|

PRICING SUPPLEMENT dated November 26, 2024

(To the Product Supplement No. WF1 dated December

20, 2023, the Underlying Supplement No. 1A dated May 16, 2024 and the Prospectus Supplement and the Prospectus, each dated December 20,

2023)

|

Registration Statement No. 333-275898

Filed Pursuant to Rule 424(b)(2)

|

|

| |

Royal Bank of Canada

Senior Global Medium-Term

Notes, Series J

|

| |

$680,000 Market Linked Securities—Leveraged

Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket

due June 3, 2030

|

| n | Linked to the performance

of an equally weighted basket (the “Basket”) consisting of the Energy Select Sector SPDR® Fund (33.33%),

the Financial Select Sector SPDR® Fund (33.33%) and the Health Care Select Sector SPDR® Fund (33.34%)

(each referred to as a “basket component”) |

| n | Unlike ordinary debt securities,

the securities do not pay interest or repay a fixed amount of principal at maturity. Instead, the securities provide for a maturity payment

amount that may be greater than, equal to or less than the face amount of the securities, depending on the performance of the Basket from

the starting level to the ending level. The maturity payment amount will reflect the following terms: |

| n | If the value of the Basket

increases, you will receive the face amount plus a positive return equal to 106% of the percentage increase in the value of the Basket

from the starting level to the ending level. |

| n | If the value of the Basket

remains flat or decreases but the decrease is not more than the buffer amount of 15%, you will receive the face amount. |

| n | If the value of the Basket

decreases by more than the buffer amount, you will receive less than the face amount and will have 1-to-1 downside exposure to the decrease

in the value of the Basket in excess of the buffer amount. |

| n | Investors may lose up to

85% of the face amount. |

| n | All payments on the securities

are subject to credit risk, and you will have no ability to pursue any securities held by any basket component for payment; if Royal Bank

of Canada, as issuer, defaults on its obligations, you could lose some or all of your investment. |

| n | No periodic interest payments

or dividends |

| n | No exchange listing; designed

to be held to maturity |

The initial estimated value of the securities

determined by us as of the pricing date, which we refer to as the initial estimated value, is $947.52 per security and is less than the

public offering price. The market value of the securities at any time will reflect many factors, cannot be predicted with accuracy and

may be less than this amount. We describe the determination of the initial estimated value in more detail below.

The securities have complex features and investing

in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations”

beginning on page PS-8 herein and “Risk Factors” beginning on page PS-5 of the accompanying product supplement.

The securities are the unsecured obligations

of Royal Bank of Canada, and, accordingly, all payments on the securities are subject to the credit risk Royal Bank of Canada. If Royal

Bank of Canada, as issuer, defaults on its obligations, you could lose some or all of your investment.

None of the Securities and Exchange Commission

(the “SEC”), any state securities commission or any other regulatory body has approved or disapproved of the securities or

passed upon the adequacy or accuracy of this pricing supplement. Any representation to the contrary is a criminal offense. The securities

will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any

other Canadian or U.S. governmental agency or instrumentality. The securities are not bail-inable notes and are not subject to conversion

into our common shares under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act.

| |

Original

Offering Price

|

Agent

Discount(1)(2)

|

Proceeds

to Royal Bank of Canada

|

| Per

Security |

$1,000.00 |

$36.20 |

$963.80 |

| Total |

$680,000 |

$24,616 |

$655,384 |

| (1) | Wells

Fargo Securities, LLC is the agent for the distribution of the securities and is acting as

principal. See “Terms of the Securities—Agent” and “Estimated Value

of the Securities” in this pricing supplement for further information. |

| (2) | In

addition to the forgoing, in respect of certain securities sold in this offering, our affiliate,

RBC Capital Markets, LLC (“RBCCM”), may pay a fee of up to $3.00 per security

to selected securities dealers in consideration for marketing and other services in connection

with the distribution of the securities to other securities dealers. |

Wells Fargo Securities

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Issuer: |

Royal Bank of Canada |

|

An equally weighted basket (the “Basket”) consisting of the Energy Select Sector SPDR® Fund (the “XLE Fund”), the Financial Select Sector SPDR® Fund (the “XLF Fund”) and the Health Care Select Sector SPDR® Fund (the “XLV Fund”) (each, a “basket component”). Each basket component is a fund for purposes of the accompanying product supplement. |

| Basket: |

Basket Component |

Bloomberg Ticker Symbol |

Initial Component Value(a) |

Basket Weighting |

| XLE Fund |

XLE UP |

$95.22 |

33.33% |

| XLF Fund |

XLF UP |

$51.16 |

33.33% |

| XLV Fund |

XLV UP |

$146.17 |

33.34% |

| |

(a) With respect to each

basket component, the closing value of that basket component on the pricing date |

| Pricing Date: |

November 26, 2024 |

| Issue Date: |

December 2, 2024 |

| Calculation Day*: |

May 29, 2030 |

| Stated Maturity Date*: |

June 3, 2030 |

| Face Amount: |

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000. |

| Maturity Payment Amount: |

On the stated maturity date, you will

be entitled to receive a cash payment per security in U.S. dollars equal to the maturity payment amount. The “maturity payment

amount” per security will equal:

• if the ending level is

greater than the starting level:

$1,000 + ($1,000 × basket return × upside participation

rate);

• if the ending level is

less than or equal to the starting level, but greater than or equal to the threshold level: $1,000; or

• if the ending level is

less than the threshold level:

$1,000 +

[$1,000 × (basket return + buffer amount)]

If the ending level is less than

the threshold level, you will have 1-to-1 downside exposure to the decrease in the value of the Basket in excess of the buffer amount

and will lose up to 85% of the face amount of your securities at maturity.

|

| Threshold Level: |

85.00, which is equal to 85% of the starting level |

| Buffer Amount: |

15% |

| Upside Participation Rate: |

106% |

| Basket Return: |

The “basket return”

is the percentage change from the starting level to the ending level, measured as follows:

ending level – starting

level

starting level

|

| Starting Level: |

Set equal to 100 on the pricing date |

| Ending Level: |

The “ending level”

will be calculated based on the weighted returns of the basket components and will be calculated as follows:

100 × [1 + (the sum of, for each

basket component, its component return times its basket weighting)]

|

| Component Return: |

The “component return”

of a basket component will be equal to:

final component value – initial

component value

initial component value

|

| Final Component |

With respect to each basket component, the closing value of that basket component on the calculation day |

