AMERICAN FINANCIAL GROUP INC false 0001042046 0001042046 2024-08-06 2024-08-06 0001042046 us-gaap:CommonStockMember 2024-08-06 2024-08-06 0001042046 afg:Five875SubordinatedDebenturesDueMarch302059Member 2024-08-06 2024-08-06 0001042046 afg:Five125SubordinatedDebenturesDueDecember152059Member 2024-08-06 2024-08-06 0001042046 afg:Five625SubordinatedDebenturesDueJune12060Member 2024-08-06 2024-08-06 0001042046 afg:Four5SubordinatedDebenturesDueSeptember152060Member 2024-08-06 2024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

AMERICAN FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Ohio |

|

1-13653 |

|

31-1544320 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 301 East Fourth Street, Cincinnati, OH |

|

45202 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 513-579-2121

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: |

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

AFG |

|

New York Stock Exchange |

| 5.875% Subordinated Debentures due March 30, 2059 |

|

AFGB |

|

New York Stock Exchange |

| 5.125% Subordinated Debentures due December 15, 2059 |

|

AFGC |

|

New York Stock Exchange |

| 5.625% Subordinated Debentures due June 1, 2060 |

|

AFGD |

|

New York Stock Exchange |

| 4.5% Subordinated Debentures due September 15, 2060 |

|

AFGE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial Information

| Item 2.02 |

Results Of Operations And Financial Condition. |

Reference is made to the press release of American Financial Group, Inc. (the “Company”) relating to the announcement of the Company’s results of operations for the second quarter of 2024 and the availability of the Investor Supplement on the Company’s website. The press release was issued on August 6, 2024. A copy of the press release is furnished as Exhibit 99.1 and a copy of the Investor Supplement is furnished as Exhibit 99.2 and are incorporated herein by reference.

The information under Item 2.02 and in Exhibits 99.1 and 99.2 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Section 9 - Financial Statements and Exhibits

| Item 9.01 |

Financial Statements and Exhibits. |

| |

(a) |

Financial statements of business acquired. Not applicable. |

| |

(b) |

Pro forma financial information. Not applicable. |

| |

(c) |

Shell company transactions. Not applicable |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN FINANCIAL GROUP, INC. |

|

|

|

|

| Date: August 7, 2024 |

|

|

|

By: |

|

/s/ Joseph C. Alter |

|

|

|

|

|

|

Joseph C. Alter |

|

|

|

|

|

|

Vice President |

3

Exhibit 99.1

American Financial Group, Inc. Announces Second Quarter Results

| |

• |

|

Net earnings per share of $2.49; includes $0.07 per share loss from

non-core items |

| |

• |

|

Second quarter core net operating earnings per share of $2.56, 8% higher than the comparable period

|

| |

• |

|

Second quarter annualized ROE of 18.0%; core operating ROE of 18.5% |

| |

• |

|

Second quarter Specialty calendar year combined ratio improved 1.4 points YOY to 90.5%

|

| |

• |

|

Overall average renewal rate increases excluding workers’ compensation of 8% |

CINCINNATI – August 6, 2024 – American Financial Group, Inc. (NYSE: AFG) today reported 2024 second quarter net earnings of $209 million

($2.49 per share) compared to $200 million ($2.34 per share) for the 2023 second quarter. Net earnings for the 2024 second quarter included after-tax non-core

losses of $6 million ($0.07 per share loss). By comparison, net earnings in the 2023 second quarter included net after-tax non-core items that reduced net income by

$2 million ($0.04 per share loss). Annualized return on equity was 18.0% and 17.9% for the second quarters of 2024 and 2023, respectively, and is calculated excluding accumulated other comprehensive income (AOCI). Other details may be found in

the table on the following page.

Core net operating earnings were $215 million ($2.56 per share) for the 2024 second quarter, compared to

$202 million ($2.38 per share) in the 2023 second quarter, reflecting meaningfully higher P&C underwriting profit. Additional details for the 2024 and 2023 second quarters may be found in the table below. Core net operating earnings for the

second quarters of 2024 and 2023 generated annualized returns on equity of 18.5% and 18.2%, respectively, which is calculated excluding AOCI.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

| Components of Pretax Core Operating Earnings |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| In millions, except per share amounts |

|

Before Impact of

Alternative Investments |

|

|

Alternative

Investments |

|

|

Core Net Operating

Earnings, as reported |

|

| P&C Pretax Core Operating Earnings |

|

$ |

286 |

|

|

$ |

244 |

|

|

$ |

33 |

|

|

$ |

55 |

|

|

$ |

319 |

|

|

$ |

299 |

|

| Other expenses |

|

|

(27 |

) |

|

|

(22 |

) |

|

|

— |

|

|

|

— |

|

|

|

(27 |

) |

|

|

(22 |

) |

| Holding company interest expense |

|

|

(19 |

) |

|

|

(19 |

) |

|

|

— |

|

|

|

— |

|

|

|

(19 |

) |

|

|

(19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pretax Core Operating Earnings |

|

|

240 |

|

|

|

203 |

|

|

|

33 |

|

|

|

55 |

|

|

|

273 |

|

|

|

258 |

|

| Related provision for income taxes |

|

|

51 |

|

|

|

44 |

|

|

|

7 |

|

|

|

12 |

|

|

|

58 |

|

|

|

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core Net Operating Earnings |

|

$ |

189 |

|

|

$ |

159 |

|

|

$ |

26 |

|

|

$ |

43 |

|

|

$ |

215 |

|

|

$ |

202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core Operating Earnings Per Share |

|

$ |

2.25 |

|

|

$ |

1.87 |

|

|

$ |

0.31 |

|

|

$ |

0.51 |

|

|

$ |

2.56 |

|

|

$ |

2.38 |

|

| Weighted Avg Diluted Shares Outstanding |

|

|

83.9 |

|

|

|

85.2 |

|

|

|

83.9 |

|

|

|

85.2 |

|

|

|

83.9 |

|

|

|

85.2 |

|

AFG’s book value per share was $52.25 at June 30, 2024. AFG paid cash dividends of $0.71 per share during the second

quarter. For the three months ended June 30, 2024, AFG’s growth in book value per share plus dividends was 4.7% and year to date, growth in book value per share plus dividends was 10.3%.

Book value per share excluding AOCI was $56.19 at June 30, 2024. For the three months ended June 30, 2024, AFG’s growth in book value per share

excluding AOCI plus dividends was 4.7%. Year to date, growth in book value per share excluding AOCI plus dividends was 9.9%.

AFG’s net earnings,

determined in accordance with U.S. generally accepted accounting principles (GAAP), include certain items that may not be indicative of its ongoing core operations. The table below identifies such items and reconciles net earnings to core net

operating earnings, a non-GAAP financial measure.

Page 1

AFG believes that its core net operating earnings provides management, financial analysts, ratings agencies, and investors with an understanding of the results from the ongoing operations of the

Company by excluding the impact of net realized gains and losses and other items that are not necessarily indicative of operating trends. AFG’s management uses core net operating earnings to evaluate financial performance against historical

results because it believes this provides a more comparable measure of its continuing business. Core net operating earnings is also used by AFG’s management as a basis for strategic planning and forecasting.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

| In millions, except per share amounts |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Components of net earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core operating earnings before income taxes |

|

$ |

273 |

|

|

$ |

258 |

|

|

$ |

563 |

|

|

$ |

566 |

|

| Pretax non-core items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Realized gains (losses) on securities |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

12 |

|

|

|

(48 |

) |

| Gain (loss) on retirement of debt |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

|

|

271 |

|

|

|

255 |

|

|

|

575 |

|

|

|

519 |

|

| Provision (credit) for income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core operating earnings |

|

|

58 |

|

|

|

56 |

|

|

|

117 |

|

|

|

117 |

|

| Non-core items |

|

|

4 |

|

|

|

(1 |

) |

|

|

7 |

|

|

|

(10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total provision for income taxes |

|

|

62 |

|

|

|

55 |

|

|

|

124 |

|

|

|

107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

209 |

|

|

$ |

200 |

|

|

$ |

451 |

|

|

$ |

412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core net operating earnings(a) |

|

$ |

215 |

|

|

$ |

202 |

|

|

$ |

446 |

|

|

$ |

449 |

|

| Non-core items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Realized gains (losses) on securities |

|

|

(2 |

) |

|

|

(1 |

) |

|

|

9 |

|

|

|

(38 |

) |

| Other |

|

|

(4 |

) |

|

|

(1 |

) |

|

|

(4 |

) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

209 |

|

|

$ |

200 |

|

|

$ |

451 |

|

|

$ |

412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Components of earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core net operating earnings(a) |

|

$ |

2.56 |

|

|

$ |

2.38 |

|

|

$ |

5.32 |

|

|

$ |

5.27 |

|

| Non-core Items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Realized gains (losses) on securities |

|

|

(0.02 |

) |

|

|

(0.02 |

) |

|

|

0.11 |

|

|

|

(0.45 |

) |

| Other |

|

|

(0.05 |

) |

|

|

(0.02 |

) |

|

|

(0.05 |

) |

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net earnings per share |

|

$ |

2.49 |

|

|

$ |

2.34 |

|

|

$ |

5.38 |

|

|

$ |

4.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnote (a) is contained in the accompanying Notes to Financial Schedules at the end of this release.

Carl H. Lindner III and S. Craig Lindner, AFG’s Co-Chief Executive Officers, issued this statement: “We are

pleased to report a second quarter annualized core operating return on equity of 18.5%. Underwriting margins in our specialty P&C insurance businesses were strong, and higher interest rates increased net investment income, excluding

alternatives, by 15% year over year. These results, coupled with effective capital management and our entrepreneurial, opportunistic culture and disciplined operating philosophy enable us to continue to create value for our shareholders.

Messrs. Lindner continued: “AFG continued to have significant excess capital at June 30, 2024. Returning capital to shareholders in the form of

regular and special cash dividends and through opportunistic share repurchases is an important and effective component of our capital management strategy. In addition, our capital will be deployed into AFG’s core businesses as we identify the

potential for healthy, profitable organic growth, and opportunities to expand our specialty niche businesses through acquisitions and start-ups that meet our target return thresholds.”

Specialty Property and Casualty Insurance Operations

The Specialty P&C insurance operations generated a strong 90.5% combined ratio in the second quarter of 2024, an improvement of 1.4 points from the 91.9%

reported in the second quarter of 2023. Second quarter 2024 results include 2.3 points related to catastrophe losses, compared to 3.5 points in the 2023 second quarter. Second quarter 2024 results benefited from 2.3 points of favorable prior year

reserve development, compared to 4.0 points in the second quarter of 2023. Underwriting profit was $151 million for the 2024 second quarter compared to $123 million in the second quarter of the prior period.

Page 2

Second quarter 2024 gross and net written premiums were up 2% and 1%, respectively, when compared to the

second quarter of 2023. We continue to achieve year-over-year premium growth as a result of a combination of new business opportunities, increased exposures, and a good renewal rate environment, which was partially offset by later reporting of crop

premiums. Tempered growth in the quarter also reflects the Company’s proactive and intentional approach to managing exposure in several of our social inflation-exposed businesses.

Average renewal pricing across our P&C Group, excluding workers’ compensation, was up approximately 8% for the quarter, and up approximately 6%

overall, consistent with pricing increases achieved in the first quarter. We believe we are achieving overall renewal rate increases in excess of prospective loss ratio trends to meet or exceed targeted returns.

The Property and Transportation Group reported an underwriting profit of $39 million in the second quarter of 2024, compared to $32 million

in the second quarter of 2023. Higher year-over-year underwriting profits in our property & inland marine and crop insurance businesses were partially offset by lower underwriting profitability in our transportation businesses. Catastrophe

losses in this group were $13 million in the second quarter of 2024, compared to $15 million in the second quarter of 2023. Overall, the businesses in the Property and Transportation Group achieved a 92.9% calendar year combined ratio in

the second quarter, improving 1.3 points from the comparable period in 2023.

Second quarter 2024 gross and net written premiums in this group were both

2% higher than the comparable prior year. Year-over-year premium growth was primarily attributed to new business opportunities, a favorable rate environment and increased exposures in our commercial auto businesses. Later reporting of crop acreage,

which impacts the timing of crop premiums, more than offset additional crop premium associated with the CRS acquisition. Excluding crop, gross and net written premiums in this group grew by 7% and 5%, respectively. Overall renewal rates in this

group increased 8% on average in the second quarter of 2024, about a point lower than the pricing achieved in this group for the first quarter of 2024.

The Specialty Casualty Group achieved an excellent 85.4% calendar year combined ratio overall in the second quarter of 2024, an improvement of 1.2

points over the very strong 86.6% reported in the second quarter of 2023. Underwriting profit was $108 million in the second quarter of 2024, compared to $95 million in the second quarter of 2023. Higher year-over-year profitability in our

targeted markets and workers’ compensation businesses and improved results in several other Specialty Casualty businesses were partially offset by lower levels of favorable prior year reserve development in our executive liability business and

adverse development in our excess liability business. Catastrophe losses for this group were $5 million in the second quarter of 2024 compared to $8 million in the prior year quarter.

Second quarter 2024 gross and net written premiums increased 1% and 2%, respectively, when compared to the same prior year period. Approximately two-thirds of the businesses in this group reported year-over-year growth as a result of new business opportunities, higher rates and strong policy retention. This growth was partially offset by non-renewal of several large accounts and other underwriting actions taken in several of our targeted markets businesses. Excluding our workers’ compensation businesses, renewal rates for this group were up

approximately 7% in the second quarter, about a point lower than the first quarter. Overall renewal rates in this group including workers’ compensation were up about 5% and consistent with the first quarter of 2024.

The Specialty Financial Group reported an underwriting profit of $25 million in the second quarter of 2024, compared to $10 million in the

second quarter of 2023. The increase was primarily the result of higher underwriting profit in our financial institutions business. Catastrophe losses for this group were $17 million in the second quarter of 2024 compared to $19 million in

the prior year quarter. This group continued to achieve excellent underwriting margins and reported a combined ratio of 89.7% for the second quarter of 2024, 5.3 points better than the 95.0% reported in the comparable period in 2023.

Page 3

Second quarter 2024 gross written premiums were flat and net written premiums were up 3% in this group,

respectively, when compared to the prior year period. Growth in our financial institutions business was partially offset by a decision to pause writing of new intellectual property-related coverage in our Innovative Markets business. Renewal pricing

in this group was up approximately 6% for the quarter, about 1 point lower than the previous quarter.

Carl Lindner III stated, “Underwriting

profitability was very strong in our Specialty P&C businesses in the second quarter of 2024, and we continue to feel confident about the strength of our reserves. A continued favorable pricing environment and new business opportunities enabled

us to selectively grow our Specialty P&C businesses. Growth in net written premium was about 4% for the first six months of the year, as timing of acreage reporting by farmers and underwriting actions in a few of our businesses tempered growth

in the second quarter. We expect growth in net written premiums to be approximately 7% for the full year in 2024.”

Further details about AFG’s

Specialty P&C operations may be found in the accompanying schedules and in our Quarterly Investor Supplement, which is posted on our website.

Investments

Net Investment Income –

For the quarter ended June 30, 2024, property and casualty net investment income was approximately 1% lower than the comparable 2023 period. Excluding the impact of alternative investments, net investment income in our property and casualty

insurance operations for the three months ended June 30, 2024, increased 15% year-over-year as a result of the impact of higher interest rates and higher balances of invested assets. The annualized return on alternative investments was

approximately 5.1% for the 2024 second quarter compared to 9.6% for the prior year quarter. Earnings from alternative investments may vary from quarter to quarter based on the reported results of the underlying investments, and generally are

reported on a quarter lag. The average annual return on alternative investments over the five calendar years ended December 31, 2023, was approximately 13%.

Non-Core Net Realized Gains (Losses) – AFG recorded second quarter 2024 net realized losses on securities

of $2 million ($0.02 per share loss) after tax, which included $2 million ($0.02 per share loss) in after-tax net losses to adjust equity securities that the Company continued to own at June 30,

2024, to fair value. By comparison, AFG recorded net realized losses on securities of $1 million ($0.02 per share loss) in the comparable 2023 period.

After-tax unrealized losses related to fixed maturities were $310 million at June 30, 2024. Our portfolio

continues to be high quality, with 94% of our fixed maturity portfolio rated investment grade and 96% of our P&C fixed maturity portfolio with a National Association of Insurance Commissioners’ designation of NAIC 1 or 2, its highest two

categories.

More information about the components of our investment portfolio may be found in our Quarterly Investor Supplement, which is posted on our

website.

About American Financial Group, Inc.

American Financial Group is an insurance holding company, based in Cincinnati, Ohio. Through the operations of Great American Insurance Group, AFG is engaged

primarily in property and casualty insurance, focusing on specialized commercial products for businesses. Great American Insurance Group’s roots go back to 1872 with the founding of its flagship company, Great American Insurance Company.

Forward Looking Statements

This press release,

and any related oral statements, contains certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. All statements in this press release not dealing with

Page 4

historical results are forward-looking and are based on estimates, assumptions, and projections. Examples of such forward-looking statements include statements relating to: the Company’s

expectations concerning market and other conditions and their effect on future premiums, revenues, earnings, investment activities and the amount and timing of share repurchases or special dividends; recoverability of asset values; expected losses

and the adequacy of reserves for asbestos, environmental pollution and mass tort claims; rate changes; and improved loss experience.

