| |

Subject to Completion

Preliminary Term Sheet dated

November 29, 2024 |

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-275898

(To Prospectus and Prospectus Supplement,

each dated December 20, 2023 and Product Supplement EQUITY ARN-1 dated December 27, 2023) |

Units

$10 principal amount per unit

CUSIP No.

|

Pricing Date*

Settlement Date*

Maturity Date* |

December , 2024

December , 2024

February , 2026 |

| *Subject to change based on the actual date the notes are priced for initial sale to the public (the “pricing date”) |

| |

|

|

|

|

Accelerated Return Notes® Linked to

an International Equity Index Basket

§ Maturity

of approximately 14 months

§ 3-to-1

upside exposure to increases in the Basket (as defined below), subject to a capped return of [14.00% to 18.00%]

· The

Basket will be composed of the EURO STOXX 50® Index, the FTSE® 100 Index, the Nikkei Stock Average Index,

the Swiss Market Index, the S&P®/ASX 200 Index and the FTSE® China 50 Index. The EURO STOXX 50®

Index will be given an initial weight of 40.00%, each of the FTSE® 100 Index and the Nikkei Stock Average Index will be

given an initial weight of 20.00%, each of the Swiss Market Index and the S&P®/ASX 200 Index will be given an initial

weight of 7.50% and the FTSE® China 50 Index will be given an initial weight of 5.00%.

§ 1-to-1

downside exposure to decreases in the Basket, with 100% of your principal at risk

§ All

payments occur at maturity and are subject to the credit risk of Royal Bank of Canada.

§ No

periodic interest payments

§ In

addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.05 per unit. See “Structuring

the Notes.”

§ Limited

secondary market liquidity, with no exchange listing

§ The

notes are unsecured debt securities and are not savings accounts or insured deposits of a bank. The notes are not insured by the Canada

Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation, or any other governmental agency of Canada or the United

States.

|

| |

The notes are being issued by Royal Bank of Canada (“RBC”).

There are important differences between the notes and a conventional debt security, including different investment risks and certain additional

costs. See “Risk Factors” beginning on page TS-6 of this term sheet and “Risk Factors” beginning on page PS-7

of product supplement EQUITY ARN-1.

The initial estimated value of the notes as of the pricing date is

expected to be between $9.06 and $9.56 per unit, which is less than the public offering price listed below. See “Summary”

on the following page, “Risk Factors” beginning on page TS-6 of this term sheet and “Structuring the Notes” below

for additional information. The actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy.

_________________________

None of the Securities and Exchange Commission (the “SEC”),

any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note

Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

| |

Per Unit |

Total |

| Public offering price(1) |

$ 10.000 |

$ |

| Underwriting discount(1) |

$ 0.175 |

$ |

| Proceeds, before expenses, to RBC |

$ 9.825 |

$ |

| (1) | For any purchase of 300,000 units or more in a single transaction by an individual investor or in combined

transactions with the investor’s household in this offering, the public offering price and the underwriting discount will be $9.950

per unit and $0.125 per unit, respectively. See “Supplement to the Plan of Distribution” below. |

The notes:

| Are Not FDIC Insured |

Are Not Bank Guaranteed |

May Lose Value |

BofA Securities

December , 2024

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

Summary

The Accelerated Return Notes® Linked to an International

Equity Index Basket, due February , 2026 (the “notes”) are our senior unsecured debt securities. The notes are not insured

by the Canada Deposit Insurance Corporation or the U.S. Federal Deposit Insurance Corporation or secured by collateral. The notes will

rank equally with all of our other unsecured and unsubordinated debt. Any payments due on the notes, including any repayment of principal,

will be subject to the credit risk of RBC. The notes are not bail-inable notes (as defined in the prospectus supplement). The notes

provide you a leveraged return, subject to a cap, if the Ending Value of the Basket, which is the international equity index basket described

below (the “Basket”), is greater than the Starting Value. If the Ending Value is less than the Starting Value, you will lose

all or a portion of the principal amount of your notes. Any payments on the notes will be calculated based on the $10 principal amount

per unit and will depend on the performance of the Basket, subject to our credit risk. See “Terms of the Notes” below.

The Basket is composed of the EURO STOXX 50® Index, the

FTSE® 100 Index, the Nikkei Stock Average Index, the Swiss Market Index, the S&P®/ASX 200 Index, and

the FTSE® China 50 Index (each a “Basket Component”). On the pricing date, the EURO STOXX 50® Index

will be given an initial weight of 40.00%, each of the FTSE® 100 Index and the Nikkei Stock Average Index will be given

an initial weight of 20.00%, each of the Swiss Market Index and the S&P®/ASX 200 Index will be given an initial weight

of 7.50% and the FTSE® China 50 Index will be given an initial weight of 5.00%.

The economic terms of the notes (including the Capped Value) are based

on our internal funding rate, which is the rate we pay to borrow funds through the issuance of market-linked notes, and the economic terms

of certain related hedging arrangements. Our internal funding rate is typically lower than the rate we would pay when we issue conventional

fixed or floating rate debt securities. This difference in funding rate, as well as the underwriting discount and the hedging-related

charge described below, reduce the economic terms of the notes to you and the price at which you may be able to sell the notes in any

secondary market. Due to these factors, the public offering price you pay to purchase the notes will be greater than the initial estimated

value of the notes.

On the cover page of this term sheet, we have provided the initial estimated

value range for the notes. This initial estimated value range was determined based on our and our affiliates’ pricing models, which

take into consideration our internal funding rate and the market prices for the hedging arrangements related to the notes. The initial

estimated value of the notes calculated on the pricing date will be set forth in the final term sheet made available to investors in the

notes. For more information about the initial estimated value and the structuring of the notes, see “Structuring the Notes”

below.

| Terms of the Notes |

Redemption Amount Determination |

| Issuer: |

Royal Bank of Canada (“RBC”) |

On the maturity date, you will receive a cash payment per unit determined as follows: |

| Principal Amount: |

$10.00 per unit |

|

| Term: |

Approximately 14 months |

| Market Measure: |

An international equity index basket composed of the EURO STOXX 50® Index (Bloomberg symbol: “SX5E”), the FTSE® 100 Index (Bloomberg symbol: “UKX”), the Nikkei Stock Average Index (Bloomberg symbol: “NKY”), the Swiss Market Index (Bloomberg symbol: “SMI”), the S&P®/ASX 200 Index (Bloomberg symbol: “AS51”) and the FTSE® China 50 Index (Bloomberg symbol: “XIN0I”). Each Basket Component is a price return index. |

| Starting Value: |

The Starting Value will be set to 100.00 on the pricing date |

| Ending Value: |

The average of the values of the Basket on each calculation day occurring during the Maturity Valuation Period, calculated as specified in “The Basket” below. The scheduled calculation days are subject to postponement in the event of Market Disruption Events, as described beginning on page PS-23 of product supplement EQUITY ARN-1. |

| Participation Rate: |

300% |

| Capped Value: |

[$11.40 to $11.80] per unit, which represents a return of [14.00% to 18.00%] over the principal amount. The actual Capped Value will be determined on the pricing date. |

| Maturity Valuation Period: |

Five scheduled calculation days shortly before the maturity date |

| Fees and Charges: |

The underwriting discount of $0.175 per unit listed on the cover page and a hedging-related charge of $0.05 per unit described in “Structuring the Notes” below. |

| Calculation Agent: |

BofA Securities, Inc. (“BofAS”) |

| Accelerated Return Notes® | TS-2 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

The terms and risks of the notes are contained in this term sheet and

in the following:

These documents (together, the “Note Prospectus”) have been

filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website as indicated above or

obtained from us, Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322.

