- Net earnings per share of $2.49; includes $0.07 per share

loss from non-core items

- Second quarter core net operating earnings per share of

$2.56, 8% higher than the comparable period

- Second quarter annualized ROE of 18.0%; core operating ROE

of 18.5%

- Second quarter Specialty calendar year combined ratio

improved 1.4 points YOY to 90.5%

- Overall average renewal rate increases excluding workers’

compensation of 8%

American Financial Group, Inc. (NYSE: AFG) today reported 2024

second quarter net earnings of $209 million ($2.49 per share)

compared to $200 million ($2.34 per share) for the 2023 second

quarter. Net earnings for the 2024 second quarter included

after-tax non-core losses of $6 million ($0.07 per share loss). By

comparison, net earnings in the 2023 second quarter included net

after-tax non-core items that reduced net income by $2 million

($0.04 per share loss). Annualized return on equity was 18.0% and

17.9% for the second quarters of 2024 and 2023, respectively, and

is calculated excluding accumulated other comprehensive income

(AOCI). Other details may be found in the table on the following

page.

Core net operating earnings were $215 million ($2.56 per share)

for the 2024 second quarter, compared to $202 million ($2.38 per

share) in the 2023 second quarter, reflecting meaningfully higher

P&C underwriting profit. Additional details for the 2024 and

2023 second quarters may be found in the table below. Core net

operating earnings for the second quarters of 2024 and 2023

generated annualized returns on equity of 18.5% and 18.2%,

respectively, which is calculated excluding AOCI.

Three Months Ended June 30,

Components of

Pretax Core Operating Earnings

2024

2023

2024

2023

2024

2023

In millions, except per share amounts

Before Impact of

Alternative

Core Net Operating

Alternative Investments

Investments

Earnings, as reported

P&C Pretax Core Operating Earnings

$

286

$

244

$

33

$

55

$

319

$

299

Other expenses

(27

)

(22

)

-

-

(27

)

(22

)

Holding company interest expense

(19

)

(19

)

-

-

(19

)

(19

)

Pretax Core Operating Earnings

240

203

33

55

273

258

Related provision for income taxes

51

44

7

12

58

56

Core Net Operating Earnings

$

189

$

159

$

26

$

43

$

215

$

202

Core Operating Earnings Per Share

$

2.25

$

1.87

$

0.31

$

0.51

$

2.56

$

2.38

Weighted Avg Diluted Shares

Outstanding

83.9

85.2

83.9

85.2

83.9

85.2

AFG’s book value per share was $52.25 at June 30, 2024. AFG paid

cash dividends of $0.71 per share during the second quarter. For

the three months ended June 30, 2024, AFG’s growth in book value

per share plus dividends was 4.7% and year to date, growth in book

value per share plus dividends was 10.3%.

Book value per share excluding AOCI was $56.19 at June 30, 2024.

For the three months ended June 30, 2024, AFG’s growth in book

value per share excluding AOCI plus dividends was 4.7%. Year to

date, growth in book value per share excluding AOCI plus dividends

was 9.9%.

AFG’s net earnings, determined in accordance with U.S. generally

accepted accounting principles (GAAP), include certain items that

may not be indicative of its ongoing core operations. The table

below identifies such items and reconciles net earnings to core net

operating earnings, a non-GAAP financial measure. AFG believes that

its core net operating earnings provides management, financial

analysts, ratings agencies, and investors with an understanding of

the results from the ongoing operations of the Company by excluding

the impact of net realized gains and losses and other items that

are not necessarily indicative of operating trends. AFG’s

management uses core net operating earnings to evaluate financial

performance against historical results because it believes this

provides a more comparable measure of its continuing business. Core

net operating earnings is also used by AFG’s management as a basis

for strategic planning and forecasting.