Actual results

and/or financial condition could differ materially from those contained in or implied by such forward-looking statements for a variety of reasons including, but not limited to: the risks and uncertainties AFG describes in the “Risk

Factors” section of its most recent Annual Report on Form 10-K, as updated by its other reports filed with the Securities and Exchange Commission; changes in financial, political and economic conditions,

including changes in interest and inflation rates, currency fluctuations and extended economic recessions or expansions in the U.S. and/or abroad; performance of securities markets; new legislation or declines in credit quality or credit ratings

that could have a material impact on the valuation of securities in AFG’s investment portfolio; the availability of capital; changes in insurance law or regulation, including changes in statutory accounting rules, including modifications to

capital requirements; changes in the legal environment affecting AFG or its customers; tax law and accounting changes; levels of natural catastrophes and severe weather, terrorist activities (including any nuclear, biological, chemical or

radiological events), incidents of war or losses resulting from pandemics, civil unrest and other major losses; disruption caused by cyber-attacks or other technology breaches or failures by AFG or its business partners and service providers, which

could negatively impact AFG’s business and/or expose AFG to litigation; development of insurance loss reserves and establishment of other reserves, particularly with respect to amounts associated with asbestos and environmental claims;

availability of reinsurance and ability of reinsurers to pay their obligations; competitive pressures; the ability to obtain adequate rates and policy terms; changes in AFG’s credit ratings or the financial strength ratings assigned by major

ratings agencies to AFG’s operating subsidiaries; the impact of the conditions in the international financial markets and the global economy relating to AFG’s international operations; and effects on AFG’s reputation, including as a

result of environmental, social and governance matters.

The forward-looking statements herein are made only as of the date of this press release. The

Company assumes no obligation to publicly update any forward-looking statements.

Conference Call

The Company will hold a conference call to discuss 2024 second quarter results at 11:30 a.m. (ET) tomorrow, Wednesday, August 7, 2024. New, simplified

event registration and access provides two ways to access the call.

Participants should register for the call here now or any time up to and

during the time of the call, and will immediately receive the dial-in number and a unique PIN to access the call. While you may register at any time up to and during the time of the call, you are encouraged to

join the call 10 minutes prior to the start of the event.

The conference call and accompanying webcast slides will also be broadcast live over the

internet. To access the event, click the following link: https://www.afginc.com/news-and-events/event-calendar. Alternatively, you can choose Events from

the Investor Relations page at www.AFGinc.com.

A replay of the webcast will be available via the same link on our website approximately two hours

after the completion of the call.

Page 5

Contact:

Diane P. Weidner, IRC, CPA (inactive)

Vice President –

Investor & Media Relations

513-369-5713

Websites:

www.AFGinc.com

www.GreatAmericanInsuranceGroup.com

# # #

(Financial summaries follow)

This earnings release and

AFG’s Quarterly Investor Supplement are available in the Investor Relations section of AFG’s website: www.AFGinc.com.

AFG2024-15

Page 6

AMERICAN FINANCIAL GROUP, INC. AND SUBSIDIARIES

SUMMARY OF EARNINGS AND SELECTED BALANCE SHEET DATA

(In Millions, Except Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| P&C insurance net earned premiums |

|

$ |

1,585 |

|

|

$ |

1,507 |

|

|

$ |

3,131 |

|

|

$ |

2,944 |

|

| Net investment income |

|

|

188 |

|

|

|

198 |

|

|

|

386 |

|

|

|

415 |

|

| Realized gains (losses) on securities |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

12 |

|

|

|

(48 |

) |

| Income of managed investment entities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment income |

|

|

98 |

|

|

|

112 |

|

|

|

197 |

|

|

|

216 |

|

| Gain (loss) on change in fair value of assets/liabilities |

|

|

4 |

|

|

|

— |

|

|

|

14 |

|

|

|

(4 |

) |

| Other income |

|

|

27 |

|

|

|

25 |

|

|

|

66 |

|

|

|

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

1,900 |

|

|

|

1,840 |

|

|

|

3,806 |

|

|

|

3,580 |

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| P&C insurance losses & expenses |

|

|

1,443 |

|

|

|

1,390 |

|

|

|

2,858 |

|

|

|

2,683 |

|

| Interest charges on borrowed money |

|

|

19 |

|

|

|

19 |

|

|

|

38 |

|

|

|

38 |

|

| Expenses of managed investment entities |

|

|

90 |

|

|

|

103 |

|

|

|

182 |

|

|

|

198 |

|

| Other expenses |

|

|

77 |

|

|

|

73 |

|

|

|

153 |

|

|

|

142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

1,629 |

|

|

|

1,585 |

|

|

|

3,231 |

|

|

|

3,061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

|

|

271 |

|

|

|

255 |

|

|

|

575 |

|

|

|

519 |

|

| Provision for income taxes |

|

|

62 |

|

|

|

55 |

|

|

|

124 |

|

|

|

107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

209 |

|

|

$ |

200 |

|

|

$ |

451 |

|

|

$ |

412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per common share |

|

$ |

2.49 |

|

|

$ |

2.34 |

|

|

$ |

5.38 |

|

|

$ |

4.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average number of diluted shares |

|

|

83.9 |

|

|

|

85.2 |

|

|

|

83.9 |

|

|

|

85.3 |

|

|

|

|

|

|

|

|

|

|

| Selected Balance Sheet Data: |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Total cash and investments |

|

$ |

15,261 |

|

|

$ |

15,263 |

|

| Long-term debt |

|

$ |

1,475 |

|

|

$ |

1,475 |

|

| Shareholders’ equity(b) |

|

$ |

4,384 |

|

|

$ |

4,258 |

|

| Shareholders’ equity (excluding AOCI) |

|

$ |

4,715 |

|

|

$ |

4,577 |

|

| Book value per share(b) |

|

$ |

52.25 |

|

|

$ |

50.91 |

|

| Book value per share (excluding AOCI) |

|

$ |

56.19 |

|

|

$ |

54.72 |

|

| Common Shares Outstanding |

|

|

83.9 |

|

|

|

83.6 |

|

Footnote (b) is contained in the accompanying Notes to Financial Schedules at the end of this release.

Page 7

AMERICAN FINANCIAL GROUP, INC.

SPECIALTY P&C OPERATIONS

(Dollars in Millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30, |

|

|

Pct.

Change |

|

|

Six months ended

June 30, |

|

|

Pct.

Change |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

| Gross written premiums |

|

$ |

2,406 |

|

|

$ |

2,369 |

|

|

|

2 |

% |

|

$ |

4,742 |

|

|

$ |

4,524 |

|

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net written premiums |

|

$ |

1,692 |

|

|

$ |

1,667 |

|

|

|

1 |

% |

|

$ |

3,326 |

|

|

$ |

3,186 |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratios (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss & LAE ratio |

|

|

59.1 |

% |

|

|

60.2 |

% |

|

|

|

|

|

|

58.8 |

% |

|

|

58.6 |

% |

|

|

|

|

| Underwriting expense ratio |

|

|

31.4 |

% |

|

|

31.7 |

% |

|

|

|

|

|

|

31.4 |

% |

|

|

32.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Specialty Combined Ratio |

|

|

90.5 |

% |

|

|

91.9 |

% |

|

|

|

|

|

|

90.2 |

% |

|

|

90.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Combined Ratio – P&C Segment |

|

|

90.5 |

% |

|

|

91.7 |

% |

|

|

|

|

|

|

90.3 |

% |

|

|

90.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

Information:(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Written Premiums: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property & Transportation |

|

$ |

1,084 |

|

|

$ |

1,059 |

|

|

|

2 |

% |

|

$ |

2,043 |

|

|

$ |

1,931 |

|

|

|

6 |

% |

| Specialty Casualty |

|

|

1,023 |

|

|

|

1,012 |

|

|

|

1 |

% |

|

|

2,120 |

|

|

|

2,073 |

|

|

|

2 |

% |

| Specialty Financial |

|

|

299 |

|

|

|

298 |

|

|

|

— |

% |

|

|

579 |

|

|

|

520 |

|

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2,406 |

|

|

$ |

2,369 |

|

|

|

2 |

% |

|

$ |

4,742 |

|

|

$ |

4,524 |

|

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Written Premiums: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property & Transportation |

|

$ |

681 |

|

|

$ |

668 |

|

|

|

2 |

% |

|

$ |

1,272 |

|

|

$ |

1,220 |

|

|

|

4 |

% |

| Specialty Casualty |

|

|

704 |

|

|

|

693 |

|

|

|

2 |

% |

|

|

1,455 |

|

|

|

1,415 |

|

|

|

3 |

% |

| Specialty Financial |

|

|

248 |

|

|

|

240 |

|

|

|

3 |

% |

|

|

482 |

|

|

|

424 |

|

|

|

14 |

% |

| Other |

|

|

59 |

|

|

|

66 |

|

|

|

(11 |

%) |

|

|

117 |

|

|

|

127 |

|

|

|

(8 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,692 |

|

|

$ |

1,667 |

|

|

|

1 |

% |

|

$ |

3,326 |

|

|

$ |

3,186 |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Combined Ratio (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property & Transportation |

|

|

92.9 |

% |

|

|

94.2 |

% |

|

|

|

|

|

|

91.0 |

% |

|

|

92.6 |

% |

|

|

|

|

| Specialty Casualty |

|

|

85.4 |

% |

|

|

86.6 |

% |

|

|

|

|

|

|

87.7 |

% |

|

|

87.1 |

% |

|

|

|

|

| Specialty Financial |

|

|

89.7 |

% |

|

|

95.0 |

% |

|

|

|

|

|

|

88.1 |

% |

|

|

90.8 |

% |

|

|

|

|

| Aggregate Specialty Group |

|

|

90.5 |

% |

|

|

91.9 |

% |

|

|

|

|

|

|

90.2 |

% |

|

|

90.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30, |

|

|

Six months ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Reserve Development (Favorable)/Adverse: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property & Transportation |

|

$ |

(33 |

) |

|

$ |

(21 |

) |

|

$ |

(76 |

) |

|

$ |

(58 |

) |

| Specialty Casualty |

|

|

(25 |

) |

|

|

(24 |

) |

|

|

(42 |

) |

|

|

(51 |

) |

| Specialty Financial |

|

|

— |

|

|

|

(11 |

) |

|

|

6 |

|

|

|

(14 |

) |

| Other Specialty |

|

|

22 |

|

|

|

(5 |

) |

|

|

25 |

|

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Specialty Group |

|

|

(36 |

) |

|

|

(61 |

) |

|

|

(87 |

) |

|

|

(125 |

) |

| Other |

|

|

1 |

|

|

|

(1 |

) |

|

|

2 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Reserve Development |

|

$ |

(35 |

) |

|

$ |

(62 |

) |

|

$ |

(85 |

) |

|

$ |

(125 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Points on Combined Ratio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property & Transportation |

|

|

(6.2 |

) |

|

|

(3.8 |

) |

|

|

(7.2 |

) |

|

|

(5.7 |

) |

| Specialty Casualty |

|

|

(3.5 |

) |

|

|

(3.4 |

) |

|

|

(2.9 |

) |

|

|

(3.6 |

) |

| Specialty Financial |

|

|

0.1 |

|

|

|

(5.7 |

) |

|

|

1.2 |

|

|

|

(3.5 |

) |

| Aggregate Specialty Group |

|

|

(2.3 |

) |

|

|

(4.0 |

) |

|

|

(2.8 |

) |

|

|

(4.2 |

) |

| Total P&C Segment |

|

|

(2.2 |

) |

|

|

(4.2 |

) |

|

|

(2.7 |

) |

|

|

(4.3 |

) |

Footnote (c) is contained in the accompanying Notes to Financial Schedules at the end of this release.

Page 8

AMERICAN FINANCIAL GROUP, INC.

Notes to Financial Schedules

| a) |

Components of core net operating earnings (in millions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30, |

|

|

Six months ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Core Operating Earnings before Income Taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| P&C insurance segment |

|

$ |

319 |

|

|

$ |

299 |

|

|

$ |

659 |

|

|

$ |

649 |

|

| Interest and other corporate expenses |

|

|

(46 |

) |

|

|

(41 |

) |

|

|

(96 |

) |

|

|

(83 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core operating earnings before income taxes |

|

|

273 |

|

|

|

258 |

|

|

|

563 |

|

|

|

566 |

|

| Related income taxes |

|

|

58 |

|

|

|

56 |

|

|

|

117 |

|

|

|

117 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core net operating earnings |

|

$ |

215 |

|

|

$ |

202 |

|

|

$ |

446 |

|

|

$ |

449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| b) |

Shareholders’ Equity at June 30, 2024, includes ($331 million) ($3.94 per share loss) in Accumulated

Other Comprehensive Income (Loss) compared to ($319 million) ($3.81 per share loss) at December 31, 2023. |

| |

• |

|

Property & Transportation includes primarily physical damage and liability

coverage for buses and trucks and other specialty transportation niches, inland and ocean marine, agricultural-related products and other commercial property coverages. |

| |

• |

|

Specialty Casualty includes primarily excess and surplus, general liability, executive liability,

professional liability, umbrella and excess liability, specialty coverages in targeted markets, customized programs for small to mid-sized businesses and workers’ compensation insurance.

|

| |

• |

|

Specialty Financial includes risk management insurance programs for lending and leasing

institutions (including equipment leasing and collateral and lender-placed mortgage property insurance), surety and fidelity products and trade credit insurance. |

| |

• |

|

Other includes an internal reinsurance facility. |

Page 9

Exhibit 99.2 American Financial Group, Inc. Investor Supplement - Second

Quarter 2024 August 6, 2024 American Financial Group, Inc. Corporate Headquarters Great American Insurance Group Tower 301 E Fourth Street Cincinnati, OH 45202 513 579 6739

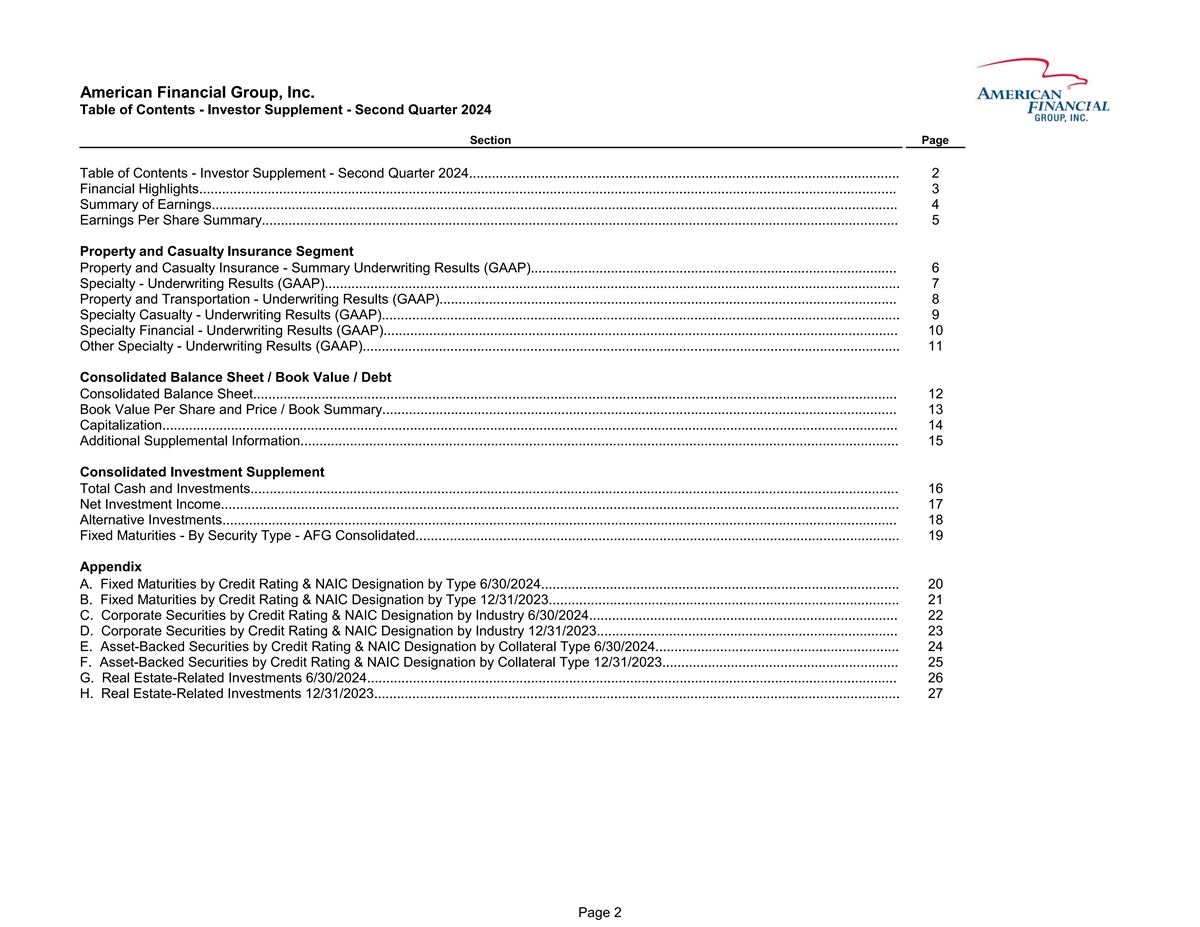

American Financial Group, Inc. Table of Contents - Investor Supplement -

Second Quarter 2024 2 Section Page Table of Contents - Investor Supplement - Second Quarter 2024................................................................................................................. 2 Financial

Highlights....................................................................................................................................................................................... 3 Summary of

Earnings.................................................................................................................................................................................... 4 Earnings Per Share

Summary....................................................................................................................................................................... 5 Property and Casualty Insurance Segment Property and Casualty Insurance

- Summary Underwriting Results (GAAP)................................................................................................ 6 Specialty - Underwriting Results

