Ahead of Wall Street - July 31, 2012 - Ahead of Wall Street

31 Julio 2012 - 4:05AM

Zacks

Tuesday, July 31, 2012

All eyes are on the U.S. Federal Reserve and the European

Central Bank as the two critical central banks hold their regular

scheduled meetings this week. The Fed’s two-day meeting starts

today and the official statement comes out Wednesday afternoon,

ahead of Friday’s key July jobs report. The consensus expectation

seems to be that the Fed will not announce anything new on

Wednesday, leaving any major policy changes to the September

meeting.

But pressure will be high on Mario Draghi, the ECB president, to

follow through on his ‘whatever it takes’ statement from last week.

Mr. Draghi’s statement has raised hopes that the ECB will start

purchasing Spanish (and Italian) government bonds whose rising

yields lately have stoked fears that the country may need a bailout

of its own. But Mr. Draghi heads a divided house, where Germany

remains opposed to any such move, making it difficult to reconcile

Germany’s concerns with Spain’s needs and the market’s demands.

But beyond what the Fed and the ECB may or may not do this week is

the more fundamental question of whether monetary policy tools are

even relevant to the issues facing these two key economies. The

answer is far from clear on that count, particularly with respect

to the Fed who has done more than any other major central bank to

do its job. But with election-year politics making it difficult to

address the core fiscal issues confronting the U.S economy, the Fed

may decide it preferable to be seen to be ‘doing something’.

Many serious market watchers even remain of the opinion that the

economy’s condition is not precarious enough to warrant fresh Fed

support. They point to last week’s 1.5% GDP growth rate in the

second quarter and expectations of 100K-plus jobs in Friday’s Jobs

report as evidence in support of this claim. This morning’s June

Personal income & Outlays reading would also fall in that

category. That may be so, but when you combine the loss of momentum

in the U.S. economy with the problems in Europe and the issues in

China, we have an almost global synchronized global slowdown that

may still have quite some ways to further down.

We are clearly seeing the impact of this global slowdown in

corporate results this earnings season, with companies finding it

difficult to achieve top-line gains. While about two-thirds of the

companies were able to beat earnings expectations – roughly in-line

with recent quarters, a far weaker percentage of about 38% are able

to come ahead of revenue expectations. Even many among these

‘revenue beaters’ are guiding towards weaker times ahead. The trend

is widespread across different sectors/industries and present in

this morning’s basket of results from Pfizer

(PFE), Coach (COH), and Goodyear

Tire (GT).

Sheraz Mian

Director of Research

COACH INC (COH): Free Stock Analysis Report

GOODYEAR TIRE (GT): Free Stock Analysis Report

PFIZER INC (PFE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

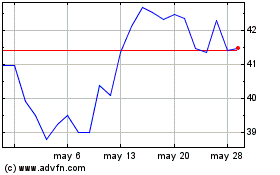

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

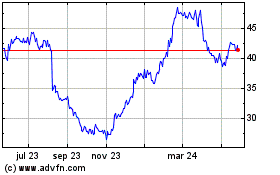

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024