As filed with the Securities and Exchange Commission

on August 1, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lifezone Metals

Limited

(Exact name of registrant as specified in its charter)

| Isle of Man |

|

1000 |

|

Not applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

Commerce House, 1 Bowring Road, Ramsey, Isle

of Man, IM8 2LQ

Telephone: +44 (0)1624 811 603

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Corporation Service Company

19 West 44th Street, Suite 200

New York, NY 10036

Telephone: (800) 927-9801

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all correspondence to:

Mark Mandel

Carol Stubblefield

Baker & McKenzie LLP

452 5th Ave

New York, NY 10018

(212) 626-4100

Approximate date of commencement

of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended,

the “Securities Act”), check the following box. ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration

statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the

Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and

Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in

this preliminary prospectus is not complete and may be changed. The registrant may not sell the securities described herein until the

registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted.

PRELIMINARY

PROSPECTUS - SUBJECT TO COMPLETION, DATED AUGUST 1, 2024

LIFEZONE METALS LIMITED

$250,000,000 OF ORDINARY SHARES,

WARRANTS, RIGHTS AND/OR UNITS OFFERED BY THE COMPANY

AND

UP TO 7,119,769 ORDINARY

SHARES OFFERED BY SELLING SECURITYHOLDERS

We may offer from time to time

in one or more series or issuances ordinary shares, par value $0.0001 per share (the “Ordinary Shares”), of Lifezone Metals

Limited, an Isle of Man company (“Lifezone Metals”), warrants to purchase Ordinary Shares, rights or any combination of the

above, separately or as units. We refer to the ordinary shares, warrants, rights and units collectively as “securities” in

this prospectus.

In addition, the selling securityholders

named in this prospectus (the “Selling Securityholders”) may offer and sell from time to time up to 7,119,769 Ordinary Shares,

consisting of (i) 6,250,000 Ordinary Shares that may be issuable to the Selling Securityholders upon conversion of the US$50 million aggregate

principal amount of Debentures (defined herein) outstanding on the date of this prospectus and (ii) additional Ordinary Shares that may

be issued as interest payments on the Debentures or upon conversion of capitalized PIK Interest (defined herein, based on assumed interest

rates, share prices and other assumptions as described herein).

The Selling Securityholders

may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market

prices or at privately negotiated prices. These securities are being registered to permit the Selling Securityholders to sell securities

from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell these securities

through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled

“Plan of Distribution” herein. In connection with any sales of securities offered hereunder, the Selling Securityholders,

any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning

of the Securities Act of 1933, as amended (the “Securities Act”).

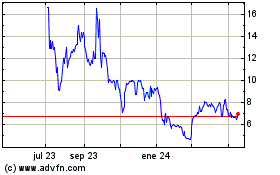

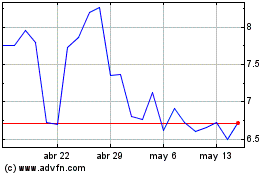

Our Ordinary Shares and public

Warrants are listed on the New York Stock Exchange (the “NYSE”) under the symbols “LZM” and “LZMW,”

respectively. On July 30, 2024, the closing price for our Ordinary Shares on the NYSE was US$7.30. On July 30, 2024, the closing price

for our Warrants on the NYSE was US$0.81.

We will not receive any proceeds

from the sale of the securities by the Selling Securityholders.

We may amend or supplement

this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments

or supplements carefully before you make your investment decision.

Lifezone Metals is an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and is therefore eligible to take advantage of certain

reduced reporting requirements otherwise applicable to other public companies.

Lifezone Metals is also a “foreign

private issuer” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is exempt from

certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under

Section 14 of the Exchange Act. In addition, Lifezone Metals’ officers, directors and principal shareholders are exempt from the

reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, Lifezone Metals is

not required to file periodic reports and financial statements with the Securities and Exchange Commission (the “SEC”) as

frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

Investing in our

securities involves a high degree of risk. See “Risk Factors” on page 2 of this prospectus before you make an

investment in the securities.

Neither the SEC nor any

state or foreign securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the SEC utilizing a “shelf” registration

process. Under this process, we may offer and sell our securities under this prospectus, and the Selling Securityholders referred to in

this prospectus and identified in supplements to this prospectus may also offer and sell Ordinary Shares under this prospectus.

Under this shelf process, we

may sell the securities described in this prospectus in one or more offerings up to a total price to the public of $250,000,000. The Selling

Securityholders may sell up to 7,119,769 Ordinary Shares in one or more offerings. The offer and sale of securities under this prospectus

may be made from time to time, in one or more offerings, in any manner described in the section of this prospectus entitled “Plan

of Distribution.”

You should not assume that

the information contained in, or incorporated by reference into, this prospectus is accurate on any date subsequent to the date set forth

on the front cover of this prospectus, even though this prospectus is delivered or ordinary shares covered by this prospectus are sold

or otherwise disposed of on a later date. It is important for you to read and consider all information contained in, or incorporated by

reference into, this prospectus in making your investment decision. You should also read and consider the information in the documents

described in the section below entitled “Where You Can Find Additional Information.”

You should rely only on information

contained in this prospectus, any prospectus supplement and any related free writing prospectus. We have not, and the Selling Securityholders

have not, authorized anyone to provide you with information different from that contained in this prospectus, any prospectus supplement

and any related free writing prospectus. The information contained in this prospectus is accurate only as of the date on the front cover

of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

Discrepancies in any table

between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain

figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100% due to rounding.

This

summary may not contain all of the information that may be important to you. You should read this entire prospectus, including the financial

data and related notes incorporated by reference in this prospectus, before making an investment decision.

Throughout this prospectus,

unless otherwise designated or the context otherwise requires, the terms “we”, “us”, “our”, “Lifezone”

and “the Company” refer to Lifezone Metals and its subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including

the information incorporated by reference herein, includes “forward-looking statements” within the meaning of Section 27A

of the Securities Act, Section 21E of the Exchange Act and the “safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995, as amended, regarding, among other things, the plans, strategies and prospects, both business and financial,

of Lifezone Metals and its subsidiaries. These statements are based on the beliefs and assumptions of our management. Although we believe

that the plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure

you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks,

uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed

future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements

may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “predicts,”

“projects,” “forecasts,” “may,” “might,” “will,” “could,” “should,”

“would,” “seeks,” “plans,” “scheduled,” “possible,” “continue,”

