FALSE000188031900018803192024-08-012024-08-010001880319us-gaap:CommonStockMember2024-08-012024-08-010001880319us-gaap:WarrantMember2024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

PERIMETER SOLUTIONS, SA

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Grand Duchy of Luxembourg | | 001-41027 | | 98-1632942 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS. Employer Identification No.) |

12E rue Guillaume Kroll, L-1882 Luxembourg

Grand Duchy of Luxembourg

352 2668 62-1

(Address of principal executive offices, including zip code)

(314) 396-7343

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary Shares, nominal value $1.00 per share | | PRM | | New York Stock Exchange |

| Warrants for Ordinary Shares | | PRMFF | | OTC Markets Group Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, Perimeter Solutions, SA issued a press release announcing its financial results for its fiscal quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1.

The information furnished under this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

The following exhibit is being furnished as part of this Current Report on Form 8-K.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Perimeter Solutions, SA |

| | |

Date: August 1, 2024 | By: | /s/ Kyle Sable |

| | Kyle Sable |

| | Chief Financial Officer |

Perimeter Solutions Reports Second Quarter 2024 Financial Results

August 1, 2024

Strong Q2 and YTD financial results in both Fire Safety and Specialty Products

Improvements driven by rigorous operational value drivers implementation, as well as supportive demand backdrops, in both businesses

Actively supporting our customers' life-saving missions during the 2024 fire season

Clayton, Missouri, August 1, 2024 – Perimeter Solutions, SA (NYSE: PRM) ("Perimeter" or the "Company"), a leading provider of mission-critical firefighting products and services, as well as high-quality phosphorus-based specialty chemicals, today reported financial results for its second quarter ended June 30, 2024.

Second Quarter 2024 Results

•Net sales increased 67% to $127.3 million in the second quarter, as compared to $76.1 million in the prior year quarter.

•Fire Safety sales increased 85% to $98.5 million, as compared to $53.1 million in the prior year quarter.

•Specialty Products sales increased 25% to $28.7 million, as compared to $23.0 million in the prior year quarter.

•Net Income during the second quarter was $21.7 million, or $0.14 per diluted share, a decrease of $30.3 million from net income of $52.0 million, or $0.31 per diluted share in the prior year quarter.

•Adjusted EBITDA increased 209% to $64.9 million in the second quarter, as compared to $21.0 million in the prior year quarter.

•Fire Safety Adjusted EBITDA increased 237% to $55.6 million, as compared to $16.5 million in the prior year quarter.

•Specialty Products Adjusted EBITDA increased 108% to $9.3 million, as compared to $4.5 million in the prior year quarter.

Year-to-Date 2024 Results

•Net sales increased 55% to $186.3 million during the year-to-date period, as compared to $120.0 million in the prior-year period.

•Fire Safety sales increased 72% to $123.7 million, as compared to $71.9 million in the prior year period.

•Specialty Products sales increased 30% to $62.6 million, as compared to $48.1 million in the prior year period.

•Net loss during the year-to-date period was $60.9 million, or $0.42 per diluted share, an increase of $122.3 million from a net income of $61.4 million, or $0.36 per diluted share in the prior year period.

•Adjusted EBITDA increased 220% to $77.0 million in the year-to-date period, as compared to $24.1 million in the prior year period.

•Fire Safety Adjusted EBITDA increased 321% to $55.4 million, as compared to $13.2 million in the prior year period.

•Specialty Products Adjusted EBITDA increased 98% to $21.6 million, as compared to $10.9 million in the prior year period.

Conference Call and Webcast

As previously announced, Perimeter Solutions management will hold a conference call at 8:30 a.m. ET on Thursday, August 1, 2024 to discuss financial results for the second quarter 2024. The conference call can be accessed by dialing (877) 407-9764 (toll-free) or (201) 689-8551 (toll).

The conference call will also be webcast simultaneously on Perimeter's website (https://ir.perimeter-solutions.com), accessed under the Investor Relations page. The webcast link will be made available on the Company's website prior to the start of the call; go to the investor relations page of our website to the News & Events menu and click on "Events & Presentations."

A slide presentation will also be available for reference during the conference call; go to the investor relations page of our website to the News & Events menu and click on "Events & Presentations."

Following the live webcast, a replay will be available on the Company's website. A telephonic replay will also be available approximately two hours after the call and can be accessed by dialing (877) 660-6853 (toll-free) or (201) 612-7415 (toll). The telephonic replay will be available until August 31, 2024.

