false000159158700015915872024-06-202024-06-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 20, 2024

AssetMark Financial Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38980 | 30-0774039 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

1655 Grant Street, 10th Floor Concord, California | 94520 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (925) 521-2200

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.001 par value | | AMK | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01 Other Events.

On June 20, 2024, AssetMark Financial Holdings, Inc., a Delaware corporation (the “Company”) and Morningstar, Inc., an Illinois corporation (“Morningstar”) issued a joint press release announcing the execution of an Asset Purchase Agreement, pursuant to which AssetMark, Inc., a California corporation and wholly owned subsidiary of the Company, will acquire all of the client advisory agreements associated with Morningstar’s turnkey asset management platform, on the terms and conditions contained therein. A copy of the joint press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) – Exhibits

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| AssetMark Financial Holdings, Inc. |

| |

| Date: June 20, 2024 | /s/ Gary Zyla |

| Gary Zyla |

| Chief Financial Officer |

AssetMark to Enter Strategic Alliance with Morningstar Wealth, Acquire Assets from TAMP Business

Concord, CA – June 20, 2024 – Wealth management platform AssetMark, Inc., a wholly owned subsidiary of AssetMark Financial Holdings, Inc. and a Registered Investment Adviser (collectively “AssetMark”), today announced a strategic alliance with Morningstar Wealth, a division of independent investing insights firm Morningstar, Inc. (Nasdaq: MORN).

As part of the alliance, AssetMark will acquire approximately $12 billion in assets from the Morningstar Wealth Turnkey Asset Management Platform (“TAMP”). Financial advisors and clients on Morningstar Wealth’s TAMP will have access to AssetMark’s platform, which provides industry-leading service, advisor technology, business consulting, and a carefully curated set of investment strategists. The account migration process will be designed to be seamless, as it will generally not require additional new client paperwork and clients’ performance histories will be maintained.

Additionally, financial advisors currently working with AssetMark will gain access to a wide range of model portfolios and separately managed accounts managed by the Morningstar Investment Management team, which has over $290 billion of assets under management and advisement (“AUMA”) globally. Morningstar Wealth will join the AssetMark platform as a third-party strategist and continue to expand its lineup of investment services.

“Morningstar has a rich heritage of providing comprehensive investment insights and services to advisors and financial professionals around the globe,” said Michael Kim, Chief Executive Officer of AssetMark. “This relationship represents best-in-class firms strategically aligning to provide innovative solutions and high-quality service to financial advisors and their clients.”

“Our alliance with AssetMark marks a significant milestone for our business. AssetMark has a long track record of providing financial advisors with the service, tools, and investments they need to build a thriving practice, and we look forward to making our models accessible to more advisors,” said Daniel Needham, President of Morningstar Wealth. “We are aligning our efforts with a clear vision to combine the strengths of our unique capabilities, enabling the advisors we support to serve investors more effectively.”

AssetMark is an experienced acquirer and integrator with a strong track record of executing transactions that enhance the value it provides to advisors and empowers them to serve their clients more holistically and efficiently. In 2021, the firm acquired a global provider of SaaS-based financial planning solutions, and, in 2022, acquired a leading provider of wealth management technology solutions to RIAs, enterprises and asset managers.

This transaction was approved by the Boards of Directors of both AssetMark and Morningstar, Inc. and is expected to close in the second half of 2024, subject to regulatory approval, necessary consents, and other customary closing conditions.

About AssetMark Financial Holdings, Inc.

AssetMark Financial Holdings, Inc. ("AFHI") operates a wealth management platform whose mission is to help financial advisors and their clients. Together with our affiliates AssetMark Trust Company, Voyant and Adhesion Wealth Advisor Solutions, we serve advisors at every stage of their journey with flexible, purpose-built solutions that champion client engagement and drive efficiency. Our ecosystem of solutions equips advisors with services and capabilities that would otherwise require significant investments of time and money and aims to deliver better investor outcomes by enhancing their productivity, profitability, and client satisfaction.

AFHI announced in April 2024 that it signed a definitive agreement to be acquired by GTCR, a leading private equity firm with substantial investment expertise in financial technology, wealth and asset management, which is subject to customary closing conditions and required regulatory approvals and is

expected to close in the fourth quarter of 2024. Consent to the transaction described in this press release was also provided by GTCR.

Founded in 1996, AFHI has over 1,000 employees and the AssetMark platform serves over 9,200 financial advisors and over 257,000 investor households. As of March 31, 2024, the company had $116.9 billion in platform assets.

AssetMark, Inc. is a Registered Investment Adviser with the U.S. Securities and Exchange Commission.

About Morningstar Wealth

Morningstar Wealth is a global organization dedicated to empowering both advisor and investor success. Our extensive range of offerings includes the Morningstar International Wealth Platform (TAMP), model portfolios managed by the Morningstar Investment Management team ($294 billion in assets under management and advisement*), Morningstar Office (portfolio management software), ByAllAccounts (data aggregation and enrichment), Morningstar Investor (individual investor platform) and Morningstar.com.

*Includes AUMA for advisory services offered by certain Morningstar subsidiaries that are authorized in the jurisdictions in which they operate to provide investment management and advisory services

About Morningstar Inc.

Morningstar, Inc. is a leading provider of independent investment insights in North America, Europe, Australia, and Asia. The Company offers an extensive line of products and solutions that serve a wide range of market participants, including individual and institutional investors in public and private capital markets, financial advisors and wealth managers, asset managers, retirement plan providers and sponsors, and issuers of fixed-income securities. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, debt securities, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with approximately $294 billion in AUMA as of March 31, 2024. The Company operates through wholly- or majority-owned subsidiaries in 32 countries. For more information, visit www.morningstar.com/company. Follow Morningstar on X (formerly known as Twitter) @MorningstarInc.

Media Contacts:

AssetMark

Alaina.kleinman@assetmark.com

Morningstar Wealth

newsroom@morningstar.com

v3.24.1.1.u2

Cover

|

Jun. 20, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 20, 2024

|

| Entity Registrant Name |

AssetMark Financial Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38980

|

| Entity Tax Identification Number |

30-0774039

|

| Entity Address, Address Line One |

1655 Grant Street

|

| Entity Address, Address Line Two |

10th Floor

|

| Entity Address, City or Town |

Concord

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94520

|

| City Area Code |

925

|

| Local Phone Number |

521-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value

|

| Trading Symbol |

AMK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001591587

|

| Current Fiscal Year End Date |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

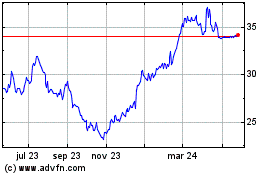

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

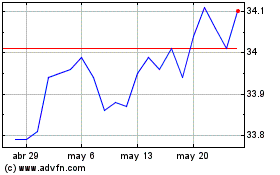

AssetMark Financial (NYSE:AMK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025