Second Quarter 2006 Highlights: HOUSTON, Aug. 3

/PRNewswire-FirstCall/ -- Natural Resource Partners L.P.

(NYSE:NRPNYSE:andNYSE:NYSE:NYSE:NSP) today reported net income of

$25.0 million for the second quarter 2006, equaling the $25.0

million reported for the same period in 2005. While net income was

the same over the two periods, net income per unit slightly

decreased from $0.92 in the 2005 period to $0.86 for the second

quarter 2006 as a result of NRP allocating more income to the

general partner and the holders of the incentive distribution

rights. Distributable cash flow for the second quarter this year

rose 4% to $30.2 million, up from $29.1 million a year ago. For the

first six months of 2006, NRP reported net income of $53.6 million,

an 18% increase over the $45.4 million reported for the same period

last year, while net income per unit rose 11% to $1.87 per unit

from $1.69 per unit for the six month periods. Distributable cash

flow rose 22% to $64.5 million from $52.8 million in 2005.

"Following an exceptional first quarter, our lessees performed as

expected this quarter," said Chief Operating Officer Nick Carter.

"These variations from quarter to quarter are typical as our

lessees move on and off of our property. In addition, as we have

stated in previous announcements, we don't expect to see the full

impact of some our recent acquisitions until 2007." Second Quarter

2006 Financial Results As forecasted, second quarter revenues

decreased slightly to $41.0 million from $41.7 million for the same

period last year. Production decreased by 0.7 million tons to 13.4

million tons from the same period last year due to several of our

lessees producing a larger percentage of coal from adjacent

properties rather than NRP properties. Average coal royalty

revenues per ton increased slightly to $2.73 from $2.69, partially

offsetting the decreased production. Coal royalty revenues

decreased $1.5 million to $36.5 million over the second quarter

2005. Other revenues increased by $0.7 million to $1.6 million

including $0.5 million, or $0.02 per unit, associated with the gain

on the sale of some timber assets. Total second quarter 2006

expenses decreased approximately 10% to $13.0 million from the

$14.5 million reported in the second quarter last year.

Depreciation, depletion and amortization was $1.4 million lower

primarily due to lower production. Year-to-date Financial Results

NRP's total revenues increased 12% to $87.5 million for the first

six months from $77.9 million for 2005. Year-to-date 2006 coal

royalty revenues rose 7% to $75.6 million compared to $70.5 million

in 2005. This increase results from both a 5% increase in average

per ton royalty revenue to $2.76 and a slight increase in

production to 27.4 million tons. Appalachian production decreased

1%, while Illinois Basin and Northern Powder River Basin production

increased approximately 31% and 11%, respectively. For the first

six months of 2006, approximately 28% of NRP's coal royalty

revenues and 22% of its production were from metallurgical coal,

which is normally priced higher than steam coal. Other revenue rose

$4.4 million, or 59%, to $11.9 million primarily due to gains on

two timber sales totaling $2.6 million, or $0.09 per unit, and a

$1.6 million, or 136%, increase in oil and gas income due to

increased production. Total expenses were essentially flat with

2005 at $27.9 million for 2006 versus $28.1 million. Depreciation,

depletion and amortization decreased 8% as a result of lower

production and lower depletion rates. General and administrative

expenses increased 15% or $1.0 million over last year primarily due

to increased costs associated with managing a larger number of

properties and incentive compensation accruals. Property, franchise

and other taxes increased $0.5 million due to franchise taxes in

additional states in which the partnership now operates.

Distributions; Expected Conversion of NSP Units On July 19, 2006,

NRP announced its twelfth consecutive increase in its quarterly

distribution, raising the distribution to $0.82 per unit, or $3.28

per unit on an annualized basis, for both NRP and NSP. This

represents a 15% increase in Natural Resource Partners'

distributions compared to the second quarter of 2005. This

distribution will be paid on August 14 to holders of record on

August 1. Following the payment of the next distribution in

November with respect to the third quarter, NRP expects that

approximately one-third of the currently outstanding subordinated

units that trade under the ticker symbol "NSP" will convert into

common units and begin trading under the "NRP" ticker symbol.

Strong Balance Sheet During the second quarter, NRP further

strengthened its balance sheet. NRP paid $13.65 million of

scheduled principal and interest payments, $16.44 million for

acquisitions, $22.3 million in distributions and still has a cash

balance of approximately $53 million and a debt to total

capitalization ratio of 36%. 2006 Guidance With six months of

actual results, NRP is reiterating its overall 2006 guidance. NRP

anticipates announcing full year results within the framework of

the previously announced ranges. While NRP is forecasting

production to be at the lower end of its previously announced

range, revenues, net income and distributable cash flow are

anticipated to be at the upper end of the ranges announced on

January 19. Natural Resource Partners L.P. is headquartered in

Houston, TX, with its operations headquarters in Huntington, WV.

NRP is a master limited partnership that is principally engaged in

the business of owning and managing coal properties in the three

major coal producing regions of the United States: Appalachia, the

Illinois Basin and the Powder River Basin. For additional

information, please contact Kathy Hager at 713-751-7555 or .