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Value: |

|

| Closing Value: |

With respect to each basket component, “closing value” has the meaning assigned to “fund closing price” set forth under “General Terms of the Securities—Certain Terms for Securities Linked to a Fund—Certain Definitions” in the accompanying product supplement. The closing value of each basket component is subject to adjustment through the adjustment factor as described in the accompanying product supplement. |

| Calculation Agent: |

RBC Capital Markets, LLC (“RBCCM”) |

|

Material Tax

Consequences:

|

For a discussion of the material U.S. federal income and certain estate tax consequences of the ownership and disposition of the securities, see the discussions in “United States Federal Income Tax Considerations” below and in the section entitled “United States Federal Tax Considerations” in the product supplement. For a discussion of the material Canadian federal income tax consequences relating to the securities, please see the section of the product supplement, “Canadian Federal Income Tax Consequences.” |

| Agent: |

Wells Fargo Securities, LLC (“WFS”). The agent will receive the agent discount

set forth on the cover page of this document. The agent may resell the securities to other securities dealers at the original offering

price of the securities less a concession not in excess of $30.00 per security. Such securities dealers may include Wells Fargo Advisors

(“WFA”) (the trade name of the retail brokerage business of WFS’s affiliates, Wells Fargo Clearing Services,

LLC and Wells Fargo Advisors Financial Network, LLC). In addition to the concession allowed to WFA, WFS may pay $1.20 per security of

the agent’s discount to WFA as a distribution expense fee for each security sold by WFA.

In addition to the forgoing, in respect of certain securities sold in this offering, our affiliate,

RBCCM, may pay a fee of up to $3.00 per security to selected securities dealers in consideration for marketing and other services in

connection with the distribution of the securities to other securities dealers. We or one of our affiliates will also pay an expected

fee to a broker-dealer that is unaffiliated with us for providing certain electronic platform services with respect to this offering.

WFS and/or RBCCM, and/or one or

more of their respective affiliates expects to realize hedging profits projected by their proprietary pricing models to the extent they

assume the risks inherent in hedging our obligations under the securities. If WFS or any other dealer participating in the distribution

of the securities or any of their affiliates conducts hedging activities for us in connection with the securities, that dealer or its

affiliates will expect to realize a profit projected by its proprietary pricing models from those hedging activities. Any such projected

profit will be in addition to any discount, concession or fee received in connection with the sale of the securities to you. |

| Denominations: |

$1,000 and any integral multiple of $1,000 |

| CUSIP: |

78017GZB0 |

| * | The calculation day is subject

to postponement due to non-trading days and the occurrence of a market disruption event. In addition, the stated maturity date will be

postponed if the calculation day is postponed and will be adjusted for non-business days. For more information regarding adjustments

to the calculation day and the stated maturity date, see “General Terms of the Securities—Consequences of a Market Disruption

Event; Postponement of a Calculation Day—Securities Linked to Multiple Market Measures” and “—Payment Dates”

in the accompanying product supplement. In addition, for information regarding the circumstances that may result in a market disruption

event, see “General Terms of the Securities—Certain Terms for Securities Linked to a Fund—Market Disruption Events”

in the accompanying product supplement. |

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Additional

Information about the Issuer and the Securities |

You should read this pricing supplement together

with the prospectus dated December 20, 2023, as supplemented by the prospectus supplement dated December 20, 2023, relating to our Senior

Global Medium-Term Notes, Series J, of which the securities are a part, the underlying supplement no. 1A dated May 16, 2024 and the product

supplement no. WF1 dated December 20, 2023. This pricing supplement, together with these documents, contains the terms of the securities

and supersedes all other prior or contemporaneous oral statements as well as any other written materials, including preliminary or indicative

pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational

materials of ours.

We have not authorized anyone to provide any information

or to make any representations other than those contained or incorporated by reference in this pricing supplement and the documents listed

below. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give

you. These documents are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where

it is lawful to do so. The information contained in each such document is current only as of its date.

If the information in this pricing supplement

differs from the information contained in the documents listed below, you should rely on the information in this pricing supplement.

You should carefully consider, among other things,

the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the documents

listed below, as the securities involve risks not associated with conventional debt securities. We urge you to consult your investment,

legal, tax, accounting and other advisers before you invest in the securities.

You may access these documents on the SEC website

at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

Our Central Index Key, or CIK, on the SEC website

is 1000275. As used in this pricing supplement, “Royal Bank of Canada,” the “Bank,” “we,” “our”

and “us” mean only Royal Bank of Canada.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Estimated

Value of the Securities |

The initial estimated value of the securities

is based on the value of our obligation to make the payments on the securities, together with the mid-market value of the derivative embedded

in the terms of the securities. Our estimate is based on a variety of assumptions, including our internal funding rate (which represents

a discount from our credit spreads), expectations as to dividends, interest rates and volatility, and the expected term of the securities.

The securities are our debt securities. As is

the case for all of our debt securities, including our structured notes, the economic terms of the securities reflect our actual or perceived

creditworthiness. In addition, because structured notes result in increased operational, funding and liability management costs to us,

we typically borrow the funds under structured notes at a rate that is lower than the rate that we might pay for a conventional fixed

or floating rate debt security of comparable maturity. The lower internal funding rate, the agent discount and the hedging-related costs

relating to the securities reduce the economic terms of the securities to you and result in the initial estimated value for the securities

being less than their original issue price. Unlike the initial estimated value, any value of the securities determined for purposes of

a secondary market transaction may be based on a secondary market rate, which may result in a lower value for the securities than if our

initial internal funding rate were used.

In order to satisfy our payment obligations under

the securities, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives)

with an affiliate of the agent, RBCCM and/or one of our other subsidiaries. The terms of these hedging arrangements may take into account

a number of factors, including our creditworthiness, interest rate movements, volatility and the tenor of the securities. The economic

terms of the securities and the initial estimated value depend in part on the terms of these hedging arrangements. Our cost of hedging

will include the projected profit that we or our counterparty(ies) expect to realize in consideration for assuming the risks inherent

in hedging our obligations under the securities. Because hedging our obligations entails risks and may be influenced by market forces

beyond our or our counterparty(ies)’ control, such hedging may result in a profit that is more or less than expected, or could result

in a loss.

See “Selected Risk Considerations—Risks

Relating To The Estimated Value Of The Securities And Any Secondary Market—The Initial Estimated Value Of The Securities Is Less

Than The Original Offering Price” below.

Any price that the agent makes available from

time to time after the original issue date at which it would be willing to purchase the securities will generally reflect the agent’s

estimate of their value, less a customary bid-ask spread for similar trades and the cost of unwinding any related hedge transactions.