Before you invest, you should read the Note Prospectus, including this term sheet and the other documents that we have filed with the

SEC for information about us and this offering. Any prior or contemporaneous oral statements and any other written materials you may have

received are superseded by the Note Prospectus. Capitalized terms used but not defined in this term sheet have the meanings set forth

in product supplement EQUITY ARN-1. Unless otherwise indicated or unless the context requires otherwise, all references in this term sheet

to “Royal Bank of Canada,” the “Bank,” “we,” “us,” “our” or similar references

mean only RBC.

“Accelerated Return Notes®” and “ARNs®”

are the registered service marks of Bank of America Corporation, the parent company of MLPF&S and BofAS.

Investor Considerations

You may wish to consider an investment in the notes if:

| § | You anticipate that the Basket will increase moderately from the Starting Value to the Ending Value. |

| § | You are willing to risk a loss of principal and return if the Basket decreases from the Starting Value to the Ending Value. |

| § | You accept that the return on the notes will be capped. |

| § | You are willing to forgo the interest payments that are paid on conventional interest-bearing debt securities. |

| § | You are willing to forgo dividends and other benefits of directly owning the securities included in the Basket Components. |

| § | You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes,

if any, will be affected by various factors, including our actual and perceived creditworthiness, our internal funding rate and fees and

charges on the notes. |

| § | You are

willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Redemption Amount. |

The notes may not be an appropriate

investment for you if:

| § | You

believe that the Basket will decrease from the Starting Value to the Ending Value or that

it will not increase sufficiently over the term of the notes to provide you with your desired

return. |

| § | You seek principal repayment or preservation of capital. |

| § | You seek an uncapped return on your investment. |

| § | You seek interest payments or other current income on your investment. |

| § | You want to receive dividends or have other benefits of directly owning the securities included in the Basket Components. |

| § | You seek an investment for which there will be a liquid secondary market. |

| § | You are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes. |

We urge you to consult your investment, legal, tax, accounting and other

advisors before you invest in the notes.

| Accelerated Return Notes® | TS-3 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

Hypothetical Payout Profile and Examples of Payments

at Maturity

The graph below is based on hypothetical numbers and values.

|

Accelerated Return Notes®

|

This graph reflects the returns on the notes,

based on the Participation Rate of 300% and a hypothetical Capped Value of $11.60 per unit (the midpoint of the Capped Value range of

[$11.40 to $11.80]). The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment

in the securities included in the Basket Components, excluding dividends.

This graph has been prepared for purposes

of illustration only.

|

The following table and examples are for purposes of illustration only.

They are based on hypothetical values and show hypothetical returns on the notes. They illustrate the calculation of the

Redemption Amount and total rate of return based on the Starting Value of 100.00, the Participation Rate of 300%, a hypothetical Capped

Value of $11.60 per unit and a range of hypothetical Ending Values. The actual amount you receive and the resulting total rate of

return will depend on the actual Ending Value and Capped Value, and whether you hold the notes to maturity. The following examples

do not take into account any tax consequences from investing in the notes.

For recent hypothetical historical values of the Basket, see

“The Basket” section below. For recent actual levels of the Basket Components, see “The Basket Components” section

below. Each Basket Component is a price return index and as such the Ending Value will not include any income generated by dividends paid

on the securities included in any of the Basket Components, which you would otherwise be entitled to receive if you invested in those

securities directly. In addition, all payments on the notes are subject to issuer credit risk.

|

Ending Value |

Percentage

Change from the Starting Value to the Ending Value |

Redemption

Amount per Unit |

Total Rate

of Return on the Notes |

| 0.00 |

-100.00% |

$0.00 |

-100.00% |

| 50.00 |

-50.00% |

$5.00 |

-50.00% |

| 80.00 |

-20.00% |

$8.00 |

-20.00% |

| 90.00 |

-10.00% |

$9.00 |

-10.00% |

| 94.00 |

-6.00% |

$9.40 |

-6.00% |

| 97.00 |

-3.00% |

$9.70 |

-3.00% |

| 100.00(1) |

0.00% |

$10.00 |

0.00% |

| 102.00 |

2.00% |

$10.60 |

6.00% |

| 103.00 |

3.00% |

$10.90 |

9.00% |

| 105.00 |

5.00% |

$11.50 |

15.00% |

| 105.34 |

5.34% |

$11.60(2) |

16.00% |

| 110.00 |

10.00% |

$11.60 |

16.00% |

| 120.00 |

20.00% |

$11.60 |

16.00% |

| 130.00 |

30.00% |

$11.60 |

16.00% |

| 140.00 |

40.00% |

$11.60 |

16.00% |

| 150.00 |

50.00% |

$11.60 |

16.00% |

| 160.00 |

60.00% |

$11.60 |

16.00% |

| (1) | The Starting Value will be set to 100.00 on the pricing date. |

| (2) | The Redemption Amount per unit cannot exceed the hypothetical Capped Value. |

| Accelerated Return Notes® | TS-4 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

Redemption Amount Calculation Examples

| Example 1 |

| The Ending Value is 50.00, or 50.00% of the Starting Value: |

| Starting Value: 100.00 |

| Ending Value: 50.00 |

|

= $5.00 Redemption Amount per unit |

| Example 2 |

| The Ending Value is 103.00, or 103.00% of the Starting Value: |

| Starting Value: 100.00 |

| Ending Value: 103.00 |

|

= $10.90 Redemption Amount per unit |

| Example 3 |

| The Ending Value is 130.00, or 130.00% of the Starting Value: |

| Starting Value: 100.00 |

| Ending Value: 130.00 |

|

= $19.00, however, because the Redemption Amount for the notes cannot exceed the hypothetical Capped Value, the Redemption Amount will be $11.60 per unit |

| Accelerated Return Notes® | TS-5 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

Risk Factors

There are important differences between the notes and a conventional

debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more

detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-7 of product supplement

EQUITY ARN-1, page S-3 of the MTN prospectus supplement, and page 1 of the prospectus identified above. We also urge you to consult your

investment, legal, tax, accounting, and other advisors before you invest in the notes.

Structure-related Risks

| § | Depending on the performance of the Basket as measured shortly before the maturity date, your investment may result in a loss; there

is no guaranteed return of principal. |

| § | Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of

comparable maturity. |

| § | Payments on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect

the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment. |

| § | Your investment return is limited to the return represented by the Capped Value and may be less than a comparable investment directly

in the securities included in the Basket Components. |

Valuation- and Market-related Risks

| § | The initial estimated value of the notes is only an estimate, determined as of a particular point in time by reference to our and

our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads, our

internal funding rate, mid-market terms on hedging transactions, expectations on dividends, interest rates and volatility, price-sensitivity

analysis and the expected term of the notes. These pricing models rely in part on certain forecasts about future events, which may prove

to be incorrect. |

| § | The public offering price you pay for the notes will exceed the initial estimated value. If you attempt to sell the notes prior to

maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to,

among other things, changes in the value of the Basket, our internal funding rate, and the inclusion in the public offering price of the

underwriting discount and the hedging-related charge, all as further described in “Structuring the Notes” below. These factors,

together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may

be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways. |

| § | The initial estimated value does not represent a minimum or maximum price at which we, MLPF&S, BofAS or any of our affiliates

would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your notes at any time after

issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Basket, our creditworthiness

and changes in market conditions. |

| § | A trading market is not expected to develop for the notes. None of us, MLPF&S or BofAS is obligated to make a market for, or to

repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market. |

Conflict-related Risks

| § | Our business, hedging and trading activities, and those of MLPF&S, BofAS and our respective affiliates (including trades in the

securities included in the Basket Components), and any hedging and trading activities we, MLPF&S, BofAS or our respective affiliates

engage in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with

you. |

| § | There may be potential conflicts of interest involving the calculation agent, which is BofAS. We have the right to appoint and remove

the calculation agent. |

Basket-related Risks

| § | Changes in the level of one Basket Component may be offset by changes in the levels of the other Basket Components. Due to the different