About Perimeter Solutions

Perimeter Solutions is a leading global solutions provider, providing high-quality firefighting products and phosphorus-based specialty chemicals. The Company's business is organized and managed in two reporting segments: Fire Safety and Specialty Products.

The Fire Safety business consists of formulating, manufacture and sale of fire retardants and firefighting foams that assist in combating various types of fires, including wildland, structural, flammable liquids and others. Our Fire Safety business also offers specialized equipment and services, typically in conjunction with our fire management products, to support our customers' firefighting operations. Our specialized equipment includes airbase retardant storage, mixing, and delivery equipment; mobile retardant bases; retardant ground application units; mobile foam equipment; and equipment that we custom design and manufacture to meet specific customer needs. Our service network can meet the emergency resupply needs of over 150 air tanker bases in North America, as well as many other customer locations in North America and internationally. The segment is built on the premise of superior technology, exceptional responsiveness to our customers' needs, and a "never-fail" service network. The segment sells products to government agencies and commercial customers around the world.

The Specialty Products business produces and sells high quality Phosphorus Pentasulfide ("P2S5") primarily used in the preparation of lubricant additives, including a family of compounds called Zinc Dialkyldithiophosphates (“ZDDP”) that provide critical anti-wear protection to engine components. P2S5 is also used in pesticide and mining chemicals applications.

Forward-looking Information

This press release may contain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will,” and similar references to future periods.

Any such forward-looking statements are not guarantees of performance or results, and involve risks, uncertainties (some of which are beyond the Company's control) and assumptions. Although Perimeter believes any forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect Perimeter's actual financial results and cause them to differ materially from those anticipated in any forward-looking statements, including the risk factors described from time to time by us in our filings with the Securities and Exchange Commission ("SEC"), including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 22, 2024. Shareholders, potential investors and other readers should consider these factors carefully in evaluating the forward-looking statements.

Any forward-looking statement made by Perimeter in this press release speaks only as of the date on which it is made. Perimeter undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

SOURCE: Perimeter Solutions, SA.

CONTACT: ir@perimeter-solutions.com

PERIMETER SOLUTIONS, SA AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| 2024 | | 2023 | | 2024 | 2023 | | | | |

| Net sales | $ | 127,276 | | | $ | 76,137 | | | $ | 186,320 | | $ | 119,995 | | | | | |

| Cost of goods sold | 54,009 | | | 46,811 | | | 92,351 | | 80,271 | | | | | |

| Gross profit | 73,267 | | | 29,326 | | | 93,969 | | 39,724 | | | | | |

| Operating expenses: | | | | | | | | | | |

| Selling, general and administrative expense | 13,906 | | | 12,226 | | | 27,368 | | 20,243 | | | | | |

| Amortization expense | 13,755 | | | 13,771 | | | 27,526 | | 27,534 | | | | | |

| Founders advisory fees - related party | 588 | | | (60,026) | | | 68,921 | | (84,262) | | | | | |

| Other operating expense | — | | | 8 | | | — | | 10 | | | | | |

| Total operating expenses | 28,249 | | | (34,021) | | | 123,815 | | (36,475) | | | | | |

| Operating income (loss) | 45,018 | | | 63,347 | | | (29,846) | | 76,199 | | | | | |

| Other expense (income): | | | | | | | | | | |

| Interest expense, net | 10,590 | | | 10,344 | | | 21,238 | | 20,490 | | | | | |

| Loss on contingent earn-out | — | | | 146 | | | — | | 392 | | | | | |

| Foreign currency loss (gain) | 224 | | | 93 | | | 1,517 | | (628) | | | | | |

| Other expense, net | 74 | | | 17 | | | 101 | | 89 | | | | | |

| Total other expense, net | 10,888 | | | 10,600 | | | 22,856 | | 20,343 | | | | | |

| Income (loss) before income taxes | 34,130 | | | 52,747 | | | (52,702) | | 55,856 | | | | | |

| Income tax (expense) benefit | (12,480) | | | (733) | | | (8,206) | | 5,589 | | | | | |

| Net income (loss) | 21,650 | | | 52,014 | | | (60,908) | | 61,445 | | | | | |

| Other comprehensive income (loss), net of tax: | | | | | | | | | | |

| Foreign currency translation adjustments | (989) | | | 2,215 | | | (6,532) | | 3,808 | | | | | |

| Total comprehensive income (loss) | $ | 20,661 | | | $ | 54,229 | | | $ | (67,440) | | $ | 65,253 | | | | | |