Further information about NRP is available on the partnership's

website at http://www.nrplp.com/ . Forward Looking Statements This

press release may include "forward-looking statements" as defined

by the Securities and Exchange Commission. All statements, other

than statements of historical facts, included in this press release

that address activities, events or developments that the

partnership expects, believes or anticipates will or may occur in

the future are forward-looking statements. Such statements include

comments regarding growth of the partnership and increases in

distributions. These statements are based on certain assumptions

made by the partnership based on its experience and perception of

historical trends, current conditions, expected future developments

and other factors it believes are appropriate in the circumstances.

Such statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the

partnership. These risks include, but are not limited to, decreases

in demand for coal; changes in operating conditions and costs;

production cuts by our lessees; commodity prices; unanticipated

geologic problems; changes in the legislative or regulatory

environment and other factors detailed in Natural Resource

Partners' Securities and Exchange Commission filings. Natural

Resource Partners L.P. has no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise. Disclosure of Non-GAAP

Financial Measures Distributable cash flow represents cash flow

from operations less actual principal payments and cash reserves

set aside for scheduled principal payments on the senior notes.

Distributable cash flow is a "non-GAAP financial measure" that is

presented because management believes it is a useful adjunct to net

cash provided by operating activities under GAAP. Distributable

cash flow is a significant liquidity metric that is an indicator of

NRP's ability to generate cash flows at a level that can sustain or

support an increase in quarterly cash distributions paid to its

partners. Distributable cash flow is also the quantitative standard

used throughout the investment community with respect to publicly

traded partnerships. Distributable cash flow is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flows from operating, investing or financing

activities. A reconciliation of distributable cash flow to net cash

provided by operating activities is included in the tables attached

to this release. Distributable cash flow may not be calculated the

same for NRP as other companies. Natural Resource Partners L.P.

Operating Statistics (In thousands except per ton data) (Unaudited)

Three months ended Six months ended June 30, June 30, 2006 2005

2006 2005 Coal royalty revenues: Appalachia Northern $2,730 $2,105

$6,038 $4,569 Central 24,543 25,894 50,385 48,072 Southern 5,133

6,346 10,617 11,357 Total Appalachia $32,406 $ 34,345 $67,040

$63,998 Illinois Basin 1,704 1,093 3,656 2,400 Northern Powder

River Basin 2,417 2,519 4,941 4,089 Total $36,527 $ 37,957 $75,637

$70,487 Coal royalty production (tons): Appalachia Northern 1,482

1,108 3,214 2,416 Central 7,982 8,958 16,176 17,197 Southern 1,436

1,675 2,862 2,999 Total Appalachia 10,900 11,741 22,252 22,612

Illinois Basin 977 707 2,140 1,574 Northern Powder River Basin

1,497 1,665 2,998 2,697 Total 13,374 14,113 27,390 26,883 Average

royalty revenue per ton: Appalachia Northern $1.84 $1.90 $1.88

$1.89 Central 3.07 2.89 3.11 2.80 Southern 3.58 3.79 3.71 3.79

Total Appalachia 2.97 2.93 3.01 2.83 Illinois Basin 1.74 1.55 1.71

1.52 Northern Powder River Basin 1.61 1.51 1.65 1.52 Total $2.73

$2.69 $2.76 $2.62 Natural Resource Partners L.P. Consolidated

Statements of Income (In thousands, except per unit data)

(Unaudited) Three months ended Six months ended June 30, June 30,

2006 2005 2006 2005 Revenues: Coal royalties $36,527 $37,957

$75,637 $ 70,487 Oil and gas royalties 928 610 2,647 1,070 Property

taxes 1,546 1,547 3,295 2,981 Minimums recognized as revenue 250

481 621 934 Override royalties 181 209 484 824 Other 1,550 893

4,826 1,648 Total revenues 40,982 41,697 87,510 77,944 Operating

costs and expenses: Depreciation, depletion and amortization 7,236

8,625 15,089 16,504 General and administrative 3,420 3,162 7,535

6,474 Property, franchise and other taxes 2,099 1,954 4,344 3,784

Coal royalty and override payments 263 745 954 1,298 Total

operating costs and expenses 13,018 14,486 27,922 28,060 Income

from operations 27,964 27,211 59,588 49,884 Other income (expense)

Interest expense (3,675) (2,570) (7,293) (5,027) Interest income

755 331 1,273 562 Net income $25,044 $24,972 $53,568 $ 45,419 Net

income attributable to: (A) General partner $2,253 $1,155 $4,348

$1,985 Holders of incentive distribution rights $943 $353 $1,764

$580 Limited partners $21,848 $23,464 $ 47,456 $ 42,854 Basic and

diluted net income per limited partner unit: Common $0.86 $0.92

$1.87 $1.69 Subordinated $0.86 $0.92 $1.87 $1.69 Weighted average

number of units outstanding: Common 16,825 13,987 16,825 13,987

Subordinated 8,515 11,354 8,515 11,354 (A) Net income is allocated

among the limited partners, the general partner and holders of the

incentive distribution rights (IDRs) based upon their pro rata

share of distributions. The IDRs are allocated 65% to the general

partner and the remaining 35% to affiliates of the general partner.