In millions, except per share amounts

Three months ended June 30,

Six months ended June 30,

2024

2023

2024

2023

Components of net earnings:

Core operating earnings before income

taxes

$

273

$

258

$

563

$

566

Pretax non-core

items:

Realized gains (losses) on securities

(2

)

(2

)

12

(48

)

Gain (loss) on retirement of debt

-

(1

)

-

1

Earnings before income taxes

271

255

575

519

Provision (credit) for income taxes:

Core operating earnings

58

56

117

117

Non-core items

4

(1

)

7

(10

)

Total provision for income taxes

62

55

124

107

Net earnings

$

209

$

200

$

451

$

412

Net earnings:

Core net operating earnings(a)

$

215

$

202

$

446

$

449

Non-core

items:

Realized gains (losses) on securities

(2

)

(1

)

9

(38

)

Other

(4

)

(1

)

(4

)

1

Net earnings

$

209

$

200

$

451

$

412

Components of earnings per share:

Core net operating earnings(a)

$

2.56

$

2.38

$

5.32

$

5.27

Non-core

Items:

Realized gains (losses) on securities

(0.02

)

(0.02

)

0.11

(0.45

)

Other

(0.05

)

(0.02

)

(0.05

)

0.01

Diluted net earnings per share

$

2.49

$

2.34

$

5.38

$

4.83

Footnote (a) is contained in the

accompanying Notes to Financial Schedules at the end of this

release.

Carl H. Lindner III and S. Craig Lindner, AFG’s Co-Chief

Executive Officers, issued this statement: “We are pleased to

report a second quarter annualized core operating return on equity

of 18.5%. Underwriting margins in our specialty P&C insurance

businesses were strong, and higher interest rates increased net

investment income, excluding alternatives, by 15% year over year.

These results, coupled with effective capital management and our

entrepreneurial, opportunistic culture and disciplined operating

philosophy enable us to continue to create value for our

shareholders.

Messrs. Lindner continued: “AFG continued to have significant

excess capital at June 30, 2024. Returning capital to shareholders

in the form of regular and special cash dividends and through

opportunistic share repurchases is an important and effective

component of our capital management strategy. In addition, our

capital will be deployed into AFG’s core businesses as we identify

the potential for healthy, profitable organic growth, and

opportunities to expand our specialty niche businesses through

acquisitions and start-ups that meet our target return

thresholds.”

Specialty Property and Casualty

Insurance Operations

The Specialty P&C insurance operations generated a strong

90.5% combined ratio in the second quarter of 2024, an improvement

of 1.4 points from the 91.9% reported in the second quarter of

2023. Second quarter 2024 results include 2.3 points related to

catastrophe losses, compared to 3.5 points in the 2023 second

quarter. Second quarter 2024 results benefited from 2.3 points of

favorable prior year reserve development, compared to 4.0 points in

the second quarter of 2023. Underwriting profit was $151 million

for the 2024 second quarter compared to $123 million in the second

quarter of the prior period.

Second quarter 2024 gross and net written premiums were up 2%

and 1%, respectively, when compared to the second quarter of 2023.

We continue to achieve year-over-year premium growth as a result of

a combination of new business opportunities, increased exposures,

and a good renewal rate environment, which was partially offset by

later reporting of crop premiums. Tempered growth in the quarter

also reflects the Company’s proactive and intentional approach to

managing exposure in several of our social inflation-exposed

businesses.

Average renewal pricing across our P&C Group, excluding

workers’ compensation, was up approximately 8% for the quarter, and

up approximately 6% overall, consistent with pricing increases

achieved in the first quarter. We believe we are achieving overall

renewal rate increases in excess of prospective loss ratio trends

to meet or exceed targeted returns.

The Property and Transportation Group reported an

underwriting profit of $39 million in the second quarter of 2024,

compared to $32 million in the second quarter of 2023. Higher

year-over-year underwriting profits in our property & inland

marine and crop insurance businesses were partially offset by lower

underwriting profitability in our transportation businesses.

Catastrophe losses in this group were $13 million in the second

quarter of 2024, compared to $15 million in the second quarter of

2023. Overall, the businesses in the Property and Transportation

Group achieved a 92.9% calendar year combined ratio in the second

quarter, improving 1.3 points from the comparable period in

2023.