Initial Component Weights, changes in the levels of some Basket Components will have a more substantial impact on the value of the Basket

than similar changes in the levels of the other Basket Components. |

| § | The index sponsors may adjust each Basket Component in a way that affects its level, and the index sponsors have no obligation to

consider your interests. |

| § | You will have no rights of a holder of the securities included in the Basket Components, and you will not be entitled to receive securities

or dividends or other distributions by the issuers of those securities. |

| § | While we, MLPF&S, BofAS or our respective affiliates may from time to time own the securities

included in the Basket Components, we, MLPF&S, BofAS and our respective affiliates do not control the issuers of those securities,

and have not verified any disclosure made by any other company. |

| Accelerated Return Notes® | TS-6 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

| § | Your return on the notes and the value of the notes may be affected by exchange rate movements

and factors affecting the international securities markets, specifically changes in the countries represented by the Basket Components.

In addition, you will not obtain the benefit of any increase in the value of the currencies in which the securities included in the Basket

Components trade against the U.S. dollar, which you would have received if you had owned the securities included in the Basket Components

during the term of your notes, although the levels of the Basket Components may be adversely affected by general exchange rate movements

in the market. |

Tax-related Risks

| § | The U.S. federal income tax consequences of an investment in the notes are uncertain. There is no direct legal authority regarding

the proper U.S. federal income tax treatment of the notes, and significant aspects of the tax treatment of the notes are uncertain. You

should review carefully the section entitled “United States Federal Income Tax Considerations” herein, in combination with

the section entitled “U.S. Federal Income Tax Summary” in the accompanying product supplement, and consult your tax adviser

regarding the U.S. federal income tax consequences of an investment in the notes. |

Other Terms of the Notes

Market Measure Business Day

The following definition supersedes

and replaces the definition of “Market Measure Business Day” set forth in product supplement EQUITY ARN-1.

A “Market Measure Business

Day” means, in respect of a Basket Component, a day on which:

| (A) | the Eurex (in the case of the EURO STOXX 50® Index), the London Stock Exchange

(in the case of the FTSE® 100 Index), the Tokyo Stock Exchange (in the case of the Nikkei Stock Average), the SIX Swiss

Exchange (in the case of the Swiss Market Index), the Australian Stock Exchange (in the case of the S&P®/ASX 200 Index)

or the Stock Exchange of Hong Kong (in the case of the FTSE® China 50 Index) (or any successor to the foregoing exchanges),

as applicable, is open for trading; and |

| (B) | that Basket Component or any successor thereto is calculated and published. |

| Accelerated Return Notes® | TS-7 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

The Basket

The Basket is designed to allow investors to participate in the percentage

changes in the levels of the Basket Components from the Starting Value to the Ending Value of the Basket. The Basket Components are described

in the section “The Basket Components” below. Each Basket Component will be assigned an initial weight on the pricing date,

as set forth in the table below.

For more information on the calculation of the value of the Basket,

please see the section entitled “Description of ARNs—Basket Market Measures” beginning on page PS-31 of product supplement

EQUITY ARN-1.

If November 27, 2024 were the pricing date, for each Basket Component,

the Initial Component Weight, the closing level, the hypothetical Component Ratio and the initial contribution to the Basket value would

be as follows:

| Basket Component |

|

Bloomberg Symbol |

|

Initial Component Weight |

|

Closing Level(1)(2) |

|

Hypothetical Component Ratio(1)(3) |

|

Initial Basket Value Contribution |

| EURO STOXX 50® Index |

|

SX5E |

|

40.00% |

|

4,733.15 |

|

0.00845103 |

|

40.00 |

| FTSE® 100 Index |

|

UKX |

|

20.00% |

|

8,274.75 |

|

0.00241699 |

|

20.00 |

| Nikkei Stock Average Index |

|

NKY |

|

20.00% |

|

38,134.97 |

|

0.00052445 |

|

20.00 |

| Swiss Market Index |

|

SMI |

|

7.50% |

|

11,644.01 |

|

0.00064411 |

|

7.50 |

| S&P®/ASX 200 Index |

|

AS51 |

|

7.50% |

|

8,406.666 |

|

0.00089215 |

|

7.50 |

| FTSE® China 50 Index |

|

XIN0I |

|

5.00% |

|

13,590.09 |

|

0.00036792 |

|

5.00 |

| |

|

|

|

|

|

|

|

Starting Value |

|

100.00 |

| (1) | The actual closing level of each Basket Component and the resulting actual Component Ratios will be determined on the pricing date,

subject to adjustment as more fully described in the section entitled “Description of ARNs—Basket Market Measures—Determination

of the Component Ratio for Each Basket Component” beginning on page PS-31 of product supplement EQUITY ARN-1. |

| (2) | These were the closing levels of the Basket Components on November 27, 2024. |

| (3) | Each hypothetical Component Ratio equals the Initial Component Weight of the relevant Basket Component (as a percentage) multiplied

by 100, and then divided by the closing level of that Basket Component on November 27, 2024 and rounded to eight decimal places. |

The calculation agent will calculate the value of the Basket by summing

the products of the closing level for each Basket Component on each calculation day during the Maturity Valuation Period and the Component

Ratio applicable to that Basket Component. If a Market Disruption Event or non-Market Measure Business Day occurs as to any Basket Component

on any scheduled calculation day, the closing level of that Basket Component will be determined as more fully described in the section

entitled “Description of the ARNs—Basket Market Measures—Ending Value of the Basket” in product supplement EQUITY

ARN -1.

| Accelerated Return Notes® | TS-8 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

While actual historical information on the Basket will not exist

before the pricing date, the following graph sets forth the hypothetical daily historical performance of the Basket from January 1, 2014

through November 27, 2024. The graph is based upon actual daily historical levels of the Basket Components, hypothetical Component Ratios

based on the closing levels of the Basket Components as of January 1, 2014, and a Basket value of 100.00 as of that date. This hypothetical

historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may

be. Any hypothetical historical upward or downward trend in the value of the Basket during any period set forth below is not an indication

that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

Hypothetical Historical Performance of the Basket

| Accelerated Return Notes® | TS-9 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

The Basket Components

All disclosures contained in this term sheet regarding the Basket Components,

including, without limitation, their make-up, method of calculation, and changes in their components, have been derived from publicly

available sources. The information reflects the policies of, and is subject to change by each of STOXX Limited (“STOXX”) with

respect to the EURO STOXX 50® Index (the “SX5E”), FTSE International Limited (“FTSE”) with respect

to the FTSE® 100 Index and the FTSE® China 50 Index (the “UKX” and the “XIN0I”,

respectively), Nikkei Inc. (“Nikkei”) with respect to the Nikkei Stock Average Index (the “NKY”), the Geneva,

Zurich, SIX Group Ltd., certain of its subsidiaries, and the Management Committee of the SIX Swiss Exchange (the “SIX Exchange”),

with respect to the Swiss Market Index (the “SMI”), and S&P Dow Jones Indices LLC (“S&P”), a division

of S&P Global, with respect to the S&P®/ASX 200 Index (the “AS51”) (STOXX, FTSE, Nikkei, SIX Exchange

and S&P together, the “index sponsors”). The index sponsors have no obligation to continue to publish, and may discontinue

or suspend the publication of any Basket Component at any time. The consequences of any index sponsor discontinuing publication of a Basket

Component are discussed in the section entitled “Description of ARNs—Discontinuance of an Index” in product supplement

EQUITY ARN-1. None of us, the calculation agent, MLPF&S, or BofAS accepts any responsibility for the calculation, maintenance, or

publication of any Basket Component or any successor index.