That estimated value will be based upon a variety of factors, including then prevailing market conditions and our creditworthiness. However,

for a period of six months after the original issue date, the price at which the agent may purchase the securities is expected to be higher

than the price that would be determined based on the agent’s valuation at that time less the bid-ask spread and hedging unwind costs

referenced above. This is because, at the beginning of this period, that price will not include certain costs that were included in the

original offering price, particularly a portion of the agent discount and commission (not including the selling concession) and the expected

profits that we or our hedging counterparty(ies) expect to receive from our hedging transactions. As the period continues, these costs

are expected to be gradually included in the price that the agent would be willing to pay, and the difference between that price and the

price that would be determined based on the agent’s valuation of the securities less a bid-ask spread and hedging unwind costs will

decrease over time until the end of this period. After this period, if the agent continues to make a market in the securities, the prices

that it would pay for them are expected to reflect the agent’s estimated value, less the bid-ask spread and hedging unwind costs

referenced above. In addition, the value of the securities shown on your account statement will generally reflect the price that the agent

would be willing to pay to purchase the securities at that time.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

The securities are not appropriate for all

investors. The securities may be an appropriate investment for investors who:

| § | seek 106% leveraged exposure to the upside performance of the Basket if the ending level is greater than

the starting level; |

| § | desire to limit downside exposure to the basket components through the buffer amount; |

| § | are willing to accept the risk that, if the ending level is less than the starting level by more than

the buffer amount, they will lose up to 85% of the face amount per security at maturity; |

| § | are willing to forgo interest payments on the securities and dividends on the basket components; and |

| § | are willing to hold the securities until maturity. |

The securities may not be an appropriate investment

for investors who:

| § | seek a liquid investment or are unable or unwilling to hold the securities to maturity; |

| § | require full payment of the face amount of the securities at stated maturity; |

| § | are unwilling to purchase securities with an estimated value as of the pricing date that is lower than

the original offering price and that may be as low as the lower estimated value set forth on the cover page; |

| § | are unwilling to accept the risk that the ending level may be less than the threshold level; |

| § | seek current income over the term of the securities; |

| § | are unwilling to accept the risk of exposure to the basket components; |

| § | seek exposure to the basket components but are unwilling to accept the risk/return trade-offs inherent

in the maturity payment amount for the securities; |

| § | are unwilling to accept the credit risk of Royal Bank of Canada to obtain exposure to the basket components

generally, or to the exposure to the basket components that the securities provide specifically; or |

| § | prefer the lower risk of fixed income investments with comparable maturities issued by companies with

comparable credit ratings. |

The considerations identified above are not

exhaustive. Whether or not the securities are an appropriate investment for you will depend on your individual circumstances, and you

should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered

the appropriateness of an investment in the securities in light of your particular circumstances. You should also review carefully the

“Selected Risk Considerations” herein and the “Risk Factors” in the accompanying product supplement for risks

related to an investment in the securities. For more information about the basket components, see the sections titled “The Energy

Select Sector SPDR® Fund,” “The Financial Select Sector SPDR® Fund” and “The

Health Care Select Sector SPDR® Fund” below.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Determining

Payment at Stated Maturity |

On the stated maturity date, you will receive

a cash payment per security (the maturity payment amount) calculated as follows:

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Selected

Risk Considerations |

An investment in the securities involves significant

risks. We urge you to consult your investment, legal, tax, accounting and other advisers before you invest in the securities. Some of

the risks that apply to an investment in the securities are summarized below, but we urge you to read also the “Risk Factors”

sections of the accompanying prospectus, prospectus supplement and product supplement. You should not purchase the securities unless you

understand and can bear the risks of investing in the securities.

Risks Relating To The Terms And Structure

Of The Securities

If The Ending Level Is Less Than The Threshold

Level, You Will Lose Up To 85% Of The Face Amount Of Your Securities At Maturity.

We will not repay you a fixed amount on the securities

on the stated maturity date. The maturity payment amount will depend on the direction of and percentage change in the ending level relative

to the starting level and the other terms of the securities. Because the value of the Basket will be subject to market fluctuations, the

maturity payment amount may be more or less, and possibly significantly less, than the face amount of your securities.

If the ending level is less than the threshold

level, the maturity payment amount will be less than the face amount and you will have 1-to-1 downside exposure to the decrease in the

value of the Basket in excess of the buffer amount, resulting in a loss of 1% of the face amount for every 1% decline in the Basket in

excess of the buffer amount. The threshold level is 85% of the starting level. As a result, if the ending level is less than the threshold

level, you will lose up to 85% of the face amount per security at maturity. This is the case even if the value of the Basket is greater

than or equal to the starting level or the threshold level at certain times during the term of the securities.

Even if the ending level is greater than the starting

level, the maturity payment amount may only be slightly greater than the face amount, and your yield on the securities may be less than

the yield you would earn if you bought a traditional interest-bearing debt security of Royal Bank of Canada or another issuer with a similar

credit rating with the same stated maturity date.

The Securities Do Not Pay Interest, And Your Return On The Securities

May Be Lower Than The Return On A Conventional Debt Security Of Comparable Maturity.

There will be no periodic interest payments on

the securities as there would be on a conventional fixed-rate or floating-rate debt security having the same maturity. The return that

you will receive on the securities, which could be negative, may be less than the return you could earn on other investments. Even if

your return is positive, your return may be less than the return you would earn if you purchased one of our conventional senior interest-bearing

debt securities.

Changes In The Value Of One Basket Component

May Be Offset By Changes In The Values Of The Other Basket Components.

A change in the value of one basket component

may not correlate with changes in the values of the other basket components. The value of one basket component may increase, while the

values of the other basket components may not increase as much, or may even decrease. Therefore, in determining the value of the Basket

as of any time, increases in the value of one basket component may be moderated, or wholly offset, by lesser increases or decreases in

the values of the other basket components.

Payments On The Securities Are Subject To Our Credit Risk, And Market

Perceptions About Our Creditworthiness May Adversely Affect The Market Value Of The Securities.

The securities are our senior unsecured debt securities,

and your receipt of any amounts due on the securities is dependent upon our ability to pay our obligations as they come due. If we were

to default on our payment obligations, you may not receive any amounts owed to you under the securities and you could lose your entire

investment. In addition, any negative changes in market perceptions about our creditworthiness may adversely affect the market value of

the securities.

The U.S. Federal Income Tax Consequences Of

An Investment In The Securities Are Uncertain.

