Compass Minerals (NYSE: CMP), a leading global provider of

essential minerals, today reported final fiscal 2024 third-quarter

results.

Unless otherwise noted, it should be assumed that time periods

referenced below are on a fiscal-year basis.

REPORTING UPDATE

On Oct. 29, 2024, Compass Minerals filed a Form 10-K/A and a

Form 10-Q/A correcting financial statements covering (i) unaudited

financial statements included in its Quarterly Report on Form 10-Q

for the quarterly period ended June 30, 2023, (ii) audited

financial statements included in its Annual Report on Form 10-K for

the period ended Sept. 30, 2023, (iii) unaudited financial

statements included in its Quarterly Report on Form 10-Q for the

quarterly period ended Dec. 31, 2023, and (iv) unaudited financial

statements included in its Quarterly Report on Form 10-Q for the

quarterly period ended March 31, 2024. With the completion of those

restatements, the company has filed its Form 10-Q for the quarterly

period ended June 30, 2024.

The final results for the third quarter of 2024 are consistent

in all material respects with the preliminary results disclosed on

Sept. 17, 2024. A complete set of press release financial

highlights follows for the quarter ended June 30, 2024, including

comparative quarterly and year-to-date amounts.

The company is currently in the process of finalizing financial

results for 2024 and completing its budget for 2025. As a result of

this timing, management believes that it would be unable to comment

on most items of current interest to the investment community and

therefore the company will forego its conference call to discuss

the results for the third quarter of 2024. The company expects to

resume the regular cadence of quarterly earnings calls beginning

with the reporting of results for the fourth quarter of 2024.

About Compass Minerals

Compass Minerals (NYSE: CMP) is a leading global provider of

essential minerals focused on safely delivering where and when it

matters to help solve nature’s challenges for customers and

communities. The company’s salt products help keep roadways safe

during winter weather and are used in numerous other consumer,

industrial, chemical and agricultural applications. Its plant

nutrition products help improve the quality and yield of crops,

while supporting sustainable agriculture. Additionally, it is

working to develop a long-term fire-retardant business. Compass

Minerals operates 12 production and packaging facilities with

nearly 2,000 employees throughout the U.S., Canada and the U.K.

Visit compassminerals.com for more information about the company

and its products.

Forward-Looking Statements and Other

Disclaimers

This press release may contain forward-looking statements,

including, without limitation, statements about timing of future

earnings calls. Forward-looking statements are those that predict

or describe future events or trends and that do not relate solely

to historical matters. The company uses words such as “may,”

“would,” “could,” “should,” “will,” “likely,” “expect,”

“anticipate,” “believe,” “intend,” “plan,” “forecast,” “outlook,”

“project,” “estimate” and similar expressions suggesting future

outcomes or events to identify forward-looking statements or

forward-looking information. These statements are based on the

company’s current expectations and involve risks and uncertainties

that could cause the company’s actual results to differ materially.

The differences could be caused by a number of factors, including

without limitation (i) weather conditions, (ii) inflation, the cost

and availability of transportation for the distribution of the

company’s products and foreign exchange rates, (iii) pressure on

prices and impact from competitive products, (iv) any inability by

the company to successfully implement its strategic priorities or

its cost-saving or enterprise optimization initiatives, and (v) the

risk that the company may not realize the expected financial or

other benefits from its ownership of Fortress North America. For

further information on these and other risks and uncertainties that

may affect the company’s business, see the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of the company’s Amended Annual

Report on Form 10-K/A for the period ended Sept. 30, 2023, its

Amended Quarterly Reports on Form 10-Q/A for the quarters ended

Dec. 31, 2023 and Mar. 31, 2024, and its Quarterly Report on Form

10-Q for the quarter ended June 30, 2024 filed with the SEC, as

well as the company's other SEC filings. The company undertakes no

obligation to update any forward-looking statements made in this

press release to reflect future events or developments, except as

required by law. Because it is not possible to predict or identify

all such factors, this list cannot be considered a complete set of

all potential risks or uncertainties.

