PRICING

SUPPLEMENT dated October 31, 2024

(To Equity Index

Underlying Supplement dated September 5, 2023,

Prospectus Supplement

dated September 5, 2023 and

Prospectus dated

September 5, 2023) |

Filed

Pursuant to Rule 424(b)(2)

Registration

No. 333-272447

|

|

Canadian

Imperial Bank of Commerce

$12,275,000

Senior

Global Medium-Term Notes

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked

Notes due November 4, 2026 |

The

notes do not bear interest. The notes will mature on

the stated maturity date (November 4, 2026, subject to adjustment) unless they are automatically called on the call observation date

(November 10, 2025, subject to adjustment). Your notes will be automatically called on the call observation date if the closing price

of the SPDR® S&P® Metals & Mining ETF (the “underlier”) on such date is greater

than or equal to 80% of the initial underlier price ($63.59, which was the closing price of the underlier on the trade date),

resulting in a payment on the call payment date equal to the principal amount of your notes times 107.33%.

The

return on your notes is linked to the performance of the underlier, and not to that of the underlying index on which the underlier is

based.

If

your notes are not automatically called, the amount that you will be paid on your notes on the stated maturity date is based on

the performance of the underlier as measured from the trade date to and including the determination date (November 2, 2026, subject to

adjustment).

At

maturity, if the final underlier price on the determination date is greater than or equal to 80% of the initial underlier price, the

return on your notes will be positive, and you will receive the maximum settlement amount ($1,146.60 for each $1,000 principal amount

of your notes). If the final underlier price declines by more than 20.00% from the initial underlier price, the return on your notes

will be negative. You could lose your entire investment in the notes.

The

return on your notes is capped. The maximum payment you could receive for each $1,000 principal amount of your notes is $1,073.30 if

your notes are automatically called, and $1,146.60 if your notes are not automatically called.

If

your notes are not automatically called on the call observation date, we will calculate the underlier return to determine your payment

at maturity, which is the percentage increase or decrease in the final underlier price from the initial underlier price. On the stated

maturity date, for each $1,000 principal amount of your notes, you will receive an amount in cash equal to:

| · | if

the underlier return is greater than or equal to -20.00% (i.e. the final underlier

price is greater than or equal to 80% of the initial underlier price), the maximum

settlement amount of $1,146.60; or |

| · | if

the underlier return is less than -20.00% (i.e. the final underlier price is less

than 80% of the initial underlier price), the sum of (i) $1,000 plus (ii)

the product of (a) 1.25 times (b) the sum of the underlier return plus

20.00% times (c) $1,000. This amount will be less than $1,000 and may be zero. |

The

notes have complex features and investing in the notes involves risks not associated with an investment in conventional debt securities.

See “Additional Risk Factors Specific to Your Notes” beginning on page PRS-9 of this Pricing Supplement and “Risk Factors”

beginning on page S-1 of the accompanying Underlying Supplement.

Our

estimated value of the notes on the trade date, based on our internal pricing models, is $968.20 per note. The estimated value is less

than the initial issue price of the notes. See “Additional Information Regarding Estimated Value of the Notes” in this Pricing

Supplement.

| |

Initial

Issue Price |

Price

to Public |

Agent’s

Commission |

Proceeds

to Issuer |

| Per

Note |

$1,000.00 |

100.00% |

1.50% |

98.50% |

| Total |

$12,275,000.00 |

$12,275,000.00 |

$184,125.00 |

$12,090,875.00 |

The

notes are unsecured obligations of Canadian Imperial Bank of Commerce and all payments on the notes are subject to the credit risk of

Canadian Imperial Bank of Commerce. The notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S.

Federal Deposit Insurance Corporation or any other government agency or instrumentality of Canada, the United States or any other jurisdiction.

The notes are not bail-inable debt securities (as defined on page 6 of the Prospectus). The notes will not be listed on any U.S. securities

exchange.

Neither

the United States Securities and Exchange Commission (the “SEC”) nor any state or provincial securities commission has approved

or disapproved of these securities or determined if this Pricing Supplement or the accompanying Underlying Supplement, Prospectus Supplement

or Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

issue price, agent’s commission and net proceeds listed above relate to the notes we will sell initially. We may decide to sell

additional notes after the trade date, at issue prices and with agent’s commissions and net proceeds that differ from the amounts

set forth above. The return (whether positive or negative) on your investment will depend in part on the issue price you pay for your

notes.

The

Bank may use this Pricing Supplement in the initial sale of the notes. Goldman Sachs & Co. LLC (“GS&Co.”) or any

of its affiliates or agents may use this Pricing Supplement in a market-making transaction in a note after its initial sale. Unless we,

GS&Co. or any of our or its respective affiliates or agents informs the purchaser otherwise in the confirmation of sale, this Pricing

Supplement is being used in a market-making transaction.

We

will deliver the notes in book-entry form through the facilities of The Depository Trust Company (“DTC”) on November 7, 2024

against payment in immediately available funds.

Goldman

Sachs & Co. LLC

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

ADDITIONAL

INFORMATION REGARDING ESTIMATED VALUE OF THE NOTES

On

the cover page of this Pricing Supplement, the Bank has provided the initial estimated value range for the notes. This range of estimated

values was determined by reference to the Bank’s internal pricing models, which take into consideration certain factors, such as

the Bank’s internal funding rate on the trade date and the Bank’s assumptions about market parameters. For more information

about the initial estimated value, see “Additional Risk Factors Specific to Your Notes” beginning on page PRS-9 herein.

The

economic terms of the notes (including the call premium amount and the maturity date premium amount) are based on the Bank’s internal

funding rate, which is the rate the Bank would pay to borrow funds through the issuance of similar market-linked notes, the underwriting

discount and the economic terms of certain related hedging arrangements. Due to these factors, the initial issue price you pay to purchase

the notes is greater than the initial estimated value of the notes. The Bank’s internal funding rate is typically lower than the

rate the Bank would pay when it issues conventional fixed rate debt securities, as discussed further under “Additional Risk Factors

Specific to Your Notes — Neither the Bank’s nor GS&Co.’s Estimated Value of the Notes at Any Time Is Determined

by Reference to Credit Spreads or the Borrowing Rate the Bank Would Pay for Its Conventional Fixed-Rate Debt Securities.” The Bank’s

use of its internal funding rate reduces the economic terms of the notes to you.

The

value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.’s

customary bid and ask spreads) at which GS&Co. would initially buy or sell notes in the secondary market (if GS&Co. makes a market,

which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately

GS&Co.’s estimate of the market value of your notes on the trade date, based on its pricing models and taking into account

the Bank’s internal funding rate, plus an additional amount (initially equal to $21.00 per $1,000 principal amount).

