0001232582false00012325822024-10-182024-10-180001232582us-gaap:CommonStockMember2024-10-182024-10-180001232582us-gaap:SeriesDPreferredStockMember2024-10-182024-10-180001232582us-gaap:SeriesFPreferredStockMember2024-10-182024-10-180001232582us-gaap:SeriesGPreferredStockMember2024-10-182024-10-180001232582us-gaap:SeriesHPreferredStockMember2024-10-182024-10-180001232582aht:SeriesIPreferredStockMember2024-10-182024-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): October 18, 2024

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-31775 | | 86-1062192 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS employer identification number) |

| | | | |

| 14185 Dallas Parkway, Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | AHT | | New York Stock Exchange |

| Preferred Stock, Series D | | AHT-PD | | New York Stock Exchange |

| Preferred Stock, Series F | | AHT-PF | | New York Stock Exchange |

| Preferred Stock, Series G | | AHT-PG | | New York Stock Exchange |

| Preferred Stock, Series H | | AHT-PH | | New York Stock Exchange |

| Preferred Stock, Series I | | AHT-PI | | New York Stock Exchange |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 18, 2024, Ashford Inc. (the “Advisor”), external advisor to Ashford Hospitality Trust, Inc. (the “Company”), entered into a compensatory arrangement (the “Compensatory Arrangement”) with Stephen Zsigray, the Company’s President and Chief Executive Officer. The Compensatory Arrangement is effective as of July 1, 2024.

The Company is not a party to the Compensatory Arrangement and all of Mr. Zsigray’s base compensation and employee health and welfare benefits are provided by the Advisor. However, in connection with the Advisor’s entry into the Compensatory Arrangement with Mr. Zsigray, the Board of Directors of the Company has agreed to pay Mr. Zsigray a one-time sign on bonus consisting of a $704,110 deferred cash award (the “Deferred Cash Award”) and grant Mr. Zsigray a one-time award of 509,000 shares of restricted common stock of the Company (the “Equity Grant”). The Deferred Cash Award is payable (i) 25% in the fourth quarter of 2024; (ii) 50% upon repayment of all amounts owing under the Company’s corporate strategic financing with Oaktree Capital Management, L.P.; and (iii) 25% on successful completion of a process to review potential value creation strategies for the Company, as determined by the Compensation Committee of the Company’s Board of Directors. The Equity Grant is eligible to vest in three equal installments on each of July 1, 2025, 2026 and 2027. Payment of the Deferred Cash Award and vesting of the Equity Grant are generally subject to Mr. Zsigray’s continued employment through each applicable milestone.

This foregoing summary of the Compensatory Arrangement does not purport to be complete and is qualified in its entirety by reference to the full text of the Compensatory Arrangement, which is filed as Exhibit 99.1 hereto and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASHFORD HOSPITALITY TRUST, INC. |

| | |

| Dated: October 24, 2024 | By: | /s/ Alex Rose |

| | Alex Rose |

| | Executive Vice President, General Counsel & Secretary |

PERSONAL AND CONFIDENTIAL

Mr. Stephen Zsigray

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254

Dear Stephen,

Below sets forth the terms of your compensation and other benefits for your service as an employee of Ashford Hospitality Advisors, LLC, a Delaware limited liability company (the “Company”), effective as of July 1, 2024 (the “Effective Date”).

1. Base Salary. The Company shall pay you (the “Executive”) a Base Salary which shall be payable in periodic installments, less statutory deductions and withholdings, according to the Company’s normal payroll practices. Commencing on the Effective Date, the Executive’s Base Salary shall be $400,000.00 per year. The board of directors of Ashford Inc. (the “AINC Board”) or a compensation committee duly appointed by the AINC Board (the “Compensation Committee”) shall thereafter review the Executive’s Base Salary annually to determine within its sole discretion whether and to what extent the Executive’s salary may be adjusted. For the purposes of this Agreement, the term “Base Salary” shall mean the amount established and adjusted from time to time pursuant to paragraph).

