Premier and Elite cardmembers will have more

ways to earn points, increased travel and dining rewards, along

with new perks for streaming, ride sharing and more.

New card design includes 100% recycled plastic

for the Premier card and added notch to help visually impaired

cardholders orient for chip readers.

HSBC today announced increased welcome bonus points and new and

enhanced benefits for the HSBC Premier credit card, designed for

everyday spending, and the HSBC Elite credit card, designed to

enhance lifestyle and travel experiences.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240806234599/en/

HSBC Premier and Elite Credit Cards

(Photo: Business Wire)

The HSBC Premier credit card has an annual fee of $95 and is

offering a welcome bonus of 50,000 points for eligible card

members, worth over $1,200 in benefits in the first year and up to

$600 every year thereafter. The HSBC Elite credit card has an

annual fee of $495 and is offering a welcome bonus of 60,000 points

worth over $2,900 in benefits in the first year and up to $2,000

every year thereafter.

New and updated credit card benefits include:

HSBC Premier Credit Card

- 50,000 welcome bonus points

- 3X Points on gas and groceries

- $85 statement credit towards Global Entry, TSA PreCheck, TSA

PreCheck by CLEAR, or NEXUS

- $60 annual TV subscription service credit

HSBC Elite Credit Card

- 60,000 welcome bonus points

- 5X Points on travel

- Complimentary airport lounge access with Priority Pass for

cardholder and up to 2 guests, worth over $469 annually

- $120 statement credit towards Global Entry, TSA PreCheck, TSA

PreCheck by CLEAR, or NEXUS

- $120 annual rideshare credit

“The HSBC Premier and Elite credit cards deliver on our

commitment to serve the banking needs of our globally connected

clients who live and work across the U.S. and around the world,”

said U.S. Head of Wealth and Personal Banking Racquel Oden. “These

credit cards offer excellent value to our clients, rewarding them

for their travel and everyday purchases and provides enhanced

benefits for their lifestyle.”

“Whether you're traveling around the world or simply shopping

for everyday essentials, HSBC cardholders have the opportunity to

earn incredible rewards for the activities they engage in as part

of their daily lives", said U.S. Head of Unsecured Lending Brian

Ahearn.

New designs feature 100% recycled plastic for the HSBC Premier

credit card and a distinctive metal design for the HSBC Elite

credit card. Both cards have a specially designed notch at the

bottom right to help cardholders with special needs supporting them

to orient the card in chip readers.

HSBC Premier

Benefits

HSBC Elite

Benefits

INTRO OFFER

50,000 points after $4,000 spend in three

months

60,000 points after $4,000 spend in three

months

REWARDS

3x on gas and groceries

2x on travel

1x on everything else

5x on travel

2x on dining

1x on everything else

ANNUAL FEE

$95 per year

$495 per year

TRAVEL BENEFITS

No foreign transaction fees

$85 statement credit towards Global Entry,

TSA PreCheck, TSA PreCheck by CLEAR or Nexus once every 4.5

years.

Rewards for miles

(11 air and 2 hotel point transfer

partners)

Travel insurance and benefits

No foreign transaction fees

$400 travel credit

(booked Via HSBC Travel)

Complimentary airport lounge access with

Priority Pass for cardholder and up to 2 guests, worth over $469

annually

$120 statement credit towards Global

Entry, TSA PreCheck, TSA PreCheck by CLEAR or Nexus once every 4.5

years

Rewards for miles

(11 air and 2 hotel point transfer

partners)

Travel insurance and benefits

EVERYDAY BENEFITS

Mastercard travel rewards

Monthly Lyft offer (“Take 3, get $5”)

$3 monthly Peacock subscription credit

(new only)

$10 off second Instacart+ order each month

and two free months (new only)

$60 annual TV subscription service

credit

Mastercard travel rewards

Monthly Lyft offer (“Take 3, get $5”)

$3 monthly Peacock subscription credit

(new only)

$10 off second Instacart+ order each month

and two free months (new only)

$120 annual rideshare credit

PEACE OF MIND BENEFITS

$600 per claim cell phone insurance

Mastercard ID theft protection

Identify fraud expense reimbursement

$800 per claim cell phone insurance

Mastercard ID theft protection

Identity Fraud Expense Reimbursement

About HSBC

HSBC Holdings plc, the parent company of HSBC, is

headquartered in London. HSBC serves customers worldwide from

offices in 60 countries and territories. With assets of US$2,975bn

at 30 June 2024, HSBC is one of the world’s largest banking and

financial services organizations.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.)

serves customers through Wealth and Personal Banking, Commercial

Banking, Private Banking, Global Banking, and Markets and

Securities Services. Deposit products are offered by HSBC Bank USA,

N.A., Member FDIC. It operates Wealth Centers in: California;

Washington, D.C.; Florida; New Jersey; New York; Virginia; and

Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC

USA Inc., a wholly-owned subsidiary of HSBC North America Holdings

Inc.

For more information, visit: HSBC in the USA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806234599/en/

Matt Kozar Vice President, External Communications

matt.kozar@us.hsbc.com

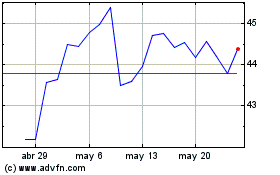

HSBC (NYSE:HSBC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

HSBC (NYSE:HSBC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024