Prior to January

31, 2025, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes

(if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your

notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount

will decline to zero on a straight-line basis from the time of pricing through January 30, 2025). On and after January 31, 2025, the

price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes

a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models. For

additional information regarding the value of your notes shown in your GS&Co. account statements and the price at which GS&Co.

would buy or sell your notes (if GS&Co. makes a market, which it is not obligated to do), each based on GS&Co.’s pricing

models; see “Additional Risk Factors Specific to Your Notes — The Price at Which GS&Co. Would Buy Or Sell Your Notes

(If GS&Co. Makes a Market, Which It Is Not Obligated To Do) Will Be Based on GS&Co.’s Estimated Value of Your Notes”.

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

ABOUT

THIS PRICING SUPPLEMENT

You

should read this Pricing Supplement together with the Prospectus dated September 5, 2023 (the “Prospectus”), the Prospectus

Supplement dated September 5, 2023 (the “Prospectus Supplement”) and the ETF Underlying Supplement dated September 5, 2023

(the “Underlying Supplement”), each relating to our Senior Global Medium-Term Notes, for additional information about the

notes. Information in this Pricing Supplement supersedes information in the accompanying Underlying Supplement, Prospectus Supplement

and Prospectus to the extent it is different from that information. Certain defined terms used but not defined herein have the meanings

set forth in the accompanying Underlying Supplement, Prospectus Supplement or Prospectus.

You

should rely only on the information contained in or incorporated by reference in this Pricing Supplement and the accompanying Underlying

Supplement, Prospectus Supplement and Prospectus. This Pricing Supplement may be used only for the purpose for which it has been prepared.

No one is authorized to give information other than that contained in this Pricing Supplement and the accompanying Underlying Supplement,

Prospectus Supplement and Prospectus, and in the documents referred to in these documents and which are made available to the public.

We have not, and GS&Co. has not, authorized any other person to provide you with different or additional information. If anyone provides

you with different or additional information, you should not rely on it.

We

are not, and GS&Co. is not, making an offer to sell the notes in any jurisdiction where the offer or sale is not permitted. You should

not assume that the information contained in or incorporated by reference in this Pricing Supplement or the accompanying Underlying Supplement,

Prospectus Supplement or Prospectus is accurate as of any date other than the date of the applicable document. Our business, financial

condition, results of operations and prospects may have changed since that date. Neither this Pricing Supplement nor the accompanying

Underlying Supplement, Prospectus Supplement or Prospectus constitutes an offer, or an invitation on our behalf or on behalf of GS&Co.,

to subscribe for and purchase any of the notes and may not be used for or in connection with an offer or solicitation by anyone in any

jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or

solicitation.

References

to “CIBC,” “the Issuer,” “the Bank,” “we,” “us” and “our” in

this Pricing Supplement are references to Canadian Imperial Bank of Commerce and not to any of our subsidiaries, unless we state otherwise

or the context otherwise requires.

You

may access the accompanying Underlying Supplement, Prospectus Supplement and Prospectus on the SEC website www.sec.gov as follows (or

if such address has changed, by reviewing our filing for the relevant date on the SEC website):

| · | Underlying

Supplement dated September 5, 2023: |

| · | Prospectus

Supplement dated September 5, 2023: |

| · | Prospectus

dated September 5, 2023: |

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

SUMMARY

INFORMATION

| We

refer to the notes we are offering by this Pricing Supplement as the “offered notes” or the “notes”. Each

of the offered notes has the terms described below. Terms used but not defined in this Pricing Supplement have the meanings set forth

in the accompanying Underlying Supplement, Prospectus Supplement or Prospectus. This section is meant as a summary and should be

read in conjunction with the accompanying Prospectus, Prospectus Supplement and Underlying Supplement. This Pricing Supplement supersedes

any conflicting provisions of the documents listed above. |

Key

Terms

Issuer:

Canadian Imperial Bank of Commerce

Underlier:

The SPDR® S&P® Metals & Mining

ETF (Bloomberg symbol, “XME UP Equity”)

Underlying

index: the index tracked by the underlier

Specified

currency: U.S. dollars (“$”)

Principal

amount: Each note will have a principal amount of $1,000; $12,275,000

in the aggregate for all the offered notes; the aggregate principal amount of the offered notes may be increased if the Issuer, at its

sole option, decides to sell an additional amount of the offered notes on a date subsequent to the trade date.

Minimum

investment: $1,000 (one note)

Denominations:

$1,000 and integral multiples of $1,000 in excess thereof

Purchase

at amount other than the principal amount: The amount we will pay you

on the call payment date or the stated maturity date, as the case may be, for your notes will not be adjusted based on the issue price

you pay for your notes, so if you acquire notes at a premium (or a discount) to the principal amount and hold them to the call payment

date or the stated maturity date, it could affect your investment in a number of ways. The return on your investment in such notes will

be lower (or higher) than it would have been had you purchased the notes at principal amount. Also, the stated buffer price would not

offer the same measure of protection to your investment as would be the case if you had purchased the notes at principal amount. See

“Additional Risk Factors Specific to Your Notes — If You Purchase Your Notes at a Premium to the Principal Amount, the Return

on Your Investment Will Be Lower Than the Return on Notes Purchased at the Principal Amount and the Impact of Certain Key Terms of the

Notes Will Be Negatively Affected” in this Pricing Supplement.

Cash

settlement amount (on the call payment date): If your notes are automatically called on the call observation date because the closing

price of the underlier on such day is greater than or equal to the call price, for each $1,000 principal amount of your notes, we will

pay you an amount in cash equal to the sum of (i) $1,000 plus (ii) the product of $1,000 times the call premium amount

Cash

settlement amount (on the stated maturity date): If your notes are

not automatically called, for each $1,000 principal amount of your notes, we will pay you on the stated maturity date an amount in cash

equal to:

| · | if

the final underlier price is greater than or equal to the buffer price, the

sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the

maturity date premium amount; or |

| · | if

the final underlier price is less than the buffer price, the sum of (i) $1,000

plus (ii) the product of (a) the buffer rate times (b) the sum

of the underlier return plus the buffer amount times (c) $1,000. In this

case, the cash settlement amount will be less than the principal amount of the notes, and

you will lose some or all of the principal amount. |

Call

premium amount: 7.33%

Maturity

date premium amount: 14.66%

Call

price: 80.00% of the initial underlier price

Buffer

price: 80.00% of the initial underlier price

Buffer

amount: 20.00%

Buffer

rate: The quotient of the initial underlier price divided

by the buffer price, which equals 125.00%

Initial

underlier price: $63.59, which was the closing price of the underlier

on the trade date, subject to adjustments as described under “Certain Terms of the Notes — Anti-Dilution Adjustments”

beginning on page S-65 of the accompanying Underlying Supplement

Final

underlier price: The closing price of the underlier on the determination

date

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

Underlier

return: The quotient of (1) the final underlier price minus

the initial underlier price divided by (2) the initial underlier price, expressed as a positive or negative percentage

Call

observation date: November 10, 2025, subject to adjustment as described under “Certain Terms of the Notes—Valuation Dates”

in the accompanying Underlying Supplement.