2. Annual Incentive Bonus. The Executive shall be eligible to earn an annual cash incentive bonus (the “Incentive Bonus”) of up to 100% of the Executive’s Base Salary for each calendar year during Executive’s employment based on the level of accomplishment of management and performance objectives as established by the CEO, the AINC Board or the Compensation Committee. The Executive’s Incentive Bonus will be pro-rated for 2024. To be eligible for a bonus you must be employed by Ashford Hospitality Advisors at the time bonus distribution is made. The Incentive Bonus shall be paid as soon as reasonably practical following each calendar year but not later than June 1st of the following year.

3. Incentive, Savings and Retirement Plans. The Executive shall be entitled to participate in all other short- and long-term incentive plans, stock and option plans, long term incentive partnership (“LTIP”) plans, practices, policies and other programs, and all savings and retirement plans, practices, policies and programs, in each case that are applicable generally to senior executives of the Company or Ashford Inc., as may be adopted, or amended from time to time, by the Compensation Committee, including, without limitation, equity incentive programs of other companies advised by the Company.

4. Initial Ashford Inc. Equity Award. The AINC Board has authorized a grant of 15,000 LTIPs to be made to the Executive, subject to the terms and conditions set forth in an award agreement, including vesting of one-third of such LTIPs on each of July 1, 2025, July 1, 2026 and July 1, 2027.

5. Initial Ashford Trust Equity Award. The board of directors of Ashford Hospitality Trust, Inc. (“Ashford Hospitality Trust”) has authorized a grant of 509,000 restricted shares of Ashford Trust common stock, subject to the terms and conditions set forth in an award agreement, including vesting of one-third of such shares on each of July 1, 2025, July 1, 2026 and July 1, 2027.

6. Initial Ashford Trust Deferred Cash Award. The board of directors of Ashford Trust has authorized a deferred cash award of $704,110.00, subject to the terms and conditions set forth in an award

agreement, including vesting and payment on the following terms: (i) 25% ($176,027.50) on October 25, 2024; (ii) 50% ($352,055.00) upon the successful repayment of Ashford Trust’s corporate strategic financing with Oaktree Capital Management, L.P.; and (iii) 25% upon the successful completion of a process to review potential value creation strategies for Ashford Trust with a subset of the board of directors of Ashford Trust.

7. Change of Control.

(a) Definitions.

(i)For purposes of this letter, a “Change of Control” will be deemed to have taken place upon the occurrence of any of the following events:

(A)any “person” (as defined in Section 3(a)(9) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as modified in Section 12(d) and 14(d) of the Exchange Act) other than (A) Ashford Inc. or any of its subsidiaries or any of its officers or directors, (B) any employee benefit plan of Ashford Inc. or the Company or any of their subsidiaries, (C) a company owned, directly or indirectly, by stockholders of Ashford Inc. in substantially the same proportions as their ownership of Ashford Inc., or (D) an underwriter temporarily holding securities pursuant to an offering of such securities, becomes the “beneficial owner” (as defined in Rule 13d-3 of the Exchange Act), directly or indirectly, of securities of Ashford Inc. or Ashford Hospitality Trust representing 30% or more of the shares of voting stock of Ashford Inc. or Ashford Hospitality Trust then outstanding;

(B)the consummation of any merger, reorganization, business combination or consolidation of the Company, Ashford Inc. or one of the subsidiaries of the Company or Ashford Inc. with or into any other company, other than a merger, reorganization, business combination or consolidation which would result in the holders of the voting securities of the Company or Ashford Inc., as applicable, outstanding immediately prior thereto holding securities which represent immediately after such merger, reorganization, business combination or consolidation more than 50% of the combined voting power of the voting securities of Ashford Inc. or the surviving company or the parent of such surviving company;

(C)the consummation of the sale or disposition by Ashford Inc. of all or substantially all of Ashford Inc.’s assets, other than a sale or disposition if the holders of the voting securities of Ashford Inc. outstanding immediately prior thereto hold securities immediately thereafter which represent more than 50% of the combined voting power of the voting securities of the acquiror, or parent of the acquiror, of such assets; or the stockholders of Ashford Inc. approve a plan of complete liquidation or dissolution of Ashford Inc. as applicable; or

(D)individuals who, as of the Effective Date, constitute the AINC Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the AINC Board ; provided, however, that any individual becoming a director subsequent to the Effective Date whose election to the AINC Board was approved or recommended to respective stockholders of Ashford Inc. by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an election contest with respect to the election or removal of directors or other solicitation of proxies or consents by or on behalf of a person other than the AINC Board.

