false000159158700015915872024-07-182024-07-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 18, 2024

AssetMark Financial Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38980 | 30-0774039 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

1655 Grant Street, 10th Floor Concord, California | 94520 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (925) 521-2200

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.001 par value | | AMK | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On July 18, 2024, AssetMark Financial Holdings, Inc. issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information contained in this Item 2.02 and Item 9.01 in this Current Report on Form 8-K, including the accompanying Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) – Exhibits

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| AssetMark Financial Holdings, Inc. |

| |

| Date: July 18, 2024 | /s/ Gary Zyla |

| Gary Zyla |

| Chief Financial Officer |

EXHIBIT 99.1

AssetMark Reports $119.4B Platform Assets for Second Quarter 2024

CONCORD, Calif., July 18, 2024, (GLOBE NEWSWIRE) — AssetMark Financial Holdings, Inc. (NYSE: AMK) today announced financial results for the quarter ended June 30, 2024.

Second Quarter 2024 Financial and Operational Highlights

•Net income for the quarter was $32.3 million, or $0.43 per share.

•Adjusted net income for the quarter was $49.8 million, or $0.66 per share, on total revenue of $198.5 million.

•Adjusted EBITDA for the quarter was $71.9 million, or 36.2% of total revenue.

•Platform assets increased 18.5% year-over-year to $119.4 billion. Quarter-over-quarter platform assets were up 2.1%, due to market impact net of fees of $0.8 billion and quarterly net flows of $1.7 billion.

•Year-to-date annualized net flows as a percentage of beginning-of-year platform assets were 6.1%.

•More than 4,300 new households and 164 new producing advisors joined the AssetMark platform during the second quarter. In total, as of June 30, 2024, there were over 9,200 advisors (approximately 3,200 were engaged advisors) and over 261,000 investor households on the AssetMark platform.

•We realized a 20.2% annualized production lift from existing advisors for the second quarter, indicating that advisors continued to grow organically and increase wallet share on our platform.

•In April, we signed a definitive agreement to be acquired by GTCR. The transaction is subject to customary closing conditions and required regulatory approvals and is still expected to close in Q4 2024.

Second Quarter 2024 Key Operating Metrics

| | | | | | | | | | | | | | | | | |

| 2Q23 | | 2Q24 | | Variance

per year |

| Operational metrics: | | | | | |

| Platform assets (at period-beginning) (millions of dollars) | $ | 96,203 | | | $ | 116,901 | | | 21.5 | % |

| Net flows (millions of dollars) | 1,695 | | | 1,703 | | | 0.5 | % |

| Market impact net of fees (millions of dollars) | 2,864 | | | 783 | | | (72.7) | % |

| Platform assets (at period-end) (millions of dollars) | $ | 100,762 | | | $ | 119,387 | | | 18.5 | % |

| Net flows lift (% of beginning of year platform assets) | 1.9 | % | | 1.6 | % | | -30 bps |

| Advisors (at period-end) | 9,323 | | | 9,245 | | | (0.8) | % |

| Engaged advisors (at period-end) | 3,032 | | | 3,238 | | | 6.8 | % |

| Assets from engaged advisors (at period-end) (millions of dollars) | $ | 93,109 | | | $ | 111,897 | | | 20.2 | % |

| Households (at period-end) | 247,934 | | | 261,341 | | | 5.4 | % |

| New producing advisors | 188 | | | 164 | | | (12.8) | % |

| Production lift from existing advisors (annualized %) | 20.2 | % | | 20.2 | % | | 0 bps |

| Assets in custody at ATC (at period-end) (millions of dollars) | $ | 74,074 | | | $ | 88,681 | | | 19.7 | % |

| ATC client cash (at period-end) (millions of dollars) | $ | 2,942 | | | $ | 2,933 | | | (0.3) | % |

| | | | | |

| Financial metrics: | | | | | |

| Total revenue (millions of dollars)* | $ | 175.5 | | | $ | 198.5 | | | 13.1 | % |

| Net income (millions of dollars) | $ | 32.9 | | | $ | 32.3 | | | (1.8) | % |

| Net income margin (%) | 18.7 | % | | 16.3 | % | | -240 bps |

| Capital expenditure (millions of dollars) | $ | 11.2 | | | $ | 13.0 | | | 16.1 | % |

| | | | | |

| Non-GAAP financial metrics: | | | | | |

| Adjusted EBITDA (millions of dollars) | $ | 60.4 | | | $ | 71.9 | | | 19.0 | % |

| Adjusted EBITDA margin (%) | 34.4 | % | | 36.2 | % | | 180 bps |

| Adjusted net income (millions of dollars) | $ | 41.2 | | | $ | 49.8 | | | 20.9 | % |

Note: Percentage variance based on actual numbers, not rounded results

All metrics include Adhesion data, except "New producing advisors," "Production lift from existing advisors" in 2023 and ATC related metrics

*The Company reclassified $7.7 million representing three months of 2023 spread-based expenses to offset spread-based revenue to account for interest credited to customer accounts on a net basis during the three months ended June 30, 2023.

Webcast and Conference Call Information

As previously announced, on April 25, 2024, AssetMark entered into an agreement to be acquired by GTCR (the “Transaction”). A copy of the press release announcing the Transaction can be found on the investor relations page of AssetMark’s website. Additional details and information about the Transaction are included in the Current Report on Form 8-K filed by AssetMark with the Securities and Exchange Commission ("SEC") on April 25, 2024. The Transaction is subject to customary closing conditions and required regulatory approvals and is expected to close in Q4 2024.