Call

payment date: November 13, 2025, subject to adjustment as described

under “Certain Terms of the Notes—Interest Payment Dates, Coupon Payment Dates, Call Payment Dates and Maturity Date”

in the accompanying Underlying Supplement.

Trade

date: October 31, 2024

Original

issue date (settlement date): November 7, 2024

Determination

date: November 2, 2026, subject to adjustment as described under “Certain

Terms of the Notes—Valuation Dates” in the accompanying Underlying Supplement.

Stated

maturity date: November 4, 2026, subject to adjustment as described

under “Certain Terms of the Notes—Interest Payment Dates, Coupon Payment Dates, Call Payment Dates and Maturity Date”

in the accompanying Underlying Supplement.

Closing

price: As described under “Certain Terms of the Notes ––

Certain Definitions –– Closing Price” in the accompanying Underlying Supplement

No

listing: The offered notes will not be listed on any securities exchange

Calculation

agent: Canadian Imperial Bank of Commerce. We may appoint a different

calculation agent without your consent and without notifying you

CUSIP

/ ISIN: 13607XU39 / US13607XU395

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

SUPPLEMENTAL

TERMS OF THE NOTES

For

purposes of the notes offered by this Pricing Supplement, all references to each of the following terms used in the accompanying Underlying

Supplement will be deemed to refer to the corresponding term used in this Pricing Supplement, as set forth in the table below:

| Underlying

Supplement Term |

Pricing

Supplement Term |

| |

|

| Final

Valuation Date |

determination

date |

| |

|

| maturity

date |

stated

maturity date |

| |

|

| Reference

Asset |

underlier |

| |

|

| Reference

Sponsor |

underlier

sponsor |

| |

|

| Initial

Price |

initial underlier

price |

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

HYPOTHETICAL

EXAMPLES

The

following table and examples are provided for purposes of illustration only. They should not be taken as an indication or prediction

of future investment results and merely are intended to illustrate the impact that the various hypothetical underlier prices on the call

observation date and on the determination date could have on the cash settlement amount on the call payment date or on the stated maturity

date, as the case may be, assuming all other variables remain constant.

The

examples below are based on a range of underlier prices that are entirely hypothetical; the underlier price on any day throughout the

life of the notes, including the underlier price on the call observation date or on the determination date, cannot be predicted. The

underlier has been highly volatile in the past — meaning that the underlier price has changed considerably in relatively short

periods — and its performance cannot be predicted for any future period.

The

information in the following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on

the original issue date at the principal amount and held to the call payment date or the stated maturity date as the case may be. If

you sell your notes in a secondary market prior to the call payment date or the stated maturity date as the case may be, your return

will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected

in the table or the examples below, such as interest rates, the volatility of the underlier and the creditworthiness of CIBC. In addition,

the estimated value of your notes at the time the terms of your notes were set on the trade date (as determined by reference to pricing

models used by CIBC) is less than the initial issue price of your notes. For more information on the estimated value of your notes, see

“Additional Risk Factors Specific to Your Notes — The Bank’s Initial Estimated Value of the Notes at the Time of Pricing

(When the Terms of Your Notes Were Set on the Trade Date) Is Lower Than the Initial Issue Price of the Notes” in this Pricing Supplement

and “Additional Information Regarding Estimated Value of the Notes” in this Pricing Supplement. The information in the following

hypothetical examples also reflects the key terms and assumptions in the box below.

| Key

Terms and Assumptions |

| Principal

amount |

$1,000 |

| Call price |

80.00%

of the initial underlier price |

| Call premium amount |

7.33%

|

| Maturity date premium amount |

14.66% |

| Buffer

price |

80.00%

of the initial underlier price |

| Buffer

rate |

125.00% |

| Buffer

amount |

20.00% |

Neither

a market disruption event nor a non-trading day occurs on the originally scheduled call observation date or determination date

No

change in or affecting the underlier, any of the underlier stocks or the policies of the underlier’s investment advisor or

the method by which the sponsor of the underlier’s underlying index calculates its underlying index

Notes

purchased on original issue date at the principal amount and held to the call payment date or the stated maturity date, as the case

may be

|

The

actual performance of the underlier over the life of your notes, as well as the cash settlement amount payable on the call payment date

or at maturity, if any, may bear little relation to the hypothetical examples shown below or to the historical underlier prices shown

elsewhere in this Pricing Supplement. For information about the historical prices of the underlier during recent periods, see “The

Underlier — Historical Closing Prices of the Underlier” below. Before investing in the offered notes, you should consult

publicly available information to determine the prices of the underlier between the date of this Pricing Supplement and the date of your

purchase of the offered notes.

Also,

the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable

to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax

return on the underlier stocks.

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

Hypothetical

Payment on the Call Payment Date

If your notes are automatically called on the call observation date (i.e.,

the closing price of the underlier on the call observation date is greater than or equal to the call price), the cash settlement amount

that we would deliver for each $1,000 principal amount of your notes on the call payment date would be the sum of $1,000 plus

the product of the call premium amount times $1,000. If, for example, the closing price of the underlier on the call

observation date were determined to be 130% of the initial underlier price, your notes would be automatically called and the cash settlement

amount that we would deliver on your notes on the call payment date would be 107.33% of the principal amount of your notes or $1,073.30

for each $1,000 of the principal amount of your notes.

Hypothetical

Payment at Maturity

If the notes

are not automatically called on the call observation date (i.e., the closing price of the underlier on the call observation

date is less than the call price), the cash settlement amount we would deliver for each $1,000 principal amount of your notes on the

stated maturity date will depend on the performance of the underlier on the determination date, as shown in the table below. The table

below assumes that the notes have not been automatically called on the call observation date and reflects hypothetical

cash settlement amounts that you could receive on the stated maturity date. The prices in the left column of the table below represent

hypothetical final underlier prices and are expressed as percentages of the initial underlier price. The amounts in the right column

represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier price, and are expressed

as percentages of the principal amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement

amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding principal amount

of the offered notes on the stated maturity date would equal 100.000% of the principal amount of a note, based on the corresponding hypothetical

final underlier price and the assumptions noted above.

The

Notes Have Not Been Automatically Called

Hypothetical

Final Underlier Price

(as

Percentage of Initial Underlier Price) |

Hypothetical

Cash Settlement Amount at Maturity

(as

Percentage of Principal Amount)

|

| 200.00% |

114.66% |

| 175.00% |

114.66% |

| 150.00% |

114.66% |

| 125.00% |

114.66% |

| 116.56% |

114.66% |

| 113.00% |

114.66% |

| 109.00% |

114.66% |

| 104.00% |

114.66% |

| 100.00% |

114.66% |

| 95.00% |

114.66% |

| 90.00% |

114.66% |

| 85.00% |

114.66% |

| 80.00% |

114.66% |

| 75.00% |

93.75% |

| 50.00% |

62.50% |

| 25.00% |

31.25% |

| 0.00% |

0.00% |

If,

for example, the notes have not been automatically called on the call observation date and the final underlier price were determined

to be 25.000% of the initial underlier price, the cash settlement amount that we would deliver on your notes at maturity would be 31.25%

of the principal amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date

at the principal amount and held them to the stated maturity date, you would lose 68.75% of your investment (if you purchased your notes

at a premium to principal amount you would lose a correspondingly higher percentage of your investment). If the final underlier price

were determined to be 0.000% of the initial underlier price, you would lose your entire investment in the notes. In addition, if the

notes have not been automatically called on the call observation date and the final underlier price were determined to be 200.000% of

the initial underlier price, the cash settlement amount that we would deliver on your notes at maturity would be 114.66% of the principal

amount of your notes,

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

as

shown in the table above. As a result, if you purchased your notes on the settlement date at the principal amount and held them to maturity,

the cash settlement amount will be capped, and you would not benefit from any increase in the final underlier price over 114.66% of the

initial underlier price.