(ii)“Cause” for termination shall be deemed to exist solely in the event of the following:

(A)The conviction of the Executive of, or the entry of a plea of guilty or nolo contendere by the Executive to, a felony (exclusive of a conviction, plea of guilty or nolo contendere arising under a statutory provision imposing criminal liability upon the Executive on a PER SE basis due to any offices held by the Executive pursuant to the terms of this Agreement, so long as any act or omission of the Executive with respect to such matter was not taken or omitted in contravention of any applicable policy or directive of the CEO or the AINC Board (except as would contradict Executive’s fiduciary duties));

(B)willful breach of duty of loyalty which is materially detrimental to the Company, Ashford Inc. or any entity advised by the Company, except as permitted in Section 1(b), which is not cured to the reasonable satisfaction of the CEO or the AINC Board within thirty (30) days following written warning to the Executive from the CEO or the AINC Board describing the alleged circumstances;

(C)willful failure to perform or adhere to explicitly stated duties or guidelines of employment or to follow the lawful directives of the CEO or the AINC Board, except as permitted in Section 1(b) of this Agreement, which continues for thirty (30) days after written warning to the Executive will be deemed a basis for a “For Cause” termination;

(D)gross negligence or willful misconduct in the performance of the Executive’s duties (which is not cured by the Executive within 30 days after written warning from the CEO or the AINC Board;

(E)the Executive’s willful commission of an act of dishonesty resulting in material economic or financial injury to the Company, Ashford Inc. or any entity advised by the Company or willful commission of fraud; or

(F)the Executive’s chronic absence from work for reasons other than illness which is not cured to the reasonable satisfaction of the CEO within 30 days following written warning to the Executive from the CEO describing the alleged circumstances.

For purposes of this hereof, no act, or failure to act, on the Executive’s part will be deemed “willful” unless done, or omitted to be done, by the Executive not in good faith and without a reasonable belief that the Executive’s act, or failure to act, was in the best interest of the Company, Ashford Inc., Ashford Trust or the entities advised by the Company, as applicable.

(iii)“Good Reason” shall mean any of the following actions, omissions or events occurring:

(A)the assignment to the Executive of any title, duties, responsibilities, directives or reporting requirements inconsistent with Section 1(b) hereof or with his positions, from time to time, with the Company or Ashford Inc. or as President and Chief Executive Officer of Ashford Trust or any material diminishment of the Executive’s duties, responsibilities, or status, including failure of Ashford Inc. or the Company to recommend to the board of directors of Ashford Trust (the “Trust Board”) that the Executive serve as the President and Chief Executive Officer of Ashford Trust, without the Executive’s prior written consent;

(B)a reduction by the Company in the Executive’s annual Base Salary or targeted Incentive Bonus without the Executive’s prior written consent;

(C)the requirement by the Company that the principal place of business at which the Executive performs his duties be changed to a location outside the greater Dallas metropolitan area without the Executive’s prior written consent; or

(D)any material breach by the Company of any provision of this Agreement.

(b) Certain Benefits Upon Change of Control. If a Change of Control occurs during the Executive’s employment and the Executive’s employment is terminated by the Company without Cause or by the Executive for Good Reason on or before the one (1) year anniversary of the effective date of the Change of Control, then the Executive shall be entitled to the following:

(i)The Executive shall be paid, in a single lump sum payment within thirty (30) days after the date of Executive’s termination, the aggregate amount of (A) the Executive’s earned but unpaid Base Salary and accrued but unpaid vacation through the date of Executive’s termination, and any Incentive Bonus required to be paid to the Executive pursuant to paragraph 2 above for the prior calendar year to the extent not previously paid, and reimbursement of all expenses through the date of Executive’s termination (the “Accrued Obligations”), and (B) three (3) (the “Severance Multiple”) times the sum of (x) the Base Salary in effect on the date of Executive’s termination plus (y) the average Incentive Bonus received by the Executive for the three complete calendar years or such lesser number of calendar years as the Executive has been employed by the Company immediately prior to the Termination Date (the “Severance Payment”).