Non-GAAP Measures

In addition to using U.S. generally accepted accounting

principles (“GAAP”) financial measures, management uses a variety

of non-GAAP financial measures described below to evaluate the

company’s and its operating segments’ performance. While the

consolidated financial statements provide an understanding of the

company’s overall results of operations, financial condition and

cash flows, management analyzes components of the consolidated

financial statements to identify certain trends and evaluate

specific performance areas.

Management uses EBITDA, EBITDA adjusted for items which

management believes are not indicative of the company’s ongoing

operating performance (“Adjusted EBITDA”) and EBITDA margin to

evaluate the operating performance of the company’s core business

operations because its resource allocation, financing methods and

cost of capital, and income tax positions are managed at a

corporate level, apart from the activities of the operating

segments, and the operating facilities are located in different

taxing jurisdictions, which can cause considerable variation in net

earnings. Management also uses adjusted operating earnings,

adjusted operating margin, adjusted net earnings, and adjusted net

earnings per diluted share, which eliminate the impact of certain

items that management does not consider indicative of underlying

operating performance. The presentation of these measures should

not be construed as an inference that future results will be

unaffected by unusual or non-recurring items. Management believes

these non-GAAP financial measures provide management and investors

with additional information that is helpful when evaluating

underlying performance. EBITDA and Adjusted EBITDA exclude interest

expense, income taxes and depreciation, depletion and amortization,

each of which are an essential element of the company’s cost

structure and cannot be eliminated. In addition, Adjusted EBITDA

and Adjusted EBITDA margin exclude certain cash and non-cash items,

including stock-based compensation, impairment charges and certain

restructuring charges. Consequently, any measure that excludes

these elements has material limitations. The non-GAAP financial

measures used by management should not be considered in isolation

or as a substitute for net earnings, operating earnings, cash flows

or other financial data prepared in accordance with GAAP or as a

measure of overall profitability or liquidity. These measures are

not necessarily comparable to similarly titled measures of other

companies due to potential inconsistencies in the method of

calculation. The calculation of non-GAAP financial measures as used

by management is set forth in the following tables. All margin

numbers are defined as the relevant measure divided by sales. The

company does not provide a reconciliation of forward-looking

non-GAAP financial measures to the most directly comparable

financial measures calculated and reported in accordance with GAAP,

as the company is unable to estimate significant non-recurring,

unusual items and/or distinct non-core initiatives without

unreasonable effort. The amounts and timing of these items are

uncertain and could be material to the company’s results.

Adjusted operating earnings, adjusted operating earnings margin,

adjusted net earnings (loss), and adjusted net earnings (loss) per

diluted share are presented as supplemental measures of the

company’s performance. Management believes these measures provide

management and investors with additional information that is

helpful when evaluating underlying performance and comparing

results on a year-over-year normalized basis. These measures

eliminate the impact of certain items that management does not

consider indicative of underlying operating performance. These

adjustments are itemized below. Adjusted net earnings (loss) per

diluted share is adjusted net earnings (loss) divided by weighted

average diluted shares outstanding. You are encouraged to evaluate

the adjustments itemized above and the reasons management considers

them appropriate for supplemental analysis. In evaluating these

measures you should be aware that in the future the company may

incur expenses that are the same as or similar to some of the

adjustments presented below.

Special Items Impacting the

Three Months Ended June 30, 2024

(unaudited, in millions, except

per share data)

Item Description

Segment

Line Item

Amount

Tax Effect(1)

After Tax

EPS Impact

Restructuring charges(2)

Corporate and Other

Other operating expense

$

1.5

$

—

$

1.5

$

0.04

Total

$

1.5

$

—

$

1.5

$

0.04

Special Items Impacting the

Nine Months Ended June 30, 2024

(unaudited, in millions, except

per share data)

Item Description

Segment

Line Item

Amount

Tax Effect(1)

After Tax

EPS Impact

Restructuring charges(2)

Corporate and Other

Other operating expense

$

16.2

$

—

$

16.2

$

0.39

Restructuring charges(2)

Salt

COGS and Other operating expense

0.4

—

0.4

0.01

Restructuring charges(2)

Plant Nutrition

COGS and Other operating expense

0.6

—

0.6

0.01

Impairments

Corporate and Other

COGS and Loss on impairments

124.8

—

124.8

3.02

Goodwill impairment

Plant Nutrition

Loss on impairments

51.0

—

51.0

1.23

Total

$

193.0

$

—

$

193.0

$

4.66

(1)

There were no substantial income tax benefits related to these

items given the U.S. valuation allowances on deferred tax assets.

