Mount Logan Capital Inc. Expands Corporate Credit Facility In Support of Key Business Initiatives

17 Diciembre 2024 - 8:07AM

Mount Logan Capital Inc. (Cboe Canada: MLC) (“Mount Logan” or the

“Company”) announced today that its wholly-owned subsidiary, MLC US

Holdings LLC (“MLC US Holdings”), as Borrower, has entered into an

amendment to its existing credit agreement (the “Fourth Amendment”)

to upsize the facility by approximately $13.0 million, while

amending the facility to, among other things, incorporate a pricing

step-down mechanism as the business continues to perform, which is

expected to reduce Mount Logan’s cost of debt. The Fourth Amendment

also provides for additional distribution capacity from MLC US

Holdings to Mount Logan to support key business initiatives. The

net new proceeds will enable Mount Logan to further invest in its

two key business segments. Proceeds will also be used for general

corporate purposes and paying related transaction fees and

expenses. The outstanding principal amount and accrued but unpaid

interest in respect of the credit facility will become payable on

August 20, 2027, subject to certain adjustments pursuant to the

credit agreement.

Ted Goldthorpe, Chief Executive Officer and

Chairman of Mount Logan, commented, “The opportunistic upsize and

amendment to our credit facility reflects Mount Logan’s strong

financial performance following significant investment into the

business. The incremental proceeds provide Mount Logan flexibility

to further invest into our two synergistic business segments, asset

management and insurance. The transaction provides us additional

liquidity for key business initiatives with a clear pathway to

reducing our cost of debt as our business continues to perform. We

are incredibly appreciative of our financing partner, who has been

critical to driving Mount Logan’s growth story since we established

the credit facility in August 2021.”

As collateral security for its obligations under

the Credit Agreement, MLC US Holdings has granted in favour of the

lenders a security interest in all of the assets of MLC US

Holdings. In addition, Mount Logan has guaranteed the obligations

of MLC US Holdings under the Credit Agreement in favour of the

lender. MLC US Holdings is the holding company for Mount Logan’s US

asset management business.

About Mount Logan Capital Inc.

Mount Logan Capital Inc. is an alternative asset

management and insurance solutions company that is focused on

public and private debt securities in the North American market and

the reinsurance of annuity products, primarily through its

wholly-owned subsidiaries Mount Logan Management LLC (“ML

Management”) and Ability Insurance Company (“Ability”),

respectively. The Company also actively sources, evaluates,

underwrites, manages, monitors and primarily invests in loans, debt

securities, and other credit-oriented instruments that present

attractive risk-adjusted returns and present low risk of principal

impairment through the credit cycle.

Ability is a Nebraska domiciled insurer and

reinsurer of long-term care policies acquired by Mount Logan in the

fourth quarter of fiscal year 2021. Ability is unique in the

insurance industry in that its long-term care portfolio’s morbidity

risk has been largely re-insured to third parties, and Ability is

no longer insuring or re-insuring new long-term care risk.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking

statements and information within the meaning of applicable

securities legislation. Forward-looking statements can be

identified by the expressions “seeks”, “expects”, “believes”,

“estimates”, “will”, “target” and similar expressions. The

forward-looking statements are not historical facts but reflect the

current expectations of the Company regarding future results or

events and are based on information currently available to it.

Certain material factors and assumptions were applied in providing

these forward-looking statements. The forward-looking statements

discussed in this release include, but are not limited to,

statements relating to MLC US Holdings’ borrowings pursuant to the

credit agreement, MLC US Holdings’ and Mount Logan’s planned use of

proceeds from the Fourth Amendment and related distribution,

expected reduction in Mount Logan’s cost of debt, and the Company’s

business strategy, model, approach and future activities. All

forward-looking statements in this press release are qualified by

these cautionary statements. The Company believes that the

expectations reflected in forward-looking statements are based upon

reasonable assumptions; however, the Company can give no assurance

that the actual results or developments will be realized by certain

specified dates or at all. These forward-looking statements are

subject to a number of risks and uncertainties that could cause

actual results or events to differ materially from current

expectations, including the matters discussed under “Risks Factors”

in the most recently filed annual information form and management

discussion and analysis for the Company. Readers, therefore, should

not place undue reliance on any such forward-looking statements.

Further, a forward-looking statement speaks only as of the date on

which such statement is made. The Company undertakes no obligation

to publicly update any such statement or to reflect new information

or the occurrence of future events or circumstances except as

required by securities laws. These forward-looking statements are

made as of the date of this press release.

This press release is not, and under no

circumstances is it to be construed as, a prospectus or an

advertisement and the communication of this release is not, and

under no circumstances is it to be construed as, an offer to sell

or an offer to purchase any securities in the Company or in any

fund or other investment vehicle. This press release is not

intended for U.S. persons. The Company’s shares are not and will

not be registered under the U.S. Securities Act of 1933, as

amended, and the Company is not and will not be registered under

the U.S. Investment Company Act of 1940 (the “1940 Act”). U.S.

persons are not permitted to purchase the Company’s shares absent

an applicable exemption from registration under each of these Acts.

In addition, the number of investors in the United States, or which

are U.S. persons or purchasing for the account or benefit of U.S.

persons, will be limited to such number as is required to comply

with an available exemption from the registration requirements of

the 1940 Act.

Contacts:Mount Logan Capital

Inc.365 Bay Street, Suite 800Toronto, ON M5H

2V1info@mountlogancapital.ca

Nikita KlassenChief Financial

OfficerNikita.Klassen@mountlogancapital.ca

Scott ChanInvestor RelationsScott.Chan@mountlogan.com

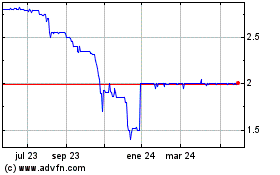

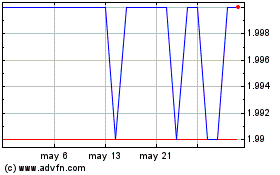

Mount Logan Capital (NEO:MLC)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Mount Logan Capital (NEO:MLC)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025