There is

no direct legal authority regarding the proper U.S. federal income tax treatment of the securities, and significant aspects of the tax

treatment of the securities are uncertain. Moreover, the securities may be subject to the “constructive ownership” regime,

in which case certain adverse tax consequences may apply upon your disposition of a security. You should review carefully the section

entitled “United States Federal Income Tax Considerations” herein, in combination with the section entitled “United

States Federal Tax Considerations” in the accompanying product supplement, and consult your tax adviser regarding the U.S. federal

income tax consequences of an investment in the securities.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

Risks Relating

To The Estimated Value Of The Securities And Any Secondary Market

There May Not Be An Active Trading Market For The Securities And

Sales In The Secondary Market May Result In Significant Losses.

There may be little or no secondary market for

the securities. The securities will not be listed on any securities exchange. The agent and/or its affiliates may make a market for the

securities; however, they are not required to do so and, if they choose to do so, may stop any market-making activities at any time. Because

other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities

is likely to depend on the price, if any, at which the agent or any of its affiliates is willing to buy the securities. Our broker-dealer

subsidiary, RBCCM, does not at this time expect to make a market in the securities. If RBCCM determines that the agent is unable or unwilling

to make a market in the securities at any time, RBCCM may, but is not obligated to, make a market in the securities at that time. If RBCCM

makes a market in the securities at any time, its valuation of the securities may differ from the agent’s valuation, and consequently

the price at which it may be willing to purchase the securities may differ from (and be lower than) the price at which the agent would

have purchased the securities at that time. Even if a secondary market for the securities develops, it may not provide enough liquidity

to allow you to easily trade or sell the securities. We expect that transaction costs in any secondary market would be high. As a result,

the difference between bid and ask prices for your securities in any secondary market could be substantial. If you sell your securities

before maturity, you may have to do so at a substantial discount from the price that you paid for them, and as a result, you may suffer

significant losses. The securities are not designed to be short-term trading instruments. Accordingly, you should be able and willing

to hold your securities to maturity.

The Initial Estimated Value Of The Securities

Is Less Than The Original Offering Price.

The initial estimated value of the securities

is less than the original offering price of the securities and does not represent a minimum price at which we, RBCCM or any of our other

affiliates would be willing to purchase the securities in any secondary market (if any exists) at any time. If you attempt to sell the

securities prior to maturity, their market value may be lower than the price you paid for them and the initial estimated value. This is

due to, among other things, changes in the values of the basket components, the internal funding rate we pay to issue securities of this

kind (which is lower than the rate at which we borrow funds by issuing conventional fixed rate debt) and the inclusion in the original

offering price of the agent discount, our or our hedge counterparty(ies)’ estimated profit and the estimated costs related to our

hedging of the securities. These factors, together with various credit, market and economic factors over the term of the securities, are

expected to reduce the price at which you may be able to sell the securities in any secondary market and will affect the value of the

securities in complex and unpredictable ways.

Assuming no change in market conditions or any other relevant factors,

the price, if any, at which you may be able to sell your securities prior to maturity may be less than your original purchase price, as

any such sale price would not be expected to include the agent discount, our or our hedge counterparty(ies)’ estimated profit and

our estimated profit or the hedging costs relating to the securities. In addition, any price at which you may sell the securities is likely

to reflect customary bid-ask spreads for similar trades. In addition to bid-ask spreads, the value of the securities determined for any

secondary market price is expected to be based on a secondary market rate rather than the internal funding rate used to price the securities

and determine the initial estimated value. As a result, the secondary market price will be less than if the internal funding rate was

used. Moreover, we expect that any secondary market price will be based on WFS’s valuation of the securities, which may differ from

(and may be lower than) the valuation that we would determine for the securities at that time based on the methodology by which we determined

the initial estimated value range set forth on the cover page of this document.

For a limited period of time after the original

issue date, WFS may purchase the securities at a price that is greater than the price that would otherwise be determined at that time

as described in the preceding paragraph. However, over the course of that period, assuming no changes in any other relevant factors, the

price you may receive if you sell your securities is expected to decline.

The securities are not designed to be short-term

trading instruments. Accordingly, you should be able and willing to hold your securities to maturity.

The Initial Estimated Value Of The Securities

Is Only An Estimate, Calculated As Of The Time The Terms Of The Securities Are Set.

The initial estimated value of the securities

is based on the value of our obligation to make the payments on the securities, together with the mid-market value of the derivative embedded

in the terms of the securities. Our estimate is based on a variety of assumptions, including our internal funding rate (which represents

a discount from our credit spreads), expectations as to dividends on the basket components or the securities held by the basket components,

interest rates and volatility, and the expected term of the securities. These assumptions are based on certain forecasts about future

events, which may prove to be incorrect. Other entities, including WFS in connection with determining any secondary market price for the

securities, may value the securities or similar securities at a price that is significantly different than we do.

The value of the securities at any time after

the pricing date will vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a

result, the actual value you would receive if you sold the securities in any secondary market, if any, should be expected to differ materially

from the initial estimated value of the securities.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

The Value Of The Securities Prior To Stated

Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways.

The value of the securities prior to stated maturity

will be affected by the then-current value of each basket component, interest rates at that time and a number of other factors, some of

which are interrelated in complex ways. The effect of any one factor may be offset or magnified by the effect of another factor. The following

factors, which we refer to as the “derivative component factors,” and which are described in more detail in the accompanying

product supplement, are expected to affect the value of the securities: performance of the basket components; interest rates; volatility

of the basket components; correlation among the basket components; time remaining to maturity; and dividend yields on the basket components.

When we refer to the “value” of your security, we mean the value you could receive for your security if you are able

to sell it in the open market before the stated maturity date.

In addition to the derivative component factors,

the value of the securities will be affected by actual or anticipated changes in our creditworthiness. You should understand that the

impact of one of the factors specified above, such as a change in interest rates, may offset some or all of any change in the value of

the securities attributable to another factor, such as a change in the values of the basket components. Because numerous factors are expected

to affect the value of the securities, changes in the values of the basket components may not result in a comparable change in the value

of the securities.

Risks Relating To Conflicts Of Interest

Our Economic Interests And Those Of Any Dealer

Participating In The Offering Are Potentially Adverse To Your Interests.

You should be aware of the following ways in which

our economic interests and those of any dealer participating in the distribution of the securities, which we refer to as a “participating

dealer,” are potentially adverse to your interests as an investor in the securities. In engaging in certain of the activities

described below and as discussed in more detail in the accompanying product supplement, our affiliates or any participating dealer or

its affiliates may take actions that may adversely affect the value of and your return on the securities, and in so doing they will have

no obligation to consider your interests as an investor in the securities. Our affiliates or any participating dealer or its affiliates

may realize a profit from these activities even if investors do not receive a favorable investment return on the securities.

| · | The calculation agent is our affiliate and may be required to make discretionary judgments that

affect the return you receive on the securities. RBCCM, which is our affiliate, will be the calculation agent for the securities.

