0001088034

Usio, Inc.

false

--12-31

Q2

2024

0.01

0.01

10,000,000

10,000,000

0

0

0

0

0.001

0.001

200,000,000

200,000,000

29,764,435

28,671,606

27,331,969

26,332,523

2,432,466

2,339,083

319,000

0

3

5

0.09

0

59.9

250,000

false

false

false

false

00010880342024-01-012024-06-30

xbrli:shares

00010880342024-08-12

thunderdome:item

iso4217:USD

00010880342024-06-30

00010880342023-12-31

iso4217:USDxbrli:shares

00010880342024-04-012024-06-30

00010880342023-04-012023-06-30

00010880342023-01-012023-06-30

0001088034usio:EmployeeAwardsMember2024-01-012024-06-30

0001088034usio:EmployeeAwardsMember2023-01-012023-06-30

00010880342022-12-31

00010880342023-06-30

0001088034usio:CommonStockOutstandingMember2023-12-31

0001088034us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001088034us-gaap:TreasuryStockCommonMember2023-12-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2023-12-31

0001088034us-gaap:RetainedEarningsMember2023-12-31

0001088034usio:CommonStockOutstandingMember2024-01-012024-03-31

0001088034us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0001088034us-gaap:TreasuryStockCommonMember2024-01-012024-03-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2024-01-012024-03-31

0001088034us-gaap:RetainedEarningsMember2024-01-012024-03-31

00010880342024-01-012024-03-31

0001088034usio:CommonStockOutstandingMember2024-03-31

0001088034us-gaap:AdditionalPaidInCapitalMember2024-03-31

0001088034us-gaap:TreasuryStockCommonMember2024-03-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2024-03-31

0001088034us-gaap:RetainedEarningsMember2024-03-31

00010880342024-03-31

0001088034usio:CommonStockOutstandingMember2024-04-012024-06-30

0001088034us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-30

0001088034us-gaap:TreasuryStockCommonMember2024-04-012024-06-30

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2024-04-012024-06-30

0001088034us-gaap:RetainedEarningsMember2024-04-012024-06-30

0001088034usio:CommonStockOutstandingMember2024-06-30

0001088034us-gaap:AdditionalPaidInCapitalMember2024-06-30

0001088034us-gaap:TreasuryStockCommonMember2024-06-30

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2024-06-30

0001088034us-gaap:RetainedEarningsMember2024-06-30

0001088034usio:CommonStockOutstandingMember2022-12-31

0001088034us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001088034us-gaap:TreasuryStockCommonMember2022-12-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2022-12-31

0001088034us-gaap:RetainedEarningsMember2022-12-31

0001088034usio:CommonStockOutstandingMember2023-01-012023-03-31

0001088034us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001088034us-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2023-01-012023-03-31

0001088034us-gaap:RetainedEarningsMember2023-01-012023-03-31

00010880342023-01-012023-03-31

0001088034usio:CommonStockOutstandingMember2023-03-31

0001088034us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001088034us-gaap:TreasuryStockCommonMember2023-03-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2023-03-31

0001088034us-gaap:RetainedEarningsMember2023-03-31

00010880342023-03-31

0001088034usio:CommonStockOutstandingMember2023-04-012023-06-30

0001088034us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0001088034us-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2023-04-012023-06-30

0001088034us-gaap:RetainedEarningsMember2023-04-012023-06-30

0001088034usio:CommonStockOutstandingMember2023-06-30

0001088034us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001088034us-gaap:TreasuryStockCommonMember2023-06-30

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2023-06-30

0001088034us-gaap:RetainedEarningsMember2023-06-30

0001088034usio:ACHAndComplementaryServiceRevenueMember2024-04-012024-06-30

0001088034usio:ACHAndComplementaryServiceRevenueMember2023-04-012023-06-30

0001088034usio:ACHAndComplementaryServiceRevenueMember2024-01-012024-06-30

0001088034usio:ACHAndComplementaryServiceRevenueMember2023-01-012023-06-30

0001088034usio:CreditCardRevenueMember2024-04-012024-06-30

0001088034usio:CreditCardRevenueMember2023-04-012023-06-30

0001088034usio:CreditCardRevenueMember2024-01-012024-06-30

0001088034usio:CreditCardRevenueMember2023-01-012023-06-30

0001088034usio:PrepaidCardServicesRevenueMember2024-04-012024-06-30

0001088034usio:PrepaidCardServicesRevenueMember2023-04-012023-06-30

0001088034usio:PrepaidCardServicesRevenueMember2024-01-012024-06-30

0001088034usio:PrepaidCardServicesRevenueMember2023-01-012023-06-30

0001088034usio:OutputSolutionsMember2024-04-012024-06-30

0001088034usio:OutputSolutionsMember2023-04-012023-06-30

0001088034usio:OutputSolutionsMember2024-01-012024-06-30

0001088034usio:OutputSolutionsMember2023-01-012023-06-30

0001088034usio:AchAndComplementaryServiceInterestRevenueMember2024-04-012024-06-30

0001088034usio:AchAndComplementaryServiceInterestRevenueMember2023-04-012023-06-30

0001088034usio:AchAndComplementaryServiceInterestRevenueMember2024-01-012024-06-30

0001088034usio:AchAndComplementaryServiceInterestRevenueMember2023-01-012023-06-30

0001088034usio:PrepaidCardServicesInterestRevenueMember2024-04-012024-06-30

0001088034usio:PrepaidCardServicesInterestRevenueMember2023-04-012023-06-30

0001088034usio:PrepaidCardServicesInterestRevenueMember2024-01-012024-06-30

0001088034usio:PrepaidCardServicesInterestRevenueMember2023-01-012023-06-30

0001088034usio:OutputSolutionsInterestMember2024-04-012024-06-30

0001088034usio:OutputSolutionsInterestMember2023-04-012023-06-30

0001088034usio:OutputSolutionsInterestMember2024-01-012024-06-30

0001088034usio:OutputSolutionsInterestMember2023-01-012023-06-30

00010880342024-04-01

00010880342023-01-012023-12-31

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2021-03-20

utr:M

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2021-03-202021-03-20

xbrli:pure

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2024-04-012024-06-30

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2023-04-012023-06-30

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2024-01-012024-06-30

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2023-01-012023-06-30

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsFolderAndInserterMember2023-10-01

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsFolderAndInserterMember2023-10-012023-10-01

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsFolderAndInserterMember2024-04-012024-06-30

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsFolderAndInserterMember2024-01-012024-06-30

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMember2020-12-152020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMember2020-12-15

utr:Y

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputSharePriceMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputExpectedTermMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputExpectedDividendRateMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputPriceVolatilityMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMember2024-04-012024-06-30

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMember2023-01-012023-06-30

0001088034us-gaap:TaxYear2023Member2023-12-31

00010880342005-01-012005-01-01

00010880342006-01-012006-12-31

00010880342007-01-012007-12-31

00010880342008-01-012008-12-31

00010880342009-01-012009-12-31

00010880342010-01-012010-12-31

00010880342013-01-012013-12-31

00010880342016-01-012016-12-31

00010880342017-01-012017-12-31

0001088034usio:AngryPugSportswearMember2024-01-012024-06-30

0001088034usio:AngryPugSportswearMember2023-01-012023-06-30

0001088034usio:AngryPugSportswearMemberusio:LouisHochMember2024-01-012024-03-31

0001088034us-gaap:RestrictedStockMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:EmployeesAndDirectorsMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:EmployeesAndDirectorsMember2024-06-21

0001088034us-gaap:RestrictedStockMembersrt:ChiefExecutiveOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockMemberusio:ChiefAccountingOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockMemberusio:DirectorOneMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockMemberusio:DirectorTwoMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:ChiefAccountingOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorOneMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorTwoMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:NonEmployeeDirectorsMember2024-06-212024-06-21

00010880342024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorThreeMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFourMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFiveMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorSixMember2024-06-212024-06-21