(GAAP)....................................................................................................................................................... 7 Property and Transportation - Underwriting Results

(GAAP)........................................................................................................................ 8 Specialty Casualty - Underwriting Results

(GAAP)........................................................................................................................................ 9 Specialty Financial - Underwriting Results

(GAAP)....................................................................................................................................... 10 Other Specialty - Underwriting Results

(GAAP)............................................................................................................................................. 11 Consolidated Balance Sheet / Book Value / Debt Consolidated Balance

Sheet......................................................................................................................................................................... 12 Book Value Per Share and Price / Book

Summary....................................................................................................................................... 13

Capitalization................................................................................................................................................................................................. 14 Additional Supplemental

Information............................................................................................................................................................. 15 Consolidated Investment Supplement Total Cash and

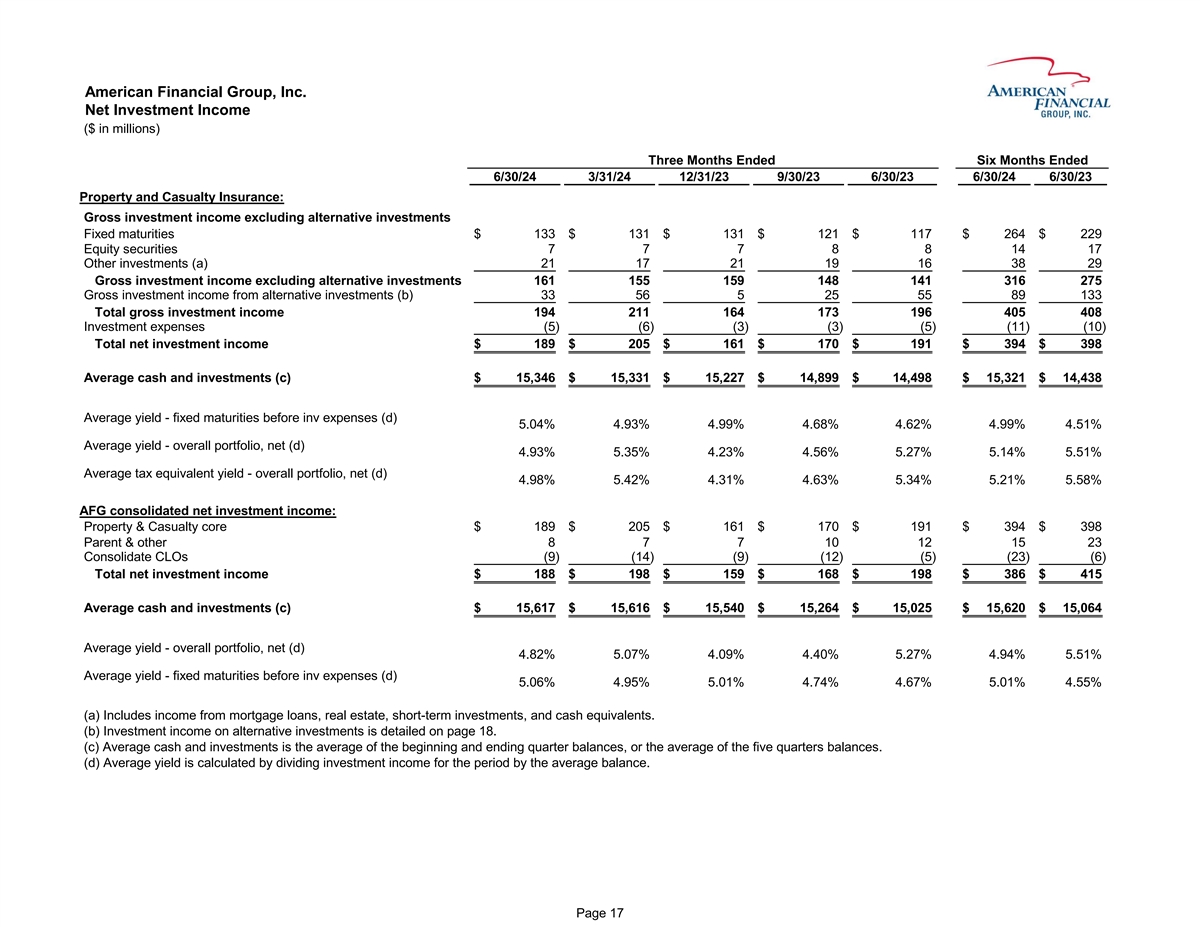

Investments.......................................................................................................................................................................... 16 Net Investment

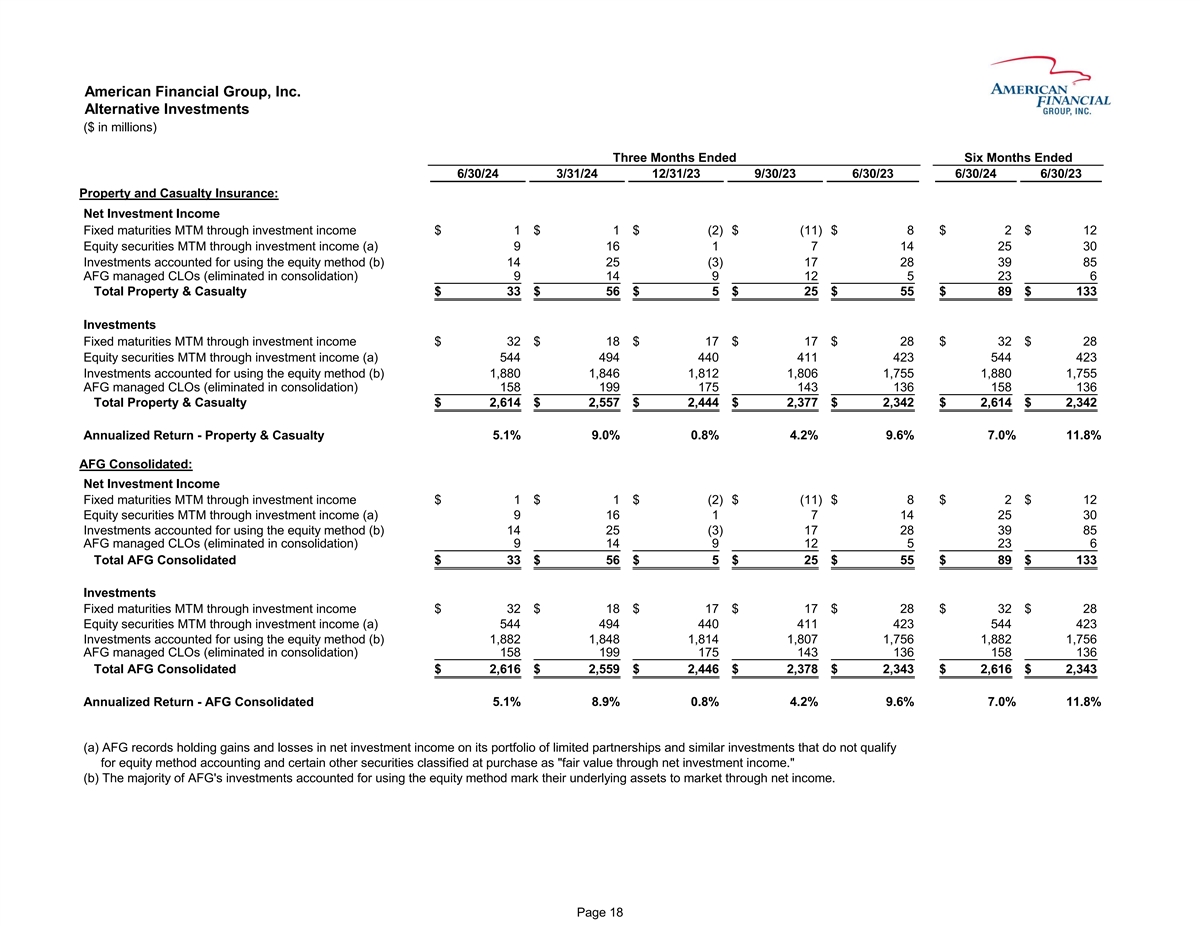

Income.................................................................................................................................................................................. 17 Alternative

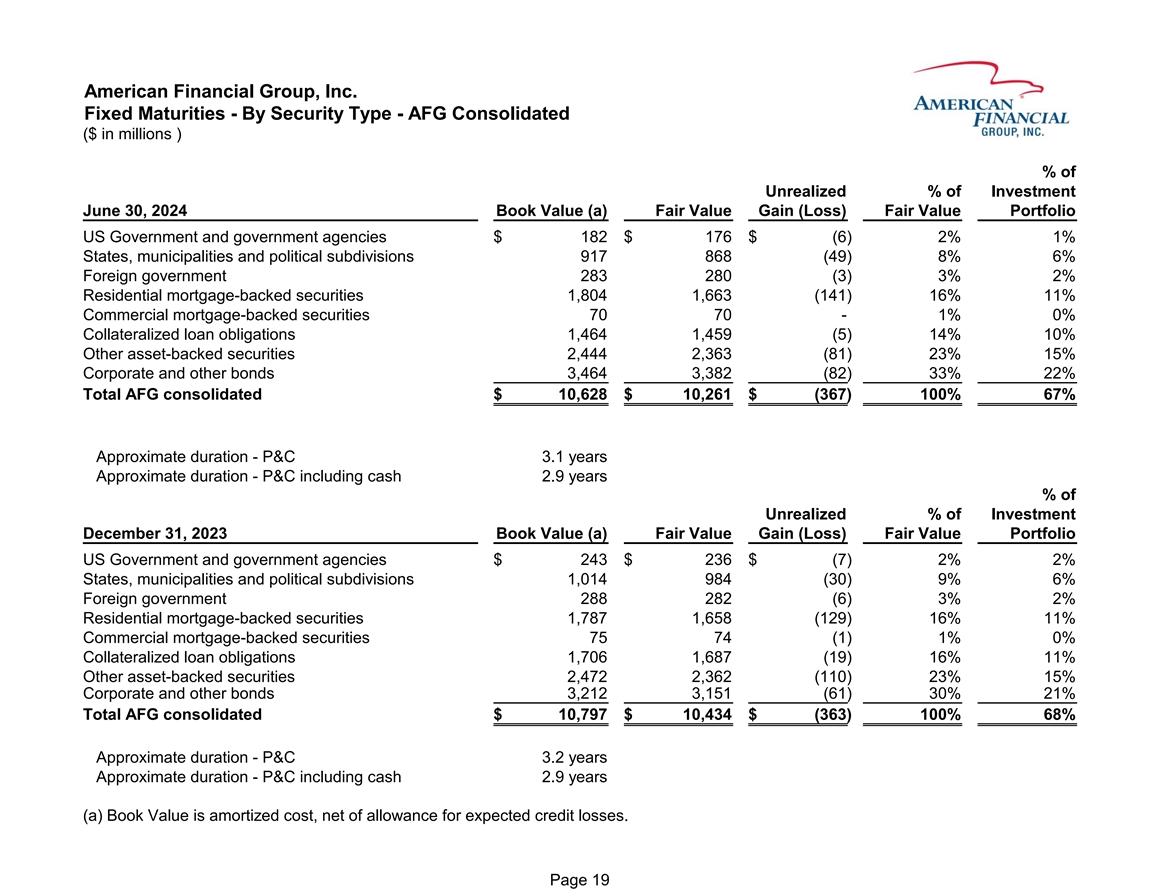

Investments................................................................................................................................................................................. 18 Fixed Maturities - By Security Type - AFG

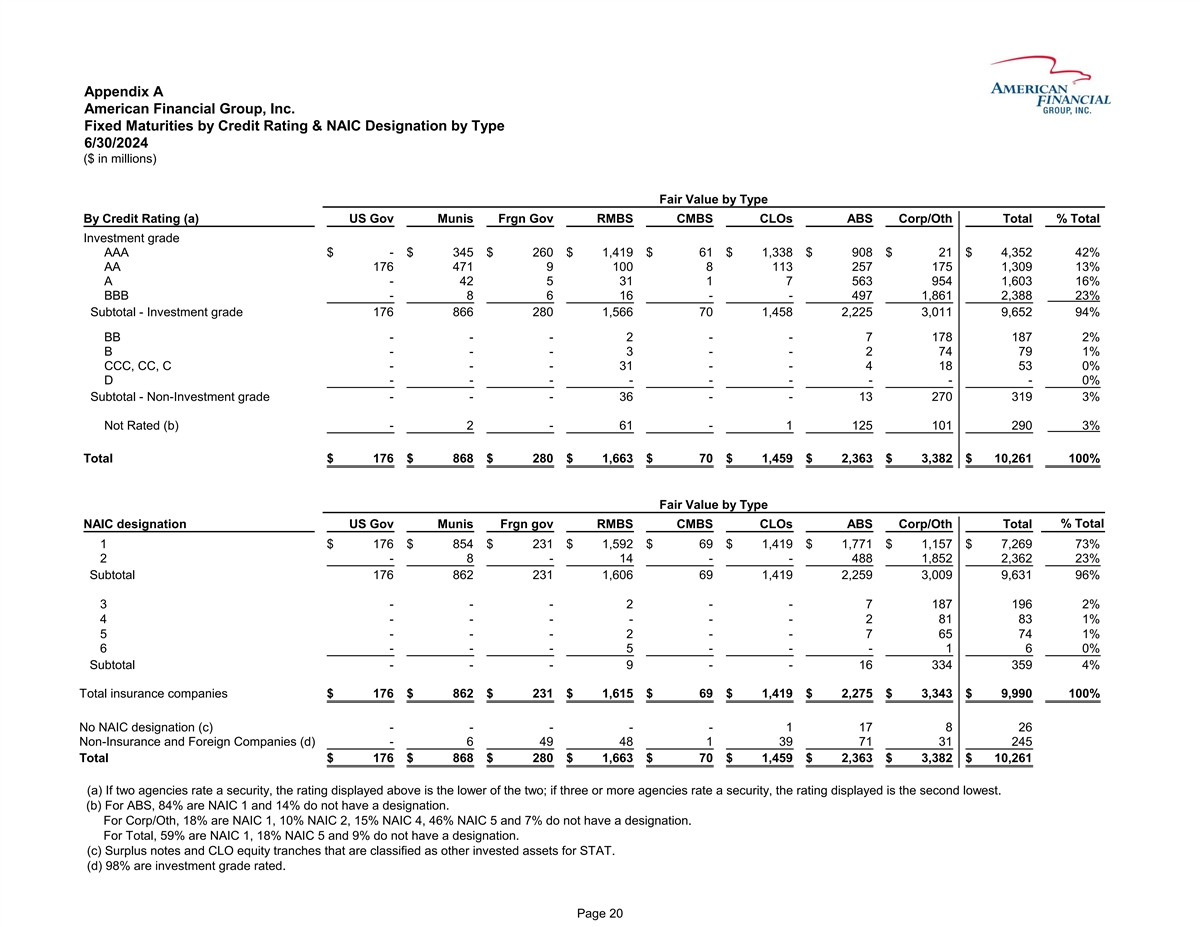

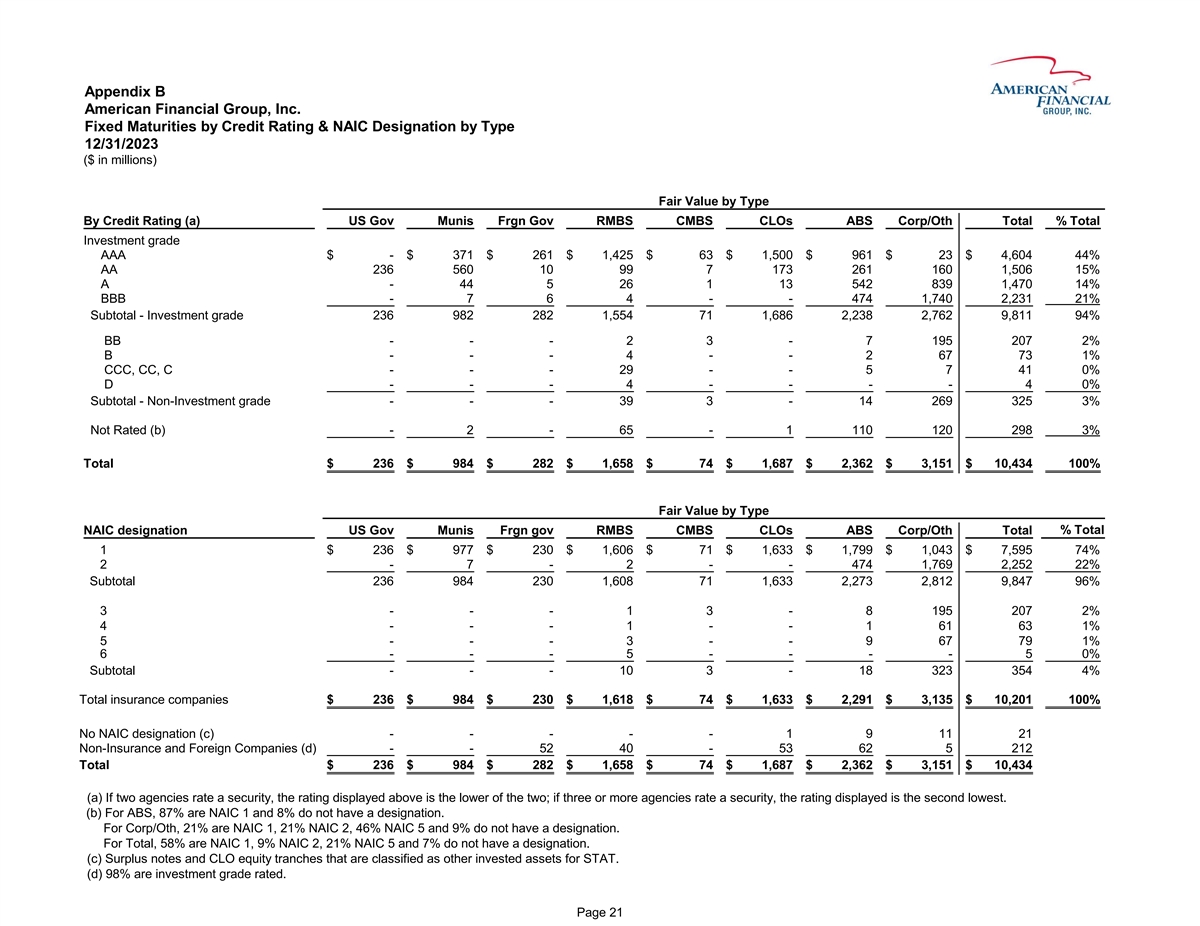

Consolidated............................................................................................................................... 19 Appendix A. Fixed Maturities by Credit Rating & NAIC Designation by Type