The

cash settlement amounts shown above are entirely hypothetical; they are based on market prices for the underlier stocks that may not

be achieved on the determination date and on assumptions that may prove to be erroneous. The actual market value of your notes prior

to the call payment date and the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear

little relation to the hypothetical cash settlement amounts shown above, and these amounts should not be viewed as an indication of the

financial return on an investment in the offered notes. The hypothetical cash settlement amounts on notes held to the call payment date

or the stated maturity date in the examples above assume you purchased your notes at their principal amount and have not been adjusted

to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes

will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the principal amount, the return

on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please

read “Risk Factors—Market Valuation Risks—The market value of the notes will be affected by various factors that interrelate

in complex ways, and their market value may be less than the principal amount” in the accompanying Underlying Supplement.

Payments

on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments

on the notes are economically equivalent to a combination of an interest-bearing bond bought by the holder and one or more options entered

into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not

modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this Pricing

Supplement.

| We

cannot predict the actual closing price of the underlier or what the market value of your notes will be on any particular trading

day, nor can we predict the relationship between the underlier price and the market value of your notes at any time prior to the

call payment date and the stated maturity date. The actual amount that you will receive, if any, on the call payment date or at maturity

and the rate of return on the offered notes will depend on the actual closing price of the underlier on the call observation date

and whether the notes are called, and the actual final underlier price determined by the calculation agent as described above. Moreover,

the assumptions on which the hypothetical returns are based may turn out to be inaccurate. Consequently, the amount of cash to be

paid in respect of your notes, if any, on the call payment date or the stated maturity date may be very different from the information

reflected in the table and the examples above. |

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

ADDITIONAL

RISK FACTORS SPECIFIC TO YOUR NOTES

| An

investment in your notes is subject to the risks described below, as well as the risks and considerations described under “Risk

Factors” in the accompanying Prospectus, Prospectus Supplement and Underlying Supplement. You should carefully review these

risks and considerations as well as the terms of the notes described herein and in the accompanying Prospectus, Prospectus Supplement

and Underlying Supplement. Your notes are a riskier investment than ordinary debt securities. Also, your notes are not equivalent

to investing directly in the underlier or the underlier stocks, i.e., the stocks held by the underlier to which your notes are linked.

You should carefully consider whether the offered notes are suited to your particular circumstances. |

Structure

Risks

You

May Lose Your Entire Investment in the Notes

You

may lose your entire investment in the notes. Assuming your notes are not automatically called on the call observation date, the cash

payment on your notes, if any, on the stated maturity date will be based on the performance of the underlier as measured from the initial

underlier price to the closing price on the determination date. If the final underlier price is less than the buffer price, you will

lose, for each $1,000 of the principal amount of your notes, an amount equal to the product of (i) the buffer rate times (ii) the sum

of the underlier return plus the buffer amount times (iii) $1,000. Thus, you may lose your entire investment in the notes, which would

include any premium to principal amount you paid when you purchased the notes.

Also,

the market price of your notes prior to the call payment date or the stated maturity date may be significantly lower than the purchase

price you pay for your notes. Consequently, if you sell your notes before the call payment date or the stated maturity date, you may

receive significantly less than the amount of your investment in the notes.

The

Cash Settlement Amount You Will Receive on the Call Payment Date or on the Stated Maturity Date, as the Case May be, Will Be Capped

Regardless

of the closing price of the underlier on the call observation date, the cash settlement amount you may receive on the call payment date,

if any, is capped. If the closing price of the underlier on the call observation date exceeds the call price, causing the notes to be

automatically called, the cash settlement amount on the call payment date will be capped, and you will not benefit from any increases

in the closing price of the underlier above the initial underlier price on the call observation date. If your notes are automatically

called on the call observation date, the maximum payment you will receive for each $1,000 principal amount of your notes will depend

on the call premium amount. If your notes are not automatically called on the call observation date, the cash settlement amount you may

receive on the stated maturity date is capped due to the maturity date premium amount.

Your

Notes Are Subject to Automatic Redemption

We

will call and automatically redeem all, but not part, of your notes on the call payment date, if the closing price of the underlier on

the call observation date is greater than or equal to the call price. Therefore, the term for your notes may be reduced to as short as

approximately 12 months after the trade date. You may not be able to reinvest the proceeds from an investment in the notes at a comparable

return for a similar level of risk in the event the notes are called prior to maturity.

The

Amount Payable on Your Notes Is Not Linked to the Price of the Underlier at Any Time Other than the Call

Observation Date or the Determination Date, as the Case May Be

The cash settlement

amount you will receive on the call payment date, if any, will be paid only if the notes are automatically called when the closing price

of the underlier on the call observation date is greater than or equal to the call price. Therefore, the closing price of the underlier

on dates other than the call observation date will have no effect on the determination as to whether the notes are automatically called.

In addition, if your notes are not automatically called on the call observation date, the cash settlement amount you will receive on

the stated maturity date, if any, will be based on the closing price of the underlier on the determination date. Therefore, if the closing

price of the underlier dropped precipitously on the determination date, the cash settlement amount for your notes may be significantly

less than it would have been had the cash settlement amount been linked to the closing price of the underlier prior to such drop in the

price of the underlier. Although the actual price of the underlier on the call payment date, the stated maturity date or at other times

during the life of your notes may be higher than the closing price of the underlier on the call observation date or the determination

date, you will not benefit from the closing prices of the underlier at any time other than on the call observation date or on the determination

date.

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

Your

Notes Do Not Bear Interest

You

will not receive any interest payments on your notes. As a result, even if the cash settlement amount payable for your notes on the call

payment date or the stated maturity date, as the case may be, exceeds the principal amount of your notes, the overall return you earn

on your notes may be less than you would have earned by investing in a non-index-linked debt security of comparable maturity that bears

interest at a prevailing market rate.

