Compass Minerals (NYSE: CMP), a leading global provider of

essential minerals, today reported preliminary fiscal 2024

third-quarter results.

The following financial results and updated 2024 outlook are

preliminary estimates and are subject to change until the filing of

the company’s Form 10-Q for the quarter ended June 30, 2024. The

company is currently finalizing its fiscal 2024 third-quarter

results and thus these preliminary estimates are based solely on

information available to management as of the date of this press

release. The company’s actual results may differ from these

estimates due to the completion of its quarter-end closing

procedures, final adjustments and developments that may arise or

information that may become available, including with respect to

the financial restatements described below, between now and the

time the company’s financial results are finalized and included in

its Form 10-Q for the quarter ended June 30, 2024. Unless otherwise

noted, it should be assumed that time periods referenced below are

on a fiscal-year basis.

MANAGEMENT COMMENTARY

"Compass Minerals' core businesses produced strong results in

the third quarter. We had solid results in the Salt segment that

reflect the robust earnings potential of that business, while we

continued to see sequential improvements in realized price,

adjusted EBITDA per ton, and adjusted EBITDA margin in the Plant

Nutrition segment,” said Edward C. Dowling Jr., president and CEO.

"It’s disappointing that we have been delayed in sharing the

positive performance of the core businesses with the market due to

issues surrounding certain historical accounting matters. It is

important for the market to know that the core Salt and Plant

Nutrition business are performing well, and that we are also

focused on positioning the company for better performance in the

future. We are building and reinforcing a culture committed to

operational excellence and continuous improvement, with an emphasis

on improving cash generation and deleveraging the balance sheet. I

expect that the improvements that we are making across the business

will result in a stronger company and higher returns for our

shareholders."

FINANCIAL RESTATEMENT

UPDATE

As previously disclosed, Compass Minerals identified

misstatements and material weaknesses in its (i) unaudited

financial statements included in its Quarterly Report on Form 10-Q

for the quarterly period ended June 30, 2023, (ii) audited

financial statements included in its Annual Report on Form 10-K for

the period ended Sept. 30, 2023, (iii) unaudited financial

statements included in its Quarterly Report on Form 10-Q for the

quarterly period ended Dec. 31, 2023, and (iv) unaudited financial

statements included in its Quarterly Report on Form 10-Q for the

quarterly period ended March 31, 2024. The misstatements primarily

relate to certain contingent consideration associated with the

company’s acquisition of Fortress North America, LLC, originally

disclosed in the company’s Form 8-K filed on July 3, 2024, together

with additional identified errors. The company provided an update

on the identified misstatements and materials weaknesses in the

company’s Form 12b-25 filed Aug. 9, 2024. The issues identified by

the company do not materially impact the company's adjusted EBITDA

or the fundamentals of the core Salt and Plant Nutrition

businesses.

The company is actively engaged with its current and predecessor

auditors as the company corrects the errors and restates the

affected financial statements. As part of that process, additional

audit procedures covering fiscal years 2021 through 2023 have been

required, thereby prolonging the process to complete the

restatements. These amended financial statements must be completed

before the company can file its Form 10-Q for the quarter ended

June 30, 2024. To date, no additional material accounting

misstatements have been identified as a result of the additional

testing being performed; however, the company has not fully

completed its review and cannot provide assurance that other errors

will not be identified.

Until the restatements are completed, Compass Minerals is

limited in the amount of financial information that it can provide.

The company is not able to provide an estimate of when it expects

the restatements to be completed. The company is providing the

following preliminary financial results for the third quarter of

2024 given its assessment that these results are not reasonably

expected to be materially impacted by the restatement work

described above.

PRELIMINARY QUARTERLY FINANCIAL

RESULTS

Three Months Ended June

30,

(in millions, except per share

data)

2024

Revenue

$

202.9

Operating earnings

5.9

Adjusted operating earnings*

7.4

Adjusted EBITDA*

32.8

Net loss

(43.6

)

Net loss per diluted share

(1.05

)

Adjusted net loss*

(42.1

)

Adjusted net loss* per diluted share

(1.01

)

*Non-GAAP financial measure.

Reconciliations to the most directly comparable GAAP financial

measure are provided in tables at the end of this press

release.

