TLG Acquisition One Corp. (NYSE: TLGA; TLGA.U) (“TLG”), a

publicly traded special purpose acquisition company, today

announced an update to its joint proxy statement/consent

solicitation statement/prospectus filed with the Securities and

Exchange Commission (the “SEC”) on July 12, 2023 (the “Proxy

Statement/Prospectus”) in connection with the special meeting of

TLG’s stockholders scheduled to be held on July 25, 2023 to, among

other things, approve the proposed business combination with

Electriq Power, Inc., a Delaware corporation (“Electriq”). The

Proxy Statement/Prospectus originally estimated the redemption

price of the TLG’s Class A common stock, par value $0.0001 per

share (“Class A Common Stock”), at $10.73 per share. After taking

into account income taxes due on earnings in the trust, the

redemption value per share of Class A Common Stock is now estimated

to be $10.63 per share.

In addition, TLG announced today an update to its proxy

statement filed with the SEC on July 7, 2023 (the “Proxy

Statement”) in connection with the special meeting of TLG’s

stockholders scheduled to be held on July 27, 2023 (the “Extension

Meeting”) to, among other things, approve an extension of the date

by which TLG must complete a business combination from August 1,

2023 to January 1, 2024 by depositing the amount specified in the

Proxy Statement into the trust account on a monthly basis. The

Proxy Statement originally estimated the redemption price of the

Class A Common Stock at $10.78 per share. After taking into account

income taxes due on the earnings in the trust, the redemption value

per share of Class A Common Stock is now estimated to be $10.63 per

share. TLG does not intend to hold the Extension Meeting if the

necessary stockholder approvals are obtained prior to July 27,

2023.

About TLG

TLG Acquisition One Corp. is a special purpose acquisition

company formed by The Lawrie Group, for the purpose of effecting a

merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more

businesses.

Additional Information and Where to Find It

This communication relates to the business combination

(“Business Combination”) involving TLG and Electriq. This

communication may be deemed to be solicitation material in respect

of the proposed Business Combination. The proposed Business

Combination has been submitted to TLG’s stockholders for their

consideration. In connection with the proposed Business

Combination, TLG has filed with the SEC a registration statement on

Form S-4 (the “Form S-4”), in which a joint proxy statement/consent

solicitation statement/prospectus (the “Proxy Statement/Consent

Solicitation Statement/Prospectus”) was included. The information

in the Form S-4 may be changed. TLG also intends to file other

relevant documents with the SEC regarding the proposed Business

Combination. The Form S-4 has been declared effective by the SEC

and the definitive Proxy Statement/Consent Solicitation

Statement/Prospectus is being mailed to TLG’s stockholders in

connection with TLG’s solicitation of proxies for the vote of TLG’s

stockholders, and Electriq’s stockholders in connection with

Electriq’s solicitation of written consent, in connection with the

proposed Business Combination and other matters as described in

such Proxy Statement/Consent Solicitation Statement/Prospectus, and

serves as the prospectus relating to the offer of the securities to

be issued to Electriq’s stockholders in connection with the

completion of the proposed Business Combination. BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED BUSINESS

COMBINATION, INVESTORS AND STOCKHOLDERS OF TLG AND INVESTORS AND

STOCKHOLDERS OF ELECTRIQ AND OTHER INTERESTED PERSONS ARE URGED TO

READ THE DEFINITIVE PROXY STATEMENT/CONSENT SOLICITATION

STATEMENT/PROSPECTUS REGARDING THE PROPOSED BUSINESS COMBINATION

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER

RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED BUSINESS COMBINATION.

The Proxy Statement/Consent Solicitation Statement/Prospectus,

any amendments or supplements thereto and other relevant materials,

and any other documents filed by TLG with the SEC, may be obtained

once such documents are filed with the SEC free of charge at the

SEC’s website at www.sec.gov or free of charge from TLG at

https://tlgacquisitions.com/investor-relations/default.aspx or by

directing a written request to TLG at 515 North Flagler Drive,

Suite 520, West Palm Beach, FL 33401.

No Offer or Solicitation

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Participants in the Solicitation

TLG, Electriq and certain of their respective executive

officers, directors, other members of management and employees may,

under the rules of the SEC, be deemed to be “participants” in the

solicitation of proxies in connection with the proposed Business

Combination.

Information regarding TLG’s directors and executive officers is

available in its Annual Report on Form 10‑K for the year ended

December 31, 2022, which was filed with the SEC on March 20, 2023

(the “Annual Report”). To the extent that holdings of TLG’s

securities have changed from the amounts reported in the Annual

Report, such changes have been or will be reflected on Statements

of Changes in Beneficial Ownership on Form 4 filed with the SEC.

These documents may be obtained free of charge from the sources

indicated above. Other information regarding the participants in

the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, is contained

in the Form S-4, the Proxy Statement/Consent Solicitation

Statement/Prospectus and other relevant materials relating to the

proposed Business Combination to be filed with the SEC when they

become available. Stockholders and other investors should read the

Proxy Statement/Consent Solicitation Statement/Prospectus carefully

when it becomes available before making any voting or investment

decisions.

Cautionary Statement Regarding Forward-Looking

Statements

This communication includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Generally, statements

that are not historical facts in this communication are

forward-looking statements. Forward-looking statements herein

generally relate to future events or the future financial or

operating performance of TLG, Electriq or the combined company

expected to result from the Business Combination (the “Combined

Company”). For example, projections of future financial or

operational performance of Electriq or the Combined Company are

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “may,” “ should,”

“ expect,” “ intend,” “ will,” “estimate,” “ anticipate,” “

believe,” “ predict,” “project,” “target,” “budget,” “forecast,”

“could,” “continue,” “plan,” or “potentially” or the negatives of

these terms or variations of them or similar terminology. Such

forward-looking statements are based on beliefs and assumptions and

on information currently available to management of TLG or Electriq

and are subject to risks, uncertainties, and other factors which

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by TLG, Electriq and

their management, as the case may be, are inherently uncertain and

subject to material change. There can be no assurance that future

developments affecting TLG or Electriq will be those that it has

anticipated. New risks and uncertainties may emerge from time to

time, and it is not possible to predict all risks and

uncertainties. Factors that may cause actual results to differ

materially from current expectations include, but are not limited

to, various factors beyond management’s control, including general

economic conditions and other risks, uncertainties and factors set

forth in TLG’s SEC filings. Nothing in this communication should be

regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. You should not place undue reliance on forward-looking

statements in this communication, which speak only as of the date

they are made and are qualified in their entirety by reference to

the cautionary statements herein and the risk factors of TLG and

Electriq described above. Neither TLG nor Electriq undertakes any

duty to update these forward-looking statements. In addition, no

responsibility, liability or duty of care is or will be accepted by

TLG, Electriq or any other person for updating or revising this

communication or providing any additional information to any

recipient and any such liability is expressly disclaimed.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230714334262/en/

Media enquiries for TLG –

email mail@tlgacquisitions.com

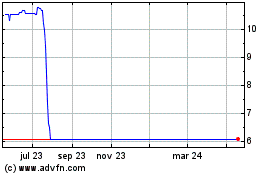

TLG Acquisition One (NYSE:TLGA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

TLG Acquisition One (NYSE:TLGA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025