As calculation agent, RBCCM will determine any values of the basket components and make any other determinations necessary to calculate

any payments on the securities. In making these determinations, RBCCM may be required to make discretionary judgments that may adversely

affect any payments on the securities. See the sections entitled “General Terms of the Securities—Certain Terms for Securities

Linked to a Fund—Market Disruption Events” and “—Anti-dilution Adjustments Relating to a Fund; Alternate Calculation”

in the accompanying product supplement. In making these discretionary judgments, the fact that RBCCM is our affiliate may cause it to

have economic interests that are adverse to your interests as an investor in the securities, and RBCCM’s determinations as calculation

agent may adversely affect your return on the securities. |

| · | The estimated value of the securities was calculated by us and is therefore not an independent third-party

valuation. |

| · | Research reports by our affiliates or any participating dealer or its affiliates may be inconsistent

with an investment in the securities and may adversely affect the values of the basket components. |

| · | Business activities of our affiliates or any participating dealer or its affiliates with the companies

whose securities are held by the basket components may adversely affect the values of the basket components. |

| · | Hedging activities by our affiliates or any participating dealer or its affiliates may adversely

affect the values of the basket components. |

| · | Trading activities by our affiliates or any participating dealer or its affiliates may adversely

affect the values of the basket components. |

| · | A participating dealer or its affiliates may realize hedging profits projected by its proprietary

pricing models in addition to any selling concession and/or fee, creating a further incentive for the participating dealer to sell the

securities to you. |

Risks Relating To The Basket Components

The Equity Securities Composing The XLE Fund

Are Concentrated In The Energy Sector.

All or substantially all of the equity securities

composing the XLE Fund are issued by companies whose primary line of business is directly associated with the energy sector. As a result,

the value of the securities may be subject to greater volatility and be more adversely affected by a single economic, political or regulatory

occurrence affecting this sector than a different investment linked to

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

securities of a more broadly diversified group

of issuers. Issuers in energy-related industries can be significantly affected by fluctuations in energy prices and supply and demand

of energy fuels. Markets for various energy-related commodities can have significant volatility, and are subject to control or manipulation

by large producers or purchasers. Companies in the energy sector may need to make substantial expenditures, and to incur significant amounts

of debt, in order to maintain or expand their reserves. Oil and gas exploration and production can be significantly affected by natural

disasters as well as changes in exchange rates, interest rates, government regulation, world events and economic conditions. These companies

may be at risk for environmental damage claims.

The Equity Securities Composing The XLF Fund

Are Concentrated In The Financial Sector.

All or substantially all of the equity securities

composing the XLF Fund are issued by companies whose primary line of business is directly associated with the financial sector. As a result,

the value of the securities may be subject to greater volatility and be more adversely affected by a single economic, political or regulatory

occurrence affecting this sector than a different investment linked to securities of a more broadly diversified group of issuers. Financial

services companies are subject to extensive government regulation, which may limit both the amounts and types of loans and other financial

commitments they can make, the interest rates, fees and prices they can charge, the scope of their activities and the amount of capital

they must maintain. Profitability is largely dependent on the availability and cost of capital funds and can fluctuate significantly when

interest rates change or due to increased competition. In addition, deterioration of the credit markets generally may cause an adverse

impact in a broad range of markets, including U.S. and international credit and interbank money markets generally, thereby affecting a

wide range of financial institutions and markets. Credit losses resulting from financial difficulties of borrowers and financial losses

associated with investment activities can negatively impact the financial sector. Changes in government regulation and oversight of financial

institutions may have an adverse effect on the financial condition of a financial institution.

The Equity Securities Composing The XLV Fund

Are Concentrated In The Health Care Sector.

All or substantially all of the equity securities

composing the XLV Fund are issued by companies whose primary line of business is directly associated with the health care sector. As a

result, the value of the securities may be subject to greater volatility and may be more adversely affected by a single economic, political

or regulatory occurrence affecting this industry than a different investment linked to securities of a more broadly diversified group

of issuers. Companies in the health care sector are subject to extensive government regulation and their profitability can be significantly

affected by restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure

(including price discounting), limited product lines and an increased emphasis on the delivery of health care through outpatient services.

Companies in the health care sector are heavily dependent on obtaining and defending patents, which may be time consuming and costly,

and the expiration of patents may also adversely affect the profitability of these companies. Health care companies are also subject to

extensive litigation based on product liability and similar claims. In addition, their products can become obsolete due to industry innovation,

changes in technologies or other market developments. Many new products in the health care sector require significant research and development

and may be subject to regulatory approvals, all of which may be time consuming and costly with no guarantee that any product will come

to market.

The Maturity Payment Amount Will Depend Upon

The Performance Of The Basket Components And Therefore The Securities Are Subject To The Following Risks, Each As Discussed In More Detail

In The Accompanying Product Supplement.

| · | Investing In The Securities Is Not The Same As Investing In The Basket Components Or The Securities

Held By The Basket Components. Investing in the securities is not equivalent to investing in the basket components or the securities

held by the basket components. As an investor in the securities, your return will not reflect the return you would realize if you actually

owned and held shares of the basket components or the securities held by each basket component for a period similar to the term of the

securities because you will not receive any dividend payments, distributions or any other payments paid on the basket components or those

securities. As a holder of the securities, you will not have any voting rights or any other rights that holders of shares of the basket

components or the securities held by the basket components would have. |

| · | Historical Values Of A Basket Component Should Not Be Taken As An Indication Of The Future Performance

Of That Basket Component During The Term Of The Securities. |

| · | Changes That Affect A Basket Component Or Its Fund Underlying Index May Adversely Affect The Value

Of The Securities And The Maturity Payment Amount. |

| · | We And Our Affiliates Have No Affiliation With Any Basket Component Sponsor Or Fund Underlying Index

Sponsor And Have Not Independently Verified Their Public Disclosure Of Information. |

| · | An Investment Linked To The Shares Of A Basket Component Is Different From An Investment Linked To

Its Fund Underlying Index. |

| · | There Are Risks Associated With A Basket Component. |

| · | Anti-dilution Adjustments Relating To The Shares Of A Basket Component Do Not Address Every Event That

Could Affect Such Shares. |

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| · | We Cannot Control Actions By Any Of The Unaffiliated Companies Whose Securities Are Held By A Basket

