TD Bank Survey Finds that U.S. Homeowners are Staying Put Amid Low Housing Supply and Leveraging Home Equity to Build Wealth, Consolidate Debt and Finance Major Renovations

14 Noviembre 2024 - 8:17AM

Business Wire

Younger generations are more likely to use home

equity loans to plan for long-term financial health

A recent survey from TD Bank, America's Most Convenient Bank®,

reveals that in the current market environment, homeowners continue

to see their properties as powerful financial assets, with

two-thirds (66%) viewing their home as a source of generational

wealth.

TD Bank’s HELOC Trend Watch is a national survey of more than

1,800 homeowners who purchased a home in the past 10 years using a

mortgage loan and currently own their home. The survey explores

trends in how homeowners are building their equity.

“Homeownership is not just about having a place to live—it's a

critical component of financial security and building generational

wealth,” said Steve Kaminski, Head of U.S. Residential Lending at

TD Bank. “With interest rates expected to continue to drop over the

next year, home prices and equity values will fluctuate alongside

the U.S. housing supply. We’re finding that home equity is playing

a bigger role in helping homeowners stay financially flexible.”

Homeowners Stay Put Amid Housing Shortage

Three out of five respondents who purchased their most recent

home (60%) reported that the low interest rates they secured on

their mortgage have influenced their decision not to sell in the

near future. Instead, they are building wealth through their home's

growing equity.

This decision is also influenced by the ongoing housing shortage

– which has encouraged many existing homeowners to stay put and tap

into their home’s equity. In fact, the percentage of homeowners who

are not planning to sell in the near future and are waiting for

housing inventory to increase before making a move has doubled

year-over-year from 9% in 2023 to 18% for this year. As a result,

many homeowners are opting to invest in their current properties,

rather than face the challenges of buying in a competitive market.

This approach aligns closely with the goals of younger homeowners,

as 74% of Gen Zers and 71% of Millennials view their homes as

sources of generational wealth, leveraging their equity to secure

their financial futures.

Homeowners are Seeking Additional Debt Consolidation

Options

Eighty-four percent of respondents are currently holding debt

beyond their mortgage, with 62% of those carrying $10,000 or more

in additional debt – increasing slightly from 61% in 2023. Rising

debt levels are putting increased pressure on household finances,

as nearly three-quarters of respondents who currently have any debt

other than their mortgage (71%) said they would be interested in

consolidating their debt under one loan at a lower interest

rate.

Though the Federal Reserve is expected to continue rate cuts

into 2025, 39% of respondents who noted they are not likely to

apply for a home equity line of credit (HELOC) or home equity loan

(HE Loan) in the near future said they still view the current

borrowing environment as challenging, remaining steady from

previous data in 2023. However, 37% of homeowners reported that the

recent interest rate cuts make them more likely to apply for a

HELOC or HE Loan, viewing it as a cost-effective way to reduce

debt.

Younger Homeowners Lead the Charge in Using HELOCs

Younger generations are setting the pace when it comes to

leveraging their home’s equity. Nearly three-quarters of Gen Z

respondents (73%) and two-thirds of Millennials (66%) who

previously had a HELOC or HE Loan or never did but know about the

products are likely to apply for one in the next 18 months,

outpacing Gen X (53%) and Baby Boomers (17%). These younger

homeowners are embracing home equity products to not only manage

debt, but also to finance renovations and improve their long-term

financial strategies.

As home values continue to rise, homeowners across all

generations are using HELOCs or HE Loans to capitalize on their

growing equity. Forty-three percent of those who are currently

renovating or planning to renovate their home are doing so to

increase the equity of their home. More than half (54%) of

respondents who had a HELOC or HE Loan have used it for

renovations, with current or future popular projects including

cosmetic changes (40%), outdoor upgrades (37%) and eco-friendly

additions (27%).

"By leveraging equity, homeowners are making essential upgrades

and investing in the longevity and value of their property," said

Jon Giles, Head of Residential Lending Strategy & Support at TD

Bank. "When used responsibly, home improvements can benefit a

borrower by not only adding value to their home but also enhancing

their quality of life. That's why it's important to speak with a

mortgage professional to identify the purpose and potential impact

of using your equity, ensuring it meets long-term financial

goals."

Survey Methodology

This report presents the findings of a CARAVAN® survey conducted

by Big Village Insights among a sample of 1,808 U.S. homeowners who

purchased a home within the past 10 years and acquired a mortgage

when they bought their most recent home. The survey was conducted

from October 3 to October 13, 2024.

About Big Village Insights

Big Village Insights is a global research and analytics business

uncovering not just the ‘what’ but the ‘why’ behind customer

behavior, supporting clients' insights needs with agile tools, CX

research, branding, product innovation, data & analytics, and

more. Big Village Insights is part of Bright Mountain Media. Find

out more at https://big-village.com.

About TD Bank, America's Most Convenient Bank®

TD Bank, America's Most Convenient Bank, is one of the 10

largest banks in the U.S. by assets, providing over 10 million

customers with a full range of retail, small business and

commercial banking products and services at more than 1,100

convenient locations throughout the Northeast, Mid-Atlantic, Metro

D.C., the Carolinas and Florida. In addition, TD Auto Finance, a

division of TD Bank, N.A., offers vehicle financing and dealer

commercial services. TD Bank and its subsidiaries also offer

customized private banking and wealth management services through

TD Wealth®. TD Bank is headquartered in Cherry Hill, N.J. To learn

more, visit www.td.com/us. Find TD Bank on Facebook at

www.facebook.com/TDBank and on Instagram at

www.instagram.com/TDBank_US/.

TD Bank is a subsidiary of The Toronto-Dominion Bank, a top 10

North American bank. The Toronto-Dominion Bank trades on the New

York and Toronto stock exchanges under the ticker symbol "TD". To

learn more, visit www.td.com/us.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114615872/en/

Media: Monet Irving Corporate Communications Manager II

Monet.Irving@td.com

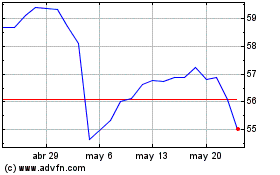

Toronto Dominion Bank (NYSE:TD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

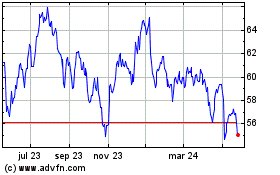

Toronto Dominion Bank (NYSE:TD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024