Lincoln Financial Group Expands Compassionate Care Services to Support Beneficiaries

21 Agosto 2024 - 8:00AM

Business Wire

Group Life insurance beneficiaries will receive

on-demand, personalized support through a dedicated care team.

Lincoln Financial Group (NYSE: LNC) has launched new grief

support services for Group Life beneficiaries, providing care

beyond the claims process. This new service, provided by Empathy –

the comprehensive support system for the bereaved – can help

families navigate the logistical aspects of loss, including estate

settlement, executing a will and more, as well as any emotional

challenges they may be facing.

On average, it can take families more than a year to resolve

their loved one's affairs, spending 20 hours per week on these

tasks.1 Three out of four beneficiaries also struggle with

estate-related financial matters, and nearly half of beneficiaries

say their work performance was negatively affected by their

loss.2

To help make this process smoother, Lincoln now offers services

from Empathy, providing beneficiaries with on-demand, personalized

support to assist with the administrative, emotional, legal and

financial challenges that can come after losing a loved one. These

services are now automatically available to all customers who have

purchased Lincoln Group Life insurance through the workplace, and

to the beneficiaries of their policies.

“We are committed to being there for our customers and their

families, especially when they need us most,” said Heather

Deichler, Lincoln's Group Protection Head of Product and

Underwriting. “We want to help our beneficiaries resolve their

claim quickly, support them beyond the financial component, and

provide ongoing assistance through their loss. We’re proud to offer

this concierge-level service so that they can get the support they

need during these incredibly difficult times.”

Empathy’s services will be offered to beneficiaries of Group

Life policies when they make their claim. They are provided with

on-demand support and personalized plans on a variety of topics

with benefits that include:

- Dedicated care manager: A dedicated care manager who is matched

with the beneficiary to guide them through all the challenges of

loss.

- Personalized care plan: Actionable steps and clear guidance to

help get all the necessary things done, fully customized to meet

each family’s specific needs.

- Probate and estate settlement guidance: Step-by-step assistance

navigating the legal process of probate and handling the ins and

outs of settling a loved one’s estate.

- Tools and resources: Help with closing accounts, assistance

creating an obituary and supportive resources created with

world-renowned experts to help beneficiaries through the complex

process of grief.

Lincoln is committed to providing this additional layer of care

to ensure that people navigating loss can focus on the things that

matter most.

About Lincoln Financial Group Lincoln Financial Group

helps people to plan, protect and retire with confidence. As of

December 31, 2023, approximately 17 million customers trust our

guidance and solutions across four core businesses – annuities,

life insurance, group protection, and retirement plan services. As

of June 30, 2024, the company had $311 billion in end-of-period

account balances, net of reinsurance. Headquartered in Radnor, Pa.,

Lincoln Financial Group is the marketing name for Lincoln National

Corporation (NYSE: LNC) and its affiliates. Learn more at

LincolnFinancial.com.

LCN-6891538-081324

______________________________ 1Empathy Cost of Dying Report,

2022-2024 2Empathy User Survey

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821121815/en/

Lincoln Financial Group Julianne Mattera

Julianne.Mattera@lfg.com 267-418-0346

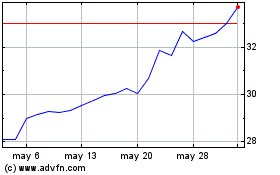

Lincoln National (NYSE:LNC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Lincoln National (NYSE:LNC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024