UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed by the Registrant |

x |

Filed by a Party other than the Registrant | |

¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

ARGO GROUP INTERNATIONAL HOLDINGS, LTD.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a6(i)(1) and 0-11. |

LONG TERM INCENTIVE (LTI) AWARDS –

FREQUENTLY ASKED QUESTIONS FOR ONE-TIME AWARD PARTICIPANTS: MARCH 2023

Why have I been awarded a one-time LTI award?

LTI awards have been granted on a very selective basis in

recognition of one or more of the following:

| · | Your exemplary performance |

| · | Your key role in leading a large, strategically important initiative in 2022 |

| · | Argo’s wish to reward and retain you through and following the closing

of the Brookfield Reinsurance transaction |

How does the LTI award work?

Your 2023 LTI award is denominated in your local currency and will

be granted in the form of restricted cash, which will vest in 4 equal annual tranches of 25% over a four-year period.

Will I be eligible for additional

LTI awards?

Argo decided to extend LTI participation in 2023 to recognize

exemplary performance and recognize significant achievements for employees who have traditionally not been eligible for such grants in

the past. Your receipt of this one-time LTI award does not mean that you will be eligible for any future LTI awards.

When will I receive additional information

on my LTI award?

You will receive a separate communication once LTI awards

are granted confirming the full details of your LTI award. LTI awards are expected to be granted on or around March 15, 2023, and

you will be asked to review and accept the terms and conditions of your LTI award in E*TRADE (the Company’s stock administration

platform) once it has been granted to you. An E*TRADE account will be set up for you as a part of this process if you don’t already

have one.

What will happen to my

2023 LTI award when the transaction with Brookfield Reinsurance closes?

Your 2023 LTI award will not vest at closing, but will continue

to vest on the original vesting schedule, based on your continued employment with Argo through each vesting date.

Congratulations on your award and thank you for your

ongoing contributions to Argo.

Cautionary Note

Regarding Forward-Looking Statements

This material may include,

and Argo and Brookfield Reinsurance may make related oral, forward-looking statements which reflect Argo’s or Brookfield Reinsurance’s

current views with respect to future events and financial performance. Such statements include forward-looking statements both with respect

to us in general, and to the insurance and reinsurance sectors in particular (both as to underwriting and investment matters). Statements

that include the words “expect,” “estimate,” “intend,” “plan,” “believe,”

“project,” “anticipate,” “seek,” “aim,” “likely,” “will,” “may,”

“could,” “should” or “would” and similar statements of a future or forward-looking nature identify

forward-looking statements in this material for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking

statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act

of 1995.

The proposed transaction

is subject to risks and uncertainties and factors that could cause Argo’s and Brookfield Reinsurance’s actual results to differ,

possibly materially, from those in the specific projections, goals, assumptions and statements herein including, but not limited to: (i) that

Argo and Brookfield Reinsurance may be unable to complete the proposed transaction because, among other reasons, conditions to the closing

of the proposed transaction may not be satisfied or waived, including the failure to obtain Argo shareholder approval for the proposed

transaction or that a governmental authority may prohibit, delay or refuse to grant approval for the consummation of the transaction;

(ii) uncertainty as to the timing of completion of the proposed transaction; (iii) the occurrence of any event, change or other

circumstance that could give rise to the termination of the Merger Agreement; (iv) risks related to disruption of management’s

attention from Argo’s or Brookfield Reinsurance’s ongoing business operations due to the proposed transaction; (v) the

effect of the announcement of the proposed transaction on Argo’s or Brookfield Reinsurance’s relationships with its clients,

employees, operating results and business generally; and (vi) the outcome of any legal proceedings to the extent initiated against

Argo or Brookfield Reinsurance or others following the announcement of the proposed transaction, as well as Argo or Brookfield Reinsurance

management’s response to any of the aforementioned factors.

The

foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary

statements that are included herein or elsewhere, including the risk factors included in Argo’s most recent Annual Report on Form 10-K

and Quarterly Report on Form 10-Q, Brookfield Reinsurance’s Form 20-F and other documents of Argo or Brookfield Reinsurance

on file with, or furnished to, the SEC. Any forward-looking statements made in this material are qualified by these cautionary statements,

and there can be no assurance that the actual results or developments anticipated by Argo will be realized or, even if substantially realized,

that they will have the expected consequences to, or effects on, Argo or its business or operations. Argo undertakes no obligation to

update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except

as required by the federal securities laws. References to additional information about Argo and Brookfield Reinsurance have been provided

as a convenience, and the information contained on such websites

is not incorporated by reference into this material.

Additional Information

about the Proposed Transaction and Where to Find It

In

connection with the proposed transaction, Argo will file with the SEC a definitive proxy statement on Schedule 14A and Argo or Brookfield

Reinsurance may file or furnish other documents with the SEC regarding the proposed transaction. This material is not a substitute for

the definitive proxy statement or any other document that Argo or Brookfield Reinsurance may file with the SEC. INVESTORS IN AND SECURITY

HOLDERS OF ARGO ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR FURNISHED OR WILL

BE FILED OR WILL BE FURNISHED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security

holders may obtain free copies of the definitive proxy statement (when available) and other documents filed with, or furnished to, the

SEC by Argo or Brookfield Reinsurance through the website maintained by the SEC at www.sec.gov or

by requesting them in writing or by telephone from the following addresses

Argo

Group Investor Relations

Wellesley

House

90

Pitts Bay Road

Pembroke

HM 08, Bermuda

Telephone: 441-296-5858

Participants in

the Solicitation

Argo,

Brookfield Reinsurance and their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies from Argo’s shareholders in connection with the proposed transaction. Information regarding Argo’s directors and

executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Argo’s

annual proxy statement filed with the SEC on October 31, 2022 and in other filings with the SEC. A more complete description will

be available in the definitive proxy statement on Schedule 14A that will be filed with the SEC in connection with the proposed transaction.

Information regarding Brookfield Reinsurance’s directors and executive officers is contained in Brookfield Reinsurance’s

Form 20-F filed on March 23, 2022. You may obtain free copies of these documents as described in the preceding paragraph filed

with, or furnished to, the SEC. All such documents, when filed or furnished are available free of charge on the SEC’s website (www.sec.gov)

or by directing a request to Argo at the Investor Relations contact above.

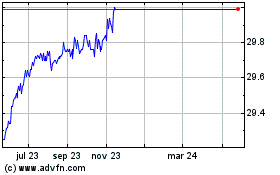

Argo (NYSE:ARGO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

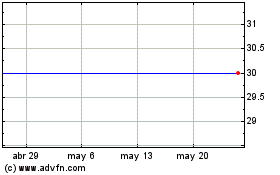

Argo (NYSE:ARGO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025