Given the announced Transaction, AssetMark will not be hosting an earnings call and webcast to discuss its second quarter 2024 results and is withdrawing all previously provided financial guidance. For further information about AssetMark’s financial performance please

refer to AssetMark’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024, which is expected to be filed on August 6, 2024 with the SEC.

About AssetMark Financial Holdings, Inc.

AssetMark operates a wealth management platform that powers independent financial advisors and their clients. Together with our affiliates Voyant and Adhesion Wealth, we serve advisors of all models at every stage of their journey with flexible, purpose-built solutions that champion client engagement and drive efficiency. Our ecosystem of solutions equips advisors with services and capabilities that would otherwise require significant investments of time and money, ultimately enabling them to deliver better investor outcomes and enhance their productivity, profitability and client satisfaction.

Founded in 1996 and based in Concord, California, the company has over 1,000 employees. Today, the AssetMark platform serves over 9,200 financial advisors and over 261,000 investor households. As of June 30, 2024, the company had $119.4 billion in platform assets.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our future financial and operating performance, which involve risks and uncertainties. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “will,” “may,” “could,” “should,” “believe,” “expect,” “estimate,” “potential” or “continue,” the negative of these terms and other comparable terminology that conveys uncertainty of future events or outcomes. Other potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023, which is on file with the Securities and Exchange Commission and available on our investor relations website at http://ir.assetmark.com. Additional information will be set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, which is expected to be filed on August 6, 2024. All information provided in this press release is based on information available to us as of the date of this press release and any forward-looking statements contained herein are based on assumptions that we believe are reasonable as of this date. Undue reliance should not be placed on the forward-looking statements in this press release, which are inherently uncertain. We undertake no duty to update this information unless required by law.

AssetMark Financial Holdings, Inc.

Unaudited Condensed Consolidated Balance Sheets

(in thousands except share data and par value)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| (unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 189,682 | | | $ | 217,680 | |

| Restricted cash | 16,000 | | | 15,000 | |

| Investments, at fair value | 21,500 | | | 18,003 | |

| Fees and other receivables, net | 21,552 | | | 21,345 | |

| Income tax receivable, net | 9,783 | | | 1,890 | |

| Prepaid expenses and other current assets | 16,298 | | | 17,193 | |

| Total current assets | 274,815 | | | 291,111 | |

| Property, plant and equipment, net | 9,002 | | | 8,765 | |

| Capitalized software, net | 118,577 | | | 108,955 | |

| Other intangible assets, net | 678,897 | | | 684,142 | |

| Operating lease right-of-use assets | 21,831 | | | 20,408 | |

| Goodwill | 487,909 | | | 487,909 | |

| Other assets | 26,382 | | | 19,273 | |

| Total assets | $ | 1,617,413 | | | $ | 1,620,563 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 645 | | | $ | 288 | |

| Accrued liabilities and other current liabilities | 83,360 | | | 75,554 | |

| Total current liabilities | 84,005 | | | 75,842 | |

| Long-term debt, net | — | | | 93,543 | |

| Other long-term liabilities | 21,301 | | | 18,429 | |

| Long-term portion of operating lease liabilities | 27,372 | | | 26,295 | |

| Deferred income tax liabilities, net | 139,072 | | | 139,072 | |

| Total long-term liabilities | 187,745 | | | 277,339 | |

| Total liabilities | 271,750 | | | 353,181 | |

| Stockholders’ equity: | | | |

| Common stock, $0.001 par value (675,000,000 shares authorized and 74,743,985 and 74,372,889 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively) | 75 | | | 74 | |

| Additional paid-in capital | 968,702 | | | 960,700 | |

| Retained earnings | 376,900 | | | 306,622 | |

| Accumulated other comprehensive loss | (14) | | | (14) | |

| Total stockholders’ equity | 1,345,663 | | | 1,267,382 | |

| Total liabilities and stockholders’ equity | $ | 1,617,413 | | | $ | 1,620,563 | |

AssetMark Financial Holdings, Inc.

Unaudited Condensed Consolidated Statements of Comprehensive Income

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Asset-based revenue | $ | 158,878 | | | $ | 137,336 | | | $ | 308,862 | | | $ | 268,375 | |

| Spread-based revenue* | 28,853 | | | 29,560 | | | 58,946 | | | 61,559 | |

| Subscription-based revenue | 4,306 | | | 3,693 | | | 8,558 | | | 7,237 | |

| Other revenue | 6,454 | | | 4,932 | | | 12,391 | | | 8,648 | |

| Total revenue | 198,491 | | | 175,521 | | | 388,757 | | | 345,819 | |

| Operating expenses: | | | | | | | |

| Asset-based expenses | 48,347 | | | 39,344 | | | 93,200 | | | 76,778 | |

| Spread-based expenses | 341 | | | 292 | | | 730 | | | 585 | |

| Employee compensation | 51,902 | | | 48,099 | | | 101,909 | | | 95,010 | |

| General and operating expenses | 27,821 | | | 24,354 | | | 55,145 | | | 50,043 | |

| Professional fees | 12,732 | | | 8,372 | | | 18,813 | | | 13,765 | |

| Depreciation and amortization | 10,296 | | | 8,684 | | | 20,218 | | | 17,112 | |

| Total operating expenses | 151,439 | | | 129,145 | | | 290,015 | | | 253,293 | |