“potential,” “anticipates” or “intends” or similar expressions; provided that the absence of these

does not means that a statement is not forward-looking. Forward-looking statements contained or incorporated into this prospectus include,

but are not limited to, statements about our ability to:

| ● | anticipate any event, change or other circumstances that could give rise to the termination of any agreement

referred to or incorporated into this prospectus; |

| ● | achieve projections and anticipate uncertainties relating to our business, operations and financial performance,

including: |

| ○ | expectations with respect to financial and business performance, including financial projections and business

metrics and any underlying assumptions; |

| ○ | expectations regarding product and technology development and pipeline; |

| ○ | expectations regarding market size; |

| ○ | expectations regarding the competitive landscape and the ability to develop, design and sell products

and services that are differentiated from those competitors; |

| ○ | expectations regarding future acquisitions, partnerships or other relationships with third parties; |

| ○ | future capital requirements and sources and uses of cash, including the ability to obtain additional capital

in the future; |

| ● | comply with applicable laws and regulations and stay abreast of modified or new laws and regulations applying

to its business, including privacy regulation; |

| ● | anticipate the impact of, and response to, new accounting standards; |

| ● | anticipate the significance and timing of contractual obligations; |

| ● | maintain key strategic relationships with partners and customers; |

| ● | successfully defend litigation; |

| ● | acquire, maintain and protect intellectual property; |

| ● | meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness;

and |

| ● | effectively respond to general economic and business conditions. |

Forward-looking statements

are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should

understand that the following important factors, in addition to those referred to under the heading “Risk Factors”

and elsewhere in this prospectus, could affect the future results of Lifezone Metals, and could cause those results or other outcomes

to differ materially from those expressed or implied in the forward-looking statements in this prospectus:

| ● | ability to maintain the NYSE’s listing standards; |

| ● | inability to recognize the anticipated benefits of the SPAC transaction consummated on July 6, 2023 (the “Business Combination”) with Lifezone Holdings Limited (“LHL”)

and GoGreen Investments Corporation (the “Business Combination”), which may be affected by,

among other things, competition, the ability of the Lifezone Metals to grow and manage growth profitably, maintain relationships with

customers and suppliers and retain its management and key employees; |

| ● | litigation, complaints and/or adverse publicity; |

| ● | changes in applicable laws or regulations; |

| ● | possibility that Lifezone Metals may be adversely affected by other economic, business or competitive

factors; |

| ● | volatility in the markets caused by geopolitical and economic factors; |

| ● | privacy and data protection laws, privacy or data breaches, or the loss of data; |

| ● | the impact of changes in consumer spending patterns, consumer preferences, local, regional and national

economic conditions, crime, weather, demographic trends and employee availability; |

| ● | any defects in new products or enhancements to existing products; and |

| ● | other risks and uncertainties referred to under the section entitled “Risk Factors.” |

New risk factors emerge from

time to time and it is not possible to predict all such risk factors, nor can the parties assess the impact of all such risk factors on

us, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in

any forward-looking statements. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements.

Lifezone Metals undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

In addition, statements of

belief and similar statements reflect the beliefs and opinions of our management on the relevant subject. These statements are based upon

information available to such parties, as applicable, as of the date of this prospectus, and while such party believes such information

forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read to indicate

that our management has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements

are inherently uncertain and you are cautioned not to unduly rely upon these statements.

PROSPECTUS

summary

This summary highlights

certain information about us, this offering and selected information contained elsewhere in or incorporated into this prospectus. This

summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the

securities covered by this prospectus. You should read the following summary together with the more detailed information in or incorporated

into this prospectus before making an investment decision.

Overview

We seek to support the clean

energy transition by licensing our in-house Hydromet Technology as an alternative to traditional smelting and refining. Combined with

our primary asset, the Kabanga Nickel Project in north-west Tanzania, Lifezone Metals aims to become an emerging supplier of responsibly-sourced,

lower-carbon dioxide and lower-sulfur dioxide emission metals (compared to smelting) to the global markets.

We are progressing our Kabanga

Nickel Project through a definitive feasibility study. Based on the Mineral Resource Estimates in the Kabanga 2023 Mineral Resource Updated

Technical Report Summary (the “TRS”), we believe Kabanga comprises one of the world’s largest and highest-grade nickel

sulfide deposits. We are also progressing a project that would utilize our Hydromet Technology to recover platinum group metals from spent

automotive catalytic converters. We aim to provide products that will responsibly and cost-effectively deliver supply chain solutions

to support the global energy transition.

We believe that our metals

resources, Hydromet Technology and expertise position us for long term growth as customers continually look for cleaner sources of metals

for the development of EVs, batteries and the hydrogen economy.

Our business consists of two

segments: (i) our metals extraction and refining business and (ii) our IP licensing business.

Lifezone Metals Limited was

incorporated under the laws of the Isle of Man on December 8, 2022. Lifezone’s registered office is located at Commerce House, 1

Bowring Road, Ramsey, IM8 2LQ, Isle of Man. Our telephone number at that address is +44 (0)1624 811 611.

Emerging Growth Company

Lifezone Metals is an “emerging

growth company,” as defined in Section 2(a)(19) of the Securities Act, as modified by the JOBS Act. As such, we are eligible to

take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging

growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section

404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in their periodic reports and proxy statements

and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any

golden parachute payments not previously approved. If some investors find Lifezone Metals’ securities less attractive as a result,

there may be a less active trading market for Lifezone Metals’ securities and the prices of Lifezone Metals’ securities may

be more volatile.

Lifezone Metals will remain

an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the date on

which Ordinary Shares were offered in connection with the Business Combination, (b) in which it has total annual gross revenues of at

least $1.235 billion, or (c) in which it is deemed to be a large accelerated filer, which means the market value of its ordinary shares

that are held by non-affiliates is equal to or exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter;

and (2) the date on which it has issued more than $1.00 billion in non-convertible debt during the prior three-year period. References

herein to “emerging growth company” have the meaning associated with it in the JOBS Act.

Foreign Private Issuer

Lifezone Metals is considered

a “foreign private issuer” under the securities laws of the U.S. and the rules of the NYSE. Under the applicable securities

laws of the U.S., “foreign private issuers” are subject to different disclosure requirements than U.S. domiciled issuers.

As a foreign private issuer, Lifezone Metals is not subject to the SEC’s proxy rules. Under the NYSE’s rules, a “foreign

private issuer” is subject to less stringent corporate governance and compliance requirements and subject to certain exceptions,

the NYSE permits a “foreign private issuer” to follow its home country’s practice in lieu of the listing requirements

of the NYSE. Accordingly, Lifezone Metals’ shareholders may not receive the same protections afforded to shareholders of companies

that are subject to all of the NYSE’s corporate governance requirements.

Lifezone Metals intends to

take all actions necessary for it to maintain compliance as a foreign private issuer under the applicable corporate governance requirements

of the Sarbanes-Oxley Act, the rules adopted by the SEC and the NYSE corporate governance rules and listing standards.