(2)

Restructuring charges do not include certain reductions in

stock-based compensation associated with forfeitures stemming from

the restructuring activities.

Reconciliation for Adjusted

Operating Earnings

(unaudited, in millions)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Operating earnings (loss)

$

5.9

$

(0.6

)

$

(87.0

)

$

75.2

Restructuring charges(1)

1.5

2.2

17.2

5.5

Loss on impairments(2)

—

—

175.8

—

Accrued loss and legal costs related to

SEC investigation(3)

—

—

—

(0.1

)

Adjusted operating earnings

$

7.4

$

1.6

$

106.0

$

80.6

Sales

202.9

207.6

908.6

971.1

Operating margin

2.9

%

(0.3

)%

(9.6

)%

7.7

%

Adjusted operating margin

3.6

%

0.8

%

11.7

%

8.3

%

(1)

The company incurred severance and related charges for reductions

in workforce and changes to executive leadership and additional

restructuring costs related to the termination of the Company’s

lithium development project.

(2)

The company recognized impairments of goodwill, long-lived assets

and inventory related to Fortress; and goodwill related to Plant

Nutrition for the nine months ended June 30, 2024. The company also

recognized the impairment of long-lived assets related to the

termination of the lithium development project for the nine months

ended June 30, 2024. Impairments of long-lived assets and goodwill

are included in loss on impairments, while the impairment of

inventory is included in product cost, both on the Consolidated

Statements of Operations.

(3)

The company recognized reimbursements related to the settled SEC

investigation.

Reconciliation for Adjusted

Net (Loss) Earnings

(unaudited, in millions)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Net (loss) earnings

$

(43.6

)

$

36.4

$

(157.8

)

$

14.5

Restructuring charges(1)

1.5

2.1

17.2

5.4

Loss on impairments(2)

—

—

175.8

—

Accrued loss and legal costs related to

SEC investigation(3)

—

—

—

(0.1

)

Adjusted net (loss) earnings

$

(42.1

)

$

38.5

$

35.2

$

19.8

Net (loss) earnings per diluted share

$

(1.05

)

$

0.88

$

(3.83

)

$

0.35

Adjusted net (loss) earnings per diluted

share

$

(1.01

)

$

0.93

$

0.83

$

0.48

Weighted-average common shares outstanding

(in thousands):

Diluted

41,342

41,142

41,284

40,663

(1)

The company incurred severance and related charges for reductions

in workforce and changes to executive leadership and additional

restructuring costs related to the termination of the Company’s

lithium development project. Charges for the three and nine months

ended June 30, 2024 were $1.5 million and $17.2 million,

respectively. Charges for the three and nine months ended June 30,

2023 were $2.2 million and $5.5 million ($2.1 million and $5.4

million net of tax), respectively.

(2)

The company recognized impairments of goodwill, long-lived assets

and inventory related to Fortress; and goodwill related to Plant

Nutrition for the three and nine months ended June 30, 2024. The

company also recognized the impairment of long-lived assets related

to the termination of the lithium development project for the nine

months ended June 30, 2024.

(3)

The company recognized reimbursements related to the settled SEC

investigation.

