UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-41737

Lifezone Metals Limited

Commerce House, 1 Bowring Road

Ramsey, Isle of Man, IM8 2LQ

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

On

December 13, 2023, during the regular quarterly meeting of the Board of Directors of Lifezone Metals

Limited (the “Company”), the Board approved the financial results of for the nine months ended September 30, 2023.

A copy of the company’s unaudited condensed consolidated interim financial statements as of September 30, 2023 and for the nine

month periods ended September 30, 2023 and 2022 is furnished as Exhibit 99.1 to this report on Form 6-K, and a copy of the company’s

management’s discussion and analysis of financial condition and results of operations for the period ended September 30, 2023 is

furnished as Exhibit 99.2 and Quantitative and Qualitative Disclosures about Market Risk is furnished as Exhibit 99.3 to this report

on Form 6-K. The Company intends to continue reporting quarterly financial results in 2024.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Lifezone Metals Limited |

| |

|

|

| Date: December 14, 2023 |

By: |

/s/ Ingo Hofmaier |

| |

Name: |

Ingo Hofmaier |

| |

Title: |

Chief Financial Officer |

3

Exhibit 99.1

LIFEZONE

METALS LIMITED

Unaudited

Condensed Consolidated INTERIM Financial Statements

FOR

THE NINE MONTHS ENDED

SEPTEMBER

30, 2023

UNAUDITED

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE LOSS

for

the Nine months ended September 30, 2023 and September 30, 2022

| | |

| |

Three

Months Ended | | |

Nine

Months ended | |

| | |

| |

September

30 | | |

September

30 | |

| | |

Note | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| |

$ | | |

$ | | |

$ | | |

$ | |

| Revenue | |

5 | |

| 556,271 | | |

| 531,739 | | |

| 1,063,019 | | |

| 1,646,044 | |

| (Including

related party revenues of $215,660 and $508,290, $654,568 and $1,573,452 for the three months end and nine months ended September

30, 2023 and 2022, respectively) | |

| |

| | | |

| | | |

| | | |

| | |

| Loss

on foreign exchange | |

8 | |

| (228,619 | ) | |

| (114,441 | ) | |

| (142,072 | ) | |

| (144,914 | ) |

| General

and administrative expenses | |

8 | |

| (347,843,080 | ) | |

| (4,613,327 | ) | |

| (361,255,729 | ) | |

| (10,128,400 | ) |

| Operating

loss | |

| |

| (347,515,428 | ) | |

| (4,196,029 | ) | |

| (360,334,782 | ) | |

| (8,627,270 | ) |

| Interest

income | |

6 | |

| 87,678 | | |

| 99,237 | | |

| 357,478 | | |

| 127,053 | |

| Interest

expense | |

7 | |

| (58,974 | ) | |

| (68,306 | ) | |

| (150,642 | ) | |

| (198,861 | ) |

| Loss

before tax | |

| |

| (347,486,724 | ) | |

| (4,165,098 | ) | |

| (360,127,946 | ) | |

| (8,699,078 | ) |

| Income

tax | |

| |

| - | | |

| - | | |

| - | | |

| - | |

| Loss

for the financial period | |

| |

| (347,486,724 | ) | |

| (4,165,098 | ) | |

| (360,127,946 | ) | |

| (8,699,078 | ) |

| Other

comprehensive income | |

| |

| | | |

| | | |

| | | |

| | |

| Other

comprehensive income that may be reclassified to profit or loss in subsequent periods (net of tax): | |

| |

| | | |

| | | |

| | | |

| | |

| Exchange

(loss) gain on translation of foreign operations | |

| |

| (213,406 | ) | |

| 5,699 | | |

| (297,697 | ) | |

| 40,888 | |

| Total

other comprehensive (loss) income for the period | |

| |

| (213,406 | ) | |

| 5,699 | | |

| (297,697 | ) | |

| 40,888 | |

| Total

other comprehensive loss for the period | |

| |

| (347,700,130 | ) | |

| (4,159,399 | ) | |

| (360,425,6423 | ) | |

| (8,658,190 | ) |

| Net

loss for the period: | |

| |

| | | |

| | | |

| | | |

| | |

| Attributable

to ordinary shareholders of the company | |

| |

| (348,749,555 | ) | |

| (3,637,183 | ) | |

| (359,153,155 | ) | |

| (7,851,748 | ) |

| Attributable

to non-controlling interests | |

| |

| 1,262,831 | | |

| (527,915 | ) | |

| (974,791 | ) | |

| (847,330 | ) |

| | |

| |

| (347,486,724 | ) | |

| (4,165,098 | ) | |

| (360,127,946 | ) | |

| (8,699,078 | ) |

| Total

comprehensive loss: | |

| |

| | | |

| | | |

| | | |

| | |

| Attributable

to ordinary shareholders of the company | |

| |

| (348,962,961 | ) | |

| (3,631,484 | ) | |

| (359,450,852 | ) | |

| (7,810,860 | ) |

| Attributable

to non-controlling interests | |

| |

| 1,262,831 | | |

| (527,915 | ) | |

| (974,791 | ) | |

| (847,330 | ) |

| | |

| |

| (347,700,130 | ) | |

| (4,159,399 | ) | |

| (360,425,643 | ) | |

| (8,658,190 | ) |

| Net loss per share: | |

| |

| | | |

| | | |

| | | |

| | |

| Basic

and diluted net loss per ordinary share | |

21 | |

| (4.53 | ) | |

| (0.07 | ) | |

| (5.56 | ) | |

| (0.13 | ) |

| /s/

Ingo Hofmaier |

|

| Ingo Hofmaier |

|

| Chief Financial Officer |

|

| Date: December 14, 2023 |

|

See

accompanying notes to unaudited condensed consolidated interim financial statements.

UNAUDITED

CONDENSED CONSOLIDATED INTERIM

STATEMENTS

OF FINANCIAL POSITION

as

of September 30, 2023 and December 31, 2022

| | |

Note | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

| |

$ | | |

$ | |

| Assets | |

| |

| | |

| |

| Non-current assets | |

| |

| | |

| |

| Goodwill | |

13 | |

| 9,020,813 | | |

| - | |

| Exploration

and evaluation assets and mining data | |

12 | |

| 48,564,547 | | |

| 18,455,306 | |

| Patents | |

13 | |

| 625,985 | | |

| 602,867 | |

| Other

intangible assets | |

13 | |

| 205,119 | | |

| 92,096 | |

| Property

and equipment | |

11 | |

| 5,449,426 | | |

| 884,322 | |

| Right-of-use

assets | |

11 | |

| 1,476,271 | | |

| 352,307 | |

| | |

| |

| 65,342,161 | | |

| 20,386,898 | |

| Current

assets | |

| |

| | | |

| | |

| Inventories | |

| |

| 104,656 | | |

| 49,736 | |

| Trade

and other receivables | |

10 | |

| 8,643,323 | | |

| 6,005,207 | |

| (Including

receivables from related parties of $75,000 and $655,683 as of September 30, 2023, and December 31, 2022, respectively and receivables

from affiliated entities of $1,612,291 and $959,935 as of September 30, 2023 and December 31, 2022, respectively) | |

| |

| | | |

| | |

| Subscription

receivable | |

15 | |

| - | | |

| 50,000,000 | |

| Cash

and cash equivalents | |

9 | |

| 73,258,538 | | |

| 20,535,210 | |

| | |

| |

| 82,006,517 | | |

| 76,590,153 | |

| Total

assets | |

| |

| 147,348,678 | | |

| 96,977,051 | |

| | |

| |

| | | |

| | |

| Liabilities

and equity | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Equity | |

| |

| | | |

| | |

| Share capital | |

20 | |

| 7,819 | | |

| 3,101 | |

| Share premium | |

20 | |

| 177,764,792 | | |

| 25,436,656 | |

| Share

based payment reserve | |

20 | |

| 265,558,785 | | |

| 25,483,348 | |

| Warrant

reserves | |

20 | |

| 15,097,425 | | |

| - | |

| Other

reserves | |

20 | |

| (6,850,950 | ) | |

| (15,495,254 | ) |

| Foreign

currency translation reserve | |

20 | |

| (181,833 | ) | |

| 115,864 | |

| Redemption

reserve | |

20 | |

| 280,808 | | |

| 280,808 | |

| Accumulated

deficit | |

20 | |

| (403,443,757 | ) | |

| (44,290,602 | ) |

| Total

Shareholders’ equity (deficit) | |

| |

| 48,233,089 | | |

| (8,466,079 | ) |

| Non-controlling

interests | |

20 | |

| 83,478,093 | | |

| 84,452,884 | |

| Total

equity | |

| |

| 131,711,182 | | |

| 75,986,805 | |

See

accompanying notes to unaudited condensed consolidated interim financial statements.

