UPDATE: Tiffany Profits Jump 27%; Holiday Off To Strong Start

24 Noviembre 2010 - 11:00AM

Noticias Dow Jones

Tiffany & Co. (TIF) provided an optimistic outlook for the

current holiday season and reported a 27% increase in third-quarter

profit Wednesday as the high-end jewelry retailer continues to

benefit from the return of affluent customers and the company's

international expansion.

Investors responded by sending Tiffany's stock to an all-time

high.

The quarterly results, which included higher sales and improved

margins, prompted Tiffany to increase its profit target for the

third time this year and provided a lift to the overall holiday

retail outlook two days before one of the busiest shopping days of

the year, the Friday after Thanksgiving.

"We are now a few weeks into the all-important two-month holiday

season, and sales growth is exceeding our expectations, although

the majority of the holiday season is certainly still ahead of us,"

Chief Executive Michael Kowalski said.

Tiffany is benefiting from the return of upper-end customers who

were scarce during the recession but have returned now that the

stock market has rebounded and other measures of their wealth are

improving. But the less affluent are still relatively scarce.

"We continue to see bifurcated performance, with declines in

sales and transactions below $500, but double-digit percentage

increases in most every other higher priced category," investor

relations chief Mark Aaron said on conference call with analysts.

"This indicates to us diverging effects to one degree or another

that the economy is having on consumer spending."

Other upper-end retailers are also seeing a resurgence in

demand. LVMH Moet Hennessy Louis Vuitton (LVMUY, MC.FR) and Coach

Inc. (COH) each reported improved results for the latest quarter.

Likewise, women's apparel retailer AnnTaylor Stores Corp. (ANN) is

seeing its higher-priced namesake stores do well, while its less

expensive LOFT stores are lagging.

Tiffany also has been benefiting from the consolidation of

jewelry retailers, especially as smaller shops have gone out of

business and other, larger concerns have had some operational

difficulties.

Tiffany, which is now doing a good deal of its business outside

the U.S., saw double-digit percentage sales increases in Asia,

Japan and Europe.

Tiffany shares recently were up 5.2% to $61.28 after jumping to

an all-time high of $61.30, on a split-adjusted basis. The

company's positive holiday outlook also boosted shares of other

retailers, like Coach, gaining 2.7%; Nordstrom Inc. (JWN), up 1.9%;

Macy's Inc. (M), adding 1.8%; and Saks Inc. (SKS), rising 1.5%.

For the period ended Oct. 31, Tiffany posted a profit of $55.1

million, or 43 cents a share, up from $43.3 million, or 35 cents a

share, a year earlier.

Excluding costs related to the relocation of its New York

headquarters staff and prior-year diamond sourcing agreements and

tax-related impacts, per-share earnings rose to 46 cents from 33

cents. Analysts polled by Thomson Reuters had forecast earnings of

37 cents a share.

Sales jumped 14% to $681.7 million following last year's 2.9%

drop. Excluding currency changes, they increased 12% and same-store

sales rose 7%. Analysts had expected $653 million in overall sales

and same-store sales increasing 4.5%.

Gross margin widened to 58.5% from 54.8%, due in part to higher

prices.

Sales in the Americas rose 9% and climbed 5% on a same-store

basis excluding currency impacts. Internet and catalog sales in the

Americas climbed 7%. At Tiffany's New York flagship store, sales

declined 3%.

Sales were up 24% and 22% in the Asia-Pacific region and Europe,

respectively.

For the fiscal year ending in January, Tiffany raised its profit

outlook by 12 cents to $2.72 to $2.77 a share. The company also

sees worldwide sales increasing 12%, one percentage point higher

than its earlier expectation.

-Matt Jarzemsky contributed to this article.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

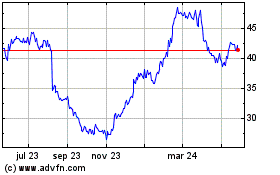

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

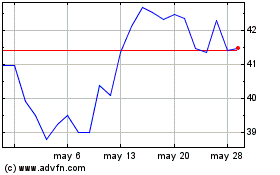

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024