Reconciliation for EBITDA and

Adjusted EBITDA

(unaudited, in millions)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Net (loss) earnings

$

(43.6

)

$

36.4

$

(157.8

)

$

14.5

Interest expense

17.2

14.3

50.4

42.4

Income tax expense (benefit)

32.7

(42.8

)

20.4

24.2

Depreciation, depletion and

amortization

26.1

24.3

78.4

72.7

EBITDA

32.4

32.2

(8.6

)

153.8

Adjustments to EBITDA:

Stock-based compensation - non-cash

(0.7

)

3.5

6.3

17.2

Interest income

(0.2

)

(1.7

)

(0.8

)

(4.7

)

(Gain) loss on foreign exchange

(0.5

)

2.3

(1.1

)

4.6

Gain from remeasurement of equity method

investment

—

(12.6

)

—

(12.6

)

Restructuring charges(1)

1.5

2.2

17.2

5.9

Loss on impairments(2)

—

—

175.8

—

Accrued loss and legal costs related to

SEC investigation(3)

—

—

—

(0.1

)

Other expense, net

0.3

2.7

1.9

3.7

Adjusted EBITDA

$

32.8

$

28.6

$

190.7

$

167.8

(1)

The company incurred severance and related charges for reductions

in workforce and changes to executive leadership and additional

restructuring costs related to the termination of the Company’s

lithium development project.

(2)

The company recognized impairments of goodwill, long-lived assets

and inventory related to Fortress; and goodwill related to Plant

Nutrition for the three and nine months ended June 30, 2024. The

company also recognized the impairment of long-lived assets related

to the termination of the lithium development project for the nine

months ended June 30, 2024.

(3)

The company recognized reimbursements related to the settled SEC

investigation.

Salt Segment

Performance

(unaudited, in millions, except

for sales volumes and prices per short ton)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Sales

$

160.6

$

155.5

$

745.3

$

824.1

Operating earnings

$

25.9

$

21.7

$

142.6

$

141.9

Operating margin

16.1

%

14.0

%

19.1

%

17.2

%

Adjusted operating earnings(1)

$

25.9

$

22.2

$

143.0

$

143.4

Adjusted operating margin(1)

16.1

%

14.3

%

19.2

%

17.4

%

EBITDA(1)

$

41.6

$

35.9

$

189.7

$

184.8

EBITDA(1) margin

25.9

%

23.1

%

25.5

%

22.4

%

Adjusted EBITDA(1)

$

41.6

$

36.4

$

190.1

$

186.3

Adjusted EBITDA(1) margin

25.9

%

23.4

%

25.5

%

22.6

%

Sales volumes (in thousands of tons):

Highway deicing

1,090

1,070

6,401

7,886

Consumer and industrial

393

421

1,403

1,529

Total Salt..

1,483

1,491

7,804

9,415

Average prices (per ton):

Highway deicing

$

77.20

$

73.86

$

73.60

$

68.86

Consumer and industrial

$

194.35

$

181.66

$

195.37

$

183.81

Total Salt

$

108.27

$

104.28

$

95.50

$

87.53

(1)

Non-GAAP financial measure. Reconciliations follow in these tables.

Reconciliation for Salt

Segment Adjusted Operating Earnings

(unaudited, in millions)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Reported GAAP segment operating

earnings

$

25.9

$

21.7

$

142.6

$

141.9

Restructuring charges(1)

—

0.5

0.4

1.5

Segment adjusted operating earnings

$

25.9

$

22.2

$

143.0

$

143.4

Segment sales

160.6

155.5

745.3

824.1

Segment operating margin

16.1

%

14.0

%

19.1

%

17.2

%

Segment adjusted operating margin

16.1

%

14.3

%

19.2

%

17.4

%

(1)

The company incurred severance and related charges related to a

reduction of its workforce.

Reconciliation for Salt

Segment EBITDA and Adjusted EBITDA

(unaudited, in millions)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Reported GAAP segment operating

earnings

$

25.9

$

21.7

$

142.6

$

141.9

Depreciation, depletion and

amortization

15.7

14.2

47.1

42.9

Segment EBITDA

$

41.6

$

35.9

$

189.7

$

184.8

Restructuring charges(1)

—

0.5

0.4

1.5

Segment adjusted EBITDA

$

41.6

$

36.4

$

190.1

$

186.3

Segment sales

160.6

155.5

745.3

824.1

Segment EBITDA margin

25.9

%

23.1

%

25.5

%

22.4

%

Segment adjusted EBITDA margin

25.9

%

23.4

%

25.5

%

22.6

%

(1)

The company incurred severance and related charges related to a

reduction of its workforce.