The EURO STOXX 50® Index

We obtained all information contained in this term sheet regarding the

EURO STOXX 50® Index (the “SX5E”), including, without limitation, its make-up, method of calculation

and changes in its components, from publicly available information. This information reflects the policies of, and is subject to change

by, STOXX Limited, a wholly owned subsidiary of Deutsche Börse AG, the index sponsor. The SX5E is calculated, maintained and published

by STOXX Limited. STOXX Limited has no obligation to continue to publish, and may discontinue publication of the SX5E at any time. The

consequences of the index sponsor discontinuing publication of the SX5E are discussed in the section entitled “Description of ARNs—Discontinuance

of an Index” in product supplement EQUITY ARN-1. None of us, the calculation agent, MLPF&S, or BofAS accepts any responsibility

for the calculation, maintenance, or publication of the SX5E or any successor index. Neither we nor any agent has independently verified

the accuracy or completeness of any information with respect to the SX5E in connection with the offer and sale of securities.

The SX5E is a free-float market capitalization weighted index composed

of 50 of the largest stocks in terms of free-float market capitalization traded on the major exchanges

of 9 Eurozone countries: Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands and Spain. At any given time,

some eligible countries may not be represented in the SX5E. The euro price return version

of the SX5E is reported by Bloomberg L.P. under the ticker symbol “SX5E.”

The selection list for the SX5E

is composed of the components of the EURO STOXX® Index. In addition, the selection

list for the SX5E includes the top 60% of the free-float market capitalization of each of

the 20 EURO STOXX® Supersector indices and all current SX5E component stocks.

All the stocks on the selection list are ranked in terms of free-float market capitalization. The largest 40 stocks on the selection list

are selected for inclusion in the SX5E; the remaining 10 stocks are selected from the largest

remaining current stocks ranked between 41 and 60. If the number of stocks selected is still below 50, then the largest remaining stocks

are selected until there are 50 stocks.

The weighting cap factor

limits the weight of each component stock within the SX5E to a maximum of 10% of the SX5E at the time of each review.

Each of the SX5E, the EURO STOXX®

Index and each EURO STOXX® Supersector Index is referred to individually as a “STOXX Benchmark Index”

and, collectively, as the “STOXX Benchmark Indices.”

STOXX Benchmark Index Maintenance

The composition of each of the

EURO STOXX® Index and the EURO STOXX® Supersector Indices is reviewed quarterly in March, June, September

and December. The review cut-off date is the last trading day of the month preceding the review month.

The composition of the SX5E

is reviewed annually in September. The review cut-off date is the last trading day of August. The

composition of the SX5E is also reviewed monthly and components that rank 75 or below are

replaced and non-component stocks that rank 25 or above are added.

In addition, changes to country

classification and listing are effective as of the next quarterly review. At that time, the relevant STOXX Benchmark Index is adjusted

accordingly to remain consistent with its country membership rules by deleting the company where necessary.

The STOXX Benchmark Indices are

also reviewed on an ongoing basis. Corporate actions (including initial public offerings, mergers and takeovers, spin-offs, delistings,

bankruptcy, and price and share adjustments) that affect a STOXX Benchmark Index composition are immediately reviewed. Any changes are

announced, implemented and effective in line with the type of corporate action and the magnitude of the effect.

With respect to the EURO STOXX®

Index, the EURO STOXX® Supersector Indices and the EURO STOXX 50® Index, to maintain the number of components

constant, a removed company is replaced by the highest-ranked non-component on the relevant selection list. The selection list is updated

on a monthly basis according to the review component selection process.

The free-float factors for each

component stock used to calculate each STOXX Benchmark Index are reviewed, calculated and implemented on a quarterly basis and are fixed

until the next quarterly review.

| Accelerated Return Notes® | TS-10 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

STOXX Benchmark Index Calculation

Each STOXX Benchmark Index

is calculated with the “Laspeyres formula,” which measures the aggregate price changes in the component stocks against a fixed

base quantity weight. The formula for calculating the value of a STOXX Benchmark Index can be expressed as follows:

| Index = |

free-float market capitalization of the relevant STOXX Benchmark Index |

| divisor |

The “free-float market capitalization of the relevant STOXX Benchmark

Index” is equal to the sum of the products, for each component stock, of the price, number

of shares, free-float factor, weighting cap factor and, if applicable, the exchange rate from the local currency into the index currency

of the relevant STOXX Benchmark Index as of the time that STOXX Benchmark Index is being calculated.

The free-float factor of each

component stock is intended to reduce the number of shares to the actual amount available on the market. All fractions of the total number

of shares that are larger than or equal to 5% and whose holding is of a long-term nature are excluded from the calculation of the STOXX

Benchmark Indices, including: cross-ownership (stock owned either by the company itself, in the form of treasury shares, or owned by other

companies); government ownership (stock owned by either governments or their agencies); private ownership (stock owned by either individuals

or families); and restricted shares that cannot be traded during a certain period or have a foreign ownership restriction. Block ownership

is not applied for holdings of custodian nominees, trustee companies, mutual funds, investment companies with short-term investment strategies,

pension funds and similar entities.

Each STOXX Benchmark Index is

also subject to a divisor, which is adjusted to maintain the continuity of the values of that STOXX Benchmark Index despite changes due

to corporate actions. The following is a summary of the adjustments to any component

stock of a STOXX Benchmark Index made for corporate actions and the effect of such adjustment on the divisor of that STOXX Benchmark Index,

where shareholders of the component stock will receive “B” number of shares for every “A” share held (where applicable).

| 𝜏 |

= |

withholding tax |

| Divt |

= |

dividend amount announced by company |

| pt-1 |

= |

closing price on the day before the ex-date |

| padj |

= |

new adjusted price |

| wft-1 |

= |

weighting factor on the day before the ex-date |

| wfadj |

= |

new adjusted weighing factor |

| st-1 |

= |

number of shares on the day before the ex-date |

| sadj |

= |

new adjusted number of shares |

| SP |

= |

subscription price |

| Special Cash Dividend |

|

Divisor |

| Cash distributions that are outside the scope of the regular dividend policy or that the company defines as an extraordinary distribution. |

|

decreases |

| |

|

|

| padj = pt-1 - Divt × (1 – 𝜏*) |

|

|

____________________

* If a withholding tax (𝜏)

applies then 𝜏 > 0, else 𝜏

= 0.

| Split and Reverse Split |

|

Divisor |

| padj = pt-1 × A / B |

|

unchanged |

| sadj = st-1 × B / A |

|

|

| Rights Offering |

|

|

|

If the subscription price is not available or equal to or greater than

the closing price on the day before the ex-date (out-of-the-money), then no adjustment is made.

