UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

30 July 2024

Commission File Number: 001-10691

DIAGEO plc

(Translation

of registrant’s name into English)

16 Great Marlborough Street, London, United Kingdom, W1F 7HS

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F X

Form

40-F

Diageo delivers resilient performance with improved market share in

the second half of the fiscal year, despite volatile operating

environment

- Reported

net sales of $20.3 billion declined 1.4% due to an unfavourable

foreign exchange impact and organic net sales decline, partially

offset by hyperinflation adjustments. Reported operating profit

grew 8.2% and reported operating profit margin grew 262bps,

primarily due to the positive impact of exceptional operating items

partially offset by a decline in organic operating

margin.

- Organic

net sales declined $129 million or 0.6%, positive price/mix of

2.9pps was more than offset by a 3.5% volume decline, primarily

driven by a 21.1% decline in our Latin America and Caribbean region

(LAC). Organic operating profit declined by $304 million or 4.8%,

of which $302 million was attributable to LAC; organic operating

margin contracted 130bps.

Excluding the impact of LAC:

-

Organic net sales grew $330 million or 1.8%, driven by price/mix of

3.9pps, partially offset by a 2.1% volume decline. A decrease in

organic net sales in North America of 2.5% was more than offset by

growth in Africa, Asia Pacific and Europe. Organic operating profit

declined 0.1%, and organic operating margin contracted

56bps.

- Diageo grew or held total market share in over 75%(1) of total net sales in measured markets, including in the US.

- Net

cash flow from operating activities increased by $0.5 billion to

$4.1 billion. Free cash flow increased by $0.4 billion to

$2.6 billion.

- Increased recommended full

year dividend by 5% to 103.48 cents

per share.

- Completed

$1.0 billion return of capital programme announced on 1 August 2023

through share buybacks.

- Leverage ratio of 3.0x as at 30 June 2024, Diageo remains committed to its target leverage ratio of 2.5x - 3.0x.

Debra Crew, Chief Executive, said:

While

fiscal 24 was a challenging year for both our industry and Diageo

with continued macroeconomic and geopolitical volatility, we

focused on taking the actions needed to ensure Diageo is

well-positioned for growth as the consumer environment

improves.

Fiscal

24 was impacted by materially weaker performance in LAC. Excluding

LAC, organic net sales grew 1.8%, driven by resilient growth in our

Africa, Asia Pacific and Europe regions. This offset the decline in

North America, which was attributable to a cautious consumer

environment and the impact of lapping inventory replenishment in

the prior year.

In

fiscal 24 we made good progress against our strategic priorities.

We ended fiscal 24 gaining or holding share in measured markets

totalling over 75% of our net sales value, including in the US. We

have taken actions to manage the inventory issues in LAC; we have

strengthened our consumer insights and redeployed resources towards

the best growth opportunities; we have stepped up our

route-to-market across several markets, including our most

significant transformation in at least a decade in our

US Spirits organisation; we have delivered record productivity savings of nearly $700 million; and we have generated $2.6 billion in free cash

flow while increasing strategic investments. We are confident that

when the consumer environment improves, the actions we are taking

will return us to growth.

Diageo

is a resilient business, benefitting from its global reach and

unrivalled brand portfolio. With iconic brands that have been

enjoyed for decades, Diageo takes a long-term view, and will

continue to invest in our brands, people and diversified footprint

to deliver sustainable long-term growth and generate shareholder

value.

|

Volume (equivalent units)

|

|

|

|

Operating profit

|

|

|

|

Earnings per share (eps)

|

|

|

|

EU230.5m

|

|

|

|

$6,001m

|

|

|

|

173.2c

|

|

|

|

(F23:

EU243.4m)

|

|

|

|

(F23(3):

$5,547m)

|

|

|

|

(F23(3):

196.3c)

|

|

|

|

Reported

movement

|

(5)%

|

↓

|

|

Reported

movement

|

8

%

|

↑

|

|

Reported

movement

|

(12)%

|

↓

|

|

Organic

movement(2)

|

(4)%

|

↓

|

|

Organic

movement(2)

|

(5)%

|

↓

|

|

Eps

before exceptional items(2)

|

(9)%

|

↓

|

|

Net sales

|

|

|

|

Net cash from operating activities

|

|

|

|

Total recommended full year dividend per share (4)

|

|

|

|

$20,269m

|

|

|

|

$4,105m

|

|

|

|

103.48c

|

|

|

|

(F23(3):