PRELIMINARY QUARTERLY FINANCIAL

HIGHLIGHTS

- Preliminary adjusted EBITDA of $32.8 million, which includes a

non-cash gain of $0.9 million related to the decrease of the

Fortress contingent liability discussed below;

- Strong Salt segment performance with adjusted EBITDA per ton of

$28.05;

- Mid-point of Salt business adjusted EBITDA guidance increased

$15 million for 2024;

- Average sales price for sulfate of potash increased for the

second consecutive quarter to $691.27 per ton; and

- Plant Nutrition adjusted EBITDA per ton and adjusted EBITDA

margin of $128.57 and 18.6%, respectively.

SALT BUSINESS SUMMARY

Preliminary operating earnings for the quarter were $25.9

million and adjusted EBITDA was $41.6 million. Preliminary adjusted

EBITDA per ton came in at $28.05. The second half of the fiscal

year reflects the normal seasonal change in sales mix as highway

deicing volumes decline going into summer months, resulting in

increased contribution from the consumer and industrial (C&I)

business. Preliminary quarterly operating earnings margin and

adjusted EBITDA margin were 16.1% and 25.9%, respectively, for the

three months ended June 30, 2024.

Preliminary Salt segment revenue totaled $160.6 million for the

third quarter. In the highway deicing business, the company

realized an average highway deicing selling price of $77.20 per ton

and sales volumes were 1.09 million tons. C&I pricing was

$194.35 per ton during the quarter. Associated volumes were 393

thousand tons, which were impacted in the quarter by short-term

interruptions in customer processing needs and timing of sales.

PLANT NUTRITION BUSINESS

SUMMARY

In the Plant Nutrition business, preliminary operating loss

totaled $1.4 million and adjusted EBITDA was $7.2 million for the

quarter.

Plant Nutrition preliminary revenue for the quarter totaled

$38.8 million. This reflects sales volumes of 56 thousand tons. The

average segment sales price for the quarter was $691.27 per ton,

which represents a sequential 2% increase in pricing.

FORTRESS NORTH AMERICA

UPDATE

Compass Minerals continues to evaluate various alternatives

regarding the path forward for Fortress North America. Discussions

are ongoing with the U.S. Forest Service (USFS) regarding the

evaluation and testing of the company's non-magnesium

chloride-based aerial fire retardants.

FINANCIAL POSITION AND

LIQUIDITY

The company ended the quarter with $220.8 million of liquidity,

comprised of $12.8 million in cash and cash equivalents and $208.0

million of availability under its $375 million revolving credit

facility.

At quarter-end, the preliminary consolidated total net leverage

ratio was 4.3 times, within the company's net leverage covenant of

6.5 times. The company has amended its credit agreement and

receivables financing agreement to accommodate the delay in

providing required final compliance certifications related to third

quarter of 2024 financial results until Nov. 29, 2024.

PRELIMINARY UPDATED 2024

OUTLOOK

Preliminary updated guidance and commentary for 2024 is

reflected below.

Salt Segment

2024 Range

Highway deicing sales volumes (thousands

of tons)

7,400 - 7,500

Consumer and industrial sales volumes

(thousands of tons)

1,800 - 1,900

Total salt sales volumes (thousands of

tons)

9,200 - 9,400

Revenue (in millions)

$900 - $910

Adj. EBITDA (in millions)

$215 - $225

The outlook for adjusted EBITDA from the Salt segment is

improved from guidance provided on May 9, 2024. Anticipated costs

related to the curtailment of Goderich mine that were expected to

be recognized in 2024 are lower than had been originally forecast,

resulting in improved expectations for adjusted EBITDA for the

year.

The company continues to work toward reducing salt inventory

levels in the coming deicing season and accelerating conversion of

excess inventory to cash.

2024/2025 North American Bid

Season

Approximately 70% of the company's North American highway

deicing bidding process for the upcoming winter season has been

completed. Based on bid results to date, which include both

positive and negative price changes that reflect regional market

conditions and competitiveness, the company expects its average

contract selling price for the coming season to be approximately 2%

lower than prices in fiscal 2024. Market bid volumes are expected

to be down approximately 7% to 10% compared to fiscal 2024, which

is consistent with expectations given inventory levels across the

service market and producer supply positions following two

consecutive mild winters. It is important to distinguish between

committed bid volumes, which are used to establish minimum and

maximum service levels for certain customers, and expected sales

volumes, which will be driven ultimately by winter weather activity

in the coming year. Sales volumes can be above or below committed

volumes in any given deicing season.