If the subscription price is available as a price range and not as a

fixed price, the price and share adjustment is performed only if both lower and upper range are in the money. The average value between

lower and upper range will be used as a subscription price.

|

|

|

|

If the subscription price is not available or equal to or greater than

the closing price on the day before the ex-date (out-of-the-money), then no adjustment is made.

If the subscription price is available as a price range and not as a

fixed price, the price and share adjustment is performed only if both lower and upper range are in the money. The average value between

lower and upper range will be used as a subscription price.

|

|

|

| Accelerated Return Notes® | TS-11 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

| Standard Rights Issue |

|

Divisor |

| padj = (pt-1 × A + SP × B) / (A + B) |

|

increases |

| sadj = st-1 × (A + B) / A |

|

|

| Highly Dilutive Rights Issue |

|

Divisor |

| A rights offering is considered as Highly Dilutive Rights Issue (HDRI) when the share ratio is larger or equal to 200% but smaller than 2000% (20 > B/A ≥ 2). |

|

|

| · Scenario 1: If the rights are tradable on ex-date on the same eligible stock exchange as the parent company: |

|

|

| · The rights will be included into the indices with a theoretical price on the ex-date with the same parameters as the parent company. |

|

unchanged on ex-date |

| · The rights will be removed at the close of the day they start to trade based on its closing price. |

|

decreases after deletion of rights |

| · If the rights issue results into listing of new shares and satisfy certain criteria relating to free float factors and share adjustments under STOXX methodology, then the number of shares will be increased after the new shares have been listed. |

|

increases on the day of the share increase |

| · Scenario 2: If the rights are not tradable on ex-date or not tradable on the ex-date on the same eligible stock exchange as the parent company: |

|

decreases on ex-date |

| · Only a price adjustment will be applied. |

|

|

| · If the rights issue results into listing of new shares and satisfy certain criteria relating to free float factors and share adjustments under STOXX methodology, then the number of shares will be increased after the new shares have been listed. |

|

increases on the day of the share increase |

| |

|

|

| Extremely Dilutive Rights Issue |

|

Divisor |

| A rights offering is considered as Extremely Dilutive Rights Issue (EDRI) when the share ratio is larger or equal to 2000% (B/A ≥ 20). |

|

|

| · Extremely dilutive rights issues with sufficient notice period* are treated as following: STOXX will announce the deletion of the company from all indices following the standard rules for index replacements. The company may enter the indices again at the next periodic index review, but only after the new shares have been listed. |

|

Decreases |

| · Extremely dilutive rights issues without sufficient notice period are treated as highly dilutive rights issues. |

|

|

____________________

* Sufficient notice period means that STOXX is able to announce index

changes with two trading days’ notice.

| Ordinary Stock Dividend |

|

Divisor |

| padj = pt-1 × A / (A + B) |

|

unchanged |

| sadj = st-1 × (A + B) / A |

|

|

| Stock Dividend From Treasury Stock (only if treated as a special cash dividend) |

|

Divisor |

| Stock dividends from treasury stocks will be adjusted as cash dividends. |

|

decreases |

| padj = pt-1 - pt-1 × B / (A + B) |

|

|

| Stock Dividend From Redeemable Shares (only if treated as a special cash dividend) |

|

Divisor |

| Stock dividends from redeemable shares will be adjusted as cash dividends. In such a case, redeemable shares are considered as: |

|

decreases |

| · A separated share line with a fixed price. |

|

|

| · Ordinary shares that are self-tendered on the same ex-date. |

|

|

| padj = pt-1 - pt-1 × B / (A + B) |

|

|

| |

|

|

| Stock Dividend of Another Company |

|

Divisor |

| padj = [(pt-1 × A) – [(1 – 𝜏*) × price of the other company × B]] / A |

|

decreases |

| Accelerated Return Notes® | TS-12 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

___________________

* If a withholding tax (𝜏)

applies then 𝜏 > 0, else 𝜏

= 0.

| Return of Capital and Share Consolidation |

|

Divisor |

| The event will be applied as a combination of cash/special dividend together with a reverse split. |

|

|

| · If the return of capital is considered as regular cash dividend, then the treatment under “Split and Reverse Split” above applies. |

|

decreases |

| · If the return of capital is considered as special cash dividend, then the treatment under “Special Cash Dividend” and “Split and Reverse Split” above apply accordingly. |

|

decreases |

| padj = [pt-1 - capital return announced by company × (1 – 𝜏*)] × A / B |

|

|

|

____________________

* If a withholding tax (𝜏)

applies then 𝜏 > 0, else 𝜏

= 0.

|

|

|

| sadj = st-1 × B / A |

|

|

| Repurchase of Shares/Self-Tender |

|

Divisor |

| padj = [(pt-1 × st-1) – (tender price × number of tendered shares)] / sadj |

|

decreases |

| sadj = st-1 - number of tendered shares |

|

|

| Spin-off |

|

Divisor |

| The adjusted price (padj), the number of shares before the ex-date (st-1) and the weighting factor on the day before the ex-date (wft-1) refer to the parent company. |

|

unchanged on ex-date |

| padj = (pt-1 × A – price of spun-off shares × B) / A |

|

|

| New number of shares for the spun-off company = st-1 × B |

|

|

| Combination of Stock Distribution (Dividend or Split) and Rights Offering |

|

Divisor |

| For the below corporate actions, the following additional assumptions apply: |

|

|

| · Shareholders receive ‘B’ new shares from the distribution and ‘C’ new shares from the rights offering for every ‘A’ share held. |

|

|

| · If ‘A’ is not equal to one, all the following ‘new number of shares’ formulas need to be divided by ‘A’: |

|

|

| · If rights are applicable after stock distribution (one action applicable to another) |

|

increases |

| padj = [pt-1 × A + SP × C × (1 + B / A)] / [(A + B) × (1 + C / A)] |

|

|

| sadj = st-1 × [(A + B) × (1 + C / A)] / A |

|

increases |

| · If stock distribution is applicable after rights (one action applicable to another) |

|

|

| padj = (pt-1 × A + SP × C) / [(A + C) × (1 + B / A)] |

|

increases |

| sadj = st-1 × (A + C) × (1 + B / A) |

|

|

| · Stock distribution and rights (neither action is applicable to the other) |

|

|

| padj = (pt-1 × A + SP × C) / (A + B + C) |

|

|

| sadj = st-1 × (A + B + C) / A |

|

|

| Addition/Deletion of A Company |

|

|

| No price adjustments are made. The change in market capitalization determines the divisor adjustment. If the change in market capitalization between added and deleted companies of an index increases (decreases), then the divisor increases (decreases). If the change is null, then the divisor remains unchanged. |

|

|

| Free Float and Shares Changes |

|

|

| No price adjustments are made. The change in market capitalization determines the divisor adjustment. If the change in market capitalization of an index increases (decreases), then the divisor increases (decreases). If the change is null, then the divisor remains unchanged. |

|

|

| Accelerated Return Notes® | TS-13 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

The following graph shows the daily historical performance of

the SX5E in the period from January 1, 2014 through November 27, 2024. We obtained this historical data from Bloomberg L.P. We have not

independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On November 27, 2024, the closing

level of the SX5E was 4,733.15.

Historical Performance of the SX5E

This historical data on the SX5E is not necessarily indicative

of the future performance of the SX5E or what the value of the notes may be. Any historical upward or downward trend in the level of the

SX5E during any period set forth above is not an indication that the level of the SX5E is more or less likely to increase or decrease

at any time over the term of the notes.