The IDRs allocated to the general partner are included in the net

income attributable to the general partner. Natural Resource

Partners L.P. Statements of Cash Flows (In thousands) (Unaudited)

Three months ended Six months ended June 30, June 30, 2006 2005

2006 2005 Cash flows from operating activities: Net income $25,044

$24,972 $53,568 $45,419 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation, depletion and

amortization 7,236 8,625 15,089 16,504 Non-cash interest charge 91

54 191 125 Gain from sale of assets (458) --- (2,634) --- Change in

operating assets and liabilities: Accounts receivable (103) (979)

(107) (3,369) Other assets (25) 351 243 601 Accounts payable (57)

161 (20) (124) Accrued interest (689) (2,078) 1,217 169 Deferred

revenue 1,040 (176) 408 (2,331) Accrued incentive plan expenses

1,139 1,219 1,510 1,224 Property, franchise and other taxes payable

(708) (771) (305) (770) Net cash provided by operating activities

32,510 31,378 69,160 57,448 Cash flows from investing activities:

Acquisition of land, plant and equipment, coal and other mineral

rights (16,438) --- (51,438) (21,544) Proceeds from sale of assets

829 --- 4,761 --- Net cash used in investing activities (15,609)

--- (46,677) (21,544) Cash flows from financing activities:

Proceeds from loans --- --- 50,000 18,000 Repayments of loans

(9,350) (9,350) (24,350) (9,350) Distributions to partners (22,299)

(18,371) (43,204) (35,897) Net cash used in financing activities

(31,649) (27,721) (17,554) (27,247) Net (decrease) or increase in

cash and cash equivalents (14,748) 3,657 4,929 8,657 Cash and cash

equivalents at beginning of period 67,368 47,103 47,691 42,103 Cash

and cash equivalents at end of period $52,620 $50,760 $52,620

$50,670 SUPPLEMENTAL INFORMATION: Cash paid during the period for

interest $4,261 $4,575 $5,861 $4,712 Natural Resource Partners L.P.

Consolidated Balance Sheets (In thousands, except for unit

information) ASSETS June 30, Dec. 31, 2006 2005 (Unaudited) Current

assets: Cash and cash equivalents $52,620 $47,691 Accounts

receivable 22,051 21,946 Accounts receivable - affiliate 8 6 Other

590 833 Total current assets 75,269 70,476 Land 12,436 14,123 Plant

and equipment, net 5,760 5,924 Coal and other mineral rights, net

626,858 590,459 Loan financing costs, net 2,266 2,431 Other assets,

net 1,257 1,583 Total assets $723,846 $684,996 LIABILITIES AND

PARTNERS' CAPITAL Current liabilities: Accounts payable $659 $677

Accounts payable - affiliate 86 88 Current portion of long-term

debt 9,350 9,350 Accrued incentive plan expenses - current portion

4,763 1,105 Property, franchise and other taxes payable 3,833 4,138

Accrued interest 2,751 1,534 Total current liabilities 21,442

16,892 Deferred revenue 15,259 14,851 Accrued incentive plan

expenses 3,247 5,395 Long-term debt 247,600 221,950 Partners'

capital: Common units (outstanding: 16,825,307) 298,190 292,990

Subordinated units (outstanding: 8,515,228) 126,029 123,114 General

partner's interest 11,559 10,024 Holders of incentive distribution

rights 1,296 582 Accumulated other comprehensive loss (776) (802)

Total partners' capital 436,298 425,908 Total liabilities and

partners' capital $723,846 $684,996 Natural Resource Partners L.P.

Reconciliation of GAAP "Net cash provided by operating activities"

To Non-GAAP "Distributable cash flow" (In thousands) (Unaudited)

Three months ended Six months ended June 30, June 30, 2006 2005

2006 2005 Cash flow from operations $32,510 $31,378 $69,160 $57,448

Less scheduled principal payments (9,350) (9,350) (9,350) (9,350)

Less reserves for future principal payments (2,350) (2,350) (4,700)

(4,700) Add reserves used for scheduled principal payments 9,400

9,400 9,400 9,400 Distributable cash flow $30,210 $29,078 $64,510

$52,798 http://www.newscom.com/cgi-bin/prnh/20060109/NRPLOGO

http://photoarchive.ap.org/ DATASOURCE: Natural Resource Partners

L.P. CONTACT: Kathy Hager of Natural Resource Partners L.P.,

+1-713-751-7555, or Web site: http://www.nrplp.com/

Copyright

Insperity (NYSE:NSP)

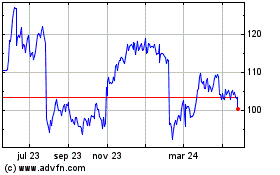

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

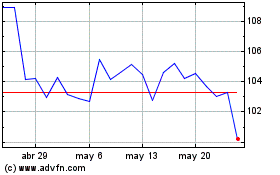

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024