Plant Nutrition

Segment

2024 Range

Sales volumes (thousands of tons)

265 - 275

Revenue (in millions)

$175 - $185

Adj. EBITDA (in millions)

$21 - $26

The revised Plant Nutrition guidance above reflects lower sales

volumes and increased costs partially offset by higher realized

pricing.

Corporate

2024 Range

Fortress1

Other2

Total

Adj. EBITDA (in millions)

$3 - $4

($44) - ($39)

($41) - ($35)

(1)

Fortress contribution includes

adjusted EBITDA carried over from its calendar year 2023 USFS

take-or-pay contract as well as ongoing overhead costs; no

assumptions with respect to 2024 activity with the USFS have been

assumed.

(2)

Other adjusted EBITDA includes i)

approximately $5 million of lithium-related costs, unchanged from

previously provided guidance, and ii) the year-to-date non-cash

gain of $23.1 million related to the decline in the valuation of

the contingent consideration liability associated with the Fortress

acquisition, reflecting quarterly fluctuations of that liability

due to changes in the discount rate and the projected business

performance used in the valuation.

Projected Corporate segment results shown in the table above

include corporate expenses in support of the company's core

businesses, operating expenses related to the company's terminated

lithium project, Fortress financial results, and the results of

DeepStore, the company's records and management services business

in the U.K. The improvement in guidance for Other reflects the

correction, disclosed in the Form 8-K filed on July 3, 2024, of an

error in the calculation of adjusted EBITDA that understated this

measure by approximately $10 million in the first half of 2024.

Total Compass Minerals

2024 Adjusted EBITDA

Salt

Plant Nutrition

Corporate1

Total

Adj. EBITDA (in millions)

$215 - $225

$21 - $26

($41) - ($35)

$195 - $216

2024 Capital

Expenditures

Sustaining

Lithium2

Fortress

Total

Capital expenditures (in millions)

$80 - $90

~$30

$5 - $10

$115 - $130

(1)

Includes financial contribution of

Fortress and DeepStore.

(2)

Lithium capital expenditures principally

relate to items committed to or made prior to the suspension of

further investment in the lithium project. As a result of the

termination of the lithium project and the related impairment in

the first quarter of 2024, a portion of these expenditures that

related to committed items that had not been received by Dec. 31,

2023 were not classified as capital expenditures within the

consolidated statements of cash flows when paid.

Total capital expenditures for the company in 2024 remain

unchanged from the company’s prior guidance and are expected to be

within a range of $115 million to $130 million. Approximately $30

million of lithium-associated expenditures are included,

principally related to items that were committed to prior to the

November 2023 project suspension. The company's projections also

include $5 million to $10 million of capital investment in the

company's fire-retardant business.

Other Assumptions

($ in millions)

2024 Range

Depreciation, depletion and

amortization

$100 - $110

Interest expense, net

$65 - $70

Effective income tax rate (excl. valuation

allowance and impairments)

(25%) - (20%)

CONFERENCE CALL

The occurrence and timing of an earnings call to discuss results

for the third quarter of 2024 will be dependent on the ultimate

completion of the aforementioned restatements.

About Compass Minerals

Compass Minerals (NYSE: CMP) is a leading global provider of

essential minerals focused on safely delivering where and when it

matters to help solve nature’s challenges for customers and

communities. The company’s salt products help keep roadways safe

during winter weather and are used in numerous other consumer,

industrial, chemical and agricultural applications. Its plant

nutrition products help improve the quality and yield of crops,

while supporting sustainable agriculture. Additionally, it is

working to develop a long-term fire-retardant business. Compass

Minerals operates 12 production and packaging facilities with

nearly 2,000 employees throughout the U.S., Canada and the U.K.

Visit compassminerals.com for more information about the company

and its products.