Plant Nutrition Segment

Performance

(unaudited, dollars in millions,

except for sales volumes and prices per short ton)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Sales

$

38.8

$

47.5

$

138.6

$

136.8

Operating (loss) earnings

$

(1.4

)

$

2.5

$

(56.7

)

$

12.8

Operating margin

(3.6

)%

5.3

%

(40.9

)%

9.4

%

Adjusted operating (loss) earnings(1)

$

(1.4

)

$

3.5

$

(5.1

)

$

14.2

Adjusted operating margin(1)

(3.6

)%

7.4

%

(3.7

)%

10.4

%

EBITDA(1)

$

7.2

$

10.7

$

(31.0

)

$

37.4

EBITDA(1) margin

18.6

%

22.5

%

(22.4

)%

27.3

%

Adjusted EBITDA(1)

$

7.2

$

11.7

$

20.6

$

38.8

Adjusted EBITDA(1) margin

18.6

%

24.6

%

14.9

%

28.4

%

Sales volumes (in thousands of tons)

56

63

205

168

Average price (per ton)

$

691.27

$

751.58

$

676.11

$

813.56

(1)

Non-GAAP financial measure. Reconciliations follow in these tables.

Reconciliation for Plant

Nutrition Segment Adjusted Operating (Loss) Earnings

(unaudited, in millions)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Reported GAAP segment operating (loss)

earnings

$

(1.4

)

$

2.5

$

(56.7

)

$

12.8

Restructuring charges(1)

—

1.0

0.6

1.4

Loss on goodwill impairment(2)

—

—

51.0

—

Segment adjusted operating (loss)

earnings

$

(1.4

)

$

3.5

$

(5.1

)

$

14.2

Segment sales

38.8

47.5

138.6

136.8

Segment operating margin

(3.6

)%

5.3

%

(40.9

)%

9.4

%

Segment adjusted operating margin

(3.6

)%

7.4

%

(3.7

)%

10.4

%

(1)

The company incurred severance and related charges related to a

reduction of its workforce.

(2)

The company recognized a goodwill impairment during the nine months

ended June 30, 2024.

Reconciliation for Plant

Nutrition Segment EBITDA and Adjusted EBITDA

(unaudited, in millions)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Reported GAAP segment operating (loss)

earnings

$

(1.4

)

$

2.5

$

(56.7

)

$

12.8

Depreciation, depletion and

amortization

8.6

8.2

25.7

24.6

Segment EBITDA

$

7.2

$

10.7

$

(31.0

)

$

37.4

Restructuring charges(1)

—

1.0

0.6

1.4

Loss on goodwill impairment(2)

—

—

51.0

—

Segment adjusted EBITDA

$

7.2

$

11.7

$

20.6

$

38.8

Segment sales

38.8

47.5

138.6

136.8

Segment EBITDA margin

18.6

%

22.5

%

(22.4

)%

27.3

%

Segment adjusted EBITDA margin

18.6

%

24.6

%

14.9

%

28.4

%

(1)

The company incurred severance and related charges related to a

reduction of its workforce.

(2)

The company recognized a goodwill impairment during the nine months

ended June 30, 2024.

COMPASS MINERALS

INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited, in millions,

except share and per-share data)

Three Months Ended June

30,

Nine Months Ended June

30,

2024

2023

2024

2023

Sales.