UNAUDITED

CONDENSED CONSOLIDATED INTERIM

STATEMENTS

OF FINANCIAL POSITION

as

of September 30, 2023 and December 31, 2022

| | |

Note | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

| |

| $ | | |

| $ | |

| Non-current liabilities | |

| |

| | | |

| | |

| Lease liabilities | |

16 | |

| 1,106,714 | | |

| 290,576 | |

| Long term asset retirement obligation provision | |

19 | |

| 303,000 | | |

| 303,000 | |

| Contingent consideration | |

18 | |

| 3,809,045 | | |

| 3,689,755 | |

| | |

| |

| 5,218,759 | | |

| 4,283,331 | |

| Current liabilities | |

| |

| | | |

| | |

| Lease liabilities | |

16 | |

| 455,749 | | |

| 105,304 | |

| Trade and other payables | |

14 | |

| 9,962,988 | | |

| 16,601,611 | |

| | |

| |

| 10,418,373 | | |

| 16,706,915 | |

| | |

| |

| | | |

| | |

| Total

liabilities | |

| |

| 15,637,496 | | |

| 20,990,246 | |

| | |

| |

| | | |

| | |

| Total

equity and liabilities | |

| |

| 147,348,678 | | |

| 96,977,051 | |

| /s/

Ingo Hofmaier |

|

| Ingo Hofmaier |

|

| Chief Financial Officer |

|

| Date: December 14, 2023 |

|

See

accompanying notes to unaudited condensed consolidated interim financial statements.

UNAUDITED

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN EQUITY

for

the nine months ended September 30, 2023 and September 30, 2022

| | |

Note | |

Share

Capital | | |

Share

Premium | | |

Share

Based

Payment

Reserve | | |

Warrant

Reserves | | |

Other

Reserves | | |

Foreign

currency

translation

reserve | | |

Redemption

Reserve | | |

Accumulated

Deficit | | |

Total

Shareholders’

equity | | |

Convertible

loans

issued | | |

Non-controlling

Interests | | |

Total

equity | |

| | |

| |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | |

| At

January 1, 2022 | |

| |

| 1,843 | | |

| 25,436,656 | | |

| 9,988,094 | | |

| - | | |

| - | | |

| - | | |

| 280,808 | | |

| (20,707,260 | ) | |

| 15,000,141 | | |

| 39,040,000 | | |

| (176,238 | ) | |

| 53,863,903 | |

| Transactions

with shareholders: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance

of ordinary shares | |

| |

| 1,258 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,258 | | |

| - | | |

| - | | |

| 1,258 | |

| Total

transactions with shareholders | |

| |

| 1,258 | | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,258 | | |

| - | | |

| - | | |

| 1,258 | |

| Total

loss for the interim financial period | |

| |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| - | | |

| (7,851,748 | ) | |

| (7,851,748 | ) | |

| - | | |

| (847,330 | ) | |

| (8,699,078 | ) |

| Total

other comprehensive income for the interim financial period | |

| |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| 40,888 | | |

| - | | |

| - | | |

| 40,888 | | |

| - | | |

| - | | |

| 40,888 | |

| At

September 30, 2022 | |

| |

| 3,101 | | |

| 25,436,656 | | |

| 9,988,094 | | |

| - | | |

| - | | |

| 40,888 | | |

| 280,808 | | |

| (28,559,008 | ) | |

| 7,190,539 | | |

| 39,040,000 | | |

| (1,023,568 | ) | |

| 45,206,971 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| At

January 1, 2023 | |

| |

| 3,101 | | |

| 25,436,656 | | |

| 25,483,348 | | |

| - | | |

| (15,495,254 | ) | |

| 115,864 | | |

| 280,808 | | |

| (44,290,602 | ) | |

| (8,466,079 | ) | |

| - | | |

| 84,452,884 | | |

| 75,986,805 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| - | | |

| | | |

| | | |

| - | |

| Acquisition

of a subsidiary: | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Reorganization: | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercise

of share options | |

| |

| 83 | | |

| 573,515 | | |

| (11,103,650 | ) | |

| - | | |

| 10,640,556 | | |

| - | | |

| - | | |

| - | | |

| 110,504 | | |

| - | | |

| - | | |

| 110,504 | |

| Exercise

of RSUs | |

| |

| 150 | | |

| 9,524,850 | | |

| (14,379,698 | ) | |

| - | | |

| 4,854,698 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Share

for share exchange | |

| |

| 2,934 | | |

| (2,934 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Issuance

of shares: | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Warrants: | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Public

warrants | |

| |

| - | | |

| (7,866,000 | ) | |

| - | | |

| 14,490,000 | | |

| (6,624,000 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Private

placement warrants | |

| |

| - | | |

| (380,475 | ) | |

| - | | |

| 607,425 | | |

| (226,950 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Earnouts: | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Earnouts

to shareholder | |

| |

| - | | |

| - | | |

| 248,464,035 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 248,464,035 | | |

| - | | |

| - | | |

| 248,464,035 | |

| Earnouts

to sponsors | |

| |

| - | | |

| - | | |

| 17,094,750 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 17,094,750 | | |

| - | | |

| - | | |

| 17,094,750 | |

| Issue

of share capital: | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Issuances

to SPAC shareholders and sponsors | |

| |

| 799 | | |

| 79,960,741 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 79,961,540 | | |

| - | | |

| - | | |

| 79,961,540 | |

| Issuance

to PIPE Investors | |

| |

| 702 | | |

| 70,172,468 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 70,173,170 | | |

| - | | |

| - | | |

| 70,173,170 | |

| Issuance

to Simulus Shareholders | |

| |

| 50 | | |

| 6,029,950 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,030,000 | | |

| - | | |

| - | | |

| 6,030,000 | |

| Equity

issuance costs | |

| |

| - | | |

| (5,683,979 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,683,979 | ) | |

| - | | |

| - | | |

| (5,683,979 | ) |

| Total

transactions with shareholders | |

| |

| 4,718 | | |

| 152,328,136 | | |

| 240,075,437 | | |

| 15,097,425 | | |

| 8,644,304 | | |

| - | | |

| - | | |

| - | | |

| 416,150,020 | | |

| - | | |

| - | | |

| 416,150,020 | |

| Total

loss for the interim financial period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (359,153,155 | ) | |

| (359,153,155 | ) | |

| - | | |

| (974,791 | ) | |

| (360,127,946 | ) |

| Total

other comprehensive loss for the interim financial period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (297,697 | ) | |

| - | | |

| - | | |

| (297,697 | ) | |

| - | | |

| - | | |

| (297,697 | ) |

| At

September 30, 2023 | |

20 | |

| 7,819 | | |

| 177,764,792 | | |

| 265,558,785 | | |

| 15,097,425 | | |

| (6,850,950 | ) | |

| (181,833 | ) | |

| 280,808 | | |

| (403,443,757 | ) | |

| 48,233,089 | | |

| - | | |

| 83,478,093 | | |

| 131,711,182 | |

See

accompanying notes to unaudited condensed consolidated interim financial statements.