Underlier

Risks

The

Underlier Is Concentrated in Metals and Mining Companies and Does Not Provide Diversified Exposure

The

underlier is not diversified. The underlier’s assets will be concentrated in metals and mining companies (including companies assigned

to the aluminum, coal & consumable fuels, copper, diversified metals & mining, gold, precious metals & minerals, silver or

steel sub-industries), which means the underlier is more likely to be adversely affected by any negative performance of metals and mining

companies than an ETF that has more diversified holdings across a number of sectors. Metals and mining companies can be significantly

affected by events relating to international political and economic developments, energy conservation, the success of exploration projects,

commodity prices, exchange rates, import controls, worldwide competition, environmental policies, consumer demand, and tax and other

government regulations. Investments in metals and mining companies may be speculative and may be subject to greater price volatility

than investments in other types of companies. Metals and mining companies are subject to various risks, including changes in international

monetary policies or economic and political conditions that can affect the supply of precious metals and consequently the value of metals

and mining company investments. In addition, the United States or foreign governments may pass laws or regulations limiting metals investments

for strategic or other policy reasons, and increased environmental or labor costs may depress the value of metals and mining investments.

At times, worldwide production of industrial materials has exceeded demand as a result of over-building or economic downturns. Metals

and mining companies can also be affected by liabilities for environmental damage and general civil liabilities, depletion of resources

and mandated expenditures for safety and pollution control.

The

Return on Your Notes Will Not Reflect Any Dividends Paid on the Underlier or the Underlier Stocks

The

return on your notes will not reflect the return you would realize if you actually owned the shares of the underlier and received the

distributions paid on the shares of the underlier. You will not receive any dividends that may be paid on any of the underlier stocks

by the underlier stock issuers or the shares of the underlier. See “—You Have No Shareholder Rights or Rights to Receive

Any Shares of the Underlier or Any Underlier Stock” below for additional information.

You

Have No Shareholder Rights or Rights to Receive Any Shares of the Underlier or Any Underlier Stock

Investing

in the notes will not make you a holder of any shares of the underlier or any underlier stocks. Neither you nor any other holder or owner

of the notes will have any rights with respect to the underlier or the underlier stocks, including any voting rights, any right to receive

dividends or other distributions, any rights to make a claim against the underlier or the underlier stocks or any other rights of a holder

of the underlier stocks. Your notes will be paid in cash and you will have no right to receive delivery of any shares of the underlier

or the underlier stocks.

The

Policies of the Underlier’s Investment Advisor and the Sponsor of The Underlying Index Could Affect the Amount Payable on Your

Notes and Their Market Value

The

underlier’s investment advisor may from time to time be called upon to make certain policy decisions or judgments with respect

to the implementation of policies of the underlier investment advisor concerning the calculation of the net asset value of the underlier,

additions, deletions or substitutions of securities in the underlier and the manner in which changes affecting the underlying index are

reflected in the underlier that could affect the market price of the shares of the underlier, and therefore, the amount payable on your

notes on the stated maturity date. The amount payable on your notes and their market value could also be affected if the underlier investment

advisor changes these policies, for example, by changing the manner in which it calculates the net asset value of the underlier, or if

the underlier investment advisor discontinues or suspends calculation or publication of the net asset value of the underlier, in which

case it may become difficult or inappropriate to determine the market value of your notes.

If

events such as these occur, the calculation agent — which initially will be CIBC — may determine the closing price of the

underlier on the determination date — and thus the amount payable on the stated maturity date, if any — in a manner, in its

sole discretion, it considers appropriate. We describe the discretion that the calculation agent will have in determining the closing

underlier price on the determination date and the amount payable on your notes more fully under “Certain Terms of the Notes —

Discontinuance of or Material Change to a Fund” in the accompanying Underlying Supplement.

In addition,

the underlying index sponsor owns the underlying index and is responsible for the design and maintenance of the underlying index. The

policies of the underlying index sponsor concerning the calculation of the underlying index,

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

including

decisions regarding the addition, deletion or substitution of the equity securities included in the underlying index, could affect the

price of the underlying index and, consequently, could affect the market prices of shares of the underlier and, therefore, the amount

payable on your notes and their market value.

There

Is No Assurance That an Active Trading Market Will Continue for the Underlier or That There Will Be Liquidity in Any Such Trading Market;

Further, the Underlier Is Subject to Management Risks, Securities Lending Risks and Custody Risks

Although

the shares of the underlier and a number of similar products have been listed for trading on securities exchanges for varying periods

of time, there is no assurance that an active trading market will continue for the shares of the underlier or that there will be liquidity

in the trading market.

In

addition, the underlier is subject to management risk, which is the risk that the underlier investment advisor’s investment strategy,

the implementation of which is subject to a number of constraints, may not produce the intended results. The underlier is also not actively

managed and may be affected by a general decline in market segments relating to the underlying index. The underlier investment advisor

invests in securities included in, or representative of, the underlying index regardless of their investment merits. The underlier investment

advisor does not attempt to take defensive positions in declining markets. In addition, the underlier’s investment advisor may

be permitted to engage in securities lending with respect to a portion of the underlier’s total assets, which could subject the

underlier to the risk that the borrower of such loaned securities fails to return the securities in a timely manner or at all.

In

addition, the underlier is subject to custody risk, which refers to the risks in the process of clearing and settling trades and to the

holding of securities by local banks, agents and depositories.

Further,

the underlier is subject to listing standards adopted by the securities exchange on which the underlier is listed for trading. There

can be no assurance that the underlier will continue to meet the applicable listing requirements, or that the underlier will not be delisted.

We

Cannot Control Actions By Any of the Unaffiliated Companies Whose Securities Are Included in the Underlier

Actions

by any company whose securities are included in the underlier may have an adverse effect on the price of its security, the closing price

of the underlier and the value of the notes. These companies will not be involved in the offering of the notes and will have no obligations

with respect to the notes, including any obligation to take our or your interests into consideration for any reason. These companies

will not receive any of the proceeds of the offering of the notes and will not be responsible for, and will not have participated in,

the determination of the timing of, prices for, or quantities of, the notes to be issued. These companies will not be involved with the

administration, marketing or trading of the notes and will have no obligations with respect to the cash settlement amount to be paid

to you on the notes.

We

and Our Respective Affiliates Have No Affiliation with the Underlier Sponsor and Have Not Independently Verified Its Public Disclosure

of Information

We

and our respective affiliates are not affiliated in any way with the underlier sponsor and have no ability to control or predict its

actions, including any errors in or discontinuation of disclosure regarding the methods or policies relating to the calculation of the

underlier. We have derived the information about the underlier sponsor and the underlier contained herein from publicly available information,

without independent verification. You, as an investor in the notes, should make your own investigation into the underlier and the underlier

sponsor. The underlier sponsor is not involved in the offering of the notes made hereby in any way and has no obligation to consider

your interest as an owner of notes in taking any actions that might affect the value of the notes.

The

Performance of the Underlier May Not Correlate With the Performance of Its Underlying Index as Well as the Net Asset Value Per Share

of the Underlier, Especially During Periods of Market Volatility.