Second quarter 2024 gross and net written premiums in this group

were both 2% higher than the comparable prior year. Year-over-year

premium growth was primarily attributed to new business

opportunities, a favorable rate environment and increased exposures

in our commercial auto businesses. Later reporting of crop acreage,

which impacts the timing of crop premiums, more than offset

additional crop premium associated with the CRS acquisition.

Excluding crop, gross and net written premiums in this group grew

by 7% and 5%, respectively. Overall renewal rates in this group

increased 8% on average in the second quarter of 2024, about a

point lower than the pricing achieved in this group for the first

quarter of 2024.

The Specialty Casualty Group achieved an excellent 85.4%

calendar year combined ratio overall in the second quarter of 2024,

an improvement of 1.2 points over the very strong 86.6% reported in

the second quarter of 2023. Underwriting profit was $108 million in

the second quarter of 2024, compared to $95 million in the second

quarter of 2023. Higher year-over-year profitability in our

targeted markets and workers’ compensation businesses and improved

results in several other Specialty Casualty businesses were

partially offset by lower levels of favorable prior year reserve

development in our executive liability business and adverse

development in our excess liability business. Catastrophe losses

for this group were $5 million in the second quarter of 2024

compared to $8 million in the prior year quarter.

Second quarter 2024 gross and net written premiums increased 1%

and 2%, respectively, when compared to the same prior year period.

Approximately two-thirds of the businesses in this group reported

year-over-year growth as a result of new business opportunities,

higher rates and strong policy retention. This growth was partially

offset by non-renewal of several large accounts and other

underwriting actions taken in several of our targeted markets

businesses. Excluding our workers’ compensation businesses, renewal

rates for this group were up approximately 7% in the second

quarter, about a point lower than the first quarter. Overall

renewal rates in this group including workers’ compensation were up

about 5% and consistent with the first quarter of 2024.

The Specialty Financial Group reported an underwriting

profit of $25 million in the second quarter of 2024, compared to

$10 million in the second quarter of 2023. The increase was

primarily the result of higher underwriting profit in our financial

institutions business. Catastrophe losses for this group were $17

million in the second quarter of 2024 compared to $19 million in

the prior year quarter. This group continued to achieve excellent

underwriting margins and reported a combined ratio of 89.7% for the

second quarter of 2024, 5.3 points better than the 95.0% reported

in the comparable period in 2023.

Second quarter 2024 gross written premiums were flat and net

written premiums were up 3% in this group, respectively, when

compared to the prior year period. Growth in our financial

institutions business was partially offset by a decision to pause

writing of new intellectual property-related coverage in our

Innovative Markets business. Renewal pricing in this group was up

approximately 6% for the quarter, about 1 point lower than the

previous quarter.

Carl Lindner III stated, “Underwriting profitability was very

strong in our Specialty P&C businesses in the second quarter of

2024, and we continue to feel confident about the strength of our

reserves. A continued favorable pricing environment and new

business opportunities enabled us to selectively grow our Specialty

P&C businesses. Growth in net written premium was about 4% for

the first six months of the year, as timing of acreage reporting by

farmers and underwriting actions in a few of our businesses

tempered growth in the second quarter. We expect growth in net

written premiums to be approximately 7% for the full year in

2024.”

Further details about AFG’s Specialty P&C operations may be

found in the accompanying schedules and in our Quarterly Investor

Supplement, which is posted on our website.

Investments

Net Investment Income – For the quarter ended June 30,

2024, property and casualty net investment income was approximately

1% lower than the comparable 2023 period. Excluding the impact of

alternative investments, net investment income in our property and

casualty insurance operations for the three months ended June 30,

2024, increased 15% year-over-year as a result of the impact of

higher interest rates and higher balances of invested assets. The

annualized return on alternative investments was approximately 5.1%

for the 2024 second quarter compared to 9.6% for the prior year

quarter. Earnings from alternative investments may vary from

quarter to quarter based on the reported results of the underlying

investments, and generally are reported on a quarter lag. The

average annual return on alternative investments over the five

calendar years ended December 31, 2023, was approximately 13%.