Forward-Looking Statements and Other

Disclaimers

This press release may contain forward-looking statements,

including, without limitation, statements regarding preliminary

results and information, statements about earnings potential and

efforts to strengthen the company and improve shareholder returns;

management of inventory levels; Fortress North America's path

forward; expectations for highway deicing pricing and volumes for

the upcoming winter; the restatement of certain of the company’s

previously issued financial statements; and the company's outlook

for 2024, including its expectations regarding sales volumes,

revenue, Adjusted EBITDA, corporate and other expense,

depreciation, depletion and amortization, interest expense, tax

rates, and capital expenditures. Forward-looking statements are

those that predict or describe future events or trends and that do

not relate solely to historical matters. The company uses words

such as “may,” “would,” “could,” “should,” “will,” “likely,”

“expect,” “anticipate,” “believe,” “intend,” “plan,” “forecast,”

“outlook,” “project,” “estimate” and similar expressions suggesting

future outcomes or events to identify forward-looking statements or

forward-looking information. These statements are based on the

company’s current expectations and involve risks and uncertainties

that could cause the company’s actual results to differ materially.

The differences could be caused by a number of factors, including

without limitation (i) weather conditions, (ii) inflation, the cost

and availability of transportation for the distribution of the

company’s products and foreign exchange rates, (iii) pressure on

prices and impact from competitive products, (iv) any inability by

the company to successfully implement its strategic priorities or

its cost-saving or enterprise optimization initiatives, and (v) the

risk that the company may not realize the expected financial or

other benefits from its ownership of Fortress North America. For

further information on these and other risks and uncertainties that

may affect the company’s business, see the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of the company’s Annual Report on

Form 10-K for the period ended Sept. 30, 2023, and its Quarterly

Reports on Form 10-Q for the quarters ended Dec. 31, 2023 and Mar.

31,2024, and any amendments thereto, as well as the company's other

SEC filings. The company undertakes no obligation to update any

forward-looking statements made in this press release to reflect

future events or developments, except as required by law. Because

it is not possible to predict or identify all such factors, this

list cannot be considered a complete set of all potential risks or

uncertainties.

Non-GAAP Measures

In addition to using U.S. generally accepted accounting

principles (“GAAP”) financial measures, management uses a variety

of non-GAAP financial measures described below to evaluate the

company’s and its operating segments’ performance. While the

consolidated financial statements provide an understanding of the

company’s overall results of operations, financial condition and

cash flows, management analyzes components of the consolidated

financial statements to identify certain trends and evaluate

specific performance areas.

Management uses EBITDA, EBITDA adjusted for items which

management believes are not indicative of the company’s ongoing

operating performance (“Adjusted EBITDA”) and EBITDA margin to

evaluate the operating performance of the company’s core business

operations because its resource allocation, financing methods and

cost of capital, and income tax positions are managed at a

corporate level, apart from the activities of the operating

segments, and the operating facilities are located in different

taxing jurisdictions, which can cause considerable variation in net

earnings. Management also uses adjusted operating earnings,

adjusted operating margin, adjusted net earnings, and adjusted net

earnings per diluted share, which eliminate the impact of certain

items that management does not consider indicative of underlying

operating performance. The presentation of these measures should

not be construed as an inference that future results will be

unaffected by unusual or non-recurring items. Management believes

these non-GAAP financial measures provide management and investors

with additional information that is helpful when evaluating

underlying performance. EBITDA and Adjusted EBITDA exclude interest

expense, income taxes and depreciation, depletion and amortization,

each of which are an essential element of the company’s cost

structure and cannot be eliminated. In addition, Adjusted EBITDA

and Adjusted EBITDA margin exclude certain cash and non-cash items,

including stock-based compensation, impairment charges and certain

restructuring charges. Consequently, any measure that excludes

these elements has material limitations. The non-GAAP financial

measures used by management should not be considered in isolation

or as a substitute for net earnings, operating earnings, cash flows

or other financial data prepared in accordance with GAAP or as a

measure of overall profitability or liquidity. These measures are

not necessarily comparable to similarly titled measures of other

companies due to potential inconsistencies in the method of

calculation. The calculation of non-GAAP financial measures as used

by management is set forth in the following tables. All margin

numbers are defined as the relevant measure divided by sales. The

company does not provide a reconciliation of forward-looking

non-GAAP financial measures to the most directly comparable

financial measures calculated and reported in accordance with GAAP,

as the company is unable to estimate significant non-recurring,

unusual items and/or distinct non-core initiatives without

unreasonable effort. The amounts and timing of these items are

uncertain and could be material to the company’s results.