0001088034srt:ChiefFinancialOfficerMember2024-02-242024-02-24

0001088034usio:ChairmanPresidentChiefExecutiveOfficerAndChiefOperatingOfficerMember2024-02-242024-02-24

0001088034srt:ChiefFinancialOfficerMember2023-11-182023-11-18

0001088034usio:ChairmanPresidentChiefExecutiveOfficerAndChiefOperatingOfficerMember2023-11-182023-11-18

0001088034srt:ExecutiveVicePresidentMember2023-02-172023-02-17

0001088034srt:ExecutiveVicePresidentMember2023-02-17

0001088034us-gaap:RestrictedStockMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:EmployeesAndDirectorsMember2023-02-082023-02-08

00010880342023-02-08

0001088034us-gaap:RestrictedStockMembersrt:ChiefExecutiveOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockMembersrt:ChiefFinancialOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockMemberusio:DirectorOneMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockMemberusio:DirectorTwoMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefFinancialOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorOneMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorTwoMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMember2023-03-162023-03-16

00010880342023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorThreeMember2023-03-162023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFourMember2023-03-162023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFiveMember2023-03-162023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorSixMember2023-03-162023-03-16

0001088034usio:ClaimByKdhmLlcAgainstUsioOutputSolutionsIncMember2021-09-282021-09-28

0001088034usio:CounterclaimByUsioOutputSolutionsIncAgainstKdhmLlcMember2021-09-282021-09-28

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________.

Commission File Number: 000-30152

USIO, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 98-0190072 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| | | |

| 3611 Paesanos Parkway, Suite 300, San Antonio, TX | | 78231 |

| (Address of principal executive offices) | | (Zip Code) |

(210) 249-4100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name on each exchange on which registered |

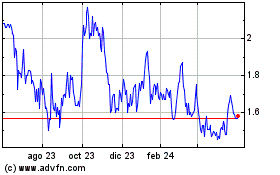

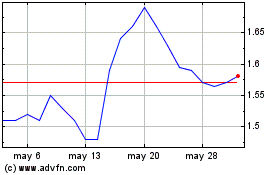

| Common stock, par value $0.001 per share | USIO | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging Growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of August 12, 2024, the number of outstanding shares of the registrant's common stock was 27,361,329.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

USIO, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | June 30, 2024 | | | December 31, 2023 | |

| | | (Unaudited) | | | | | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 7,498,256 | | | $ | 7,155,687 | |

| Accounts receivable, net | | | 5,494,539 | | | | 5,564,138 | |

| Settlement processing assets | | | 51,122,984 | | | | 44,899,603 | |

| Prepaid card load assets | | | 28,056,918 | | | | 31,578,973 | |

| Customer deposits | | | 1,808,006 | | | | 1,865,731 | |

| Inventory | | | 407,013 | | | | 422,808 | |

| Prepaid expenses and other | | | 819,163 | | | | 444,071 | |

| Current assets before merchant reserves | | | 95,206,879 | | | | 91,931,011 | |

| Merchant reserves | | | 4,851,839 | | | | 5,310,095 | |

| Total current assets | | | 100,058,718 | | | | 97,241,106 | |

| | | | | | | | | |

| Property and equipment, net | | | 3,427,109 | | | | 3,660,092 | |

| | | | | | | | | |

| Other assets: | | | | | | | | |

| Intangibles, net | | | 1,317,370 | | | | 1,753,333 | |

| Deferred tax asset, net | | | 1,504,000 | | | | 1,504,000 | |

| Operating lease right-of-use assets | | | 2,184,415 | | | | 2,420,782 | |

| Other assets | | | 340,285 | | | | 355,357 | |

| Total other assets | | | 5,346,070 | | | | 6,033,472 | |

| | | | | | | | | |

| Total assets | | $ | 108,831,897 | | | $ | 106,934,670 | |

| | | | | | | | | |

| Liabilities and stockholders’ equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 968,217 | | | $ | 1,031,141 | |

| Accrued expenses | | | 3,214,518 | | | | 3,801,278 | |

| Operating lease liabilities, current portion | | | 442,668 | | | | 633,616 | |

| Equipment loan, current portion | | | 192,206 | | | | 107,270 | |

| Settlement processing obligations | | | 51,122,984 | | | | 44,899,603 | |

| Prepaid card load obligations | | | 28,056,918 | | | | 31,578,973 | |

| Customer deposits | | | 1,808,006 | | | | 1,865,731 | |

| Current liabilities before merchant reserve obligations | | | 85,805,517 | | | | 83,917,612 | |

| Merchant reserve obligations | | | 4,851,839 | | | | 5,310,095 | |

| Total current liabilities | | | 90,657,356 | | | | 89,227,707 | |

| | | | | | | | | |

| Non-current liabilities: | | | | | | | | |

| Equipment loan, net of current portion | | | 597,176 | | | | 718,980 | |

| Operating lease liabilities, net of current portion | | | 1,863,147 | | | | 1,919,144 | |

| Total liabilities | | | 93,117,679 | | | | 91,865,831 | |

| | | | | | | | | |

| Commitments and contingencies (Note 9) | | | | | | | | |

| Stockholders’ equity: | | | | | | | | |

| Preferred stock, $0.01 par value, 10,000,000 shares authorized; -0- shares outstanding at June 30, 2024 (unaudited) and December 31, 2023, respectively | | | — | | | | — | |

| Common stock, $0.001 par value, 200,000,000 shares authorized; 29,764,435 and 28,671,606 issued, and 27,331,969 and 26,332,523 outstanding at June 30, 2024 (unaudited) and December 31, 2023, respectively | | | 198,179 | | | | 197,087 | |

| Additional paid-in capital | | | 99,222,467 | | | | 97,479,830 | |

| Treasury stock, at cost; 2,432,466 and 2,339,083 shares at June 30, 2024 (unaudited) and December 31, 2023, respectively | | | (4,511,919 | ) | | | (4,362,150 | ) |

| Deferred compensation | | | (7,681,660 | ) | | | (6,907,775 | ) |

| Accumulated deficit | | | (71,512,849 | ) | | | (71,338,153 | ) |

| Total stockholders’ equity | | | 15,714,218 | | | | 15,068,839 | |

| | | | | | | | | |

| Total liabilities and stockholders’ equity | | $ | 108,831,897 | | | $ | 106,934,670 | |

See the accompanying notes to the condensed interim consolidated financial statements.

USIO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | | | | | | | | | | | |

| Revenues | | $ | 20,079,888 | | | $ | 21,436,572 | | | $ | 41,050,274 | | | $ | 42,952,842 | |

| Cost of services | | | 15,280,074 | | | | 16,250,988 | | | | 31,396,765 | | | | 32,795,417 | |

| Gross profit | | | 4,799,814 | | | | 5,185,584 | | | | 9,653,509 | | | | 10,157,425 | |

| | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses: | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | 460,061 | | | | 577,869 | | | | 959,334 | | | | 1,082,443 | |

| Other SG&A | | | 4,000,845 | | | | 3,854,022 | | | | 8,061,070 | | | | 7,727,241 | |

| Depreciation and amortization | | | 547,849 | | | | 522,999 | | | | 1,124,003 | | | | 1,041,028 | |

| Total selling, general and administrative | | | 5,008,755 | | | | 4,954,890 | | | | 10,144,407 | | | | 9,850,712 | |

| | | | | | | | | | | | | | | | | |

| Operating income (loss) | | | (208,941 | ) | | | 230,694 | | | | (490,898 | ) | | | 306,713 | |

| | | | | | | | | | | | | | | | | |

| Other income and (expense): | | | | | | | | | | | | | | | | |

| Interest income | | | 107,270 | | | | 43,978 | | | | 222,624 | | | | 66,880 | |

| Other income | | | 261,413 | | | | — | | | | 261,413 | | | | — | |

| Interest expense | | | (14,250 | ) | | | (533 | ) | | | (27,835 | ) | | | (1,195 | ) |

| Other income, net | | | 354,433 | | | | 43,445 | | | | 456,202 | | | | 65,685 | |

| | | | | | | | | | | | | | | | | |

| Income (loss) before income tax expense | | | 145,492 | | | | 274,139 | | | | (34,696 | ) | | | 372,398 | |

| Income tax expense | | | 70,000 | | | | 69,098 | | | | 140,000 | | | | 152,524 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 75,492 | | | $ | 205,041 | | | $ | (174,696 | ) | | $ | 219,874 | |

| | | | | | | | | | | | | | | | | |

| Basic income (loss) per common share: | | $ | 0.00 | | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.01 | |

| Diluted income (loss) per common share: | | $ | 0.00 | | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.01 | |

| Weighted average common shares outstanding | | | | | | | | | | | | | | | | |

| Basic | | | 26,534,407 | | | | 26,413,329 | | | | 26,454,848 | | | | 26,410,340 | |

| Diluted | | | 26,534,407 | | | | 26,413,329 | | | | 26,454,848 | | | | 26,410,340 | |