Before investing in the notes, you should consult publicly available

sources for the levels of the SX5E.

License Agreement

We have entered into or expect to enter into a non-exclusive license

agreement with STOXX providing for the license to us and certain of our affiliated or subsidiary companies, in exchange for a fee, of

the right to use indices owned and published by STOXX in connection with certain securities, including the notes offered hereby.

The license agreement between us and STOXX requires or is expected to

require that the following language be stated in this term sheet:

STOXX has no relationship to us, other than the licensing of the STOXX

Benchmark Indices and the related trademarks for use in connection with the notes. STOXX does not:

| |

· |

sponsor, endorse, sell, or promote the notes; |

| |

· |

recommend that any person invest in the notes offered hereby or any other securities; |

| |

· |

have any responsibility or liability for or make any decisions about the timing, amount, or pricing of the notes; |

| |

· |

have any responsibility or liability for the administration, management, or marketing of the notes; or |

| |

· |

consider the needs of the notes or the holders of the notes in determining, composing, or calculating the STOXX Benchmark Indices, or have any obligation to do so. |

STOXX will not have any liability in connection with the notes. Specifically:

| |

· |

STOXX does not make any warranty, express or implied, and disclaims any and all warranty concerning: |

| |

o |

the results to be obtained by the notes, the holders of the notes or any other person in connection with the use of the STOXX Benchmark Indices and the data included in the STOXX Benchmark Indices; |

| |

o |

the accuracy or completeness of the STOXX Benchmark Indices and their data; |

| |

o |

the merchantability and the fitness for a particular purpose or use of the STOXX Benchmark Indices and their data; |

| Accelerated Return Notes® | TS-14 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

| |

· |

STOXX will have no liability for any errors, omissions, or interruptions in the STOXX Benchmark Indices or their data; and |

| |

· |

Under no circumstances will STOXX be liable for any lost profits or indirect, punitive, special, or consequential damages or losses, even if STOXX knows that they might occur. |

The licensing agreement between us and STOXX is solely for their benefit

and our benefit, and not for the benefit of the holders of the notes or any other third parties.

| Accelerated Return Notes® | TS-15 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

The FTSE® 100 Index

We obtained all information contained in this term sheet regarding the

FTSE® 100 Index (the “UKX”), including, without limitation, its make-up, method of calculation and changes

in its components, from publicly available information. That information reflects the policies of, and is subject to change by, FTSE Russell

(“FTSE”), the index sponsor. FTSE is a wholly owned subsidiary of the London Stock Exchange Group plc (the “LSEG”).

The UKX is an index calculated, published and disseminated by FTSE. FTSE has no obligation to continue to publish, and may discontinue

publication of, the UKX at any time. The consequences of the index sponsor discontinuing publication of the UKX are discussed in the section

entitled “Description of ARNs—Discontinuance of an Index” in product supplement EQUITY ARN-1. None of us, the calculation

agent, MLPF&S, or BofAS accepts any responsibility for the calculation, maintenance, or publication of the UKX or any successor index.

Neither we nor any agent has independently verified the accuracy or completeness of any information with respect to the UKX in connection

with the offer and sale of securities.

The UKX is reported by Bloomberg L.P. under the ticker symbol “UKX.”

The UKX measures the composite price performance of stocks of the 100

largest companies (determined on the basis of market capitalization) traded on the London Stock Exchange (the “LSE”).

Publication of the UKX began in January 1984.

Composition of the UKX

The 100 stocks included in the UKX (the “FTSE Underlying Stocks”)

were selected from a reference group of stocks of U.K. companies trading on the LSE that were selected by excluding certain stocks that

have low liquidity based on public float, accuracy and reliability of prices, size and number of trading days. The FTSE Underlying Stocks

were selected from this reference group by selecting 100 stocks with the largest market value. Where there are multiple lines of listed

equity capital in a company, all are included and priced separately, provided that the secondary line’s full market capitalization

(i.e., before the application of any investability weightings), is greater than 25% of the full market capitalization of the company’s

principal line and the secondary line satisfies the eligibility rules and screens in its own right in all respects. A list of the issuers

of the FTSE Underlying Stocks is available from FTSE.

A company will be considered a U.K. company if it is U.K. incorporated,

the company has its sole listing in the United Kingdom and the company has a minimum free float of 10%. If a company is not incorporated

in the U.K., the company will be eligible to be considered a U.K. company if it publicly acknowledges adherence to the principles of the

UK Corporate Governance Code, pre-emption rights and the UK Takeover Code as far as practicable, and it has a minimum free float of 25%.

A company will be allocated to a single country.

Companies are required to have greater than 5% of the company’s

voting rights (aggregated across all of its equity securities, including, where identifiable, those that are not listed or trading) in

the hands of unrestricted shareholders in order to be eligible for index inclusion. The voting rights screen is applied to any potential

new constituents on a quarterly basis, and existing constituents will be tested on an annual basis in conjunction with the June review.

The UKX is overseen and reviewed quarterly by the FTSE Russell Europe,

Middle East & Africa Regional Equity Advisory Committee (the “Index Steering Committee”) in order to maintain continuity

in the level. The Index Steering Committee undertakes the reviews of the UKX and ensures that constituent changes and index calculations

are made in accordance with the ground rules of the UKX. The UKX is reviewed on a quarterly basis in March, June, September and December.

Each review is based on data from the close of business on the Tuesday before the first Friday of the review month. Any constituent changes

are implemented after the close of business on the third Friday of the review month (i.e., effective Monday), following the expiry

of the ICE Futures Europe futures and options contracts.

The FTSE Underlying Stocks may be replaced, if necessary, in accordance

with deletion/addition rules that provide generally for the removal and replacement of a stock from the UKX if such stock is delisted

or its issuer is subject to a takeover offer that has been declared unconditional or it has ceased, in the opinion of the Index Steering

Committee, to be a viable component of the UKX. To maintain continuity, a stock will be added at the quarterly review if it has risen

to 90th place or above and a stock will be deleted if at the quarterly review it has fallen to 111th place or below, in each case ranked

on the basis of market capitalization. A constant number of constituents will be maintained for the UKX. Where a greater number of companies

qualify to be inserted in the UKX than those qualifying to be deleted, the lowest ranking constituents presently included in the UKX will

be deleted to ensure that an equal number of companies are inserted and deleted at the periodic review. Likewise, where a greater number

of companies qualify to be deleted than those qualifying to be inserted, the securities of the highest ranking companies which are presently

not included in the UKX will be inserted to match the number of companies being deleted at the periodic review.

Companies that are large enough to be constituents of the UKX but do

not pass the liquidity test are excluded. They will remain ineligible until the next annual review in June when they will be re-tested

against all eligibility screens.

Calculation of the UKX

The UKX is an arithmetic weighted index where the weights are the market

capitalization of each FTSE Underlying Stock. The UKX is calculated by summing the free float adjusted market values (or capitalizations)

of all FTSE Underlying Stocks within the index divided by the divisor. On the base date, the divisor is calculated as the sum of the market

capitalizations of the FTSE Underlying Stocks divided by the initial index value of 1,000. The divisor is subsequently adjusted for any

capital changes in the FTSE Underlying Stocks. In order to minimize and/or prevent discontinuities in the UKX in the event of a corporate

action or change in constituents, adjustments are made to the prices used to calculate the UKX with the goal of ensuring that the changes

in the UKX between two consecutive dates reflects only market movements rather than including change due to the impact of corporate actions

or constituent changes. These adjustments are made in an attempt to ensure that the values of the UKX remain comparable over time and

that changes in the level of the UKX properly reflect the change in value of a portfolio of FTSE Underlying Stocks with weights the same

as in the UKX.