| Interest expense | 2,202 | | | 2,137 | | | 4,496 | | | 4,484 | |

| Other (income) expense, net | (196) | | | (288) | | | (528) | | | 19,577 | |

| Income before income taxes | 45,046 | | | 44,527 | | | 94,774 | | | 68,465 | |

| Provision for income taxes | 12,732 | | | 11,650 | | | 24,496 | | | 18,366 | |

| Net income | 32,314 | | | 32,877 | | | 70,278 | | | 50,099 | |

| Net comprehensive income | $ | 32,314 | | | $ | 32,877 | | | $ | 70,278 | | | $ | 50,099 | |

| Net income per share attributable to common stockholders: | | | | | | | |

| Basic | $ | 0.43 | | | $ | 0.44 | | | $ | 0.94 | | | $ | 0.68 | |

| Diluted | $ | 0.43 | | | $ | 0.44 | | | $ | 0.94 | | | $ | 0.67 | |

| Weighted average number of common shares outstanding, basic | 74,487,417 | | 73,986,326 | | 74,435,341 | | 73,938,510 |

| Weighted average number of common shares outstanding, diluted | 75,283,986 | | 74,505,158 | | 75,109,611 | | 74,325,580 |

*The Company reclassified $7.7 million and $14.0 million from spread-based expenses to offset spread-based revenue to account for interest credited to customer accounts on a net basis for the three and six months ended June 30, 2023, respectively

AssetMark Financial Holdings, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income | $ | 70,278 | | | $ | 50,099 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 20,218 | | | 17,112 | |

Interest expense, net | (321) | | | (45) | |

| Share-based compensation | 8,003 | | | 7,974 | |

| Debt acquisition cost write-down | 255 | | | 92 | |

| Changes in certain assets and liabilities: | | | |

| Fees and other receivables, net | (457) | | | (863) | |

| Receivables from related party | 250 | | | 480 | |

| Prepaid expenses and other current assets | 2,812 | | | 2,954 | |

| Accounts payable, accrued liabilities and other current liabilities | 6,291 | | | 13,614 | |

| Income tax receivable and payable, net | (7,893) | | | 14,062 | |

| Net cash provided by operating activities | 99,436 | | | 105,479 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

Purchase of Adhesion Wealth | — | | | (3,000) | |

| Purchase of investments | (2,099) | | | (1,528) | |

| Sale of investments | 179 | | | 257 | |

| Purchase of property and equipment | (1,530) | | | (469) | |

| Purchase of computer software | (23,302) | | | (20,920) | |

| Purchase of convertible notes | (5,932) | | | (4,275) | |

| Net cash used in investing activities | (32,684) | | | (29,935) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Payments on term loan | (93,750) | | | (25,000) | |

| Net cash used in financing activities | (93,750) | | | (25,000) | |

| Net change in cash, cash equivalents, and restricted cash | (26,998) | | | 50,544 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 232,680 | | | 136,274 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 205,682 | | | $ | 186,818 | |

| SUPPLEMENTAL CASH FLOW INFORMATION | | | |

| Income taxes paid, net | $ | 32,378 | | | $ | 4,298 | |

| Interest paid | $ | 4,178 | | | $ | 5,736 | |

Non-cash operating and investing activities: | | | |

| Non-cash changes to right-of-use assets | $ | 4,183 | | | $ | 1,795 | |

| Non-cash changes to lease liabilities | $ | 4,183 | | | $ | 1,795 | |

Explanations and Reconciliations of Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), we believe adjusted EBITDA, adjusted EBITDA margin and adjusted net income, all of which are non-GAAP measures, are useful in evaluating our performance. We use adjusted EBITDA, adjusted EBITDA margin and adjusted net income to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that such non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, such non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP.

Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison.

Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single financial measure to evaluate our business.

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA is defined as EBITDA (net income plus interest expense, income tax expense, depreciation and amortization and less interest income), further adjusted to exclude certain non-cash charges and other adjustments set forth below. Adjusted EBITDA margin is defined as adjusted EBITDA divided by total revenue. Adjusted EBITDA and adjusted EBITDA margin are useful financial metrics in assessing our operating performance from period to period because they exclude certain items that we believe are not representative of our core business, such as certain material non-cash items and other adjustments such as share-based compensation, strategic initiatives and reorganization and integration costs. We believe that adjusted EBITDA and adjusted EBITDA margin, viewed in addition to, and not in lieu of, our reported GAAP results, provide useful information to investors regarding our performance and overall results of operations for various reasons, including:

•non-cash equity grants made to employees at a certain price and point in time do not necessarily reflect how our business is performing at any particular time; as such, share-based compensation expense is not a key measure of our operating performance; and

•costs associated with acquisitions and the resulting integrations, debt refinancing, restructuring, conversions, as well as other non-recurring litigation costs, can vary from period to period and transaction to transaction; as such, expenses associated with these activities are not considered a key measure of our operating performance.

We use adjusted EBITDA and adjusted EBITDA margin:

•as measures of operating performance;

•for planning purposes, including the preparation of budgets and forecasts;

•to allocate resources to enhance the financial performance of our business;

•to evaluate the effectiveness of our business strategies;

•in communications with our board of directors concerning our financial performance; and

•as considerations in determining compensation for certain employees.