$20,555m)

|

|

|

|

(F23(3):

$3,636m)

|

|

|

|

(F23(3):

98.55c)

|

|

|

|

Reported

movement

|

(1)%

|

↓

|

|

F24

free cash flow(2)

$2,609m

|

|

|

|

Increase

|

5 %

|

↑

|

|

Organic

movement(3)

|

(1)%

|

↓

|

|

F23

free cash flow(2),(3)

$2,235m

|

|

|

|

|

|

|

(1) Internal

estimates incorporating Nielsen, Association of Canadian

Distillers, Dichter & Neira, Frontline, INTAGE, IRI, ISCAM,

NABCA, State Monopolies, TRAC, IPSOS and other third- party

providers. All analysis of data has been applied with a tolerance

of +/- 3 bps and the descriptions applied of gaining, holding or

losing share by the Company or brands are based on estimated

performance within that tolerance. Percentages represent percent of

markets by total Diageo net sales contribution that have held or

gained total trade share fiscal year to date. Measured markets

indicate a market where we have purchased any market share data.

Market share data may include beer, wine, spirits or other

elements. Measured market net sales value sums to 89% of total

Diageo net sales value in fiscal 24.

(2) See pages 42-43 for an explanation and reconciliation of non-GAAP measures.

(3) See pages

29-30

for an explanation under Basis of preparation.

(4) Includes recommended final dividend of 62.98 cents.

See

pages 42-43 for an explanation and reconciliation of non-GAAP

measures, including organic net sales, organic marketing

investment, organic operating profit, free cash flow, eps before

exceptionals, adjusted net debt, adjusted EBITDA and tax rate

before exceptional items. Unless otherwise stated, movements in

results are for the year ended 30 June 2024 compared to the year

ended 30 June 2023.

To view

the preliminary results document in full, please paste the

following URL into the address bar of your browser: http://www.rns-pdf.londonstockexchange.com/rns/2892Y_1-2024-7-29.pdf

|

Investor

enquiries to:

|

Durga

Doraisamy

|

+44 (0)

7902 126 906

|

|

|

Andy

Ryan

|

+44 (0)

7803 854 842

|

|

|

Brian

Shipman

|

+1 917

710 3007

|

|

|

|

investor.relations@diageo.com

|

|

|

|

|

|

Media

enquiries to:

|

Brendan

O'Grady

|

+44 (0)

7812 183 750

|

|

|

Becky

Perry

|

+44 (0)

7590 809 101

|

|

|

Clare

Cavana

|

+44 (0)

7751 742 072

|

|

|

Isabel

Batchelor

|

+44 (0)

7731 988 857

|

|

|

|

press@diageo.com

|

Diageo plc

LEI: 213800ZVIELEA55JMJ32

The

preliminary results for the year ended 30 June 2024 have been

submitted in full unedited text to the Financial Conduct

Authority's National Storage Mechanism and will be available

shortly for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

The

preliminary results are also available in full on the corporate

website at https://www.diageo.com/en/news-and-media/press-releases/2024/2024-preliminary-results-year-ended-30-june-2024

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Diageo plc

|

|

|

(Registrant)

|

|

|

|

|

Date:

30 July 2024

|

|

|

|

|

|

|

By:___/s/

James Edmunds

|

|

|

|

|

|

James Edmunds

|

|

|

Deputy Company Secretary

|

EXHIBIT INDEX

|

EXHIBIT

NUMBER

|

EXHIBIT

DESCRIPTION

|

|

99.1

|

|

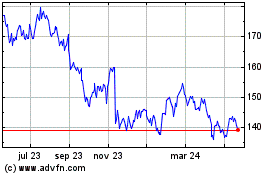

Diageo (NYSE:DEO)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

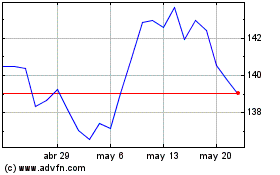

Diageo (NYSE:DEO)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024