Component Or Included In Its Fund Underlying Index. |

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Hypothetical

Examples and Returns |

The payout profile, return table and examples

below illustrate the maturity payment amount for a $1,000 face amount security on a hypothetical offering of securities under various

scenarios, with the assumptions set forth in the table below. The terms used for purposes of these hypothetical examples do not represent

any actual initial component value. The hypothetical initial component value of $100.00 for each basket component has been chosen for

illustrative purposes only and does not represent the actual initial component value of any basket component. The actual initial component

value for each basket component is set forth under “Terms of the Securities” above. For historical data regarding the actual

closing prices of the basket components, see the historical information set forth below. The payout profile, return table and examples

below assume that an investor purchases the securities for $1,000 per security. These examples are for purposes of illustration only and

the values used in the examples may have been rounded for ease of analysis. The actual maturity payment amount and resulting pre-tax total

rate of return will depend on the actual terms of the securities.

| Starting Level: |

100.00 |

| Threshold Level: |

85.00 (85% of the starting level) |

| Upside Participation Rate: |

106% |

| Hypothetical Initial Component Value: |

For each basket component, $100.00 |

| Buffer Amount: |

15% |

Hypothetical Payout Profile

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

Hypothetical Returns

|

Hypothetical

ending level

|

Hypothetical

basket return

|

Hypothetical

maturity payment amount per security

|

Hypothetical

pre-tax total

rate of return(1)

|

| 200.00 |

100.00% |

$2,060.00 |

106.00% |

| 175.00 |

75.00% |

$1,795.00 |

79.50% |

| 150.00 |

50.00% |

$1,530.00 |

53.00% |

| 140.00 |

40.00% |

$1,424.00 |

42.40% |

| 130.00 |

30.00% |

$1,318.00 |

31.80% |

| 120.00 |

20.00% |

$1,212.00 |

21.20% |

| 110.00 |

10.00% |

$1,106.00 |

10.60% |

| 105.00 |

5.00% |

$1,053.00 |

5.30% |

| 102.00 |

2.00% |

$1,021.20 |

2.12% |

| 100.00 |

0.00% |

$1,000.00 |

0.00% |

| 95.00 |

-5.00% |

$1,000.00 |

0.00% |

| 90.00 |

-10.00% |

$1,000.00 |

0.00% |

| 85.00 |

-15.00% |

$1,000.00 |

0.00% |

| 80.00 |

-20.00% |

$950.00 |

-5.00% |

| 70.00 |

-30.00% |

$850.00 |

-15.00% |

| 60.00 |

-40.00% |

$750.00 |

-25.00% |

| 50.00 |

-50.00% |

$650.00 |

-35.00% |

| 40.00 |

-60.00% |

$550.00 |

-45.00% |

| 30.00 |

-70.00% |

$450.00 |

-55.00% |

| 20.00 |

-80.00% |

$350.00 |

-65.00% |

| 10.00 |

-90.00% |

$250.00 |

-75.00% |

| 0.00 |

-100.00% |

$150.00 |

-85.00% |

| (1) | The

hypothetical pre-tax total rate of return is the number, expressed as a percentage, that

results from comparing the maturity payment amount per security to the face amount of $1,000. |

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

Hypothetical Examples

Example 1. Maturity payment amount is greater

than the face amount:

| |

XLE Fund |

XLF Fund |

XLV Fund |

| Hypothetical initial component value: |

$100.00 |

$100.00 |

$100.00 |

| Hypothetical final component value: |

$115.00 |

$106.00 |

$109.00 |

| Hypothetical component return: |

15.00% |

6.00% |

9.00% |

Based on the hypothetical component

returns set forth above, the hypothetical ending level would equal:

100 × [1 + (33.33% × 15.00%) + (33.33% ×

6.00%) + (33.34% × 9.00%)] = 110.00

The hypothetical basket return in this example is equal

to 10.00%.

Because the hypothetical ending level

is greater than the starting level, the maturity payment amount per security would be equal to:

$1,000 + ($1,000 ×

basket return × upside participation rate)

= $1,000 + ($1,000 × 10.00% ×

106%)

= $1,000 + $106.00

= $1,106.00

On the stated maturity date you would receive

$1,106.00 per security.

Example 2. Maturity payment amount is equal to the face amount:

| |

XLE Fund |

XLF Fund |

XLV Fund |

| Hypothetical initial component value: |

$100.00 |

$100.00 |

$100.00 |

| Hypothetical final component value: |

$90.00 |

$101.00 |

$94.00 |

| Hypothetical component return: |

-10.00% |

1.00% |

-6.00% |

Based on the hypothetical component

returns set forth above, the hypothetical ending level would equal:

100 × [1 + (33.33% × -10.00%)

+ (33.33% × 1.00%) + (33.34% × -6.00%)] = 95.00

The hypothetical basket return in this

example is equal to -5.00%.

Because the hypothetical ending level

is less than the starting level, but not by more than the buffer amount, you would not lose any of the face amount of your securities.

On the stated maturity date you would receive

$1,000.00 per security.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

Example 3. Maturity payment amount is less

than the face amount:

| |

XLE Fund |

XLF Fund |

XLV Fund |

| Hypothetical initial component value: |

$100.00 |

$100.00 |

$100.00 |

| Hypothetical final component value: |

$45.00 |

$20.00 |

$25.00 |

| Hypothetical component return: |

-55.00% |

-80.00% |

-75.00% |

Based on the hypothetical component

returns set forth above, the hypothetical ending level would equal:

100 × [1 + (33.33% × -55.00%)

+ (33.33% × -80.00%) + (33.34% × -75.00%)] = 30.00

The hypothetical basket return in this

example is equal to -70.00%

Because the hypothetical ending level

is less than the starting level by more than the buffer amount, you would lose a portion of the face amount of your securities and receive

a maturity payment amount equal to:

$1,000 + [$1,000

× (basket return + buffer amount)]

= $1,000 +

[$1,000 × (-70.00% + 15%)]

= $450.00

On the stated maturity date you would receive

$450.00 per security.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Hypothetical

Historical Performance of the Basket |

The Basket will represent a weighted portfolio

of the three basket components, with the return of each basket component having the basket weighting set forth above. For more information

regarding the basket components, see the information provided below.

While historical information on the value of the

Basket does not exist, the following graph sets forth the hypothetical historical daily values of the Basket for the period from January

1, 2014 to November 26, 2024, assuming that the Basket was constructed on January 1, 2014 with a starting level of 100.00 and that each

of the basket components had the applicable basket weighting as of that day. We obtained the fund closing prices used in the graph below

from Bloomberg Finance L.P. (“Bloomberg”), without independent investigation.