(ii)At the time when incentive bonuses are paid to the Company’s other senior executives for the calendar year of the Company in which the date of Executive’s termination occurs, the Executive shall be paid a pro-rated Incentive Bonus in an amount equal to the product of (x) the amount of the Incentive Bonus to which the Executive would have been entitled if the Executive’s employment had not been terminated, and (y) a fraction, the numerator of which is the number of days in the applicable calendar year for which the Executive was employed through the date of Executive’s termination and the denominator of which is the 365 days of the calendar year (a “Pro-Rated Bonus”).

(iii)The Company will allow the Executive and his dependents, at the Company’s cost, to continue to participate for a period of thirty-six (36) months following the date of Executive’s termination in the Company’s medical, dental and vision plan in effect as of the date of Executive’s termination. The Company’s payment of this medical coverage will be made monthly during this period of coverage. To the extent such medical benefits are taxable to the Executive, such benefits will not affect benefits to be provided in any other taxable year, and such amounts are intended to meet the requirements of Treasury Regulation Section 1.409A-3(i)(1)(iv)(A) as “in-kind benefits”; provided, that if such continued medical, dental, or vision coverage cannot be provided under the terms of the applicable benefit plan or applicable law, or would result in the imposition of penalties or excise taxes under the Internal Revenue Code, then the Company shall instead pay the Executive a monthly amount during such thirty-six (36) month period equal to the monthly premiums paid for the Executive’s (and his applicable dependents’) participation in such medical, dental, and vision coverage as of immediately prior to the date of Executive’s termination. In addition, the Company will reimburse the Executive for a period of thirty-six (36) months following the date of Executive’s termination for the cost of coverage for life insurance and long-term disability insurance, based upon the level of such benefits that were provided to the Executive under the Company’s life insurance and long-term disability plans in effect as of the date of Executive’s termination, which reimbursements will be paid within seven (7) days after the Executive pays any applicable premium. (The amount of any such reimbursements may not affect the expenses eligible for reimbursement in any other year. Such reimbursements are intended to meet the requirements of Treasury Regulation Section 1.409A-3(i)(1)(iv)(A).) (Collectively, these welfare benefits under (iii) are referred to as the “Other Benefits”). If the Executive engages in regular employment after his termination of employment with any

organization, any employee welfare benefits received by the Executive in consideration of such employment which are similar in nature to the Other Benefits provided by the Company will relieve the Company of its obligation under this paragraph 7(b)(iii) to provide comparable benefits (or reimbursements) to the extent of the benefits so received, and such benefit hereunder shall be forfeited.

(iv)Any annual performance shares, restricted shares, LTIP units or options awarded to Executive shall immediately vest. Without limiting the foregoing, it is agreed that if the Executive’s employment is terminated pursuant to this paragraph 7, all outstanding stock options, restricted stock, LTIP units, and other equity awards granted to the Executive under any of the Company’s equity incentive plans (or awards substituted therefore covering the securities of a successor company) shall become immediately vested and exercisable in full. Likewise, all outstanding stock options, restricted stock, LTIP units and other equity awards granted to the Executive under any of the equity incentive plans of any entity advised by Ashford Inc. shall become immediately vested and exercisable in full to the extent provided in such plans and consistent with the vesting terms of such awards. All payments under this paragraph 7(b) are subject to the restrictions set forth in paragraph 7(c) and may be delayed as set forth in paragraph 7(c) in order to satisfy the requirements of Section 409A of the Internal Revenue Code.

