Lincoln Financial Releases Its Q4 Market Intel Exchange Report, a Comprehensive Analysis of Top Industry Trends and Themes on the Minds of Investors

07 Octubre 2024 - 8:00AM

Business Wire

This quarter's report highlights the impacts of the Federal

Reserve’s rate cutting cycle and market expectations surrounding

presidential elections

Lincoln Financial (NYSE: LNC) released its latest edition of

Market Intel Exchange, curated from the firm’s in-house investment

expertise and in partnership with industry-leading asset managers,

known as Lincoln’s Multimanager Platform. In conjunction with this

data, Jayson Bronchetti, Chief Investment Officer, shares a

high-level overview of the takeaways, using visuals from the report

in the company’s CIO Perspectives video.

Key insights from the latest edition include:

What the start of the Fed rate cutting cycle may mean for

investors: The Federal Reserve recently began its highly

anticipated easing of monetary policy with a 50-basis point

reduction as their attention turns from inflation to the labor

market. With additional easing expected, investors are assessing

the potential implications for their portfolios. This may be a

catalyst for cash to begin moving off the sidelines as yields on

cash equivalents have historically declined 2% on average within

twelve months of the first cut. U.S. equities generally see

positive returns after the start of cuts, but results are highly

dependent on the state of the U.S. economy. Regardless of where

this cycle lands, investors should stay focused on their long-term

financial goals, as stock performance in the five years later has

historically generated positive returns, even when coinciding with

a recession.

How have markets performed in the months surrounding

presidential elections: With the presidential election quickly

approaching, investors may begin to see volatility work its way

into equity markets if history is an indicator. However, research

shows that this choppiness tends to dissipate quickly once the

results are in. Markets have also historically experienced a strong

rally following election day, gaining roughly 16% on average over

the subsequent eight months, and 11.6% annually over the next

decade. Regardless of which party prevails, investors are likely to

be rewarded by exercising patience and maintaining a balanced

portfolio.

Market volatility should be seen as an opportunity for

investors: Market volatility is a feature, not defect, of

investing, and the numbers show that investors can consider times

of unease as opportunities, rather than setbacks. Using the daily

closing prices of the CBOE Volatility Index (VIX), a real-time

measure of expected near-term volatility of the S&P 500, an

investment made on any day had a solid average return just shy of

10% over the following year. However, an investment made on days

where VIX closed at elevated levels typically associated with

periods of stress performed significantly better, rising upwards of

25% or more on average over the subsequent 12 months. By viewing

volatility through an opportunistic lens, investors may feel

empowered to not only stay the course through periods of

turbulence, but perhaps even capitalize on the opportunity to put

additional capital to work for the long-term.

“Lincoln Financial is proud to bring timely market insights and

data to financial professionals and their clients every quarter. In

partnership with our dedicated team of investment professionals,

and our robust multimanager platform, we continue to help our

customers achieve their long-term investment goals,” said

Bronchetti.

More insights from Lincoln Financial and its network of asset

management partners can be found on the Market Insights page on

LincolnFinancial.com.

About Lincoln Financial

Lincoln Financial helps people to plan, protect and retire with

confidence. As of December 31, 2023, approximately 17 million

customers trust our guidance and solutions across four core

businesses — annuities, life insurance, group protection, and

retirement plan services. As of June 30, 2024, the company had $311

billion in end-of-period account balances, net of reinsurance.

Headquartered in Radnor, Pa., Lincoln Financial is the marketing

name for Lincoln National Corporation (NYSE: LNC) and its

affiliates.

© 2024 Lincoln National Corporation. All rights reserved.

Lincoln Financial is the marketing name for Lincoln National

Corporation and insurance company affiliates, including The Lincoln

National Life Insurance Company, Fort Wayne, IN, and in New York,

Lincoln Life & Annuity Company of New York, Syracuse, NY.

Variable products distributed by broker-dealer/affiliate Lincoln

Financial Distributors, Inc., Radnor, PA. Securities and investment

advisor services may be offered through non-affiliated broker

dealers.

This material is provided by The Lincoln National Life Insurance

Company, Fort Wayne, IN, and, in New York, Lincoln Life &

Annuity Company of New York, Syracuse, NY, and their applicable

affiliates (collectively referred to as “Lincoln”). This material

is intended for general use with the public. Lincoln does not

provide investment advice, and this material is not intended to

provide investment advice. Lincoln has financial interests that are

served by the sale of Lincoln programs, products and services.

LCN-7088300-100324

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241007950869/en/

Tina Madon 800-237-2920 Investor Relations

InvestorRelations@LFG.com

Chrissie Dwyer 484-319-5069 Corporate Communications

Chrissie.Dwyer@LFG.com

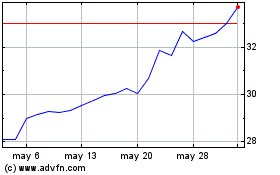

Lincoln National (NYSE:LNC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Lincoln National (NYSE:LNC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024