UNAUDITED

CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENTS

for

the nine months ended September 30, 2023 and September 30, 2022

| | |

| |

September 30 | | |

September 30 | |

| | |

Note | |

2023 | | |

2022 | |

| | |

| |

$ | | |

$ | |

| Cash flows from operating activities | |

| |

| | |

| |

| Consolidated loss for year | |

| |

| (360,425,643 | ) | |

| (8,658,190 | ) |

| Adjustments for: | |

| |

| | | |

| | |

| SPAC transaction expenses | |

8 | |

| 76,857,484 | | |

| - | |

| Share-based compensation expense | |

20 | |

| 265,558,785 | | |

| - | |

| Interest income | |

6 | |

| (357,478 | ) | |

| (127,053 | ) |

| Amortization of intangibles | |

13 | |

| 123,274 | | |

| 33,619 | |

| Foreign exchange loss | |

8 | |

| 142,072 | | |

| 144,914 | |

| Interest expense | |

7 | |

| 150,642 | | |

| 198,861 | |

| Depreciation of property

and equipment and right-of-use assets | |

11 | |

| 848,951 | | |

| 109,992 | |

| Operating loss before working

capital changes | |

| |

| (17,101,913 | ) | |

| (8,297,857 | ) |

| Changes in trade and other receivables | |

| |

| (836,648 | ) | |

| (1,495,262 | ) |

| Changes in related party receivables | |

| |

| (64,832 | ) | |

| (142,802 | ) |

| Changes in inventories | |

| |

| (54,920 | ) | |

| (55,406 | ) |

| Changes in other current assets | |

| |

| (1,623,805 | ) | |

| (485,283 | ) |

| Changes in prepaid mining license | |

| |

| 754,753 | | |

| 758,735 | |

| Changes in customer credit to related party | |

| |

| - | | |

| (208,550 | ) |

| Changes in trade and

other payables | |

14 | |

| (4,704,319 | ) | |

| 571,371 | |

| Net

cash used in operating activities | |

| |

| (23,631,684 | ) | |

| (9,355,054 | ) |

| Cash flows from investing

activities | |

| |

| | | |

| | |

| Interest received from bank | |

6 | |

| 350,637 | | |

| 120,232 | |

| Patent costs incurred | |

| |

| (81,100 | ) | |

| (69,014 | ) |

| Expenditure on property and equipment | |

11 | |

| (540,871 | ) | |

| (7,512 | ) |

| Expenditure on other intangible assets | |

13 | |

| (178,315 | ) | |

| - | |

| Investment in exploration and evaluation assets | |

12 | |

| (30,109,241 | ) | |

| (3,527,986 | ) |

| Acquisition of subsidiaries,

net of cash acquired | |

22 | |

| (8,085,255 | ) | |

| (7,591 | ) |

| Net

cash used in investing activities | |

| |

| (38,644,542 | ) | |

| (3,491,871 | ) |

| Cash flows from financing activities | |

| |

| | | |

| | |

| Proceeds from exercise of stock options | |

| |

| 110,534 | | |

| - | |

| Net proceeds from PIPE transaction | |

1 | |

| 70,173,170 | | |

| - | |

| Proceeds from SPAC acquisition | |

1 | |

| 3,104,056 | | |

| - | |

| Share issuance cost | |

8 | |

| (5,683,979 | ) | |

| - | |

| Payment of lease liabilities | |

16 | |

| (179,222 | ) | |

| (66,223 | ) |

| Proceeds from receipt

of subscription receivable, net of transaction cost | |

1 | |

| 47,500,000 | | |

| - | |

| Net

cash provided by (used in) financing activities | |

| |

| 115,024,529 | | |

| (66,223 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| |

| 52,748,700 | | |

| (12,913,148 | ) |

| Cash and cash equivalents | |

| |

| | | |

| | |

| Effect of exchange rate changes in cash | |

| |

| (25,372 | ) | |

| (73,350 | ) |

| Beginning of period | |

| |

| 20,535,210 | | |

| 45,624,110 | |

| End of period | |

| |

| 73,258,538 | | |

| 32,637,612 | |

See

accompanying notes to unaudited condensed consolidated interim financial statements.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

Lifezone

Metals Limited (the Company, individually and together with its controlled subsidiaries “Lifezone”) is a limited company

incorporated and domiciled in Isle of Man, whose shares are publicly traded on the New York Stock Exchange (“NYSE”)

since July 6, 2023 under the trading symbol LZM. Lifezone warrants trade under the symbol LZMW.

Lifezone’s

registered office is located at Commerce House, 1 Bowring Road, Ramsey, IM8 2LQ, Isle of Man. The Unaudited Condensed Consolidated Interim

Financial Statements of Lifezone for the nine months ended September 30, 2023, were authorized for release in accordance with a resolution

of the Directors of Lifezone on December 13, 2023.

The

Unaudited Condensed Consolidated Interim Financial Statements of Lifezone have been reviewed by Grant Thornton Ireland, an independent

public accountant prior to filing in accordance with the standards of the United States Public Company Accounting Oversight Board applicable

to reviews of interim financial information.

Lifezone

is a modern metals company engaged in the development, patenting, and licensing of its hydrometallurgical processing technology (“Hydromet

Technology”) for use in the extractive metallurgy, minerals, and recycling industries. Lifezone’s primary metals asset

is the Kabanga Nickel project in Tanzania, believed to be one of the world’s largest and highest-grade undeveloped nickel sulfide

deposits. Information on the group structure of Lifezone is provided in Note 2.3.

Information

on other related party relationships of Lifezone is provided in Note 17.

Background

and basis for preparation

History

and organization

Lifezone

Holdings Limited (“Lifezone Holdings”) was formed as a holding company for Lifezone Limited and acquired 100% of the

equity interest (including outstanding options and Restricted Stock Units, “RSUs”) in Lifezone Limited on June 24,

2022, in consideration for issuing shares of Lifezone Holdings on a 1:1 basis to Lifezone Limited shareholders at the time (following

a 1:200 split of shares of Lifezone Limited) (the “Lifezone Holdings Transaction”). Also, on June 24, 2022 (just prior

to the Lifezone Holdings Transaction), the shareholders of Kabanga Nickel Limited (“KNL”), other than Lifezone Limited

and BHP Billiton (UK) DDS Limited (“BHP”), exchanged their shares of KNL for shares of Lifezone Holdings on a 1:1

basis (the “Flip-Up”). The KNL options were also exchanged for options in Lifezone Holdings on a 1:1 basis as part

of the Flip-Up.

As

Lifezone Holdings did not have any previous operations, Lifezone Limited and KNL (together with its subsidiaries) are together viewed

as the predecessors to Lifezone Holdings and its consolidated subsidiaries. As a result, the consolidated financial statements of Lifezone

Holdings recognize the assets and liabilities received in the Lifezone Holdings Transaction and the Flip-Up at their historical carrying

amounts, as reflected in the historical financial statements of Lifezone Limited and KNL (together with its subsidiaries).

Lifezone

Metals Limited was incorporated on December 8, 2022 for the purpose of effectuating the SPAC Transaction referred to below. Prior to

the consummation of the transaction, Lifezone Metals Limited had no material assets and did not operate any businesses.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 1. | General

information (continued) |

BHP investments

On

December 24, 2021, KNL entered into a $40 million convertible loan agreement with BHP and Lifezone Limited established a joint venture

with BHP under the Lifezone Subscription Agreement in relation to the Kabanga Nickel project. Following the conversion of convertible

loans on July 1, 2022, BHP held an 8.9% interest in KNL, reflected within non-controlling interests.