Because Lifezone Metals is

a foreign private issuer, its directors and senior management are not subject to short-swing profit and insider trading reporting obligations

under Section 16 of the Exchange Act. They will, however, be subject to the obligations to report changes in share ownership under Section

13 of the Exchange Act and related SEC rules.

RISK

FACTORS

Investing in our securities

involves a high degree of risk. Before making an investment decision, you should consider carefully the risks described under the section

titled “Item 3.D.: Risk Factors” in our most recent Annual Report on Form 20-F which is incorporated by reference herein,

as well as any other information included or incorporated by reference in this prospectus. Our business, operating results, financial

condition or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are

material. If any of the risks actually occurs, our business, operating results, financial condition and prospects could be adversely affected.

In that event, the market price of the Ordinary Shares could decline, and you could lose part or all of your investment.

USE OF PROCEEDS

Unless otherwise indicated

in the applicable prospectus supplement, we intend to use the net proceeds from the sale of securities offered by us pursuant to this

prospectus for general corporate purposes. The timing and amount of our actual expenditures will be based on many factors, including cash

flows from operations and the anticipated growth of our business. As a result, unless otherwise indicated in the applicable prospectus

supplement, our management will have broad discretion to allocate the net proceeds of the offerings.

All of the Ordinary Shares

offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts.

We will not receive any of the proceeds from such sales. We will pay certain expenses associated with the registration of the securities

covered by this prospectus, as described in the section entitled “Plan of Distribution.”

MARKET PRICE OF OUR SECURITIES AND DIVIDEND

POLICY

Our Ordinary Shares and

Warrants began trading on the NYSE under the symbols “LZM” and “LZMW,” respectively, on July 6, 2023. On July

30, 2024, the last reported sales price of the Ordinary Shares on the NYSE was US$7.30 and the last reported sales price of the Warrants

was US$0.81.

As of July 30, 2024, there

were approximately 109 holders of record of our Ordinary Shares and approximately 27 holders of record of our Warrants based on public

filings. Such numbers do not include beneficial owners holding our securities through nominee names.

Lifezone Metals has not paid

any cash dividends on the Ordinary Shares to date. It is presently intended that Lifezone Metals will retain its earnings for use in business

operations and, accordingly, it is not anticipated that Lifezone Metals’ board of directors (the “Board”) will declare

dividends in the foreseeable future.

CAPITALIZATION AND INDEBTEDNESS

The table below sets forth

our capitalization and indebtedness as of June 30, 2024:

| | |

As of

June 30,

2024 | |

| | |

(US dollars) | |

| Cash and cash equivalents | |

| 63,492,965 | |

| | |

| | |

| Debt | |

| | |

| Unsecured convertible debenture | |

| 50,409,506 | |

| Lease obligations - current | |

| 656,935 | |

| Lease obligations - non-current | |

| 926,588 | |

| Contingent liability | |

| 3,851,611 | |

| Total Debt | |

| 55,844,640 | |

| | |

| | |

| Equity | |

| | |

| Share capital | |

| 7,829 | |

| Paid-in capital and other reserves | |

| 452,817,420 | |

| Retained losses | |

| (418,864,653 | ) |

| Non controlling Interest | |

| 84,922,155 | |

| Total Equity | |

| 118,882,751 | |

| Total capitalization | |

| 174,727,391 | |

SELLING SECURITYHOLDERS

The resale of an

aggregate 6,250,000 Ordinary Shares issuable upon the conversion of the outstanding $50 million aggregate principal amount of

unsecured convertible debentures (the “Debentures”) is based on (i) the outstanding Debentures on the date of this

prospectus multiplied by the current $8 per share conversion price. However, this prospectus includes the resale of up to an

aggregate maximum of 7,119,769 Ordinary Shares (i) issuable upon the conversion of the outstanding Debentures, (ii) issuable as

Interest Shares (as defined below) or (iii) issuable upon the conversion of capitalized PIK Interest (as defined below), based on

the assumed interest rates and VWAP and other assumptions described herein.

The Debentures bear interest

at a rate of SOFR plus 4.0% per annum, subject to a SOFR floor of 3.0%. For the period following the effective date of the registration

statement of which this prospectus forms a part through the second anniversary of the closing date (so long as the Ordinary Share VWAP

is more than US$4.00 for the five trading days preceding the applicable calculation date), the Company is required to pay interest on

the Debentures as follows:

| (i) | as to two-thirds of the applicable interest payment in cash, which shall accrue (the “PIK Interest”)

to the outstanding principal amount on each interest payment date until the second anniversary of the closing date; and |

| (ii) | as to one third of the applicable interest payment, by the issue of the equivalent value in Ordinary Shares

(the “Interest Shares”) at a price per Interest Share equal to a 7.5% discount to the Ordinary Share VWAP for the five trading

days preceding the applicable interest payment date. |

The amount of PIK Interest

(and shares issuable upon conversion of PIK Interest) and the number of Interest Shares assumes that the full aggregate $50 million of

the original principal amount of the Debentures remains outstanding until March 27, 2026, the second anniversary of the closing date of

the Debenture placement, at which date both the original principal amount of the Debentures and the PIK Interest would convert into Ordinary

Shares at a conversion price of US$8.00 per share. The assumed interest rate and interest amounts have been calculated using the 1-month

term SOFR forward curve as of June 25, 2024, assuming interest becomes payable as PIK Interest and Interest Shares as of August 30, 2024.

The amount of shares payable as Interest Shares was calculated on an assumed VWAP of US$8.00 per share. On the basis described above,

the aggregate amount of PIK Interest would be approximately US$4.5 million convertible into 564,588 Ordinary Shares and an aggregate of

305,181 Interest Shares would be payable.

The Selling Securityholders

may from time to time offer and sell any or all of the securities set forth below pursuant to this prospectus. When we refer to the “Selling

Securityholders” in this prospectus, we mean the persons listed in the tables below.

The table below sets forth,

as of the date of this prospectus, the name of the Selling Securityholders for which we are registering securities for resale to the public

and the number of Ordinary Shares that the Selling Securityholders may offer pursuant to this prospectus.

The individuals and entities

listed below have beneficial ownership over their respective securities. The SEC has defined “beneficial ownership” of a security

to mean the possession, directly or indirectly, of voting power and/or investment power over such security. A shareholder is also deemed

to be, as of any date, the beneficial owner of all securities that such shareholder has the right to acquire within 60 days after that

date through (i) the exercise of any option, warrant or right, (ii) the conversion of a security, (iii) the power to revoke a trust, discretionary

account or similar arrangement or (iv) the automatic termination of a trust, discretionary account or similar arrangement. In computing

the number of shares beneficially owned by a person and the percentage ownership of that person, Ordinary Shares subject to options or

other rights (as set forth above) held by that person that are currently exercisable, or will become exercisable within 60 days thereafter,

are deemed outstanding, while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person.

