Mount Logan Capital Inc. (CBOE: MLC) (“Mount Logan,” “our,” “we,”

or the “Company”) is pleased to announce that it has agreed to

purchase a minority stake in Runway Growth Capital LLC (“Runway”),

a leading provider of growth loans to both venture and

non-venture-backed companies. Runway is the investment adviser to

investment funds, including Runway Growth Finance Corp. (Nasdaq:

RWAY) (“Runway Growth Finance”), a business development company,

and other private funds. All amounts are stated in United States

dollars, unless otherwise indicated.

Key Commentary

- Runway, a leading provider

of growth loans to both venture and non-venture-backed companies

seeking an alternative to raising equity, and BC

Partners Credit, the $8 billion credit arm of BC Partners, an

approximately $40 billion AUM alternative investment firm, today

announced a definitive agreement whereby BC Partners Credit will

acquire a majority stake in Runway.

- Mount Logan is acquiring

the remaining minority stake in Runway in exchange for $5

million of Mount Logan common shares, alongside BC Partners and its

affiliates majority investment. There will be no changes following

the close of the transaction to the management team or day-to-day

operations of the Company. Mount Logan’s $5 million indirect

interest in Runway will be satisfied through the issuance of common

shares of Mount Logan to certain selling members of Runway, at a

price per share to be determined upon closing of the offering based

on the 20-day volume weighted average price of the common shares of

Mount Logan prior to the date thereof, subject to the approval of

the Cboe Canada.

- Mount Logan expected to

benefit significantly from access to Runway’s differentiated

private credit investing capabilities, specifically

focused on venture and non-venture backed growth

companies. The transaction further bolsters Mount

Logan’s portfolio of credit products.

- Mount Logan looks forward

to working closely with BC Partners Credit and Runway’s management

and investment teams to capitalize on the opportunities available

in the North American credit markets.

- Runway Growth Capital LLC

is expected to remain the investment advisor to its managed

investment funds, including Runway Growth Finance Corp.

(Nasdaq: RWAY) (“Runway Growth Finance”), a business

development company, and other private funds.

- The closing of the

transaction, which is expected to occur in the fourth quarter of

2024, is subject to customary closing conditions,

including approval of the new investment advisory agreement with

Runway by Runway Growth Finance’s stockholders, the terms of which

are expected to remain the same as the existing investment advisory

agreement. The Runway Growth Finance Board of Directors unanimously

recommended that Runway Growth Finance's stockholders approve the

new investment advisory agreement, under which Runway will continue

in its capacity as the Company's investment adviser. Senior

management of Runway Growth Capital LLC has agreed to vote their

shares in favor of the transaction.

- Wildeboer Dellelce LLP is acting as

Canadian legal counsel to Mount Logan. Simpson Thacher &

Bartlett LLP is acting as legal counsel to BC Partners. Oppenheimer

& Co. Inc. is acting as exclusive financial advisor to Runway

Growth Capital LLC. Wachtell, Lipton, Rosen & Katz is acting as

legal counsel to Runway Growth Capital LLC and Eversheds Sutherland

(US) LLP is acting as legal counsel to the independent directors of

Runway Growth Finance.

Management Commentary

- Ted Goldthorpe, Chief

Executive Officer and Chairman of Mount Logan, said,

“David and the team at Runway have built one of the most

well-respected, pure-play late- and growth-stage lending platforms

in venture lending, and we are extremely excited to work with them

to build on their strong momentum. We see incredibly compelling

opportunities for Runway to create value for investors and

borrowers under the Mount Logan and BC Partners Credit umbrellas.

We see tremendous benefits for Mount Logan investors from the

strategic alignment with the Runway team, expanding our credit

investment expertise and ability to increase our products offered

to our target markets, and moving Mount Logan another step closer

to operating as a fully diversified Private Credit manager.”

- David Spreng, Chief

Executive Officer and Founder of Runway, said, “This

transaction will deliver increased value for both investors and

borrowers in the near- and long-term as we join the BC Partners

platform. We believe strongly in the benefits of combining our

expertise with the capabilities of the BC Partners platform and

Mount Logan, a growing North American asset management and

insurance solutions business. We see strategic long-term value in

broadening the investor universe for our venture lending product

across institutional, retail and insurance pockets of capital. We

are excited about delivering to our investors the increased

benefits from greater exposure and access to a larger number of

investment opportunities, additional diversification and the

potential for improved returns, which will accrue to the benefit of

all stakeholders.”

About Mount Logan Capital

Inc.

Mount Logan Capital Inc. is an alternative asset

management and insurance solutions company that is focused on

public and private debt securities in the North American market and

the reinsurance of annuity products primarily through its wholly

owned subsidiaries, Mount Logan Management LLC and Ability

Insurance Company (“Ability”), respectively. The Company also

actively sources, evaluates, underwrites, manages, monitors and

primarily invests in loans, debt securities, and other

credit-oriented instruments that present attractive risk-adjusted

returns and present low risk of principal impairment through the

credit cycle.

Ability is a Nebraska domiciled insurer and

reinsurer of long-term care policies and annuity products acquired

by Mount Logan in the fourth quarter of fiscal year 2021. Ability

is unique in the insurance industry in that its long-term care

portfolio’s morbidity risk has been largely reinsured to third

parties, and Ability is also no longer insuring or re-insuring new

long-term care risk.