On

October 14, 2022, BHP agreed to invest a further $50 million in KNL in the form of equity under the Tranche 2 Subscription Agreement,

the completion of which was subject to certain conditions. Lifezone Limited satisfied substantially all the closing conditions and received

the $50 million on February 15, 2023 and issued a stock certificate on the same day, bringing BHP’s interest in KNL from 8.9% as

of December 31, 2022 to 17.0%, effective February 15, 2023. Associated with this transaction KNL paid $2.5 million equity issuance cost,

with the liability to an investment bank accounted for as a payable in 2022.

SPAC Transaction

On

December 13, 2022, Lifezone and GoGreen Investments Corporation (“GoGreen”), an exempted special purchase acquisition

company (“SPAC”) incorporated under the laws of the Cayman Islands and formerly listed on the NYSE, entered into a

business combination agreement (“BCA”) with GoGreen Sponsor 1 LP, a Delaware limited partnership (the “Sponsor”),

Aqua Merger Sub, a Cayman Islands exempted company (the “Merger Sub”) and Lifezone Holdings.

Lifezone,

Lifezone Holdings and GoGreen consummated the SPAC Transaction pursuant to the BCA (the “SPAC Transaction”) on July

6, 2023 (the “Closing” and the “Closing Date” respectively). The transaction was unanimously approved

by GoGreen’s Board of Directors and was approved at the extraordinary general meeting of GoGreen’s shareholders held on June

29, 2023 (the “EGM”). GoGreen’s shareholders also voted to approve all the other proposals presented at the

EGM. As a result of the SPAC Transaction, the Merger Sub, as the surviving entity after the SPAC Transaction, and Lifezone Holdings each

became wholly owned subsidiaries of Lifezone Metals Limited. As Lifezone shareholders hold the majority of shares in the combined entity

post the acquisition, Lifezone’s key management personnel continues to direct the combined business and Lifezone set the direction

of the board composition, Lifezone is considered the accounting acquirer.

The

SPAC Transaction was accounted for as a capital reorganization (“Reorganization”). Under this method of accounting,

GoGreen was treated as the “acquired” company for financial reporting purposes, with Lifezone being the accounting acquirer

and accounting predecessor. Accordingly, the Reorganization was treated as the equivalent of Lifezone Metals issuing shares at Closing

of the Reorganization for the net assets of GoGreen, accompanied by a recapitalization via Private Investment in Public Equity (“PIPE”)

transaction. The Reorganization, which is not within the scope of IFRS 3 since GoGreen did not meet the definition of a business in accordance

with IFRS 3, was accounted for within the scope of IFRS 2. In accordance with IFRS 2, Lifezone recorded a one-time non-cash expense of

$76.9 million recognized as a SPAC Transaction expense, based on the excess of the fair value of Lifezone shares issued at a value of

$10 per share over the fair value of GoGreen’s identifiable net assets acquired.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 1. | General

information (continued) |

SPAC

Transaction (continued)

GoGreen’s

net assets as of June 30, 2023, prior to the Closing of the SPAC Transaction predominantly comprised of cash and cash equivalents, less

current liabilities, are together considered the fair value of GoGreen’s identifiable net assets. In accordance with IFRS 2 paragraph

10, the net assets of GoGreen will be stated at fair value, with no goodwill or other intangible assets recorded and any excess of fair

value of Lifezone shares issued over the fair value of GoGreen’s identifiable net assets acquired represents a compensation for

the service of a stock exchange listing for its shares, shown as SPAC Transaction expenses below.

| | |

Shares

issued at

Closing | | |

Fair

value

per Share | | |

Fair

value of

shares at

closing date | |

| | |

| | |

| | |

$ | |

| Previous

GoGreen Sponsor shareholders | |

| 6,468,600 | | |

| 10.00 | | |

| 64,686,000 | |

| Previous GoGreen public

shareholders | |

| 1,527,554 | | |

| 10.00 | | |

| 15,275,540 | |

| | |

| 7,996,154 | | |

| | | |

| 79,961,540 | |

| Fair value of GoGreen

net assets | |

| | | |

| | | |

| (3,104,056 | ) |

| SPAC

Transaction expense | |

| | | |

| | | |

| 76,857,484 | |

The

BCA was signed concurrent to the closing of the PIPE transaction, which raised $70.2 million of gross proceeds.

Prior

to the Closing, the SPAC incurred 94.47% of redemptions from public shareholders following a redemption vote deadline of June 27, 2023,

leaving 1,527,554 residual shares in trust. At the Closing, Lifezone acquired GoGreen and former GoGreen shareholders received the number

of Lifezone shares and warrants equal to their former holdings of GoGreen shares and warrants. The outstanding warrants formerly associated

with GoGreen will therefore be recognized in Lifezone future reported financial position.

Immediately

prior to the Closing, holders of all outstanding Lifezone Holdings options (18,054 total) and restricted stock units (30,000 total) elected

to exercise or settle, respectively, their options and restricted stock units for Lifezone Holdings shares. All outstanding Lifezone

Holdings shares were subsequently exchanged for Lifezone shares at the Closing Date July 6, 2023 at a ratio of c. 94:1.

The

SPAC Transaction is expected to have a significant impact on Lifezone’s future capital structure and operating results. The most

significant change in Lifezone’s reported financial positions is an approximate increase in cash and cash equivalents from $44.4

million as at June 30, 2023 to $73.3 million as at September 30, 2023. Cash inflows during the three months ending September 30, 2023

related to $70.2 million in gross proceeds from the PIPE transaction consummated substantially simultaneously with the SPAC Transaction

and $16.5 million GoGreen cash (post redemptions, but before paying all existing GoGreen liabilities), resulting in $86.6 million gross

proceeds for Lifezone before listing and equity issuance costs.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 1. | General

information (continued) |

SPAC

Transaction (continued)

As

a result of the SPAC Transaction, Lifezone as the new parent company, became a SEC-registered Foreign Private Issuer (“FPI”)

listed on the NYSE, which requires implementing procedures and processes to address public company regulatory requirements and customary

practices. Management expects to incur additional annual expenses as a public company.

Following

the Closing, but prior to the completion acquisition of Simulus Group Pty Ltd (“Simulus”) on July 18, 2023 as described

in detail below, Lifezone shareholders comprised all prior shareholders of Lifezone Holdings, prior shareholders of GoGreen (including

its public shareholders post-redemptions and Sponsor shareholders) plus all PIPE investors resulting in Lifezone having a total of 77,693,602

shares issued and outstanding.

Pursuant

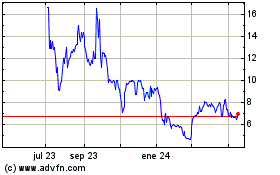

to earnout arrangements under the BCA, former Lifezone Holdings and Sponsor shareholder will receive additional Lifezone shares if the

daily volume-weighted average price of Lifezone shares equals or exceeds (i) $14.00 per share for any 20 trading days within a 30-trading

day period (“Trigger Event 1”) and (ii) $16.00 for any 20 trading days within a 30-trading day period (“Trigger

Event 2”). Of the total shares issued and outstanding, 1,725,000 shares are issued but in escrow and relate to the Sponsor

earnouts, which are subject to the occurrence of the two trigger events. Further information on the accounting earnouts is provided in

Note 20.