We cannot advise you as to

whether the Selling Securityholders will in fact sell any or all of such securities. In addition, the Selling Securityholders may sell,

transfer or otherwise dispose of, at any time and from time to time, the ordinary shares in transactions exempt from the registration

requirements of the Securities Act after the date of this prospectus, subject to applicable law.

| | |

Securities beneficially owned prior to this offering | | |

Securities being offered | | |

Securities beneficially owned after sale | |

| Name of Selling Securityholder | |

Ordinary Shares | | |

Ordinary Shares | | |

Ordinary Shares | | |

% | |

| Bromma Resource Master Fund Inc.(1) | |

| 711,977 | | |

| 711,977 | | |

| 0 | | |

| 0 | |

| EdgePoint Investment Group Inc.(2) | |

| 854,373 | | |

| 854,373 | | |

| 0 | | |

| 0 | |

| MMCAP International Inc. SPC(3) | |

| 4,983,839 | | |

| 4,983,839 | | |

| 0 | | |

| 0 | |

| Resource Exploration & Development Private Placement LP(4) | |

| 58,239 | | |

| 58,239 | | |

| 0 | | |

| 0 | |

| Resource Exploration and Development Private Placement QP(5) | |

| 84,155 | | |

| 84,155 | | |

| 0 | | |

| 0 | |

| Term Oil Inc(6) | |

| 427,186 | | |

| 427,186 | | |

| 0 | | |

| 0 | |

| (1) | Represents 625,000 Ordinary Shares issuable upon conversion of US$5,000,000 original principal amount

of the Debentures, plus 56,459 shares issuable upon conversion of US$451,671 payable as PIK Interest and 30,518 Ordinary Shares issuable

as Interest Shares. The business address of Bromma Resource Master Fund Inc. is 1517- 25 Adelaide St E, Toronto, ON, M5C 3A1. |

| (2) | Represents 750,000 Ordinary Shares issuable upon conversion of US$6,000,000 original principal amount

of the Debentures, plus 67,751 shares issuable upon conversion of US$542,005 payable as PIK Interest and 36,622 Ordinary Shares issuable

as Interest Shares. The business address of EdgePoint Investment Group Inc. is 150 Bloor St West, Suite 500, Toronto ON, M5S 2X9. |

| (3) | Represents 4,375,000 Ordinary Shares issuable upon conversion of US$35,000,000 original principal amount

of the Debentures, plus 395,212 shares issuable upon conversion of US$3,161,698 payable as PIK Interest and 213,627 Ordinary Shares issuable

as Interest Shares. The business address of MMCAP International Inc. SPC is c/o MM Asset Management Inc. 161 Bay St. Ste 2240, BOX 600

Toronto, ON, M5J 2S1. |

| (4) | Represents 51,125 Ordinary Shares issuable upon conversion of US$409,000 original principal amount of

the Debentures, plus 4,618 shares issuable upon conversion of US$36,947 payable as PIK Interest and 2,496 Ordinary Shares issuable as

Interest Shares. The business address of Resource Exploration & Development Private Placement LP is 1910 Palomar Point Way, STE 200,

Carlsbad, CA 92008. |

| (5) | Represents 73,875 Ordinary Shares issuable upon conversion of US$591,000 original principal amount of

the Debentures, plus 6,673 shares issuable upon conversion of US$53,388 payable as PIK Interest and 3,607 Ordinary Shares issuable as

Interest Shares. The business address of Resource Exploration & Development Private Placement QP is 1910 Palomar Point Way, STE 200,

Carlsbad, CA 92008. |

| (6) | Represents 375,000 Ordinary Shares issuable upon conversion of US$3,00,000 original principal amount of

the Debentures, plus 33,875 shares issuable upon conversion of US$271,003 payable as PIK Interest and 18,311 Ordinary Shares issuable

as Interest Shares. The business address of Term Oil Inc. is 5869 Section Ave, Anacortes, WA 98221-9066. |

TAXATION

Material U.S. Federal Income Tax Considerations

Our Annual Report filed on

Form 20-F provides a discussion of the material U.S. federal income tax considerations that may be relevant to prospective investors in

our securities. The applicable prospectus supplement for any offers of securities by the Company may also contain information about any

material U.S. federal income tax considerations relating to the securities covered by such prospectus supplement.

Non-United States Federal Income Tax Considerations

Our Annual Report filed on

Form 20-F provides a discussion of Isle of Man tax consequences that may be relevant to prospective investors in our securities. The applicable

prospectus supplement for any offers of securities by the Company may also contain information about any non-U.S. tax considerations relating

to the securities covered by such prospectus supplement.

General

We are not providing any

tax advice as to the acquisition, holding or disposition of the securities offered herein. Investors in our securities, particularly investors

who are not residents of the U.S., are strongly encouraged to consult their own tax advisor to determine the U.S. federal, state and any

applicable foreign tax consequences relating to their investment in our securities.

DESCRIPTION OF SECURITIES

The

descriptions of the securities contained in this prospectus, together with the applicable prospectus supplements, summarize the material

terms and provisions of the various types of securities that we may offer. We will describe in the applicable prospectus supplement the

particular terms of any securities offered by such prospectus supplement. If we so indicate in the

applicable prospectus supplement, the terms of the securities may differ from the terms we have summarized below.

We may sell from time to

time, in one or more offerings, Ordinary Shares, warrants, rights and units comprising any combination of these securities. The total

dollar amount of all securities that we may issue under this prospectus will not exceed $250,000,000.

DESCRIPTION OF LIFEZONE METALS ORDINARY SHARES

Voting Rights

Except as otherwise

specified in the memorandum and articles of association of Lifezone Metals (the “A&R Articles of Association”) or as required by

law or NYSE rules, holders of Ordinary Shares registered in the register of members of Lifezone Metals will vote as a single class.

Holders of Ordinary Shares shall at all times vote together on all resolutions submitted to a vote of the members. Voting at any

meeting of members is by show of hands unless a poll is demanded. A poll may be demanded by the chairperson of such meeting, at

least five members present in person or by proxy, or by a member or members present in person or by proxy representing not less than

one-tenth of the voting rights of all the members.

The holders of Ordinary Shares

are entitled to one vote per share on all matters to be voted on by shareholders. The A&R Articles of Association do not provide for

cumulative voting with respect to the election of directors. The Board is divided into three classes, each consisting initially of an

equal number of directors (to the extent feasible).

Transfer

All Ordinary Shares are issued

in registered form and may be freely transferred under the A&R Articles of Association, unless any such transfer is restricted or

prohibited by another instrument, the NYSE rules or applicable securities laws.