Corporate Events Affecting the UKX

| Accelerated Return Notes® | TS-16 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

FTSE applies corporate actions to the UKX on a daily basis. FTSE has

stated as general principles that the treatment of corporate events (a) should reflect how such events are likely to be dealt with in

investment portfolios to maintain the portfolio structure in line with the target set out in the index objective and index methodology

and (b) should normally be designed to minimize the trading activity required by investors to match the index performance. No assurance

can be provided that corporate actions and events will be treated by FTSE in a manner consistent with its statement of general principles.

In addition, FTSE has established guidance for the treatment of corporation

actions and events, including, but not limited to, dividends, capital repayments, companies converting to a REIT structure, share buybacks,

rights issues, mergers, acquisitions, tender offers, split-offs, spin-offs, bankruptcies, insolvencies, liquidations and trading suspensions.

However, because of the complexities involved in some cases, those guidelines are not definitive rules that will determine FTSE’s

actions in all circumstances. FTSE reserves the right to determine the most appropriate method of implementation for any corporate event

which is not covered by those guidelines or which is of a complex nature.

| Accelerated Return Notes® | TS-17 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

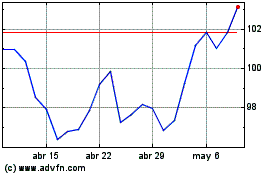

The following graph shows the daily historical performance of

the UKX in the period from January 1, 2014 through November 27, 2024. We obtained this historical data from Bloomberg L.P. We have not

independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On November 27, 2024, the closing

level of the UKX was 8,274.75.

Historical Performance of the UKX

This historical data on the UKX is not necessarily indicative

of the future performance of the UKX or what the value of the notes may be. Any historical upward or downward trend in the level of the

UKX during any period set forth above is not an indication that the level of the UKX is more or less likely to increase or decrease at

any time over the term of the notes.

Before investing in the notes, you should consult publicly available

sources for the levels of the UKX.

License Agreement

The notes are not in any way sponsored, endorsed, sold or promoted by

FTSE or by the Exchange or by The Financial Times Limited (“FT”) and neither FTSE or Exchange or FT makes any warranty

or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the UKX and/or the figure

at which the said UKX stands at any particular time on any particular day or otherwise. The UKX is compiled and calculated solely by FTSE.

However, neither FTSE or the Exchange or FT shall be liable (whether in negligence or otherwise) to any person for any error in the UKX

and neither FTSE or the Exchange or FT shall be under any obligation to advise any person of any error therein. “FTSE100”

is a trademark of London Stock Exchange Plc and The Financial Times Limited and are used by FTSE under license. “All-World”

is a trademark of FTSE.

| Accelerated Return Notes® | TS-18 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

The Nikkei Stock Average Index

We obtained all information contained in this term sheet regarding the

Nikkei Stock Average Index (the “NKY”), including, without limitation, its make-up, method of calculation, and changes

in its components, from publicly available information. That information reflects the policies of, and is subject to change by, Nikkei

Inc. (“Nikkei”), the index sponsor. Nikkei has no obligation to continue to publish, and may discontinue publication

of, the NKY at any time. The consequences of the index sponsor discontinuing publication of the NKY are discussed in the section entitled

“Description of ARNs—Discontinuance of an Index” in product supplement EQUITY ARN-1. None of us, the calculation agent,

MLPF&S, or BofAS accepts any responsibility for the calculation, maintenance, or publication of the NKY or any successor index. Neither

we nor any agent has independently verified the accuracy or completeness of any information with respect to the NKY in connection with

the offer and sale of the securities.

The NKY is reported by Bloomberg L.P. under the ticker symbol “NKY.”

The NKY, also known as the Nikkei 225 Index, is a stock index that measures

the composite price performance of selected Japanese stocks. The NKY is currently based on 225 underlying stocks (the “Nikkei

Underlying Stocks”) trading on the Tokyo Stock Exchange (the “TSE”) representing a broad cross-section of

Japanese industries. Non-ordinary shares, such as shares of exchange-traded funds, real estate investment trusts, preferred stock or other

preferred securities or tracking stocks, are excluded from the NKY.

All 225 Nikkei Underlying Stocks are stocks listed on the TSE Prime

Market. Stocks listed on the TSE Prime Market are among the most actively traded stocks on the TSE. Prior to April 2022, constituent stocks

were selected from the Tokyo Stock Exchange First Section. Nikkei rules require that the 75 most liquid issues (one-third of the component

count of the NKY) be included in the NKY. The NKY was launched on September 7, 1950 and first calculated by the TSE. Nikkei first calculated

and published the NKY in 1970.

Rules of the Periodic Review

Nikkei Underlying Stocks are reviewed twice a year (the “periodic

review”) in accordance with the following rules with a base date at the end of January and July, and results of the review are

applied in the beginning of April and October, respectively. Results of the review become effective on the first trading day of April

and October, and the maximum number of Nikkei Underlying Stocks that can be affected is three, excluding any Nikkei Underlying Stock affected

by corporate reorganization near the time of periodic review. Stocks selected by the procedures outlined below are presented as candidates

to a committee composed of academics and market professionals for comment; based on comments from the committee, Nikkei determines and

announces any changes to the Nikkei Underlying Stocks.

High Liquidity Group

The top 450 most liquid stocks are chosen from the TSE Prime Market.

For purposes of this selection, liquidity is measured by (i) trading volume in the preceding 5-year period and (ii) the magnitude of price

fluctuation by trading value (defined as (high price/low price)/trading value) in the preceding 5-year period. These 450 stocks constitute

the “High Liquidity Group” for the review. Those Nikkei Underlying Stocks that are not in the High Liquidity Group

are removed. Those stocks that are not currently Nikkei Underlying Stocks but that are in the top 75 of the High Liquidity Group are added.

Sector Balance

The High Liquidity Group is then categorized into the following six

sectors: Technology, Financials, Consumer Goods, Materials, Capital Goods/Others and Transportation and Utilities. These six sector categories

are further divided into 36 industrial classifications as follows:

| |

· |

Technology — Pharmaceuticals, Electrical Machinery, Automobiles & Auto Parts, Precision Instruments and Communications; |

| |

· |

Financials — Banking, Other Financial Services, Securities and Insurance; |

| |

· |

Consumer Goods — Fishery, Food, Retail and Services; |

| |

· |

Materials — Mining, Textiles & Apparel, Pulp & Paper, Chemicals, Petroleum, Rubber, Glass & Ceramics, Steel, Nonferrous Metals and Trading Companies; |

| |

· |

Capital Goods/Others — Construction, Machinery, Shipbuilding, Transportation Equipment, Other Manufacturing and Real Estate; and |

| |

· |

Transportation/Utilities — Railway & Bus, Land Transport, Marine Transport, Air Transport, Warehousing, Electric Power and Gas. |

The “appropriate number” of constituents for each

sector is defined to be half the number of stocks in that sector. After the liquidity-based adjustments, discussed above, a rebalancing

is conducted if any of the sectors are over- or under-represented. The degree of representation is evaluated by comparing the actual number

of constituents in the sector against the appropriate number for that sector.

For over-represented sectors, current constituents in the sector are

deleted in the order of liquidity (lowest liquidity first) to correct the overage. For under-represented sectors, non-constituent stocks

are added from the High Liquidity Group in the order of liquidity (highest liquidity first) to correct the shortage.