6/30/2024.............................................................................................. 20 B. Fixed Maturities by Credit Rating & NAIC Designation by Type

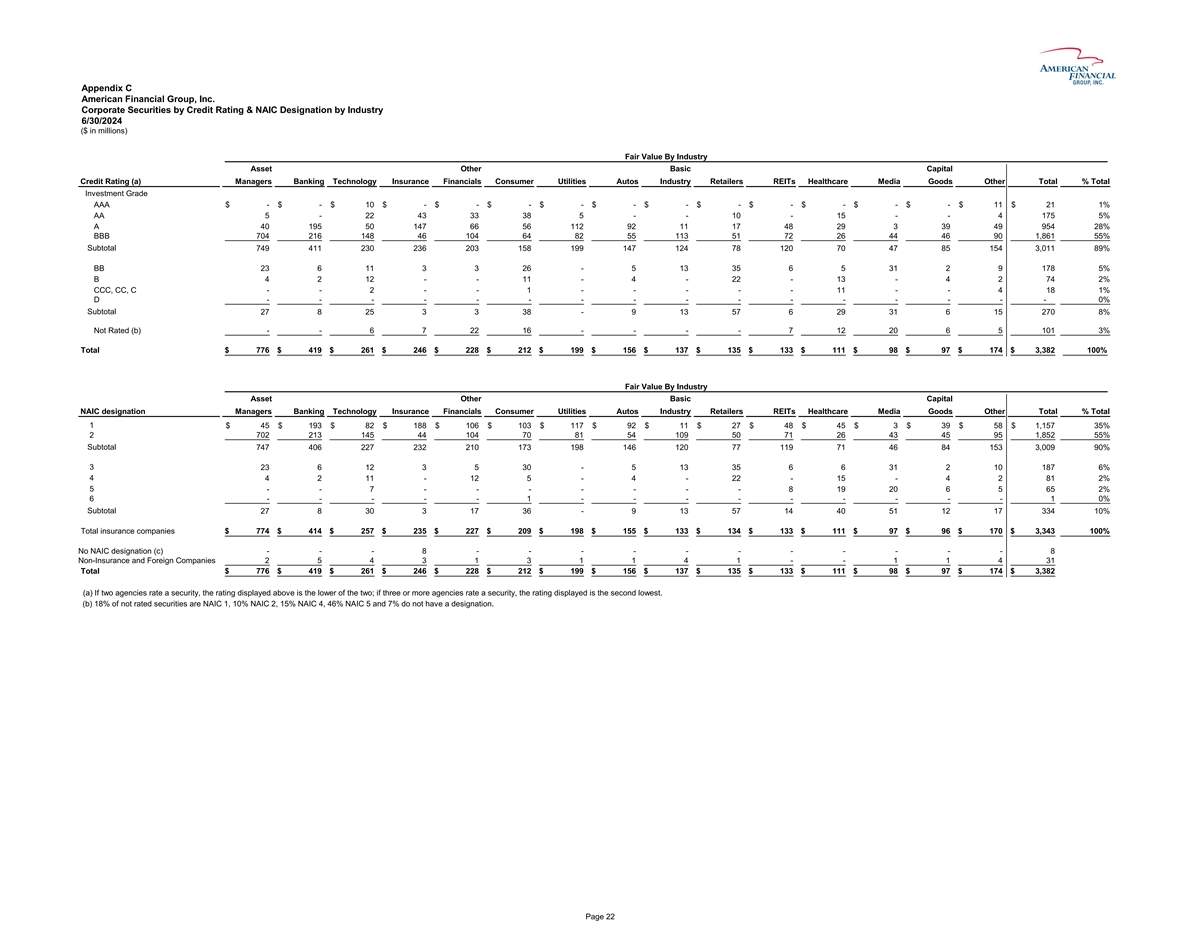

12/31/2023............................................................................................ 21 C. Corporate Securities by Credit Rating & NAIC Designation by Industry

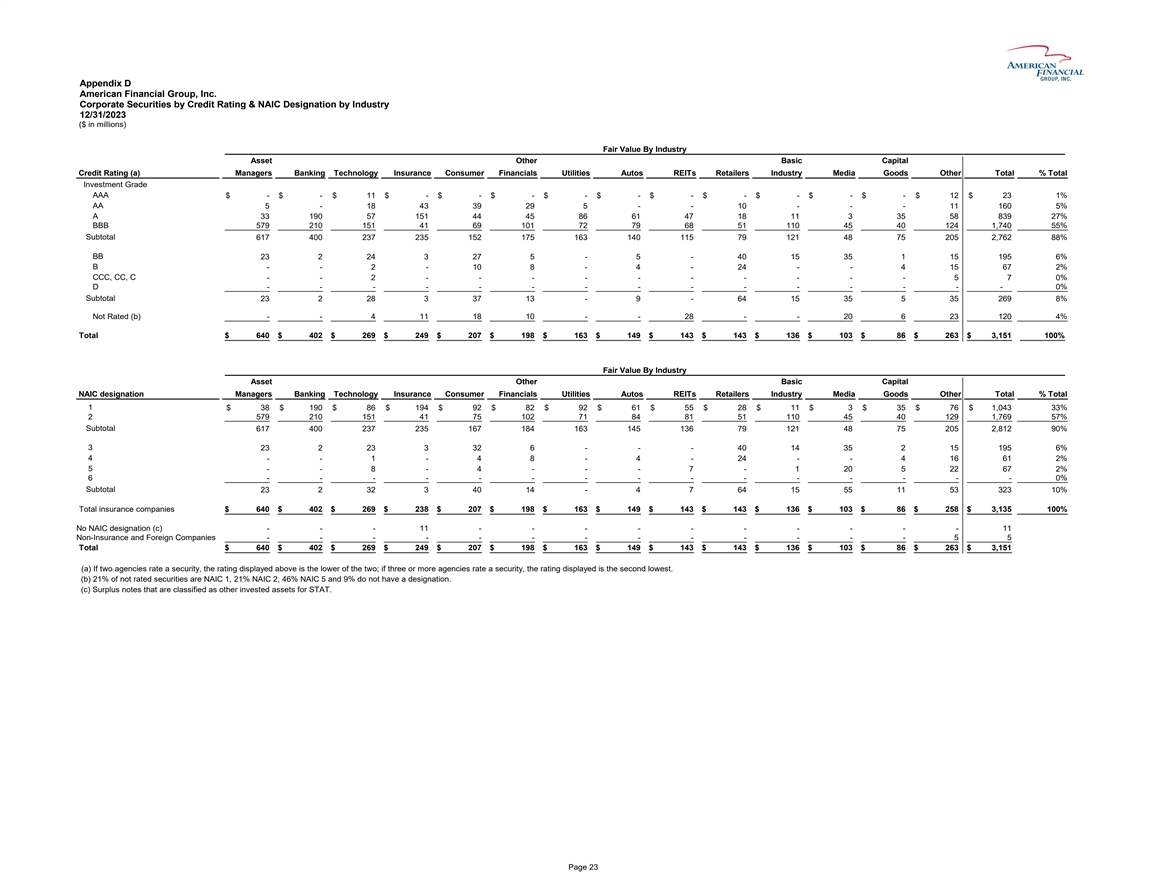

6/30/2024................................................................................. 22 D. Corporate Securities by Credit Rating & NAIC Designation by Industry

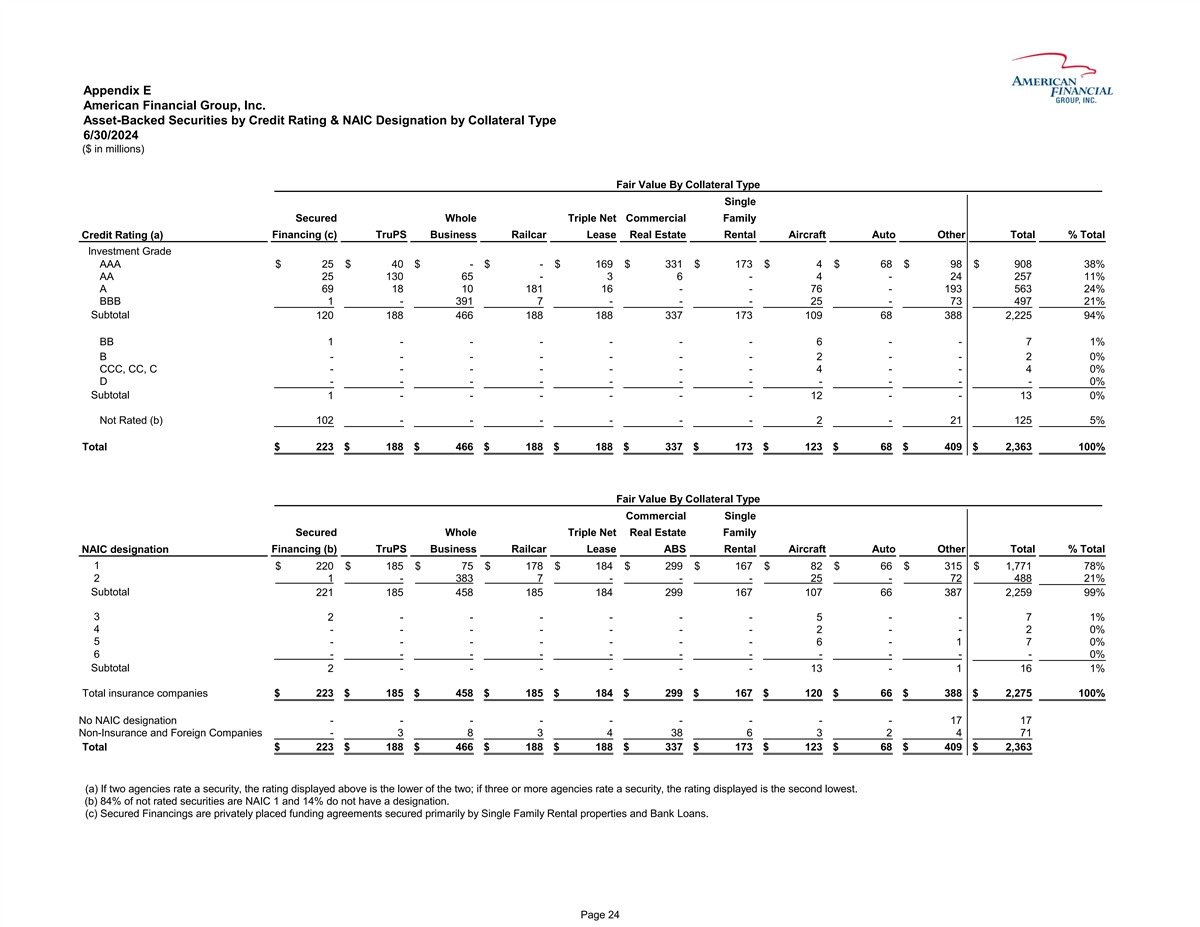

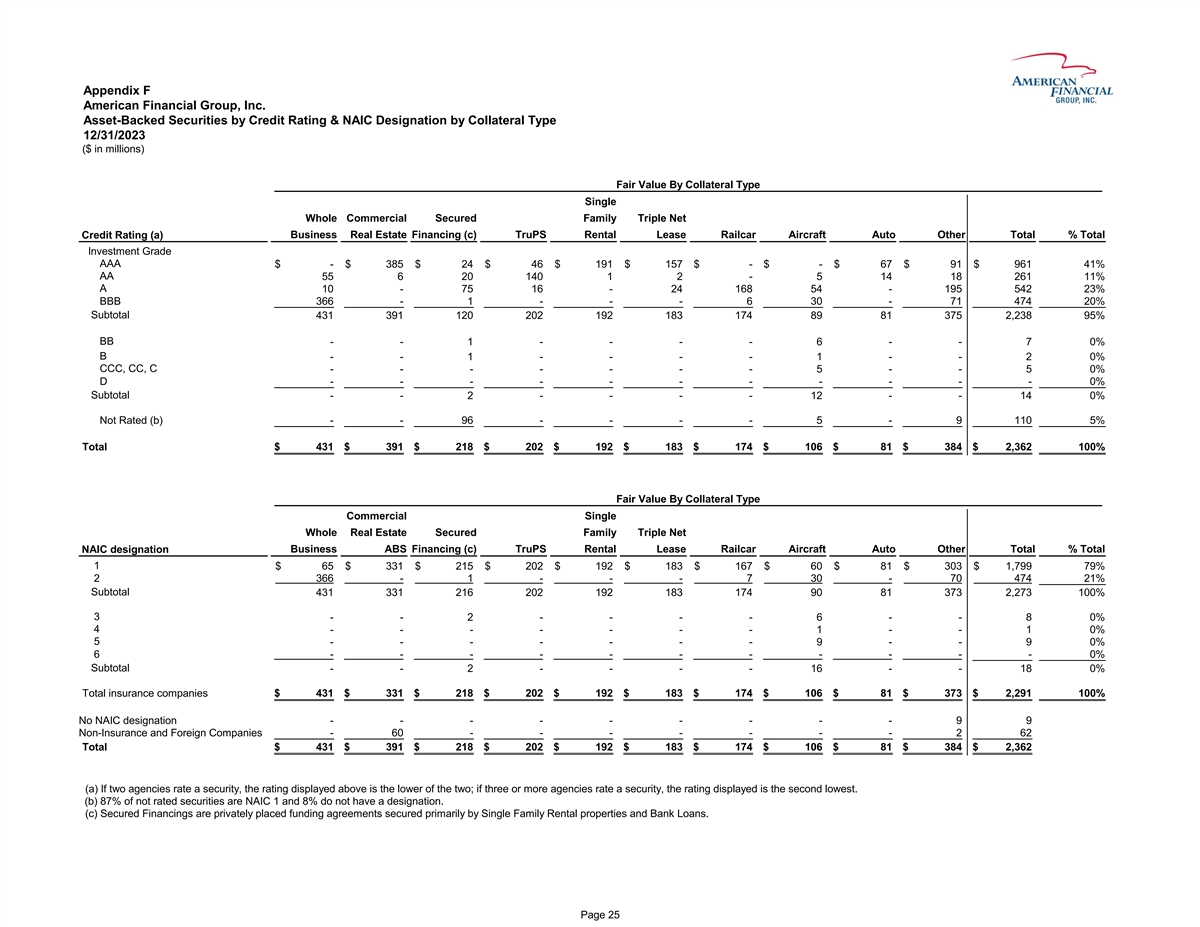

12/31/2023............................................................................... 23 E. Asset-Backed Securities by Credit Rating & NAIC Designation by Collateral Type

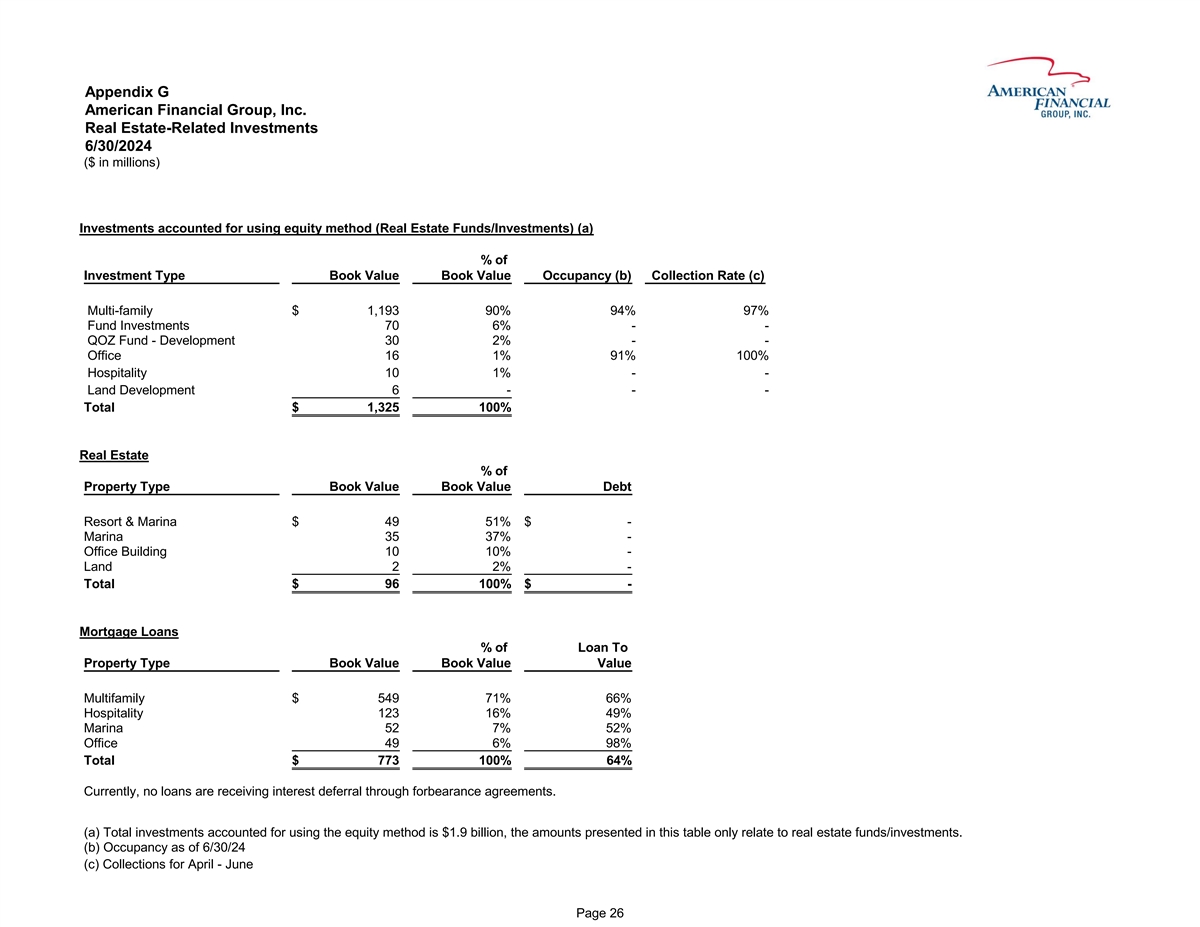

6/30/2024................................................................ 24 F. Asset-Backed Securities by Credit Rating & NAIC Designation by Collateral Type 12/31/2023.............................................................. 25 G. Real