Adjusted EBITDA and adjusted EBITDA margin have limitations as analytical tools, and should not be considered in isolation to, or as substitutes for, analysis of our results as reported under GAAP. Some of these limitations are:

•adjusted EBITDA and adjusted EBITDA margin do not reflect all cash expenditures, future requirements for capital expenditures or contractual commitments;

•adjusted EBITDA and adjusted EBITDA margin do not reflect changes in, or cash requirements for, working capital needs;

•adjusted EBITDA and adjusted EBITDA margin do not reflect interest expense on our debt or the cash requirements necessary to service interest or principal payments; and

•the definitions of adjusted EBITDA and adjusted EBITDA margin can differ significantly from company to company and as a result have limitations when comparing similarly titled measures across companies.

Set forth below is a reconciliation from net income, the most directly comparable GAAP financial measure, to adjusted EBITDA for the three and six months ended June 30, 2024 and 2023 (unaudited).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Three Months Ended June 30, |

| (in thousands except for percentages) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 32,314 | | | $ | 32,877 | | | 16.3 | % | | 18.7 | % |

| Provision for income taxes | | 12,732 | | | 11,650 | | | 6.4 | % | | 6.6 | % |

| Interest income | | (4,362) | | | (2,509) | | | (2.1) | % | | (1.4) | % |

| Interest expense | | 2,202 | | | 2,137 | | | 1.1 | % | | 1.2 | % |

| Depreciation and amortization | | 10,296 | | | 8,684 | | | 5.2 | % | | 5.0 | % |

| EBITDA | | $ | 53,182 | | | $ | 52,839 | | | 26.9 | % | | 30.1 | % |

Share-based compensation(1) | | 3,835 | | | 4,152 | | | 1.9 | % | | 2.4 | % |

Reorganization and integration costs(2) | | 3,200 | | | 3,556 | | | 1.6 | % | | 2.0 | % |

Merger and acquisition expenses(3) | | 11,002 | | | (140) | | | 5.5 | % | | (0.1) | % |

Long-term incentive cash awards(4) | | 398 | | | — | | | 0.2 | % | | — | |

| Other (income) expense, net | | 256 | | | (10) | | | 0.1 | % | | — | |

| Adjusted EBITDA | | $ | 71,873 | | | $ | 60,397 | | | 36.2 | % | | 34.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands except for percentages) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 70,278 | | | $ | 50,099 | | | 18.1 | % | | 14.5 | % |

| Provision for income taxes | | 24,496 | | | 18,366 | | | 6.3 | % | | 5.3 | % |

| Interest income | | (8,385) | | | (4,560) | | | (2.2) | % | | (1.3) | % |

| Interest expense | | 4,496 | | | 4,484 | | | 1.2 | % | | 1.3 | % |

| Depreciation and amortization | | 20,218 | | | 17,112 | | | 5.2 | % | | 5.0 | % |

| EBITDA | | $ | 111,103 | | | $ | 85,501 | | | 28.6 | % | | 24.8 | % |

Share-based compensation(1) | | 8,003 | | | 7,974 | | | 2.1 | % | | 2.3 | % |

Reorganization and integration costs(2) | | 5,962 | | | 5,465 | | | 1.5 | % | | 1.6 | % |

Merger and acquisition expenses(3) | | 12,090 | | | 173 | | | 3.1 | % | | — | |

Long-term incentive cash awards(4) | | 398 | | | — | | | 0.1 | % | | — | |

Business continuity plan(5) | | — | | | (6) | | | — | | | — | |

Accrual for SEC settlement(6) | | — | | | 20,000 | | | — | | | 5.8 | % |

| Other (income) expense, net | | 224 | | | 77 | | | — | | | — | |

| Adjusted EBITDA | | $ | 137,780 | | | $ | 119,184 | | | 35.4 | % | | 34.5 | % |

(1)“Share-based compensation” represents granted share-based compensation in the form of restricted stock unit and stock appreciation right grants by us to certain of our directors and employees. Although this expense occurred in each measurement period, we have added the expense back in our calculation of adjusted EBITDA because of its noncash impact.

(2)“Reorganization and integration costs” includes costs related to our functional reorganization within our Operations, Technology and Retirement functions as well as duplicate costs related to the outsourcing of back-office operations functions. While we have incurred such expenses in all periods measured, these expenses serve varied reorganization and integration initiatives, each of which is non-recurring. We do not consider these expenses to be part of our core operations.

(3)“Merger and acquisition expenses” includes employee severance, transition and retention expenses, duplicative general and administrative expenses and other professional fees related to acquisitions and costs related to the merger with GTCR.

(4) “Long-term incentive cash awards” represents deferred cash bonuses granted in June 2024 in lieu of share-based compensation to certain of our directors and employees. The bonuses vest on the earlier of the one-year anniversary of the grant or our completed merger with GTCR.

(5)“Business continuity plan” includes incremental compensation and other costs that are directly related to a transition to a hybrid workforce in 2022.