Although the

underlier is designed to track the performance of its underlying index, the performance of the underlier and that of its underlying index

generally will vary due to, for example, transaction costs, management fees, certain corporate actions, and timing variances. Moreover,

it is also possible that the performance of the underlier may not fully replicate or may, in certain circumstances, diverge significantly

from the performance of its underlying index. This could be due to, for example, the underlier not holding all or substantially all of

the underlying assets included in the underlying index and/or holding assets that are not included in the underlying index, the temporary

unavailability of certain securities in the secondary market, the performance of any derivative instruments held by the underlier, differences

in trading hours between the underlier (or the underlying assets held by the underlier) and the underlying index, or due to other circumstances.

This variation in performance is called the “tracking error,” and, at times, the tracking error may be significant.

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

In

addition, because the shares of the underlier are traded on a securities exchange and are subject to market supply and investor demand,

the market price of one share of the underlier may differ from its net asset value per share; shares of the underlier may trade at, above,

or below its net asset value per share.

During

periods of market volatility, securities held by the underlier may be unavailable in the secondary market, market participants may be

unable to calculate accurately the net asset value per share of the underlier and the liquidity of the underlier may be adversely affected.

This kind of market volatility may also disrupt the ability of market participants to create and redeem shares of the underlier. Further,

market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to buy and sell shares

of the underlier. As a result, under these circumstances, the market value of shares of the underlier may vary substantially from the

net asset value per share of the underlier.

For

the foregoing reasons, the performance of the underlier may not match the performance of its underlying index over the same period. Because

of this variance, the return on the notes, to the extent dependent on the performance of the underlier, may not be the same as an investment

directly in the securities, commodities, or other assets included in the underlying index or the same as a debt security with a return

linked to the performance of the underlying index.

The

Historical Performance of the Underlier Should Not Be Taken as an Indication of Its Future Performance

The

closing price of the underlier on the call observation date or the determination date will determine the amount to be paid on the notes

on the call payment date or at maturity, as the case may be. The historical performance of the underlier does not necessarily give an

indication of its future performance. As a result, it is impossible to predict whether the price of the underlier will rise or fall during

the term of the notes. The price of the underlier will be influenced by complex and interrelated political, economic, financial and other

factors.

Conflicts

of Interest

There

Are Potential Conflicts of Interest Between You and the Calculation Agent

The

calculation agent will, among other things, determine the cash settlement amount payable on the notes. We will serve as the calculation

agent. We may appoint a different calculation agent without your consent and without notifying you. The calculation agent will exercise

its judgment when performing its functions. For example, the calculation agent may have to determine whether a market disruption event

affecting the underlier has occurred. This determination may, in turn, depend on the calculation agent’s judgment as to whether

the event has materially interfered with our ability or the ability of one of our affiliates or a similarly situated party to unwind

our hedge positions. Since this determination by the calculation agent will affect the payment on the notes, the calculation agent may

have a conflict of interest if it needs to make a determination of this kind. See

“Certain Terms of the Notes — Role of the Calculation Agent” in the accompanying Underlying Supplement.

Our

Economic Interests and Those of GS&Co. and any Dealer Participating in the Offering of the Notes Will Potentially Be Adverse to Your

Interests

You

should be aware of the following ways in which our economic interests and those of GS&Co. and any dealer participating in the distribution

of the notes, which we refer to as a “participating dealer,” will potentially be adverse to your interests as an investor

in the notes. In engaging in certain of the activities described below, our affiliates, GS&Co. or its affiliates or any participating

dealer or its affiliates may take actions that may adversely affect the value of and your return on the notes, and in so doing they will

have no obligation to consider your interests as an investor in the notes. Our affiliates, GS&Co. or its affiliates or any participating

dealer or its affiliates may realize a profit from these activities even if investors do not receive a favorable investment return on

the notes.

Research

Reports by Our Affiliates, GS&Co. or Its Affiliates or Any Participating Dealer or Its Affiliates May Be Inconsistent With an Investment

in the Notes and May Adversely Affect the Price of the Underlier

Our affiliates,

GS&Co. or its affiliates or any dealer participating in the offering of the notes or its affiliates may, at present or in the future,

publish research reports on the underlier or any underlier stocks. This research will be modified from time to time without notice and

may, at present or in the future, express opinions or provide recommendations that are inconsistent with purchasing or holding the notes.

Any research reports on the underlier or any underlier stocks could adversely affect the price of the underlier and, therefore, adversely

affect the value of and your return on the notes. You are encouraged to derive information concerning the underlier from multiple sources

and should not rely on the views expressed by us or our affiliates, GS&Co. or its affiliates or any participating dealer or its affiliates.

In addition, any research reports on the underlier or any underlier stocks published on or prior to the trade date could result in an

increase in the price of the underlier on the trade date, which would adversely affect investors in the notes by increasing the price

at which the underlier must close on the determination date in order for investors in the notes to receive a favorable return.

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

Hedging

Activities by Our Affiliates, GS&Co. or Its Affiliates or Any Participating Dealer or Its Affiliates May Adversely Affect the Price

of the Underlier

We

expect to hedge our obligations under the notes through one or more hedge counterparties, which may include our affiliates, GS&Co.

or its affiliates or any participating dealer or its affiliates. Pursuant to such hedging activities, our hedge counterparty may acquire

the underlier or any underlier stocks and/or other instruments

linked to the underlier or any underlier stocks. Depending on, among other

things, future market conditions, the aggregate amount and the composition of such positions are likely to vary over time. To the extent

that our hedge counterparty has a long hedge position in the underlier or any underlier stocks, or derivative or synthetic instruments

related to the underlier or any underlier stocks, they may liquidate a portion of such holdings at or about the time of the determination

date or at or about the time of a change in the underlier or any underlier stocks. These hedging activities could potentially adversely

affect the price of the underlier and, therefore, adversely affect the value of and your return on the notes.

Trading

Activities by Our Affiliates, GS&Co. or Its Affiliates or Any Participating Dealer or Its Affiliates May Adversely Affect the Price

of the Underlier

Our

affiliates, GS&Co. or its affiliates or any participating dealer or its affiliates may engage in trading in the underlier or any

underlier stocks and other instruments relating to the underlier or any underlier stocks on a regular basis as part of their general

broker-dealer and other businesses. Any of these trading activities could potentially adversely affect the price of the underlier and,

therefore, adversely affect the value of and your return on the notes.

A

Participating Dealer or Its Affiliates May Realize Hedging Profits Projected by Its Proprietary Pricing Models in Addition to Any Selling

Concession or Any Distribution Expense Fee, Creating a Further Incentive for the Participating Dealer to Sell the Notes to You

If

any participating dealer or any of its affiliates conducts hedging activities for us in connection with the notes, that participating

dealer or its affiliates will expect to realize a projected profit from such hedging activities, and this projected profit will be in

addition to any concession or distribution expense fee that the participating dealer receives for the sale of the notes to you. This

additional projected profit may create a further incentive for the participating dealer to sell the notes to you.