| Earnings (loss) per share: | | | | | | | | | | |

| Basic | $ | 0.15 | | | $ | 0.33 | | | $ | (0.42) | | $ | 0.39 | | | | | |

| Diluted | $ | 0.14 | | | $ | 0.31 | | | $ | (0.42) | | $ | 0.36 | | | | | |

| Weighted average number of ordinary shares outstanding: | | | | | | | | | | |

| Basic | 145,236,526 | | | 156,525,006 | | | 145,279,938 | | 157,109,418 | | | | | |

| Diluted | 154,664,770 | | | 168,310,311 | | | 145,279,938 | | 168,894,723 | | | | | |

| | | | | | | | | | |

PERIMETER SOLUTIONS, SA AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Assets | (Unaudited) | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 43,162 | | | $ | 47,276 | |

| Accounts receivable, net | 96,321 | | | 39,593 | |

| Inventories | 142,172 | | | 145,652 | |

| Prepaid expenses and other current assets | 13,662 | | | 18,493 | |

| Total current assets | 295,317 | | | 251,014 | |

| Property, plant, and equipment, net | 59,369 | | | 59,402 | |

| Operating lease right-of-use assets | 15,446 | | | 16,339 | |

| Finance lease right-of-use assets | 6,553 | | | 6,064 | |

| Goodwill | 1,030,180 | | | 1,036,279 | |

| Customer lists, net | 653,472 | | | 674,786 | |

| Technology and patents, net | 173,456 | | | 180,653 | |

| Tradenames, net | 86,745 | | | 89,568 | |

| Other assets, net | 1,092 | | | 1,317 | |

| Total assets | $ | 2,321,630 | | | $ | 2,315,422 | |

| Liabilities and Shareholders Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 21,805 | | | $ | 21,639 | |

| Accrued expenses and other current liabilities | 42,991 | | | 30,710 | |

| Founders advisory fees payable - related party | 9,129 | | | 2,702 | |

| Deferred revenue | 7,927 | | | — | |

| Total current liabilities | 81,852 | | | 55,051 | |

| Long-term debt, net | 667,125 | | | 666,494 | |

| Operating lease liabilities, net of current portion | 14,068 | | | 14,908 | |

| Finance lease liabilities, net of current portion | 6,063 | | | 5,547 | |

| Deferred income taxes | 247,809 | | | 253,454 | |

| Founders advisory fees payable - related party | 116,708 | | | 56,917 | |

| Redeemable preferred shares | 107,862 | | | 105,799 | |

| Redeemable preferred shares - related party | 2,818 | | | 2,764 | |

| Other liabilities | 2,151 | | | 2,193 | |

| Total liabilities | 1,246,456 | | | 1,163,127 | |

| Commitments and contingencies | | | |

| Shareholders' equity: | | | |

Ordinary shares, $1 nominal value per share, 4,000,000,000 shares authorized; 166,824,659 and 165,066,195 shares issued; 145,221,577 and 146,451,005 shares outstanding at June 30, 2024 and December 31, 2023, respectively | 166,825 | | | 165,067 | |

Treasury shares, at cost; 21,603,082 and 18,615,190 shares at June 30, 2024 and December 31, 2023, respectively | (127,824) | | | (113,407) | |

| Additional paid-in capital | 1,704,141 | | | 1,701,163 | |

| Accumulated other comprehensive loss | (26,242) | | | (19,710) | |

| Accumulated deficit | (641,726) | | | (580,818) | |

| Total shareholders' equity | 1,075,174 | | | 1,152,295 | |

| Total liabilities and shareholders' equity | $ | 2,321,630 | | | $ | 2,315,422 | |

PERIMETER SOLUTIONS, SA AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, 2024 |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net (loss) income | $ | (60,908) | | | $ | 61,445 | |

| Adjustments to reconcile net (loss) income to net cash provided by (used in) operating activities: | | | |

| Founders advisory fees - related party (change in fair value) | 68,921 | | | (84,262) | |

| Depreciation and amortization expense | 32,771 | | | 32,217 | |

| Interest and payment-in-kind on preferred shares | 3,528 | | | 3,396 | |

| Share-based compensation | 4,736 | | | (1,879) | |

| Non-cash lease expense | 2,622 | | | 2,271 | |

| Deferred income taxes | (4,756) | | | (11,076) | |

| | | |

| Amortization of deferred financing costs | 856 | | | 824 | |

| Loss on contingent earn-out | — | | | 392 | |

| Foreign currency loss (gain) | 1,517 | | | (628) | |

| Loss on disposal of assets | 9 | | | 20 | |

| Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (57,319) | | | (35,640) | |