See the accompanying notes to the condensed interim consolidated financial statements.

USIO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | Six Months Ended June 30, | |

| | | 2024 | | | 2023 | |

| Operating activities: | | | | | | | | |

| Net income (loss) | | $ | (174,696 | ) | | $ | 219,874 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | | |

| Depreciation | | | 688,039 | | | | 605,095 | |

| Amortization | | | 435,964 | | | | 435,933 | |

| Employee stock-based compensation | | | 959,334 | | | | 1,082,443 | |

| Non-cash revenue from returned common stock | | | — | | | | (156,162 | ) |

| Changes in current assets and current liabilities: | | | | | | | | |

| Accounts receivable | | | 69,599 | | | | (850,132 | ) |

| Prepaid expenses and other | | | (375,092 | ) | | | (176,728 | ) |

| Operating lease right-of-use assets | | | 236,367 | | | | 114,956 | |

| Other assets | | | 15,072 | | | | — | |

| Inventory | | | 15,795 | | | | 25,185 | |

| Accounts payable and accrued expenses | | | (649,684 | ) | | | 136,401 | |

| Operating lease liabilities | | | (246,945 | ) | | | (134,979 | ) |

| Prepaid card load obligations | | | (3,522,055 | ) | | | 26,227,715 | |

| Merchant reserves | | | (458,256 | ) | | | 231,539 | |

| Customer deposits | | | (57,725 | ) | | | 9,070 | |

| Net cash provided by (used in) operating activities | | | (3,064,283 | ) | | | 27,770,210 | |

| | | | | | | | | |

| Investing activities: | | | | | | | | |

| Purchases of property and equipment | | | (455,057 | ) | | | (388,628 | ) |

| Net cash (used in) investing activities | | | (455,057 | ) | | | (388,628 | ) |

| | | | | | | | | |

| Financing activities: | | | | | | | | |

| Payments on equipment loan | | | (36,868 | ) | | | (28,215 | ) |

| Proceeds from issuance of common stock | | | 10,510 | | | | — | |

| Purchases of treasury stock | | | (149,769 | ) | | | (19,036 | ) |

| Net cash (used in) financing activities | | | (176,127 | ) | | | (47,251 | ) |

| | | | | | | | | |

| Change in cash, cash equivalents, prepaid card load assets, customer deposits and merchant reserves | | | (3,695,467 | ) | | | 27,334,331 | |

| Cash, cash equivalents, prepaid card load assets, customer deposits and merchant reserves, beginning of period | | | 45,910,486 | | | | 32,343,501 | |

| | | | | | | | | |

| Cash, Cash Equivalents, Prepaid Card Load Assets, Customer Deposits and Merchant Reserves, End of Period | | $ | 42,215,019 | | | $ | 59,677,832 | |

| | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | $ | 27,835 | | | $ | 1,195 | |

| Income taxes | | | — | | | | 312,158 | |

| Non-cash financing activity: | | | | | | | | |

| Issuance of deferred stock compensation | | | 1,497,300 | | | | 2,478,506 | |

See the accompanying notes to the condensed interim consolidated financial statements.

USIO, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY

(UNAUDITED)

| | | Common Stock | | | Additional Paid- In | | | Treasury | | | Deferred | | | Accumulated | | | Total Stockholders' | |

| | | Shares | | | Amount | | | Capital | | | Stock | | | Compensation | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2023 | | | 28,671,606 | | | $ | 197,087 | | | $ | 97,479,830 | | | $ | (4,362,150 | ) | | $ | (6,907,775 | ) | | $ | (71,338,153 | ) | | $ | 15,068,839 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock under equity incentive plan | | | 107,600 | | | | 107 | | | | 153,118 | | | | — | | | | — | | | | — | | | | 153,225 | |

| Deferred compensation amortization | | | — | | | | — | | | | — | | | | — | | | | 346,047 | | | | — | | | | 346,047 | |

| Purchase of treasury stock costs | | | — | | | | — | | | | — | | | | (44,823 | ) | | | — | | | | — | | | | (44,823 | ) |

| Net (loss) for the period | | | — | | | | — | | | | — | | | | — | | | | — | | | | (250,188 | ) | | | (250,188 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2024 | | | 28,779,206 | | | $ | 197,194 | | | $ | 97,632,948 | | | $ | (4,406,973 | ) | | $ | (6,561,728 | ) | | $ | (71,588,341 | ) | | $ | 15,273,100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock under equity incentive plan | | | 994,049 | | | | 994 | | | | 1,610,320 | | | | — | | | | (1,497,300 | ) | | | — | | | | 114,014 | |

| Issuance of common stock under employee stock purchase plan | | | 6,180 | | | | 6 | | | | 10,504 | | | | — | | | | — | | | | — | | | | 10,510 | |

| Reversal of deferred compensation amortization that did not vest | | | (15,000 | ) | | | (15 | ) | | | (31,305 | ) | | | — | | | | 31,320 | | | | — | | | | — | |

| Deferred compensation amortization | | | — | | | | — | | | | — | | | | — | | | | 346,048 | | | | — | | | | 346,048 | |

| Purchase of treasury stock costs | | | — | | | | — | | | | — | | | | (104,946 | ) | | | — | | | | — | | | | (104,946 | ) |

| Net income for the period | | | — | | | | — | | | | — | | | | — | | | | — | | | | 75,492 | | | | 75,492 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2024 | | | 29,764,435 | | | $ | 198,179 | | | $ | 99,222,467 | | | $ | (4,511,919 | ) | | $ | (7,681,660 | ) | | $ | (71,512,849 | ) | | $ | 15,714,218 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2022 | | | 27,044,900 | | | $ | 195,471 | | | $ | 94,048,603 | | | $ | (3,749,027 | ) | | $ | (5,697,900 | ) | | $ | (70,863,049 | ) | | $ | 13,934,098 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock under equity incentive plan | | | 1,421,250 | | | | 1,421 | | | | 2,638,529 | | | | — | | | | (2,444,054 | ) | | | — | | | | 195,896 | |

| Deferred compensation amortization | | | — | | | | — | | | | — | | | | — | | | | 308,676 | | | | — | | | | 308,676 | |

| Purchase of treasury stock costs | | | — | | | | — | | | | — | | | | (8,529 | ) | | | — | | | | — | | | | (8,529 | ) |

| Net income for the period | | | — | | | | — | | | | — | | | | — | | | | — | | | | 14,833 | | | | 14,833 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2023 | | | 28,466,150 | | | $ | 196,892 | | | $ | 96,687,132 | | | $ | (3,757,556 | ) | | $ | (7,833,278 | ) | | $ | (70,848,216 | ) | | $ | 14,444,974 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock under equity incentive plan | | | 111,456 | | | | 111 | | | | 354,199 | | | | — | | | | (34,452 | ) | | | — | | | | 319,858 | |

| Reversal of deferred compensation amortization that did not vest | | | (115,000 | ) | | | (115 | ) | | | (188,088 | ) | | | — | | | | 103,091 | | | | — | | | | (85,112 | ) |

| Deferred compensation amortization | | | — | | | | — | | | | — | | | | — | | | | 343,123 | | | | — | | | | 343,123 | |

| Purchase of treasury stock costs | | | — | | | | — | | | | — | | | | (10,507 | ) | | | — | | | | — | | | | (10,507 | ) |

| Non-cash return of common stock | | | — | | | | — | | | | — | | | | (156,162 | ) | | | — | | | | — | | | | (156,162 | ) |

| Net income for the period | | | — | | | | — | | | | — | | | | — | | | | — | | | | 205,041 | | | | 205,041 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2023 | | | 28,462,606 | | | $ | 196,888 | | | $ | 96,853,243 | | | $ | (3,924,225 | ) | | $ | (7,421,516 | ) | | $ | (70,643,175 | ) | | $ | 15,061,215 | |