The hypothetical historical Basket values, as calculated solely for

the purposes of the offering of the securities, fluctuated in the past and may, in the future, experience significant fluctuations. Any

historical upward or downward trend in the value of the Basket during any period shown below is not an indication that the basket return

is more likely to be positive or negative during the term of the securities. The hypothetical historical values do not give an indication

of future values of the Basket.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| The

Energy Select Sector SPDR® Fund |

According to publicly available information, the

XLE Fund is an exchange-traded fund of the Select Sector Trust, a registered investment company, that seeks to provide investment results

that, before expenses, correspond generally to the price and yield performance of the Energy Select Sector Index (with respect to the

XLE Fund, the “Fund Underlying Index”). The Fund Underlying Index is a capped modified market capitalization-based index that

measures the performance of the GICS® energy sector, which currently includes companies in the following industries: oil,

gas and consumable fuels; and energy equipment and services. For more information about the XLE Fund, see “Exchange-Traded Funds—The

Select Sector SPDR® Funds” in the accompanying underlying supplement.

Historical Information

We obtained the closing prices of the XLE Fund

in the graph below from Bloomberg, without independent verification.

The following graph sets forth daily closing prices

of the XLE Fund for the period from January 1, 2014 to November 26, 2024. The closing price of the XLE Fund on November 26, 2024 was $95.22.

The historical performance of the XLE Fund should not be taken as an indication of the future performance of the XLE Fund during the term

of the securities.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| The

Financial Select Sector SPDR® Fund |

According to publicly available information, the

XLF Fund is an exchange-traded fund of the Select Sector Trust, a registered investment company, that seeks to provide investment results

that, before expenses, correspond generally to the price and yield performance of the Financial Select Sector Index (with respect to the

XLF Fund, the “Fund Underlying Index”). The Fund Underlying Index is a capped modified market capitalization-based index that

measures the performance of the GICS® financials sector, which currently includes companies in the following industries:

diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts; consumer finance; and thrifts

and mortgage finance. For more information about the XLF Fund, see “Exchange-Traded Funds—The Select Sector SPDR®

Funds” in the accompanying underlying supplement.

Historical Information

We obtained the closing prices of the XLF Fund

in the graph below from Bloomberg, without independent verification.

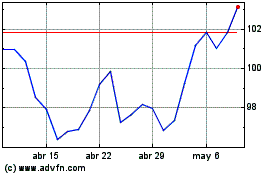

The following graph sets forth daily closing prices

of the XLF Fund for the period from January 1, 2014 to November 26, 2024. The closing price of the XLF Fund on November 26, 2024 was $51.16.

The historical performance of the XLF Fund should not be taken as an indication of the future performance of the XLF Fund during the term

of the securities.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| The

Health Care Select Sector SPDR® Fund |

According to publicly available information, the

XLV Fund is an exchange-traded fund of the Select Sector Trust, a registered investment company, that seeks to provide investment results

that, before expenses, correspond generally to the price and yield performance of the Health Care Select Sector Index (with respect to

the XLV Fund, the “Fund Underlying Index”). The Fund Underlying Index is a capped modified market capitalization-based index

that measures the performance of the GICS® health care sector, which currently includes companies in the following industries:

pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services;

and health care technology. For more information about the XLV Fund, see “Exchange-Traded Funds—The Select Sector SPDR®

Funds” in the accompanying underlying supplement.

Historical Information

We obtained the closing prices of the XLV Fund

in the graph below from Bloomberg, without independent verification.

The following graph sets forth daily closing prices

of the XLV Fund for the period from January 1, 2014 to November 26, 2024. The closing price of the XLV Fund on November 26, 2024 was $146.17.

The historical performance of the XLV Fund should not be taken as an indication of the future performance of the XLV Fund during the term

of the securities.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| United States

Federal Income Tax Considerations |

You should review carefully the section in the

accompanying product supplement entitled “United States Federal Tax Considerations.” The following discussion, when read in

combination with that section, constitutes the full opinion of our counsel, Davis Polk & Wardwell LLP, regarding the material U.S.

federal income tax consequences of owning and disposing of the securities.

Generally, this discussion assumes that you purchased

the securities for cash in the original issuance at the stated issue price and does not address other circumstances specific to you, including

consequences that may arise due to any other investments relating to the Basket. You should consult your tax adviser regarding the effect

any such circumstances may have on the U.S. federal income tax consequences of your ownership of a security.

In the opinion of our counsel, it is reasonable

to treat the securities for U.S. federal income tax purposes as prepaid derivative contracts that are “open transactions,”

as described in the section entitled “United States Federal Tax Considerations—Tax Consequences to U.S. Holders—Securities

Treated as Prepaid Derivative Contracts that are Open Transactions” in the accompanying product supplement. There is uncertainty

regarding this treatment, and the Internal Revenue Service (the “IRS”) or a court might not agree with it. A different tax

treatment could be adverse to you. Generally, if this treatment is respected, (i) you should not recognize taxable income or loss prior

to the taxable disposition of your securities (including upon maturity or an earlier redemption, if applicable) and (ii) the gain or loss

on your securities should be treated as short-term capital gain or loss unless you have held the securities for more than one year, in

which case your gain or loss should be treated as long-term capital gain or loss.

Even if the treatment of the securities as prepaid

derivative contracts is respected, purchasing a security could be treated as entering into a “constructive ownership transaction”

within the meaning of Section 1260 of the Internal Revenue Code (“Section 1260”). In that case, all or a portion of any long-term

capital gain you would otherwise recognize upon the taxable disposition of the security would be recharacterized as ordinary income to

the extent such gain exceeded the “net underlying long-term capital gain” as defined in Section 1260. Any long-term capital

gain recharacterized as ordinary income would be treated as accruing at a constant rate over the period you held the security, and you

would be subject to a notional interest charge in respect of the deemed tax liability on the income treated as accruing in prior tax years.

Due to the lack of direct legal authority, our counsel is unable to opine as to whether or how Section 1260 applies to the securities.

We do not plan to request a ruling from the IRS

regarding the treatment of the securities. An alternative characterization of the securities could materially and adversely affect the

tax consequences of ownership and disposition of the securities, including the timing and character of income recognized. In addition,

the U.S. Treasury Department and the IRS have requested comments on various issues regarding the U.S. federal income tax treatment of

“prepaid forward contracts” and similar financial instruments and have indicated that such transactions may be the subject

of future regulations or other guidance. Furthermore, members of Congress have proposed legislative changes to the tax treatment of derivative

contracts. Any legislation, Treasury regulations or other guidance promulgated after consideration of these issues could materially and

adversely affect the tax consequences of an investment in the securities, possibly with retroactive effect.