Tax

Risks

The

U.S. Federal Tax Consequences of An Investment in the Notes Are Unclear

There

is no direct legal authority regarding the proper U.S. federal tax treatment of the notes, and we do not plan to request a ruling from

the U.S. Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the notes are uncertain,

and the IRS or a court might not agree with the treatment of the notes as prepaid cash-settled derivative contracts. If the IRS were

successful in asserting an alternative treatment of the notes, the tax consequences of the ownership and disposition of the notes might

be materially and adversely affected. The U.S. Treasury Department and the IRS released a notice requesting comments on various issues

regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. See “Material

U.S. Federal Income Tax Consequences” in the accompanying Underlying Supplement. Any Treasury regulations or other guidance promulgated

after consideration of these issues could materially and adversely affect the tax consequences of an investment in the notes, including

the character and timing of income or loss and the degree, if any, to which income realized by non-U.S. persons should be subject to

withholding tax, possibly with retroactive effect. Both U.S. and non-U.S. persons considering an investment in the notes should review

carefully the section of the accompanying Underlying Supplement entitled “Material U.S. Federal Income Tax Consequences”

and consult their tax advisers regarding the U.S. federal tax consequences of an investment in the notes (including possible alternative

treatments and the issues presented by the notice), as well as tax consequences arising under the laws of any state, local or non-U.S.

taxing jurisdiction.

There

Can Be No Assurance that the Canadian Federal Income Tax Consequences of an Investment in the Notes Will Not Change in the Future

There

can be no assurance that Canadian federal income tax laws, the judicial interpretation thereof, or the administrative policies and assessing

practices of the Canada Revenue Agency will not be changed in a manner that adversely affects investors. For a discussion of the Canadian

federal income tax consequences of investing in the notes, please read the section of this Pricing Supplement entitled “Certain

Canadian Federal Income Tax Considerations” as well as the section entitled “Material Income Tax Consequences — Canadian

Taxation” in the accompanying Prospectus. You should consult your tax advisor with respect to your own particular situation.

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

General

Risks

The

Notes Are Subject to the Credit Risk of the Bank

Although

the return on the notes will be based on the performance of the underlier, the payment of any amount due on the notes is subject to the

credit risk of the Bank, as issuer of the notes. The notes are our unsecured obligations. As further described in the accompanying Prospectus

and Prospectus Supplement, the notes will rank on par with all of the other unsecured and unsubordinated debt obligations of the Bank,

except such obligations as may be preferred by operation of law. Investors are dependent on our ability to pay all amounts due on the

notes, and therefore investors are subject to our credit risk and to changes in the market’s view of our creditworthiness. See

“Description of Senior Debt Securities — Ranking” in the accompanying Prospectus.

The

Bank’s Initial Estimated Value of the Notes at the Time of Pricing (When the Terms of Your Notes Were Set on the Trade Date) Is

Lower Than the Initial Issue Price of the Notes

The

Bank’s initial estimated value of the notes is only an estimate. The initial issue price of the notes exceeds the Bank’s

initial estimated value. The difference between the initial issue price of the notes and the Bank’s initial estimated value reflects

costs associated with selling and structuring the notes, as well as hedging its obligations under the notes with a third party.

Neither

the Bank’s nor GS&Co.’s Estimated Value of the Notes at Any Time Is Determined by Reference to Credit Spreads or the

Borrowing Rate the Bank Would Pay for Its Conventional Fixed-Rate Debt Securities

The

Bank’s initial estimated value of the notes was determined and GS&Co.’s estimated value of the notes at any time are

determined by reference to the Bank’s internal funding rate. The internal funding rate used in the determination of the estimated

value of the notes generally represents a discount from the credit spreads for the Bank’s conventional fixed-rate debt securities

and the borrowing rate the Bank would pay for its conventional fixed-rate debt securities. This discount is based on, among other things,

the Bank’s view of the funding value of the notes as well as the higher issuance, operational and ongoing liability management

costs of the notes in comparison to those costs for the Bank’s conventional fixed-rate debt securities. If the interest rate implied

by the credit spreads for the Bank’s conventional fixed-rate debt securities or the borrowing rate the Bank would pay for its conventional

fixed-rate debt securities were to be used, the Bank would expect the economic terms of the notes to be more favorable to you. Consequently,

the use of an internal funding rate for the notes increases the estimated value of the notes at any time and has an adverse effect on

the economic terms of the notes.

The

Bank’s Initial Estimated Value of the Notes Does Not Represent Future Values of the Notes and May Differ From Others’ (Including

GS&Co.’s) Estimates

The

Bank’s initial estimated value of the notes was determined by reference to its internal pricing models when the terms of the notes

were set. These pricing models consider certain factors, such as the Bank’s internal funding rate on the trade date, the expected

term of the notes, market conditions and other relevant factors existing at that time, and the Bank’s assumptions about market

parameters, which can include volatility, dividend rates, interest rates and other factors. Different pricing models and assumptions

(including the pricing models and assumptions used by GS&Co.) could provide valuations for the notes that are different, and perhaps

materially lower, from the Bank’s initial estimated value. Therefore, the price at which GS&Co. or any other party would buy

or sell your notes (if GS&Co. makes a market, which it is not obligated to do) may be materially lower than the Bank’s initial

estimated value. In addition, market conditions and other relevant factors in the future may change, and any assumptions may prove to

be incorrect.

The

Price at Which GS&Co. Would Buy Or Sell Your Notes (If GS&Co. Makes a Market, Which It Is Not Obligated To Do) Will Be Based

on GS&Co.’s Estimated Value of Your Notes

GS&Co.’s

estimated value of the notes is determined by reference to its pricing models and takes into account the Bank’s internal funding

rate. The price at which GS&Co. would initially buy or sell your notes in the secondary market (if GS&Co. makes a market, which

it is not obligated to do) exceeds GS&Co.’s estimated value of your notes at the time of pricing. As agreed by GS&Co. and

the distribution participants, this excess (i.e., the additional amount described under “Additional Information Regarding Estimated

Value of the Notes” above) will decline to zero on a straight line basis over the period from the trade date through the applicable

date set forth above under “Additional Information Regarding Estimated Value of the Notes” above. Thereafter, if GS&Co.

buys or sells your notes, it will do so at prices that reflect the estimated value determined by reference to GS&Co.’s pricing

models at that time. The price at which GS&Co. will buy or sell your notes at any time also will reflect its then current bid and

ask spread for similar sized trades of structured notes. If GS&Co. calculated its estimated value of your notes by reference to the

Bank’s credit spreads or the borrowing rate the Bank would pay for its conventional fixed-rate debt securities (as opposed to the

Bank’s internal funding rate), the price at which GS&Co. would buy or sell your notes (if GS&Co. makes a market, which

it is not obligated to do) could be significantly lower.