See the accompanying notes to the condensed interim consolidated financial statements.

USIO, INC.

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1. Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements of Usio, Inc. and its subsidiaries (collectively, the “Company”) have been prepared without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the "Commission" or the "SEC"). Certain information and footnote disclosures normally included in financial statements prepared in accordance with United States generally accepted accounting principles ("GAAP") have been omitted pursuant to such rules and regulations. In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements reflect all adjustments of a normal recurring nature considered necessary to present fairly the Company's financial position, results of operations and cash flows for such periods. The accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company's annual report on Form 10-K for the year ended December 31, 2023, as filed with the Commission on March 27, 2024 (the "2023 Annual Report"). Results of operations for interim periods are not necessarily indicative of results that may be expected for any other interim periods or the full fiscal year. References in this quarterly report to "the quarter" or the "second quarter" mean the three month period ended June 30, 2024 or 2023, as the case may be and unless otherwise noted.

Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition: Revenue consists primarily of fees generated through the electronic processing of payment transactions and related services. Revenue is recognized during the period in which the transactions are processed or when the related services are performed. The Company complies with ASC 606-10 and reports revenues at gross as a principal versus net as an agent. Although some of the Company's processing agreements vary with respect to specific credit risks, the Company has determined that for each agreement it is acting in the principal role. Merchants may be charged for these processing services at a bundled rate based on a percentage of the dollar amount of each transaction and, in some instances, additional fees are charged for each transaction. Certain merchant customers are charged a flat fee per transaction, while others may also be charged miscellaneous fees, including fees for chargebacks or returns, monthly minimums, and other miscellaneous services. Revenues derived from electronic processing of credit, debit, and prepaid card transactions that are authorized and captured through third-party networks are reported gross of amounts paid to sponsor banks as well as interchange and assessments paid to credit card associations. Certain card distributors remit payment of fees earned 45 days after the end of the processing period. Prepaid card distributors have payment terms of 30 days following the end of the month. Sales taxes billed are reported directly as a liability to the taxing authority and are not included in revenue. Usio Output Solutions, Inc. ("Output Solutions"), a wholly-owned subsidiary of Usio, Inc., provides bill preparation, presentment and mailing services. Revenue from Output Solutions is recognized when the related services are performed for printing and delivered to the United States Postal Services, or USPS, for postage. We also earn revenues from interest and fees earned on certain assets underlying customer balances. Interest earned on assets directly related to our core business line operations are recorded in the revenue source underlying the associated customer balances. Customer balances held on which the Company earns interest revenues include balances from our Automated Clearing House, or ACH, and complementary services, prepaid card services, and Output Solutions business lines.

The following table presents the Company's consolidated revenues by source:

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | | | | | | | | | | | |

| ACH and complementary services | | $ | 3,894,330 | | | $ | 4,079,157 | | | $ | 7,776,064 | | | $ | 7,419,879 | |

| Credit card | | | 7,261,268 | | | | 7,115,884 | | | | 14,822,002 | | | | 14,455,782 | |

| Prepaid card services | | | 3,673,418 | | | | 5,217,468 | | | | 7,014,642 | | | | 10,024,872 | |

| Output Solutions | | | 4,686,869 | | | | 4,849,197 | | | | 10,224,792 | | | | 10,807,417 | |

| Interest - ACH and complementary services | | | 190,233 | | | | 40,361 | | | | 401,873 | | | | 43,306 | |

| Interest - Prepaid card services | | | 334,624 | | | | 125,058 | | | | 737,365 | | | | 186,018 | |

| Interest - Output Solutions | | | 39,146 | | | | 9,447 | | | | 73,536 | | | | 15,568 | |

| Total revenue | | $ | 20,079,888 | | | $ | 21,436,572 | | | $ | 41,050,274 | | | $ | 42,952,842 | |

Cash and Cash Equivalents: Cash and cash equivalents includes cash and other money market instruments. The Company considers all highly liquid investments with an original maturity of 90 days or less to be cash equivalents.

Settlement Processing Assets and Obligations: Settlement processing assets and obligations represent intermediary balances arising in our settlement process for merchants. The Company earns interest on these underlying processing assets, which is recognized as revenue in the ACH and complementary services business line.

Prepaid Card Load Assets and Obligations: The Company maintains pre-funding accounts for its customers to facilitate prepaid card loads as initiated by the customer. These prepaid card load assets are carried on the Company's balance sheet with a corresponding liability. As the prepaid business line expands, card load assets will increase as funds are sent from customers to the Company. As customers begin to load cash onto cards, the balance of both the prepaid card asset and corresponding liability decrease. As these balances decrease, the Company recognizes processing revenue and cardholder fees. The Company earns interest on these prepaid card load assets and obligations, which is recognized as revenue in the prepaid card services business line.

Customer Deposits: The Company holds customer deposits primarily for postage expenses to ensure the Company is not out of pocket for amounts billed daily by the USPS. These customer deposits are carried on the Company's balance sheet with a corresponding liability. The Company earns interest on these customer deposits, which is recognized as revenue in the Output Solutions business line.

Merchant Reserves: The Company has merchant reserve requirements associated with ACH transactions. The merchant reserve assets are carried on the Company's balance sheet with a corresponding liability. Merchant reserves are set for each merchant and funds are collected and held as collateral to minimize contingent liabilities associated with any losses that may occur. While this cash is not restricted in its use, the Company believes that designating this cash to collateralize merchant reserves strengthens the Company's standing with its member sponsors and is in accordance with the guidelines set by the card networks. The Company earns interest on these merchant reserves, which is recognized as revenue in our ACH and complementary services business line.

The reconciliation of cash and cash equivalents to cash, cash equivalents, prepaid card load assets, customer deposits and merchant reserves is as follows for each period presented:

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | | | | | | | | | | | |

| Beginning cash, cash equivalents, prepaid card load assets, customer deposits and merchant reserves: | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 7,053,812 | | | $ | 6,763,813 | | | $ | 7,155,687 | | | $ | 5,709,117 | |

| Prepaid card load assets | | | 28,698,878 | | | | 18,812,954 | | | | 31,578,973 | | | | 20,170,761 | |

| Customer deposits | | | 1,808,263 | | | | 1,575,075 | | | | 1,865,731 | | | | 1,554,122 | |

| Merchant reserves | | | 5,322,095 | | | | 4,744,615 | | | | 5,310,095 | | | | 4,909,501 | |

| Total | | $ | 42,883,048 | | | $ | 31,896,457 | | | $ | 45,910,486 | | | $ | 32,343,501 | |

| | | | | | | | | | | | | | | | | |

| Ending cash, cash equivalents, prepaid card load assets, customer deposits and merchant reserves: | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 7,498,256 | | | $ | 6,575,124 | | | $ | 7,498,256 | | | $ | 6,575,124 | |

| Prepaid card load assets | | | 28,056,918 | | | | 46,398,476 | | | | 28,056,918 | | | | 46,398,476 | |

| Customer deposits | | | 1,808,006 | | | | 1,563,192 | | | | 1,808,006 | | | | 1,563,192 | |

| Merchant reserves | | | 4,851,839 | | | | 5,141,040 | | | | 4,851,839 | | | | 5,141,040 | |

| Total | | $ | 42,215,019 | | | $ | 59,677,832 | | | $ | 42,215,019 | | | $ | 59,677,832 | |