Non-Core Net Realized Gains (Losses) – AFG recorded

second quarter 2024 net realized losses on securities of $2 million

($0.02 per share loss) after tax, which included $2 million ($0.02

per share loss) in after-tax net losses to adjust equity securities

that the Company continued to own at June 30, 2024, to fair value.

By comparison, AFG recorded net realized losses on securities of $1

million ($0.02 per share loss) in the comparable 2023 period.

After-tax unrealized losses related to fixed maturities were

$310 million at June 30, 2024. Our portfolio continues to be high

quality, with 94% of our fixed maturity portfolio rated investment

grade and 96% of our P&C fixed maturity portfolio with a

National Association of Insurance Commissioners’ designation of

NAIC 1 or 2, its highest two categories.

More information about the components of our investment

portfolio may be found in our Quarterly Investor Supplement, which

is posted on our website.

About American Financial

Group, Inc.

American Financial Group is an insurance holding company, based

in Cincinnati, Ohio. Through the operations of Great American

Insurance Group, AFG is engaged primarily in property and casualty

insurance, focusing on specialized commercial products for

businesses. Great American Insurance Group’s roots go back to 1872

with the founding of its flagship company, Great American Insurance

Company.

Forward Looking

Statements

This press release, and any related oral statements, contains

certain statements that may be deemed to be "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. All

statements in this press release not dealing with historical

results are forward-looking and are based on estimates,

assumptions, and projections. Examples of such forward-looking

statements include statements relating to: the Company's

expectations concerning market and other conditions and their

effect on future premiums, revenues, earnings, investment

activities and the amount and timing of share repurchases or

special dividends; recoverability of asset values; expected losses

and the adequacy of reserves for asbestos, environmental pollution

and mass tort claims; rate changes; and improved loss

experience.

Actual results and/or financial condition could differ

materially from those contained in or implied by such

forward-looking statements for a variety of reasons including, but

not limited to: the risks and uncertainties AFG describes in the

“Risk Factors” section of its most recent Annual Report on Form

10-K, as updated by its other reports filed with the Securities and

Exchange Commission; changes in financial, political and economic

conditions, including changes in interest and inflation rates,

currency fluctuations and extended economic recessions or

expansions in the U.S. and/or abroad; performance of securities

markets; new legislation or declines in credit quality or credit

ratings that could have a material impact on the valuation of

securities in AFG’s investment portfolio; the availability of

capital; changes in insurance law or regulation, including changes

in statutory accounting rules, including modifications to capital

requirements; changes in the legal environment affecting AFG or its

customers; tax law and accounting changes; levels of natural

catastrophes and severe weather, terrorist activities (including

any nuclear, biological, chemical or radiological events),

incidents of war or losses resulting from pandemics, civil unrest

and other major losses; disruption caused by cyber-attacks or other

technology breaches or failures by AFG or its business partners and

service providers, which could negatively impact AFG’s business

and/or expose AFG to litigation; development of insurance loss

reserves and establishment of other reserves, particularly with

respect to amounts associated with asbestos and environmental

claims; availability of reinsurance and ability of reinsurers to

pay their obligations; competitive pressures; the ability to obtain

adequate rates and policy terms; changes in AFG’s credit ratings or

the financial strength ratings assigned by major ratings agencies

to AFG’s operating subsidiaries; the impact of the conditions in

the international financial markets and the global economy relating

to AFG’s international operations; and effects on AFG’s reputation,

including as a result of environmental, social and governance

matters.

The forward-looking statements herein are made only as of the

date of this press release. The Company assumes no obligation to

publicly update any forward-looking statements.

Conference Call

The Company will hold a conference call to discuss 2024 second

quarter results at 11:30 a.m. (ET) tomorrow, Wednesday, August 7,

2024. New, simplified event registration and access provides two

ways to access the call.