Lifezone’s

Form F-1 registration statement became effective on September 29, 2023, registering the resale of certain Lifezone Metals shares and

(private) warrants owned by certain previous Lifezone Holdings shareholders, the Sponsor shareholders (including its limited partners),

PIPE investors and the sellers of the Simulus business. Pursuant to the BCA, a 180-day lock-up period following the Closing Date applies

to (i) 5,133,600 Lifezone shares, and 667,500 warrants received by the Sponsor shareholders and (ii) the Lifezone shares received by

the previous Lifezone Holdings shareholders who owned 1.5% or more of the outstanding Lifezone Holdings shares prior to the Closing Date,

in each case, subject to certain exceptions. 1,335,000 Lifezone shares received by the Sponsor shareholders were subject to a 60-day

lock-up from the Closing Date.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 1. | General

information (continued) |

SPAC

Transaction (continued)

Lifezone’s

shareholdings at the time of the Closing are summarized below. The table below excludes shares issued at the completion of the acquisition

of Simulus which was completed on July 18, 2023 as discussed in Note 22.

| Shareholders | |

Shares

At

Closing | | |

%

At

Closing | | |

Shares

(Fully Diluted) | | |

Fully

Diluted % | |

| Previous Lifezone Holdings shareholders | |

| 62,680,131 | | |

| 80.7 | % | |

| 62,680,131 | | |

| 52.5 | % |

| Previous GoGreen Sponsor shareholders | |

| 6,468,600 | | |

| 8.3 | % | |

| 6,468,600 | | |

| 5.4 | % |

| Previous GoGreen public shareholders | |

| 1,527,554 | | |

| 2.0 | % | |

| 1,527,554 | | |

| 1.3 | % |

| PIPE Investors | |

| 7,017,317 | | |

| 9.0 | % | |

| 7,017,317 | | |

| 5.9 | % |

| Total | |

| 77,693,602 | | |

| 100.0 | % | |

| 77,693,602 | | |

| 65.0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Warrants ($11.50 Exercise Share Price) | |

| | | |

| | | |

| | | |

| | |

| Previous GoGreen public warrants | |

| | | |

| | | |

| 13,800,000 | | |

| 11.6 | % |

| Previous GoGreen Sponsor

warrants | |

| | | |

| | | |

| 667,500 | | |

| 0.6 | % |

| Total | |

| | | |

| | | |

| 14,467,500 | | |

| 12.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Earnout Trigger Event 1 ($14.00 per

Share) | |

| | | |

| | | |

| | | |

| | |

| Previous Lifezone Holdings shareholders | |

| | | |

| | | |

| 12,536,026 | | |

| 10.5 | % |

| Previous GoGreen Sponsor

shareholders | |

| | | |

| | | |

| 862,500 | | |

| 0.7 | % |

| Total | |

| | | |

| | | |

| 13,398,526 | | |

| 11.2 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Earnout Trigger Event 2 ($16.00 per

Share) | |

| | | |

| | | |

| | | |

| | |

| Previous Lifezone Holdings shareholders | |

| | | |

| | | |

| 12,536,026 | | |

| 10.5 | % |

| Previous GoGreen Sponsor

shareholders | |

| | | |

| | | |

| 862,500 | | |

| 0.7 | % |

| Total | |

| | | |

| | | |

| 13,398,526 | | |

| 11.2 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Fully

Diluted Total | |

| | | |

| | | |

| 119,458,154 | | |

| 100.0 | % |

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 1. | General

information (continued) |

Simulus

acquisition

On

March 3, 2023, Metprotech, a wholly owned subsidiary of Lifezone, signed a share sale agreement with the shareholders of Simulus, a leading

hydrometallurgical laboratory and engineering company located in Perth, Australia.

The

transaction formally closed on July 18, 2023 for a total consideration of $14.53 million comprising a $1.0 million deposit paid on March

27, 2023, a cash consideration of $7.5 million paid on closing and 500,000 shares in Lifezone. The vendors are restricted from disposing

of, transferring, or assigning their consideration shares for a period of six months from the completion of the Simulus acquisition.

Further

information on the accounting of the Simulus acquisition is provided in Note 22.

| 2. | Significant

accounting policies |

Lifezone’s

Unaudited Condensed Consolidated Interim Financial Statements for the nine months ended September 30, 2023 have been prepared in accordance

with IAS 34 ‘Interim Financial Reporting’ under the International Financial Reporting Standards (“IFRS”),

as issued by the International Accounting Standards Board (“IASB”) and are reported in U.S. dollars (“USD”

or “$”).

The

Unaudited Condensed Consolidated Interim Financial Statements have been prepared on a historical cost basis unless otherwise stated.

The

same accounting policies, presentation and methods of computation have been followed in these Unaudited Condensed Consolidated Interim

Financial Statements as were applied in the preparation of the financial statements of Lifezone Holdings for the year ended December

31, 2022, except for the impact of the adoption of the Standards and Interpretations as described in Note 2.2

These

standards and amendments do not have a significant impact on these unaudited condensed consolidated interim financial statements and

therefore the disclosures have not been made.

Management

anticipates that all relevant pronouncements will be adopted for the first period beginning on or after the effective date of the pronouncement.

New IFRS, amendments and Interpretations not adopted in the current year have not been disclosed as they are not expected to have a material

impact on the Lifezone’s financial statements.

The

Unaudited Condensed Consolidated Interim Financial Statements incorporate the results of the Flip-Up as discussed in Note 1, as of June

24, 2022. Lifezone Holdings acquired 100% of the equity interest in Lifezone Limited, a transaction accounted for using the predecessor

value method. Business combinations under common control are outside the scope of IFRS 3, therefore, Lifezone management used its judgment

to develop an accounting policy that is relevant and reliable, in accordance with IAS 8. Management considered the application of the

predecessor value method as the most appropriate (also known as merger accounting), which involves accounting for the assets and liabilities

of the acquired business using existing carrying values of the acquired business.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 2. | Significant

accounting policies (continued) |

| 2.1. | Basis

of preparation (continued) |

In

the Unaudited Condensed Consolidated Interim Statement of Financial Position, the acquiree’s identifiable assets and liabilities

are recognized at their carrying values at the acquisition date. The increase in the fair value of share-based payment reserves, assumed

by Lifezone Holdings as part of the Flip-Up, was accounted for directly in equity under Other Reserves. The results of acquired operations

are included in the Unaudited Condensed Consolidated Interim Statement of Comprehensive Income from the date on which control is obtained.

Lifezone

has prepared the Unaudited Condensed Consolidated Interim Financial Statements on the basis that it will continue to operate as a going

concern as discussed in Note 2.5.

The

Unaudited Condensed Consolidated Interim Financial Statements comprise the financial statements of Lifezone and all its controlled subsidiaries

as of September 30, 2023. Control is achieved when Lifezone is exposed, or has rights, to variable returns from its involvement with

the investee and has the ability to affect those returns through its power over the investee. Specifically, Lifezone controls an investee

if, and only if, Lifezone has:

| ● | power

over the investee (i.e., existing rights that give it the current ability to direct the relevant

activities of the investee); |

| ● | exposure,

or rights, to variable returns from its involvement with the investee; or |

| ● | the

ability to use its power over the investee to affect its returns. |

Generally,

there is a presumption that a majority of voting rights results in control. To support this presumption and when Lifezone has less than

a majority of the voting or similar rights of an investee, Lifezone considers all relevant facts and circumstances in assessing whether

it has power over an investee, including:

| ● | the

contractual arrangement(s) with the other vote holders of the investee; |

| ● | rights

arising from other contractual arrangements; and |

| ● | Lifezone’s

voting rights and potential voting rights. |

Lifezone

reassesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three

elements of control. Consolidation of a subsidiary begins when Lifezone obtains control over the subsidiary and ceases when Lifezone

loses control of the subsidiary. Assets, liabilities, income, and expenses of a subsidiary acquired or disposed of during the year are

included in the Unaudited Condensed Consolidated Interim Financial Statements from the date Lifezone gains control until the date Lifezone

ceases to control the subsidiary.

| 2.2. | Accounting

pronouncements |

The

accounting policies adopted in the preparation of the unaudited condensed consolidated interim financial statements are consistent with

those followed in the preparation of the annual consolidated financial statements of Lifezone Holdings for the year ended December 31,

2022, except for the adoption of new standards effective as of January 1, 2023. Lifezone has not early adopted any standard, interpretation

or amendment that has been issued but is not yet effective. Several amendments apply for the first time in 2023, but do not have an impact

on the unaudited condensed consolidated interim financial statements of the Company, as follows:

| ● | IFRS

17 ‘Insurance Contracts’ |

| ● | Deferred

Tax related to Assets and Liabilities arising from a Single Transaction (Amendments

to IAS 12, Income Taxes) |

| ● | Definition

of Accounting Estimates (Amendments to IAS 8, Accounting Policies, Changes in Accounting

Estimates and Errors) |

| ● | Disclosure

of Accounting Policies (Amendments to IAS 1, Presentation of Financial Statements, and IFRS

Practice Statement 2, Making Materiality Judgements) |

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 2. | Significant

accounting policies (continued) |

| 2.3. | Basis

of consolidation |

Profit

or loss and each component of other comprehensive income are attributed to the equity holders of Lifezone Metals Limited as the parent

entity of Lifezone and to the non-controlling interests, even if this results in the non-controlling interests having a deficit balance.

When necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies in line with Lifezone’s

accounting policies. All intra-group assets and liabilities, equity, income, expenses, and cash flows relating to transactions between

members of Lifezone are eliminated on full consolidation.

A

change in the ownership interest of a subsidiary, without a loss of control, is accounted for as an equity transaction. If Lifezone loses

control over a subsidiary, it derecognizes the related assets (including goodwill), liabilities, non-controlling interest, and other

components of equity, while any resultant gain or loss is recognized in profit or loss. Any investment remains recognized at fair value.

Lifezone

attributes total comprehensive income or loss of subsidiaries between the owners of Lifezone Metals Limited as the parent entity and

the non-controlling interests based on their respective ownership interests.

The

Consolidated Interim Financial Statements comprise the financial statements as of September 30, 2023, of the following 19 subsidiaries.

| | |

Direct

/ | |

Country

of | |

Principal

place of | |

Percentage

of

Ownership (%) | |

| Name

of subsidiary | |

Indirect | |

incorporation | |

Business | |

2023 | | |

2022 | |

| Aqua

Merger Sub (in liquidation) | |

Direct | |

Cayman

Islands | |

Cayman

Islands | |

| 100.0 | % | |

| 100.0 | % |

| Lifezone

Holdings Limited | |

Indirect | |

Isle of Man | |

Isle of Man | |

| 100.0 | % | |

| 100.0 | % |

| Lifezone

Limited | |

Indirect | |

Isle of Man | |

Isle of Man | |

| 100.0 | % | |

| 100.0 | % |

| Lifezone

Holdings US, LLC | |

Indirect | |

United State of America | |

United State of America | |

| 100.0 | % | |

| 0 | % |

| Lifezone

US Holdings Limited | |

Indirect | |

United Kingdom | |

United Kingdom | |

| 100.0 | % | |

| 0 | % |

| Lifezone

US Holdings LLC | |

Indirect | |

United State of America | |

United State of America | |

| 100.0 | % | |

| 0 | % |

| Lifezone

Recycling US, LLC | |

Indirect | |

United State of America | |

United State of America | |

| 100.0 | % | |

| 0 | % |

| LZ

Services Limited | |

Indirect | |

United Kingdom | |

United Kingdom | |

| 100.0 | % | |

| 100.0 | % |

| Kabanga

Holdings Limited | |

Indirect | |

Cayman Islands | |

Cayman Islands | |

| 83.0 | % | |

| 91.1 | % |

| Kabanga

Nickel Company Limited | |

Indirect | |

Tanzania | |

Tanzania | |

| 83.0 | % | |

| 91.1 | % |

| Kabanga

Nickel Limited | |

Indirect | |

United Kingdom | |

United Kingdom | |

| 83.0 | % | |

| 91.1 | % |

| Kagera

Mining Company Limited | |

Indirect | |

Tanzania | |

Tanzania | |

| 83.0 | % | |

| 91.1 | % |

| Metprotech

Pacific Proprietary Limited | |

Indirect | |

Australia | |

Australia | |

| 100.0 | % | |

| 100.0 | % |

| The

Simulus Group Pty Limited | |

Indirect | |

Australia | |

Australia | |

| 100.0 | % | |

| 0 | % |

| Simulus

Pty Limited | |

Indirect | |

Australia | |

Australia | |

| 100.0 | % | |

| 0 | % |

| Romanex

International Limited | |

Indirect | |

Canada | |

Canada | |

| 83.0 | % | |

| 91.1 | % |

| Tembo

Nickel Corporation Limited | |

Indirect | |

Tanzania | |

Tanzania | |

| 69.7 | % | |

| 76.5 | % |

| Tembo

Nickel Mining Company Limited | |

Indirect | |

Tanzania | |

Tanzania | |

| 69.7 | % | |

| 76.5 | % |

| Tembo

Nickel Refining Company Limited | |

Indirect | |

Tanzania | |

Tanzania | |

| 69.7 | % | |

| 76.5 | % |

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 2. | Significant

accounting policies (continued) |

| 2.3. | Basis

of consolidation (continued) |

Lifezone

Holdings US, LLC, Lifezone US Holdings LLC and Lifezone Recycling US, LLC were incorporated on September 15, 2023 in the state of Delaware,

USA. Lifezone US Holdings Limited was incorporated on September 12, 2023 in the United Kingdom. Investments in these entities as of September

30, 2023 reflect the nominal share value. These three companies have no tangible assets or business activities at the date of this report.

| 2.4. | Business

combinations under common control |

Business

combinations involving entities under common control are outside the scope of IFRS 3 ‘Business Combinations’ (Paragraphs

B5–B12D) and there is no other specific IFRS guidance. Accordingly, Lifezone management used its judgement to develop an accounting

policy that is relevant and reliable, in accordance with

IAS

8 ‘Accounting Policies, Changes in Accounting Estimates and Errors’.

The

management of Lifezone has assessed the going concern assumptions of Lifezone during the preparation of these Unaudited Condensed Consolidated

Interim Financial Statements. Lifezone generated a net comprehensive loss attributable to ordinary shareholders of the company of $359.5

million for the nine months ended September 30, 2023 (September 30, 2022: $7.8 million) and accumulated losses of $403.4 million at September

30, 2023 (December 31, 2022: $44.4 million).

As

of September 30, 2023, Lifezone had consolidated cash and cash equivalents of $73.3 million. The cash flow for the nine months ended

September 30, 2023 was $52.7 million (September 30, 2022: net outflows $13.0 million), consisting of $115.0 million of net inflows (September

30, 2022: net outflows $0.07 million) from financing activities arising from the completion of the SPAC Transaction, the PIPE transaction

and an investment by BHP in KNL. Net outflows from operating activities of $23.6 million (September 30, 2022: net outflows $9.4 million)

and net outflows from investing activities of $38.6 million (September 30, 2022: net outflows $3.5 million), relate mainly to expenditure

for the Kabanga Nickel project and the Simulus acquisition.

Based

on Lifezone’s current and increasing liquidity and anticipated funding requirements, Lifezone will need additional capital in the

future to fund its operations and project developments. Lifezone’s future operating losses and capital requirements may vary materially

from those currently planned and will depend on many factors including Lifezone’s growth rate, the execution of various growth

projects, and the demand for the Hydromet Technology, capital costs expected for the construction costs of the Kabanga Nickel project,

and the demand for the minerals we envision extracting in our metals extraction business and as well as for Lifezone’s working

capital requirements.