Extraordinary Replacement Rules

Nikkei Underlying Stocks that meet the following criteria will be deleted

from the NKY: designation as “securities to be delisted” or “securities on alert,” delisting due to corporate

restructuring such as merger, share exchange or share transfer, or transfer to a market other than the TSE Prime Market. However, if a

constituent stock is delisted due to a corporate restructuring and a stock of a company which succeeds the substance of the delisted company

is added, the newly listed stock will replace the delisted stock on the date of its

| Accelerated Return Notes® | TS-19 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

listing in principle. A constituent designated as a “security

under supervision” remains a constituent at the time of designation. However, Nikkei may replace such constituent with a pre-announcement

when it is highly inappropriate to keep the stock as a constituent (e.g. the probability of delisting is extremely high).

When a Nikkei Underlying Stock is deleted from the NKY as outlined in

the preceding paragraph, a new Nikkei Underlying Stock will be selected and added, in principle, from the same sector of the High Liquidity

Group in order of liquidity. Notwithstanding the foregoing, the following rules may apply depending on the timing and circumstances of

the deletion: (i) when such deletion is scheduled close to the time of the periodic review, additional stocks may be selected as part

of the periodic review process and (ii) when multiple deletions are scheduled in a season other than the periodic review, additions may

be selected using the liquidity and sector balancing rules outlined above.

Procedures to Implement Constituent Changes

As a general rule, for both the periodic review and the extraordinary

replacement rules, additions and deletions are made effective on the same day in order to keep the number of Nikkei Underlying Stocks

225. However, under the circumstances outlined below, when an addition cannot be made on the same day as a deletion, the NKY may be calculated

with fewer than 225 Nikkei Underlying Stocks. In this case, the divisor is adjusted to ensure continuity.

Calculation of the NKY

The NKY is a modified, price-weighted index (i.e., a Nikkei Underlying

Stock’s weight in the index is based on its price per share rather than the total market capitalization of the issuer) that is calculated

by (i) multiplying the per share price of each Nikkei Underlying Stock by the corresponding price adjustment factor for such Nikkei Underlying

Stock (a “PAF”), (ii) calculating the sum of all these products and (iii) dividing such sum by a divisor. The divisor

is subject to periodic adjustments as set forth below. The stock prices used in the calculation of the NKY are those reported by a primary

market for the Nikkei Underlying Stocks (currently the TSE). The level of the NKY is calculated every 5 seconds.

The PAF of a Nikkei Underlying Stock will equal 1 if the per share price

of such Nikkei Underlying Stock does not exceed 1% of the sum of the adjusted per share prices for all Nikkei Underlying Stocks. If the

per share price of a Nikkei Underlying Stock exceeds 1% of the sum of the adjusted per share prices for all Nikkei Underlying Stocks,

the PAF for such Nikkei Underlying Stock will be calculated in intervals of 0.1 (rounded down) and will equal the highest possible value

that, when multiplied by the per share price of such Nikkei Underlying Stock, does not exceed 1% of the sum of the adjusted per share

prices for all Nikkei Underlying Stocks. PAFs are evaluated annually on the base date at the end of July. If an average daily trading

value of a stock to be added is relatively low compared with its expected weight, the stock may be added with the PAF which is one-half

(rounded up to the nearest 0.1) of the value set by the method described in the preceding sentence. In such case, the PAF of the stock

shall be raised to the planned value at the next periodic review in principle.

Effective October 2022, if the weight of any Nikkei Underlying Stock

exceeds a certain threshold (the “weight cap threshold”) on the base date of a periodic review, a capping ratio will

be applied to decrease the weight of that Nikkei Underlying Stock. The weight cap threshold for any Nikkei Underlying Stock is (i) 12%

as of the October 2022 periodic review, (ii) 11% as of the October 2023 periodic review and (iii) 10% as of the October 2024 periodic

review. For any Nikkei Underlying Stock to which a capping ratio is applied, the price of that Nikkei Underlying Stock is adjusted by

a capped price adjustment factor (“CPAF”) equal to (i) the capping ratio multiplied by (ii) the PAF.

If, on the base date of a periodic review, the weight of any Nikkei

Underlying Stock exceeds the weight cap threshold and a capping ratio does not already apply to that Nikkei Underlying Stock, a capping

ratio of 0.9 is applied on the effective date of the periodic review. If a capping ratio already applies to any Nikkei Underlying Stock,

the capping ratio will be decreased in increments of 0.1 on the effective date of the periodic review until there is a change in the CPAF.

If, on the base date of a periodic change, the weight of a Nikkei Underlying Stock to which a capping ratio is applied is below 5%, the

capping ratio will be increased in increments of 0.1 on the effective date of the periodic review until there is a change in the CPAF;

however, the capping ratio will be canceled if it increases to 1.0. When a Nikkei Underlying Stock to which a capping ratio is applied

effects a large-scale stock split or reverse split and the PAF is adjusted by the ratio of the split or reverse split, the capping ratio

may be revised as necessary to ensure that the new CPAF does not change the weight of that Nikkei Underlying Stock.

In order to maintain continuity of the NKY in the event of certain changes

due to non-market factors affecting the Nikkei Underlying Stocks, such as the addition or deletion of stocks, substitution of stocks,

stock splits or distributions of assets to stockholders, the divisor used in calculating the NKY is adjusted in a manner designed to prevent

any instantaneous change or discontinuity in the level of the NKY. Thereafter, the divisor remains at the new value until a further adjustment

is necessary as the result of another change. As a result of such change affecting any Nikkei Underlying Stock, the divisor is adjusted

in such a way that the sum of all share prices immediately after such change multiplied by the applicable PAF and divided by the new divisor

(i.e., the level of the NKY immediately after such change) will equal the level of the NKY immediately prior to the change.

| Accelerated Return Notes® | TS-20 |

Accelerated Return Notes®

Linked to an International Equity Index Basket, due February , 2026 | |

The following graph shows the daily historical performance of

the NKY in the period from January 1, 2014 through November 27, 2024. We obtained this historical data from Bloomberg L.P. We have not

independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On November 27, 2024, the closing

level of the NKY was 38,134.97.

Historical Performance of the NKY

This historical data on the NKY is not necessarily indicative

of the future performance of the NKY or what the value of the notes may be. Any historical upward or downward trend in the level of the

NKY during any period set forth above is not an indication that the level of the NKY is more or less likely to increase or decrease at

any time over the term of the notes.

Before investing in the notes, you should consult publicly available

sources for the levels of the NKY.

License Agreement

We have entered into or expect to enter into a non-exclusive license

agreement with Nikkei, which will allow us and our affiliates, in exchange for a fee, to use the NKY in connection with this offering.

We are not affiliated with Nikkei; the only relationship between Nikkei and us will be the licensing of the use of the NKY and trademarks

relating to the NKY.

Nikkei is under no obligation to continue the calculation and dissemination

of the NKY. The notes are not sponsored, endorsed, sold or promoted by Nikkei. No inference should be drawn from the information contained

in this term sheet that Nikkei makes any representation or warranty, implied or express, to us, any holder of the notes or any member

of the public regarding the advisability of investing in securities generally, or in the notes in particular, or the ability of the NKY

to track general stock market performance.

Nikkei determines, composes and calculates the NKY without regard to

the notes. Nikkei has no obligation to take into account your interest, or that of anyone else having an interest, in the notes in determining,

composing or calculating the NKY. Nikkei is not responsible for, and has not participated in the determination of, the terms, prices or