(6)“Accrual for SEC settlement” represents an accrual that pertains to a settled SEC matter from 2023 discussed in Note 12 of notes to unaudited condensed consolidated financial statements in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

Set forth below is a summary of the adjustments involved in the reconciliation from net income and net income margin, the most directly comparable GAAP financial measures, to adjusted EBITDA and adjusted EBITDA margin for three and six months ended June 30, 2024 and 2023 (unaudited), broken out by compensation and non-compensation expenses (unaudited).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| (in thousands) | | Compensation | | Non-

Compensation | | Total | | Compensation | | Non-

Compensation | | Total |

Share-based compensation(1) | | $ | 3,835 | | | $ | — | | | $ | 3,835 | | | $ | 4,152 | | | $ | — | | | $ | 4,152 | |

Reorganization and integration costs(2) | | 1,675 | | | 1,525 | | | 3,200 | | | 1,204 | | | 2,352 | | | 3,556 | |

Merger and acquisition expenses(3) | | — | | | 11,002 | | | 11,002 | | | — | | | (140) | | | (140) | |

Long-term incentive cash awards(4) | | 398 | | | — | | | 398 | | | — | | | — | | | — | |

| Other (income) expense, net | | — | | | 256 | | | 256 | | | — | | | (10) | | | (10) | |

| Total adjustments to adjusted EBITDA | | $ | 5,908 | | | $ | 12,783 | | | $ | 18,691 | | | $ | 5,356 | | | $ | 2,202 | | | $ | 7,558 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| (in percentages) | | Compensation | | Non-

Compensation | | Total | | Compensation | | Non-

Compensation | | Total |

Share-based compensation(1) | | 1.9 | % | | — | | | 1.9 | % | | 2.4 | % | | — | | | 2.4 | % |

Reorganization and integration costs(2) | | 0.8 | % | | 0.8 | % | | 1.6 | % | | 0.7 | % | | 1.3 | % | | 2.0 | % |

Merger and acquisition expenses(3) | | — | | | 5.5 | % | | 5.5 | % | | — | | | (0.1) | % | | (0.1) | % |

Long-term incentive cash awards(4) | | 0.2 | % | | — | | | 0.2 | % | | — | | | — | | | — | |

| Other (income) expense, net | | — | | | 0.1 | % | | 0.1 | % | | — | | | — | | | — | |

| Total adjustments to adjusted EBITDA margin % | | 2.9 | % | | 6.4 | % | | 9.3 | % | | 3.1 | % | | 1.2 | % | | 4.3 | % |

(1)Share-based compensation” represents granted share-based compensation in the form of restricted stock unit and stock appreciation right grants by us to certain of our directors and employees. Although this expense occurred in each measurement period, we have added the expense back in our calculation of adjusted EBITDA because of its noncash impact.

(2)“Reorganization and integration costs” includes costs related to our functional reorganization within our Operations, Technology and Retirement functions as well as duplicate costs related to the outsourcing of back-office operations functions. While we have incurred such expenses in all periods measured, these expenses serve varied reorganization and integration initiatives, each of which is non-recurring. We do not consider these expenses to be part of our core operations.

(3)“Merger and acquisition expenses” includes employee severance, transition and retention expenses, duplicative general and administrative expenses and other professional fees related to acquisitions and costs related to the merger with GTCR.

(4)“Long-term incentive cash awards” represents deferred cash bonuses granted in June 2024 in lieu of share-based compensation to certain of our directors and employees. The bonuses vest on the earlier of the one-year anniversary of the grant or our completed merger with GTCR.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| (in thousands) | | Compensation | | Non-

Compensation | | Total | | Compensation | | Non-

Compensation | | Total |

Share-based compensation(1) | | $ | 8,003 | | | $ | — | | | $ | 8,003 | | | $ | 7,974 | | | $ | — | | | $ | 7,974 | |

Reorganization and integration costs(2) | | 3,206 | | | 2,756 | | | 5,962 | | | 2,269 | | | 3,196 | | | 5,465 | |

Merger and acquisition expenses(3) | | — | | | 12,090 | | | 12,090 | | | 100 | | | 73 | | | 173 | |

Long-term incentive cash awards(4) | | 398 | | | — | | | 398 | | | — | | | — | | | — | |

Business continuity plan(5) | | — | | | — | | | — | | | — | | | (6) | | | (6) | |

Accrual for SEC settlement(6) | | — | | | — | | | — | | | — | | | 20,000 | | | 20,000 | |

| Other (income) expense, net | | — | | | 224 | | | 224 | | | — | | | 77 | | | 77 | |

| Total adjustments to adjusted EBITDA | | $ | 11,607 | | | $ | 15,070 | | | $ | 26,677 | | | $ | 10,343 | | | $ | 23,340 | | | $ | 33,683 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| (in percentages) | | Compensation | | Non-

Compensation | | Total | | Compensation | | Non-

Compensation | | Total |

Share-based compensation(1) | | 2.1 | % | | — | | | 2.1 | % | | 2.3 | % | | — | | | 2.3 | % |

Reorganization and integration costs(2) | | 0.8 | % | | 0.7 | % | | 1.5 | % | | 0.7 | % | | 0.9 | % | | 1.6 | % |

Merger and acquisition expenses(3) | | — | | | 3.1 | % | | 3.1 | % | | — | | | — | | | — | |

Long-term incentive cash awards(4) | | 0.1 | % | | — | | | 0.1 | % | | — | | | — | | | — | |

Business continuity plan(5) | | — | | | — | | | — | | | — | | | — | | | — | |

Accrual for SEC settlement(6) | | — | | | — | | | — | | | — | | | 5.8 | % | | 5.8 | % |

| Other (income) expense, net | | — | | | — | | | — | | | — | | | — | | | — | |

| Total adjustments to adjusted EBITDA margin % | | 3.0 | % | | 3.8 | % | | 6.8 | % | | 3.0 | % | | 6.7 | % | | 9.7 | % |

(1) “Share-based compensation” represents granted share-based compensation in the form of restricted stock unit and stock appreciation right grants by us to certain of our directors and employees. Although this expense occurred in each measurement period, we have added the expense back in our calculation of adjusted EBITDA because of its noncash impact.

