Lincoln Financial Group Expands Suite of In-Plan Guaranteed Lifetime Income Products to Offer More Flexibility, Choice and Customization in Retirement

06 Agosto 2024 - 10:00AM

Business Wire

Most recent expansion is a result of increased need for

guaranteed income option

Lincoln Financial Group (NYSE: LNC) has expanded its Lincoln

PathBuilder Income® powered by YourPath® product to add a lifetime

income guarantee to an underlying asset allocation investment fund.

This builds on the success of Lincoln Financial’s broad suite of

in-plan guaranteed lifetime income products and offers more

flexibility, choice and customization to plan sponsors and

participants.

Lincoln continues to see a need for guaranteed retirement income

products, which can help create a foundation for security,

providing monthly income that continues for as long as the

participant lives. In Lincoln’s 2023 Wellness@Work study, stating

35% of participants said they would increase their contributions if

offered a guaranteed retirement income option and 72% of

non-participants say having a guaranteed income option in their

plan would encourage them to participate (up from 52% in 2021).

This newly added lifetime income balanced fund option is

available within managed accounts and as a stand-alone option in

retirement plans, and will allow participants to:

- Receive guaranteed payments for the rest of their lives;

- Enjoy protection in times of declining markets;

- Participate in rising markets with potentially higher income

levels;

- Have flexibility and access to their underlying account value

should their needs change.

“After the success of our current guaranteed lifetime income

products, we saw the opportunity to develop additional options to

be used in a variety of other settings,” says Matt Condos, senior

vice president, Retirement Plan Services Product Solutions. “We

engaged the best and brightest investment managers to innovate a

new solution. Our full suite of Lincoln PathBuilder Income® powered

by YourPath® products are truly a differentiator for Lincoln

clients when it comes to flexibility, choice and customization in

the guaranteed lifetime income space.”

To learn more about Lincoln’s broad suite of guaranteed income

products, click here.

About Lincoln Financial Group

Lincoln Financial Group helps people to plan, protect and retire

with confidence. As of December 31, 2023, approximately 17 million

customers trust our guidance and solutions across four core

businesses – annuities, life insurance, group protection, and

retirement plan services. As of June 30, 2024, the company had $311

billion in end-of-period account balances, net of reinsurance.

Headquartered in Radnor, Pa., Lincoln Financial Group is the

marketing name for Lincoln National Corporation (NYSE: LNC) and its

affiliates. Learn more at LincolnFinancial.com.

YourPath® conservative, moderate, aggressive, and lifetime

income portfolios are target-date + risk portfolios available as

investment options in the Lincoln Alliance® program and the Lincoln

Director℠ group variable annuity contract. Lincoln PathBuilder

Income® powered by YourPath® solution consists of

YourPath® portfolios along with a guarantee.

Solutions are offered as a group annuity. The guarantee is

provided by a contract with The Lincoln National Life Insurance

Company that provides a plan participant with guaranteed annual

retirement income. All contract and rider guarantees, including

those for optional benefits, guaranteed income, or annuity payout

rates, are subject to the claims-paying ability of the issuing

insurance company. They are not backed by the broker-dealer or

insurance agency this annuity is purchased from or any affiliates

of those entities other than the issuing company affiliates, and

none makes any representations or guarantees regarding the

claims-paying ability of the issuer. A group variable annuity is a

long-term investment product designed particularly for retirement

purposes and may not be suitable for all investors. Group annuities

contain insurance components and have fees and expenses, including

administrative fees. The group annuity is paired with an investment

option that fluctuates with the market value. Withdrawals may carry

tax consequences, including possible tax penalties.

Lincoln PathBuilder Income® group contingent deferred annuity

contract (contract form AN-745 and state variations) is issued by

The Lincoln National Life Insurance Company, Fort Wayne, IN, and

distributed by Lincoln Financial Distributors, Inc., a

broker-dealer. Limitations and exclusions may apply. May not be

available in all states. Check with your Lincoln representative.

The Lincoln National Life Insurance Company does not solicit

business in the state of New York, nor is it authorized to do

so.

Investors are advised to consider carefully the investment

objectives, risks, and charges and expenses of the group variable

annuity and its underlying investment option before investing. For

this and other additional information, please contact Lincoln

Financial. Please read this information carefully before investing

or sending money. Products and features are subject to state

availability.

LCN-6786375-071224

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806046913/en/

484-268-4492

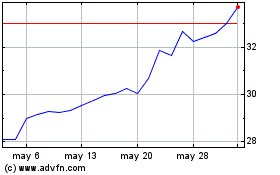

Lincoln National (NYSE:LNC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Lincoln National (NYSE:LNC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024