To

enhance our liquidity position or increase our cash reserve for future investments or operations, we continue to explore arrangements

with potential customers for the offtake of the metals that we expect to produce in the future from the Kabanga Nickel project, and we

may in the future seek equity, mezzanine and alternative or debt financing. Additionally, we may receive the proceeds from any exercise

of any warrants in cash. Each Lifezone warrant represents the right to purchase one ordinary Lifezone share at a price of $11.50 per

share in cash.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 2. | Significant

accounting policies (continued) |

| 2.5. | Going

concern (continued) |

Lifezone’s

Form F-1 registration statement became effective on September 29, 2023, registering the resale of certain Lifezone Metals shares and

(private) warrants owned by certain previous Lifezone Holdings shareholders, the Sponsor shareholders (including its limited partners),

PIPE investors and the sellers of the Simulus business. Pursuant to the BCA, a 180-day lock-up period following the Closing applies to

(i) 5,133,600 Lifezone shares, and 667,500 warrants received by the Sponsor shareholders and (ii) the Lifezone shares received by the

previous Lifezone Holding’s shareholders who owned 1.5% or more of the outstanding Lifezone Holdings shares prior to the Closing,

in each case, subject to certain exceptions. 1,335,000 Lifezone shares received by the Sponsor shareholders were subject to a 60-day

lock-up from the Closing Date.

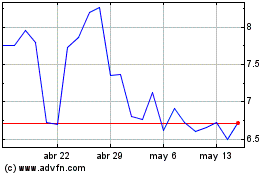

We

believe the likelihood that warrant holders will exercise their warrants, and therefore the

amount of cash proceeds that we would receive is dependent upon the market price of our Lifezone

ordinary shares. On December 13, 2023, the market price for our Lifezone ordinary shares

was $8.50. When the market price for our Lifezone ordinary shares is less than $11.50 per

share (i.e., the warrants are “out of the money”), we believe warrant holders

will be unlikely to exercise their warrants. If all the warrants are exercised, an additional

14,391,200 Lifezone ordinary shares would be

outstanding, with further details available under Note 27 (Subsequent events).

The

Unaudited Condensed Consolidated Interim Financial Statements have been prepared on a going concern basis which contemplates the continuity

of normal business activities and the realization of assets and discharge of liabilities in the ordinary course of business. Lifezone

has not generated significant revenues from operations and, as common with many exploration-stage mining companies, Lifezone raises financing

for its exploration, study and research and development activities in discrete tranches. As such, the ability of Lifezone to continue

as a going concern depends on its ability to secure this additional financing. In the event Lifezone issues additional equity in the

future, shareholders could face significant dilution in their holdings.

Together

with its brokers and financial advisors, Lifezone continuously monitors capital market conditions, and the Board recurrently considers

various forms of financing available to Lifezone.

In

the event that Lifezone is unable to secure sufficient funding, it may not be able to fully develop its projects, and this may have a

consequential impact on the carrying value of the related exploration and evaluation assets and the investment of Lifezone Metals Limited

in its subsidiaries as well as the going concern status of Lifezone. Given the nature of Lifezone’s current activities, it will

remain dependent on equity, mezzanine, debt funding or monetizing the offtake from the Kabanga Nickel project until such time as the

Lifezone becomes self-financing from the commercial production of its mineral resources and royalties received from intellectual property

rights linked to its Hydromet Technology. To the extent that Lifezone foresees increasing financing risks, jeopardizing the existence

of Lifezone, Lifezone can accelerate the reduction of costs and aim for smaller, more targeted capital raises.

Given

that Lifezone will likely need to raise funds within twelve months from the date of approval of these unaudited condensed consolidated

interim financial statements for project development, new projects, acquisitions and to fund operations, the situation gives rise to

a material uncertainty as there can be no assurance Lifezone will be able to raise required financing in the future. Notwithstanding

this material uncertainty, the Directors of Lifezone consider it appropriate to prepare the financial statements on a going concern basis

given Lifezone’s ability to raise necessary funding and its shareholder base at Lifezone and at KNL. The financial statements do

not include the adjustments that would result if Lifezone was unable to continue as a going concern.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 2. | Significant

accounting policies (continued) |

| 2.6. | Functional

and reporting currency |

These

Unaudited Condensed Consolidated Interim Financial Statements are presented in USD, which is Lifezone’s functional currency, and

all values are rounded to the nearest USD, except where otherwise indicated. The functional currency is the currency of the primary economic

environment in which the entity operates. Accordingly, Lifezone measures its financial results and financial position in USD, expressed

as $ in this document.

Lifezone

incurs transactions mainly in USD, British Pounds (“GBP”), Australian Dollars (“AUD”) and Tanzanian

Shillings (“TZS”).

The

subsidiaries LZ Services Limited (“LZSL”) a company incorporated in England and Wales; and Metprotech Pacific Pty

Ltd (“Metprotech”) a company incorporated in Australia, are both wholly owned subsidiaries of Lifezone Limited, and

have functional currencies as GBP and AUD respectively. Simulus and its subsidiary Simulus Pty Limited both companies incorporated in

Australia, are wholly owned subsidiaries of Metprotech and have functional currencies of AUD. The balances of the subsidiaries reporting

under other currencies are translated to USD.

| 3. | Key

sources of estimation and uncertainty |

Significant

accounting judgements, estimates and assumptions.

The

preparation of Lifezone’s Unaudited Condensed Consolidated Interim Financial Statements requires management to make judgements,

estimates and assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, and the accompanying disclosures,

and the disclosure of contingent liabilities. Uncertainty about these assumptions and estimates could result in outcomes that require

a material adjustment to the carrying amount of assets or liabilities affected in the future period.

The

judgements, estimates and assumptions applied in the Unaudited Condensed Consolidated Interim Financial Statements, including the key

sources of estimation uncertainty, were the same as those applied in Lifezone’s (and its predecessor holding companies) last annual

financial statements for the year ended December 31, 2022.

Fair

value hierarchy

A

fair value measurement of a non-financial asset takes into account a market participant’s ability to generate economic benefits

by using the asset in its highest and best use or by selling it to another market participant that would use the asset in its highest

and best use.

The

Group uses valuation techniques that are appropriate in the circumstances and for which sufficient data are available to measure fair

value, maximising the use of relevant observable inputs and minimising the use of unobservable inputs.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 3. | Key

sources of estimation and uncertainty (continued) |

Fair

value hierarchy (continued)

Equity

Instruments for which fair value is measured or disclosed in the financial statements are categorised within the fair value hierarchy,

described as follows, based on the lowest level input that is significant to the fair value measurement as a whole:

| ● | Level

1 — Quoted (unadjusted) market prices in active markets for identical assets or liabilities |

| ● | Level

2 — Valuation techniques for which the lowest level input that is significant to the

fair value measurement is directly or indirectly observable |

| ● | Level

3 — Valuation techniques for which the lowest level input that is significant to the

fair value measurement is unobservable |

For

instruments that are recognised in the financial statements at fair value, the Group determines whether transfers have occurred between

levels in the hierarchy by re-assessing categorisation (based on the lowest level input that is significant to the fair value measurement

as a whole) at the end of each reporting period.

The

management determines the policies and procedures for non-recurring measurement, such as share options and restricted stock units. There

are no recurring fair value measurements, and the movement in the fair value of the share options and restricted stock units is due to

a modification during the year.

Management

have involved external valuers for valuation of the equity instruments. Selection criteria include market knowledge, reputation, independence

and whether professional standards are maintained. Share options and restricted stock units are currently measured under Level 3, the

inputs for which are disclosed in Note 20.

Management

have assessed that the fair values of cash and cash equivalents, trade receivables, trade payables and other current liabilities approximate

their carrying amounts largely due to the short-term maturities of these instruments.

For

management purposes, Lifezone is organized into business units based on the main types of activities and has two reportable operating

segments, as follows:

| ● | Metals

extraction and refining business; and |

| ● | Intellectual

property (“IP”) licensing business. |

The

Metals extraction and refining segment of the business consists of Lifezone’s interest in KNL, comprising the Kabanga Nickel project.