Under the A&R

Articles of Association, uncertificated Ordinary Shares that are listed on a recognized exchange may be transferred without the need

for a written instrument of transfer if the transfer is carried out in accordance with the laws, rules, procedures and other

requirements applicable to shares listed on the recognized exchange and subject to the A&R Articles of Association, the

Companies Act 2006 of the Isle of Man (the “IOM Companies Act”) and the Isle of Man Uncertificated Securities Regulations 2006.

Among other things, the

shareholders of LHL and certain key shareholders of GoGreen Investments Corporation and limited partners of the GoGreen Sponsor 1 LP

have agreed not to transfer their Ordinary Shares during a lock-up period following the consummation of the Business Combination.

Further, the shareholders of The Simulus Group Pty Limited receiving Ordinary Shares as consideration pursuant to the

acquisition by Lifezone Metals of all of the issued share capital of LHL in exchange for the issue to shareholders of LHL of

Ordinary Shares and, if applicable, earnout shares (the “Simulus Acquisition”), have agreed, pursuant to a Share Sale Agreement, dated July 3, 2023, not to transfer such Ordinary Shares during the applicable lock-up period following the consummation of the Simulus

Acquisition. Additionally, any Ordinary Shares and Lifezone Metals warrants received in the Business Combination by persons who are

or become affiliates of Lifezone Metals for purposes of Rule 144 under the Securities Act may be resold only in transactions

permitted by Rule 144, or as otherwise permitted under the Securities Act. Persons who may be deemed affiliates of Lifezone

Metals generally include individuals or entities that control, are controlled by or are under common control with, Lifezone Metals

and may include the directors and executive officers of Lifezone Metals, as well as its significant shareholders.

Purchase of Ordinary Shares by Lifezone Metals

The IOM Companies Act and the

A&R Articles of Association permit Lifezone Metals to purchase its own shares with the prior written consent of the relevant members,

or pursuant to an offer to all members, on such terms and in such manner as may be determined by the Board and by a resolution of directors

in accordance with the prescribed requirements of the IOM Companies Act.

Dividends and Distributions

Pursuant to the A&R Articles

of Association and the IOM Companies Act the Board may from time to time declare dividends and other distributions, and authorize payment

thereof, if the Board is satisfied that, in accordance with the IOM Companies Act, immediately after the payment of any such dividend

or distribution, (a) Lifezone Metals will be able to pay its debts as they become due in the normal course of its business and (b) the

value of Lifezone Metals’ assets will exceed the value of its liabilities. Each Lifezone Metals ordinary share has equal rights

with regard to dividends and to distributions of the surplus assets of Lifezone Metals, if any.

Other Rights

Under the A&R Articles

of Association, the holders of Ordinary Shares are not entitled to any pre-emptive rights or anti-dilution rights. Ordinary Shares are

not subject to any sinking fund provisions.

Issuance of Additional Shares

The A&R Articles of Association

authorize the Board to issue additional Ordinary Shares from time to time as the Board shall determine, subject to the IOM Companies Act

and the provisions, if any, in the A&R Articles of Association and, where applicable, the rules and regulations of any applicable

exchange, the SEC and/or any other competent regulatory authority and without prejudice to any rights attached to any existing shares.

However, under Isle of Man

law, Lifezone Metals’ directors may only exercise the rights and powers granted to them under the A&R Articles of Association

for a proper purpose and for what they believe in good faith to be in the best interests of Lifezone Metals.

Meetings of Shareholders

Under the A&R Articles

of Association, Lifezone Metals is required to hold an annual general meeting each year. The Board may call an annual general meeting

on not less than 21 clear days’ notice or an extraordinary general meeting upon not less than 14 clear days’ notice

unless such notice is waived in accordance with the A&R Articles of Association. A meeting notice must specify, among other things,

the place, day and time of the meeting and the general nature of the business to be conducted at such meeting. At any meeting of

Lifezone Metals shareholders, one or more shareholders entitled to attend and to vote on the business to be transacted and holding more

than 50% of the Ordinary Shares shall be a quorum. Subject to the requirements of the IOM Companies Act and Isle of Man law, only those

matters set forth in the notice of the general meeting or (solely in the case of a meeting convened upon a Members’ Requisition

(as defined below)) properly requested in connection with a Members’ Requisition may be considered or acted upon at a meeting of

Lifezone Metals shareholders.

Each general meeting, other

than an annual general meeting, shall be an extraordinary general meeting. Under the IOM Companies Act shareholders have the right to

require the directors to call an extraordinary general meetings of shareholders (a “Members’ Requisition”). To properly

call an extraordinary general meeting pursuant to a Members’ Requisition, (a) the request of shareholders representing not

less than 10% of the voting power represented by all issued and outstanding shares of Lifezone Metals in respect of the matter for which

such meeting is requested must be deposited at the registered office of Lifezone Metals and (b) the requisitioning shareholders must

comply with certain information requirements specified in the A&R Articles of Association.

In connection with any meeting

of shareholders, the right of a shareholder to bring other business or to nominate a candidate for election to the Board must be exercised

in compliance with the requirements of the A&R Articles of Association. Among other things, notice of such other business or nomination

must be received at the registered office of Lifezone Metals not later than the close of business on the date that is 120 days before,

and not earlier than the close of business on the date that is 150 days before, the one-year anniversary of the preceding year’s

annual general meeting, subject to certain exceptions.

Liquidation

On a liquidation or winding

up of Lifezone Metals assets available for distribution among the holders of Ordinary Shares shall be distributed among the holders of

the Ordinary Shares on a pro rata basis.

Inspection of Books and Records

Any director of Lifezone

Metals is entitled, on giving reasonable notice to Lifezone Metals, to inspect the documents and records maintained by Lifezone Metals

and to make copies of or take extracts from such documents and records.

A company is required to

keep at the office of its registered agent: its memorandum and articles of association of the company; the register of members or a copy

of the register of members; the register of directors or a copy of the register of directors; the register of charges (if any) or a copy

of the register of charges; copies of all notices and other documents filed by the company in the previous six years; originals or

copies of the accounting records required to be kept under the IOM Companies Act; and originals of any financial statements prepared.

Anti-Takeover Provisions

Some provisions of the A&R

Articles of Association may discourage, delay or prevent a change of control of Lifezone Metals or management that members may consider

favorable, including, among other things:

| ● | a classified board of directors with staggered, three-year terms; |

| ● | the ability of the Board to issue preferred shares and to determine

the price and other terms of those shares, including preferences and voting rights, potentially without shareholder approval; |

| ● | the limitation of liability of, and the indemnification of and advancement

of expenses to, members of the Board; |

| ● | advance notice procedures with which members must comply to nominate

candidates to the Board or to propose matters to be acted upon at an annual general meeting or extraordinary general meeting, which could

preclude members from bringing matters before an annual general meeting or extraordinary general meeting and delay changes in the Board; |

| ● | that members may not act by written consent in lieu of a meeting; |

| ● | the right of the Board to fill vacancies created by the expansion of

the Board or the resignation, death or removal of a director; and |

| ● | that the A&R Articles of Association may be amended only by the affirmative vote of the holders of

at least three-fourths of the votes cast at a general meeting. |

However, under Isle of Man

law, the directors of Lifezone Metals may only exercise the rights and powers granted to them under the IOM Companies Act for proper purposes

and for what they believe in good faith to be in the best interests of Lifezone Metals.