Adjusted operating earnings, adjusted operating earnings margin,

adjusted net earnings (loss), and adjusted net earnings (loss) per

diluted share are presented as supplemental measures of the

company’s performance. Management believes these measures provide

management and investors with additional information that is

helpful when evaluating underlying performance and comparing

results on a year-over-year normalized basis. These measures

eliminate the impact of certain items that management does not

consider indicative of underlying operating performance. These

adjustments are itemized below. Adjusted net earnings (loss) per

diluted share is adjusted net earnings (loss) divided by weighted

average diluted shares outstanding. You are encouraged to evaluate

the adjustments itemized above and the reasons management considers

them appropriate for supplemental analysis. In evaluating these

measures, you should be aware that in the future the company may

incur expenses that are the same as or similar to some of the

adjustments presented below.

Special Items Impacting the

Three Months Ended June 30, 2024 (unaudited, in millions,

except per share data)

Item Description

Segment

Line Item

Amount

Tax Effect(1)

After Tax

EPS Impact

Restructuring charges(2)

Corporate and Other

Other operating expense

$

1.5

$

—

$

1.5

$

0.04

Total

$

1.5

$

—

$

1.5

$

0.04

(1)

There were no substantial income tax

benefits related to these items given the U.S. valuation allowances

on deferred tax assets.

(2)

Restructuring charges do not include

certain reductions in stock-based compensation associated with

forfeitures stemming from the restructuring activities.

Reconciliation for Adjusted

Operating Earnings (unaudited, in millions)

Three Months Ended June

30,

2024

Operating earnings

$

5.9

Restructuring charges(1)

1.5

Adjusted operating earnings

$

7.4

Sales

202.9

Operating margin

2.9

%

Adjusted operating margin

3.6

%

(1)

The company incurred severance and related

charges for reductions in workforce and changes to executive

leadership and additional restructuring costs related to the

termination of the company’s lithium development project.

Reconciliation for Adjusted

Net Loss (unaudited, in millions)

Three Months Ended June

30,

2024

Net loss

$

(43.6

)

Restructuring charges(1)

1.5

Adjusted net loss

$

(42.1

)

Net loss per diluted share

$

(1.05

)

Adjusted net loss per diluted share

$

(1.01

)

Weighted-average common shares outstanding

(in thousands):

Diluted

41,342

(1)

The company incurred severance and related

charges for reductions in workforce and changes to executive

leadership and additional restructuring costs related to the

termination of the company’s lithium development project.

Reconciliation for EBITDA and

Adjusted EBITDA (unaudited, in millions)

Three Months Ended June

30,

2024

Net loss

$

(43.6

)

Interest expense

17.2

Income tax expense

32.7

Depreciation, depletion and

amortization

26.1

EBITDA

32.4

Adjustments to EBITDA:

Stock-based compensation - non-cash

(0.7

)

Interest income

(0.2

)

Gain on foreign exchange

(0.5

)

Restructuring charges(1)

1.5

Other expense, net

0.3

Adjusted EBITDA

$

32.8

(1)

The company incurred severance and related

charges for reductions in workforce and changes to executive

leadership and additional restructuring costs related to the

termination of the company’s lithium development project.

Salt Segment Performance

(unaudited, in millions, except for sales volumes and prices per

short ton)

Three Months Ended June

30,

2024

Sales

$

160.6

Operating earnings

$

25.9

Operating margin

16.1

%

EBITDA(1)

$

41.6

EBITDA(1) margin

25.9

%

Sales volumes (in thousands of tons):

Highway deicing

1,090

Consumer and industrial

393

Total Salt

1,483

Average prices (per ton):

Highway deicing

$

77.20

Consumer and industrial

$

194.35

Total Salt

$

108.27

(1)

Non-GAAP financial measure.

Reconciliations follow in these tables.

Reconciliation for Salt

Segment EBITDA (unaudited, in millions)

Three Months Ended June

30,

2024

Reported GAAP segment operating

earnings

$

25.9

Depreciation, depletion and

amortization

15.7

Segment EBITDA

$

41.6

Segment sales

160.6

Segment EBITDA margin

25.9

%

(1)

The company incurred severance and related

charges related to a reduction of its workforce.