Participants should register for the call here now or any time

up to and during the time of the call, and will immediately receive

the dial-in number and a unique PIN to access the call. While you

may register at any time up to and during the time of the call, you

are encouraged to join the call 10 minutes prior to the start of

the event.

The conference call and accompanying webcast slides will also be

broadcast live over the internet. To access the event, click the

following link:

https://www.afginc.com/news-and-events/event-calendar.

Alternatively, you can choose Events from the Investor

Relations page at www.AFGinc.com.

A replay of the webcast will be available via the same link on

our website approximately two hours after the completion of the

call.

Websites: www.AFGinc.com

www.GreatAmericanInsuranceGroup.com

(Financial summaries follow)

This earnings release and AFG’s Quarterly Investor Supplement

are available in the Investor Relations section of AFG’s website:

www.AFGinc.com.

AMERICAN FINANCIAL GROUP, INC.

AND SUBSIDIARIES

SUMMARY OF EARNINGS AND

SELECTED BALANCE SHEET DATA

(In Millions, Except Per Share

Data)

Three months ended June 30,

Six months ended June 30,

2024

2023

2024

2023

Revenues

P&C insurance net earned premiums

$

1,585

$

1,507

$

3,131

$

2,944

Net investment income

188

198

386

415

Realized gains (losses) on securities

(2

)

(2

)

12

(48

)

Income of managed investment entities:

Investment income

98

112

197

216

Gain (loss) on change in fair value of

assets/liabilities

4

-

14

(4

)

Other income

27

25

66

57

Total revenues

1,900

1,840

3,806

3,580

Costs and expenses

P&C insurance losses &

expenses

1,443

1,390

2,858

2,683

Interest charges on borrowed money

19

19

38

38

Expenses of managed investment

entities

90

103

182

198

Other expenses

77

73

153

142

Total costs and expenses

1,629

1,585

3,231

3,061

Earnings before income taxes

271

255

575

519

Provision for income taxes

62

55

124

107

Net earnings

$

209

$

200

$

451

$

412

Diluted earnings per common share

$

2.49

$

2.34

$

5.38

$

4.83

Average number of diluted shares

83.9

85.2

83.9

85.3

Selected Balance

Sheet Data:

June 30, 2024

December 31, 2023

Total cash and investments

$

15,261

$

15,263

Long-term debt

$

1,475

$

1,475

Shareholders’ equity(b)

$

4,384

$

4,258

Shareholders’ equity (excluding AOCI)

$

4,715

$

4,577

Book value per share(b)

$

52.25

$

50.91

Book value per share (excluding AOCI)

$

56.19

$

54.72

Common Shares Outstanding

83.9

83.6

Footnote (b) is contained in the

accompanying Notes to Financial Schedules at the end of this

release.

AMERICAN FINANCIAL GROUP,

INC.

SPECIALTY P&C

OPERATIONS

(Dollars in Millions)

Three months ended

June 30,

Pct.

Change

Six months ended

June 30,

Pct.

Change

2024

2023

2024

2023

Gross written premiums

$

2,406

$

2,369

2

%

$

4,742

$

4,524

5

%

Net written premiums

$

1,692

$

1,667

1

%

$

3,326

$

3,186

4

%

Ratios (GAAP):

Loss & LAE ratio

59.1

%

60.2

%

58.8

%

58.6

%

Underwriting expense ratio

31.4

%

31.7

%

31.4

%

32.0

%

Specialty Combined Ratio

90.5

%

91.9

%

90.2

%

90.6

%

Combined Ratio – P&C

Segment

90.5

%

91.7

%

90.3

%

90.5

%

Supplemental

Information:(c)

Gross Written Premiums:

Property & Transportation

$

1,084

$

1,059

2

%

$

2,043

$

1,931

6

%

Specialty Casualty

1,023

1,012

1

%

2,120

2,073

2

%

Specialty Financial

299

298

-

%

579

520

11

%

$

2,406

$

2,369

2

%

$

4,742

$

4,524

5

%

Net Written Premiums:

Property & Transportation

$

681

$

668

2

%

$

1,272

$

1,220

4

%

Specialty Casualty

704

693

2

%

1,455

1,415

3

%

Specialty Financial

248

240

3

%

482

424

14

%

Other

59

66

(11

%)

117

127

(8

%)

$

1,692

$

1,667

1

%

$

3,326

$

3,186

4

%

Combined Ratio (GAAP):

Property & Transportation

92.9

%

94.2

%

91.0

%

92.6

%

Specialty Casualty

85.4

%

86.6

%

87.7

%

87.1

%

Specialty Financial

89.7

%

95.0

%

88.1

%

90.8

%

Aggregate Specialty Group

90.5

%

91.9

%

90.2

%

90.6

%

Three months ended

June 30,

Six months ended

June 30,

2024

2023

2024

2023

Reserve Development

(Favorable)/Adverse:

Property & Transportation

$

(33

)

$

(21

)

$

(76

)

$

(58

)

Specialty Casualty

(25

)

(24

)

(42

)

(51

)

Specialty Financial

-

(11

)

6

(14

)

Other Specialty

22

(5

)

25

(2

)

Specialty Group

(36

)

(61

)

(87

)

(125

)

Other

1

(1

)

2

-

Total Reserve Development

$

(35

)

$

(62

)

$

(85

)

$

(125

)

Points on Combined Ratio:

Property & Transportation

(6.2

)

(3.8

)

(7.2

)

(5.7

)

Specialty Casualty

(3.5

)

(3.4

)

(2.9

)

(3.6

)

Specialty Financial

0.1

(5.7

)

1.2

(3.5

)

Aggregate Specialty Group

(2.3

)

(4.0

)

(2.8

)

(4.2

)

Total P&C Segment

(2.2

)

(4.2

)

(2.7

)

(4.3

)

Footnote (c) is contained in the

accompanying Notes to Financial Schedules at the end of this

release.

AMERICAN FINANCIAL GROUP, INC. Notes

to Financial Schedules

a) Components of core net operating earnings (in millions):

Three months ended June 30,

Six months ended June 30,

2024

2023

2024

2023

Core Operating

Earnings before Income Taxes:

P&C insurance segment

$

319

$

299

$

659

$

649

Interest and other corporate expenses

(46

)

(41

)

(96

)

(83

)

Core operating earnings before income

taxes

273

258

563

566

Related income taxes

58

56

117

117

Core net operating earnings

$

215

$

202

$

446

$

449

b) Shareholders’ Equity at June 30, 2024, includes ($331

million) ($3.94 per share loss) in Accumulated Other Comprehensive

Income (Loss) compared to ($319 million) ($3.81 per share loss) at

December 31, 2023.

c) Supplemental Notes:

- Property & Transportation includes primarily

physical damage and liability coverage for buses and trucks and

other specialty transportation niches, inland and ocean marine,

agricultural-related products and other commercial property

coverages.

- Specialty Casualty includes primarily excess and

surplus, general liability, executive liability, professional

liability, umbrella and excess liability, specialty coverages in

targeted markets, customized programs for small to mid-sized

businesses and workers’ compensation insurance.

- Specialty Financial includes risk management insurance

programs for lending and leasing institutions (including equipment

leasing and collateral and lender-placed mortgage property

insurance), surety and fidelity products and trade credit

insurance.

- Other includes an internal reinsurance facility.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806215147/en/

Diane P. Weidner, IRC, CPA (inactive) Vice President – Investor

& Media Relations 513-369-5713

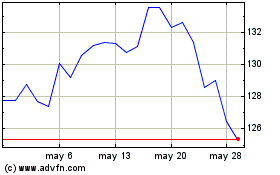

American Financial (NYSE:AFG)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

American Financial (NYSE:AFG)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025