GS&Co.’s

pricing models consider certain variables, including principally the Bank’s internal funding rate, interest rates (forecasted,

current and historical rates), volatility, price-sensitivity analysis and the time to maturity of the notes. These

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

pricing

models are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, the

actual value you would receive if you sold your notes in the secondary market, if any, to others may differ, perhaps materially, from

the estimated value of your notes determined by reference to GS&Co.’s models, taking into account the Bank’s internal

funding rate, due to, among other things, any differences in pricing models or assumptions used by others. See “Risk Factors—Market

Valuation Risks—The market value of the notes will be affected by various factors that interrelate in complex ways, and their market

value may be less than the principal amount” in the accompanying Underlying Supplement.

In

addition to the factors discussed above, the value and quoted price of your notes at any time will reflect many factors and cannot be

predicted. If GS&Co. makes a market in the notes, the price quoted by GS&Co. would reflect any changes in market conditions and

other relevant factors, including any deterioration in the Bank’s creditworthiness or perceived creditworthiness. These changes

may adversely affect the value of your notes, including the price you may receive for your notes in any market making transaction. To

the extent that GS&Co. makes a market in the notes, the quoted price will reflect the estimated value determined by reference to

GS&Co.’s pricing models at that time, plus or minus GS&Co.’s then current bid and ask spread for similar sized trades

of structured notes (and subject to the declining excess amount described above).

Furthermore,

if you sell your notes, you will likely be charged a commission for secondary market transactions, or the price will likely reflect a

dealer discount. This commission or discount will further reduce the proceeds you would receive for your notes in a secondary market

sale.

There

is no assurance that GS&Co. or any other party will be willing to purchase your notes at any price and, in this regard, GS&Co.

is not obligated to make a market in the notes. See “—The Notes Will Not Be Listed on Any Securities Exchange and Your Notes

May Not Have an Active Trading Market” below.

The

Notes Will Not Be Listed on Any Securities Exchange and We Do Not Expect A Trading Market For the Notes to Develop

The

notes will not be listed on any securities exchange. Although GS&Co. and/or its affiliates may purchase the notes from holders, they

are not obligated to do so and are not required to make a market for the notes. There can be no assurance that a secondary market will

develop for the notes. Because we do not expect that any market makers will participate in a secondary market for the notes, the price

at which you may be able to sell your notes is likely to depend on the price, if any, at which GS&Co. and/or its affiliates are willing

to buy your notes.

If

a secondary market does exist, it may be limited. Accordingly, there may be a limited number of buyers if you decide to sell your notes

prior to the call payment date or the stated maturity date. This may affect the price you receive upon such sale. Consequently, you should

be willing to hold the notes to the call payment date or the stated maturity date.

We

May Sell an Additional Aggregate Principal Amount of the Notes at a Different Issue Price

At

our sole option, we may decide to sell an additional aggregate principal amount of the notes subsequent to the trade date. The issue

price of the notes in the subsequent sale may differ substantially (higher or lower) from the initial issue price you paid as provided

on the cover of this Pricing Supplement.

If

You Purchase Your Notes at a Premium to the Principal Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased

at the Principal Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected

The cash settlement

amount will not be adjusted based on the issue price you pay for the notes. If you purchase notes at a price that differs from the principal

amount of the notes, then the return on your investment in such notes held to the call payment date or the stated maturity date will

differ from, and may be substantially less than, the return on notes purchased at the principal amount. If you purchase your notes at

a premium to the principal amount and hold them to the call payment date or the stated maturity date, the return on your investment in

the notes will be lower than it would have been had you purchased the notes at the principal amount or a discount to the principal amount.

In addition, the impact of the buffer price on the return on your investment will depend upon the price you pay for your notes relative

to the principal amount. For example, if you purchase your notes at a premium to the principal amount and the final underlier price is

less than the buffer price, you will incur a greater percentage decrease in your investment in the notes than would have been the case

for notes purchased at the principal amount or a discount to the principal amount.

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

THE

UNDERLIER

The

underlier seeks to track the investment results that, before fees and expenses, correspond generally to the price and yield performance

of the S&P Metals & Mining Select Industry Index (the “underlying index”), which is designed to measure the performance

of narrow GICS® sub-industries. The underlying index comprises stocks in the S&P Total Market Index that are classified

in the GICS Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals & Mining, Silver

and Steel sub-industries. The shares of the underlier are listed and trade on the NYSE Arca under the ticker symbol “XME.”

Information

filed by the underlier with the SEC pursuant to the Securities Exchange Act of 1934 and the Investment Company Act can be located by

reference to the CIK Number of 0001064642 on the SEC’s website at http://www.sec.gov.

In

addition, information may be obtained from other publicly available sources including, but not limited to, the Investment Adviser’s

website (including information regarding (i) fees paid to the Investment Adviser, (ii) returns of the underlier and the underlying index

for certain periods, and (iii) the underlier’s and the underlying index’s top constituents and their respective weightings).

We are not incorporating by reference into this document the website or any material it includes. None of us, GS&Co. or any of our

respective affiliates makes any representation that such publicly available information regarding the underlier is accurate or complete.

Historical

Closing Prices of the Underlier

The

closing price of the underlier has fluctuated in the past and may, in the future, experience significant fluctuations. Any historical

upward or downward trend in the closing price of the underlier during the period shown below is not an indication that the underlier

is more or less likely to increase or decrease at any time during the life of your notes.

You

should not take the historical prices of the underlier as an indication of the future performance of the underlier. We

cannot give you any assurance that the future performance of the underlier or the underlier stocks will result in the automatic call

of your notes or your receiving an amount greater than the outstanding principal amount of your notes on the stated maturity date.

None

of us, GS&Co. or any of our respective affiliates makes any representation to you as to the performance of the underlier. Before

investing in the offered notes, you should consult publicly available information to determine the prices of the underlier between the

date of this Pricing Supplement and the date of your purchase of the offered notes. The actual performance of the underlier over the

life of the offered notes, as well as the cash settlement amount on the call payment date or at maturity, may bear little relation to

the historical closing prices shown below.

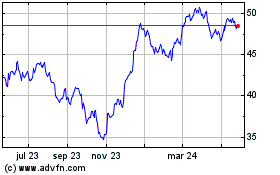

The graph below

shows the daily historical closing prices of the underlier from October 31, 2014 through October 31, 2024. On October 31, 2024, the closing

price of the underlier was $63.59. We obtained the closing prices in the graph below from Bloomberg Financial Services, without independent

verification.

Historical Performance of the SPDR®

S&P® Metals & Mining ETF

Source: Bloomberg

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked Notes

due

November 4, 2026

SUPPLEMENTAL

PLAN OF DISTRIBUTION

GS&Co.

has agreed to purchase the notes at a discount reflecting commissions of $15.00 per $1,000 principal amount of notes. A fee will also

be paid to iCapital Markets LLC (“iCapital”), a broker-dealer with no affiliation with us, for services it is providing in

connection with this offering. An affiliate of GS&Co. holds an indirect minority equity interest in iCapital. At the time we issue

the notes, we will enter into certain hedging arrangements (which may include call options, put options or other derivatives) with GS&Co.