Non-U.S. holders. As discussed under “United

States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders—Dividend Equivalents under Section 871(m) of the Code”

in the accompanying product supplement, Section 871(m) of the Internal Revenue Code and Treasury regulations promulgated thereunder (“Section

871(m)”) generally impose a 30% withholding tax on dividend equivalents paid or deemed paid to non-U.S. holders with respect to

certain financial instruments linked to U.S. equities or indices that include U.S. equities. The Treasury regulations, as modified by

an IRS notice, exempt financial instruments issued prior to January 1, 2027 that do not have a “delta” of one. Based on certain

determinations made by us, our counsel is of the opinion that Section 871(m) should not apply to the securities with regard to non-U.S.

holders. Our determination is not binding on the IRS, and the IRS may disagree with this determination.

We will not be required to pay any additional

amounts with respect to U.S. federal withholding taxes.

You should consult your tax adviser regarding the U.S. federal income

tax consequences of an investment in the securities, including possible alternative treatments, as well as tax consequences arising under

the laws of any state, local or non-U.S. taxing jurisdiction.

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

| Supplemental

Benefit Plan Investor Considerations |

The securities are contractual financial instruments.

The financial exposure provided by the securities is not a substitute or proxy for, and is not intended as a substitute or proxy for,

individualized investment management or advice for the benefit of any purchaser or holder of the securities. The securities have not been

designed and will not be administered in a manner intended to reflect the individualized needs and objectives of any purchaser or holder

of the securities.

Each purchaser or holder of any securities acknowledges

and agrees that:

| · | the purchaser or holder or its fiduciary has made and shall make all investment decisions for the purchaser

or holder and the purchaser or holder has not relied and shall not rely in any way upon us or any of our affiliates to act as a fiduciary

or adviser of the purchaser or holder with respect to (i) the design and terms of the securities, (ii) the purchaser or holder’s

investment in the securities, (iii) the holding of the securities or (iv) the exercise of or failure to exercise any rights we or any

of our affiliates, or the purchaser or holder, has under or with respect to the securities; |

| · | we and our affiliates have acted and will act solely for our own account in connection with (i) all transactions

relating to the securities and (ii) all hedging transactions in connection with our or our affiliates’ obligations under the securities; |

| · | any and all assets and positions relating to hedging transactions by us or any of our affiliates are assets

and positions of those entities and are not assets and positions held for the benefit of the purchaser or holder; |

| · | our interests and the interests of our affiliates are adverse to the interests of the purchaser or holder;

and |

| · | neither we nor any of our affiliates is a fiduciary or adviser of the purchaser or holder in connection

with any such assets, positions or transactions, and any information that we or any of our affiliates may provide is not intended to be

impartial investment advice. |

See “Benefit Plan Investor Considerations”

in the accompanying prospectus.

| Validity

of the Securities |

In the opinion of Norton Rose Fulbright Canada

LLP, as Canadian counsel to the Bank, the issue and sale of the securities has been duly authorized by all necessary corporate action

of the Bank in conformity with the indenture, and when the securities have been duly executed, authenticated and issued in accordance

with the Indenture and delivered against payment therefor, the securities will be validly issued and, to the extent validity of the securities

is a matter governed by the laws of the Province of Ontario or Québec, or the federal laws of Canada applicable therein, will be

valid obligations of the Bank, subject to the following limitations: (i) the enforceability of the indenture may be limited by the Canada

Deposit Insurance Corporation Act (Canada), the Winding-up and Restructuring Act (Canada) and bankruptcy, insolvency, reorganization,

receivership, moratorium, arrangement or winding-up laws or other similar laws of general application affecting the enforcement of creditors’

rights generally; (ii) the enforceability of the indenture is subject to general equitable principles, including the principle that the

availability of equitable remedies, such as specific performance and injunction, may only be granted at the discretion of a court of competent

jurisdiction; (iii) under applicable limitations statutes generally, including that the enforceability of the indenture will be subject

to the limitations contained in the Limitations Act, 2002 (Ontario), and such counsel expresses no opinion as to whether a court may find

any provision of the indenture to be unenforceable as an attempt to vary or exclude a limitation period under such applicable limitations

statutes; (iv) rights to indemnity and contribution under the securities or the indenture which may be limited by applicable law; and

(v) courts in Canada are precluded from giving a judgment in any currency other than the lawful money of Canada and such judgment may

be based on a rate of exchange in existence on a day other than the day of payment, as prescribed by the Currency Act (Canada). This opinion

is given as of the date hereof and is limited to the laws of the Provinces of Ontario and Québec and the federal laws of Canada

applicable therein. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and

delivery of the indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain

factual matters, all as stated in the opinion letter of such counsel dated December 20, 2023, which has been filed as Exhibit 5.3 to the

Bank’s Form 6-K filed with the SEC dated December 20, 2023.

In the opinion of Davis Polk & Wardwell LLP,

as special United States products counsel to the Bank, when the securities offered by this pricing supplement have been issued by the

Bank pursuant to the indenture, the trustee has made, in accordance with the indenture, the appropriate notation to the master note evidencing

such securities (the “master note”), and such securities have been delivered against payment as contemplated herein, such

securities will be valid and binding obligations of the Bank, enforceable in accordance with their terms, subject to applicable bankruptcy,

insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general

applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and possible judicial or

regulatory actions or applications giving effect to governmental actions or foreign laws affecting creditors’ rights, provided

that such counsel expresses no opinion as to (i) the enforceability of any waiver of rights under any usury or stay law or (ii) the

effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion

is given as of the date hereof and is limited to the laws of the State of New York. Insofar as the foregoing opinion involves matters

governed by the laws of the Provinces of Ontario and Québec and the federal laws of Canada, you have received, and we understand

that you are relying upon, the opinion of Norton Rose Fulbright Canada LLP, Canadian counsel for the Bank, set forth above. In addition,

this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and

the authentication of the master note and the validity, binding nature and enforceability of the indenture

Market Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket due June 3, 2030

with respect to the trustee, all as stated in

the opinion of Davis Polk & Wardwell LLP dated May 16, 2024, which has been filed as an exhibit to the Bank’s Form 6-K filed

with the SEC on May 16, 2024.

| Terms

Incorporated in the Master Note |

All terms of the securities included in this pricing

supplement and the relevant terms included in the section entitled “General Terms of The Securities” in the accompanying product

supplement, as modified by this pricing supplement, if applicable, are incorporated into the master note.

424B2

EX-FILING FEES

0001000275

333-275898

0001000275

2024-11-29

2024-11-29

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLES

F-3

ROYAL BANK OF CANADA

Narrative Disclosure

The maximum aggregate offering price of the securities to which the prospectus relates is $680,000. The

prospectus is a final prospectus for the related offering(s).

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_RegnFileNb |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

| X |