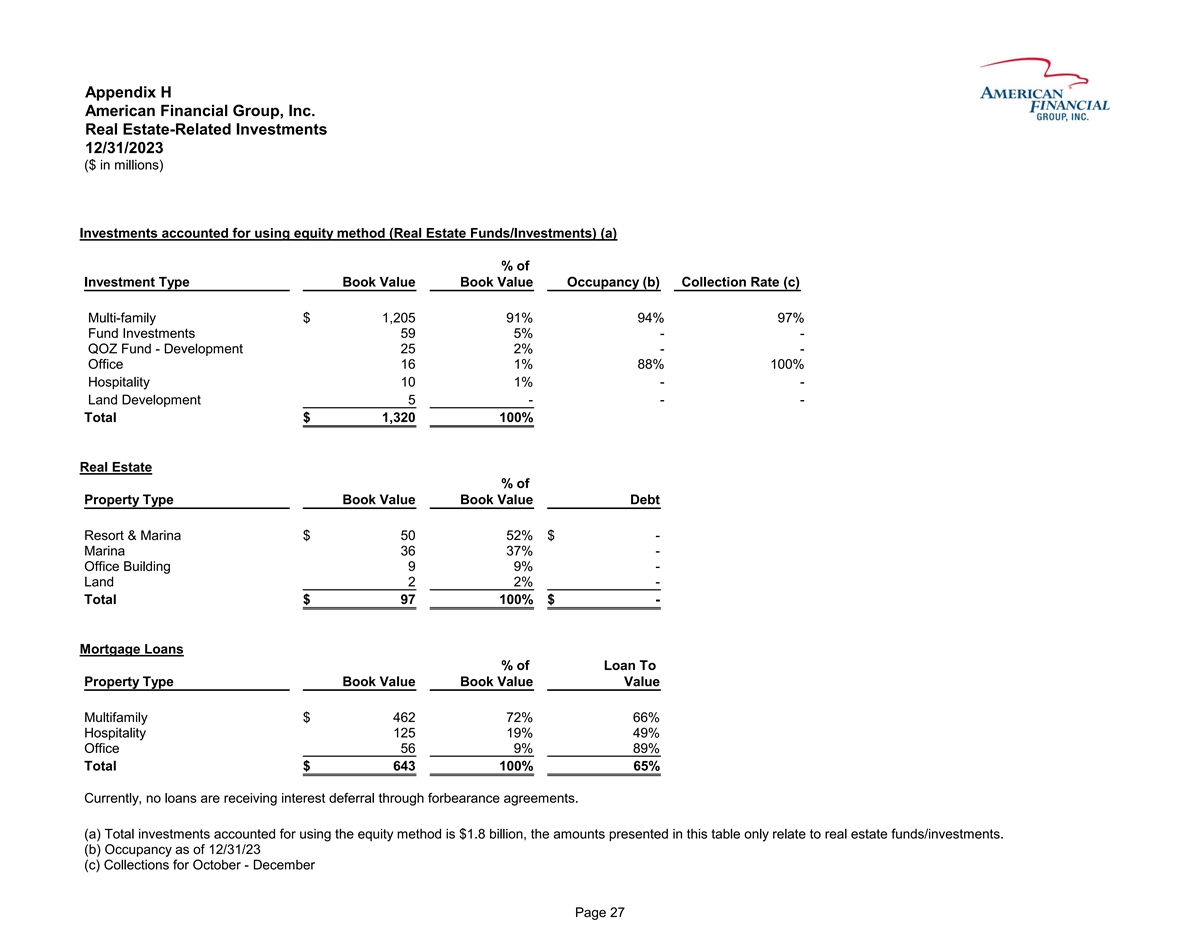

Estate-Related Investments 6/30/2024........................................................................................................................................... 26 H. Real Estate-Related Investments

12/31/2023.......................................................................................................................................... 27 Page 2

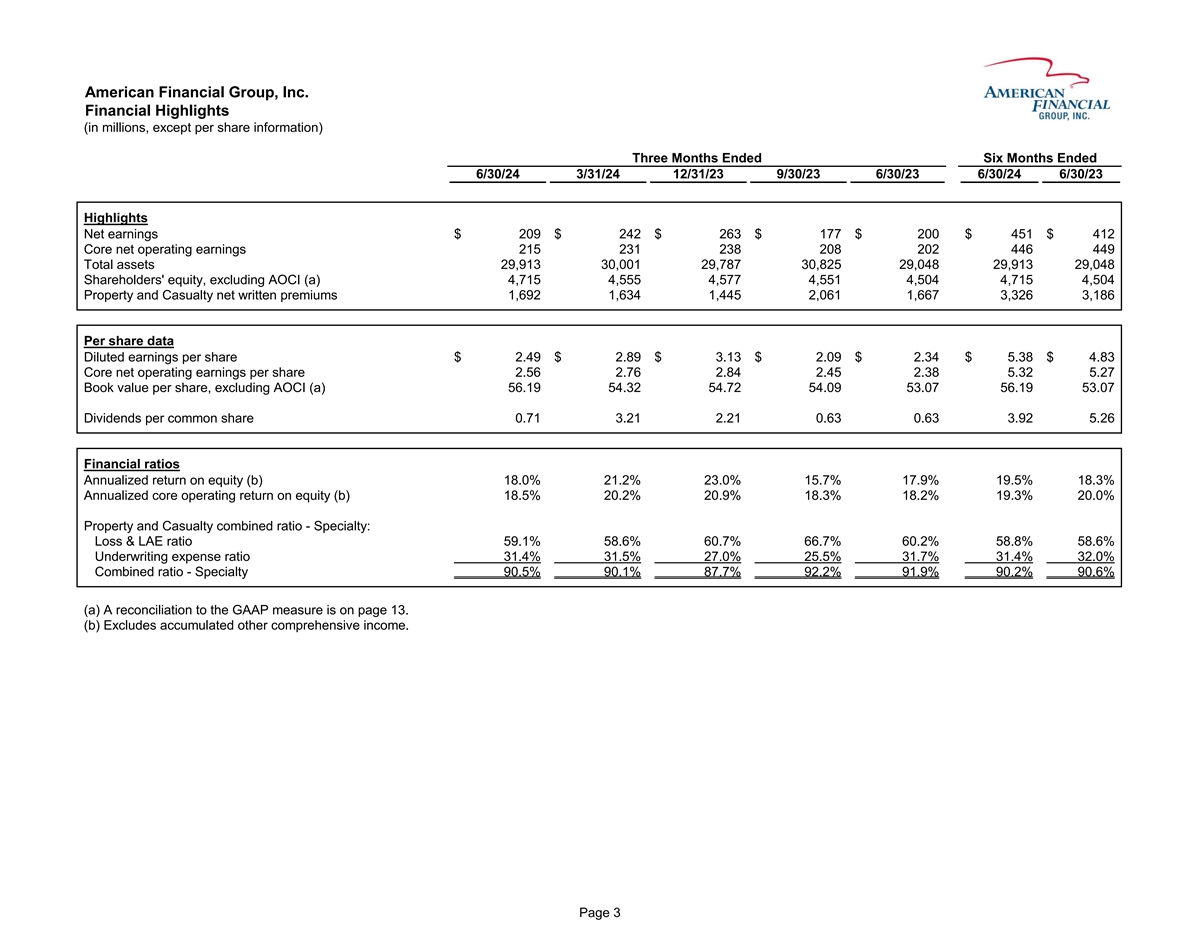

American Financial Group, Inc. Financial Highlights (in millions, except

per share information) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Highlights Net earnings $ 209 $ 242 $ 263 $ 177 $ 200 $ 451 $ 412 Core net operating earnings 215 231 238 208 202 446 449 Total

assets 29,913 30,001 29,787 30,825 29,048 29,913 29,048 Shareholders' equity, excluding AOCI (a) 4,715 4,555 4,577 4,551 4,504 4,715 4,504 Property and Casualty net written premiums 1,692 1,634 1,445 2,061 1,667 3,326 3,186 Per share data Diluted

earnings per share $ 2.49 $ 2.89 $ 3.13 $ 2.09 $ 2.34 $ 5.38 $ 4.83 Core net operating earnings per share 2.56 2.76 2.84 2.45 2.38 5.32 5.27 Book value per share, excluding AOCI (a) 56.19 54.32 54.72 54.09 53.07 56.19 53.07 Dividends per common

share 0.71 3.21 2.21 0.63 0.63 3.92 5.26 Financial ratios Annualized return on equity (b) 18.0% 21.2% 23.0% 15.7% 17.9% 19.5% 18.3% Annualized core operating return on equity (b) 18.5% 20.2% 20.9% 18.3% 18.2% 19.3% 20.0% Property and Casualty

combined ratio - Specialty: Loss & LAE ratio 59.1% 58.6% 60.7% 66.7% 60.2% 58.8% 58.6% Underwriting expense ratio 31.4% 31.5% 27.0% 25.5% 31.7% 31.4% 32.0% Combined ratio - Specialty 90.5% 90.1% 87.7% 92.2% 91.9% 90.2% 90.6% (a) A reconciliation

to the GAAP measure is on page 13. (b) Excludes accumulated other comprehensive income. Page 3

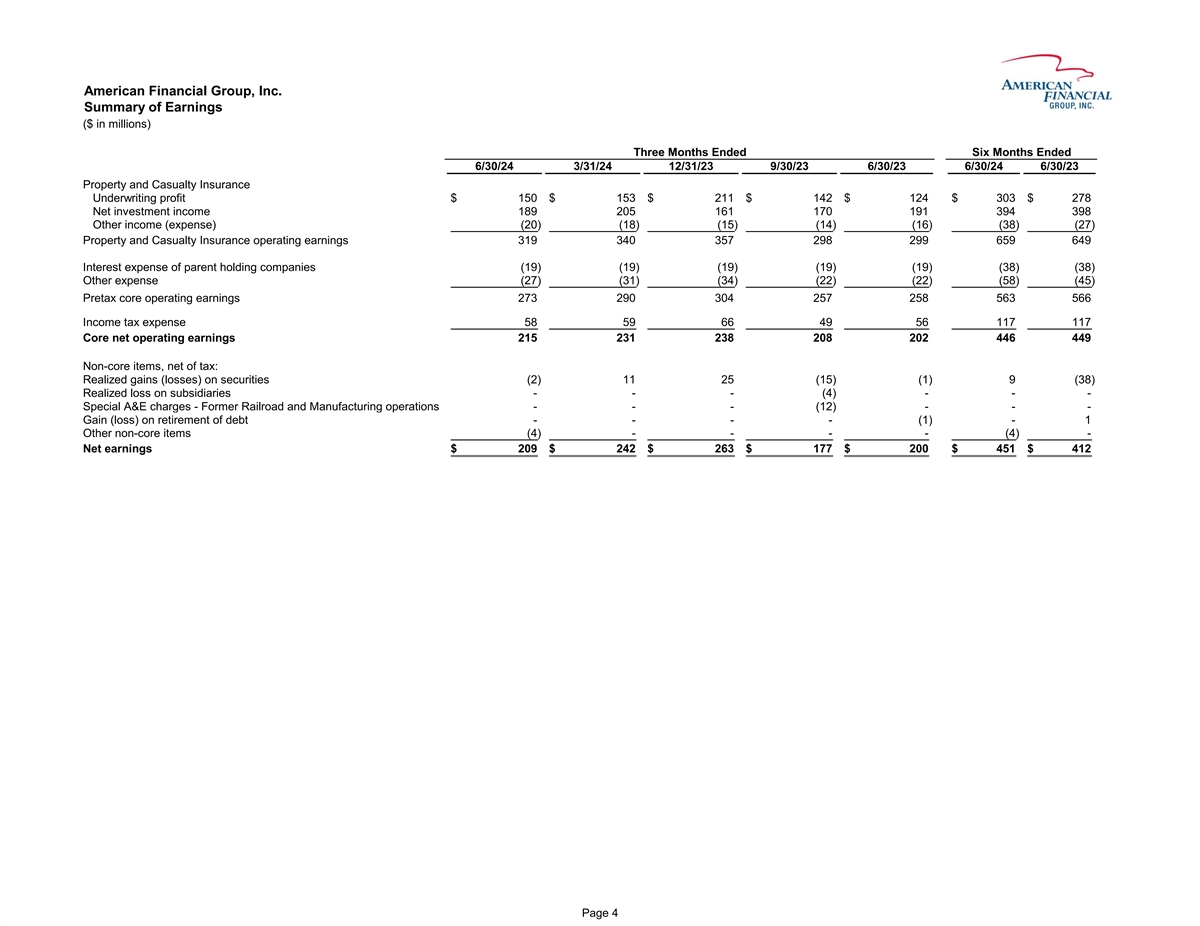

American Financial Group, Inc. Summary of Earnings ($ in millions) Three

Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Property and Casualty Insurance Underwriting profit $ 150 $ 153 $ 211 $ 142 $ 124 $ 303 $ 278 Net investment income 189 205 161 170 191 394 398 Other income

(expense) (20) (18) (15) (14) (16) (38) (27) Property and Casualty Insurance operating earnings 319 340 357 298 299 659 649 Interest expense of parent holding companies (19) (19) (19) (19) (19) (38) (38) Other expense (27) (31) (34) (22) (22) (58)

(45) Pretax core operating earnings 273 290 304 257 258 563 566 Income tax expense 58 59 66 49 56 117 117 Core net operating earnings 215 231 238 208 202 446 449 Non-core items, net of tax: Realized gains (losses) on securities (2) 11 25 (15) (1) 9

(38) Realized loss on subsidiaries - - - (4) - - - Special A&E charges - Former Railroad and Manufacturing operations - - - (12) - - - Gain (loss) on retirement of debt - - - - (1) - 1 Other non-core items (4) - - - - (4) - Net earnings $ 209 $

242 $ 263 $ 177 $ 200 $ 451 $ 412 Page 4

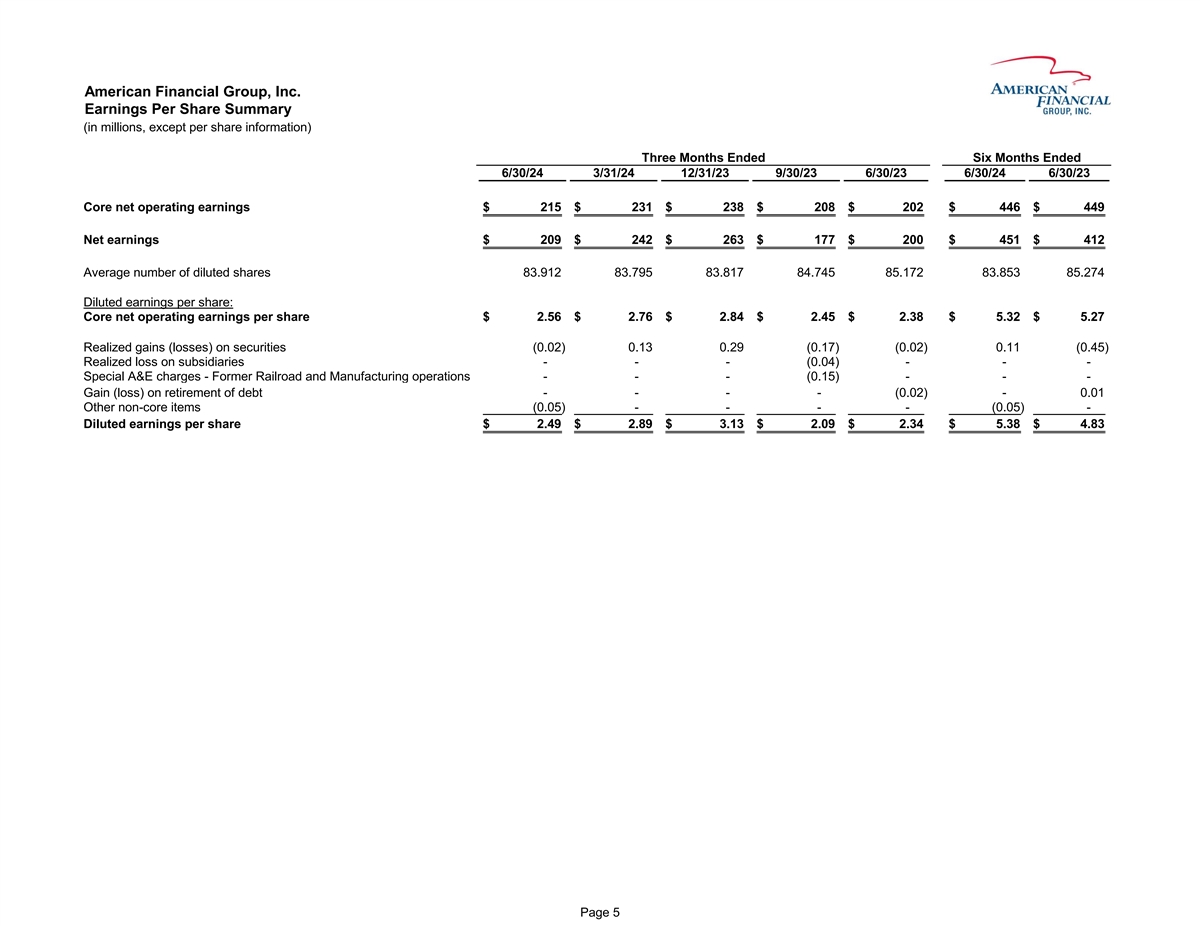

American Financial Group, Inc. Earnings Per Share Summary (in millions,

except per share information) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Core net operating earnings $ 215 $ 231 $ 238 $ 208 $ 202 $ 446 $ 449 Net earnings $ 209 $ 242 $ 263 $ 177 $ 200 $ 451 $ 412