DESCRIPTION OF WARRANTS

We may issue warrants to

purchase our Ordinary Shares in one or more series together with other securities or separately, as described in the applicable prospectus

supplement. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent.

The warrant agent will act solely as our agent and will not assume any obligation or relationship of agency for or with holders or beneficial

owners of warrants. The terms of any warrants to be issued and a description of the material provisions of the applicable warrant agreement

will be set forth in the applicable prospectus supplement.

The applicable prospectus

supplement will describe the following terms of any warrants in respect of which this prospectus is being delivered:

| ● | the title of such warrants; |

| ● | the aggregate number of such warrants; |

| ● | the price or prices at which such warrants will be issued; |

| ● | the price at which, and the currency or currencies in which, the securities upon exercise of such warrants

may be purchased; |

| ● | the designation, amount and terms of the securities purchasable upon exercise of such warrants; |

| ● | the date on which the right to exercise such warrants shall commence and the date on which such right

shall expire; |

| ● | if applicable, the minimum or maximum amount of such warrants which may be exercised at any one time; |

| ● | if applicable, the designation and terms of the securities with which such warrants are issued and the

number of such warrants issued with each such security; |

| ● | if applicable, the date on and after which such warrants and the related securities will be separately

transferable; |

| ● | information with respect to book-entry procedures, if any; |

| ● | if applicable, any material Isle of Man and U.S. federal income tax considerations; |

| ● | the anti-dilution of such warrants, if any; and |

| ● | any other terms of such warrants, including terms, procedures and limitations relating to the exchange

and exercise of such warrants. |

DESCRIPTION OF RIGHTS

General

We

may issue rights to purchase any of our securities or any combination thereof. Rights may be issued independently or together with any

other offered security and may or may not be transferable by the person purchasing or receiving the rights. In connection with any rights

offering to our shareholders, we may enter into a standby underwriting arrangement with one or more underwriters pursuant to which such

underwriters will purchase any offered securities remaining unsubscribed for after such rights offering. We may also appoint a rights

agent that may act solely as our agent in connection with the rights that are sold. No such agent will assume any obligation or relationship

of agency or trust with any of the holders of the rights. In connection with a rights offering to our shareholders, we will distribute

certificates evidencing the rights and a prospectus supplement to our shareholders on the record date that we set for receiving rights

in such rights offering.

The

applicable prospectus supplement will describe the following terms of rights in respect of which this prospectus is being delivered:

| ● | the title of such rights; |

| ● | the securities for which such rights are exercisable; |

| ● | the exercise price for such rights; |

| ● | the number of such rights issues with respect to each ordinary share; |

| ● | the extent to which such rights are transferable; |

| ● | if applicable, a discussion of the material income tax considerations applicable to the issuance or exercise

of such rights; |

| ● | the date on which the right to exercise such rights shall commence, and the date on which such rights

shall expire (subject to any extension); |

| ● | the extent to which such rights include an over-subscription privilege with respect to unsubscribed securities; |

| ● | if applicable, the material terms of any standby underwriting or other purchase arrangement, or any agency

agreement, that we may enter into in connection with the rights offering; and |

| ● | any other terms of such rights, including terms, procedures and limitations relating to the exchange and

exercise of such rights. |

Exercise of Rights

Each right will entitle the

holder of the right to purchase for cash such securities or any combination thereof at such exercise price as shall in each case be set

forth in, or be determinable as set forth in, the prospectus supplement relating to the rights offered thereby. Rights may be exercised

at any time up to the close of business on the expiration date for such rights set forth in the prospectus supplement. After the close

of business on the expiration date, all unexercised rights will become void.

Rights may be exercised as

set forth in the prospectus supplement relating to the rights offered thereby. Upon receipt of payment and the rights certificate being

properly completed and duly executed at the corporate trust office of the rights agent or any other office indicated in the prospectus

supplement, we will forward, as soon as practicable, the securities purchasable upon such exercise. We may determine to offer any unsubscribed

offered securities directly to persons other than shareholders, to or through agents, underwriters or dealers or through a combination

of such methods, including pursuant to standby underwriting arrangements, as set forth in the applicable prospectus supplement.

DESCRIPTION OF UNITS

We may issue units consisting

of any combination of the other types of securities offered under this prospectus in one or more series. We may evidence each series of

units by unit certificates that we will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit

agent will be a bank or trust company that we select. We will indicate the name and address of the unit agent in the applicable prospectus

supplement relating to a particular series of units.

The following description,

together with the additional information included in any applicable prospectus supplement, summarizes the general features of the units

that we may offer under this prospectus. You should read any prospectus supplement and any free writing prospectus that we may authorize

to be provided to you related to the series of units being offered, as well as the complete unit agreements that contain the terms of

the units. Specific unit agreements will contain additional important terms and provisions and we will file as an exhibit to the registration

statement of which this prospectus is a part, or will incorporate by reference from another report that we file with the SEC, the form

of each unit agreement relating to units offered under this prospectus.

If we offer any units,

certain terms of that series of units will be described in the applicable prospectus supplement, including, without limitation, the following,

as applicable:

| ● | the title of the series of units; |

| ● | identification and description of the separate constituent securities comprising the units; |

| ● | the price or prices at which the units will be issued; |

| ● | the date, if any, on and after which the constituent securities comprising the units will be separately transferable; |

| ● | a discussion of certain United States and Isle of Man federal income tax considerations applicable to the units; and |

| ● | any other terms of the units and their constituent securities. |

PLAN OF DISTRIBUTION

We may sell the securities

to or through underwriters, through dealers or agents, directly to you or through a combination of these methods. The prospectus supplement

with respect to any offering of securities will describe the specific terms of the securities being offered, including:

| ● | the name or names of any underwriters; |

| ● | the purchase price, the proceeds from that sale and the expected use of such proceeds; |

| ● | any underwriting discounts and other items constituting underwriters’ compensation; |

| ● | any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers;

and |

| ● | any securities exchanges on which the securities may be listed. |

Through

Underwriters. If we use underwriters in the sale of the securities, the underwriters will acquire the offered securities for

their own account. We will execute an underwriting agreement with an underwriter or underwriters once an agreement for sale of the securities

is reached. The underwriters may resell the offered securities in one or more transactions, including negotiated transactions, at a fixed

public offering price or at varying prices determined at the time of sale. The underwriters may sell the offered securities directly or

through underwriting syndicates represented by managing underwriters. Unless otherwise stated in the prospectus supplement relating to

offered securities, the obligations of the underwriters to purchase those offered securities will be subject to certain conditions, and

the underwriters will be obligated to purchase all of those offered securities if they purchase any of them.