Accounts Receivable/Allowance for Estimated Credit Losses: The Company maintains an allowance for estimated credit losses resulting from the inability or failure of the Company’s customers to make required payments. The Company determines the allowance based on an account-by-account review, taking into consideration such factors as the age of the outstanding balance, historical pattern of collections, and financial condition of the customer to conform with Accounting Standards Update (ASU) Topic 326. During the six months ended June 30, 2024 and the year ended December 31, 2023, there were no credit losses incurred. In the past, losses incurred by the Company due to credit losses were within its expectations. If the financial conditions of the Company’s customers were to deteriorate, resulting in an impairment of their ability to make contractual payments, additional losses may be incurred in future periods. Estimates for credit losses are variable based on the volume of transactions processed and could increase or decrease accordingly. The allowance for credit losses was $319,000 at June 30, 2024 and December 31, 2023.

Inventory: Inventory is stated at the lower of cost or net realizable value. At June 30, 2024 and December 31, 2023, inventory consisted primarily of printing and paper supplies used for Output Solutions.

Accounting for Internal Use Software: The Company capitalizes the costs associated with software being developed or obtained for internal use when both the preliminary project stage is completed and it is probable that computer software being developed will be completed and placed in service. Capitalized costs include only (i) external direct costs of materials and services consumed in developing or obtaining internal-use software, (ii) payroll and other related costs for employees who are directly associated with and who devote time to the internal-use software project, and (iii) interest costs incurred, when material, while developing internal-use software. The Company ceases capitalization of such costs no later than the point at which the project is substantially complete and ready for its intended purpose. During the six months ended June 30, 2024 and June 30, 2023, the Company capitalized software costs of $353,316 and $378,197, respectively.

Valuation of Long-Lived and Intangible Assets: The Company assesses the impairment of long-lived and intangible assets at least annually, and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Factors considered important, which could trigger an impairment review, include the following: significant underperformance relative to historical or projected future cash flows; significant changes in the manner of use of the assets or the strategy of the overall business; and significant negative industry trends. When management determines that the carrying value of long-lived and intangible assets may not be recoverable, impairment is measured as the excess of the assets’ carrying value over the estimated fair value. No impairment losses were recorded in 2023 or during the six months ended June 30, 2024. Management is not aware of any impairment charges that may currently be required; however, the Company cannot predict the occurrence of events that might adversely affect the reported values in the future.

Reserve for Processing Losses: If, due to insolvency or bankruptcy of one of the Company’s merchant customers, or for any other reason, the Company is not able to collect amounts from its credit card, ACH or prepaid customers that have been properly "charged back" by the customer, or if a prepaid cardholder incurs a negative balance, the Company must bear the credit risk for the full amount of the transaction. The Company may require cash deposits and other types of collateral from certain merchants to minimize any such risks. In addition, the Company utilizes multiple systems and procedures to manage merchant risk. ACH, prepaid and credit card merchant processing loss reserves are primarily determined by performing a historical analysis of the Company’s loss experience, considering other factors that could affect that experience in the future, such as the types of transactions processed and nature of the merchant relationship with its consumers and the Company’s relationship with the Company’s prepaid card holders. This reserve amount is subject to the risk that actual losses may be greater than the Company’s estimates. Estimates for processing losses are variable based on the volume of transactions processed and could increase or decrease accordingly. At June 30, 2024 and December 31, 2023, the Company’s reserve for processing losses was $892,528 and $826,528, respectively, carried on the Company's balance sheet as an accrued expense.

Legal Proceedings: In addition to the legal proceedings disclosed in this quarterly report, the Company may be involved in legal matters arising in the ordinary course of business from time to time. Litigation is subject to inherent uncertainties, and an adverse result in the legal proceedings disclosed in this quarterly report or other matters that may arise from time to time may harm our business.

Recently Adopted Accounting Pronouncements: Accounting standards that have been issued or proposed by the FASB, the SEC or other standard setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company's consolidated financial statements upon adoption.

Reclassifications: We have reclassified certain prior period amounts in the accompanying consolidated financial statements in order to be consistent with the current period presentation. These reclassifications had no effect on net income, total assets, total liabilities or equity.

Note 2. Leases

The Company leases facilities and office equipment under various operating leases, which generally are expected to be renewed or replaced by other leases. For each of the three months ended June 30, 2024 and 2023, operating lease expenses totaled $133,973 and $146,415, respectively. For each of the six months ended June 30, 2024 and 2023, operating lease expenses totaled $266,105 and $257,038, respectively.

Note 3. Accrued Expenses

Accrued expenses consisted of the following balances:

| | | June 30, 2024 | | | December 31, 2023 | |

| | | | | | | | | |

| Accrued commissions | | $ | 1,092,870 | | | $ | 2,433,353 | |

| Reserve for processing losses | | | 892,528 | | | | 826,528 | |

| Other accrued expenses | | | 713,415 | | | | 246,444 | |

| Accrued taxes | | | 145,906 | | | | 294,953 | |

| Accrued salaries | | | 369,799 | | | | — | |

| Total accrued expenses | | $ | 3,214,518 | | | $ | 3,801,278 | |

Note 4. Equipment Loan

On March 20, 2021, the Company entered into a debt arrangement to finance $165,996 for the purchase of an Output Solutions sorter. The loan was for a period of 36 months with a maturity date of March 20, 2024 and annual interest of 3.95%. Monthly principal and interest payments were required in the amount of $4,902. Principal payments for the three months ended June 30, 2024 and 2023 were $0 and $14,171, respectively, and are reflected on the Company's Condensed Consolidated Statement of Cash Flows. Principal payments for the six months ended June 30, 2024 and 2023 were $14,312 and $27,659, respectively. This loan was paid in full on its maturity date.

On October 1, 2023, the Company entered into a debt arrangement to finance $811,819 for the purchase of an Output Solutions folder and inserter. The loan is for a period of 66 months with a maturity date of April 5, 2029 and annual interest of 6.75%. Monthly principal and interest payments are required in the amount of $16,017, with interest only payments required for the first six months of the loan term. Total interest and principal payments on this folder and inserter equipment loan were $36,687 for the three months ended June 30, 2024. Total interest and principal payments on this folder and inserter equipment loan were $50,168 for the six months ended June 30, 2024.

Note 5. Stockholders' Equity

Stock Warrants: On December 15, 2020, the Company issued warrants to purchase 945,599 shares of the Company's common stock with an initial exercise price of $4.23 per share, subject to adjustment as provided in the warrant agreement governing the warrants, to Information Management Solutions, LLC ("Management Solutions"). Management Solutions' warrants vest and become exercisable annually over three years in three equal tranches beginning on December 15, 2021 and become fully vested on December 15, 2023. Each warrant is exercisable for a period of five years beginning on the date it vests. At the time of issuance, these warrants were valued using the Black-Scholes option pricing model. Assumptions used were as follows: (i) the fair value of the underlying stock was $0.58 per share; (ii) the risk-free interest rate was 0.09%; (iii) the contractual life was 5 years; (iv) the dividend yield was 0%; and (v) the volatility was 59.9%. The fair value of the warrants amounted to $552,283 and was recorded as an increase in the customer list asset and a corresponding amount to additional paid in capital. The amortization of these warrants, which is included in the total amortization expense of the customer list intangible asset, totaled $27,615 and $55,228 in each of the three and six months ended June 30, 2024 and 2023, respectively.

