Avista Makes Annual Price Adjustment Filings in Idaho

31 Julio 2024 - 3:05PM

Avista

(NYSE: AVA) has made annual rate adjustment

filings with the Idaho Public Utilities Commission (IPUC or

Commission) that, if approved, are designed to decrease overall

electric revenues by approximately $16.6 million or 5.4% effective

Oct. 1, 2024 and decrease overall natural gas revenue by

approximately $29.8 million or 25.8% effective Nov. 1, 2024. These

annual filings have no impact on Avista’s earnings.

Electric Adjustment FilingsTwo

annual electric adjustments were filed, that if approved, are

designed to change overall electric revenues effective Oct. 1, 2024

as follows:

- Power Cost Adjustment (PCA): a

decrease of approximately $22.8 million or 7.4%

- Fixed Cost Adjustment (FCA): an

increase of approximately $6.2 million or 2.0%

Natural Gas Adjustment

FilingsTwo annual natural gas adjustments were filed, that

if approved, are designed to change overall natural gas revenues

effective Nov. 1, 2024 as follows:

- Purchased Gas Cost Adjustment

(PGA): a decrease of approximately $32.3 million or 27.9%

- Fixed Cost Adjustment (FCA): an

increase of approximately $2.5 million or 2.1%

Customer Bills Resulting from these

FilingsIf the electric PCA and FCA filings are approved,

residential electric customers in Idaho using an average of 927

kilowatt hours per month would see their monthly bills decrease

from $104.18 to $101.46, a decrease of $2.72 per month, or

approximately 2.6%. The proposed electric rate change would be

effective Oct. 1, 2024.

The net effect, on an annual revenue basis, for

the requested electric rate changes by rate schedule are as

follows:

|

Residential Service - Schedule 1 |

|

-2.7% |

| General

Service - Schedules 11 & 12 |

|

-7.2% |

| Large

General Service - Schedules 21 & 22 |

|

-6.3% |

| Extra Large

General Service - Schedule 25 |

|

-10.7% |

| Extra Large

General Service - Schedule 25P |

|

-11.7% |

| Pumping

Service - Schedules 31 & 32 |

|

-5.5% |

| Street &

Area Lights - Schedules 41-49 |

|

-1.8% |

| Overall |

|

-5.4% |

If the natural gas PGA and FCA filings are

approved, residential natural gas customers in Idaho using an

average of 64 therms per month would see their monthly bills

decrease from $78.03 to $59.37, a decrease of $18.66 per month, or

approximately 23.9%. The proposed natural gas rate change would be

effective Nov. 1, 2024.

The net effect, on a revenue basis, for the

requested natural gas rate change by rate schedule are as

follows:

|

General Service - Schedule 101 |

|

-24.3% |

| Large

General Service - Schedules 111 & 112 |

|

-31.6% |

|

Interruptible Service - Schedules 131 & 132 |

|

0.0% |

|

Transportation Service - Schedule 146 |

|

0.0% |

| Overall |

|

-25.8% |

Power Cost Adjustment (PCA)The

PCA is an annual rate adjustment made to reflect the difference

between the actual cost of generating and purchasing electric power

to serve customers and the cost currently included in customer

rates. Over the last year, power supply costs were lower than those

included in retail rates due to lower wholesale electric and

natural gas prices.

Fixed Cost Adjustment (FCA)The

electric and natural gas FCA is a mechanism designed to break the

link between a utility’s revenues and customers’ energy usage.

Avista’s actual revenue, based on kilowatt hour or therm sales,

will vary, up or down, from the level included in a general rate

case and approved by the Commission. This could be caused by

changes in weather, energy conservation or other factors. Under the

FCA, Avista’s revenues are adjusted each month based on the number

of customers. The annual difference between revenues based on sales

and the number of customers is surcharged or rebated to customers

beginning in the following year. The proposed FCA rate adjustments

are primarily driven by variations in 2023 customer usage related

to weather and savings from participating in efficiency programs.

The FCA mechanisms do not apply to Avista’s Electric Extra Large

General and Street Lighting Service Schedules, nor to its Natural

Gas Interruptible and Transportation Service Schedules.

Purchased Gas Cost Adjustment

(PGA)PGA requests are typically filed annually to balance

the actual cost of wholesale natural gas purchased by Avista to

serve customers with the amount presently included in customer’s

rates. Avista does not make a profit on, or markup, the wholesale

cost of natural gas. PGAs ensure customers pay what Avista pays,

dollar for dollar, only at a more predictable and stable rate

throughout the year. These rate adjustments are driven primarily by

a reduction in the current surcharge amortization rate and lower

wholesale natural gas prices observed during this past winter,

which were below the amounts included in rates.

Rate Application

ProcedureAvista’s applications are proposals, subject to

public review and a Commission decision. Copies of the applications

are available for public review at the offices of both the

Commission and Avista, and on the Commission’s website

(www.puc.idaho.gov). Customers may file with the Commission written

comments related to Avista’s filings. Customers may also subscribe

to the Commission’s RSS feed (https://puc.idaho.gov/RssPage) to

receive periodic updates via e-mail about the case. Copies of rate

filings are also available on Avista’s website at

www.myavista.com/rates.

If you would like to submit comments on the

proposed rate change, you can do so by going to the Commission

website or mailing comments to:

Idaho Public Utilities CommissionP.O. Box

83720Boise, ID 83720-0074

About Avista Corp.Avista Corp.

is an energy company involved in the production, transmission and

distribution of energy as well as other energy-related businesses.

Avista Utilities is the operating division that provides electric

service to 418,000 customers and natural gas to 382,000 customers.

Its service territory covers 30,000 square miles in eastern

Washington, northern Idaho and parts of southern and eastern

Oregon, with a population of 1.7 million. Alaska Energy and

Resources Company is an Avista subsidiary that provides retail

electric service to 18,000 customers in the city and borough of

Juneau, Alaska, through its subsidiary Alaska Electric Light and

Power Company. Avista stock is traded under the ticker symbol

"AVA." For more information about Avista, please visit

www.avistacorp.com.

Avista Corp. and the Avista Corp. logo are trademarks of Avista

Corporation.

SOURCE: Avista Corporation

To unsubscribe from Avista’s news release distribution, send a

reply message to dalila.sheehan@avistacorp.com

Contact:Media: Lena Funston (509) 495-8090

lena.funston@avistacorp.comInvestors: Stacey Wenz (509) 495-2046

stacey.wenz@avistacorp.comAvista 24/7 Media Access (509)

495-4174

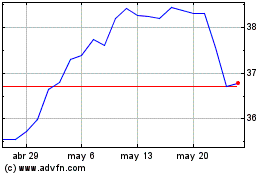

Avista (NYSE:AVA)

Gráfica de Acción Histórica

De Jul 2024 a Jul 2024

Avista (NYSE:AVA)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024