Through

Dealers. If we use a dealer to sell the securities, we will sell the offered securities to the dealer as principal. The dealer

may then resell those offered securities at varying prices determined at the time of resale. Any initial public offering price and any

discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

Through

Agents. If we use agents in the sale of securities, we may designate one or more agents to sell offered securities.

Directly

to Purchasers. We may sell the securities directly to one or more purchasers. In this case, no underwriters, dealers or agents

would be involved. We will describe the terms of our direct sales in our prospectus supplement.

At the Market Offering.

We may also sell equity securities covered by this registration statement in an “at the market” offering as defined in Rule

415(a)(4) under the Securities Act. Such offering may be made into an existing trading market for such securities in transactions

at other than a fixed price. Such “at the market” offerings, if any, may be conducted by underwriters acting as principal

or agent.

Selling Securityholders

We will not receive any proceeds

from any sale by the Selling Securityholders of the Ordinary Shares being registered hereunder. We will bear all costs, expenses and fees

in connection with the registration of the securities offered by this prospectus, whereas the Selling Securityholders will bear all incremental

selling expenses, including commissions, brokerage fees and other similar selling expenses.

The Selling Securityholders

may offer and sell, from time to time, some or all of the securities covered by this prospectus. As used herein, “Selling Securityholders”

means the persons listed in the tables in the section “Selling Securityholders.” We have registered the securities

covered by this prospectus for offer and sale so that those securities may be freely sold to the public by the Selling Securityholders.

Registration of the securities covered by this prospectus does not mean, however, that those securities necessarily will be offered or

resold by the Selling Securityholders.

Sales of the securities offered

hereby may be effected by the Selling Securityholders from time to time in one or more types of transactions (which may include block

transactions) on the NYSE at prevailing market prices, in negotiated transactions, through put or call options transactions relating to

the securities offered hereby, through short sales of the securities offered hereby, or a combination of such methods of sale. Such transactions

may or may not involve brokers or dealers. In effecting sales, brokers or dealers engaged by the Selling Securityholders may arrange for

other brokers or dealers to participate. Broker-dealer transactions may include purchases of the securities by a broker-dealer as principal

and resales of the securities by the broker-dealer for its account pursuant to this prospectus, ordinary brokerage transactions or transactions

in which the broker-dealer solicits purchasers. Such broker-dealers may receive compensation in the form of discounts, concessions or

commissions from the Selling Securityholders and/or the purchasers of the securities offered hereby for whom such broker-dealers may act

as agents or to whom they sell as principal, or both (which compensation as to a particular broker-dealer might be in excess of customary

commissions). Any broker-dealers participating in the distribution of the securities covered by this prospectus may be deemed to be “underwriters”

within the meaning of the Securities Act, and any commissions received by any of those broker-dealers may be deemed to be underwriting

commissions under the Securities Act.

There can be no assurance that

the Selling Securityholders will sell all or any of the securities offered by this prospectus. In addition, the Selling Securityholders

may also sell securities under Rule 144 under the Securities Act, if available, or in other transactions exempt from registration, rather

than under this prospectus. Rule 144 is not available for the resale of securities initially issued by shell companies or issuers that

have been at any time previously a shell company. However, Rule 144 also includes an important exception to this prohibition if the following

conditions are met: (i) the issuer of the securities that was formerly a shell company has ceased to be a shell company; (ii) the issuer

of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; (iii) the issuer of the securities

has filed all Exchange Act reports and materials required to be filed, as applicable, during the preceding 12 months (or such shorter

period that the issuer was required to file such reports and materials), other than current reports; and (iv) at least one year has elapsed

from the time that the issuer filed current Form 20-F type information with the SEC reflecting its status as an entity that is not a shell

company (which we filed with the SEC on July 11, 2023).

The Selling Securityholders

have the sole and absolute discretion not to accept any purchase offer or make any sale of securities if they deem the purchase price

to be unsatisfactory at any particular time.

Upon our being notified by

any Selling Securityholder that any material arrangement has been entered into with a broker-dealer for the sale of securities offered

hereby through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, a

supplement to this prospectus will be filed, if required, pursuant to Rule 424(b) under the Securities Act, disclosing:

| ● | the name of the participating broker-dealer(s); |

| ● | the specific securities involved; |

| ● | the initial price at which such securities are to be sold; |

| ● | the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable; and |

| ● | other facts material to the transaction. |

To the extent required, we

will use our best efforts to file one or more supplements to this prospectus to describe any material information with respect to the

plan of distribution not previously disclosed in this prospectus or any material change to such information.

Indemnification

We may indemnify underwriters,

dealers or agents who participate in the distribution of securities against certain liabilities, including liabilities under the Securities

Act and agree to contribute to payments which these underwriters, dealers or agents may be required to make.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling Lifezone Metals pursuant

to the foregoing provisions, Lifezone Metals has been informed that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act and is therefore unenforceable.

Expenses

The following table sets forth the expenses (other than underwriting

discounts and commissions or agency fees and other items constituting underwriters’ or agents’ compensation, if any) expected

to be incurred by us in connection with a possible offering of securities registered under this registration statement.

| | |

Amount | |

| SEC registration fee | |

$ | 44,355.98 | |

| FINRA filing fee | |

$ | 38,000 | |

| Printing and engraving expenses | |

| | * |

| Legal fees and expenses | |

| | * |

| Accounting fees and expenses | |

| | * |

| Miscellaneous costs | |

| | * |

| Total | |

| | * |

* To be provided by a prospectus

supplement or a Report on Form 6-K that is incorporated by reference into this prospectus for expenses incurred in connection with an

offering by us.

LEGAL

MAtters

The

validity of our ordinary shares offered by this prospectus relating to Isle of Man law will be passed upon for us by Appleby (Isle

of Man) LLC.

EXPERTS

The consolidated financial

statements of the Company as of December 31, 2023 and 2022, and for each of the three years in the period ended December 31, 2023, included

in this prospectus and elsewhere in the registration statement have been so included in reliance upon the reports of Grant Thornton Ireland,

independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

Sharron Sylvester, BSc (Geol),

RPGeo AIG (10125), Technical Director - Geology at OreWin Pty Ltd and Bernard Peters, BEng (Mining), FAusIMM (201743), Technical Director

- Mining at OreWin Pty Ltd. both prepared the TRS. Both individuals are Qualified Persons as defined in subpart 1300 of Regulation S-K

and are considered independent of Lifezone Metals.

