Equifax Canada Exploring How Payday Loan Data Could Help Drive Financial Inclusion

17 Mayo 2024 - 2:02PM

Equifax Canada, a global data, analytics, and technology

company, is committed to promoting financial inclusion and access

to fair and responsible credit opportunities for all Canadians. As

part of this commitment, Equifax is exploring how data sources not

traditionally used in credit scores, such as payday loans, could

help create a more complete picture of consumers' credit health.

"We believe everyone deserves the opportunity to build a strong

financial future," said Rebecca Oakes, Vice President of

Advanced Analytics at Equifax Canada. "By exploring new

data sources like payday loans and the possibility of including

this data in a consumer’s credit history, it could put the

financial mainstream within reach for more Canadians and promote

greater financial inclusion."

Equifax Canada is currently working to analyze data and

understand its potential impact on credit histories and scores.

Exploring new credit models and insights that leverage

non-traditional data sources has the potential to create increased

credit visibility for those consumers looking to rebuild their

credit, those with thin credit files or those that may have been

previously unbanked or unscored.

“Using alternative data could result in improved credit scores

for those consumers with responsive repayment of payday loans,”

explained Oakes. “Adding this data to the mix could paint a more

accurate picture for those who don’t have data traditionally used

to describe their financial health, which, in turn, could lead to

better loan terms and interest rates from lenders in the

future.”

Equifax Canada is committed to exploring new ways to drive

critical financial opportunities to help people live their

financial best and create financially inclusive communities.

About EquifaxAt Equifax (NYSE:

EFX), we believe knowledge drives progress. As a global data,

analytics, and technology company, we play an essential role in the

global economy by helping financial institutions, companies,

employers, and government agencies make critical decisions with

greater confidence. Our unique blend of differentiated data,

analytics, and cloud technology drives insights to power decisions

to move people forward. Headquartered in Atlanta and supported by

nearly 15,000 employees worldwide, Equifax operates or has

investments in 24 countries in North America, Central and South

America, Europe, and the Asia Pacific region. For more information,

visit Equifax.ca.

Contact:

Andrew FindlaterSELECT Public

Relationsafindlater@selectpr.ca(647) 444-1197

Angie AndichEquifax Canada Media

RelationsMediaRelations@equifax.com

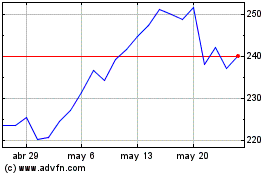

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024