About BC Partners & BC Partners

Credit

BC Partners is a leading international

investment firm in private equity, private debt, and real estate

strategies. BC Partners Credit was launched in February 2017, with

a focus on identifying attractive credit opportunities in any

market environment, often in complex market segments. The platform

leverages the broader firm's deep industry and operating resources

to provide flexible financing solutions to middle-market companies

across Business Services, Industrials, Healthcare and other select

sectors. For further information, visit

www.bcpartners.com/credit-strategy.

About Runway Growth Capital

LLC

Runway Growth Capital LLC is the investment

adviser to investment funds, including Runway Growth Finance Corp.

(Nasdaq: RWAY), a business development company, and other private

funds, which are lenders of growth capital to companies seeking an

alternative to raising equity. Led by industry veteran David

Spreng, these funds provide senior term loans of a target of $30

million to $150 million to fast-growing companies based in the

United States and Canada. For more information on Runway Growth

Capital LLC and its platform, please visit our website at

www.runwaygrowth.com.

About Runway Growth Finance

Corp.

Runway Growth Finance is a growing specialty

finance company focused on providing flexible capital solutions to

late- and growth-stage companies seeking an alternative to raising

equity. Runway Growth Finance is a closed-end investment fund that

has elected to be regulated as a business development company under

the Investment Company Act of 1940. Runway Growth Finance is

externally managed by Runway Growth Capital LLC, an established

registered investment adviser that was formed in 2015 and led by

industry veteran David Spreng. For more information, please

visit www.runwaygrowth.com.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains forward-looking

statements and information within the meaning of applicable

securities legislation. Forward-looking statements can be

identified by the expressions "seeks", "expects", "believes",

"estimates", "will", "target" and similar expressions. The

forward-looking statements are not historical facts but reflect the

current expectations of the Company regarding future results or

events and are based on information currently available to it.

Certain material factors and assumptions were applied in providing

these forward-looking statements. The forward-looking statements

discussed in this release include, but are not limited to,

statements relating to the Company’s business strategy, model,

approach and future activities; portfolio composition, size and

performance, asset management activities and related income,

capital raising activities, future credit opportunities of the

Company, portfolio realizations, the protection of stakeholder

value, the expansion of the Company’s loan portfolio, including

through its investment in Runway, synergies to be achieved by both

the Company and Runway through the Company’s strategic minority

investment, any future growth and expansion of each of both the

Company and Runway, any change in earnings potential for the

Company as a result of any growth of Runway, the business and

future activities and prospects of Runway and the Company and the

approval of the Cboe for the issuance of common shares of the

Company to the selling members of Runway. All forward-looking

statements in this press release are qualified by these cautionary

statements. The Company believes that the expectations reflected in

forward-looking statements are based upon reasonable assumptions;

however, the Company can give no assurance that the actual results

or developments will be realized by certain specified dates or at

all. These forward-looking statements are subject to a number of

risks and uncertainties that could cause actual results or events

to differ materially from current expectations, including that the

expected synergies of the investment in Runway may not be realized

as expected; the risk that each of the Company and Runway may

require a significant investment of capital and other resources in

order to expand and grow their respective businesses; the Company

has a limited operating history with respect to an asset management

oriented business model and the matters discussed under "Risk

Factors" in the most recently filed annual information form and

management discussion and analysis for the Company. Readers,

therefore, should not place undue reliance on any such

forward-looking statements. Further, a forward-looking statement

speaks only as of the date on which such statement is made. The

Company undertakes no obligation to publicly update any such

statement or to reflect new information or the occurrence of future

events or circumstances except as required by securities laws.

These forward-looking statements are made as of the date of this

press release.

This press release is not, and under no

circumstances is it to be construed as, a prospectus or an

advertisement and the communication of this release is not, and

under no circumstances is it to be construed as, an offer to sell

or an offer to purchase any securities in the Company or in any

fund or other investment vehicle. This press release is not

intended for U.S. persons. The Company’s shares are not registered

under the U.S. Securities Act of 1933, as amended, and the Company

is not registered under the U.S. Investment Company Act of 1940

(the “1940 Act”). U.S. persons are not permitted to purchase the

Company’s shares absent an applicable exemption from registration

under each of these Acts. In addition, the number of investors in

the United States, or which are U.S. persons or purchasing for the

account or benefit of U.S. persons, will be limited to such number

as is required to comply with an available exemption from the

registration requirements of the 1940 Act.

Contacts:Mount Logan Capital

Inc.

365 Bay Street, Suite 800Toronto, ON M5H 2V1

Nikita KlassenChief Financial

OfficerNikita.Klassen@mountlogancapital.ca

RunwayInvestors:Alex JorgensenProsek

Partnersrway@prosek.com

Thomas B. RatermanChief Financial Officer and Chief Operating

Officertr@runwaygrowth.com

Media: Josh ClarksonProsek Partnersrway@prosek.com

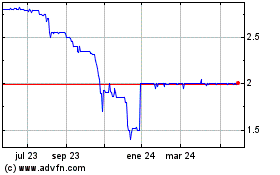

Mount Logan Capital (NEO:MLC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

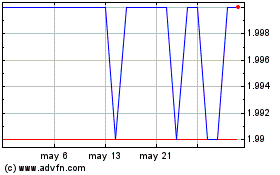

Mount Logan Capital (NEO:MLC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025