(2)“Reorganization and integration costs” includes costs related to our functional reorganization within our Operations, Technology and Retirement functions as well as duplicate costs related to the outsourcing of back-office operations functions. While we have incurred such expenses in all periods measured, these expenses serve varied reorganization and integration initiatives, each of which is non-recurring. We do not consider these expenses to be part of our core operations.

(3)“Merger and acquisition expenses” includes employee severance, transition and retention expenses, duplicative general and administrative expenses and other professional fees related to acquisitions and costs related to the merger with GTCR.

(4) “Long-term incentive cash awards” represents deferred cash bonuses granted in June 2024 in lieu of share-based compensation to certain of our directors and employees. The bonuses vest on the earlier of the one-year anniversary of the grant or our completed merger with GTCR.

(5)“Business continuity plan” includes incremental compensation and other costs that are directly related to a transition to a hybrid workforce in 2022.

(6)“Accrual for SEC settlement” represents an accrual that pertains to a settled SEC matter from 2023 discussed in Note 12 of notes to unaudited condensed consolidated financial statements in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

Adjusted Net Income

Adjusted net income represents net income before: (a) share-based compensation expense, (b) amortization of acquisition-related intangible assets, (c) acquisition and related integration expenses, (d) restructuring and conversion costs and (e) certain other expenses. Reconciled items are tax effected using the income tax rates in effect for the applicable period, adjusted for any potentially non-deductible amounts. We prepared adjusted net income to eliminate the effects of items that we do not consider indicative of our core operating performance. We believe that adjusted net income, viewed in addition to, and not in lieu of, our reported GAAP results, provides useful information to investors regarding our performance and overall results of operations for various reasons, including the following:

•non-cash equity grants made to employees at a certain price and point in time do not necessarily reflect how our business is performing at any particular time; as such, share-based compensation expense is not a key measure of our operating performance;

•costs associated with acquisitions and related integrations, debt refinancing, restructuring and conversions can vary from period to period and transaction to transaction; as such, expenses associated with these activities are not considered a key measure of our operating performance; and

•amortization expenses can vary substantially from company to company and from period to period depending upon each company’s financing and accounting methods, the fair value and average expected life of acquired intangible assets and the method by which assets were acquired; as such, the amortization of intangible assets obtained in acquisitions is not considered a key measure of our operating performance.

Adjusted net income does not purport to be an alternative to net income or cash flows from operating activities. The term adjusted net income is not defined under GAAP, and adjusted net income is not a measure of net income, operating income or any other performance or liquidity measure derived in accordance with GAAP. Therefore, adjusted net income has limitations as an analytical tool and should not be considered in isolation to, or as a substitute for, analysis of our results as reported under GAAP. Some of these limitations are:

•adjusted net income does not reflect all cash expenditures, future requirements for capital expenditures or contractual commitments;

•adjusted net income does not reflect changes in, or cash requirements for, working capital needs; and

•other companies in the financial services industry may calculate adjusted net income differently than we do, limiting its usefulness as a comparative measure.

The schedule set forth below presents the Company’s GAAP results from the Condensed Consolidated Statements of Comprehensive Income (unaudited) for the three and six months ended June 30, 2024 and 2023, with certain line items adjusted for the items described above. Included below is also a reconciliation from net income, the most directly comparable GAAP financial measure, to adjusted net income for the three and six months ended June 30, 2024 and 2023 (unaudited).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Asset-based revenue | $ | 158,878 | | | $ | 137,336 | | | $ | 308,862 | | | $ | 268,375 | |

Spread-based revenue(1) | 28,853 | | 29,560 | | | 58,946 | | 61,559 | |

| Subscription-based revenue | 4,306 | | 3,693 | | | 8,558 | | 7,237 | |

| Other revenue | 6,454 | | 4,932 | | | 12,391 | | 8,648 | |

| Total revenue | 198,491 | | 175,521 | | | 388,757 | | 345,819 | |

| Operating expenses: | | | | | | | |

| Asset-based expenses | 48,347 | | 39,344 | | | 93,200 | | 76,778 | |

| Spread-based expenses | 341 | | 292 | | | 730 | | 585 | |

Adjusted employee compensation(2) | 45,994 | | 42,743 | | | 90,302 | | 84,667 | |

Adjusted general and operating expenses(2) | 21,966 | | 23,731 | | | 47,582 | | 48,536 | |

Adjusted professional fees(2) | 6,060 | | 6,783 | | | 11,530 | | 12,009 | |

Adjusted depreciation and amortization(3) | 8,116 | | 6,504 | | | 15,858 | | 12,758 | |

| Total adjusted operating expenses | 130,824 | | 119,397 | | | 259,202 | | 235,333 | |

| Interest expense | 2,202 | | 2,137 | | | 4,496 | | 4,484 | |

Adjusted other expenses, net(2) | (452) | | (278) | | | (752) | | (500) | |

| Adjusted income before income taxes | 65,917 | | 54,265 | | | 125,811 | | 106,502 | |

Adjusted provision for income taxes(4) | 16,150 | | 13,023 | | | 30,824 | | 25,560 | |

| Adjusted net income | $ | 49,767 | | | $ | 41,242 | | | $ | 94,987 | | | $ | 80,942 | |

| Net income per share attributable to common stockholders: | | | | | | | |

| Adjusted earnings per share | $ | 0.66 | | | $ | 0.55 | | | $ | 1.26 | | | $ | 1.09 | |

| Weighted average number of common shares outstanding, diluted | 75,283,986 | | 74,505,158 | | 75,109,611 | | 74,325,580 |

(1) The Company reclassified $7.7 million and $14.0 million from spread-based expenses to offset spread-based revenue to account for interest credited to customer accounts on a net basis for the three and six months ended June 30, 2023, respectively.