$

202.9

$

207.6

$

908.6

$

971.1

Shipping and handling cost

53.2

53.8

255.1

291.3

Product cost

117.1

119.2

478.0

490.0

Gross profit

32.6

34.6

175.5

189.8

Selling, general and administrative

expenses

27.5

33.0

106.5

109.2

Loss on impairments

—

—

173.4

—

Other operating (income) expense

(0.8

)

2.2

(17.4

)

5.4

Operating earnings (loss)

5.9

(0.6

)

(87.0

)

75.2

Other (income) expense:

Interest income

(0.2

)

(1.7

)

(0.8

)

(4.7

)

Interest expense

17.2

14.3

50.4

42.4

(Gain) loss on foreign exchange

(0.5

)

2.3

(1.1

)

4.6

Net loss in equity investee

—

0.8

—

3.1

Gain from remeasurement of equity method

investment

—

(12.6

)

—

(12.6

)

Other expense, net

0.3

2.7

1.9

3.7

(Loss) earnings before income taxes

(10.9

)

(6.4

)

(137.4

)

38.7

Income tax expense (benefit)

32.7

(42.8

)

20.4

24.2

Net (loss) earnings

$

(43.6

)

$

36.4

$

(157.8

)

$

14.5

Basic net (loss) earnings per common

share

$

(1.05

)

$

0.88

$

(3.83

)

$

0.35

Diluted net (loss) earnings per common

share

$

(1.05

)

$

0.88

$

(3.83

)

$

0.35

Weighted-average common shares outstanding

(in thousands):(1)

Basic

41,342

41,142

41,284

40,663

Diluted

41,342

41,142

41,284

40,663

(1)

Weighted participating securities include RSUs and PSUs that

receive non-forfeitable dividends and consist of 632,000 and

698,000 weighted participating securities for the three and nine

months ended June 30, 2024, respectively, and 453,000 and 469,000

weighted participating securities for the three and nine months

ended June 30, 2023, respectively.

COMPASS MINERALS

INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in

millions)

June 30,

Sept. 30,

2024

2023

ASSETS

Cash and cash equivalents

$

12.8

$

38.7

Receivables, net

92.3

129.3

Inventories

407.5

399.5

Other current assets

34.4

33.4

Property, plant and equipment, net

787.9

852.5

Intangible and other noncurrent assets

260.3

363.5

Total assets

$

1,595.2

$

1,816.9

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current portion of long-term debt

$

6.3

$

5.0

Other current liabilities

182.1

269.6

Long-term debt, net of current portion

868.8

800.3

Deferred income taxes and other noncurrent

liabilities

185.9

221.0

Total stockholders' equity

352.1

521.0

Total liabilities and stockholders'

equity

$

1,595.2

$

1,816.9

COMPASS MINERALS

INTERNATIONAL, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited, in

millions)

Nine Months Ended June

30,

2024

2023

Net cash provided by operating

activities

$

27.1

$

126.9

Cash flows from investing activities:

Capital expenditures

(93.3

)

(84.5

)

Acquisition of business, net of cash

acquired

—

(18.9

)

Other, net

(1.7

)

(2.5

)

Net cash used in investing activities

(95.0

)

(105.9

)

Cash flows from financing activities:

Proceeds from revolving credit facility

borrowings

359.6

66.7

Principal payments on revolving credit

facility borrowings

(289.2

)

(218.2

)

Proceeds from issuance of long-term

debt

69.4

237.5

Principal payments on long-term debt

(70.3

)

(311.7

)

Payments for contingent consideration

(9.1

)

—

Net proceeds from private placement of

common stock

—

240.7

Dividends paid

(12.7

)

(18.7

)

Deferred financing costs

(2.1

)

(3.9

)

Shares withheld to satisfy employee tax

obligations

(2.0

)

(1.6

)

Other, net

(1.4

)

(0.9

)

Net cash provided by (used in) financing

activities

42.2

(10.1

)

Effect of exchange rate changes on cash

and cash equivalents

(0.2

)

1.0

Net change in cash and cash

equivalents

(25.9

)

11.9

Cash and cash equivalents, beginning of

the year

38.7

46.1

Cash and cash equivalents, end of

period

$

12.8

$

58.0

COMPASS MINERALS

INTERNATIONAL, INC.