Average number of diluted shares 83.912 83.795 83.817 84.745 85.172 83.853 85.274 Diluted earnings per share: Core net operating earnings per share $ 2.56 $ 2.76 $ 2.84 $ 2.45 $ 2.38 $ 5.32 $ 5.27 Realized gains (losses) on securities (0.02) 0.13

0.29 (0.17) (0.02) 0.11 (0.45) Realized loss on subsidiaries - - - (0.04) - - - Special A&E charges - Former Railroad and Manufacturing operations - - - (0.15) - - - Gain (loss) on retirement of debt - - - - (0.02) - 0.01 Other non-core items

(0.05) - - - - (0.05) - Diluted earnings per share $ 2.49 $ 2.89 $ 3.13 $ 2.09 $ 2.34 $ 5.38 $ 4.83 Page 5

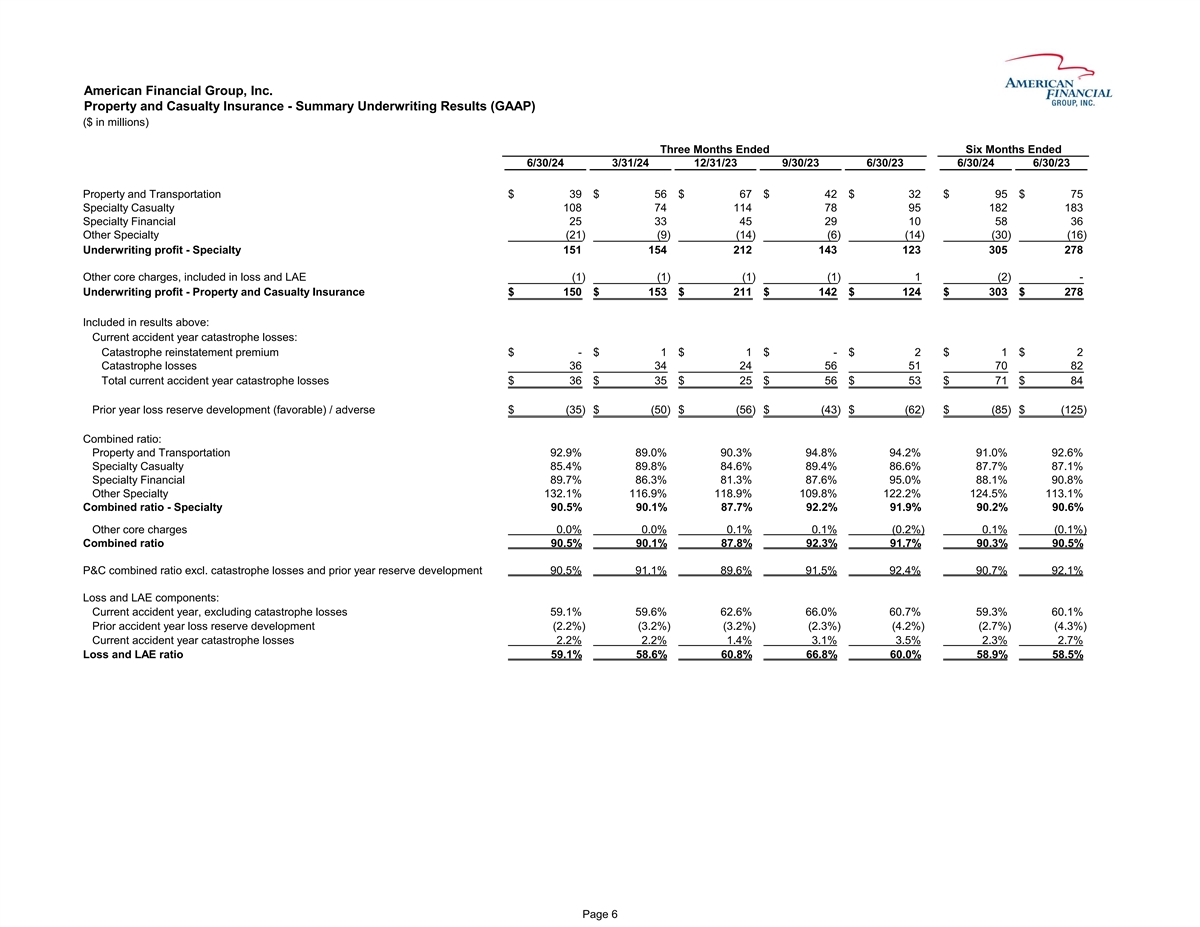

American Financial Group, Inc. Property and Casualty Insurance - Summary

Underwriting Results (GAAP) ($ in millions) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Property and Transportation $ 39 $ 56 $ 67 $ 42 $ 32 $ 95 $ 75 Specialty Casualty 108 74 114 78 95 182 183

Specialty Financial 25 33 45 29 10 58 36 Other Specialty (21) (9) (14) (6) (14) (30) (16) Underwriting profit - Specialty 151 154 212 143 123 305 278 Other core charges, included in loss and LAE (1) (1) (1) (1) 1 (2) - Underwriting profit - Property

and Casualty Insurance $ 150 $ 153 $ 211 $ 142 $ 124 $ 303 $ 278 Included in results above: Current accident year catastrophe losses: Catastrophe reinstatement premium $ - $ 1 $ 1 $ - $ 2 $ 1 $ 2 Catastrophe losses 36 34 24 56 51 70 82 Total current

accident year catastrophe losses $ 36 $ 35 $ 25 $ 56 $ 53 $ 71 $ 84 Prior year loss reserve development (favorable) / adverse $ (35) $ (50) $ (56) $ (43) $ (62) $ (85) $ (125) Combined ratio: Property and Transportation 92.9% 89.0% 90.3% 94.8% 94.2%

91.0% 92.6% Specialty Casualty 85.4% 89.8% 84.6% 89.4% 86.6% 87.7% 87.1% Specialty Financial 89.7% 86.3% 81.3% 87.6% 95.0% 88.1% 90.8% Other Specialty 132.1% 116.9% 118.9% 109.8% 122.2% 124.5% 113.1% Combined ratio - Specialty 90.5% 90.1% 87.7%

92.2% 91.9% 90.2% 90.6% Other core charges 0.0% 0.0% 0.1% 0.1% (0.2%) 0.1% (0.1%) Combined ratio 90.5% 90.1% 87.8% 92.3% 91.7% 90.3% 90.5% P&C combined ratio excl. catastrophe losses and prior year reserve development 90.5% 91.1% 89.6% 91.5%

92.4% 90.7% 92.1% Loss and LAE components: Current accident year, excluding catastrophe losses 59.1% 59.6% 62.6% 66.0% 60.7% 59.3% 60.1% Prior accident year loss reserve development (2.2%) (3.2%) (3.2%) (2.3%) (4.2%) (2.7%) (4.3%) Current accident

year catastrophe losses 2.2% 2.2% 1.4% 3.1% 3.5% 2.3% 2.7% Loss and LAE ratio 59.1% 58.6% 60.8% 66.8% 60.0% 58.9% 58.5% Page 6

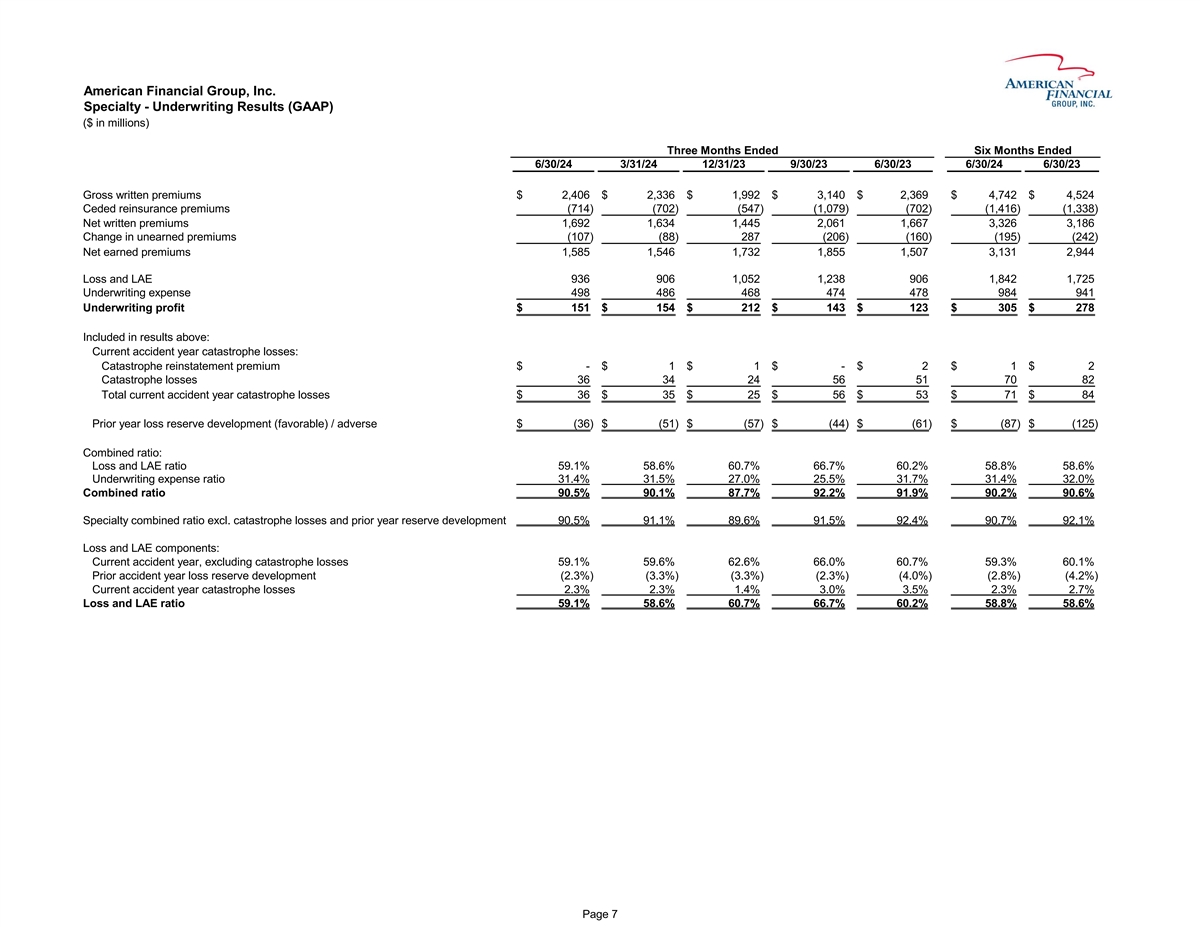

American Financial Group, Inc. Specialty - Underwriting Results (GAAP)

($ in millions) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Gross written premiums $ 2,406 $ 2,336 $ 1,992 $ 3,140 $ 2,369 $ 4,742 $ 4,524 Ceded reinsurance premiums (714) (702) (547) (1,079) (702)

(1,416) (1,338) Net written premiums 1,692 1,634 1,445 2,061 1,667 3,326 3,186 Change in unearned premiums (107) (88) 287 (206) (160) (195) (242) Net earned premiums 1,585 1,546 1,732 1,855 1,507 3,131 2,944 Loss and LAE 936 906 1,052 1,238 906

1,842 1,725 Underwriting expense 498 486 468 474 478 984 941 Underwriting profit $ 151 $ 154 $ 212 $ 143 $ 123 $ 305 $ 278 Included in results above: Current accident year catastrophe losses: Catastrophe reinstatement premium $ - $ 1 $ 1 $ - $ 2 $ 1

$ 2 Catastrophe losses 36 34 24 56 51 70 82 Total current accident year catastrophe losses $ 36 $ 35 $ 25 $ 56 $ 53 $ 71 $ 84 Prior year loss reserve development (favorable) / adverse $ (36) $ (51) $ (57) $ (44) $ (61) $ (87) $ (125) Combined ratio:

Loss and LAE ratio 59.1% 58.6% 60.7% 66.7% 60.2% 58.8% 58.6% Underwriting expense ratio 31.4% 31.5% 27.0% 25.5% 31.7% 31.4% 32.0% Combined ratio 90.5% 90.1% 87.7% 92.2% 91.9% 90.2% 90.6% Specialty combined ratio excl. catastrophe losses and prior

year reserve development 90.5% 91.1% 89.6% 91.5% 92.4% 90.7% 92.1% Loss and LAE components: Current accident year, excluding catastrophe losses 59.1% 59.6% 62.6% 66.0% 60.7% 59.3% 60.1% Prior accident year loss reserve development (2.3%) (3.3%)

(3.3%) (2.3%) (4.0%) (2.8%) (4.2%) Current accident year catastrophe losses 2.3% 2.3% 1.4% 3.0% 3.5% 2.3% 2.7% Loss and LAE ratio 59.1% 58.6% 60.7% 66.7% 60.2% 58.8% 58.6% Page 7

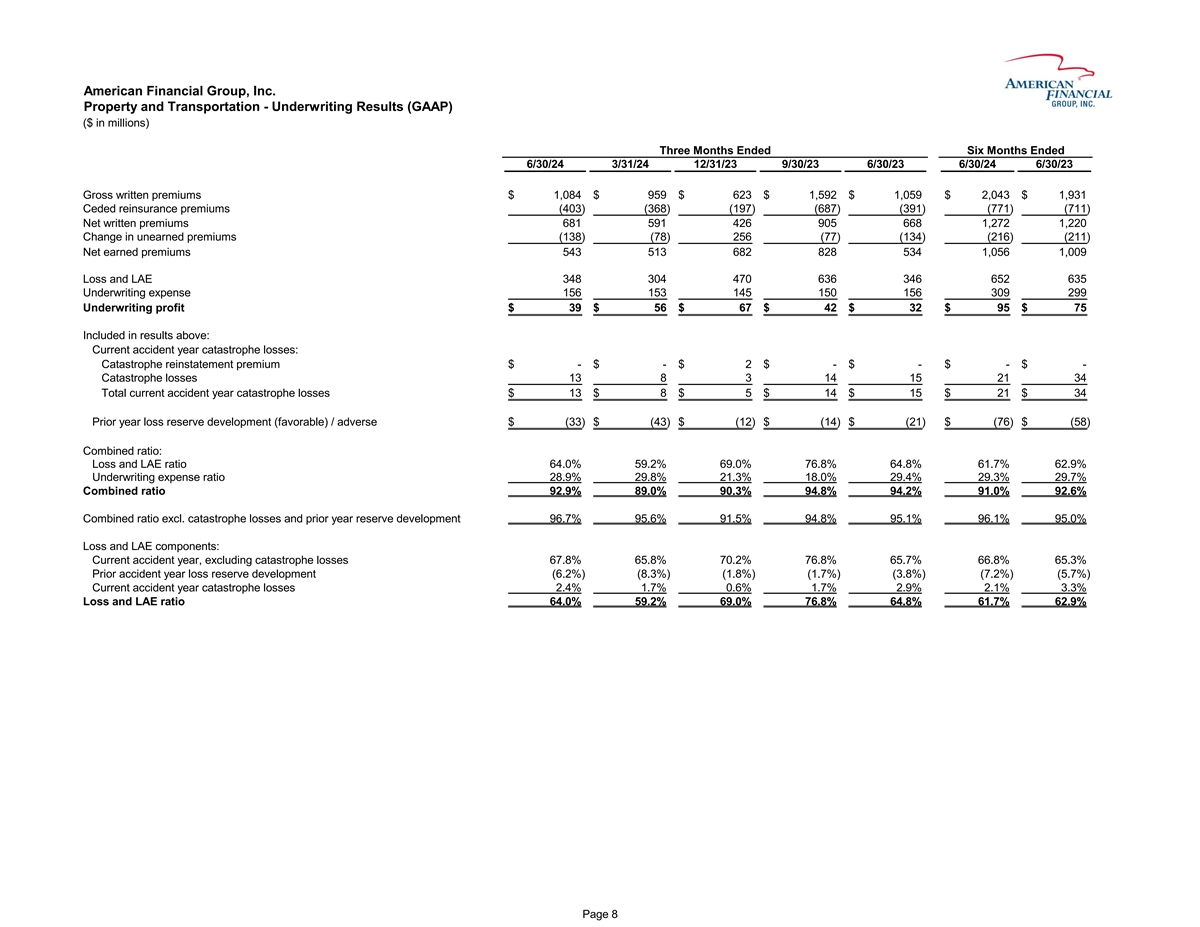

American Financial Group, Inc. Property and Transportation -

Underwriting Results (GAAP) ($ in millions) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Gross written premiums $ 1,084 $ 959 $ 623 $ 1,592 $ 1,059 $ 2,043 $ 1,931 Ceded reinsurance premiums (403)