| Inventories | 2,681 | | | (19,963) | |

| Prepaid expenses and current other assets | (126) | | | 1,260 | |

| Accounts payable | 277 | | | (4,744) | |

| Deferred revenue | 7,927 | | | 2,653 | |

| Income taxes payable, net | 8,635 | | | (10,479) | |

| Accrued expenses and other current liabilities | 5,237 | | | (1,805) | |

| Founders advisory fees - related party (cash settled) | (2,702) | | | (4,655) | |

| Operating lease liabilities | (1,629) | | | (2,263) | |

| Financing lease liabilities | (262) | | | (67) | |

| Other, net | (597) | | | 47 | |

| Net cash provided by (used in) operating activities | 11,418 | | | (72,936) | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (5,196) | | | (4,375) | |

| Proceeds from short-term investments | 5,383 | | | — | |

| | | |

| Net cash provided by (used in) investing activities | 187 | | | (4,375) | |

| Cash flows from financing activities: | | | |

| Ordinary shares repurchased | (14,417) | | | (27,212) | |

| Principal payments on finance lease obligations | (367) | | | (103) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in financing activities | (14,784) | | | (27,315) | |

| Effect of foreign currency on cash and cash equivalents | (935) | | | (6) | |

| Net change in cash and cash equivalents | (4,114) | | | (104,632) | |

| Cash and cash equivalents, beginning of period | 47,276 | | | 126,750 | |

| Cash and cash equivalents, end of period | $ | 43,162 | | | $ | 22,118 | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 17,153 | | | $ | 17,153 | |

| Cash paid for income taxes | $ | 4,448 | | | $ | 18,317 | |

| | | |

| | | |

Non-GAAP Financial Metrics

Adjusted EBITDA

The computation of Adjusted EBITDA is defined as net income plus income tax expense, net interest and other financing expenses, and depreciation and amortization, adjusted on a consistent basis for certain non-recurring, unusual or non-operational items in a balanced manner. These items include (i) severance costs, and integration and restructuring related costs (ii) founder advisory fee expenses, (iii) stock compensation expense and (iv) foreign currency loss (gain). To supplement the Company's condensed consolidated financial statements presented in accordance with U.S. GAAP, Perimeter is providing a summary to show the computations of Adjusted EBITDA, which is a non-GAAP measure used by the Company's management and by external users of Perimeter’s financial statements, such as investors, commercial banks and others, to assess the Company's operating performance as compared to that of other companies, without regard to financing methods, capital structure or historical cost basis. Adjusted EBITDA should not be considered an alternative to net income (loss), operating income (loss), cash flows provided by (used in) operating activities or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income (loss) before income taxes | $ | 34,130 | | | $ | 52,747 | | | $ | (52,702) | | | $ | 55,856 | |

| Depreciation and amortization | 16,359 | | | 16,130 | | | 32,771 | | | 32,217 | |

| Interest and financing expense | 10,590 | | | 10,344 | | | 21,238 | | | 20,490 | |

| Founders advisory fees - related party | 588 | | | (60,026) | | | 68,921 | | | (84,262) | |

Non-recurring expenses 1 | 23 | | | 361 | | | 563 | | | 1,920 | |

| Share-based compensation expense | 2,994 | | | 1,195 | | | 4,736 | | | (1,879) | |

| Loss on contingent earn-out | — | | | 146 | | | — | | | 392 | |

| Foreign currency loss | 224 | | | 93 | | | 1,517 | | | (628) | |

| Adjusted EBITDA | $ | 64,908 | | | $ | 20,990 | | | $ | 77,044 | | | $ | 24,106 | |

| | | | | | | |

____________________

(1)Adjustment to reflect non-recurring expenses; severance costs, and integration and restructuring related costs.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

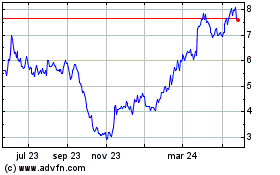

Perimeter Solutions (NYSE:PRM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

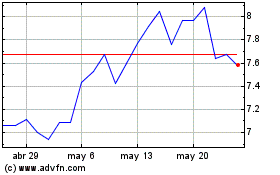

Perimeter Solutions (NYSE:PRM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024