Note 6. Net Income (Loss) Per Share

Basic income (loss) per share (EPS) was computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted EPS differs from basic EPS due to the assumed conversion of potentially dilutive awards and options that were outstanding during the period. Unvested restricted stock awards have the right to receive nonforfeitable dividends on the same basis as common shares; therefore, unvested restricted stock is considered a participating security for the purpose of calculating EPS. The following is a reconciliation of the numerators and the denominators of the basic and diluted per share computations for net income (loss) for the three and six months ended June 30, 2024 and June 30, 2023.

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| Numerator: | | | | | | | | | | | | | | | | |

| Numerator for basic and diluted income (loss) per share, net income (loss) available to common shareholders | | $ | 75,492 | | | $ | 205,041 | | | $ | (174,696 | ) | | $ | 219,874 | |

| Denominator: | | | | | | | | | | | | | | | | |

| Denominator for basic income (loss) per share, weighted average shares outstanding | | | 26,534,407 | | | | 26,413,329 | | | | 26,454,848 | | | | 26,410,340 | |

| Effect of dilutive securities | | | — | | | | — | | | | — | | | | — | |

| Denominator for diluted earnings per share, adjusted for weighted average shares and assumed conversion | | | 26,534,407 | | | | 26,413,329 | | | | 26,454,848 | | | | 26,410,340 | |

| Basic income (loss) per common share | | $ | 0.00 | | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.01 | |

| Diluted income (loss) per common share and common share equivalent | | $ | 0.00 | | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.01 | |

The awards and options to purchase shares of common stock that were outstanding at June 30, 2024 and June 30, 2023 that were not included in the computation of diluted earnings per share because the effect would have been anti-dilutive, are as follows:

| | | Six Months Ended June 30, | |

| | | 2024 | | | 2023 | |

| Anti-dilutive awards and options | | | 945,599 | | | | 945,599 | |

Note 7. Income Taxes

Deferred tax assets and liabilities are recorded based on the difference between financial reporting and tax basis of assets and liabilities and are measured by the enacted tax rates and laws that are expected to be in effect when the differences are expected to reverse. Deferred tax assets are computed with the presumption that they will be realizable in future periods when taxable income is generated. Predicting the ability to realize these assets in future periods requires judgment by management. GAAP prescribes a recognition threshold and measurement attribute for a tax position taken or expected to be taken in a tax return. Income tax benefits that meet the “more likely than not” recognition threshold are recognized.

The Company has recognized a deferred tax asset of approximately $1.5 million recorded net of a valuation allowance of approximately $6.1 million. The Company reviews the assessment of the deferred tax asset and valuation allowance on an annual basis or more often when events indicate that a change to the valuation allowance may be warranted.

At December 31, 2023, the Company had available net operating loss carryforwards of approximately $23.3 million. Net operating loss carryforwards generated during or prior to 2017 are available to offset taxable income of future periods and expire 20 years after the loss was generated. Net operating loss carryforwards generated after 2017 do not expire.

The schedule below outlines when the Company's net operating losses for 2017 and prior years were generated and the year they may expire.

| Tax Year End | | NOL | | | Expiration | |

| 2005 | | $ | 1,768,851 | | | | 2025 | |

| 2006 | | | 1,350,961 | | | | 2026 | |

| 2007 | | | 1,740,724 | | | | 2027 | |

| 2008 | | | 918,960 | | | | 2028 | |

| 2009 | | | 835,322 | | | | 2029 | |

| 2010 | | | 429,827 | | | | 2030 | |

| 2013 | | | 504,862 | | | | 2033 | |

| 2016 | | | 474,465 | | | | 2036 | |

| 2017 | | | 1,267,336 | | | | 2037 | |

| Total | | $ | 9,291,308 | | | | | |

Management is not aware of any tax positions that would have a significant impact on the Company’s financial position.

Note 8. Related Party Transactions

Louis Hoch

During the six months ended June 30, 2024 and June 30, 2023, the Company purchased a total of $4,402 and $18,148, respectively, of corporate imprinted sportswear, promotional items, and caps from Angry Pug Sportswear. Louis Hoch, the Company’s Chairman of the Board, President, Chief Executive Officer and Chief Operating Officer, is a 50% owner of Angry Pug Sportswear.

Directors and Officers

On June 21, 2024, the Company granted 966,000 shares of restricted common stock with a 10-year vesting period and 277,200 restricted stock units ("RSUs") with a 3-year vesting period to employees and Directors as a performance bonus at an issue price of $1.55 per share. RSUs vest in equal tranches over their 3-year vesting period, while 10-year grants are cliff vesting, and vest in full at the conclusion of their 10-year vesting period. Upon vesting, employees and Directors will receive issued shares. Executive officers and Directors included in the 10-year restricted stock grant were Louis Hoch (160,000 shares), Michael White (120,000 shares), Greg Carter (80,000 shares), and Houston Frost (40,000 shares). Executive officers included in the RSU grant were Louis Hoch (21,000 RSUs), Michael White (18,000 RSUs), Greg Carter (18,000 RSUs),and Houston Frost (12,000 RSUs).

On June 21, 2024, the Company granted 84,000 RSUs with a 3-year vesting period to Non-employee Directors as a performance bonus at an issue price of $1.55 per share. Directors included in the RSU grant were Blaise Bender (21,000 RSUs), Brad Rollins (21,000 RSUs), Ernesto Beyer (21,000 RSUs) and Michelle Miller (21,000 RSUs).

On February 24, 2024, we repurchased 2,075 shares of our common stock for $3,258 in a private transaction based on the $1.57 per share closing price on February 24, 2024 from Tom Jewell, the Company's former Chief Financial Officer, to cover his share of taxes in connection with equity grants.

On February 24, 2024, we repurchased 4,911 shares of our common stock for $7,710 in a private transaction based on the $1.57 per share closing price on February 24, 2024 from Louis Hoch, the Company's Chairman, President, Chief Executive Officer and Chief Operating Officer, to cover his share of taxes in connection with equity grants.

On November 30, 2023, Tom Jewell, the Senior Vice President, Chief Financial Officer, and principal financial and accounting officer of the Company, notified the Company of his intention to retire. On December 11, 2023, Mr. Jewell entered into a Separation and Mutual Release of Claims Agreement (“Separation Agreement”) with the Company. Pursuant to the Separation Agreement, Mr. Jewell will be paid installment payments equal to his current base salary until and including April 18, 2024. Additionally, Mr. Jewell will be permitted to retain any unvested Company stock options or other equity awards, which shall vest in accordance with the applicable schedules. Mr. Jewell will also receive all employee benefits including, but not limited to, health, dental, vision and life insurances that he was receiving prior to his execution of the Agreement until April 18, 2024.

On November 18, 2023, we repurchased 2,619 shares of our common stock for $4,452 in a private transaction based on the $1.70 per share closing price on November 18, 2023 from Tom Jewell, the Company's former Chief Financial Officer, to cover his share of taxes in connection with equity grants.

On November 18, 2023, we repurchased 3,927 shares of our common stock for $6,675 in a private transaction based on the $1.70 per share closing price on November 18, 2023 from Louis Hoch, the Company's Chairman, President, Chief Executive Officer and Chief Operating Officer, to cover his share of taxes in connection with equity grants.

Effective on February 17, 2023, the Company entered into an employment agreement with Greg Carter, the Company’s Executive Vice President, Payment Acceptance. Under the terms of this agreement, Mr. Carter will receive an annual salary of $250,000, Override/Commissions of 10% of the actual cash commissions paid to salespersons under direct management of Mr. Carter, to be paid quarterly, and the payment of a one-time signing bonus of $40,000.

