shares of Common Stock underlying the following Award of TBRSUs* and PBRSUs**:

| | | | | | | | | | | | | | |

| TBRSUs* | | | |

| Number of Shares | | Vesting Date | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| PBRSUs** | | | |

| Number of Shares | | Vesting Date | |

| | | | |

| | | | |

* Time-Based Restricted Stock Units

** Performance-Based Restricted Stock Units (also subject to time-based vesting conditions)

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated March 25, 2024, with respect to the consolidated financial statements, incorporated therein by reference, of Union Bankshares, Inc. included in the Annual Report (Form 10-K and Form 10-K/A) for the year ended December 31, 2023.

Manchester, New Hampshire

November 21, 2024

Vermont Registration No. 92-0000278

| | | | | | | | | | | | | | |

Maine n New Hampshire n Massachusetts n Connecticut n West Virginia n Arizona n Puerto Rico |

| berrydunn.com |

Exhibit 107

Filing Fee Calculation Table

Form S-8

(Form Type)

UNION BANKSHARES, INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Share | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

Equity | Common Stock, par value $2.00 per share | Rules 457(c) and 457(h)(2) | 250,000(3) | $31.14(2) | $7,785,000(2) | $0.0001531 | $1,191.88 |

| Total Offering Amounts | | $7,786,191.88 | | $1,191.88 |

| Total Fee Offsets | | | | $— |

| Net Fee Due | | | | $1,191.88 |

(1)Pursuant to Rule 416(a) under the Securities Act of 1933 (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s Common Stock that become issuable under the Union Bankshares, Inc. 2024 Equity Incentive Plan (the “Plan”), by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected that results in an increase to the number of outstanding shares of the Registrant’s Common Stock.

(2)Estimated in accordance with Rule 457(c) and Rule 457(h) under the Securities Act, solely for the purpose of calculating the registration fee, based on the average of the high ($31.33) and low ($30.95) sales prices of the Registrant’s Common Stock as reported on The Nasdaq Global Market on November 20, 2024, which date is within five business days prior to the date of filing of this Registration Statement.

(3)Represents 250,000 shares of the Registrant’s Common Stock reserved for issuance pursuant to the equity compensation grants under the Plan.

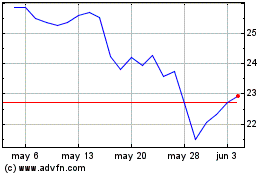

Union Bankshares (NASDAQ:UNB)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Union Bankshares (NASDAQ:UNB)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025