(2) Consists of the adjustments to EBITDA listed in the adjusted EBITDA reconciliation table above.

(3) Relates to intangible assets established in connection with HTSC’s acquisition of our Company in 2016.

(4) Consists of adjustments to normalize our estimated tax rate in determining adjusted net income.

Set forth below is a reconciliation from net income, the most directly comparable GAAP financial measure, to adjusted net income for the three and six months ended June 30, 2024 and 2023 (unaudited).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, 2024 | | Three months ended June 30, 2023 |

| Reconciliation of Non-GAAP Presentation | GAAP | | Adjustments | | Adjusted | | GAAP | | Adjustments | | Adjusted |

| Revenue: | | | | | | | | | | | |

| Asset-based revenue | $ | 158,878 | | | $ | — | | | $ | 158,878 | | | $ | 137,336 | | | $ | — | | | $ | 137,336 | |

Spread-based revenue(1) | 28,853 | | | — | | | 28,853 | | | 29,560 | | | — | | | 29,560 | |

| Subscription-based revenue | 4,306 | | | — | | | 4,306 | | | 3,693 | | | — | | | 3,693 | |

| Other revenue | 6,454 | | | — | | | 6,454 | | | 4,932 | | | — | | | 4,932 | |

| Total revenue | 198,491 | | | — | | | 198,491 | | | 175,521 | | | — | | | 175,521 | |

| Operating expenses: | | | | | | | | | | | |

| Asset-based expenses | 48,347 | | | — | | | 48,347 | | | 39,344 | | | — | | | 39,344 | |

| Spread-based expenses | 341 | | | — | | | 341 | | | 292 | | | — | | | 292 | |

Employee compensation(2) | 51,902 | | | (5,908) | | | 45,994 | | | 48,099 | | | (5,356) | | | 42,743 | |

General and operating expenses(2) | 27,821 | | | (5,855) | | | 21,966 | | | 24,354 | | | (623) | | | 23,731 | |

Professional fees(2) | 12,732 | | | (6,672) | | | 6,060 | | | 8,372 | | | (1,589) | | | 6,783 | |

Depreciation and amortization(3) | 10,296 | | | (2,180) | | | 8,116 | | | 8,684 | | | (2,180) | | | 6,504 | |

| Total operating expenses | 151,439 | | | (20,615) | | | 130,824 | | | 129,145 | | | (9,748) | | | 119,397 | |

| Interest expense | 2,202 | | | — | | | 2,202 | | | 2,137 | | | — | | | 2,137 | |

Other expenses, net(2) | (196) | | | (256) | | | (452) | | | (288) | | | 10 | | (278) | |

| Income before income taxes | 45,046 | | | 20,871 | | | 65,917 | | | 44,527 | | | 9,738 | | | 54,265 | |

Provision for income taxes(4) | 12,732 | | | 3,418 | | | 16,150 | | | 11,650 | | | 1,373 | | | 13,023 | |

| Net income | $ | 32,314 | | | | | $ | 49,767 | | | $ | 32,877 | | | | | $ | 41,242 | |

(1) The Company reclassified $7.7 million and $14.0 million from spread-based expenses to offset spread-based revenue to account for interest credited to customer accounts on a net basis for the three and six months ended June 30, 2023, respectively.

(2) Consists of the adjustments to EBITDA listed in the adjusted EBITDA reconciliation table above.

(3) Relates to intangible assets established in connection with HTSC’s acquisition of our Company in 2016.

(4) Consists of adjustments to normalize our estimated tax rate in determining adjusted net income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, 2024 | | Six months ended June 30, 2023 |

| Reconciliation of Non-GAAP Presentation | GAAP | | Adjustments | | Adjusted | | GAAP | | Adjustments | | Adjusted |

| Revenue: | | | | | | | | | | | |

| Asset-based revenue | $ | 308,862 | | | $ | — | | | $ | 308,862 | | | $ | 268,375 | | | $ | — | | | $ | 268,375 | |

Spread-based revenue(1) | 58,946 | | | — | | | 58,946 | | | 61,559 | | | — | | | 61,559 | |

| Subscription-based revenue | 8,558 | | | — | | | 8,558 | | | 7,237 | | | — | | | 7,237 | |

| Other revenue | 12,391 | | | — | | | 12,391 | | | 8,648 | | | — | | | 8,648 | |

| Total revenue | 388,757 | | | — | | | 388,757 | | | 345,819 | | | — | | | 345,819 | |

| Operating expenses: | | | | | | | | | | | |

| Asset-based expenses | 93,200 | | | — | | | 93,200 | | | 76,778 | | | — | | | 76,778 | |

| Spread-based expenses | 730 | | | — | | | 730 | | | 585 | | | — | | | 585 | |

Employee compensation(2) | 101,909 | | | (11,607) | | | 90,302 | | | 95,010 | | | (10,343) | | | 84,667 | |

General and operating expenses(2) | 55,145 | | | (7,563) | | | 47,582 | | | 50,043 | | | (1,507) | | | 48,536 | |

Professional fees(2) | 18,813 | | | (7,283) | | | 11,530 | | | 13,765 | | | (1,756) | | | 12,009 | |