On February 8, 2023, the Company granted 1,403,000 shares of restricted common stock with a 10-year vesting period and 273,000 RSUs with a 3-year vesting period to employees and Directors as a performance bonus at an issue price of $1.75 per share. RSUs vest in equal tranches over their 3-year vesting period, while 10-year grants are cliff vesting, and vest in full at the conclusion of their 10-year vesting period. Upon vesting, employees and Directors will receive issued shares. Executive officers and Directors included in the 10-year restricted stock grant were Louis Hoch (330,000 shares), Tom Jewell (200,000 shares), Greg Carter (100,000 shares) and Houston Frost (100,000 shares). Executive officers included in the RSU grant were Louis Hoch (33,000 RSUs), Tom Jewell (21,000 RSUs), Greg Carter (12,000 RSUs) and Houston Frost (12,000 RSUs).

On March 16, 2023, the Company granted 69,000 RSUs with a 3-year vesting period to Non-employee Directors as a performance bonus at an issue price of $1.60 per share. Directors included in the RSU grant were Blaise Bender (21,000 RSUs), Brad Rollins (21,000 RSUs), Ernesto Beyer (21,000 RSUs) and Michelle Miller (6,000 RSUs).

Note 9. Commitments and Contingencies

Legal Proceedings.

Ben Kauder, Nina Pioletti, & Triple Pay Play, Inc.

In 2017, Usio acquired Singular Payments, Inc. (“Singular”), another payment processing company with offices in Nashville, Tennessee and St. Augustine, Florida.

Ben Kauder and Nina Pioletti were executives of Singular and, after the acquisition, Usio hired them as executive-level employees. Usio hired Kauder to serve as Senior Vice President of Integrated Payments, and Pioletti was hired to serve as Director of Sales. As a condition of employment, Kauder and Pioletti agreed to be bound by certain Usio policies, including as related to preserving the confidentiality of Usio’s proprietary information. As Usio executives, Kauder and Pioletti were afforded access to and contributed to the development of Usio’s trade secrets and other proprietary information not generally known by the public at large, including but not limited to financial information, marketing plans, cost and operational/strategic plans, and sales presentations.

In May 2021, Kauder resigned from Usio followed by Pioletti in July of 2022. Thereafter, Kauder and Pioletti formed Triple Pay Play, another payment processing company which competes with the same services as Usio. Upon information and belief, Kauder and Pioletti were working to form Triple Pay Play while employed by Usio, during Usio business hours, and while using Usio resources and Usio property.

On or about June 21, 2023, Usio filed suit against Kauder, Pioletti and Triple Pay Play for breach of contract and misappropriation of trade secrets and unfair business competition.

On July 6, 2023, Kauder, Pioletti and Triple Pay Play filed a Motion to Dismiss for Lack of Jurisdiction. The motion was granted. Subsequently, in February of 2024, Usio refiled its case in Tennessee, where Kauder, Pioletti, and Triple Pay Play reside.

On May 3, 2024, Kauder, Pioletti and Triple Pay Play filed a Motion to Dismiss Usio’s Complaint; this motion was heard August 5, 2024. The Judge did not make a ruling and is currently reviewing all materials filed in regards to this matter.

Greenwich Business Capital, LLC

On or about September 25, 2019, Usio and Greenwich Business Capital LLC (“GBC”), entered into an Agreement for payment processing services (the “Agreement”). Pursuant to the terms of the Agreement, Usio effectively terminated the Agreement with GBC on October 31, 2023, by providing Greenwich with a 30-days written notice as required by the Agreement.

On November 13, 2023, GBC filed lawsuit against Usio, alleging violations of the National Automated Clearing House Association (NACHA) rules in the State of Rhode Island Kent Superior Court. In early March of 2024, Usio filed a Motion to Dismiss for improper venue and failure to state a claim.

On May 20, 2024, Usio’s Motion to Dismiss was heard in the State of Rhode Island Kent Superior Court. The Judge did not make a ruling and is currently reviewing all materials filed in regards to this matter.

KDHM, LLC

On September 1, 2021, KDHM, LLC, an entity owned by the former owners of IMS, sued PDS Acquisition Corp, now known as Usio Output Solutions, Inc., in the 73rd District Court of Bexar County, Texas claiming a breach of the asset purchase agreement executed by the parties on December 14, 2020. The lawsuit alleges that due to a mistake, accident, or inadvertence, certain customer deposits in the amount of $317,000 were improperly transferred to us.

On September 28, 2021, we filed an answer generally denying the plaintiff’s allegations. On October 5, 2021, we filed a counterclaim and third-party petition. Therein, we allege that neither KDHM nor its principals disclosed that KDHM was not accounting for the customer deposits in accordance with GAAP. KDHM and third-party defendants, its principals Henry Minten and Thomas Dowe, affirmatively represented and warranted in section 3.1(e) of the asset purchase agreement that “[t]he Annual Financial Statements and the Interim Financial Statements have been prepared from the books and records of Seller in accordance with GAAP applied on a consistent basis.”

We also discovered that KDHM by and through its principals failed to disclose that $305,000 in additional customer deposits existed and that these deposits were not conveyed to us as required by the asset purchase agreement. KDHM, Minten and Dowe provided us with fraudulent and misleading financial statements that did not disclose these additional customer deposits. KDHM and the defendants do not dispute that these additional customer deposits existed and that they were purchased by Usio. However, despite a written representation that these funds would be returned, KDHM and its principals have held these funds hostage. Section 2.1(b)(x) of the asset purchase agreement provides that the purchased assets include “All of Seller’s deposits from its customer, including without limitation, those customer deposits listed on Schedule 2.1(b)(xi) of the Disclosure Schedules.” Finally, we discovered that KDHM did not provide us with all customer lists, which are identified as purchased assets under the agreement.

In our counterclaims and third-party petition, we have asserted causes of action for fraud, breach of contract and conversion.

On August 18, 2023, the judge granted a summary motion entitling KDHM to deposits for customer accounts that were printed and mailed prior to the acquisition, and Usio Output Solutions, Inc. was entitled to deposits for accounts that were not yet printed and printed but not yet mailed prior to the acquisition. Usio has requested a reconsideration of the motion, as it does not consider that deposits are only owed to KDHM if they were earned and offset against accounts receivable.

On March 4, 2024, the court held a hearing on KDHM’s Supplemental Rule 166(G) Motion and the court granted the motion in favor of KDHM. However, Usio believes the court erred in granting the motion and filed a motion for reconsideration on March 19, 2024.

On March 28, 2024, the court heard Usio’s Motion for Reconsideration of Order Granting Plaintiff’s Supplemental Rule 166(g). On May 2, 2024, the court denied Usio’s motion. On July 12, 2024, we filed an appeal on the lower court's decision, which is pending review.

We believe that plaintiff's claims contradict the express terms of the asset purchase agreement, and we intend to vigorously defend this matter. As a result of this post-sale dispute, we subsequently discovered that KDHM, LLC and its principals made certain misrepresentations and breached the terms of the asset purchase agreement.

Other proceedings

Aside from these proceedings, the Company may be involved in legal matters arising in the ordinary course of business from time to time. While we believe that such matters are currently not material, there can be no assurance that matters arising in the ordinary course of business for which we are or could become involved in litigation will not have a material adverse effect on our business, financial condition, or results of operations.

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD-LOOKING STATEMENTS DISCLAIMER

This Quarterly Report on Form 10-Q (this "quarterly report" or this "report") contains forward-looking statements that involve risks and uncertainties. If used in this report, the words "will," "anticipate," "believe," "estimate," "intend," and other words or phrases of similar import are intended to identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including the risks described in the 2023 Annual Report and other reports we file with the Commission. Although we believe the expectations reflected in the forward-looking statements are reasonable, they relate only to events as of the date on which the statements are made. We do not intend to update any of the forward-looking statements after the date of this report to conform these statements to actual results or to changes in our expectations, except as required by law.

This discussion and analysis should be read in conjunction with the unaudited interim condensed consolidated financial statements and the notes thereto included in this report, and the 2023 Annual Report, including the audited consolidated financial statements and the notes contained therein.

