0001232582false00012325822024-09-232024-09-230001232582us-gaap:CommonStockMember2024-09-232024-09-230001232582us-gaap:SeriesDPreferredStockMember2024-09-232024-09-230001232582us-gaap:SeriesFPreferredStockMember2024-09-232024-09-230001232582us-gaap:SeriesGPreferredStockMember2024-09-232024-09-230001232582us-gaap:SeriesHPreferredStockMember2024-09-232024-09-230001232582aht:SeriesIPreferredStockMember2024-09-232024-09-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): September 23, 2024

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-31775 | | 86-1062192 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS employer identification number) |

| | | | |

| 14185 Dallas Parkway, Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | AHT | | New York Stock Exchange |

| Preferred Stock, Series D | | AHT-PD | | New York Stock Exchange |

| Preferred Stock, Series F | | AHT-PF | | New York Stock Exchange |

| Preferred Stock, Series G | | AHT-PG | | New York Stock Exchange |

| Preferred Stock, Series H | | AHT-PH | | New York Stock Exchange |

| Preferred Stock, Series I | | AHT-PI | | New York Stock Exchange |

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On September 23, 2024, Ashford Hospitality Trust, Inc. (the “Company”) received a written notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that it is not in compliance with Section 802.01C of the NYSE Listed Company Manual because the average closing price of the Company’s common stock was less than $1.00 over a consecutive 30 trading-day period. The notice does not result in the immediate delisting of the Company’s common stock from the NYSE.

The Company plans to notify the NYSE within 10 business days of receipt of the Notice that it intends to cure the stock price deficiency and to return to compliance with the NYSE continued listing standards. The Company can regain compliance at any time within a six-month cure period following its receipt of the Notice if, on the last trading day of any calendar month during such cure period, the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month. The Company intends to remain listed on the NYSE and intends to execute a 1-for-10 reverse stock split to regain compliance with the NYSE’s continued listing standards. Section 802.01C provides for an extension to the six-month cure period if the action required to cure the price condition requires stockholder approval, in which case, the action needs to be approved by no later than the Company’s next annual stockholder’s meeting and implemented promptly thereafter.

The Company’s common stock will continue to be listed and traded on the NYSE during this period, subject to the Company’s compliance with other NYSE continued listing standards. The Company’s common stock will continue to trade under the symbol “AHT,” but will have an added designation of “.BC” to indicate that the Company is not currently in compliance with NYSE continued listing standards.

The Notice does not affect the Company’s ongoing business operations or its Securities and Exchange Commission reporting requirements, nor does it trigger a breach of the Company’s material debt obligations. The Company can provide no assurances that it will be able to satisfy any of the steps outlined above and maintain the listing of its shares on the NYSE.

A copy of the Company’s press release dated September 26, 2024, regarding the receipt of the Notice from the NYSE, is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

Certain statements and assumptions in this current report on Form 8-K contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following subjects are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases, sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to operate our business; our understanding of our competition; projected capital expenditures; the impact of technology on our operations and business; the risk that the Notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company’s common stock; and the Company’s ability to regain compliance with the NYSE continued listing standards. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the Company’s filings with the SEC.

The forward-looking statements included in this current report are only made as of the date of this current report. Investors should not place undue reliance on these forward-looking statements. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise.

Item 7.01 Regulation FD Disclosure.

As required by Section 802.01C, the Company issued a press release on September 26, 2024, announcing that it had received the notice of noncompliance with the NYSE’s continued listing standards. A copy of the press release is being furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASHFORD HOSPITALITY TRUST, INC. |

| | |

| Dated: September 26, 2024 | By: | /s/ Alex Rose |

| | Alex Rose |

| | Executive Vice President, General Counsel & Secretary |

NEWS RELEASE

| | | | | | | | | | | |

|

| | | |

| Contact: | Deric Eubanks | Joseph Calabrese | Laken Rapier |

| Chief Financial Officer | Financial Relations Board | Media Contact |

| (972) 490-9600 | (212) 827-3772 | (469) 236-2400 |

ASHFORD HOSPITALITY TRUST ANNOUNCES REVERSE

STOCK SPLIT TO MAINTAIN LISTING ON THE NYSE

DALLAS – September 26, 2024 – Ashford Hospitality Trust, Inc. (NYSE: AHT) (“Ashford Trust” or the “Company”) today announced that it was notified by the New York Stock Exchange (the “NYSE”) on September 23, 2024 that it is not in compliance with Section 802.01C of the NYSE’s Listed Company Manual, which requires listed companies to maintain an average closing share price of at least $1.00 over a consecutive 30 trading day period.

The Company plans to notify the NYSE within 10 business days of receipt of the notice that it intends to execute a 1-for-10 reverse stock split in order to regain compliance. The Company can regain compliance at any time within a six-month cure period following its receipt of the notice if, on the last trading day of any calendar month during such cure period, the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month.

The Company believes the reverse stock split will benefit all shareholders by addressing several items impacting its common stock:

•It will allow the Company’s common stock to continue trading on the NYSE.

•The Company anticipates that the reverse stock split will meaningfully increase the Company’s market price per share above the $5 per share threshold required by many institutions to hold shares.

•Some brokers limit the ability or increase the cost to margin a stock under $5 per share.

By implementing a reverse stock split, the Company and its Board of Directors believes it can realize increased incremental demand for its common stock while also making the Company’s shares more attractive to a broader range of potential long-term institutional investors, individual investors, and buy-side analysts.

The Company’s common stock will continue to be listed and traded on the NYSE during this period, subject to the Company’s compliance with other NYSE continued listing standards. The Company’s common stock will continue to trade under the symbol “AHT,” but will have an added designation of “.BC” to indicate that the Company is not currently in compliance with NYSE continued listing standards.

The notice does not affect the Company’s ongoing business operations or its Securities and Exchange Commission reporting requirements, nor does it trigger a breach of the Company’s material debt obligations. The Company can provide no assurances that it will be able to satisfy any of the steps outlined above and maintain the listing of its shares on the NYSE.

* * * * *

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels.

Forward-Looking Statements

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following subjects are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases, sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to operate our business; our understanding of our competition; projected capital expenditures; the impact of technology on our operations and business; the risk that the notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company’s common stock; and the Company’s ability to regain compliance with the NYSE continued listing standards. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the Company’s filings with the SEC.

The forward-looking statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance on these forward-looking statements. We will not publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise except to the extent required by law.

v3.24.3

Document and Entity Information

|

Sep. 23, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 23, 2024

|

| Entity Registrant Name |

ASHFORD HOSPITALITY TRUST, INC.

|

| Entity Central Index Key |

0001232582

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-31775

|

| Entity Tax Identification Number |

86-1062192

|

| Entity Address, Address Line One |

14185 Dallas Parkway, Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

972

|

| Local Phone Number |

490-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AHT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series D |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series D

|

| Trading Symbol |

AHT-PD

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series F |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series F

|

| Trading Symbol |

AHT-PF

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series G |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series G

|

| Trading Symbol |

AHT-PG

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series H |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series H

|

| Trading Symbol |

AHT-PH

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series I |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series I

|

| Trading Symbol |

AHT-PI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aht_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

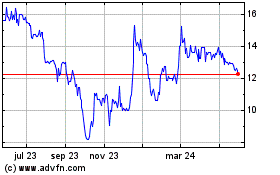

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

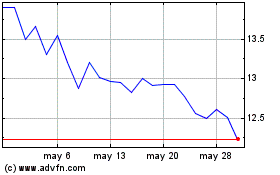

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024