Depreciation and amortization(3) | 20,218 | | | (4,360) | | | 15,858 | | | 17,112 | | | (4,354) | | | 12,758 | |

| Total operating expenses | 290,015 | | | (30,813) | | | 259,202 | | | 253,293 | | | (17,960) | | | 235,333 | |

| Interest expense | 4,496 | | | — | | | 4,496 | | | 4,484 | | | — | | | 4,484 | |

Other expenses, net(2) | (528) | | | (224) | | | (752) | | | 19,577 | | | (20,077) | | | (500) | |

| Income before income taxes | 94,774 | | | 31,037 | | | 125,811 | | | 68,465 | | | 38,037 | | | 106,502 | |

Provision for income taxes(4) | 24,496 | | | 6,328 | | | 30,824 | | | 18,366 | | | 7,194 | | | 25,560 | |

| Net income | $ | 70,278 | | | | | $ | 94,987 | | | $ | 50,099 | | | | | $ | 80,942 | |

(1) The Company reclassified $7.7 million and $14.0 million from spread-based expenses to offset spread-based revenue to account for interest credited to customer accounts on a net basis for the three and six months ended June 30, 2023, respectively.

(2) Consists of the adjustments to EBITDA listed in the adjusted EBITDA reconciliation table above.

(3) Relates to intangible assets established in connection with HTSC’s acquisition of our Company in 2016.

(4) Consists of adjustments to normalize our estimated tax rate in determining adjusted net income.

Set forth below is a summary of the adjustments involved in the reconciliation from net income, the most directly comparable GAAP financial measure, to adjusted net income for three and six months ended June 30, 2024 and 2023 (unaudited), broken out by compensation and non-compensation expenses (unaudited).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| (in thousands) | | Compensation | | Non-

Compensation | | Total | | Compensation | | Non-

Compensation | | Total |

| Net income | | | | | | $ | 32,314 | | | | | | | $ | 32,877 | |

Acquisition-related amortization(1) | | $ | — | | | $ | 2,180 | | | 2,180 | | | $ | — | | | $ | 2,180 | | | 2,180 | |

Expense adjustments(2) | | 2,073 | | | 12,527 | | | 14,600 | | | 1,204 | | | 2,212 | | | 3,416 | |

| Share-based compensation | | 3,835 | | | — | | | 3,835 | | | 4,152 | | | — | | | 4,152 | |

| Other (income) expense, net | | — | | | 256 | | | 256 | | | — | | | (10) | | | (10) | |

Tax effect of adjustments(3) | | (1,447) | | | (1,971) | | | (3,418) | | | (1,285) | | | (88) | | | (1,373) | |

| Adjusted net income | | $ | 4,461 | | | $ | 12,992 | | | $ | 49,767 | | | $ | 4,071 | | | $ | 4,294 | | | $ | 41,242 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| (in thousands) | | Compensation | | Non-

Compensation | | Total | | Compensation | | Non-

Compensation | | Total |

| Net income | | | | | | $ | 70,278 | | | | | | | $ | 50,099 | |

Acquisition-related amortization(1) | | $ | — | | | $ | 4,360 | | | 4,360 | | | $ | — | | | $ | 4,354 | | | 4,354 | |

Expense adjustments(2) | | 3,604 | | | 14,846 | | | 18,450 | | | 2,369 | | | 23,263 | | | 25,632 | |

| Share-based compensation | | 8,003 | | | — | | | 8,003 | | | 7,974 | | | — | | | 7,974 | |

| Other (income) expense, net | | — | | | 224 | | | 224 | | | — | | | 77 | | | 77 | |

Tax effect of adjustments(3) | | (2,844) | | | (3,484) | | | (6,328) | | | (2,482) | | | (4,712) | | | (7,194) | |

| Adjusted net income | | $ | 8,763 | | | $ | 15,946 | | | $ | 94,987 | | | $ | 7,861 | | | $ | 22,982 | | | $ | 80,942 | |

(1)Relates to intangible assets established in connection with HTSC’s acquisition of our Company in 2016.

(2)Consists of the adjustments to EBITDA listed in the adjusted EBITDA reconciliation table above other than share-based compensation.

(3)Consists of adjustments to normalize our estimated tax rate in determining adjusted net income.

.

Contacts

Investors:

Taylor J. Hamilton, CFA

Head of Investor Relations

InvestorRelations@assetmark.com

Media:

Alaina Kleinman

Head of PR & Communications

alaina.kleinman@assetmark.com

SOURCE: AssetMark Financial Holdings, Inc.

v3.24.2

Cover

|

Jul. 18, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 18, 2024

|

| Entity Registrant Name |

AssetMark Financial Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38980

|

| Entity Tax Identification Number |

30-0774039

|

| Entity Address, Address Line One |

1655 Grant Street

|

| Entity Address, Address Line Two |

10th Floor

|

| Entity Address, City or Town |

Concord

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94520

|

| City Area Code |

925

|

| Local Phone Number |

521-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value

|

| Trading Symbol |

AMK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001591587

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

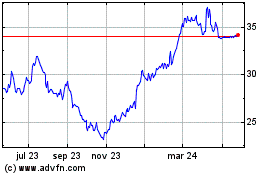

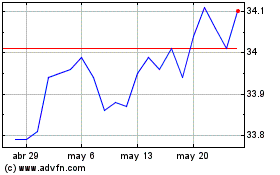

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024