Overview

As a cloud-based, Fintech payment processor, we serve multiple industry verticals with technology that facilitates payment acceptance and funds disbursement in a single, full-stack ecosystem. We provide payment acceptance through multiple payment methods including: payment facilitation, prepaid card and electronic billing products and services to businesses, merchants and consumers. We seek to grow our business both organically through the continued development and enhancement of our products and services and through acquisitions of new products and services. We will continue to look for opportunities (both internally and externally) to enhance our offerings to meet customer demands as they arise.

Since 1998, Usio has entered a number of market verticals within the payments industry in order to satisfy the growing payment needs of consumers and merchants across the United States. Beginning with our Electronic Bill Presentment and Payment, or EBPP, product that launched the Company, we entered into the electronic funds transfer space through the ACH network, developing ancillary and complementary products such as PINless debit in 2016, and Remotely Created Checks, or RCC, account validation, and account inquiry in 2019. These supplementary product options offer customers access to faster and more convenient payment options and tools to improve operating efficiencies. Further, our credit card payment offering was expanded in 2017 with the development of Payment Facilitation, or PayFac, that utilizes our unique technology that allows for instant enrollment of merchants and combined our suite of payment options into an integrated platform for merchants and customers to utilize.

Through our innovative Prepaid Debit Card platform, we offer a variety of prepaid card products such as reloadable, incentive, promotional and corporate card programs. Combined with our printing and mailing services, through the acquisition of IMS in December of 2020, we can satisfy the diverse requirements of customer needs with physical and virtual document creation and distribution, including traditional paper checks. Our Consumer Choice product developed and debuted in 2022 that provides flexible ways to initiate a variety of payment distributions through a multitude of payment methods including physical prepaid and virtual cards, ACH, paper checks, real-time PINless debit and others. This offering allows us a superior opportunity to increase our cross-selling efforts through all of our payment methods.

With the growing need for faster payment methods, we continue to invest in technology that can help us further expand our suite of payment technology. With the rise of Real Time Payments, or RTP, we began expansion into this market vertical in 2023, which serves as an alternative to ACH payments. As well, we continue to enhance our existing product offerings, with improvements in reporting, data management, fraud and risk monitoring, ease of access, and accelerations in client onboarding and implementation times. With our transition to a cloud-based platform, our speed, security, and scalability in payment processing is further expanded, allowing us to seamlessly grow as the market demands.

Payment Acceptance. We provide integrated electronic payment processing services to merchants and businesses, including credit, and debit card-based processing services and electronic funds transfer via the ACH network. The ACH network is a nationwide electronic funds transfer system that is regulated by the Federal Reserve and the National Automatic Clearing House Association, or NACHA, the electronic payments association, and provides for the clearing of electronic payments between participating financial institutions. Our ACH processing services enable merchants or businesses to both disburse and collect funds electronically using e-checks instead of traditional paper checks. An e-check is an electronic debit to a bank checking account that is initiated at the point-of-sale, on the Internet, over the telephone, or via a bill payment sent through the mail via a physical check. E-checks are processed using the ACH network. We are one of nine companies that hold the prestigious NACHA certification for Third-Party Senders and were the second company to receive the certification and are the most tenured to hold the certification.

Our payment acceptance services are delivered in a variety of forms and situations. For example, our capabilities allow merchants to convert a paper check to an e-check or receive card authorization at the point-of-sale, allow our merchants’ respective customer service representatives to take e-check or card payments from their consumers by telephone, and enable their consumers to make e-check or card payments directly through the use of a website or by calling an interactive voice response telephone system.

Similarly, our PINless debit product allows merchants to debit and credit accounts in real-time.

Card-Based Services. Our card-based processing services enable merchants to process both traditional card-present, tap-and-pay, or "swipe" transactions, as well as card-not-present transactions. A traditional card-present transaction occurs whenever a card holder physically presents a credit or debit card to a merchant at the point-of-sale. A card-not-present transaction occurs whenever the customer does not physically present a payment card at the point-of-sale and may occur over the Internet, mail, or telephone. A tap-and-pay transaction occurs whenever a consumer taps their phone on a physical terminal utilizing third party wallet services like Apple Pay®, Samsung Pay™ and Google Pay™.

Payment Facilitation. Following the completion of the Singular Payments acquisition in 2017, we launched our payment facilitation, or PayFac, platform called "PayFac-in-a-Box" in late 2018 targeting partnership opportunities with app and software developers in bill-centric verticals, such as legal, healthcare, property management, utilities and insurance. The PayFac-in-a-Box platform 'integration layer' offers a simple integration experience for technology companies who are looking to monetize payments within an existing base of downstream clients. The added value of offering our integration partners access to real-time merchant enrollment, credit card, debit card, ACH and prepaid card issuance capabilities through a single vendor partner relationship in face-to-face, mobile and virtual payment acceptance environments provides a true single channel commerce experience through an application programming interface, or API.

Prepaid and Incentive Card Services. Through our December 2014 acquisition of the assets of Akimbo Financial, Inc., we added a highly talented technical staff of industry subject matter experts and an innovative cardholder service platform including cardholder web and mobile applications and launched what is now our UsioCard business. As a result of this acquisition, through our subsidiary, FiCentive, Inc., we offer customizable prepaid cards which companies use for expense management, incentives, refunds, claims and disbursements, as well as unique forms of compensation such as per diem payments, government disbursements, and similar payments. This comprehensive money disbursement platform allows businesses to pay their contractors, employees, or other recipients by choosing among a prepaid debit Mastercard, real-time deposit to a checking account, traditional ACH, direct deposit or paper check. These cardholder web and mobile applications have been fully integrated into FiCentive’s prepaid card core processor, and now support all program types and brands offered by FiCentive and its clients.

As part of our Prepaid card-based processing services, we develop and manage a variety of Mastercard-branded prepaid card program types, including consumer reloadable, consumer gift, incentive, promotional, general and government disbursement and corporate expense cards. We also offer prepaid cards to consumers for use as a tool to stay on budget, manage allowances and share money with family and friends. Our UsioCard platform supports Apple Pay®, Samsung Pay™ and Google Pay™.

In our over 20+year history, we have created a loyal customer base that relies on us for our convenient, secure, innovative and adaptive services and technology, and we have built long-standing and valuable relationships with premier banking institutions such as Fifth Third Bank, Sunrise Bank, TransPecos and others.

Electronic Billing. On December 15, 2020, we entered into the business of electronic bill presentment, document composition, document decomposition and printing and mailing services serving hundreds of customers representing a wide range of industry verticals, including utilities and financial institutions through the acquisition of IMS. This product offering provides an outsourced solution for document design, print, and electronic delivery to potential customers and entities looking to reduce postage costs and increase efficiencies. This acquisition increased our ability to grow new revenue streams and allowed us to reenter the electronic bill presentment and payment revenue stream. The success of this new business line depends on our ability to realize the anticipated growth opportunities; we cannot provide any assurance that we will be able to realize these opportunities.

Summary of Results

We believe that our success will continue to depend in large part on our ability to (a) grow revenues, (b) manage our selling, general, and administrative expenses, (c) add quality customers to our client base, (d) meet evolving customer requirements, (e) adapt to technological changes in an emerging market, and (f) assimilate current and future acquisitions of companies and customer portfolios. We will continue to invest in our sales force and technology platforms to drive revenue growth. In particular, we are focused on growing our ACH merchants, adding new software integrators, growing our electronic bill presentment, document composition, document decomposition, printing and mailing services business while providing incremental services to existing merchants. In addition to our near-term growth opportunities, we are focused on leveraging and optimizing the infrastructure of our business allowing expansion of our payment processing and mail and printing capabilities without significantly increasing our operating costs. We continue to seek ways to grow revenue, and net new client implementations and onboards occur regularly due to our ability to address the needs of our market.