Plant Nutrition Segment

Performance (unaudited, dollars in millions, except for sales

volumes and prices per short ton)

Three Months Ended June

30,

2024

Sales

$

38.8

Operating loss

$

(1.4

)

Operating margin

(3.6

)%

EBITDA(1)

$

7.2

EBITDA(1) margin

18.6

%

Sales volumes (in thousands of tons)

56

Average price (per ton)

$

691.27

(1)

Non-GAAP financial measure.

Reconciliations follow in these tables.

Reconciliation for Plant

Nutrition Segment EBITDA (unaudited, in millions)

Three Months Ended June

30,

2024

Reported GAAP segment operating loss

$

(1.4

)

Depreciation, depletion and

amortization

8.6

Segment EBITDA

$

7.2

Segment sales

38.8

Segment EBITDA margin

18.6

%

COMPASS MINERALS

INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in millions, except share and per-share

data)

Three Months Ended June

30,

2024

Sales

$

202.9

Shipping and handling cost

53.2

Product cost

117.1

Gross profit

32.6

Selling, general and administrative

expenses

27.5

Other operating income

(0.8

)

Operating earnings

5.9

Other (income) expense:

Interest income

(0.2

)

Interest expense

17.2

Gain on foreign exchange

(0.5

)

Other expense, net

0.3

Loss before income taxes

(10.9

)

Income tax expense

32.7

Net loss

$

(43.6

)

Basic net loss per common share

$

(1.05

)

Diluted net loss per common share

$

(1.05

)

Weighted-average common shares outstanding

(in thousands):(1)

Basic

41,342

Diluted

41,342

(1)

Weighted participating securities include

RSUs and PSUs that receive non-forfeitable dividends and consist of

632,000 weighted participating securities for the three months

ended June 30, 2024.

COMPASS MINERALS

INTERNATIONAL, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited, in millions)

June 30,

2024

ASSETS

Cash and cash equivalents

$

12.8

Receivables, net

92.3

Inventories

407.5

Other current assets

34.4

Property, plant and equipment, net

787.9

Intangible and other noncurrent assets

260.3

Total assets

$

1,595.2

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current portion of long-term debt

$

6.3

Other current liabilities

182.1

Long-term debt, net of current portion

868.8

Deferred income taxes and other noncurrent

liabilities

185.9

Total stockholders' equity

352.1

Total liabilities and stockholders'

equity

$

1,595.2

COMPASS MINERALS

INTERNATIONAL, INC. SEGMENT INFORMATION (unaudited,

in millions)

Three Months Ended June 30,

2024

Salt

Plant Nutrition

Corporate &

Other(1)

Total

Sales to external customers

$

160.6

$

38.8

$

3.5

$

202.9

Intersegment sales

—

2.8

(2.8

)

—

Shipping and handling cost

48.2

5.0

—

53.2

Operating earnings (loss)(2)(3)

25.9

(1.4

)

(18.6

)

5.9

Depreciation, depletion and

amortization

15.7

8.6

1.8

26.1

Total assets (as of end of period)

1,013.3

408.1

173.8

1,595.2

(1)

Corporate and other includes corporate

entities, records management operations, the Fortress fire

retardant business, equity method investments, lithium costs and

other incidental operations and eliminations. Operating earnings

(loss) for corporate and other includes indirect corporate

overhead, including costs for general corporate governance and

oversight, lithium-related expenditures, as well as costs for the

human resources, information technology, legal and finance

functions.

(2)

Corporate operating results were impacted

by net gains of $0.9 million related to the decline in the

valuation of the Fortress contingent consideration for the three

months ended June 30, 2024.

(3)

The company continued to take steps to

align its cost structure to its current business needs. These

initiatives impacted Corporate operating results and resulted in

net severance and related charges for reductions in workforce and

changes to executive leadership and additional restructuring costs

related to the termination of the company’s lithium development

project of $1.5 million for the three months ended June 30,

2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917394898/en/

Investor Contact Brent Collins Vice President, Treasurer

& Investor Relations +1.913.344.9111

InvestorRelations@compassminerals.com

Media Contact Rick Axthelm Chief Public Affairs and

Sustainability Officer +1.913.344.9198

MediaRelations@compassminerals.com

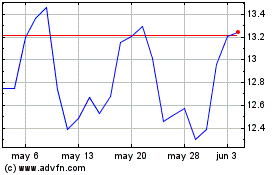

Compass Minerals (NYSE:CMP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Compass Minerals (NYSE:CMP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024