(368) (197) (687) (391) (771) (711) Net written premiums 681 591 426 905 668 1,272 1,220 Change in unearned premiums (138) (78) 256 (77) (134) (216) (211) Net earned premiums 543 513 682 828 534 1,056 1,009 Loss and LAE 348 304 470 636 346 652 635

Underwriting expense 156 153 145 150 156 309 299 Underwriting profit $ 39 $ 56 $ 67 $ 42 $ 32 $ 95 $ 75 Included in results above: Current accident year catastrophe losses: Catastrophe reinstatement premium $ - $ - $ 2 $ - $ - $ - $ - Catastrophe

losses 13 8 3 14 15 21 34 Total current accident year catastrophe losses $ 13 $ 8 $ 5 $ 14 $ 15 $ 21 $ 34 Prior year loss reserve development (favorable) / adverse $ (33) $ (43) $ (12) $ (14) $ (21) $ (76) $ (58) Combined ratio: Loss and LAE ratio

64.0% 59.2% 69.0% 76.8% 64.8% 61.7% 62.9% Underwriting expense ratio 28.9% 29.8% 21.3% 18.0% 29.4% 29.3% 29.7% Combined ratio 92.9% 89.0% 90.3% 94.8% 94.2% 91.0% 92.6% Combined ratio excl. catastrophe losses and prior year reserve development 96.7%

95.6% 91.5% 94.8% 95.1% 96.1% 95.0% Loss and LAE components: Current accident year, excluding catastrophe losses 67.8% 65.8% 70.2% 76.8% 65.7% 66.8% 65.3% Prior accident year loss reserve development (6.2%) (8.3%) (1.8%) (1.7%) (3.8%) (7.2%) (5.7%)

Current accident year catastrophe losses 2.4% 1.7% 0.6% 1.7% 2.9% 2.1% 3.3% Loss and LAE ratio 64.0% 59.2% 69.0% 76.8% 64.8% 61.7% 62.9% Page 8

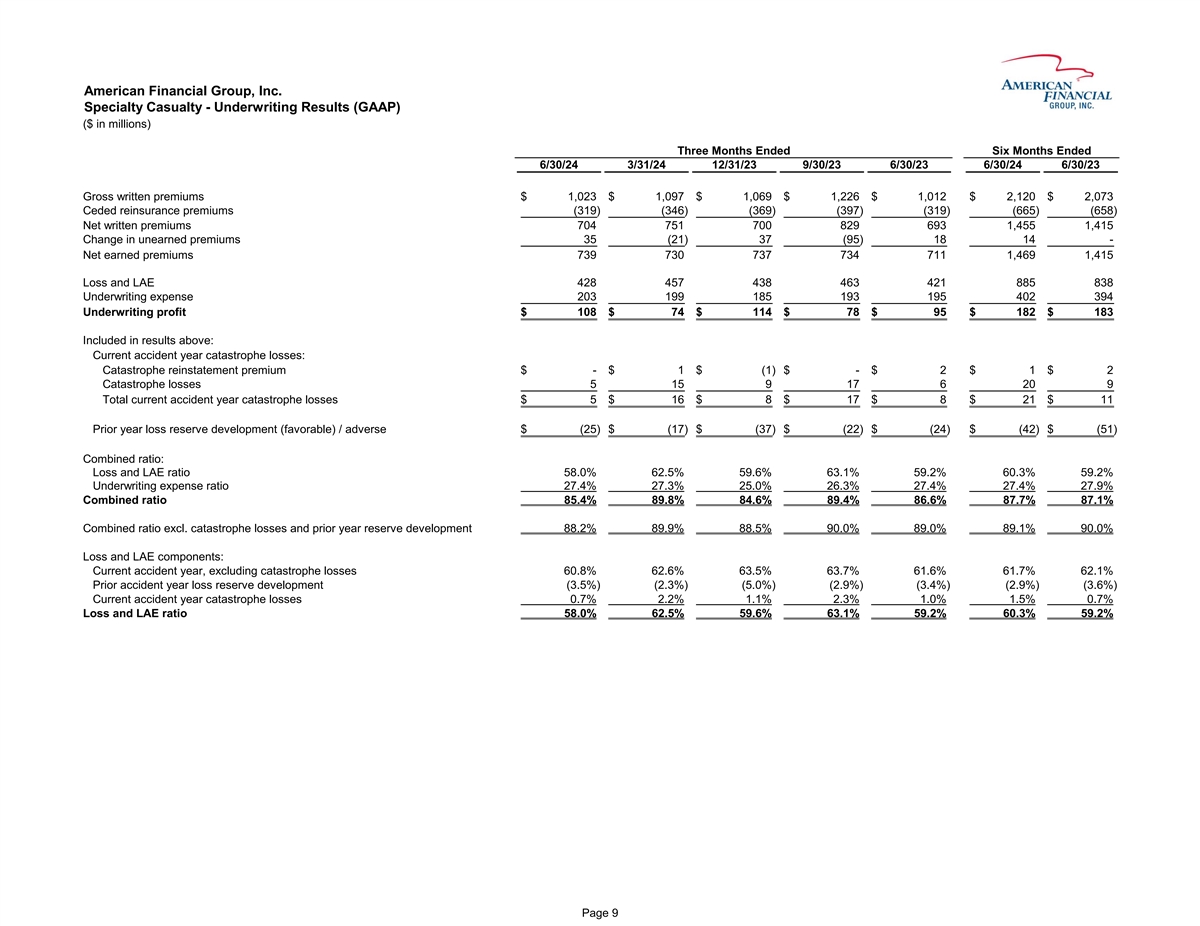

American Financial Group, Inc. Specialty Casualty - Underwriting Results

(GAAP) ($ in millions) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Gross written premiums $ 1,023 $ 1,097 $ 1,069 $ 1,226 $ 1,012 $ 2,120 $ 2,073 Ceded reinsurance premiums (319) (346) (369) (397)

(319) (665) (658) Net written premiums 704 751 700 829 693 1,455 1,415 Change in unearned premiums 35 (21) 37 (95) 18 14 - Net earned premiums 739 730 737 734 711 1,469 1,415 Loss and LAE 428 457 438 463 421 885 838 Underwriting expense 203 199 185

193 195 402 394 Underwriting profit $ 108 $ 74 $ 114 $ 78 $ 95 $ 182 $ 183 Included in results above: Current accident year catastrophe losses: Catastrophe reinstatement premium $ - $ 1 $ (1) $ - $ 2 $ 1 $ 2 Catastrophe losses 5 15 9 17 6 20 9 Total

current accident year catastrophe losses $ 5 $ 16 $ 8 $ 17 $ 8 $ 21 $ 11 Prior year loss reserve development (favorable) / adverse $ (25) $ (17) $ (37) $ (22) $ (24) $ (42) $ (51) Combined ratio: Loss and LAE ratio 58.0% 62.5% 59.6% 63.1% 59.2%

60.3% 59.2% Underwriting expense ratio 27.4% 27.3% 25.0% 26.3% 27.4% 27.4% 27.9% Combined ratio 85.4% 89.8% 84.6% 89.4% 86.6% 87.7% 87.1% Combined ratio excl. catastrophe losses and prior year reserve development 88.2% 89.9% 88.5% 90.0% 89. 0% 89.1%

90.0% Loss and LAE components: Current accident year, excluding catastrophe losses 60.8% 62.6% 63.5% 63.7% 61.6% 61.7% 62.1% Prior accident year loss reserve development (3.5%) (2.3%) (5. 0%) (2. 9%) (3.4%) (2. 9%) (3. 6%) Current accident year

catastrophe losses 0.7% 2.2% 1.1% 2.3% 1. 0% 1.5% 0.7% Loss and LAE ratio 58.0% 62.5% 59.6% 63.1% 59.2% 60.3% 59.2% Page 9

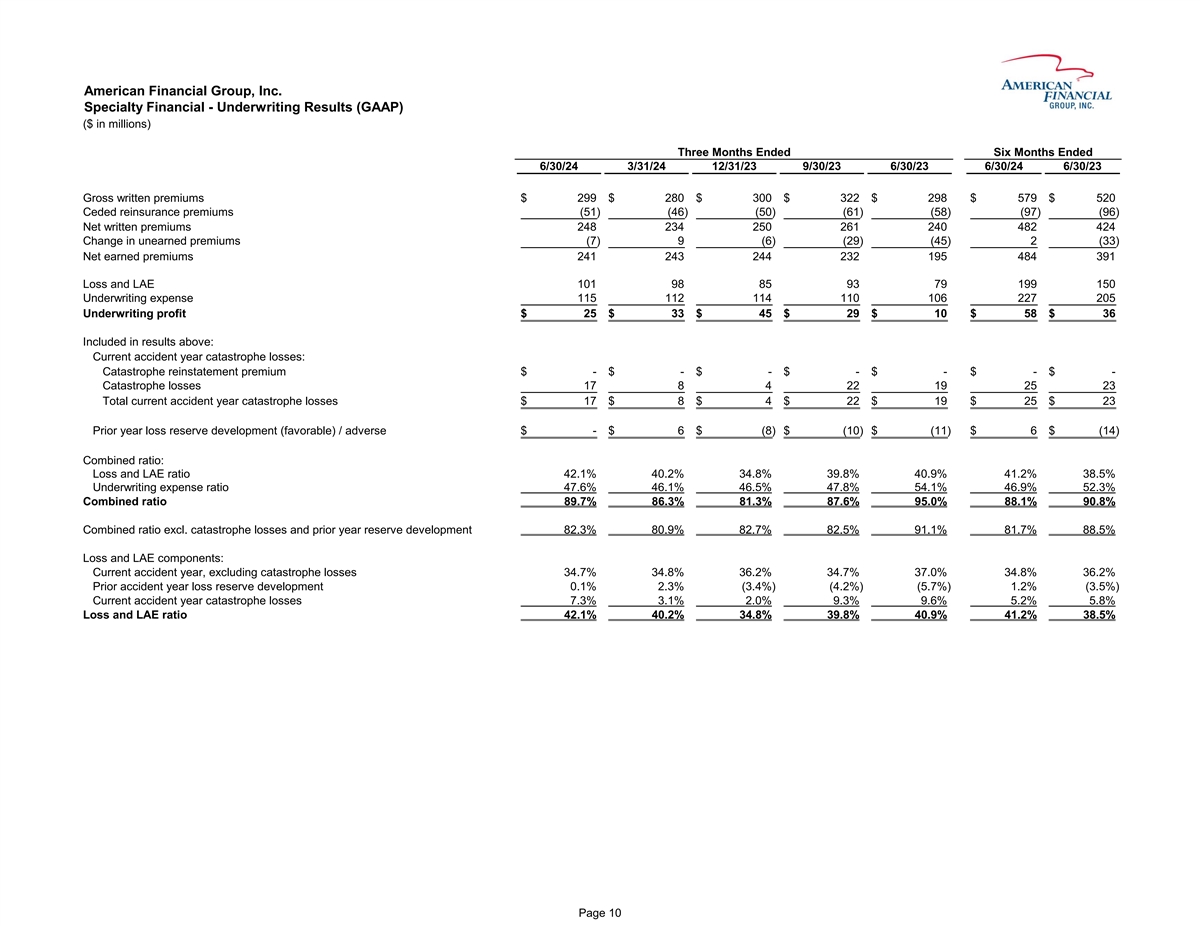

American Financial Group, Inc. Specialty Financial - Underwriting

Results (GAAP) ($ in millions) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Gross written premiums $ 299 $ 280 $ 300 $ 322 $ 298 $ 579 $ 520 Ceded reinsurance premiums (51) (46) (50) (61) (58) (97)

(96) Net written premiums 248 234 250 261 240 482 424 Change in unearned premiums (7) 9 (6) (29) (45) 2 (33) Net earned premiums 241 243 244 232 195 484 391 Loss and LAE 101 98 85 93 79 199 150 Underwriting expense 115 112 114 110 106 227 205

Underwriting profit $ 25 $ 33 $ 45 $ 29 $ 10 $ 58 $ 36 Included in results above: Current accident year catastrophe losses: Catastrophe reinstatement premium $ - $ - $ - $ - $ - $ - $ - Catastrophe losses 17 8 4 22 19 25 23 Total current accident

year catastrophe losses $ 17 $ 8 $ 4 $ 22 $ 19 $ 25 $ 23 Prior year loss reserve development (favorable) / adverse $ - $ 6 $ (8) $ (10) $ (11) $ 6 $ (14) Combined ratio: Loss and LAE ratio 42.1% 40.2% 34.8% 39.8% 40.9% 41.2% 38.5% Underwriting

expense ratio 47.6% 46.1% 46.5% 47.8% 54.1% 46.9% 52.3% Combined ratio 89.7% 86.3% 81.3% 87.6% 95.0% 88.1% 90.8% Combined ratio excl. catastrophe losses and prior year reserve development 82.3% 80.9% 82.7% 82.5% 91.1% 81.7% 88.5% Loss and LAE

components: Current accident year, excluding catastrophe losses 34.7% 34.8% 36.2% 34.7% 37.0% 34.8% 36.2% Prior accident year loss reserve development 0.1% 2.3% (3.4%) (4. 2%) (5. 7%) 1.2% (3.5%) Current accident year catastrophe losses 7.3% 3.1%

2.0% 9.3% 9.6% 5.2% 5.8% Loss and LAE ratio 42.1% 40.2% 34.8% 39.8% 40.9% 41.2% 38.5% Page 10

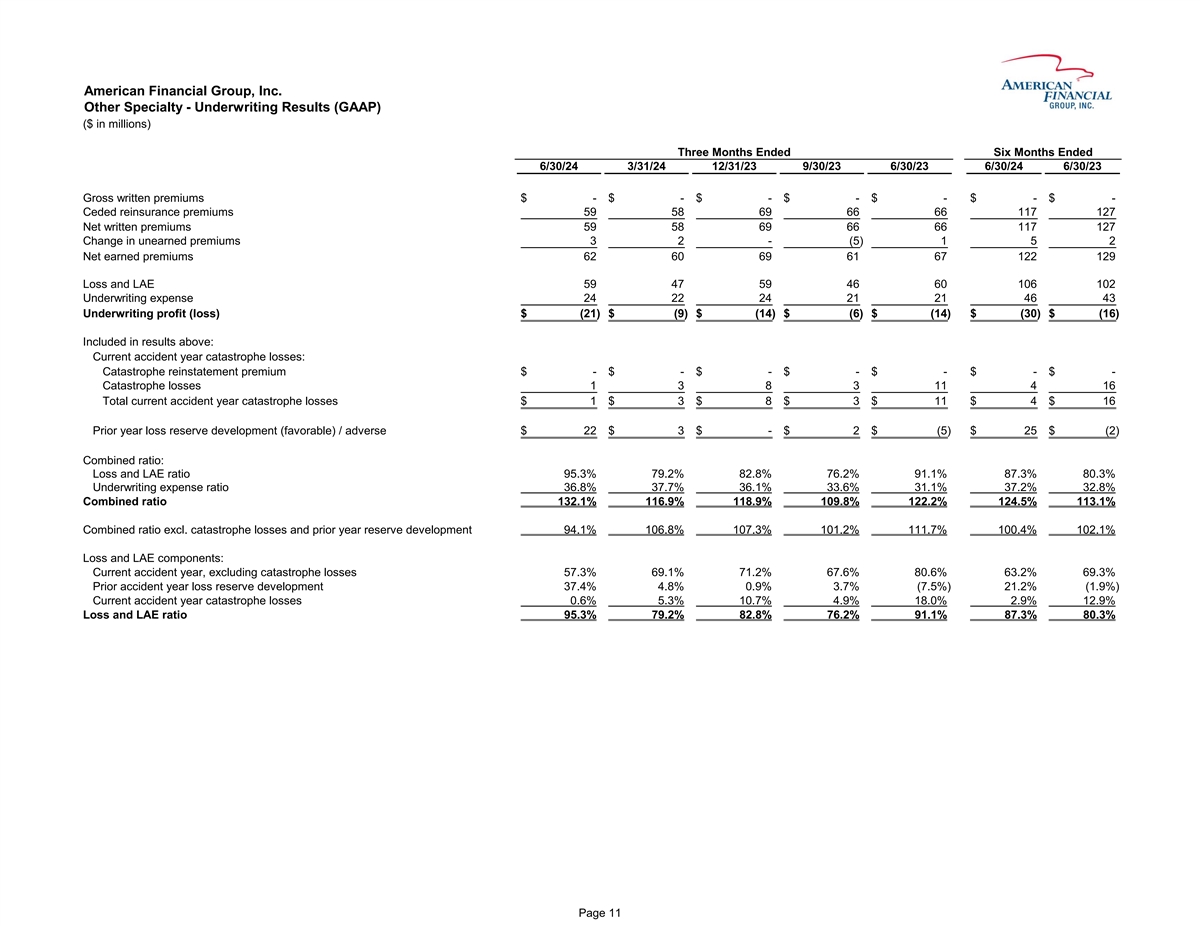

American Financial Group, Inc. Other Specialty - Underwriting Results

(GAAP) ($ in millions) Three Months Ended Six Months Ended 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 6/30/24 6/30/23 Gross written premiums $ - $ - $ - $ - $ - $ - $ - Ceded reinsurance premiums 59 58 69 66 66 117 127 Net written premiums 59 58 69 66