(c) Code Section 409A and Termination Payments. All payments provided under this letter shall be subject to this paragraph 7(c). Notwithstanding anything herein to the contrary, to the extent that the AINC Board reasonably determines, in its sole discretion, that any payment or benefit to be provided under this letter to or for the benefit of Executive would be subject to the additional tax imposed under Section 409A(a)(1)(B) of the Code or a successor or comparable provision, the commencement of such payments and/or benefits shall be delayed until the earlier of (i) the date that is six months following the date of Executive’s termination or (ii) the date of Executive’s death (such date is referred to herein as the “Distribution Date”), provided, if at such time Executive is a “specified employee” of the Company (as defined in Treasury Regulation Section 1.409A-1(i)) and if amounts payable under this Agreement are on account of an “involuntary separation from service” (as defined in Treasury Regulation Section 1.409A-1(m)), Executive shall receive payments during the six-month period immediately following the date of Executive’s termination equal to the lesser of (x) the amount payable under this letter, as the case may be, or (y) two times the compensation limit in effect under Code Section 401(a)(17) for the calendar year in which the date of Executive’s termination occurs (with any amounts that otherwise would have been payable under this letter during such six-month period being paid on the first regular payroll date following the six-month anniversary of the date of Executive’s termination). In the event that the AINC Board determines that the commencement of any of the employee benefits to be provided under this letter are to be delayed pursuant to the preceding sentence, the Company shall require Executive to bear the full cost of such employee benefits until the Distribution Date at which time the Company shall reimburse Executive for all such costs. Finally, for the purposes of this letter, amounts payable under this letter shall be deemed not to be a “deferral of compensation” subject to Section 409A to the extent provided in the exceptions in Treasury Regulation Sections 1.409A-1(b)(4) (“short-term deferrals”) and (b)(9) (“separation pay plans,” including the exception under subparagraph (iii)) and other applicable provisions of Treasury Regulation Section 1.409A-1 through A-6.

8. D&O Insurance Coverage. During Executive’s employment, and for a period three (3) years thereafter, the Executive shall be entitled to director and officer insurance coverage for his acts and omissions while an officer of the Company and Ashford Hospitality Trust on a basis no less favorable to him than the coverage provided current officers or directors.

9. Indemnification. The company will indemnify the Executive, to the maximum extent permitted by applicable law, against all costs, charges and expenses incurred or sustained by the Executive, including the cost of legal counsel selected and retained by the Executive in connection with any action, suit or proceeding to which the Executive may be made a party by reason of the Executive being or having been an officer, director, or employee of the Company or any subsidiary or affiliate of the Company, Ashford

Inc., or any entity advised by the Company, or any new platform or entity to be created by, or spun off from, Ashford Inc., Braemar Hotels & Resorts Inc. or Ashford Hospitality Trust. The Company’s obligations under this section shall be in addition to any other indemnification rights to which the Executive may be entitled.

10. At-Will Employment. The Executive understands and acknowledges Executive’s employment is an at-will relationship with Ashford Hospitality Advisors and that either party is free to end the employment relationship at any time. Nothing contained in this letter, or any other document provided to Executive is intended to be, nor should be construed as a contract of employment or a guarantee that employment will be continued for any period of time.

Your acknowledgment of this letter indicates your understanding of the above. I wish you continued success. If you have any questions or concerns regarding the above, please let me know as soon as possible.

Sincerely,

/s/ Monty Bennett

Monty Bennett

CEO and Chairman of the Board

/s/ Stephen Zsigray

Stephen Zsigray

v3.24.3

Document and Entity Information

|

Oct. 18, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 18, 2024

|

| Entity Registrant Name |

ASHFORD HOSPITALITY TRUST, INC.

|

| Entity Central Index Key |

0001232582

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-31775

|

| Entity Tax Identification Number |

86-1062192

|

| Entity Address, Address Line One |

14185 Dallas Parkway, Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

972

|

| Local Phone Number |

490-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AHT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series D |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series D

|

| Trading Symbol |

AHT-PD

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series F |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series F

|

| Trading Symbol |

AHT-PF

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series G |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series G

|

| Trading Symbol |

AHT-PG

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series H |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series H

|

| Trading Symbol |

AHT-PH

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series I |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series I

|

| Trading Symbol |

AHT-PI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aht_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

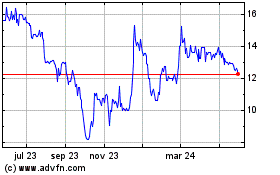

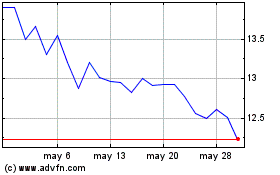

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ashford Hospitality (NYSE:AHT-I)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024