SEGMENT INFORMATION

(unaudited, in

millions)

Three Months Ended June 30,

2024

Salt

Plant Nutrition

Corporate &

Other(1)

Total

Sales to external customers

$

160.6

$

38.8

$

3.5

$

202.9

Intersegment sales

—

2.8

(2.8

)

—

Shipping and handling cost

48.2

5.0

—

53.2

Operating earnings (loss)(2)(3)

25.9

(1.4

)

(18.6

)

5.9

Depreciation, depletion and

amortization

15.7

8.6

1.8

26.1

Total assets (as of end of period)

1,013.3

408.1

173.8

1,595.2

Three Months Ended June 30,

2023

Salt

Plant Nutrition

Corporate &

Other(1)

Total

Sales to external customers

$

155.5

$

47.5

$

4.6

$

207.6

Intersegment sales

—

2.8

(2.8

)

—

Shipping and handling cost

48.2

5.6

—

53.8

Operating earnings (loss)(3)

21.7

2.5

(24.8

)

(0.6

)

Depreciation, depletion and

amortization

14.2

8.2

1.9

24.3

Total assets (as of end of period)

970.1

477.1

286.3

1,733.5

Nine Months Ended June 30, 2024

Salt

Plant Nutrition

Corporate &

Other(1)

Total

Sales to external customers

$

745.3

$

138.6

$

24.7

$

908.6

Intersegment sales

—

6.6

(6.6

)

—

Shipping and handling cost

235.9

18.6

0.6

255.1

Operating earnings (loss)(2)(3)(4)

142.6

(56.7

)

(172.9

)

(87.0

)

Depreciation, depletion and

amortization

47.1

25.7

5.6

78.4

Nine Months Ended June 30, 2023

Salt

Plant Nutrition

Corporate &

Other(1)

Total

Sales to external customers

$

824.1

$

136.8

$

10.2

$

971.1

Intersegment sales

—

7.1

(7.1

)

—

Shipping and handling cost

274.9

16.4

—

291.3

Operating earnings (loss)(2)(3)

141.9

12.8

(79.5

)

75.2

Depreciation, depletion and

amortization

42.9

24.6

5.2

72.7

(1)

Corporate and other includes corporate entities, records management

operations, the Fortress fire retardant business, equity method

investments, lithium costs and other incidental operations and

eliminations. Operating earnings (loss) for corporate and other

includes indirect corporate overhead, including costs for general

corporate governance and oversight, lithium-related expenditures,

as well as costs for the human resources, information technology,

legal and finance functions.

(2)

Corporate operating results were impacted by net gains of $0.9

million and $23.1 million related to the decline in the valuation

of the Fortress contingent consideration for the three and nine

months ended June 30, 2024, respectively. Corporate operating

results also include net reimbursements related to the settled SEC

investigation of $0.1 million for the nine months ended June 30,

2023.

(3)

The company continued to take steps to align its cost structure to

its current business needs. These initiatives impacted Corporate

operating results and resulted in net severance and related charges

for reductions in workforce and changes to executive leadership and

additional restructuring costs related to the termination of the

Company’s lithium development project of $1.5 million and $17.2

million for the three and nine months ended June 30, 2024,

respectively, and $2.2 million and $5.5 million for the three and

nine months ended June 30, 2023, respectively.

(4)

The company recognized impairments of goodwill, long-lived assets

and inventory related to Fortress; and goodwill related to Plant

Nutrition of $175.8 million during the nine months ended June 30,

2024, which impacted operating results. The company also recognized

the impairment of long-lived assets related to the termination of

the lithium development project for the nine months ended June 30,

2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030134038/en/

Investor Contact Brent Collins Vice President, Treasurer

& Investor Relations +1.913.344.9111

InvestorRelations@compassminerals.com

Media Contact Rick Axthelm Chief Public Affairs and

Sustainability Officer +1.913.344.9198

MediaRelations@compassminerals.com

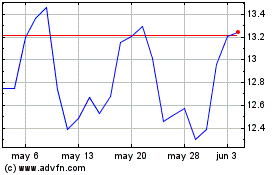

Compass Minerals (NYSE:CMP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Compass Minerals (NYSE:CMP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024