66 117 127 Change in unearned premiums 3 2 - (5) 1 5 2 Net earned premiums 62 60 69 61 67 122 129 Loss and LAE 59 47 59 46 60 106 102 Underwriting expense 24 22 24 21 21 46 43 Underwriting profit (loss) $ (21) $ (9) $ (14) $ (6) $ (14) $ (30) $ (16)

Included in results above: Current accident year catastrophe losses: Catastrophe reinstatement premium $ - $ - $ - $ - $ - $ - $ - Catastrophe losses 1 3 8 3 11 4 16 Total current accident year catastrophe losses $ 1 $ 3 $ 8 $ 3 $ 11 $ 4 $ 16 Prior

year loss reserve development (favorable) / adverse $ 22 $ 3 $ - $ 2 $ (5) $ 25 $ (2) Combined ratio: Loss and LAE ratio 95.3% 79.2% 82.8% 76.2% 91.1% 87.3% 80.3% Underwriting expense ratio 36.8% 37.7% 36.1% 33.6% 31.1% 37.2% 32.8% Combined ratio

132.1% 116.9% 118.9% 109.8% 122.2% 124.5% 113.1% Combined ratio excl. catastrophe losses and prior year reserve development 94.1% 106.8% 107.3% 101.2% 111.7% 100.4% 102.1% Loss and LAE components: Current accident year, excluding catastrophe losses

57.3% 69.1% 71.2% 67.6% 80.6% 63.2% 69.3% Prior accident year loss reserve development 37.4% 4.8% 0.9% 3.7% (7. 5%) 21.2% (1.9%) Current accident year catastrophe losses 0.6% 5.3% 10.7% 4.9% 18.0% 2.9% 12.9% Loss and LAE ratio 95.3% 79.2% 82.8%

76.2% 91.1% 87.3% 80.3% Page 11

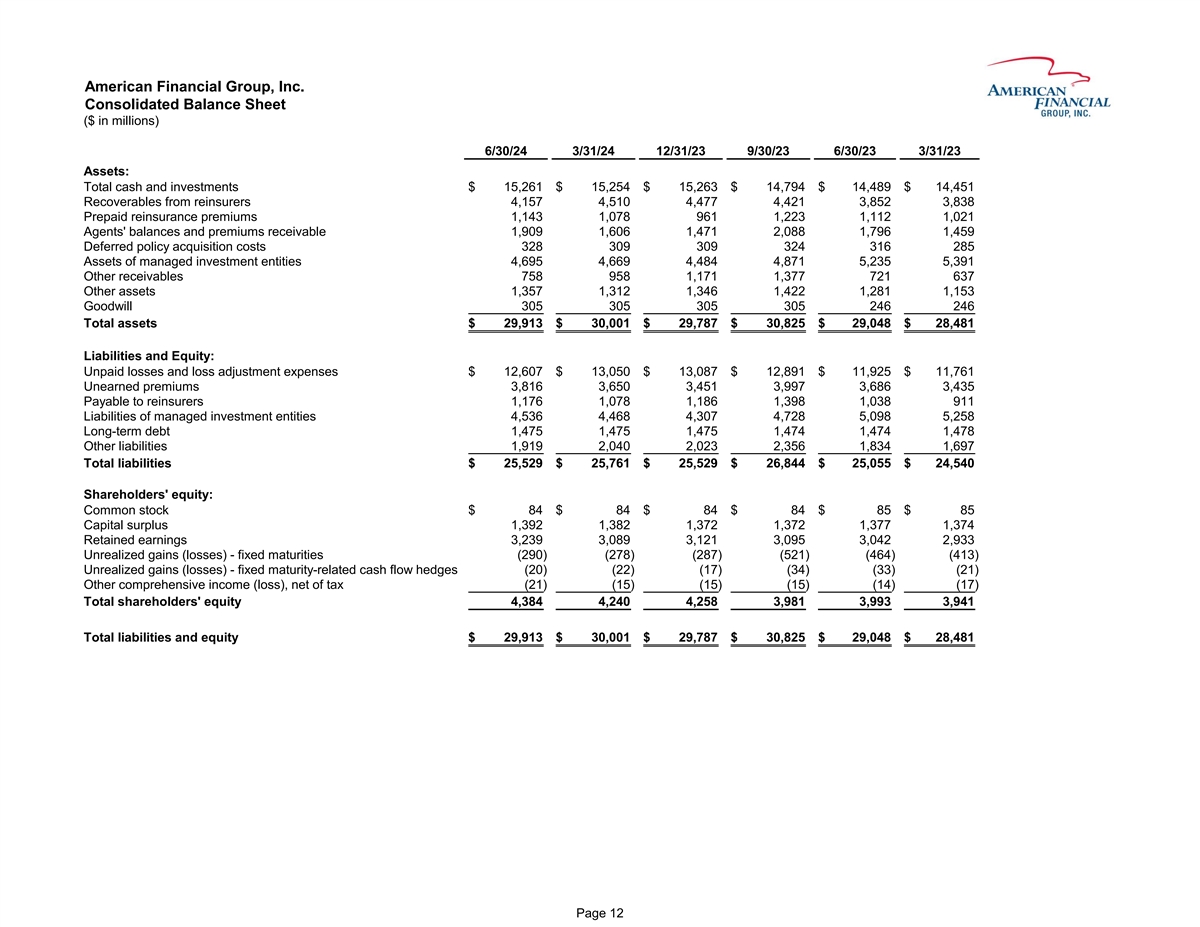

American Financial Group, Inc. Consolidated Balance Sheet ($ in

millions) 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 3/31/23 Assets: Total cash and investments $ 15,261 $ 15,254 $ 15,263 $ 14,794 $ 14,489 $ 14,451 Recoverables from reinsurers 4,157 4,510 4,477 4,421 3,852 3,838 Prepaid reinsurance premiums 1,143

1,078 961 1,223 1,112 1,021 Agents' balances and premiums receivable 1,909 1,606 1,471 2,088 1,796 1,459 Deferred policy acquisition costs 328 309 309 324 316 285 Assets of managed investment entities 4,695 4,669 4,484 4,871 5,235 5,391 Other

receivables 758 958 1,171 1,377 721 637 Other assets 1,357 1,312 1,346 1,422 1,281 1,153 Goodwill 305 305 305 305 246 246 Total assets $ 29,913 $ 30,001 $ 29,787 $ 30,825 $ 29,048 $ 28,481 Liabilities and Equity: Unpaid losses and loss adjustment

expenses $ 12,607 $ 13,050 $ 13,087 $ 12,891 $ 11,925 $ 11,761 Unearned premiums 3,816 3,650 3,451 3,997 3,686 3,435 Payable to reinsurers 1,176 1,078 1,186 1,398 1,038 911 Liabilities of managed investment entities 4,536 4,468 4,307 4,728 5,098

5,258 Long-term debt 1,475 1,475 1,475 1,474 1,474 1,478 Other liabilities 1,919 2,040 2,023 2,356 1,834 1,697 Total liabilities $ 25,529 $ 25,761 $ 25,529 $ 26,844 $ 25,055 $ 24,540 Shareholders' equity: Common stock $ 84 $ 84 $ 84 $ 84 $ 85 $ 85

Capital surplus 1,392 1,382 1,372 1,372 1,377 1,374 Retained earnings 3,239 3,089 3,121 3,095 3,042 2,933 Unrealized gains (losses) - fixed maturities (290) (278) (287) (521) (464) (413) Unrealized gains (losses) - fixed maturity-related cash flow

hedges (20) (22) (17) (34) (33) (21) Other comprehensive income (loss), net of tax (21) (15) (15) (15) (14) (17) Total shareholders' equity 4,384 4,240 4,258 3,981 3,993 3,941 Total liabilities and equity $ 29,913 $ 30,001 $ 29,787 $ 30,825 $ 29,048

$ 28,481 Page 12

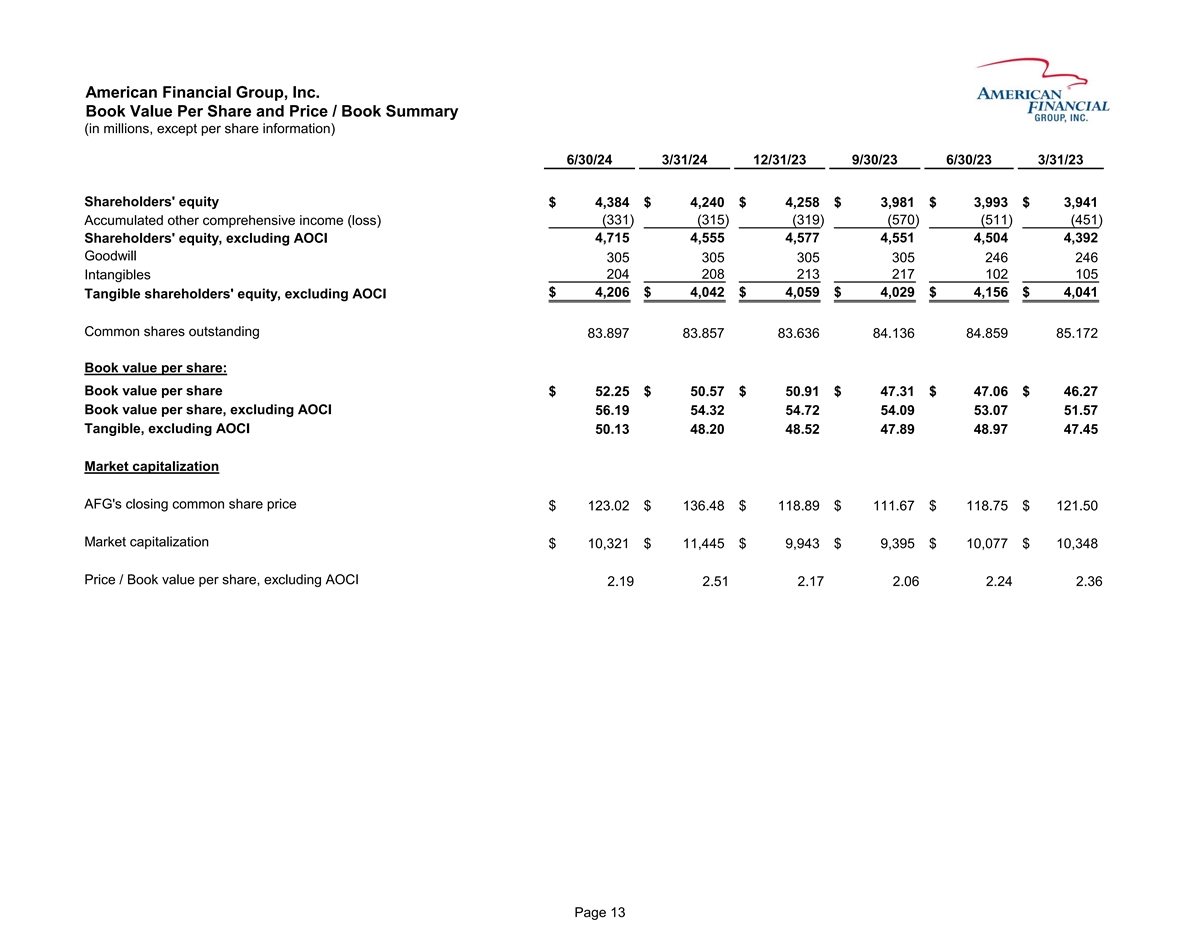

American Financial Group, Inc. Book Value Per Share and Price / Book

Summary (in millions, except per share information) 6/30/24 3/31/24 12/31/23 9/30/23 6/30/23 3/31/23 Shareholders' equity $ 4,384 $ 4,240 $ 4,258 $ 3,981 $ 3,993 $ 3,941 Accumulated other comprehensive income (loss) (331) (315) (319) (570) (511)

(451) Shareholders' equity, excluding AOCI 4,715 4,555 4,577 4,551 4,504 4,392 Goodwill 305 305 305 305 246 246 Intangibles 204 208 213 217 102 105 $ 4,206 $ 4,042 $ 4,059 $ 4,029 $ 4,156 $ 4,041 Tangible shareholders' equity, excluding AOCI Common

shares outstanding 83.897 83.857 83.636 84.136 84.859 85.172 Book value per share: Book value per share $ 52.25 $ 50.57 $ 50.91 $ 47.31 $ 47.06 $ 46.27 Book value per share, excluding AOCI 56.19 54.32 54.72 54.09 53.07 51.57 Tangible, excluding AOCI

50.13 48.20 48.52 47.89 48.97 47.45 Market capitalization AFG's closing common share price $ 123.02 $ 136.48 $ 118.89 $ 111.67 $ 118.75 $ 121.50 Market capitalization $ 10,321 $ 11,445 $ 9,943 $ 9,395 $ 10,077 $ 10,348 Price / Book value per share,

excluding AOCI 2.19 2.51 2.17 2.06 2.24 2.36 Page 13

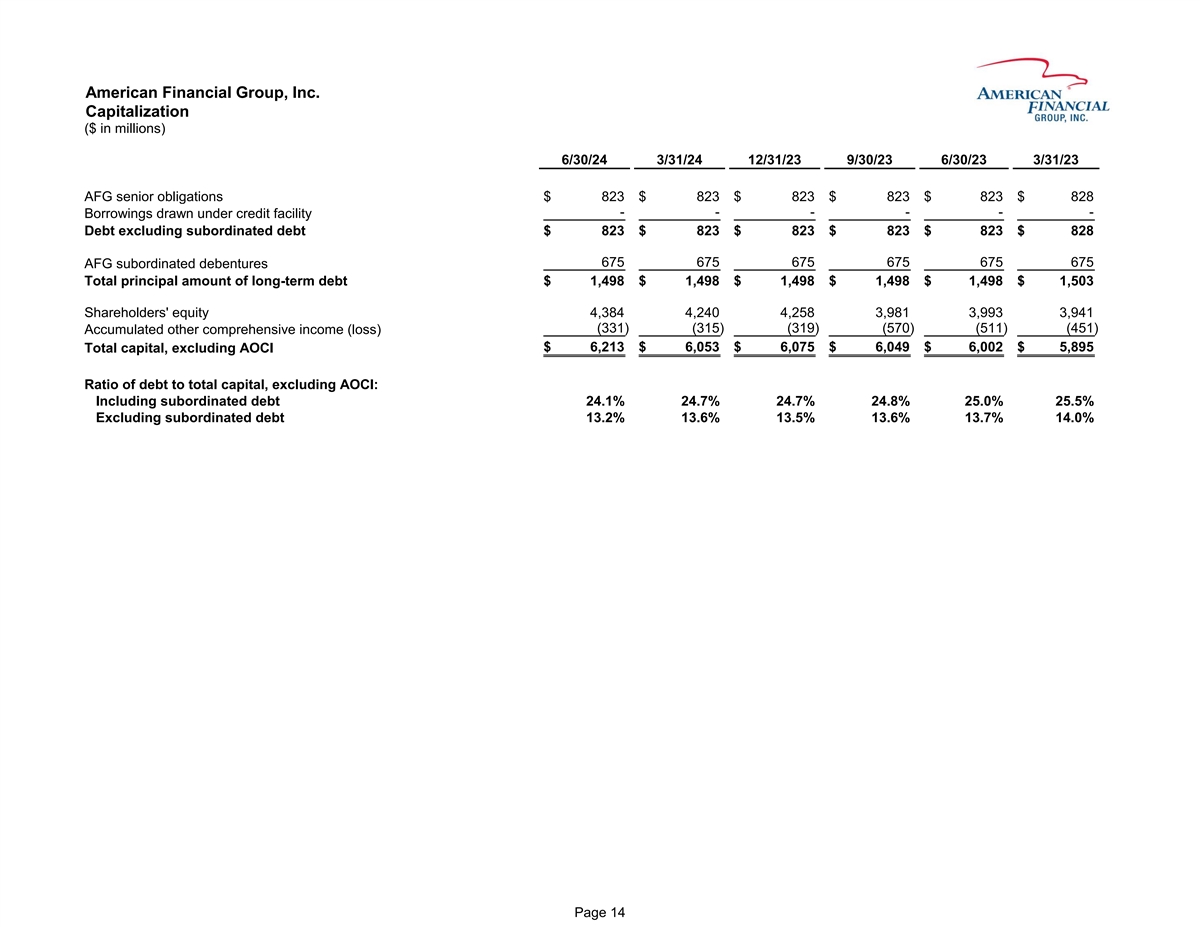

American Financial Group, Inc. Capitalization ($ in millions) 6/30/24

3/31/24 12/31/23 9/30/23 6/30/23 3/31/23 AFG senior obligations $ 823 $ 823 $ 823 $ 823 $ 823 $ 828 - - - - - - Borrowings drawn under credit facility Debt excluding subordinated debt $ 823 $ 823 $ 823 $ 823 $ 823 $ 828 675 675 675 675 675 675 AFG

subordinated debentures Total principal amount of long-term debt $ 1,498 $ 1,498 $ 1,498 $ 1,498 $ 1,498 $ 1,503 Shareholders' equity 4,384 4,240 4,258 3,981 3,993 3,941 (331) (3 15) (319) (570) (511) (451) Accumulated other comprehensive income