The IP segment comprises patents residing with and managed by Lifezone’s subsidiary Lifezone Limited, and a team of highly trained

engineers and scientists based in Lifezone’s newly acquired hydromet laboratory based in Perth, with the majority having joined

via the Simulus acquisition, that closed on July 18, 2023.

Further

information on the accounting of the Simulus acquisition is provided in Notes 1 and 22.

The

Chief Executive Officer ensures that the corporate strategy is being implemented. He manages Lifezone on a day-to-day basis, monitors

the operating results of its two business units separately for the purpose of making decisions about resource allocation and performance

assessment and is Lifezone’s Chief Operating Decision Maker. Segment performance is evaluated based on cash flows, operating profit

or loss before taxes and is measured with operating profit or loss in the Unaudited Condensed Consolidated Interim Financial Statements.

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 4. | Segment

information (continued) |

However,

Lifezone’s financing and treasury operations are managed by corporate functions based in London.

Inter-segment

eliminations and transactions are identified separately, and the combined segments’ information is reconciled to the Statement

of Financial Position and Statement of Comprehensive Income.

Inter-segment

revenues are eliminated upon consolidation and reflected in the ‘Inter-segment eliminations’ column.

The

results for the nine months ending September 30, 2023 and September 30, 2022 respectively are shown below.

| | |

Intellectual | | |

Metals | | |

Inter-Segment | | |

| |

| | |

Property | | |

Extraction | | |

eliminations | | |

Total | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| For the nine months ended September 30, 2023 | |

| | |

| | |

| | |

| |

| Revenue | |

| 8,027,904 | | |

| 1,274,076 | | |

| (8,238,961 | ) | |

| 1,063,019 | |

| Interest income | |

| 78,023 | | |

| 279,455 | | |

| - | | |

| 357,478 | |

| (Loss) gain on foreign exchange | |

| (253,222 | ) | |

| 111,150 | | |

| - | | |

| (142,072 | ) |

| General and administrative expenses | |

| (26,929,249 | ) | |

| (342,565,441 | ) | |

| 8,238,961 | | |

| (361,255,729 | ) |

| Interest expense | |

| (71,851 | ) | |

| (78,791 | ) | |

| - | | |

| (150,642 | ) |

| Loss

before tax | |

| (19,148,395 | ) | |

| (340,979,551 | ) | |

| - | | |

| (360,127,946 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| For the period ended September 30, 2023 | |

| | | |

| | | |

| | | |

| | |

| Segment assets | |

| 10,738,961 | | |

| 136,609,717 | | |

| - | | |

| 147,348,678 | |

| Segment liabilities | |

| (4,616,593 | ) | |

| (11,020,903 | ) | |

| - | | |

| (15,637,496 | ) |

| | |

Intellectual | | |

Metals | | |

Inter-Segment | | |

| |

| | |

Property | | |

Extraction | | |

eliminations | | |

Total | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| For the nine months ended September 30, 2022 | |

| | |

| | |

| | |

| |

| Revenue | |

| 6,440,383 | | |

| - | | |

| (4,794,339 | ) | |

| 1,646,044 | |

| Interest income | |

| 46,122 | | |

| 80,931 | | |

| - | | |

| 127,053 | |

| (Loss) on foreign exchange | |

| (55,753 | ) | |

| (89,161 | ) | |

| - | | |

| (144,914 | ) |

| General and administrative expenses | |

| (3,256,825 | ) | |

| (11,665,914 | ) | |

| 4,794,339 | | |

| (10,128,400 | ) |

| Interest expense | |

| - | | |

| (198,861 | ) | |

| - | | |

| (198,861 | ) |

| Gain

(loss) before tax | |

| 3,173,927 | | |

| (14,873,005 | ) | |

| - | | |

| (8,699,078 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| For the period ended September 30, 2022 | |

| | | |

| | | |

| | | |

| | |

| Segment assets | |

| 11,870,999 | | |

| 45,521,793 | | |

| - | | |

| 54,392,792 | |

| Segment liabilities | |

| (372,848 | ) | |

| (8,812,973 | ) | |

| - | | |

| (9,185,821 | ) |

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| | |

Three

months ended

September 30, | | |

Nine

months ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Kellplant Proprietary Ltd | |

| 56,140 | | |

| 130,583 | | |

| 129,680 | | |

| 1,133,122 | |

| Kelltechnology SA Proprietary

Ltd | |

| 159,520 | | |

| 377,707 | | |

| 524,888 | | |

| 440,330 | |

| Consulting and management fee with affiliated

companies | |

| 215,660 | | |

| 508,290 | | |

| 654,568 | | |

| 1,573,452 | |

| Non-affiliated company

revenue | |

| 340,611 | | |

| 23,449 | | |

| 408,451 | | |

| 72,592 | |

| | |

| 556,271 | | |

| 531,739 | | |

| 1,063,019 | | |

| 1,646,044 | |

Revenue

is attributable to Hydromet consulting related to mineral beneficiation operations of affiliated companies and technical and laboratory

services provided by Simulus to a wide array of customers. The affiliated entities are joint venture entities of Lifezone. Lifezone Limited

has a 50% interest in Kelltech Limited, a joint venture with Sedibelo Resources Limited. Lifezone Limited has an indirect 33.33% interest

in Kelltechnology SA Proprietary Ltd (“KTSA”), a subsidiary of Kelltech Limited, and Kellplant Proprietary Ltd (“Kellplant”),

a wholly owned subsidiary of KTSA as disclosed in detail in Note 23.

Non-affiliated

company revenue of $340k during the three months ending September 30, 2023 relates to third party customers following the Simulus acquisition

as disclosed in Note 1 and 22.

| | |

Three

months ended

September 30, | | |

Nine

months ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Interest on shareholder loans | |

| - | | |

| 2,656 | | |

| 6,841 | | |

| 6,821 | |

| Other interest company

revenue | |

| 87,678 | | |

| 96,581 | | |

| 350,637 | | |

| 120,232 | |

| | |

| 87,678 | | |

| 99,237 | | |

| 357,478 | | |

| 127,053 | |

Other

interest income arises from cash in bank deposits with bank interest averaging 0.10 -1.40% over the period.

| | |

| |

Three

months ended

September 30, | | |

Nine

months ended

September 30, | |

| | |

Note | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| |

$ | | |

$ | | |

$ | | |

$ | |

| Interest accretion on contingent

consideration | |

18 | |

| 40,186 | | |

| 59,905 | | |

| 119,290 | | |

| 179,714 | |

| Interest accretion on lease liability | |

16 | |

| 18,788 | | |

| 7,006 | | |

| 31,352 | | |

| 17,752 | |

| Other interest expenses | |

| |

| - | | |

| 1,395 | | |

| - | | |

| 1,395 | |

| | |

| |

| 58,974 | | |

| 68,306 | | |

| 150,642 | | |

| 198,861 | |

Notes

to the Unaudited Condensed Consolidated Interim Financial Statements

for

the nine months ended September 30, 2023

| 8. | General

and administrative expenses |

The following

is a summary of key expenses included in general and administrative expenses:

| | |

| |

Three

months ended

September 30, | | |

Nine

months ended

September 30, | |

| | |

Note | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| |

$ | | |

$ | | |

$ | | |

$ | |

| Wages

& employee benefits | |

| |

| 2,070,172 | | |

| 925,602 | | |

| 3,886,714 | | |

| 2,224,736 | |

| Professional

fees | |

| |

| 1,181,725 | | |

| 1,075,535 | | |

| 11,374,386 | | |

| 3,119,398 | |

| Directors’

fees | |

| |

| 262,179 | | |

| 43,604 | | |

| 348,679 | | |

| 130,729 | |

| Legal