As at the date hereof, none

of the above-named experts has received, or is to receive, in connection with the offering, an interest, direct or indirect, in Lifezone

Metals or its subsidiaries.

SERVICE

OF PROCESS AND ENFORCEABILITY OF CIVIL LIABILITIES UNDER U.S. SECURITIES LAWS

Lifezone Metals is an Isle

of Man company and substantially all of its assets and operations are located outside of the U.S. In addition, certain of Lifezone Metals’

directors and officers reside outside the U.S. As a result, it may be difficult for you to effect service of process within the U.S. or

elsewhere upon these persons. It may also be difficult for you to enforce in the jurisdictions in which Lifezone Metals operates or Isle

of Man courts judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal securities laws against Lifezone

Metals and its officers and directors, certain of whom are not residents in the U.S. and the substantial majority of whose assets are

located outside of the U.S. It may be difficult or impossible for you to bring an action against Lifezone Metals in the Isle of Man if

you believe your rights under the U.S. securities laws have been infringed. In addition, there is uncertainty as to whether the courts

of the Isle of Man or jurisdictions in which Lifezone Metals operates would recognize or enforce judgments of U.S. courts against Lifezone

Metals or such persons predicated upon the civil liability provisions of the securities laws of the U.S. or any state and it is uncertain

whether such Isle of Man or courts in jurisdictions in which Lifezone Metals operates would hear original actions brought in the Isle

of Man or jurisdictions in which Lifezone Metals operates against Lifezone Metals or such persons predicated upon the securities laws

of the U.S. or any state.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus is part of

the registration statement on Form F-3 we filed with the SEC under the Securities Act with respect to the securities offered by this prospectus.

However, as is permitted by the rules and regulations of the SEC, this prospectus, which is part of our registration statement on Form

F-3, omits certain information, exhibits, and undertakings set forth in the registration statement. For further information about us,

the securities offered by this prospectus. Please refer to the registration statements and exhibits filed as a part of the registration

statement.

We are subject to certain of

the informational filing requirements of the Exchange Act. As a foreign private issuer, we are not subject to all of the disclosure requirements

applicable to public companies organized within the United States. For example, we are exempt from certain rules under the Exchange Act

that regulate disclosure obligations and procedural requirements related to the solicitation of proxies, consents or authorizations applicable

to a security registered under the Exchange Act, including the U.S. proxy rules under Section 14 of the Exchange Act. In addition, our

officers and directors are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange

Act and related rules with respect to their purchases and sales of our securities. Moreover, we are not required to file periodic reports

and financial statements with the SEC as frequently or as promptly as U.S. public companies and are not required to file quarterly reports

on Form 10-Q or current reports on Form 8-K under the Exchange Act.

The SEC maintains a website

at http://www.sec.gov that contains reports and other information that we file with or furnish electronically with the SEC. You

may also find such documents on our website at http://www.lifezonemetals.com. The information on our website is not incorporated

by reference into this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We file annual and special

reports and other information with the SEC (File Number 001-41737). These filing contain important information which does not appear in

this prospectus. The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can

disclose important to you by referring you to other documents which we have filed or furnished with the SEC. We are incorporating by reference

in this prospectus the documents listed below:

| ● | Our Annual Report on Form 20-F for the fiscal year ended on December 31, 2023, filed with the SEC on April 1, 2024; |

| ● | Our Form 6-K for the month of May 2024 disclosing certain information about the first quarter of 2024, furnished to the SEC on May 13, 2024; |

| ● | Our Form 6-K for the month of May 2024 reporting materials relating to our 2024 annual meeting of shareholders, furnished to the SEC on May 24, 2024; and |

| ● | The description of the ordinary shares contained in our registration statement on Form 8-A, as filed with the SEC on July 5, 2023, including any subsequent amendment or any report filed for the purpose of updating such description. |

All subsequent annual reports

filed by us pursuant to the Exchange Act on Form 20-F prior to the termination of an offering shall be deemed to be incorporated by reference

into this prospectus and to be a part hereof from the date of the filing of such documents. We may also incorporate part of all of any

Form 6-K subsequently submitted by us to the SEC prior to the termination of an offering by identifying in such Forms 6-K that they, or

certain parts of their contents, are being incorporated by reference herein, and any Forms 6-K so identified shall be deemed to be incorporated

by reference in this prospectus and to be a part hereof from the date of submission of such documents. Any statement contained in a document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be

incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this prospectus.

We will provide each person,

including any beneficial owner to whom a prospectus is delivered, without charge, upon a written or oral request, a copy of any of the

documents incorporated by reference in this prospectus, other than exhibits to such documents which are not specifically incorporated

by reference into such documents. Written or telephone requests should be directed to: Lifezone Metals Limited, Investor Relations:- info@lifezonemetals.com

or +44 (0)1624 811 603.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 8. Indemnification

of Directors and Officers

Subject to the provisions of

the Isle Of Man Companies Act, the Amended and Restated Memorandum and Articles of Association of Lifezone Metals provide that Lifezone

Metals shall indemnify each of its directors and officers (including former directors and officers) out of its assets, to the fullest

extent permissible under the laws of the Isle of Man, against any liability, action, proceeding, claim, demand, costs, damages or expenses,

including legal expenses, whatsoever, which any of those directors or officers may incur as a result of any act or failure to act in carrying

out their functions unless that liability arises through their actual fraud or willful default. The Isle Of Man Companies Act permits

the indemnification of directors and officers provided that such person acted honestly and in good faith and in what such person believed

to be in the best interests of the company and, in the case of criminal proceedings, had no reasonable cause to believe that the conduct

of such person was unlawful.

Costs and expenses, including

reasonable attorneys’ fees, incurred by a director or officer in connection with the defense of any action, suit, proceeding or

investigation involving them may be paid by Lifezone Metals in advance of the final disposition of such proceedings upon receipt of an

undertaking by or on behalf of the director or officer to repay the amount if it shall be determined by final judgment that the director

is not entitled to be indemnified by Lifezone Metals in accordance with its Amended and Restated Memorandum and Articles of Association.

The indemnification and advancement

of expenses provided by, or granted pursuant to, the Amended and Restated Memorandum and Articles of Association of Lifezone Metals is

not exclusive of any other rights to which the person seeking indemnification or advancement of expenses may be entitled.

The directors, on behalf of

Lifezone Metals, may purchase and maintain insurance for the benefit of any current or former director or other officer of Lifezone Metals

against any liability which, by virtue of any rule of law, would otherwise attach to such person in respect of any negligence, default,

breach of duty or breach of trust of which such person may be guilty in relation to Lifezone Metals.

In addition, Lifezone Metals

has purchased and intends to maintain standard policies of insurance under which coverage is provided to its directors and officers against